On the Eve of Subsidy Reduction: Avatr, Backed by the 'National Team,' Sets Sail for Hong Kong Listing

![]() 11/28 2025

11/28 2025

![]() 506

506

As the year winds down, the new - energy sector on the Hong Kong stock market is once again making waves.

First off, Li Auto slipped back into the red after 11 quarters of profitability. This has prompted the market to take a fresh look at the profitability challenges lurking behind the rapid progress of new - energy forces. At the same time, the looming reduction in new - energy vehicle purchase tax subsidies in 2026 hangs over the industry like the Sword of Damocles, heightening the sense of urgency.

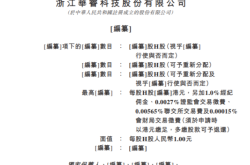

Then, Avatr Technology, which is supported by three industry behemoths—Changan Automobile, Huawei, and CATL—recently submitted its prospectus to the Hong Kong Stock Exchange. It has become the first purely new - energy vehicle company under a central enterprise to rush for a Hong Kong stock listing.

As a high - end intelligent electric vehicle brand jointly crafted by Changan Automobile, CATL, and Huawei, Avatr has been drawing significant market attention since its inception. This IPO application comes at a time when Chery Automobile successfully went public on the Hong Kong stock market in September this year, raising approximately HK$8.9 billion, and when Dongfeng Motor's VOYAH is also considering a listing.

Amid the increasingly cut - throat competition in the new - energy vehicle market, Avatr's move to raise capital has led the market to re - evaluate the development prospects of 'national team' new - energy brands.

'Three Models in Three Years, One Model in the Fourth Year' Fuels Revenue Surge, But Cumulative Losses Top 11 Billion Yuan

Avatr's performance showcases the typical traits of new - energy forces: skyrocketing delivery volumes and revenue, yet persistently high losses.

Since it started delivering vehicles in December 2022, the company's vehicle deliveries have soared from 20,000 units in 2023 to 61,600 units, and reached 56,700 units in the first half of 2025.

This explosive sales growth has directly catapulted its revenue from RMB 28.34 million in 2022 to RMB 5.645 billion in 2023, and then to RMB 15.195 billion in 2024, achieving a remarkable triple - jump. The year - on - year increase in the first half of 2025 remained as high as 98.4%, with corresponding revenue hitting RMB 12.208 billion, getting close to the full - year level of 2024.

The high growth rate in deliveries stands out in the fiercely competitive price range of RMB 200,000 to RMB 700,000. Particularly, with monthly deliveries exceeding 12,800 units in June 2025, it shows that the market has a deeper recognition of its product strategy. Based on the sales growth rate, Avatr has climbed to the top tier among second - tier new - energy forces.

The trajectory of gross margin improvement offers another angle. From 2022 to 2024, Avatr's gross margins were - 365.5%, - 3.0%, and 6.8% respectively, and further improved to 10.1% in the first half of 2025.

This trend indicates that as the company's scale expands, its cost - control capabilities are gradually getting stronger, which is in line with the common 'scale effect' pattern in the new - energy vehicle industry.

However, scale expansion hasn't yet translated into a profitability edge. Over the past three and a half years, its cumulative losses have exceeded RMB 11 billion, with the loss trend widening from RMB 2.015 billion in 2022 to RMB 4.018 billion in 2024. Although the loss rate narrowed to 13% in the first half of 2025, the absolute loss amount still reached RMB 1.585 billion.

The main culprits are high R & D investment and sales expenses. Even though the gross margin improved to 10.1% in the first half of 2025, there's still a gap in cost - scale control compared to the approximately 20% gross margin level of profitable automakers like Li Auto.

Fierce Competition in the Red Ocean: Avatr Aims for Growth through Listing

In the past, Avatr's survival and operation heavily depended on capital infusions.

Since its inception, it has completed four rounds of financing, totaling approximately RMB 19 billion. The Series C financing at the end of 2024 raised over RMB 11 billion. Frequent capital injections and sustained revenue growth have kept its cash reserves at RMB 13.483 billion, providing a short - term buffer for R & D and channel expansion.

However, the long - term need for massive business expansion and R & D investment remains a real challenge, especially as the internal capital pressure within Changan Holdings Group intensifies. Diversifying financing channels has become an inevitable and necessary step for Avatr's growth, which is why the Hong Kong stock listing has been put on the agenda. Of course, this cycle of 'financing - expansion - losses' is also a microcosm of the fierce competition in the new - energy industry.

Currently, although Avatr's cost - operation capabilities have shown signs of optimization, it still faces two major hurdles. First, there's persistently high R & D investment, as technical input has to keep increasing during the 'three models in three years, one model in the fourth year' product layout from 2023 to 2024. Second, there are soaring expenses from sales network expansion, with significant single - store costs and operational pressures.

Accelerating effective sales conversion is the best way to tackle these challenges. However, with the domestic new - energy vehicle penetration rate reaching 55%, the market has long been considered a red ocean, making it no easy feat for Avatr to achieve accelerated sales expansion.

The 'Triple Giant Alliance' Offers Support but Also Has Hidden Agendas

From an industry perspective, Avatr is under multiple pressures.

On one hand, brands incubated by traditional automakers, such as Zeekr and VOYAH, are speeding up their high - end layouts. VOYAH even achieved a profit of RMB 434 million in the first seven months of 2025. On the other hand, new - energy forces like NIO and Li Auto are building barriers through technological self - research and ecosystem construction.

Avatr tries to stand out with a 'dual powertrain layout across the entire lineup,' but it only achieved 41% of its annual sales target of 220,000 units in the first nine months of 2025, revealing the gap between its goals and reality. To maintain capital market confidence, it needs to quickly cross the breakeven point while expanding its scale.

Avatr's unique competitiveness still lies in the strategic synergy of its shareholders. Changan Automobile brings manufacturing heritage, CATL provides battery technology, and Huawei injects intelligent driving solutions through Yinwang Company. Avatr has already acquired a 10% stake in Yinwang for RMB 11.5 billion, and both parties plan to launch 17 models by 2030.

This 'technology + supply chain + channel' ecological layout theoretically reduces R & D risks and costs. However, differences in cooperation models lead to varying degrees of resource allocation.

For example, although the 'HI mode' ensures Changan Automobile's dominance, it limits Avatr's access to Huawei's channel dividends. As for the 17 models jointly planned for future launch, the depth of cooperation will hinge on technological integration efficiency and benefit - distribution mechanisms.

The 'Triple Giant Alliance' behind Avatr actually has its own hidden agendas.

The Chinese mid - to - high - end new - energy market has shifted from a blue ocean to a 'red ocean.' In the first three quarters of 2025, sales of extended - range and plug - in hybrid models declined by 12% and 7% respectively, while Avatr's main model price range is being encircled by the Li L series, AITO M series, and NIO ET series. Notably, Avatr's cumulative sales in the first nine months of 2025 only reached 90,700 units, achieving 41.2% of its annual target of 220,000 units. The low target achievement rate indicates that the market competition is fiercer than expected.

Avatr's breakthrough strategy clearly focuses on full product coverage, globalization, and technological self - research. According to the information, the funds raised in this listing will be mainly used for product development, platform and technology development, brand building, and sales and service network construction to further enhance core competitiveness.

According to the plan, it will launch five upgraded products jointly with Huawei in 2026 and gradually introduce multiple models priced above RMB 300,000 over the next three years, achieving comprehensive coverage of the high - end and luxury markets. Simultaneously, it aims to enter over 80 countries by 2030, establish 700 overseas channels, and jointly develop the next - generation platform with Huawei.

However, referring to the benchmark case of Chery Automobile's Hong Kong stock listing, Avatr needs to prove that its overseas expansion capabilities can replicate its domestic growth story. After all, amid external factors such as EU anti - subsidy investigations and US tariff barriers, the path for Chinese new - energy brands to go global is far from smooth.

Avatr's rush for a Hong Kong stock listing will, in the short term, ease its cash flow pressure and provide ammunition for product R & D and channel expansion. However, its real challenge lies in whether, amid the impending subsidy reduction in 2026 and the tug - of - war between resources from the three giants and market competition, it can further accelerate effective sales and market expansion. Moreover, how can it achieve a qualitative change in gross margin, control loss margins, and enter the ranks of profitable new - energy forces before the capital market's patience runs out?

This journey is much more arduous than simply submitting a prospectus.