Dual-Star Dialogue: YC's 'Cornerstone' Vision vs. a16z's 'Crown' Pursuit

![]() 01/04 2026

01/04 2026

![]() 373

373

As the year draws to a close, Y Combinator (YC) partners are busy tallying up developer API usage rates, while a16z's consumer team is deep into analyzing the click behaviors of hundreds of millions of users. A glance at these two annual reports from the heart of Silicon Valley reveals both the industry's divisions and its consensus.

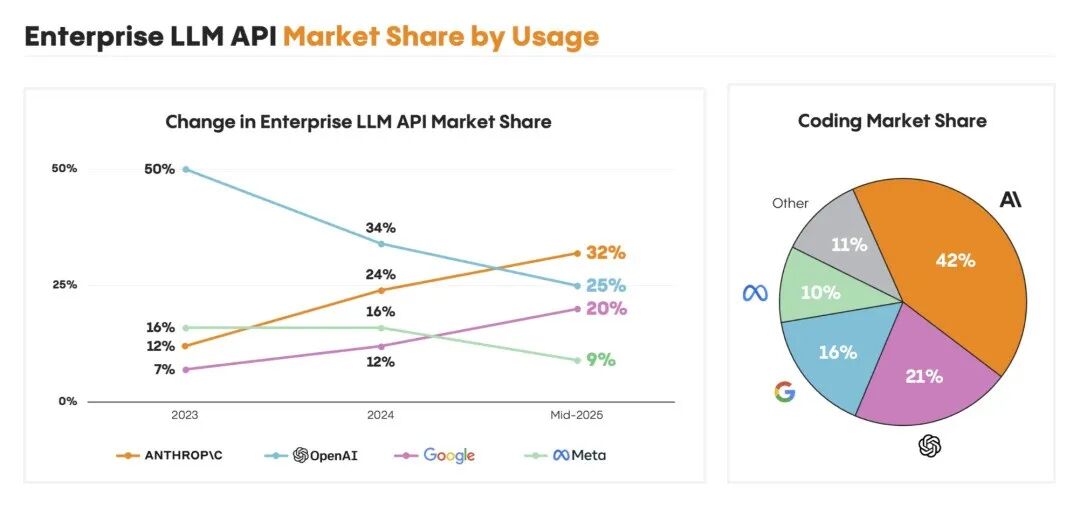

At Y Combinator, partners have noticed a historic shift in entrepreneurs' technological preferences. "In this batch (Summer 2026) of applications, Anthropic's API has actually taken the top spot. It's just slightly ahead of OpenAI—who would have guessed?" For the first time, Anthropic's API usage rate has surpassed OpenAI's, becoming the go-to choice for YC entrepreneurs.

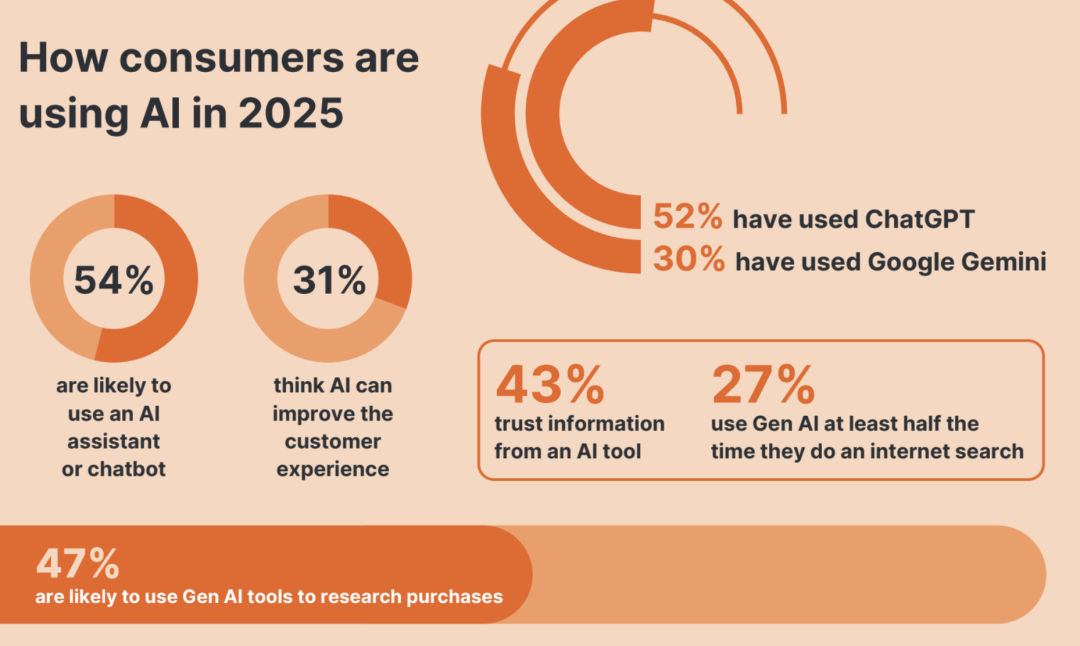

Meanwhile, in a16z's consumer team meetings, data analysis paints a different picture. "Only 9% of consumers pay for more than one product from the ChatGPT, Gemini, Claude, and Cursor group." A staggering 91% of paying users stick to just one mainstream AI product, with ChatGPT maintaining an absolute dominance in user mindshare.

These seemingly contradictory phenomena actually sketch out the true landscape of the 2025 AI industry. While the three-tier structure of infrastructure, models, and applications has stabilized, power struggles within each tier have intensified. Infrastructure and model ecosystems are solidifying, and the battle for user mindshare and application innovation is reaching its peak.

01┃ Three-Tier Structure Established, Game Rules Clarified

"I feel like the AI economy has found its footing. We've got model layer companies, application layer companies, and infrastructure layer companies." This assessment from a YC interview is echoed in a16z's data. Despite differing viewpoints, both confirm that the industry has formed a clear three-tier structure. Within the infrastructure layer, an unseen arms race is in full swing. Zephyr Fusion (space nuclear fusion) and Boom Supersonic (energy solutions), mentioned in YC interviews, aim to tackle AI computing's ultimate bottlenecks—energy and space. These seemingly far-fetched explorations are actually defining the industry's ceiling.

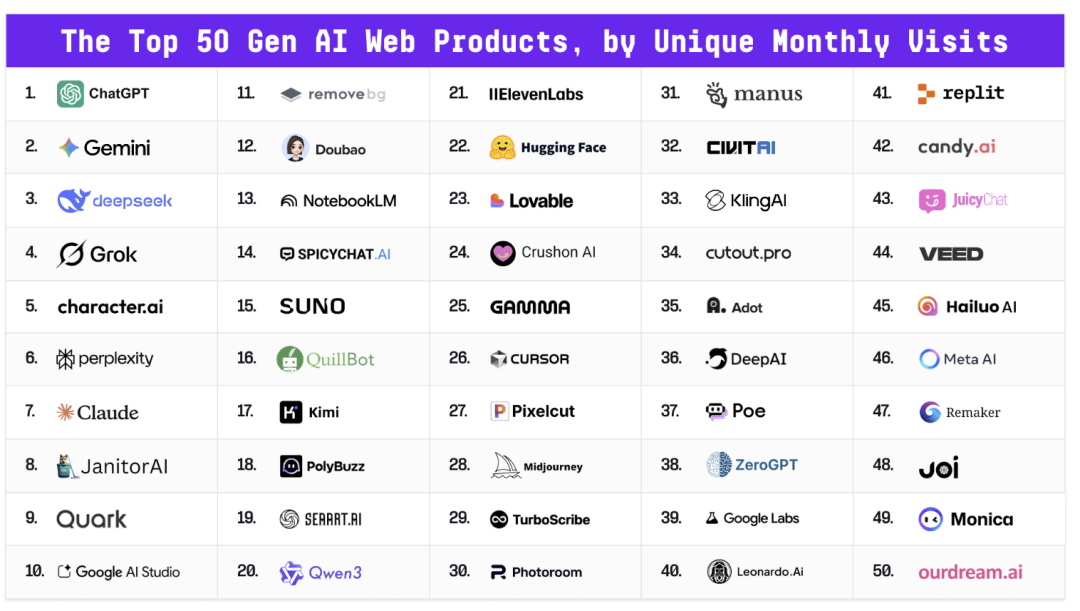

(Image source: a16z consumer)

(Image source: a16z consumer)

The a16z team observes a direct consequence of this shift from the consumer side: "Fierce competition among model layer companies has actually driven down application development costs." Models are no longer scarce resources but have become orchestratable 'infrastructure components.' What does this mean for entrepreneurs? YC partners offer clear advice: "The founder's argument is that overcapacity creates opportunities for everyone." Certainty brings new game rules. Entrepreneurs no longer need to bet on a single technological path but can build long-term businesses based on stable expectations.

02┃ Model Wars: The Clash of Technological Edge and User Habits

The most dramatic changes in 2025 are happening within the model layer. Anthropic's resurgence is confirmed in YC data, while a16z's consumer data offers a different take on this victory.

From YC's perspective, this proves that technological depth can triumph over scale advantages. "It turns out the model that excels in 'vibe coding' and building automated coding workflows is from Anthropic... They set this as their technological north star early on, and now you can see the results in the model's capabilities." Anthropic's dedication to coding and complex reasoning has won over technical builders.

(Image source: a16z consumer)

(Image source: a16z consumer)

However, a16z's consumer data reveals the stubbornness of user habits. "ChatGPT currently leads by a wide margin, with 800-900 million weekly active users. The average person still uses just one AI product, and ChatGPT serves as the universal currency—the starting point and benchmark for all transactions and dreams—akin to San Francisco's Gold Rush in 1849."

Another 2025 dark horse, Google Gemini, has also made waves with 155% year-over-year growth—not from traditional text conversation scenarios but from a flawless breakthrough driven by top-tier multimodal models that went viral on social media. a16z data shows clear inflection points in its growth momentum, highly coinciding with the release of two key products: the image model Nano Banana and video model Veo.

"The releases of Nano Banana and Veo triggered viral spread on social media," notes the a16z team. This represents not just a technological victory but a product strategy triumph. While YC's technical experts delve into nuanced differences in models for professional tasks like 'code reasoning,' a16z's consumer team sees Gemini directly targeting ordinary users' desires to 'create and share' through content that is 'shareable and show-off-worthy.' These AI-generated contents that go viral on TikTok and X (formerly Twitter) have become Gemini's most powerful growth hacks, confirming a brutal consumer market logic: in the battle to conquer mass users, a 'killer feature' that sparks sharing often outperforms a perfect technical evaluation report.

03┃ Application Layer Strategies: Navigating Between Giants' Shadows and Glow

For application layer entrepreneurs, 2025 offers both a guidebook and a warning. Conversations between YC and a16z outline survival strategies from different angles.

First up is a16z's warning: "When inputs and outputs are text, that's exactly where ChatGPT and Gemini shine brightest... Prying users away from those habits will be extremely difficult." What does this mean? Startups whose value proposition is merely better text generation are almost doomed to fail. The combination of user habits and network effects forms the giants' strongest moat.

Opportunities emerge in YC's observations: "They're actually abstracting all this away to build this orchestration layer... For example, I heard about a startup using Gemini 3.0 for contextual engineering and then feeding the results into OpenAI for execution." This precisely means model orchestration has become a core technical strategy for startups. Rather than relying on a single model, they select optimal components based on tasks—a flexibility large companies struggle to match. Vertical depth offers another path. A YC interview mentions a medical AI startup that, using a domain-specific fine-tuned model with just 8 billion parameters, outperformed GPT-5 in medical benchmark tests. This represents not just a technological victory but a commercial strategy triumph. However, YC issues a stern warning: "We also have YC companies that beat OpenAI's GPT-3.5... But then GPT-4.5 released and basically shattered their fine-tuning advantages."

04┃ Breaking Through in 2026: From Stock Habits to Incremental Experience Battlegrounds

The 2025 consumer market reveals a fierce tug-of-war between technological acceleration and behavioral inertia. a16z's data uncovers a core contradiction: rapid model iteration coexists with extreme user conservatism, creating a winner-takes-all landscape. ChatGPT has built a towering mindshare moat through first-mover advantage and user habits. However, this moat protects 'tool utility' rather than 'emotional connection' or 'social identity.'

OpenAI's attempt to add social functionality (Cameo) to Sora proves that while technology can generate stunning content, it struggles to create social capital carrying genuine interpersonal relationships: "The fundamental dilemma of AI-generated content is that it strips away 'self-expression.' When content isn't tied to 'you,' it cannot fulfill the social purpose of seeking recognition and building connections." This precisely points to the breakthrough direction for 2026: competition must shift from fighting over existing user tool choices to creating incremental value through 'experience definition.'

Multimodal capabilities, model orchestration, and vertical integration together form the 'Breakthrough Triangle' challenging giant monopolies. For instance, Gemini's Nano Banana derives value not from technical parameters but from transforming AI into a visually expressive tool accessible to everyone, opening entirely new user scenarios. Meanwhile, cutting-edge entrepreneurs no longer rely on single models but build intelligent scheduling hubs that flexibly combine globally optimal models, elevating 'which model to use' from a technical choice to a core strategy. In domains where giants struggle due to organizational inertia, startups create safe havens with both user value and commercial barriers by constructing deep workflow closures (e.g., Gamma, Perplexity Comet).

All three converge on one conclusion: when underlying technologies become homogeneous, victory hinges not on 'which models you own' but on 'for whom, solving what problems, and creating what experiences.' Ultimately, as underlying technologies stabilize, the decisive factor will be: who can most precisely capture and satisfy those uncertain, nuanced, and entirely new human desires for experience on an established ecological foundation.