NVIDIA Loses Monopoly After Missing Out on Leapmotor

![]() 01/06 2026

01/06 2026

![]() 519

519

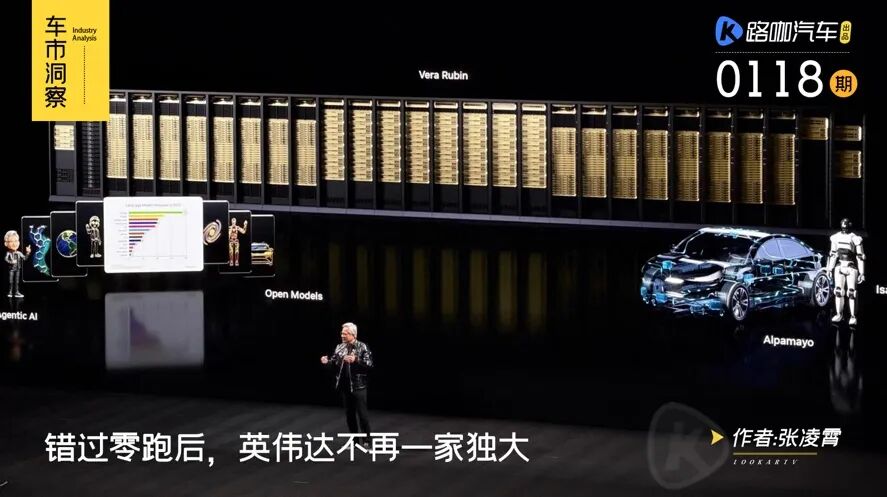

This year's CES has emerged as the epicenter for intelligent vehicles, especially autonomous driving technologies. NVIDIA unveiled its formidable weapon—the Alpamayo Open Model Family. Jensen Huang declared that a new 'World Model + VLA' framework is being systematically integrated into automotive-grade development. Chinese automakers including BYD, Geely, Great Wall, SAIC, and Xiaomi have already embraced NVIDIA's ecosystem.

On the eve of CES, Elon Musk made a high-profile announcement that the robotaxi, Cybercab, is poised for mass production. The competition between NVIDIA and Tesla in the autonomous driving arena has escalated from L2 to L4 levels.

Across the CES exhibition hall, Qualcomm is striving to break NVIDIA's stranglehold on the autonomous driving chip market with its 'Integrated Cabin and Driving' solution.

NVIDIA and Qualcomm Step Up Challenges to FSD

At CES 2026, NVIDIA introduced the Alpamayo Open Model Family, marking the first time the 'World Model + VLA (Vision-Language-Action)' framework was systematically introduced into automotive-grade development. This move reflects NVIDIA's evaluation of the L4 autonomous driving path: autonomous vehicles must reason and make decisions like humans in complex and long-tail scenarios. The core of this approach is that Alpamayo transforms the traditional serial decision-making stack of 'perception-prediction-planning' into a closed-loop system of 'understanding-rehearsal-judgment-correction'.

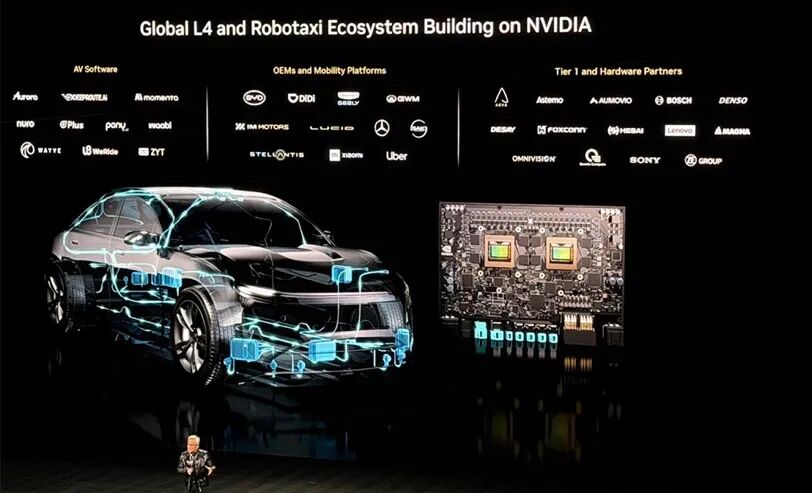

During the event, NVIDIA displayed its L4 ecosystem, encompassing Chinese manufacturers such as BYD, Didi, Geely, Xiaomi, Great Wall, and SAIC.

On the eve of CES, Elon Musk disclosed on social media that Cybercab, a robotaxi specifically designed for driverless ride-hailing, is set to commence mass production in April 2026. The most striking feature of Cybercab is its lack of a steering wheel, accelerator, and brake pedals. Most critically, it relies on FSD, employing a pure vision solution and trained through an end-to-end large model. In contrast, the Alpamayo solution supports multi-sensor fusion (camera + radar + LiDAR), with Chinese LiDAR supplier Hesai also part of NVIDIA's L4 ecosystem.

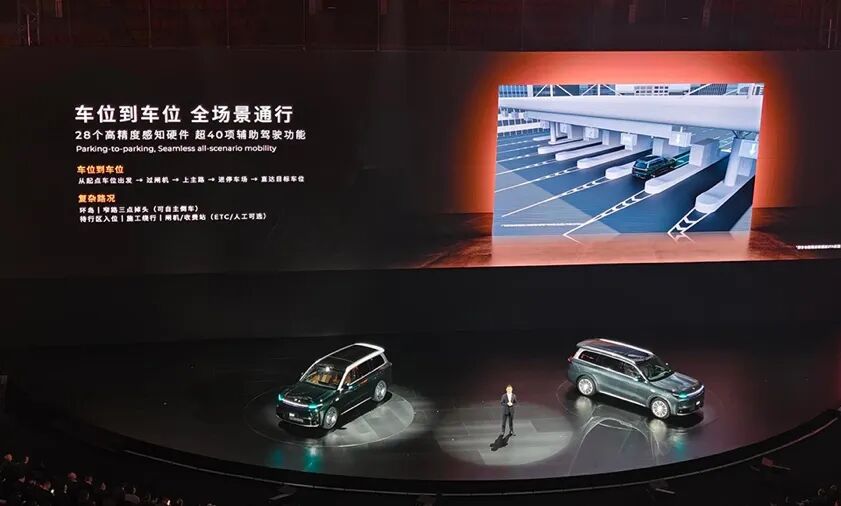

Apart from NVIDIA's Alpamayo, FSD encountered another competitor at this year's CES: Leapmotor and Qualcomm jointly unveiled the world's first cross-domain integration solution featuring the Snapdragon Cockpit Platform Elite and the Snapdragon Ride Platform Elite.

Compared to Qualcomm, NVIDIA already enjoys a substantial scale advantage in the L2 market. Taking the Chinese market as an example, numerous mainstream intelligent driving players have opted for NVIDIA's solutions, with the Orin series dominating the autonomous driving chip market.

Qualcomm's trump card is its 'Integrated Cabin and Driving' solution. At CES, Qualcomm announced that with the backing of dual Snapdragon automotive platforms, this central domain controller can not only merge intelligent driving and cockpit functions but also unify multiple key automotive domains, including body control (lights, windows, etc.) and vehicle gateways. This multi-domain integration approach for 'cockpit-intelligent driving-body/chassis' can expedite the OEM's self-developed integration cycle.

Qualcomm highlighted at CES that the Snapdragon Ride Platform's strength lies in its scalable, engineering-focused ADAS/AD platform, compatible with multiple algorithm and mapping partners, facilitating rapid mass production. Prior to this year's CES, Qualcomm had already announced its collaboration with Google to introduce generative AI into automotive applications, with Google's Gemini model empowering Qualcomm's Snapdragon Digital Chassis.

Qualcomm's 'multi-domain integration' technical route enables partners to iterate cockpit/intelligent driving/chassis within a replicable engineering framework, evolving towards higher levels through an initial ADAS/L2+ scaling path.

NVIDIA No Longer Dominates the Market

From this year's CES, it is clear that the technological paths for autonomous driving are converging along two major axes: 'end-to-end × world model' and 'central computing × multi-domain integration.' Different players exhibit significant disparities in sensor strategies, ecosystem partnerships, and commercialization rhythms.

Geely Automobile announced its foray into full-domain AI 12.0 and introduced the WAM (World Action Model), which can be interpreted as 'VLA + World Model.' This aligns with a discernible trend in the autonomous driving field: moving towards large models, end-to-end systems, and human-like reasoning. VLA and world models are complementing and integrating with each other, forming a division of labor framework of 'cloud-based world model + vehicle-end VLA'.

As technological routes converge, NVIDIA no longer holds a monopoly in computational power and supply chains. NIO and XPENG have already commenced mass production of their self-developed intelligent driving chips. Horizon Robotics' HSD solution, based on its self-developed chips, aims to bring urban NOA to the 100,000-yuan market segment. Qualcomm's integrated cabin and driving solution has secured partnerships not only with Leapmotor but also with Buick, Momenta, and other manufacturers.

Indeed, as China's best-selling new energy vehicle brand, Leapmotor's decision to partner with Qualcomm rather than NVIDIA reflects a deeper rationale. As cost control becomes increasingly crucial, more automakers are inclined to opt for platform solutions that offer higher integration, moderate development difficulty, a comprehensive ecosystem, and cost-effectiveness. Qualcomm precisely caters to these needs. This collaboration model enables Leapmotor to concentrate on core algorithms and differentiated user experiences without heavily investing in underlying hardware development, facilitating a faster and more cost-effective market launch of intelligent driving capabilities.

In the past, NVIDIA's DRIVE platform was the preferred choice for many OEMs and L4 companies due to its superior computational power and comprehensive software ecosystem. Today, domestic and international players such as Qualcomm, Huawei, and Horizon Robotics are leveraging their respective strengths to offer highly competitive intelligent driving solutions.

Automakers are diversifying their choices of intelligent driving chips and solutions. The competition among intelligent driving solutions is shifting from pure 'computational power' to a comprehensive contest of 'delivery capability,' 'integration capability,' and 'cost-effectiveness.' Simply providing top-tier chips is no longer adequate to win the favor of all automakers.

The convergence of technological routes does not signal the end of competition; instead, it intensifies the competition in business models. Domestic automakers' self-developed investments, integrated breakthroughs by platforms like Qualcomm, and the rise of local chips like Horizon Robotics are collectively driving a diversified landscape for autonomous driving computing platforms.