Domestic Tech 'Game-Changer': With 2.8 Billion Yuan in Accumulated Losses Over Three and a Half Years, How Will Iluvatar CoreX Navigate Its IPO?

![]() 01/04 2026

01/04 2026

![]() 484

484

Recently, Shanghai Iluvatar CoreX Semiconductor Co., Ltd. (hereinafter referred to as 'Iluvatar CoreX', HK:09903) has kicked off its IPO process, set to wrap up on January 5. The company plans to make its debut on the Hong Kong Stock Exchange on January 8, 2026, under the ticker symbol '09903'.

As per the announcement, Iluvatar CoreX intends to offer 25.4318 million shares globally, with 2.5432 million shares earmarked for the Hong Kong public and 22.8886 million shares designated for international investors. Based on a per-share issue price of HK$144.60, Iluvatar CoreX is projected to raise approximately HK$3.7 billion through this IPO, with an estimated market capitalization hovering around HK$35.442 billion.

With the Hong Kong stock market opening its doors, this AI chip company, established in 2015 and dedicated to the research and development of general-purpose GPUs (GPGPUs) as well as the mass production of inference GPGPU chips, is poised to leverage domestic technology as a springboard. It aims to propel the autonomous development of China's intelligent computing infrastructure on a fresh capital journey.

However, against a backdrop where domestic GPU companies are generally in a phase of heavy technological investment, Iluvatar CoreX has yet to break free from persistent losses, with its net losses generally on an upward trajectory. Translating technological prowess into sustainable commercial value remains a daunting challenge that Iluvatar CoreX must tackle post-IPO.

I. Specializing in General-Purpose GPUs with a Relatively Narrow Product Range

As a service provider深耕 (specializing) in the general-purpose GPU sector, Iluvatar CoreX's product lineup primarily comprises general-purpose GPU chips and accelerator cards, along with customized AI computing solutions (including general-purpose GPU servers and clusters). The company seamlessly integrates hardware with proprietary software stacks to cater to specific customer needs in both training and inference scenarios.

Iluvatar CoreX's general-purpose GPU offerings cater to a wide array of needs across two core application scenarios: training and inference. The 'Tiankai' series stands as the company's flagship training-specific product line, engineered for AI model training with cutting-edge computing cores and optimized multi-card cluster architectures.

Complementing the 'Tiankai' series, Iluvatar CoreX's 'Zhikai' series marks the first domestic general-purpose GPU product tailored explicitly for inference. It zeroes in on inference applications with enhanced integer computing units and efficient data pathways, optimized for deployment scenarios.

As of the end of June 2025, Iluvatar CoreX has shipped over 52,000 general-purpose GPU products to more than 290 customers across diverse industries, achieving over 900 deployments and applications in key sectors such as financial services, healthcare, and transportation.

Data from Frost & Sullivan also reveals that among Chinese chip design companies, Iluvatar CoreX leads the pack as the first to achieve mass production of both inference and training general-purpose GPU chips, and the first to reach these milestones using advanced 7nm process technology.

Turning to Iluvatar CoreX's AI computing solutions, they seamlessly blend a certain number of general-purpose GPU accelerator cards with integrated software stacks, typically employed in dedicated general-purpose GPU servers that handle enterprise AI workloads. The company also integrates its general-purpose GPU products with third-party infrastructure to meet scalable general-purpose GPU computing cluster demands.

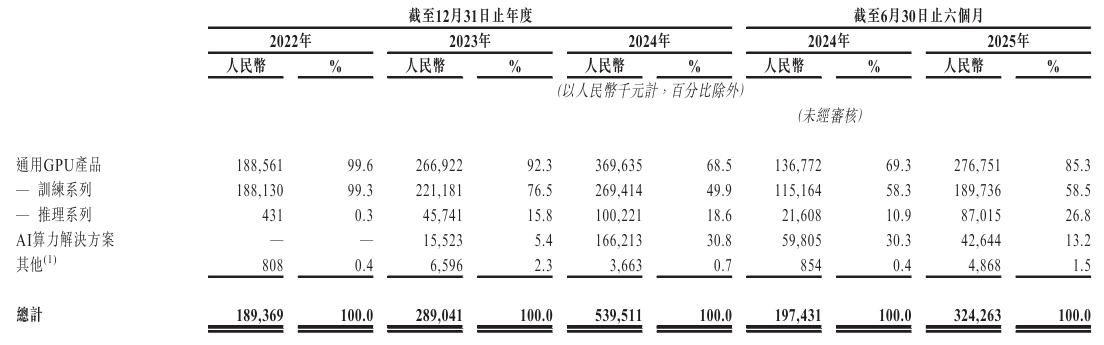

However, as of now, general-purpose GPU products remain the backbone of Iluvatar CoreX's performance. During the 2022, 2023, 2024, and the first half of 2025 (hereinafter referred to as the 'Reporting Period'), the company's revenue from general-purpose GPU products accounted for 99.6%, 92.3%, 68.5%, and 85.3%, respectively, underscoring its reliance on revenue from a single product.

In contrast, Iluvatar CoreX's AI computing solutions began generating revenue in 2023 and raked in HK$166 million in 2024. However, in 2025, revenue from this business segment plummeted by 28.7% year-on-year to HK$42.644 million, with its revenue share dropping to 13.2%.

Iluvatar CoreX explained that this downturn was attributed to a large customer order in the first half of 2024, which inflated the revenue base. Given that the specific configurations and component combinations of the company's AI computing solutions vary significantly based on project requirements, and average selling prices fluctuate widely depending on deployment performance levels and scale, the future revenue-generating capacity remains uncertain.

II. Expansion Fails to Stem Losses, Gross Margin Levels Decline

Thanks to continuous technological breakthroughs, Iluvatar CoreX has made significant strides in customer expansion, with its customer base swelling from 22 in 2022 to 181 in 2024. Its general-purpose GPU shipments also surged from 7,800 units to 16,800 units, reaching a further 15,700 units in the first half of 2025, forming a scale effect in the market.

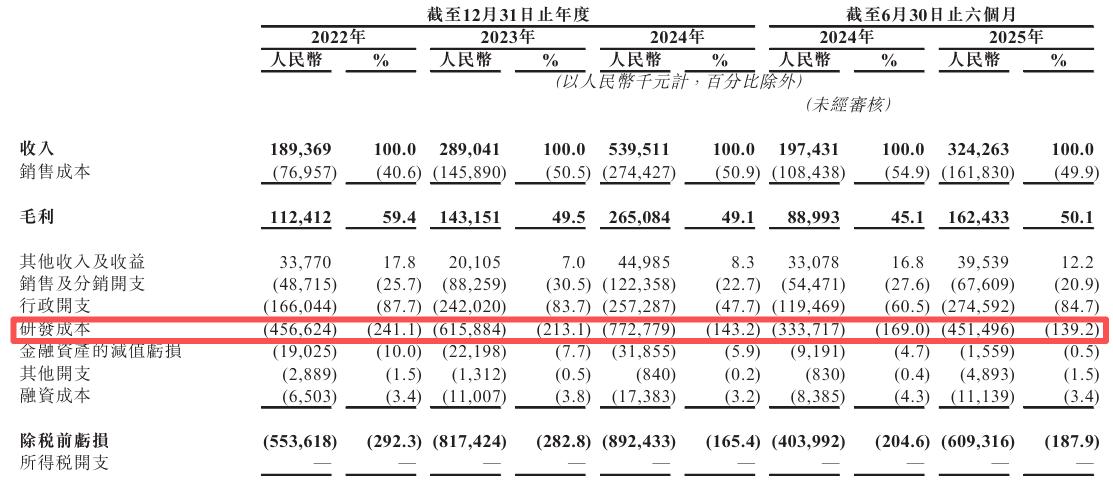

Meanwhile, Iluvatar CoreX's overall revenue has also shown a steady upward trend. From 2022 to 2024, the company's revenue was RMB 189 million, RMB 289 million, and RMB 540 million, respectively, with a compound annual growth rate of approximately 68.8%. In the first half of 2025, it also achieved revenue of RMB 324 million, a year-on-year increase of 64.2%.

Iluvatar CoreX's revenue structure has also undergone optimization. During 2022-2024, revenue from its top five customers accounted for as high as 94.2%, 73.3%, and 73.4%, respectively, and the company had previously highlighted the risk of customer concentration in its prospectus. This figure dropped to 38.6% in the first half of 2025, reflecting a diversification of revenue sources.

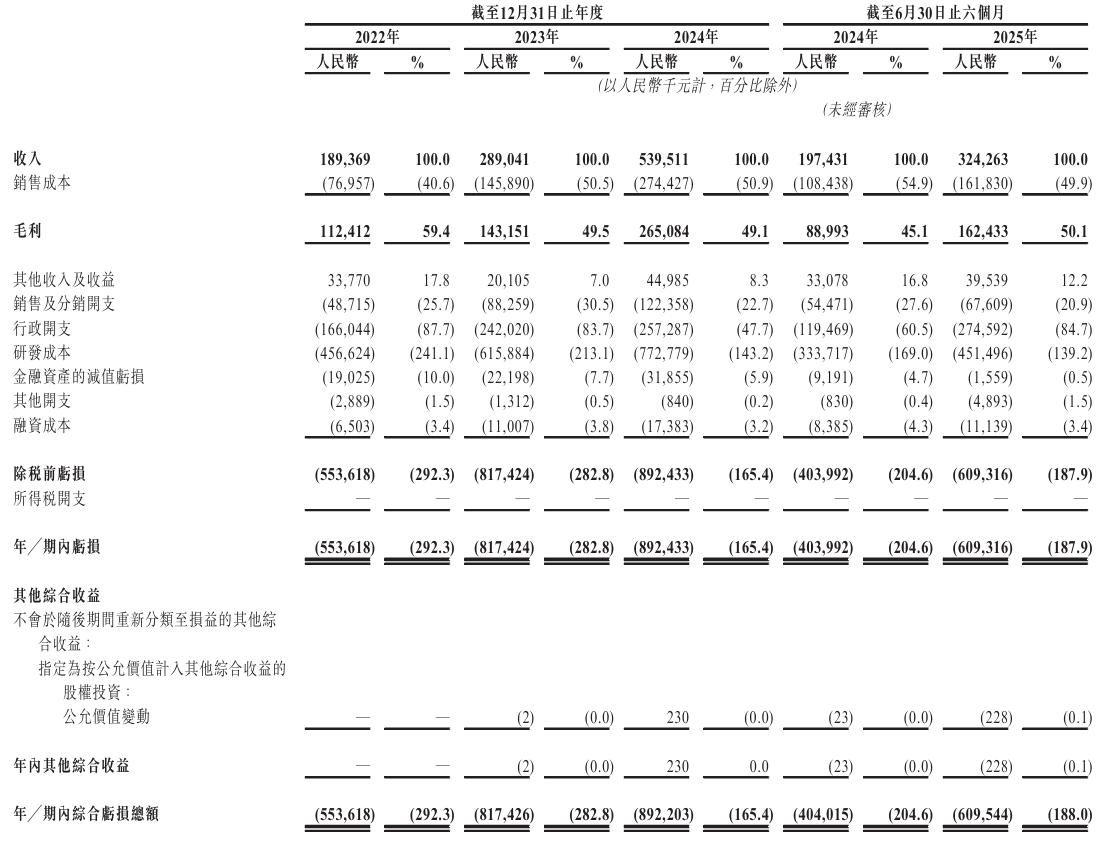

However, it's crucial to note that Iluvatar CoreX has been mired in significant losses for an extended period. From 2022 to 2024, its net losses were RMB 554 million, RMB 817 million, and RMB 892 million, respectively, further widening to RMB 610 million in the first half of 2025. Not only has it accumulated nearly RMB 2.9 billion in losses over three and a half years, but it also exhibits a trend of 'increasing sales but worsening losses'.

Although domestic GPU companies are generally in an investment phase, among the 'Four Little Dragons of Domestic GPUs', only Iluvatar CoreX and Biren Technology (06082.HK) have found themselves in the situation of 'increasing revenue but decreasing profits'. In the first half of 2025, Biren Technology's revenue was RMB 58.903 million, a year-on-year increase of 49.9%, but its net loss widened by approximately 80% to RMB 1.601 billion.

In comparison, although Moore Threads (688795.SH) has not achieved break-even, its revenue of RMB 702 million in the first half of 2025 exceeded the sum of the previous three years, with its net loss narrowing to RMB 271 million. MetaX Technologies (688802.SH) also achieved significant revenue growth of over 400%, with its net loss decreasing by 63.7% year-on-year to RMB 186 million.

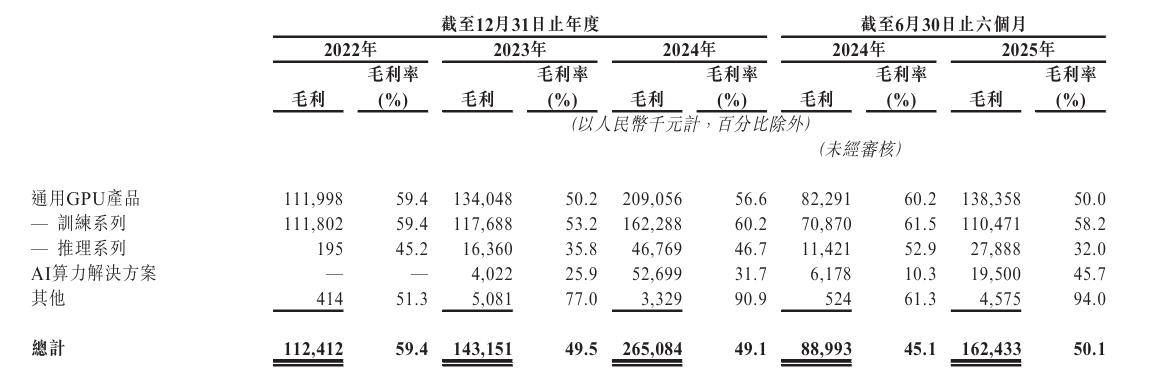

Furthermore, due to the increasing proportion of low-margin AI computing solution business and the decline in gross margins of general-purpose GPU products caused by new product iterations and pricing strategy adjustments, Iluvatar CoreX's gross margin has dropped from 59.4% in 2022 to 50.1% in the first half of 2025. The commercialization path under the impact of peer competition will be more challenging.

III. R&D Drives Up Costs, Balancing Technology and Commerce Remains a Hurdle

Regarding past losses, Iluvatar CoreX explained that the main reasons lie in the characteristics of the AI chip and general-purpose GPU market, which involve substantial upfront investment and a long product commercialization cycle. This is specifically reflected in significant upfront investment in R&D projects, limited scale benefits, the early stage of the commercialization phase, and substantial sales costs and operating expenses.

From 2022 to 2024 and the first half of 2025, Iluvatar CoreX's R&D expenditures were RMB 457 million, RMB 616 million, RMB 773 million, and RMB 451 million, respectively, accounting for as high as 241.1%, 213.1%, 143.2%, and 139.2% of its revenue in the same periods, with cumulative R&D investment of nearly RMB 2.3 billion over three and a half years.

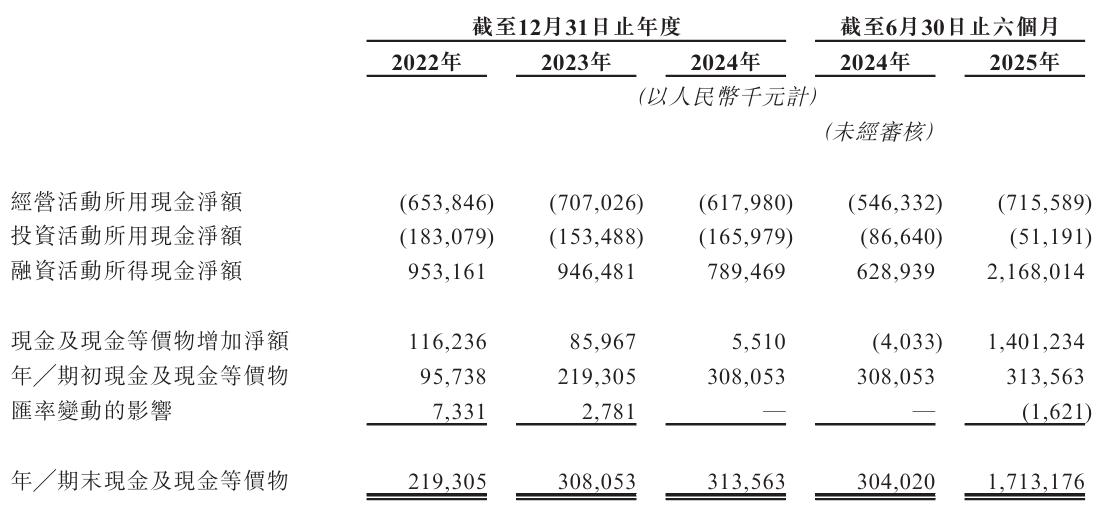

The substantial and sustained R&D investment, coupled with the appreciation growth of prepayments, inventory, and receivables, has directly resulted in Iluvatar CoreX's operating cash flow remaining in a net outflow state for an extended period. During the reporting period, the cumulative outflow of funds exceeded RMB 2.5 billion, forcing the company to rely on external financing to support its daily operations.

Since its inception, Iluvatar CoreX has completed a total of seven rounds of financing, raising over RMB 5 billion in total. Its investors include prominent institutions such as Centurium Capital, Yunbo Capital, and Sequoia Capital China. Prior to completing its Series D+ financing in June 2025, the company's pre-money valuation had already reached RMB 12 billion.

It's important to note that Iluvatar CoreX admitted in its prospectus (global offering draft) that due to the rise in share-based compensation expenses and continued investment in new product R&D, its net loss for 2025 is expected to increase significantly, and it has not disclosed a specific timeline for achieving profitability.

It's worth mentioning that MetaX Technologies and Moore Threads had previously predicted their profitability timelines. MetaX Technologies expects to achieve break-even as early as 2026, while Moore Threads anticipates profitability as early as 2027. Both companies were established later than Iluvatar CoreX, which has sparked market attention and discussions regarding its profitability prospects.

Undeniably, after going public, Iluvatar CoreX is expected to alleviate its financial pressure through capital replenishment. However, amidst fierce market competition and intensive R&D investment among domestic startups, whether it can achieve a dual leap in technological breakthroughs and commercial closures through its capital platform remains to be seen over time.