Hong Kong Stock Exchange's First AI Large Model Stock: The Duel Between Zhipu and MiniMax

![]() 01/05 2026

01/05 2026

![]() 525

525

Introduction: Two distinct paths to commercialization have drawn the attention of the same group of investors.

As 2026 dawned, the Chinese AI large model sector marked a significant milestone with Zhipu (2513.HK) and MiniMax (0100.HK, Xiyu Technology) gearing up for their listings on the Hong Kong Stock Exchange. As leading AI unicorns in China, these two firms have not only secured over 10 billion yuan in funding but also captured widespread interest from the capital market.

According to their prospectuses, MiniMax has raised over $1.5 billion (approximately 10.8 billion yuan) in cumulative financing, while Zhipu has garnered over 8.3 billion yuan. Both companies rank at the forefront in terms of AI sector financing. Additionally, MiniMax's IPO valuation stands at approximately HK$46.1-50.4 billion, whereas Zhipu AI's valuation is around HK$51.1 billion. Both valuations are in the same ballpark, reflecting the market's optimistic outlook on the future of AI.

Not only are their valuation scales similar, but both companies have also attracted top-tier investment institutions such as Alibaba, Tencent, Hillhouse Capital, and IDG Capital.

However, MiniMax is focusing on C-end (consumer-end) multimodal AI products, while Zhipu has opted for a B-end (business-end) open-source plus API calling strategy, resulting in starkly different commercialization approaches.

Currently, both companies are in a phase of heavy investment and significant losses, with uncertain timelines for profitability. After listing on the Hong Kong Stock Exchange, which one will realize its commercialization goals more swiftly?

01 Who Has a Clearer Market Position?

According to the prospectuses of the two companies, Zhipu positions itself as the 'national team + industrial mainstay.' Based on 2024 revenue, it ranks first among independent general-purpose large model developers in the domestic market and second among all general-purpose large model developers, with a market share of 6.6%. Its client base predominantly consists of institutional clients, emphasizing a strong B-to-B focus.

Zhipu claims to be the first domestic pre-trained large model framework and ranks first globally in GLM-4.6 coding capabilities (as ranked by CodeArena in November 2025, the latest globally recognized assessment platform).

As of June 30, 2025, Zhipu's models have supported over 8,000 institutional clients, and as of the last practical date, they have powered approximately 80 million devices.

If Zhipu has been elevated to a core player position by 'industry consensus,' MiniMax appears to still be in the stage of 'proving its identity.'

The most notable difference is that MiniMax lags behind Zhipu in industry rankings and market share. MiniMax claims to be the world's tenth-largest large model technology company, with a market share of 0.3%, but does not disclose its domestic ranking. Additionally, MiniMax states that based on model-based revenue in 2024, it is the world's fourth-largest pure-play large model technology company.

Furthermore, MiniMax resembles more of a 'product-oriented startup,' offering AI-native products primarily targeting individual users and 'open platforms and other AI-based enterprise services' mainly for enterprise clients and developers.

Among these, AI-native products generate revenue primarily through subscription services for applications such as MiniMax (large language model), MiniMax Voice (audio generation), Hailuo AI (video generation), and Talkie (for international markets)/Xingye (for domestic markets).

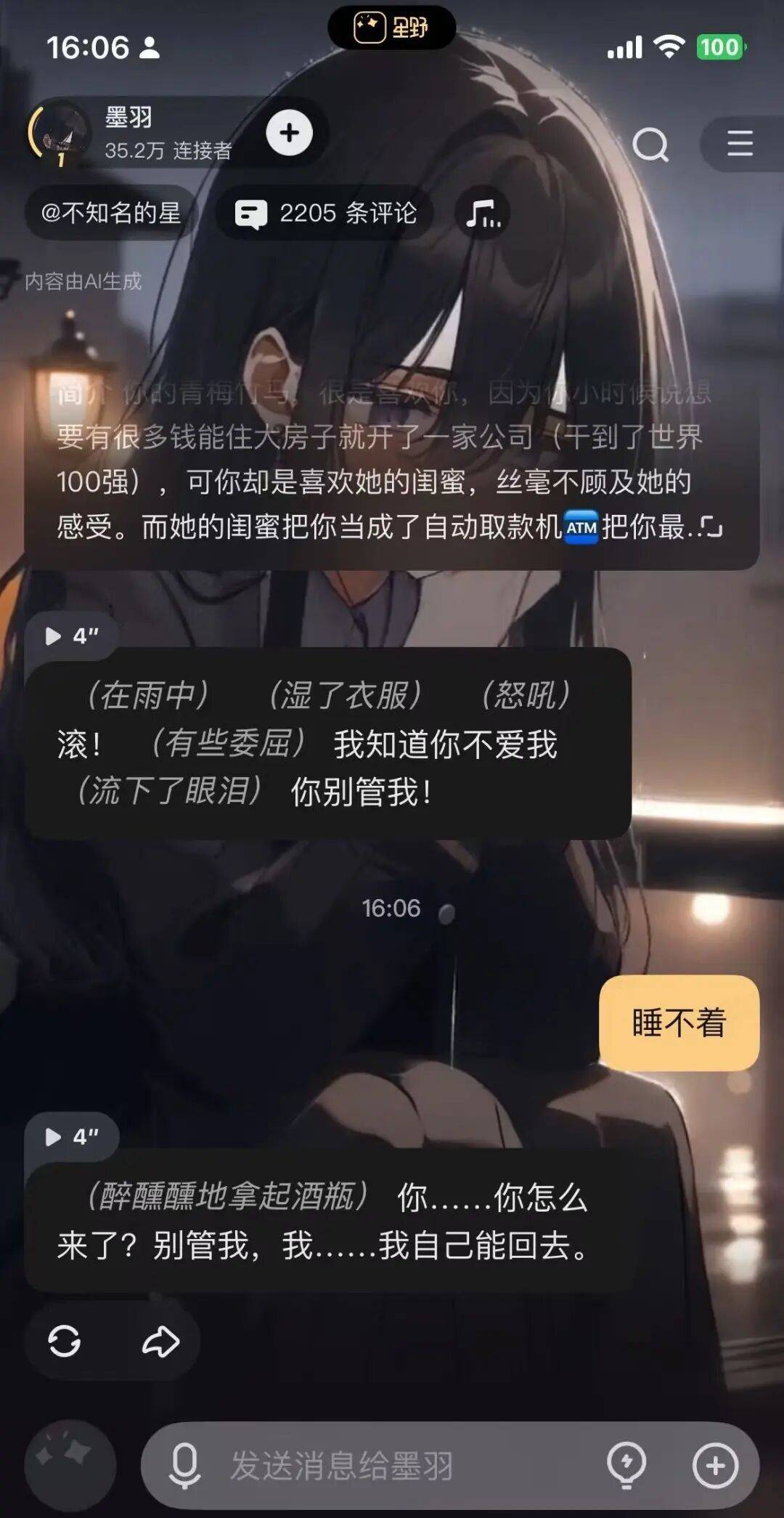

The author personally experienced Xingye and found it to resemble more of a 'large language model with a skin.' According to MiniMax, it is 'powered by the company's self-developed AI models, enabling users to interact with AI agents or virtual characters to evoke emotions.'

Its main feature is that users can create a virtual character and set up various interaction scenarios, such as caring, accompanying, soothing to sleep, waking up, arguing, apologizing, etc. Many users enjoy chatting and interacting with virtual characters created by other users. Of course, Xingye also has a community interaction channel where users can post updates, comments, etc.

Source: Xingye Interactive Interface

However, on the App Store, numerous users report that Xingye has started limiting chat times, requiring payment to lift the restriction. Additionally, Xingye has set a large number of sensitive words, leading some users to complain that Xingye has become 'overly sensitive,' unable to send even ordinary words.

As of September 30, 2025, MiniMax's AI-native products have served over 200 million individual users from more than 200 countries and regions, as well as over 100,000 enterprises and developers from more than 100 countries and regions.

In fact, Zhipu's AI products also encompass large language models, video generation, image generation, and audio processing. Moreover, Zhipu has developed its own AI agent: AutoGLM — Rumination ('think while doing'), an autonomous task completion agent with deep thinking capabilities that can directly take over your computer.

02 Faster Revenue Growth vs. More Stable Revenue

In terms of revenue quality, Zhipu resembles more of a 'seller of computing power and models,' while MiniMax appears to be a 'seller of application stories.'

Zhipu's revenue was 312 million yuan in 2024 and 191 million yuan in the first half of 2025, with a declining customer concentration. The share of its top five clients dropped from 61.5% to 40%, clarifying its B-to-B + MaaS (Model as a Service) path.

MiniMax's revenue was $30.523 million in 2024 and $53.437 million in the first nine months of 2025 (with significant fluctuations). Its To C products have a large user base, with AI-native products contributing over 71% of its revenue.

MiniMax 'appears to be growing faster,' but Zhipu's revenue is more predictable and easier to price by the capital market.

In comparison, MiniMax's revenue growth is more rapid (782% year-over-year in 2024), but its absolute scale is still smaller than Zhipu's. Although Zhipu's growth is slower (a compound annual growth rate of 130% from 2022 to 2024), it has established a larger revenue base.

MiniMax resembles more of a 'Silicon Valley-style extreme bet,' but in the context of the Hong Kong Stock Exchange, Chinese regulation, and the computing power environment, risks need to be closely monitored.

Both companies are currently in the early loss-making stage. MiniMax reported a net loss of $465 million in 2024 and $512 million in the first nine months of 2025. Its R&D expenses were approximately $189 million in 2024, and its operating cash flow continued to experience significant outflows.

Zhipu, on the other hand, has sustained losses during the reporting period, but the scale is significantly smaller than MiniMax's. Its main funds are used for R&D computing power and model iteration, but it already has a clear revenue expansion path to support it. Zhipu resembles more of a company that 'has not yet reached the profit inflection point' rather than one that 'cannot see the inflection point.'

MiniMax has larger dollar-denominated losses but holds more cash reserves, indicating stronger cash sustainability.

Additionally, MiniMax faces intellectual property lawsuits: it has been sued by Disney and others. According to MiniMax's prospectus, in the worst-case scenario, it may need to compensate approximately 500 million yuan. Furthermore, MiniMax has a substantial amount of redeemable convertible debt, and once its To C products decline, its valuation logic will need to be rebuilt.

Zhipu has no major intellectual property disputes and has not been placed on any entity lists, indicating a relatively favorable policy environment.

03 High Capital Concentration in the AI Sector

Although MiniMax and Zhipu AI are both in the large model sector, their market strategies are vastly different: MiniMax bets on C-end blockbuster products, while Zhipu AI chooses a B-end ecosystem construction path. The differences in their commercialization paths determine that their investment logic and risk assessment dimensions are completely different.

In terms of commercialization, MiniMax bets on C-end blockbuster products, creating consumer-facing blockbuster applications in short video, gaming, and film and television production through multimodal AI technology. This business model is similar to that of internet companies, achieving commercialization through rapid product iteration and user growth.

Zhipu, on the other hand, chooses a B-end ecosystem construction path, attracting developers through open-source models and then achieving commercialization through API calls. This model is similar to the 'free + paid' strategy of cloud computing platforms, first establishing a market position through open-source and then gradually guiding enterprise users to pay for usage.

Interestingly, both companies have attracted a highly overlapping group of top-tier investment institutions, particularly core players in the AI sector such as Alibaba, Tencent, Hillhouse Capital, and IDG Capital, indicating a high level of capital concentration in China's AI large model sector.

However, MiniMax has attracted more international capital (such as sovereign wealth funds like the Abu Dhabi Investment Authority and Aspex, as well as international asset management institutions), which may be related to its global layout strategy and technological leadership.

Zhipu, on the other hand, has received more support from domestic internet giants (Meituan, Xiaomi, Ant Group) and local government state-owned assets (Chengdu High-Tech Zone, Pudong Venture Capital, etc.), reflecting its advantages in industrial application scenarios and policy resources.

Both companies saw accelerated financing in 2023-2024. MiniMax completed its Series C and cornerstone investment rounds in 2024, while Zhipu AI completed at least four rounds of financing (B3-B6) in 2024 and multiple rounds of strategic financing in March 2025.

MiniMax's financing has shown a clear acceleration trend, taking only three years from the angel round to Series C, but with rapidly increasing financing amounts and valuations. Its Series B financing of $600 million was led by Alibaba, marking the internet giants' bet on the AI large model sector. Series C introduced the Shanghai State-Owned Asset Mother Fund. The 2025 cornerstone investment round attracted subscriptions from 14 institutions, including sovereign wealth funds like the Abu Dhabi Investment Authority, reflecting international capital's recognition of China's AI unicorns.

Zhipu's financing history, on the other hand, exhibits a 'Tsinghua-affiliated + industrial capital + state-owned assets' triple structure. Early financing was led by Tsinghua University Asset Management and Zhongke Chuangxing, reflecting support for the commercialization of university scientific and technological achievements. After 2023, the financing pace significantly accelerated, with internet giants like Meituan, Alibaba, Tencent, and Xiaomi getting involved, indicating recognition of Zhipu AI's value in industrial application scenarios. After 2024, state-owned capital (Beijing State-Owned Assets, Chengdu High-Tech Zone, Pudong Venture Capital, etc.) continued to increase its bets, reflecting local governments' emphasis on the strategic position of the AI large model industry.

From the perspective of offering prices, although the financial thresholds for Zhipu and MiniMax are in the same order of magnitude (HK$110,000-160,000), the true investment thresholds are more reflected in cognitive depth and risk tolerance:

MiniMax is more suitable for investors who understand the logic of internet-style AI products, are optimistic about C-end AI commercialization, and can tolerate high valuation fluctuations. Zhipu, on the other hand, may be more suitable for investors who agree with the open-source ecosystem model, are optimistic about the B-end AI market, and can accept long-term losses in exchange for market position.

Disclaimer: The above content is for reference only and does not constitute any investment advice. The market is risky, and investment should be cautious. Investors are advised to make decisions based on their own circumstances and under the guidance of professional investment advisors.