Burning Cash, Clashing Forces, and the Survival Round: Are Horizon and Momenta Headed to the Finals?

![]() 01/05 2026

01/05 2026

![]() 556

556

Text by Guo Jiage, Edited by Zhang Xiao

The realm of intelligent driving has reached a pivotal turning point.

For the past several years, intelligent driving has been touted as a premium selling point for high-end vehicles. However, as penetration rates surge into the mainstream, the industry's focus has shifted from theoretical potential showcased in PowerPoint presentations to real-world delivery and scalability. The ultimate competitive edge now hinges on whether intelligent driving can become affordable and widely used by the masses.

Late last year, Horizon held its first Technical Ecology Conference in a decade. At the event, Horizon's founder and CEO, Yu Kai, set an ambitious new target: cars priced at 100,000 yuan will commonly feature urban Navigation on Autopilot (NOA).

Earlier, at the start of the previous year, Momenta's founder, Cao Xudong, also declared that high-level intelligent driving would achieve scale by 2025 and penetrate the 100,000-yuan market by 2026.

Internally, this reflects a further squeeze on technology and costs; externally, it signifies an active embrace of a more inclusive, large-scale market.

In reality, when it comes to capability delegation, it's not just complete vehicle manufacturers that shoulder the engineering complexity, cost pressures, and delivery responsibilities.

Horizon and Momenta embody a crucial yet underappreciated segment of the intelligent driving supply chain: Horizon leverages automotive-grade chips and toolchains to establish replicable mass production capabilities through integrated software and hardware solutions; Momenta adopts a progressive, iterative approach driven by algorithms and data, forging deep ties with automakers to drive the widespread deployment of high-level solutions.

Their roles extend beyond mere technology providers; they are pivotal forces driving the democratization of intelligent driving.

If past industry competition resembled a shouting match to flaunt strength, then since 2025, intelligent driving has truly entered the deep waters of cost efficiency, reliability, and delivery capabilities. The stability of a supplier's position and the sustainability of its model will directly influence the pace of intelligent driving's adoption and its capability boundaries.

The industry has never doubted the future trajectory of intelligent driving, but in this new era dominated by mass production, the focus has shifted to who can truly support the widespread deployment of intelligent technologies.

01

Suppliers Take Center Stage

To the average consumer, when it comes to intelligent driving, the conversation often revolves around Huawei, BYD, Li Auto, and XPENG. Yet, just as everyone knows that it's not Seres but Hongmeng Intelligent Driving that powers AITO's intelligent driving capabilities, the technological foundation of intelligent driving is not independently crafted by automakers but supported by a complex supply chain spanning chips, algorithms, and engineering delivery.

Traditionally, the division of labor in intelligent driving systems has been relatively clear: OEMs (automakers) define requirements and handle vehicle integration; Tier 1 suppliers act as general contractors, providing complete control systems; algorithm companies offer perception and decision-making capabilities; and chip manufacturers supply the computational power foundation.

From a channel perspective, this has been a hierarchically structured serial link: automakers select general contractors, who then partner with an algorithm company, which in turn relies on chip adaptation.

This system functioned effectively during the L2 era, where functions were optional, cost-sensitive, and supply efficiency was prioritized. However, as intelligent driving begins to penetrate on a large scale and structurally, becoming a key driver for sales and brand momentum, this link is rapidly 'de-linearizing.'

When competition shifts from 'can it be done' to 'how well it is done,' pricing strategies also transition from hardware costs to experience and scalability capabilities.

Consequently, the entire industry is undergoing a period of ecological reconstruction.

Algorithm and chip companies have begun to directly establish capabilities facing automakers. Some algorithm companies have penetrated upstream, mastering core experience differentiation through self-developed software and data closures; chip companies extend downstream, directly participating in solution deployment through software-hardware integration. Tier 1 suppliers are no longer irreplaceable 'general contractors,' and the supply relationship has shifted from serial to multi-center collaboration.

Moreover, to seize experience advantages and cost flexibility, more and more OEMs are opting to self-research key modules or even develop their own chips.

However, true full-stack self-research demands an extremely high threshold, requiring a vast number of deployment scenarios and long-term iterative accumulation. Thus, self-research and supply cooperation coexist: those capable of self-research differentiate, those unable continue to purchase, and partners capable of software-hardware synergy become preferred.

This implies that suppliers are not just vendors but co-achievers. Intelligent driving must be delivered on a large scale across different vehicles to accelerate data return and algorithm iteration. Players with scalable capabilities and vehicle-end deployment experience truly hold value.

Against this backdrop, a select few intelligent driving companies with systemic capabilities have emerged as core nodes in the ecosystem. The companies truly powering intelligent driving from behind the scenes are stepping onto the stage and growing stronger.

Within the industry, there's a saying about the top domestic suppliers: 'Hua, Da, Di, Mo,' referring to Huawei, Zhoyu Technology (formerly DJI Automotive), Horizon, and Momenta. In recent years, companies like Qcraft and Rongxing have also gained momentum, all possessing full-stack R&D capabilities and scalable mass production strength, albeit with varying technical routes and market positioning.

Figure/Euro Intelligence Research Institute

Figure/Euro Intelligence Research Institute

Therefore, the competition focus in the intelligent driving industry is shifting from automakers and brands to the supply chain system: who can support the scalable deployment of high-level intelligent driving? Who can ensure a stable experience and controllable costs? Who can truly form delivery capabilities and technological reuse? These answers will not be reflected in the car's front logo but hidden within the supply chain.

02

Divergent Paths, Staggered Competition?

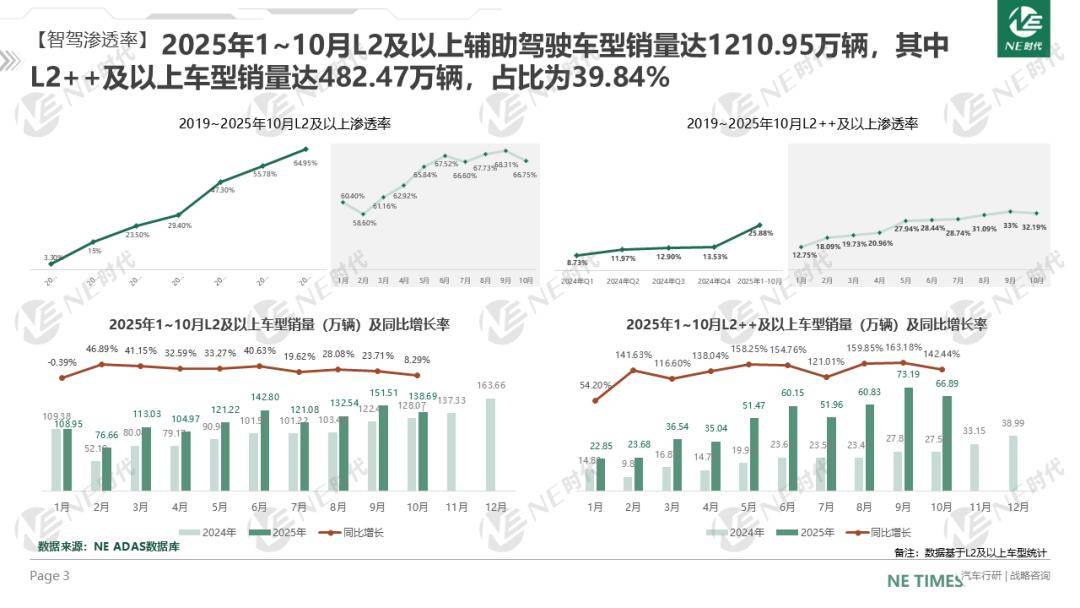

If the past five years are viewed as a technical preparation phase for intelligent driving, then starting in 2025, the industry has entered a true scalability competition. According to NE Times data, the penetration rate of L2 and above assisted driving reached 65% from January to October 2025, meaning that out of every 10 new cars sold, more than 6 possess basic intelligent driving capabilities.

Figure/NE Times New Energy

Figure/NE Times New Energy

This shift poses vastly different challenges for various types of suppliers: chip drivers must demonstrate that their general capabilities can be replicated across more models at sufficiently low costs; algorithm drivers must ensure that their technological iteration speed can keep pace with the scale pressure of scenario expansion.

Horizon and Momenta are representative players on these two distinct paths.

In the past, integrating intelligent driving solutions into vehicles resembled a multi-layer subcontracting collaboration: algorithm companies relied on Tier 1s, and chip manufacturers were categorized as further downstream Tier 2s. Any instability in these links could result in wasted computational power, hindered functional updates, and uncontrollable costs.

As intelligent driving begins to land on a large scale, both automakers and suppliers need to ensure that solutions can run stably and replicably on more models. At this juncture, the significance of software-hardware synergy is rapidly amplified.

This explains the logic behind Horizon's ascent.

Global automotive-grade AI chips have long been dominated by overseas giants. Horizon entered the market with self-developed chips as its foundation, becoming the first in China to achieve a scalable alternative solution; simultaneously, it is not a traditional chip company—its BPU architecture and toolchains were designed for intelligent driving from the outset.

Since 2024, Horizon's strategic adjustment has been clear: no longer solely emphasizing chip technology indicators but directly influencing terminal deployment through software-hardware integration capabilities.

Solutions based on the Journey series chips have accelerated mass production. Since the release of the Journey 6P chip, boasting the highest computational power to date, and the HSD (High-Level Driving Assistance Solution) in April of the previous year, only seven months later, HSD has been commercially deployed in the Chang'an Shenlan L07 and Chery Exeed ET5. In just two weeks, the number of HSD activations reached 12,000.

As HSD enters the scale delivery stage in more automakers' urban NOA projects, it also signifies that hardware general capabilities and algorithm portability are gradually being validated.

In other words, in the most cost and engineering-intensive field of intelligent driving, Horizon attempts to provide automakers with 'an easier path to success' through deep integration of chips and algorithms.

At the recent conference, Yu Kai also revealed that the performance of Horizon's Journey 6P has caught up with the current computational power of Tesla's main chip, and the upcoming Journey 7 series chip, equipped with the fourth-generation BPU architecture Riemann, will match the computational power of Tesla's next-generation AI chip and be launched simultaneously.

Horizon emphasizes systematic capabilities, while Momenta places greater emphasis on evolution speed.

Unlike Horizon's path, Momenta's foundational capability stems from continuous closed-loop optimization of data. Thus, its model depends more on the mass production scale and urban coverage progress of partner automakers.

Since last year, Momenta has completed two rounds of financing, C12 and C13, with the C13 round valuation reaching 6 billion USD.

Currently, Momenta has collaborated with global mainstream automakers on over 160 models, with deployed vehicles exceeding 500,000. Besides independent automakers, Momenta has secured numerous orders from multinational automakers, partnering with all three German luxury brands (BBA) and establishing relationships with General Motors, Toyota, Honda, etc.

With new model launches and urban expansions, the efficiency of autonomous driving data recovery and model training has improved, significantly shortening the iteration cycle of urban NOA capabilities.

However, the algorithm-driven approach also faces unique challenges. On the one hand, end-to-end models require high data scale and annotation quality, necessitating deep data sharing and model iteration mechanisms with automakers; on the other hand, as hardware costs continue to decline and integration methods become more diverse, whether algorithm advantages can be sustained in lower price ranges becomes key to scalable deployment.

In terms of overall architecture, Momenta emphasizes co-defining product metrics with automakers rather than just providing a 'toolbox.' However, this strong collaborative relationship also makes Momenta more sensitive to partnership rhythms. When automakers' confidence in self-research increases or supply chains adjust, its market coverage requires continuous effort.

In a sense, with the arrival of the scalable mass production era, both companies are moving towards establishing a positive scalability cycle: stable functionality -> increased deployment -> data growth -> enhanced capabilities -> reduced costs.

In this process, the power structure of the supply chain is quietly changing: from individual delivery orders to long-term bindings co-building capabilities with automakers.

When suppliers transition from deliverers to co-developers, although their technological routes differ, their industrial positions are simultaneously elevated. It can be said that before the true acceleration of urban NOA popularization, Horizon and Momenta have long become unavoidable forces on this track.

03

As Boundaries Blur, Do Horizon and Momenta Accelerate Invasion into Each Other's Territories?

If competition in intelligent driving over the past few years has primarily focused on highway scenarios, the number of functional points, and demonstration effects, what truly transforms the supply chain landscape is the entry of urban NOA into the mass production window.

The reason is straightforward. Early NOA primarily concentrated on highway scenarios, achieving functions like lane keeping, automatic following, ramp entry/exit, and automatic lane changing—essentially point-to-point highway assisted driving.

In contrast, urban NOA demands full-process autonomous driving in complex intersections, traffic lights, unstructured lanes, and dynamic traffic environments, posing systemic upgrades to algorithmic scene understanding, redundant safety strategies, computational platforms, and supply chain synergy capabilities.

For intelligent driving suppliers, this is not just a leap in technological capabilities but also a turning point in commercial value: those who can be the first to mass-produce and cover mainstream models will become core players in the supply chain, directly influencing bargaining power and market share with automakers, marking a crucial transition from conceptual verification to large-scale deployment.

It is precisely at this juncture that the business boundaries of Horizon and Momenta begin to significantly overlap.

For an extended period, Momenta has enjoyed a first - mover advantage in the urban NOA (Navigate on Autopilot) market. Leveraging its early algorithmic deployment and in - depth collaboration with multiple OEMs (Original Equipment Manufacturers), its urban assisted driving solutions have been deployed on a large scale across various car brands and models. This has resulted in significant installation volumes and a steady flow of data returns. Even now, this first - mover advantage still positions Momenta at the forefront in terms of current market share and market coverage.

However, Horizon's moves carry significant strategic importance in different phases. Although its chips had already been widely used in the L2 (Level 2 Autonomous Driving) market previously, its clear and rapid acceleration in entering the urban NOA market as a "solution provider" only gained momentum in the second half of 2025. With the mass - production deployment of Horizon's HSD urban assisted driving system in Chery Exeed brand models, it becomes evident that both companies are now addressing the same challenge: how to introduce urban NOA into larger - scale mainstream models while keeping costs under control.

From the perspective of target markets, their strategic directions are highly aligned. Whether it's Horizon's proposal of "enabling urban NOA in 100,000 - yuan models" or Momenta's prediction that "high - level intelligent driving will reach the 100,000 - yuan price range by 2026", both are targeting the same emerging market segment. This is a mass market that is highly sensitive to intelligent features but extremely cost - conscious.

In the market for models priced between 200,000 and 300,000 yuan, intelligent driving has long been part of an ecosystem. In this ecosystem, automakers have sufficient budgets and strong intentions for in - house research and development. Suppliers are more diversified, and intelligent driving capabilities are often seen as a means of brand differentiation. However, in the 100,000 - yuan price range, the situation is entirely different. Cost, delivery stability, and the ability to scale up and replicate solutions become the top priorities. Automakers in this segment rely heavily on external suppliers, and typically, each OEM works with only 1 - 2 core intelligent driving partners.

When Horizon and Momenta are placed side by side in the same solution comparison table, just as Cao Xudong said, "The competition in the automotive assisted driving market will conclude in 2026, with only three domestic players emerging as winners."

Whether they can become that "one - third" will determine who can advance to the next stage of the industrial competition.

Apart from Huawei's solutions, another key advantage that Horizon currently holds is its unique ecological position in the domestic chip market. Against the backdrop of the escalating Sino - US technological competition, when automakers are choosing computational platforms, they have to consider not only performance and cost but also supply security and long - term sustainability. For many OEMs, besides NVIDIA, Horizon is almost the only viable option for scalable mass - production chips.

However, this advantage is not yet strong enough to create an absolute competitive barrier.

As early as the end of 2023, Momenta established a chip subsidiary named Xinxin Hangtu and began to explore a software - hardware integration route, targeting NVIDIA's Orin N and Horizon's Journey 6E chips. According to 36kr, the first - generation assisted driving chip (codenamed BMC) has already started on - board testing, with mass production and on - board deployment expected in 2026. At that point, Momenta will directly compete with Horizon.

The more challenging reality is that as the level of intelligent driving solutions continues to improve, the demand for computing power keeps rising. In the short term, the cost of high - performance automotive - grade chips will continue to increase. To better control costs and manage the pace of system development in the long run, an increasing number of leading automakers are starting to explore the development of in - house intelligent driving chips.

Since 2023, NIO, Geely, and XPENG have all successfully completed the tape - out of their self - developed intelligent driving chips. Projects from Li Auto and BYD are also in progress. For these automakers with large shipment volumes, in - house chip development is no longer just a technological exploration but a practical way to manage costs.

This also means that in addition to facing direct competition from Momenta, Horizon Robotics has to deal with the long - term pressure arising from the growing autonomy of automakers.

It is foreseeable that as the boundaries between software and hardware continue to blur, the competition among intelligent driving suppliers is becoming more balanced. It is no longer a mismatched situation where "you make chips and I make algorithms", but rather a head - to - head competition centered around the same models and market segments.

The battle for dominance in urban NOA may well serve as the most critical prelude to the knockout phase in the intelligent driving supply chain.

04

Intensifying Knockout Phase: Who Will Come Out on Top?

Despite the accelerating adoption of intelligent driving technologies, the commercial environment for intelligent driving suppliers remains far from favorable.

There is an industry consensus that the Matthew Effect is starting to accelerate. Automakers are no longer blindly experimenting with different suppliers. Instead, they tend to form core partnerships with a select few suppliers that have systematic capabilities. Orders, data, and capital are concentrating towards the leading players. This means that the survival space for mid - to - long - tail suppliers is significantly shrinking, and teams with leading technology but weak mass - production capabilities are being rapidly marginalized.

However, even for the leading players, the pressure has not subsided.

The most direct issue stems from the business model itself. Intelligent driving is characterized by high research and development (R&D) costs, high trial - and - error costs, and high engineering delivery costs. At the current stage, it is almost an industry - wide consensus that "high - end solutions don't sell in large volumes, while low - end solutions don't generate significant profits". High - end solutions have not yet entered the mainstream adoption phase and have long delivery cycles. Meanwhile, the prices for basic functions continue to be compressed, resulting in limited contribution per vehicle.

Financial reports show that Horizon Robotics' R&D expenditure reached 2.3 billion yuan in the first half of 2025. These expenditures have increased along with revenue growth, directly leading to an operating loss of 1.6 billion yuan during that period.

Figure/Horizon Robotics' Semi - Annual Report

Figure/Horizon Robotics' Semi - Annual Report

For manufacturers like Horizon Robotics, which have an integrated software - hardware engineering system, scaling up can help dilute costs. However, the pace of adoption still depends on the volume increase of automakers. For algorithm - driven companies like Momenta, enhancing capabilities is highly dependent on mass - production scale and user data feedback. As a result, commercial returns inevitably lag. As delivery volumes increase, Momenta's capital chain pressure will only intensify.

With the U.S. IPO application, originally scheduled for mid - 2024 and expired in June 2025, there were once rumors that Momenta might abandon its U.S. listing plans and switch to Hong Kong instead.

Momenta's urgent need to go public reflects, to some extent, a common trait in the industry - algorithm - driven companies require long - term capital to support R&D. Meanwhile, as Horizon Robotics' chip shipments grow, it must also continue to invest in software matching (software support) and compress hardware margins to stay competitive.

The second source of pressure comes from the fragility of competitive advantages.

On the surface, Horizon Robotics' integrated software - hardware approach and Momenta's data - driven model have both established short - term competitive barriers. However, fundamentally, both models remain heavily reliant on the "choices" of automakers. Against the backdrop of the increasing trend of in - house development among automakers, "you may be a partner today, but a replaceable option tomorrow". Unless suppliers can establish irreplaceability in terms of data, mass - delivery scale, or ecosystem binding, it will be difficult to guarantee long - term customer loyalty and bargaining power.

Compared to NVIDIA's integrated "software + chip + training cluster" system, what exactly constitutes the competitive advantage for domestic suppliers - absolute leadership in technological iteration or data monopoly driven by mass - production scale? The answer may not be clear yet.

As Cao Xudong once argued, he believes that this brutal knockout phase is expected to last one to two years, and the market landscape will stabilize after 2027.

This judgment points to a highly concentrated future. Industry competition is shifting from a race of "having the technology" to a contest of "scaling up", ultimately leading to a decisive battle over "ecosystem stability". Whether it will be a "winner - takes - all" scenario or a situation where a few giants and some regional players co - exist remains uncertain.

The ultimate goal of autonomous driving is still far off, but this knockout phase has already entered an accelerated stage. Only those who can survive the commercial downturn and navigate through technological cycles will be worthy of discussing the next round of growth.