The Acquisition of Manus: How Chinese Enterprises Are Undergoing Organizational-Level Transformations in Their Global Expansion

![]() 01/06 2026

01/06 2026

![]() 421

421

A Chinese founder, a Singaporean headquarters, a U.S. dollar-denominated capital structure, and standardized SaaS products—what Manus sold to Meta was not merely technology, but a passport to the "Global Enterprise Club."

While the market engages in endless debates over the $2 billion valuation, a more fundamental transformation is taking place: The core challenge for Chinese enterprises going global has shifted from market expansion to organizational capability reconstruction. What Manus sold to Meta transcends mere AI technology. Its true value lies in its radical self-reinvention, transforming from a Chinese-backed startup into a "standardized component" recognized and embraced by the global industrial system, thereby securing a coveted spot in the tech world's elite tier.

01┃Reconstruction: The First Step in Global Expansion

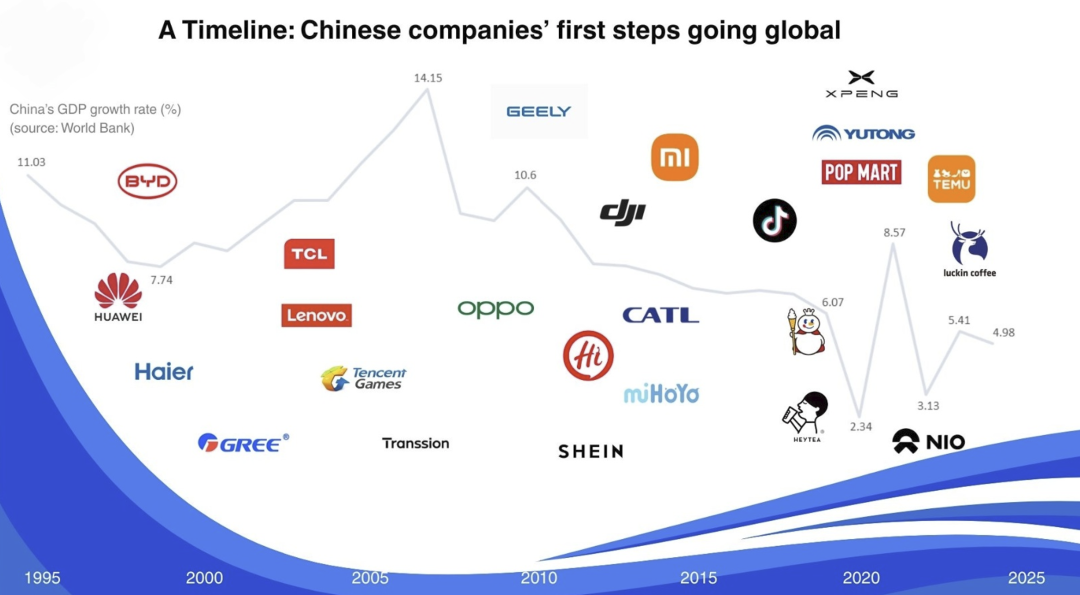

Over the past decade, the path of Chinese enterprises going global has undergone three distinct generational shifts: The first generation focused on trade, exporting Chinese-made products overseas; the second generation emphasized operations, establishing local teams and service systems abroad; now, the third generation, epitomized by Manus, prioritizes organizational reconstruction—redefining every facet of the company using global standards.

This reconstruction is not a gradual adjustment but a radical genetic overhaul. In product architecture, Manus abandoned the domestically prevalent customized solution model, opting instead to build standardized API interfaces and scalable SaaS products. This shift represents not just a technical choice but a fundamental reset in product philosophy—moving from catering to specific client needs to creating standardized tools that can be procured by global enterprises.

Financially, Manus established a clear subscription revenue and unit economic model within months, presenting a predictable, understandable profit path to global capital markets. While most AI companies were burning cash to acquire users, Manus demonstrated profitability from day one. Governance-wise, establishing a Singapore headquarters was not merely a change in registration but the creation of a full suite of internationally compliant decision-making processes, compliance systems, and information disclosure mechanisms.

The outcome of this comprehensive reconstruction: When Meta's M&A team reviewed Manus' due diligence files, they encountered not a "Chinese company" in need of transformation but a mature module capable of seamless integration into Meta's existing ecosystem.

02┃The "Standardized Component" Logic in Global M&A Markets

What exactly did Meta's $2 billion acquisition secure?

The key to Manus' high valuation lies in its success in transforming itself into a universal "standardized component" within the global tech industry. In global M&A markets, top buyers employ a clear and stringent evaluation framework for target companies: This includes technical integrability (whether their tech stack seamlessly aligns with the acquirer's existing systems), product standardization (whether it's an out-of-the-box SaaS solution or a heavily customized project), data compliance (whether data processing adheres to GDPR and other global standards), and team integrability (whether organizational culture can rapidly merge with the acquirer's).

Most globalizing companies meet only some of these criteria, whereas Manus chose to thoroughly reconstruct itself against all standards. This comprehensive transformation came at a high cost: sacrificing certain short-term market opportunities, investing heavily in global legal, financial, and compliance systems, and even altering internal decision-making mechanisms and culture. However, the rewards are substantial: Once a plug-and-play "standardized component," the company enters the core M&A radar of top tech giants. At this stage, valuation logic transcends simple revenue multiples, embodying crucial strategic positioning value. Meta's willingness to pay up to $2 billion essentially purchases a standardized module requiring no additional modification—one that can be directly integrated to create strategic synergy.

03┃From "Chinese Company" to "Global Asset"

Manus' path clearly outlines the complete model for the third stage of Chinese enterprise globalization: organizational-level globalization.

Unlike the first stage ("trade globalization"—selling products) and the second stage ("operational globalization"—building teams), the third stage's core action is systemic reconstruction according to universal standards of the global industrial system, aiming to become a high-value "standardized component" in the global supply or innovation chain.

Global reconstruction of capital structure by introducing international top-tier capital, which is not just about funding but securing global credit endorsement and networks. Platform-based reconstruction of product logic, shifting from solving specific problems to building foundational capabilities callable by ecosystems. SaaS-based reconstruction of delivery models, establishing globally scalable service systems. International reconstruction of compliance systems, proactively adapting to GDPR and other global rules. Diversified reconstruction of talent structures, building authentic global leadership and culture.

Completing reconstruction across these five dimensions means the enterprise has undergone "code conversion" from the inside out. Its output is no longer a "customized solution" requiring complex interpretation but a "standardized module" that global tech giants can plug and play with rapid evaluation. Its ultimate form is not a "Chinese company" with overseas operations but a "world-class enterprise asset" born in China but genetically global.

04┃M&A Is Not the Endpoint, But the Start of New Competition

As the Manus team begins a new chapter at Meta, a deeper question emerges.

While this acquisition validates a successful path of self-reconstruction to integrate into global core circles, it also sharply points to the future of innovation ecosystems. If the crowning achievement of a generation's most ambitious Chinese entrepreneurs repeatedly culminates in "being acquired by giants," we may be systematically sacrificing the potential to nurture the next independent global platform capable of challenging the existing tech order. Giants "outsource" cutting-edge innovation through capital, then "internalize" and integrate it via acquisitions; entrepreneurs, with remarkable efficiency, transform themselves into the most attractive M&A targets.

This mutually beneficial conspiracy inadvertently narrows the space for disruptive innovation. Meta's $2 billion, while writing a perfect finale for one team, may also have bought out a more ambitious future possibility. When acquisition becomes the universally recognized glory exit, are we moving closer to or farther from that innovative wilderness reminiscent of the Hundred Schools of Thought contending and grassroots entrepreneurship? This transcends commerce, becoming a profound inquiry into the diversity of technological civilization.