MiniMax vs. Zhipu: Who Leads the "Six Little Tigers" in the AI Race?

![]() 01/09 2026

01/09 2026

![]() 495

495

The first workweek of 2026 witnessed heightened activity in the large model market, with Zhipu and MiniMax seizing the moment to go public. Although Zhipu claimed the title of the "first large model stock," MiniMax's consumer-centric approach appeared more promising. Consequently, the market showed greater preference for MiniMax, which soared by 109.09% on its listing day, doubling its issue price and surpassing Zhipu's cumulative two-day gain. MiniMax's success in the consumer market directly highlights a significant difference between this generation's "Six Little Tigers" of large models and the previous "Four Little Dragons" of AI. The latter, led by SenseTime, exclusively targeted the business market, similar to Zhipu, which rushed to become the "first large model stock." The only two publicly listed companies in this sector, SenseTime and CloudWalk, have been incurring losses since their listings.

MiniMax Lists on the Hong Kong Stock Exchange

SenseTime has transitioned towards large models, with this segment accounting for nearly 80% of its revenue. In contrast, CloudWalk seems to be sticking to its visual technology roots. This doesn't bode well for Zhipu. This company, backed by numerous state-owned shareholders, resembles SenseTime of this wave. Moreover, this battle involves major players. Previously, image recognition made remarkable strides, yet hardly anyone anticipated AGI. The consumer market remained stagnant, and major players showed little interest. This time, with ChatGPT boasting 800 million monthly active users and Doubao surpassing 100 million daily active users, the emergence of universal apps has compelled almost all major players to respond.

Doubao Surpasses 100 Million Daily Active Users; MiniMax, with Hailuo and Xingye, Embraces New Trends. Yan Junjie, formerly SenseTime's vice president, deliberately chose a different path after venturing out, leading to the overseas consumer-focused MiniMax. While Hailuo's visual prowess partly stems from SenseTime's legacy, it's the virtual companion app Xingye, backed by MiHoYo, that generates revenue. The juxtaposition of MiniMax and Zhipu offers an intriguing comparison, revealing a commercial essence that transcends large models themselves: in today's fiercely competitive landscape, those with extensive social connections can embrace the business market, while those aiming to thrive in the consumer market must go global.

Cost Reduction or Price Increase?

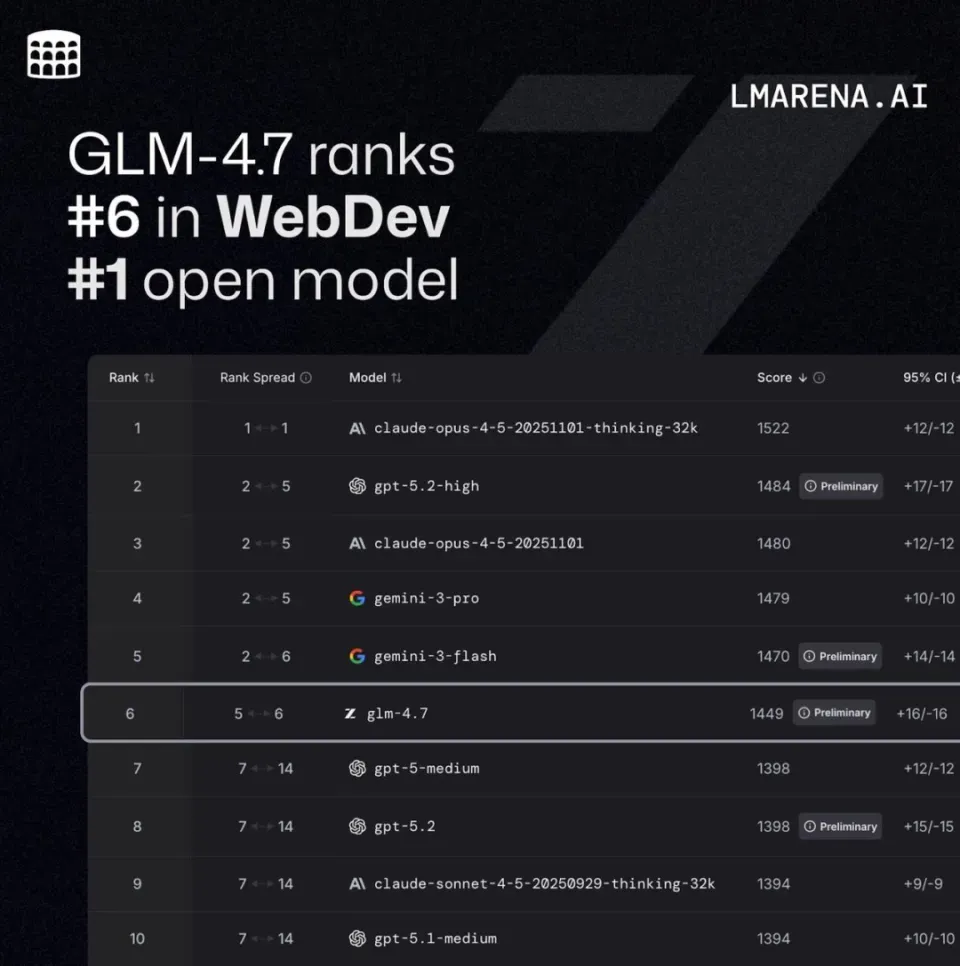

MiniMax remains a small team, with over 400 employees and only around 20 overseas. Despite weak overseas operations, its success lies in innovative content formats. TikTok's global triumph wasn't due to ByteDance's deep understanding of overseas cultures but rather the short video (short video) format. The same applies to MiniMax. Its revenue exceeding $50 million in the first nine months of last year indicates a willingness to pay overseas. The question now is whether costs can be contained. During a conversation with Luo Yonghao, Yan Junjie expressed hope for a future AI market with multiple players coexisting, as cost constraints will force each to make trade-offs in content generated by large models. Some will prioritize accuracy, while others will embrace creativity, but not both simultaneously.

MiniMax Founder Yan Junjie in Conversation with Luo Yonghao

Having worked with the same large models reveals a decline in the quality of many returned results. Especially for some second-tier large firms, the highest response quality often occurs at launch. Subsequently, bills shock responsible parties, leading to inevitable cost-cutting and quality degradation. Reducing quantity without lowering prices is one strategy; raising prices is another. Last August and September, domestic large model firms raised prices, partly in response to the "anti-inner roll" policy. Price hikes amid fierce competition indicate the prohibitively high usage costs of large models. Not just domestically, ChatGPT's Pro version costs $200, ten times its previous maximum of $20. Even two years ago, there were suggestions that the slow progress of the Scaling Law hadn't made the new GPT significantly superior to its predecessor, justifying the reluctance to set such high prices.

ChatGPT Subscription Prices

Following Yan Junjie's vision, specialized large models for the business and consumer markets will emerge. However, current mainstream players, even with MiniMax focusing on consumers and Zhipu on businesses, haven't abandoned the other market. MiniMax is preparing to target Southeast Asian enterprise clients, while Zhipu isn't overlooking the AI phone trend. Of course, these could be temporary strategies, potentially changing after securing high valuations through IPOs.

Where Are the Genuine Demands?

On its IPO debut, Zhipu's stock peaked at HK$135, a 16% gain. SenseTime, also business-focused, had an issue price of HK$3.85 and surged over 20% on its first day in December 2021. SenseTime's all-time high of HK$9.7 on January 4, 2022, was followed by a steady decline, briefly becoming a penny stock. Fortunately, the large language model boom provided a transformation (transformation) opportunity, maintaining its market value around HK$100 billion. Although Zhipu's standing among the "Little Tigers" may be lower than Kimi's, it pales compared to SenseTime's former glory. Even if large models represent a more revolutionary breakthrough than visual AI, considering China's fiercely competitive business market, Zhipu's performance may not surpass SenseTime's.

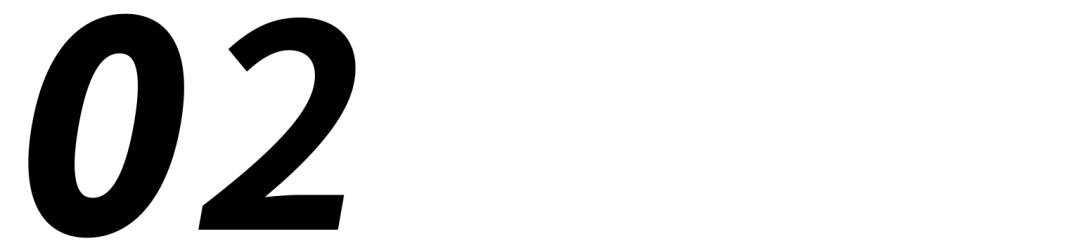

Zhipu's Flagship Model GLM-4.7 Ranks First in Open Source and Domestic Markets, Surpassing GPT-5.2

Shareholder relationships indeed serve as Zhipu's moat, but its major clients are less financially robust than SenseTime's were. Don't expect Zhipu to rival Anthropic. Beyond its moat, the domestic market is as competitive as the consumer market, with major clients seeking new revenue streams. Meanwhile, under the influence of massive investments by major players, hardware prices like servers have skyrocketed. Financially constrained clients facing a heated market may adopt a wait-and-see approach. Zhipu is also striving to transition to MaaS. However, the domestic market structure dictates that most demand remains for private deployments. Yan Junjie, who has SenseTime PTSD, excels in this regard, refusing private deployments. MiniMax's revenue comes from enterprise services, Xingye, and Hailuo, each contributing equally. Achieving profitability for these segments remains uncharted territory.

MiniMax Prospectus

Traditional internet consumer strategies—acquiring users first, then profiting—fail in large model applications lacking network effects. More users mean higher token consumption and escalating costs. Moreover, Xingye and Hailuo have different business models. Xingye is a virtual companion app, while Hailuo is a video productivity tool. Xingye's monthly active users peaked in the first half of last year and have since declined to two-thirds of their peak. This indicates that while Xingye was the first to generate revenue, it's unlikely to become the primary revenue stream. Fortunately, Hailuo also generates revenue, but copyright issues have arisen. iQIYI's domestic lawsuit is ongoing, and Disney, Universal Pictures, and Warner Bros have sued MiniMax in California, with potential damages reaching $75 million. Disney has exclusively embraced OpenAI, investing $1 billion.

Warner Bros Sues MiniMax for Using Copyrighted Character "Wonder Woman"

Domestic long-video platforms with copyrights either have backings from major players or have signed strategic cooperation agreements. Alibaba has integrated the Wanxiang 2.6 model into the Qianwen APP and launched AI applications on Youku. Tencent boasts numerous IPs from Reading articles (Yuewen) and gaming. iQIYI's 2022 cooperation with Douyin extended into the AI era... Without the ability to adapt IPs creatively, Hailuo's capabilities are limited. Even if possible, the cost may not attract small business clients. Moreover, major video platforms are tightening regulations to prevent harmful content from damaging their ecosystems. Currently, neither Zhipu nor MiniMax, the two pioneering "Little Tigers," can meet genuine demands, necessitating vigilance for when the wind subsides.

Source: Zhipu Official Website

Several years ago, central banks worldwide raised interest rates to combat inflation caused by monetary easing during the pandemic. However, this didn't lead to stock market adjustments. Under pressure from "the Donald," the Federal Reserve initiated a rate-cutting cycle, prolonging the bull market. The strength of US tech giants, exemplified by Oracle, is showing signs of fatigue. This year, a long-overdue adjustment may finally arrive. The capital frenzy surrounding Zhipu and MiniMax has enriched founder teams, state-owned entities, VC/PE firms, internet giants, and overseas funds. Will their stock prices follow SenseTime's trajectory? The common folk should wait for the tide to recede before drawing conclusions.