MiniMax Goes Public: Can 'Dopamine' Fuel Its 'AGI Ambition'?

![]() 01/09 2026

01/09 2026

![]() 531

531

The opening act of AI in 2026 arrived earlier and more dramatically than the market anticipated.

Zhipu AI, affiliated with 'Tsinghua School,' just went public, while the 'geek-oriented' Moonshot AI 'politely declined' an IPO with billions in cash on hand. MiniMax (Xiyu Technology), an 'outsider' that maintained a subtle sense of detachment amid the 'Hundred-Model War' and least resembled an AI company, has also submitted its answer sheet.

This is not just a capital market sprint but a violent correction of past AI business logic.

Over the past three years, we've grown accustomed to the OpenAI narrative: billions in funding, top-tier teams of thousands, and cost-ignoring compute stack-ups.

However, MiniMax's prospectus reveals another possibility to the market: Could extreme efficiency and excellent monetization capabilities be the true shortcuts to AGI (Artificial General Intelligence)?

From 'SenseTime PTSD' to Extreme Efficiency

In the AI startup circle, Yan Junjie defies easy labeling. He lacks the 'starry-eyed' evangelical aura of Yang Zhilin, nor does he have the deep academic resources backing Zhipu CEO Zhang Peng.

If forced to find a spiritual anchor, he resembles an 'extreme product manager with SenseTime PTSD,' attempting to chart a middle path between MiHoYo's romanticism and ByteDance's ruthlessness.

Yan Junjie, the former VP of SenseTime, accomplished a profound 'self-genetic recombination' through MiniMax. Instead of replicating his former employer's path, he veered toward its opposite, transforming MiniMax into a precisely engineered contradiction.

His tenure at SenseTime, the leader among the 'Four Little Dragons of AI,' may have instilled in him a rejection of traditional AI business models reliant on 'headcount stacking, paper churning, and custom projects.' This painful memory translated into a maniacal focus on human efficiency at MiniMax.

He created an environment of extreme youth and flatness: its 385 employees average just 29 years old. Management is shockingly young, with directors averaging 32. The organizational structure caps at three layers beneath the CEO, designed to eliminate bureaucratic bloat and information decay.

In 'Luo Yonghao's Crossroads,' Yan Junjie revealed the secret to efficiency: 'At MiniMax, AI is deeply integrated into workflows, with roughly 80% of programming code generated by AI. This isn't just AI assisting humans—it's AI and humans co-evolving and co-creating.'

This former SenseTime VP is attempting a profound 'self-genetic recombination' through MiniMax.

Since inception, MiniMax has spent approximately $500 million. For context, OpenAI has burned through $40–55 billion to date. In other words, MiniMax replicated a full-modality 'mini-giant' with roughly 1% of OpenAI's capital, achieving jaw-dropping capital efficiency.

This isn't mere 'cost-cutting' but a systemic tactical choice. Regarding capital allocation, MiniMax demonstrates astonishing restraint and precision: cash flow statements show that nearly all large outflows in investment activities went toward purchasing wealth management products (the vast majority of its $1.102 billion reserves are in wealth management and cash), rather than Crazy procurement (frantically purchasing) fixed assets like traditional tech firms.

This 'asset-light, model-heavy, high-human-efficiency' approach has made it a 'cash cow' in an AI industry prone to bleeding IPOs, boasting $1.102 billion in cash reserves sufficient to sustain 53 months of operations.

Fueling the Brain with Dopamine

While MiniMax's prospectus dazzles with numbers, it also stings. As of September 30, 2025, its C-end business contributed over 71% of revenue, with the core driver being Talkie (Xingye)—a platform filled with virtual companions, role-playing, and gacha mechanics.

The outside world often labels MiniMax as 'otaku' or 'virtual romance,' and a persistent 'misalignment' anxiety lingers within the company. The crux of this anxiety: they deeply resent being defined as a 'secondary game company,' yet survival hinged on 'dopamine economics.'

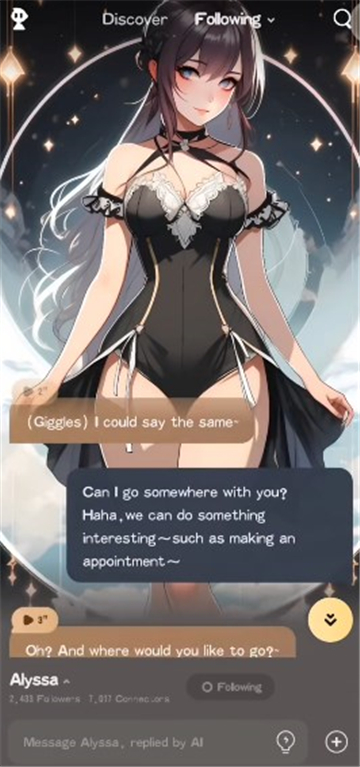

Talkie (Xingye's international version) interface

In capital market terms, this is a red flag. Game companies typically trade at 15–20x PE (price-to-earnings), while tech/AGI firms can command 50x PS (price-to-sales) or higher.

If the market pegs MiniMax as 'AI's MiHoYo,' its current $5–6 billion valuation seek becomes froth. Yan Junjie isn't just roadshowing for an IPO—he's waging a difficult 'de-gamification' whitewashing campaign.

This explains MiniMax's 'hardcore' and 'counterintuitive' tech marketing: making money from virtual chat while aggressively pushing M1/M2 models' 'logical reasoning' and 'code generation' capabilities. Its M2 model debuted in the global top five (first among open-source) on Artificial Analysis, ranked third globally in programming scene token usage on OpenRouter, and even saw its original CISPO algorithm cited by Meta.

MiniMax is screaming through these metrics: 'Look closely—I build AGI, not chat companions.' This stark divergence between tech route (roadmap) and business model is MiniMax's greatest contradiction.

Fortunately, institutions have provided valuation benchmarks. CITIC Securities favors Zhipu's position as China's leading general large model enterprise, assigning it a 30x PS valuation for 2026, implying a target market cap of approximately HK$53.9 billion.

The 'secondary game' aesthetic permeates MiniMax's core product, Xingye—the surface-level trait that most resembles MiHoYo. As one of MiniMax's earliest strategic investors, MiHoYo injected not just capital but a 'tech-nerds-save-the-world' worldview. Unlike Zhipu AI, which carries a strong academic tone and aims to build a 'superbrain,' MiniMax prioritizes crafting 'super companions.'

At the product level, this manifests as an extreme focus on satisfying C-end users' emotional needs. Talkie (Xingye) essentially transplants MiHoYo's 'character gacha' and 'emotional bonding' logic onto large models.

Yan Junjie likely grasped a key insight: users may not Continuous payment (continuously pay) for 'smarter AI,' but they will spend heavily via in-app purchases for 'AI companions that understand them.' The underlying logic isn't vastly different—emotional companionship is indeed the most promising C-end breakthrough scenario for chatbots. After all, XX remains the ultimate productivity driver.

When Yan Junjie left SenseTime, his goal was 'Artificial General Intelligence (AGI).' He once emphasized that AGI's core lies in integrating technology as seamlessly as infrastructure into daily life, akin to how Douyin became a routine tool rather than being perceived as a 'recommendation system.' Yet MiniMax's C-end products struggle to evoke AGI.

In today's capital environment, no fund will back another 'non-revenue-generating' idealist venture. Survival became the overriding imperative. He temporarily set aside scientific pride and embraced the most monetizable—yet often dismissed—'hormone economy.' He leveraged Talkie's high user engagement and in-app purchase revenue to fund extremely costly video models (Hailuo) and trillion-parameter foundation model R&D.

The more addicted Xingye and Talkie users become, the further MiniMax drifts from the image of a 'serious tech giant.' But without its C-end business, MiniMax would have perished like other large model startups in Series A.

The B-End Is the Ultimate Path

'AGI shouldn't be a lofty superweapon but a helper for ordinary people.' This was Yan Junjie's founding mantra when he left SenseTime to start MiniMax, repeatedly emphasized to investors.

Today, this original aspiration (original aspiration) materializes through the B-end business overshadowed by C-end glory—not merely a commercial supplement add replenish complement (supplement) but the AGI endgame Yan laid for MiniMax. As of September 30, 2025, B-end revenue hit $15.42 million, accounting for nearly 30% of total revenue and surging 161% YoY. Its 69.4% gross margin far exceeds industry averages, becoming the 'core battlefield' for validating AGI capabilities and sustaining tech iteration.

This strategy hides Yan's deep reflection on 'SenseTime's old path.' During his SenseTime tenure, he witnessed the burden of heavy asset-based customized services—expending immense resources on project patches while diluting focus on foundational model R&D.

Thus, MiniMax from day one adopted a 'light asset, standardized' B-end strategy: refusing customized private deployments and only offering full-modality API services via open platforms.

This choice extends his 'focus on long-term breakthroughs' trait, enabling a 385-person team to forge partnerships with 130,000 enterprise clients across over 100 countries without succumbing to giant-scale redundancy.

Enterprise clients' steadfast choices fundamentally validate Yan's AGI philosophy. He always believed true AGI must be multimodal—humans perceive the world through eyes, ears, mouths, and noses, so should AI.

This persistence gives MiniMax's B-end services a unique edge: full coverage of text, voice, video, and music modalities, allowing enterprises to address all AI scenarios through a single supplier.

Alibaba's iFlow uses its text model as a programming foundation, Tencent Video relies on its Hailuo model for film/TV special effects (special effects), and even robot dog Vbot depends on M2.1's 'interleaved thinking chain' technology for autonomous 'thinking-execution' in complex environments. These collaborations aren't mere tech exports but embed AGI capabilities into every corner of production and life, transforming it into genuine infrastructure.

More critically, B-end revenue is fueling AGI's continuous evolution.

Yan once calculated: U.S. AI firms spend 50–100x more yet lead by only 5%. Chinese companies must innovate, not just stack compute, to break through.

B-end large-scale application (scaled applications) provide the most valuable 'combat data': Monks Marketing's 50% cost reduction case helped optimize batch creation efficiency; LinkedIn's ad conversion scenarios refined voice synthesis for commercial needs; WPS's office scenarios honed long-text processing and logical reasoning. These real-world feedbacks from thousands of industries let MiniMax's models iterate through 'combat'—far more valuable than lab benchmarks.

From SenseTime's tech refinement to MiniMax's strategic layout (layout), Yan's AGI path remains clear: C-end 'dopamine supply' ensures survival, while B-end 'tech implementation' is the ultimate direction. With M2 models now integrated into Amazon Bedrock, Google Vertex AI, and Microsoft AI Foundry—the three top global cloud platforms—MiniMax's B-end business proves that AGI's final form isn't an isolated superbrain but 'smart infrastructure' embedded in countless products.

Epilogue

MiniMax's IPO feels like a 'cognitive reset' for the AI industry. With a 385-person team, 1% of OpenAI's capital, and 53 months of cash reserves, it proves AGI isn't a 'burn cash or bust' path. Its 'C-end dopamine supply + B-end tech monetization' dual-wheel model cracks the AI startup dilemma of 'ideals versus survival.' With 70% of revenue from overseas, it offers a viable answer for Chinese large models to 'escape internal competition and embrace global markets.'""Yan Junjie's 'contradictory' entrepreneurship strikes at the AI industry's core challenge: the AGI journey demands both passionate tech idealism and grounded business rationality. Extreme efficiency isn't 'cost-cutting' but precise resource control; commercial compromises aren't 'betrayals' but pragmatic choices to sustain ideals.