Jensen Huang couldn't help but start cashing out

![]() 07/08 2024

07/08 2024

![]() 475

475

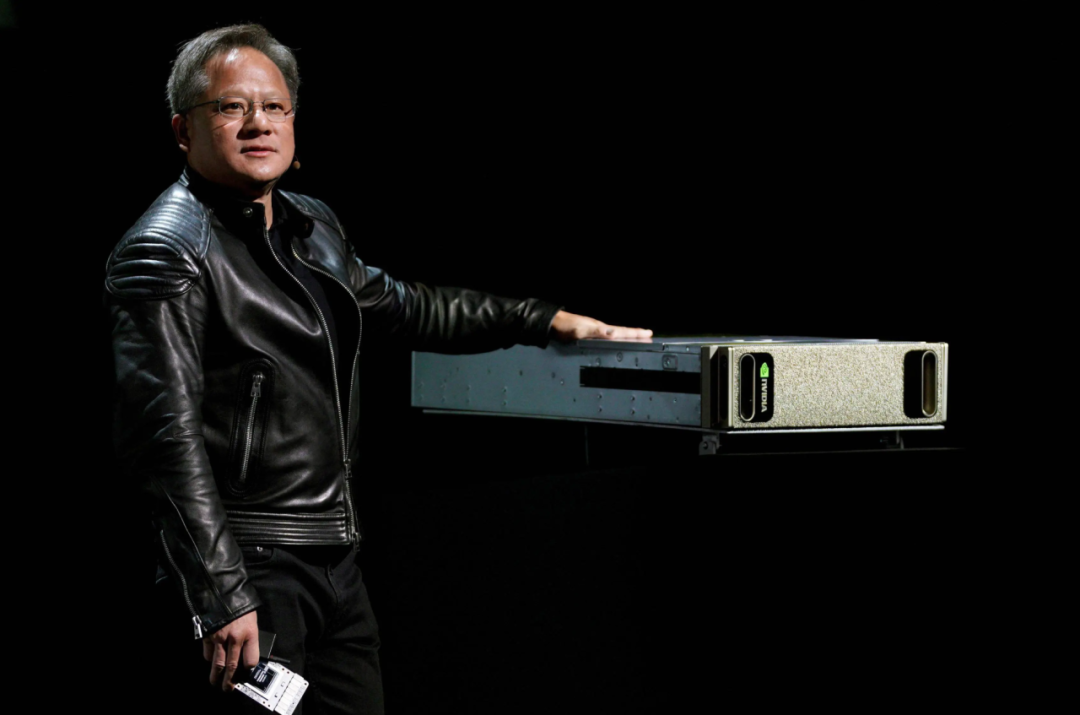

NVIDIA has unknowingly found itself in the midst of a storm.

Looking at the "lofty" stock price, Jensen Huang couldn't help but start cashing out.

In the past June, NVIDIA CEO Jensen Huang sold NVIDIA stocks worth nearly $170 million (equivalent to approximately RMB 1.241 billion).

Based on the data disclosed in the regulatory filing, Huang sold a total of 1.3 million NVIDIA shares in June, estimated to be worth close to $169 million, setting a personal record for the highest monthly stock sale and cash-out.

Although this move only involved a small portion of his personal holdings, Huang's gains were quite considerable against the backdrop of NVIDIA's continuously soaring stock price. However, Huang's stock sale plan was announced as early as March this year, when NVIDIA mentioned in its quarterly financial report that Huang would sell up to 600,000 shares through the 10b5-1 stock sale plan by the end of March 2025.

It's worth mentioning that the stocks Huang sold are part of his executive compensation system, including restricted stock units (RSU) and performance stock units (PSU), which are relatively common among corporate executives.

According to statistics compiled by Washington Service, the main provider of insider trading data in the US market, NVIDIA executives and board members have sold approximately 770,000 NVIDIA shares worth over $700 million so far this year, excluding the impact of the company's 1-for-10 stock split on June 10.

The explosive growth of the company's stock has made many NVIDIA employees extremely wealthy, with most employees who joined the company five years ago or earlier now enjoying "financial freedom." According to data from Levels.fyi, a website that collects compensation and benefits data for US tech companies, NVIDIA's product managers (IC3 level) earn an average base salary of $260,000 annually and receive equity awards of $104,000.

"Only 30 days away from bankruptcy"

While optimism about NVIDIA's future prospects pervades Wall Street, not everyone is so optimistic.

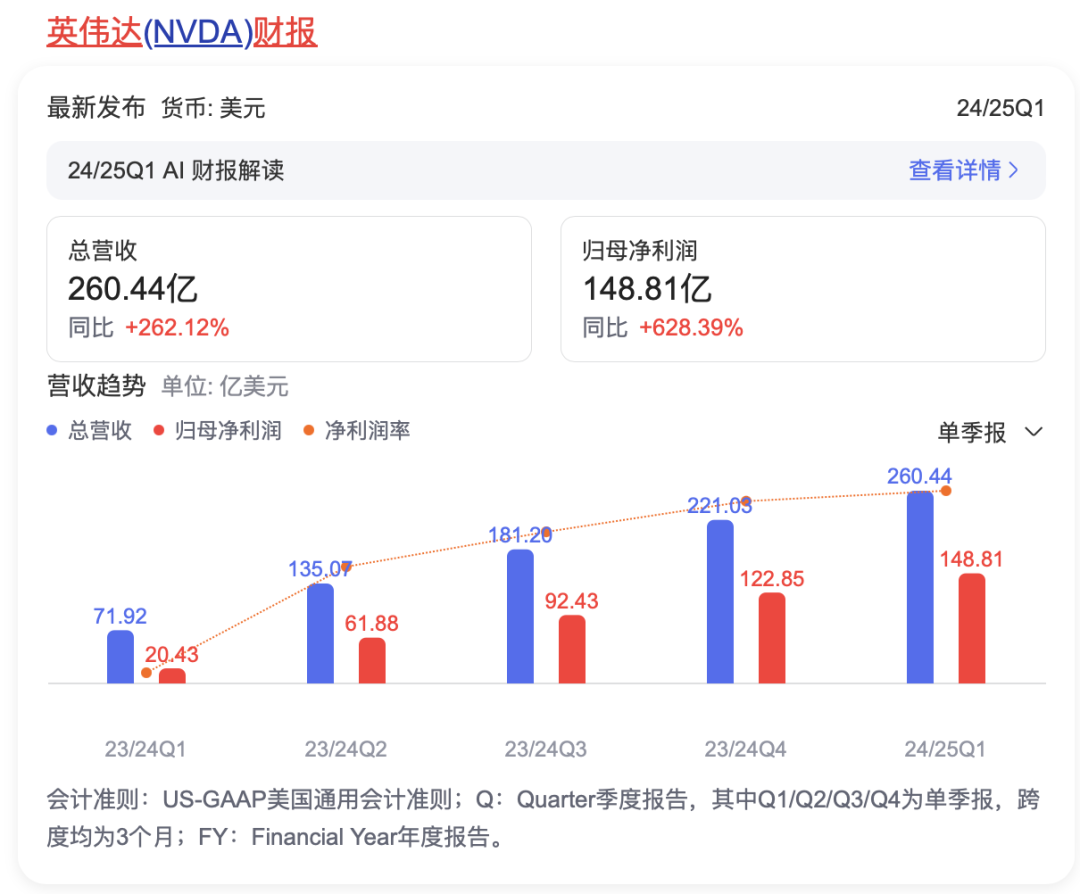

Analysts say that NVIDIA's quarterly results actually show signs of slowing down, and the key to its future performance lies in the sales of B100 and B200 chips based on the Blackwell system in the second half of the year.

Additionally, the financial report projects second-quarter revenue of $28 billion, representing a year-on-year growth of only 5%-10%, and expects non-GAAP gross margin to drop to 75.5%, with the full-year gross margin narrowing to about 70% (plus or minus 2%), lower than expected.

Rob Arnott, the legendary investor and chairman of Research Affiliates, said, "NVIDIA's current price-to-sales ratio (total market capitalization/revenue) has reached 40 times, which seems like an astronomical figure. The high valuation stems from investors' belief that NVIDIA's high profit margin can be sustained."

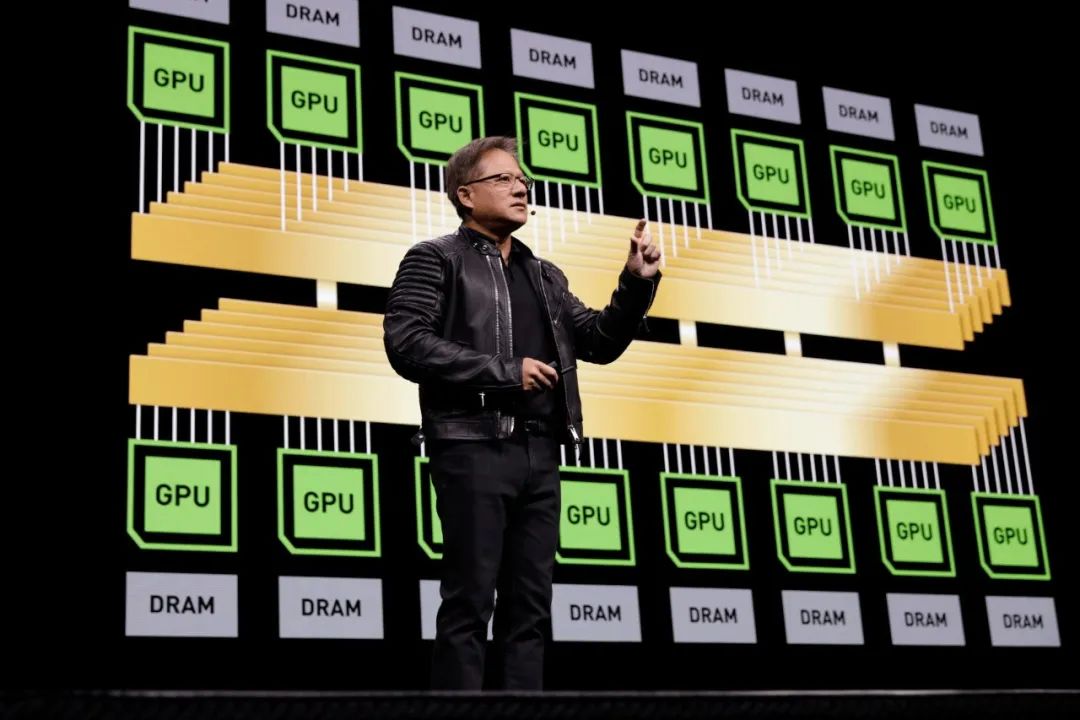

However, NVIDIA's competitors such as AMD, Intel, and TSMC are unlikely to allow NVIDIA to maintain such high profit margins and market share for a long time.

Take AMD, for example. Currently, AMD's GPUs are primarily used for gaming and, like NVIDIA, are being repurposed for AI models in data centers. AMD's flagship chip is the Instinct MI300X. Microsoft has purchased AMD processors and provides access through its Azure cloud.

Recently, Microsoft said it is using AMD Instinct GPUs to power its Copilot model. Morgan Stanley analysts believe this news indicates that AMD's AI chip sales this year may exceed $4 billion, which is the company's public goal.

Intel, which was surpassed by NVIDIA in revenue last year, is also trying to establish a foothold in the AI field. The company recently released the third version of its AI accelerator, Gaudi 3. Intel claims that its product is more cost-effective, outperforms NVIDIA's H100 in inference, and is faster in training models.

At the same time, more and more AI chip startups, including Cerebras, SambaNova, Groq, and the latest Etched and Axelera, see an opportunity to carve out a share of NVIDIA's AI chip business. They are also focused on meeting the specific needs of AI companies.

Therefore, as competitive pressures intensify, it is inevitable that NVIDIA's market share in global AI chips will gradually erode.

Not only that, according to statistics from venture capital firm Sequoia Capital in March, the entire AI industry has invested $50 billion in NVIDIA chips to train large language models, but the revenue of generative AI startups is only $3 billion.

The huge cost of AI training has also made NVIDIA's customers less "loyal." Companies like Google, Microsoft, Meta, and Amazon have started developing their own chips, and more and more AI companies are looking for ways to build and deploy smaller models, reducing their reliance on NVIDIA's hardware.

"If NVIDIA doesn't go all out, it will indeed go bankrupt in 30 days." In addition to the competitive pressure from the market, surging demand is also testing NVIDIA's supply capabilities. On June 28, local time, Huang admitted during the 2024 Download Day.

The bubble may burst soon

Last Friday, despite the collective rise of the three major US stock market indices, NVIDIA's stock price suddenly plummeted at the end of the session. By the close, the stock price had dropped nearly 2%, with the total market capitalization evaporating by $60.3 billion (equivalent to approximately RMB 440 billion) in a single day. On the news front, Pierre Ferragu, an analyst from market research firm New Street Research, issued a warning on NVIDIA stock and downgraded its rating to "neutral."

Pierre Ferragu said that NVIDIA's stock has limited upside potential unless it is in a bull market. After rising 240% and 157% last year and this year, respectively, NVIDIA's stock price has fully reflected its valuation.

"Although NVIDIA remains the most powerful franchise in the AI data center space, recent expectations and valuations suggest a more cautious view of the stock." Pierre Ferragu believes that the revenue model shows that NVIDIA's growth rate will slow down to a moderate level, and GPU revenue is expected to grow by only 35% next year.

It's worth mentioning that there are currently very few analysts on Wall Street who hold a negative view of NVIDIA. Prior to this, only DZ Bank in Germany downgraded NVIDIA's rating from "Buy" to "Hold" in May this year.

However, NVIDIA can be said to have unknowingly found itself in the midst of a storm.

According to a warning from Margrethe Vestager, the EU's competition chief, NVIDIA faces a "huge bottleneck" in AI chip supply.

Just earlier last week, it was reported that French regulators would file an antitrust lawsuit against NVIDIA, which would be the first enforcement agency in the world to take antitrust action against the company.

France plans to file an antitrust lawsuit against NVIDIA, accusing it of exploiting its market dominance and expressing concerns about the AI industry's deep reliance on CUDA programming tools. Under French antitrust regulations, companies that violate antitrust laws may face fines of up to 10% of their global annual revenue, but they can also make concessions to avoid fines.

Last November, Bruno Le Maire, France's Minister of Economy, Finance, Industry, and Digital Sovereignty, said that NVIDIA's dominant position in the AI chip market exacerbates international inequality and suppresses market competition. Data shows that NVIDIA accounts for 92% of the GPU market.

The European Commission has also been informally collecting opinions to determine whether NVIDIA may have violated EU antitrust regulations, but no formal investigation into monopoly behavior has been launched yet.

Analysts believe that the EU's antitrust measures reflect concerns about the dominance of US tech giants in new technology areas. European companies have long invested and spent less on research and development, resulting in their growth lagging behind that of the US.

Meanwhile, NVIDIA's revenue share in the Chinese market has not only failed to improve but has even dropped to a single-digit percentage, compared to a peak of nearly 25%. In contrast, revenue in regions like Europe and North America has remained high growth.

Regarding this issue, Huang not only personally lobbied US regulators to relax restrictions but also repeatedly courted NVIDIA's major Chinese customers and launched the "castrated" H100 in the shortest possible time. Unfortunately, regulators have not relented, and the performance of the H800, a substitute specifically for the Chinese market, has been unsatisfactory. NVIDIA has not yet found a better solution.

However, industry analysts point out that even under stricter market restrictions, its H20 computing cards still show strong sales potential. It is predicted that NVIDIA is expected to supply more than one million H20 computing cards to the Chinese market in 2024.

Specifically, the pricing range of each H20 computing card remains stable between $12,000 and $13,000 (equivalent to approximately RMB 87,220 to 94,489). Based on this price estimate, its total sales are expected to exceed the $12 billion mark, significantly surpassing NVIDIA's total revenue in China in the previous fiscal year.

Regarding the current frenzy of market sentiment towards NVIDIA, sober analysts believe that AI enthusiasm will subside. For example, ChatGPT's traffic has gradually decreased since last May, and some investors have started to slow down the speed of capital inflows. "After all, every major technology goes through an adoption cycle, especially when the technology begins to enter people's vision, there will be a strong hype stage, which may also be one of the factors driving NVIDIA's inflated market value."

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.