Luobo Quickrun takes off, are automakers the ultimate winners in the RoboTaxi game?

![]() 07/15 2024

07/15 2024

![]() 555

555

What can truly help automakers break through is autonomous driving.

Wuhan is hot, Luobo Quickrun is hot, and Baidu is hot too.

No one expected that just over 400 Robotaxi (driverless taxis) would propel Baidu's Luobo Quickrun and Wuhan onto trending topics continuously, sparking heated discussions among countless netizens and many insiders. This fiery level of discussion has led many to wonder if Robotaxi is truly on the verge of large-scale commercialization.

No, things aren't that simple. While discussions about Robotaxi often focus on the impact on practitioners in traditional industries (taxis, ride-hailing), in the long run, the emergence of Robotaxi poses challenges and disruptions to the transportation industry, the automotive industry, and even the transportation sector as a whole.

As the "upstream" industry in the Robotaxi sector, automakers are facing significant opportunities and challenges. Even Tesla, the giant in the new energy vehicle industry, has been eyeing the Robotaxi industry avidly, and its stock even experienced turbulence due to delays in the release of its Robotaxi product. Other automakers are also at a crossroads, deciding whether to enter the Robotaxi industry.

Tesla investors are unhappy with the delayed Robotaxi launch

After nearly 20 consecutive days of share price gains due to sales exceeding expectations, Tesla's stock plummeted by $70.9 billion (approximately RMB 515 billion) overnight.

The reason behind Tesla's stock volatility this time was not a business operational issue but rather a setback in the release of its Robotaxi (autonomous taxi). According to Bloomberg, the project was likely to be delayed until October due to Tesla's desire to produce more prototypes ahead of schedule.

Tesla has had several past examples of "delayed launches," such as the Cybertruck electric pickup truck, which was delayed three times over four years. Bloomberg's revelation may have triggered investors' unease, leading to such a sharp drop in Tesla's share price.

Investors' strong reactions are understandable. In the U.S. market, companies like Waymo (owned by Google) and Cruise (owned by General Motors) have launched Robotaxi services, which have brought new growth curves to their respective companies. However, these companies' Robotaxi products still have flaws in their user experience (mainly causing frequent traffic accidents), so investors are more optimistic about Tesla, with its advanced technology in the field of autonomous driving, being able to clear the air and reshape the transportation industry, even developing into a new engine driving Tesla's revenue growth.

Unfortunately, the "expected" delay has cast a shadow over these expectations.

The industry's optimism towards Tesla's Robotaxi stems largely from its leading global business model. Elon Musk revealed that not only will Tesla have dedicated models for Robotaxi, but the Model 3/Y/X/S can also be upgraded through software to become Robotaxi. Considering Tesla's annual sales exceeding one million units, with consumers across the United States, once the Robotaxi project is launched, there is an opportunity to deploy more Robotaxi across the country than Waymo and Cruise in a very short time.

Even some Tesla owners who have not yet activated FSD (Full Self-Driving Capability) will pay for FSD or other packages once Tesla's Robotaxi goes online. After all, upgrading their cars to Robotaxi means earning an extra income while commuting.

The rosy future Tesla has painted for Robotaxi has gotten many investors excited, and for other automakers not yet involved, the emergence of Robotaxi has also presented new opportunities. In addition to earning additional profits through new travel modes and business models, automakers' manufacturing and software capabilities offer opportunities to profit in the Robotaxi era. It is not difficult to understand why every move in the Robotaxi industry has become a barometer for Tesla's stock profits and losses.

With the explosion of Robotaxi, are automakers the biggest winners?

As of April 30, 2024, a total of 6.964 million online car-hailing driver licenses have been issued in China. From 2016 to 2023, the total sales of new taxis and online car-hailing vehicles in China reached 4.23 million units, excluding non-operating vehicles converted into online taxis and taxis. In 2023 alone, China added 850,000 new taxis and online car-hailing vehicles.

Based on data from various related news sources (such as sharp declines in taxi driver income), it is inferred that the saturation range of online car-hailing in China should be between 5 million and 6 million units. GAC Aion and Beijing Automotive Group's BJEV have directly benefited from the online car-hailing market, especially GAC Aion, whose flagship product AION S derives nearly 90% of its sales from the online car-hailing market. With total sales of 480,000 units in 2023, it ranks among the top three in the domestic market (in terms of new energy vehicles), making it the envy of many automakers.

Thus, if Robotaxi can truly blaze a trail and redefine the transportation industry, the final product iterations will bring new growth to the industry, turning into a new trend. The logic is similar to the "replacement wave" brought about by smartphones switching from 3G to 4G and then to 5G, where automakers have much to gain.

In general, there are three levels of opportunity for automakers.

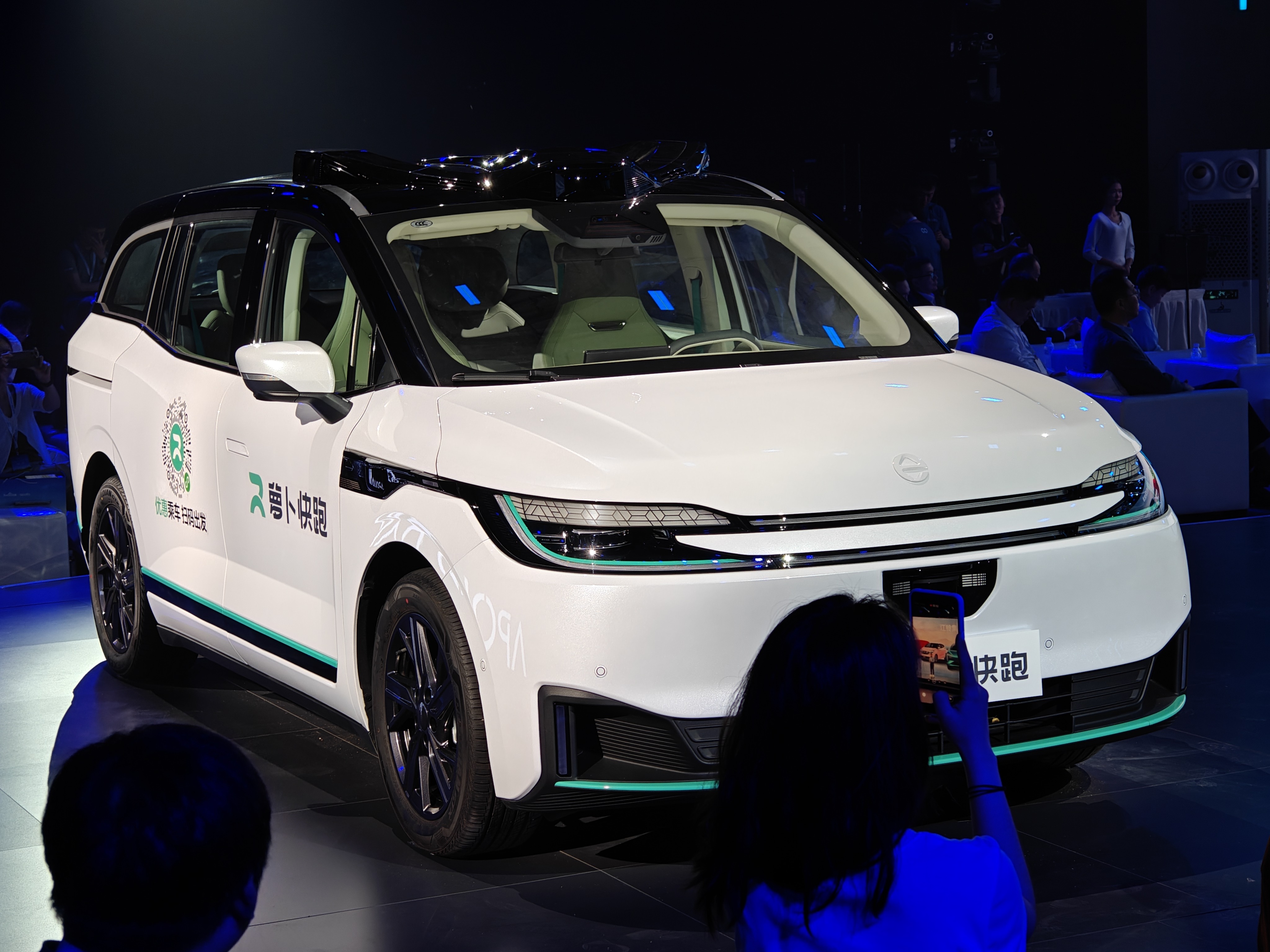

The first is to act as an upstream company in the Robotaxi industry, providing automotive products to downstream companies. Many Robotaxi operators do not have the capability to produce cars, for example, the fifth-generation driverless car of Luobo Quickrun is produced by ARCFOX of Beijing Automotive Group. This approach may earn less money but avoids direct competition with other automakers for Robotaxi market share, thus reducing risk.

The second is to share the pie together. Automakers can create Robotaxi platforms, undertake the responsibilities of Robotaxi business operations and scheduling, sell products to consumers, and share the deployment costs of Robotaxi with consumers while also sharing some profits with them.

Recently, Zhou Hongyi, a top figure in the automotive industry, tweeted that many online car-hailing drivers complained that Robotaxi was taking their jobs. He suggested that Robotaxi could be sold to consumers, giving them a self-driving online car-hailing vehicle to share the pie.

The sixth-generation driverless car under Baidu has already reduced its cost to 200,000 yuan, but if Luobo Quickrun wants to capture one-fifth of the online car-hailing market, it would need to deploy over one million Robotaxi, with a starting cost of 200 billion yuan. This is a burden that Baidu alone, or any other automaker, cannot bear.

Sharing the burden of deploying Robotaxi with consumers and sharing the profits with them may be the best option. This approach facilitates the rapid deployment of a large number of Robotaxi into the market and leverages the low-cost advantage of Robotaxi to create a siphon effect, competing with rivals for market share and rapidly growing into an industry giant.

Tesla follows this route, albeit sharing part of the pie with consumers, but the potential of this model is immense. Financially capable consumers can even purchase multiple vehicles as low-risk, small-scale investment projects. This approach also avoids competition with online car-hailing drivers, benefiting the overall economy.

The final opportunity is for automakers to research, develop, deploy, and operate Robotaxi across the entire chain, keeping the entire pie for themselves. Strictly speaking, many domestic automakers have already chosen this route, such as GAC Motor and Ruqi Mobility, FAW Group, Dongfeng Motor, Changan Automobile, and T3 Mobility.

In early June of this year, the Ministry of Industry and Information Technology and three other departments jointly announced the "Basic Information on the Pilot Joint Venture for the Access and Road Access of Intelligent and Connected Vehicles," announcing that nine automakers, including BYD, FAW Group, Changan Automobile, GAC Motor, NIO, Beijing Electric Vehicle, SAIC Motor, SAIC Hongyan, and Yutong Bus, have become pilot joint ventures.

The reason it is called a "joint venture" is that the entities using the pilot qualifications are not these automakers but related mobility companies. For example, the entity using FAW Group's pilot qualification for intelligent and connected vehicle access and road access is FAW Mobility Technology Co., Ltd. Now it seems that this pilot program is highly likely to help some automakers quickly deploy Robotaxi.

Overall, automakers' "all-in" approach is the best way to maximize profits, but it also places stringent requirements on automakers' capabilities across various aspects. Beyond manufacturing capabilities, operation and scheduling capabilities, social resource capabilities, etc., the most critical aspect is autonomous driving technology, which is the final and highest threshold.

Precisely because of this, we find that the currently most successful Robotaxi enterprise operating in China is Baidu from the internet camp rather than traditional automakers. The core reason is that Baidu's autonomous driving technology is the key to enabling Robotaxi to be successfully implemented and operated.

RoboTaxi is just the appetizer, autonomous driving has become the lifeblood of automakers

When Musk announced Tesla's Robotaxi plan, there were some质疑 voices from the outside, including industry experts like He Xiaopeng, who believed that the key to successful Robotaxi lies in autonomous driving technology. Looking back at the recent controversies surrounding Luobo Quickrun, we can attribute them all to "the impact of autonomous driving on conventional perceptions." Consumers are unclear and unfamiliar with this cutting-edge technology, leading to doubts, denials, and even concerns.

Dianchetong believes that the recent controversies surrounding Robotaxi essentially stem from the disruption of autonomous driving technology to the automotive industry. However, as a manned scenario requiring direct contact with the public, Robotaxi has been pushed to the forefront, while in reality, in corners unknown to the general public, the disruption of autonomous driving has already occurred.

Robotaxi is just the tip of the iceberg in autonomous driving use cases. On a larger scale, domestic enterprises such as Pony.ai and Huawei are involved in fields like freight trucks and mining. With the support of autonomous driving technology, removing certain labor and emergency response costs can reduce freight and mining costs, thereby lowering prices of many commodities and benefiting everyone.

On a smaller scale, in areas like logistics and express delivery, SF Express has introduced unmanned delivery vehicles in many regions in China, capable of intelligently delivering parcels to consumers' doorsteps. Without leaving home, one can easily receive parcels, making life more convenient and efficient. There are also areas like firefighting and medical ambulances that await further development by automakers.

Overall, the development of autonomous driving technology is essentially about liberating productivity, which will ultimately achieve the goals of cost reduction and efficiency enhancement. It will also bring about a series of additional effects such as standardizing road traffic and reducing congestion, and the disruption of the automotive industry is inevitable.

The challenges facing automakers, which were briefly mentioned earlier, can be simply summarized as a competition in technology. According to previous compilations by Dianchetong, many automakers do not directly possess autonomous driving technology but seek partnerships with technology providers such as Pony.ai, Momenta, and Wenyuan Zhixing. As a result, they lag behind automakers like Xpeng and Tesla, which can highly vertically integrate hardware and software, in terms of speed in product integration and market deployment.

It is not difficult to see here Elon Musk's deeper understanding of the automotive industry. Tesla has positioned itself from the beginning as an AI company and an autonomous driving company rather than just a "car manufacturer," and autonomous driving technology (FSD) has become the only core technology across multiple product lines.

Hindsight being 20/20, from family passenger cars to commercial trucks and even household robots, Tesla has been able to dabble in and excel in various products with vastly different target scenarios and service requirements. Autonomous driving technology has played a crucial role in this. Looking at the Robotaxi product, despite the unexpected delay, Tesla's Robotaxi deployment speed still leads the industry, and Musk himself is confident in achieving "peak performance right out of the gate." In fact, this is the confidence brought about by leading autonomous driving technology.

Here, Dianchetong advises automakers to look beyond the recent controversies surrounding Robotaxi and see the essence of the matter. The competition in the automotive and transportation industries in the future will inevitably revolve around autonomous driving technology, and investment and layout are the sooner, the better. Opportunities often only go to those who are prepared. Which automakers are already ready?

Source: Leitech