"Domestic NVIDIAs", Rush to IPO in A-share Market

![]() 09/24 2024

09/24 2024

![]() 450

450

Domestic alternatives to NVIDIA GPUs are collectively rushing to IPO in the A-share market.

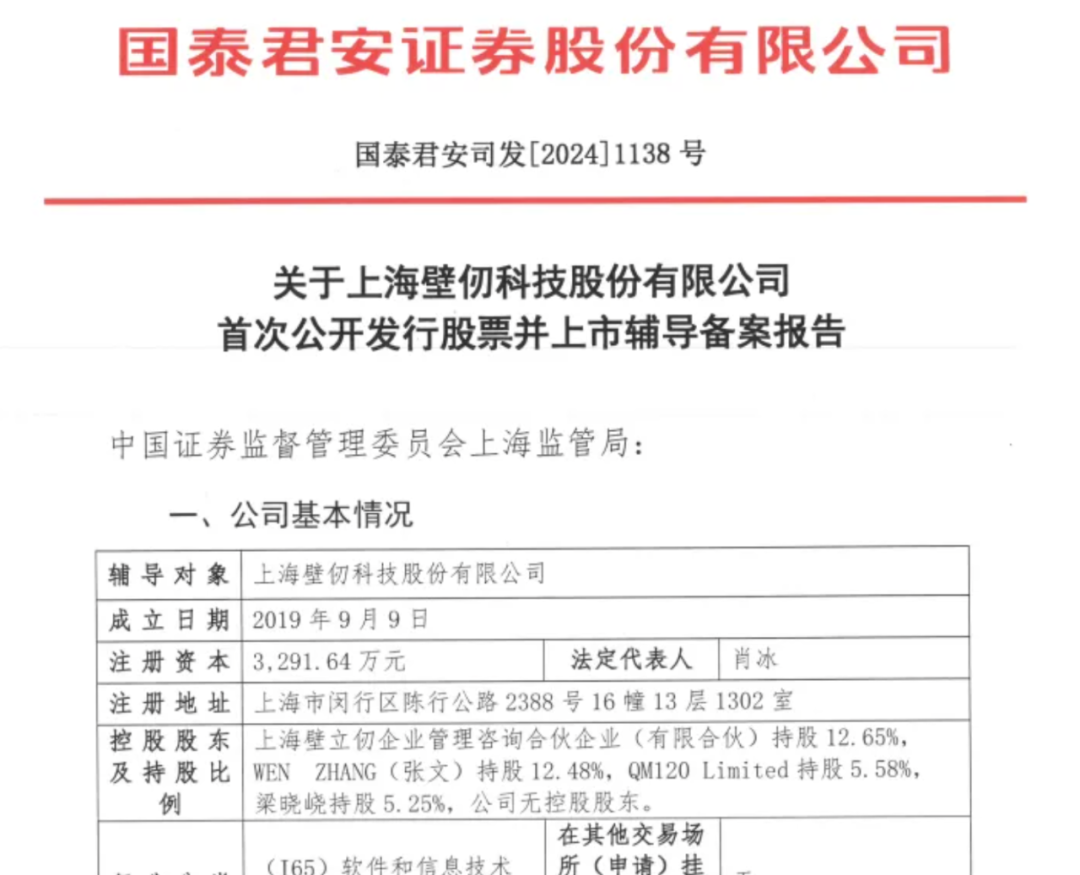

Just recently, the China Securities Regulatory Commission (CSRC) disclosed that BiRen Technology, a star unicorn in China's AI chip industry, has registered for pre-IPO tutoring at the Shanghai Securities Regulatory Bureau, intending to issue shares for the first time. Guotai Junan Securities is serving as the tutoring securities firm.

Almost simultaneously, Suiyuan Technology also completed this step, with news at the end of August that its application for pre-IPO tutoring registration had been accepted. China International Capital Corporation Limited (CICC) is serving as the tutoring institution.

If everything goes smoothly, after Cambricon, two new members will join the domestic AI computing power supplier IPO club.

Another noteworthy detail is that both companies have followed the footsteps of Cambricon, the first domestic AI chip stock, and have unanimously chosen to list on the A-share market rather than in the US or Hong Kong.

Given the current elevated listing threshold for A-shares, why have they made this choice?

He Xiongsong, Executive General Manager of Shanghai Chen Tao Asset Management Co., Ltd., believes that currently, Chinese companies have faced significant obstacles in listing on US stock exchanges, and the liquidity of Hong Kong's stock market is poor. Therefore, the A-share market is likely to be more supportive of such enterprises.

An investor also told CyberAuto that for companies dedicated to AI computing infrastructure, the A-share market is currently the best destination in terms of sensitivity, valuation, and support.

However, after going public, how far are domestic NVIDIA alternatives from truly replacing NVIDIA? At present, it is only the beginning.

01 Domestic AI Chips Rush to A-share IPOs

The two startups that have recently announced their intention to initiate A-share IPO procedures are BiRen Technology and Suiyuan Technology, both of which are star enterprises.

Official documents disclose BiRen Technology's IPO preparation information

According to disclosure documents from the CSRC, BiRen Technology was established in September 2019 with a registered capital of 32.9164 million yuan.

BiRen Technology Founder Zhang Wen (first from right)

Founder and Chairman Zhang Wen has a diverse background, with a bachelor's degree in electronic engineering and a Ph.D. in law from Harvard Law School. Before starting his business, he worked as a lawyer and investment banker. He also served as President at SenseTime.

In 2019, after careful consideration, Zhang Wen chose to embark on a chip industry venture, focusing on GPUs and DSA (Domain-Specific Accelerators), delving into general-purpose computing chips.

Since its inception, BiRen Technology has attracted talents such as Hong Zhou and Zhang Linglan, who were previously responsible for GPU development at Huawei Hisilicon.

In terms of financing, thanks to Zhang Wen's rich professional background and the momentum of the entire industry, BiRen Technology has garnered significant capital appeal since its establishment. Public information shows that it has completed eight rounds of financing, raising a cumulative total of over 5 billion yuan.

On Hurun's 2024 Global Unicorn List, BiRen Technology ranks 495th with a valuation of 15.5 billion yuan.

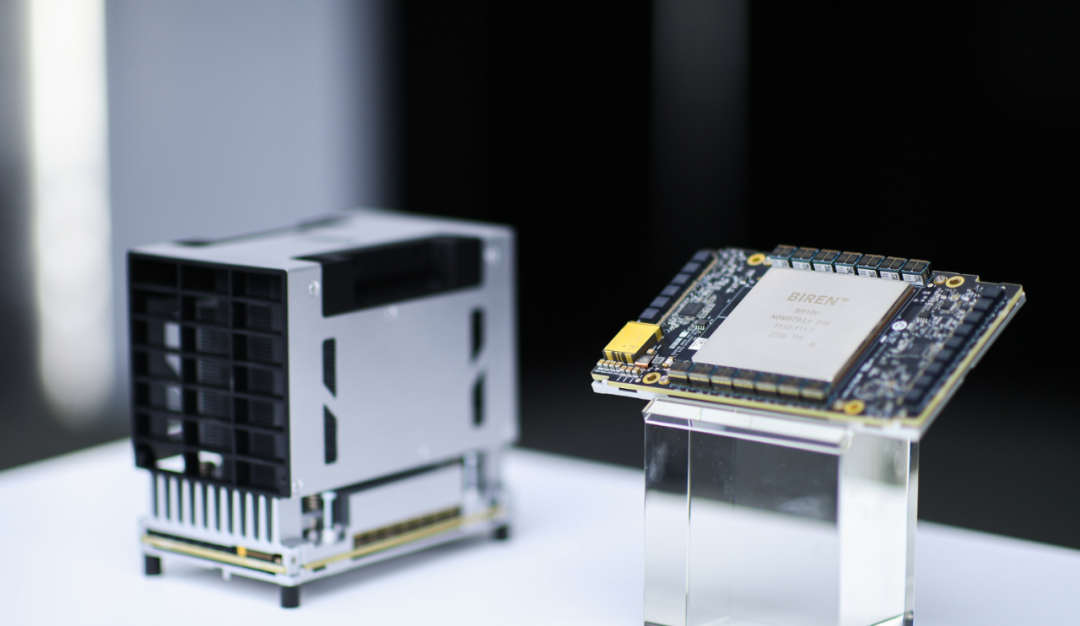

BiRen Technology's BR100 Product

In terms of business progress, BiRen Technology has also made remarkable achievements. In 2022, it launched its first general-purpose GPU, the BR100, which set a new global record for computing power.

More recently, at the Global AI Chip Summit, BiRen Technology unveiled its heterogeneous GPU collaborative training solution, supporting simultaneous model training on three or more heterogeneous GPUs. This is a path chosen by many domestic players to fill the vacuum left by NVIDIA after its related products were restricted.

Suiyuan Technology was established slightly earlier than BiRen Technology, but both are players who have caught up with the AI wave. Documents show that Suiyuan Technology was established in Shanghai in 2018. Its core founding members come from AMD.

Suiyuan Technology Founder Zhao Lidong

One of the founding members, Zhao Lidong, serves as Chairman and CEO of Suiyuan Technology. He graduated from the EE85 class of Tsinghua University's Department of Wireless Communications, with a professional background, and later joined AMD to oversee the development of core IPs such as CPUs and GPUs.

He also worked at Tsinghua Unigroup, responsible for semiconductor investments.

Another founding member, Zhang Yalin, serves as COO and worked with Zhao Lidong at AMD for five years. Zhao Lidong was once his direct supervisor, indicating a strong working relationship between the two. This is likely one of the reasons why these two technical experts came together.

In terms of financing, Suiyuan Technology is on par with BiRen Technology. Since its establishment, it has undergone ten rounds of financing, raising a cumulative total of nearly 7 billion yuan. On this year's Hurun Global Unicorn List, it ranks 482nd with a valuation of 16 billion yuan.

During this period, Tencent invested in multiple rounds and became Suiyuan Technology's largest shareholder, holding a 20.49% stake.

Suiyuan Technology's T20 Product

In terms of business, Suiyuan Technology focuses on cloud-based AI training/inference chips and has launched three generations of products since its establishment, including the training chips T10, T20, and T21, as well as the inference chips i10 and i20 series.

Both companies have representative characteristics in the industry, such as high individual functional metrics for their products and high financing amounts and valuations at the capital level.

02 Why Rush to IPO Now? Why A-shares?

First, let's address the first question: why are they rushing to IPO now?

From the basic requirements of an IPO, companies have a financing need. For this wave of AI chip companies, this need is undoubtedly urgent, as chip manufacturing is a highly capital-intensive industry that requires significant investments.

A reference point is Cambricon, which has successfully listed on the A-share market. Recently, Cambricon released its financial report for the first half of this year, showing a net loss of 609 million yuan after deducting non-recurring items. Since its listing in 2020, its cumulative losses have exceeded 5 billion yuan.

These losses are largely attributed to high R&D expenditures. Data shows that its cumulative R&D expenditures since listing have reached 4.992 billion yuan.

However, in terms of revenue, Cambricon only recorded 64.7653 million yuan in the first half of this year, which barely supports its operations. For companies like BiRen Technology, which were established around 2019, the funds raised in the primary market are approaching depletion.

Moreover, there are examples of peers struggling due to a lack of funding.

Xiangdixian GPU Processor

While BiRen Technology and Suiyuan Technology were preparing for their IPOs, Xiangdixian, another star player known as the "Chinese NVIDIA," was rumored to have disbanded and owed salaries.

Later, Xiangdixian issued a statement denying the rumors but acknowledged the business pressures it was facing. The root cause, as reported in the market, was that expected funding had not arrived, leading to financial difficulties.

One can imagine the situation of other players in this industry, especially third-party startups without the backing of giants like Huawei or Baidu.

However, primary market financing has become increasingly challenging in this cautious investment environment, and the high valuations of industry players have narrowed financing channels. Of course, there is also the need for investors to cash out. All these factors combined have made rushing to IPO a pressing matter.

The second question is: why A-shares?

After all, given the gradually rising listing threshold, the operating conditions of such companies are not optimistic, and there is significant uncertainty about their success.

However, from the perspective of investors, the A-share market is considered a relatively ideal channel for domestic AI chips.

For example, He Xiongsong, Executive General Manager of Shanghai Chen Tao Asset Management Co., Ltd., believes that currently, Chinese companies face significant obstacles in listing on US stock exchanges, and the liquidity of Hong Kong's stock market is poor. Therefore, the A-share market is likely to be more supportive of such enterprises.

In fact, the A-share market's "green channel" does provide certain support for high-tech industries, especially those with technological breakthroughs.

Bai Yu, an analyst at Huaxi Securities, also believes that the A-share market is more likely to provide ideal valuations for companies that have made breakthroughs in addressing key technologies.

However, He Xiongsong noted that it is difficult to predict the extent of support the A-share market will provide to these companies because many of them are not profitable and have unstable performance. Nevertheless, the support is likely to be greater than under normal circumstances.

03 Domestic NVIDIAs? The Journey Begins with IPO

With the rise of large AI models and the gradual restriction of NVIDIA's related products as computing infrastructure, the domestic Substitutability of AI chips has been a topic of concern.

Cambricon's share price surged with the popularity of AI

Cambricon, which has incurred significant losses and minimal revenue, has a market value of nearly 100 billion yuan, likely due to this trend.

In fact, domestic players have indeed made remarkable products and progress during this process.

From a product perspective, domestic high-end AI chips have approached or surpassed NVIDIA in certain dimensions. For example, BiRen Technology's BR100 chip uses a 7nm advanced manufacturing process and offers a peak computing power of 2048 TOPS@INT8, exceeding the A100's 624 TOPS@INT8.

However, as the inventor of GPUs, NVIDIA's position in this field is undeniable. From a technological perspective, compared to other major global competitors, NVIDIA leads in product completeness, market share, and other aspects, and this advantage is likely to persist for a long time.

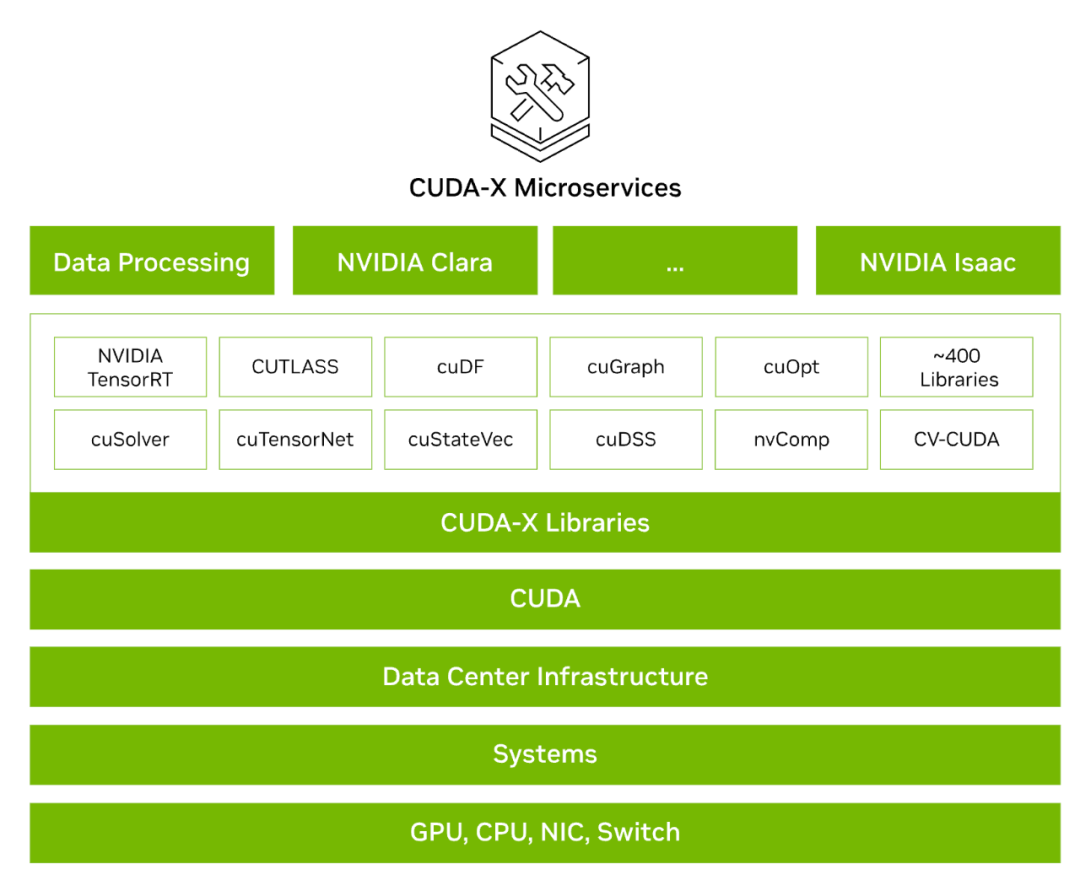

From a software ecosystem perspective, NVIDIA's CUDA (Compute Unified Device Architecture) platform has a high barrier to entry, and user migration incurs significant costs.

NVIDIA boasts a rich development platform, CUDA

In terms of versatility, domestic manufacturers still lag behind NVIDIA. Overall, domestic GPU manufacturers lag behind NVIDIA and AMD by about 1-2 generations in terms of half-precision and single-precision computing capabilities. In the field of double-precision (64-bit) computing, their capabilities are nearly non-existent, while double-precision computing is more commonly used in complex scientific calculations.

Therefore, as Wu Qiang, founder of Horizon Robotics, said in an interview, to replace NVIDIA, domestic manufacturers would need to offer products that are at least 5-10 times better in performance. A 1-2 times improvement would not be enough to lure customers away from NVIDIA's products and software ecosystem.

However, as the US tightens its control over chips, domestic GPU manufacturers have seized the opportunity. What Chinese enterprises need to do is to focus on technology and product commercialization.

On the one hand, they should intensify the recruitment of core technical talents. The addition of top talents can significantly boost a company's competitiveness. For example, AMD's competitiveness in the data center market significantly improved after the return of legendary chip architect Jim Keller, who developed the Zen architecture based on x86-64 and ARM microarchitectures.

On the other hand, they should accelerate the entire process from product design to mass production and delivery. Under the ban, some domestic customers will be forced to use domestic GPU products, which can help establish close relationships with relevant enterprises and facilitate rapid technology and product iterations.

Of course, as a capital-intensive industry, high-intensity and long-term capital support is also a necessary condition.

Rushing to list and raising funds is just the beginning. -END-