"Creating Market" vs. "Algorithm Evolution": A Fork in the Road for the AI Race Between China and the US

![]() 09/25 2024

09/25 2024

![]() 558

558

"The business model of AI is to create a market, not an algorithm." This is the view of Michael I. Jordan, a world-renowned AI expert.

However, in the current global AI market, China and the US, the two dominant players, have taken two distinct technical paths. While China focuses on exploring cutting-edge technologies, the US emphasizes application optimization and commercialization.

These two opposing directions may not allow for a direct comparison of ranking or merits, but China clearly has a distinct approach to application and implementation, and may soon surpass the US. Kai-Fu Lee, former head of Google China, predicts that by early next year, China's application adoption rate will far exceed that of the US.

Yet, the sacrifices made by Chinese companies along this journey are rarely known.

Domestic AI Large Models: From "Springing Up Like Mushrooms" to "Vanishing Without a Trace"

In November 2022, following the launch of ChatGPT, the domestic market was ignited with unprecedented enthusiasm. Early in 2023, the first batch of large model entrepreneurs emerged in China, sparking a small wave of entrepreneurship around large models. In June of the same year, the "Hundred Models War" officially began.

In less than three months, over 200 large models emerged in China, but by December 2023, the number of continuously updated models had rapidly declined to 156. By May of this year, only 19 remained. Many large models were fleeting, like a fleeting flower.

The so-called "Six Little Tigers" in the industry—Zhipu AI, ZeroOne AI, Baichuan Intelligence, MiniMax, Dark Side of the Moon, and Stepwise Stars—have also begun to adjust their businesses. Some have suspended the development of pre-trained models, some have gradually exited the consumer market to focus on B-end business, and some companies have even downsized their staff.

Behind this phenomenon, it is foreseeable that the business model driven solely by financing is a thing of the past. Facing the global competition among AI large models, China's AI industry needs to deeply reflect and seek a breakthrough. The primary goal is to return to the essence of commerce, abandon the impetuous mindset of purely pursuing technical parameter competitions, and focus more on market-demand-oriented research and development and application innovation.

At that time, domestic AI large models began to further differentiate. Based on modality, large models can be divided into natural language processing (NLP) large models, computer vision (CV) large models, multimodal large models, etc. According to deployment methods, they can be classified into cloud-side large models and edge-side large models.

Among them, cloud-side large models can be further divided into general-purpose large models and industry-specific large models. General-purpose large models are widely applicable and are currently represented by models such as Wenxin ERNIE Bot, Tongyi Qianwen, and iFLYTEK's Mars. Industry-specific large models are characterized by their professionalism and are trained for the needs of specific industries (such as finance, healthcare, and government).

It is evident that the application path of domestic AI large models is becoming increasingly clear, roughly following the path of "basic large model → industry-specific large model → end-user application."

It is worth noting that after the cooling of the Hundred Models War and the clarification of the application path, a price war has also begun. A typical example is that on May 21st of this year, Baidu announced the free opening of two large models: Speed and Lite. These two relatively lightweight large models are provided for free, while the most powerful large model remains paid.

Although low prices or even free access can increase user numbers, they also impose considerable pressure on businesses, as they violate the most basic commercial logic. However, if a company's technology and products are sufficiently competitive, there is no need to actively participate in a price war.

In this way, while the initiation of a price war is not a good omen, it also indirectly pushes AI technological innovation into a new acceleration phase.

Behind the multi-dimensional differences between China and the US, the paths to technology implementation are already different.

Against the backdrop of the ongoing global AI race, the question of who is stronger between China and the US has always been a topic of interest. It is reported that China and the US together account for about 80% of the total number of large models released globally, occupying an absolute dominant position.

Specifically, differences exist between China and the US in terms of technological background, cultural attributes, market environment, talent development, computing power, and data.

In terms of technological background, American technological development places particular emphasis on "technology first" and "knowledge density first." Industries and enterprises attach importance to basic innovation and maintain a strong encouragement and promotion attitude towards emerging things. At the same time, the division of labor in the entire ecosystem is clearer, forming a relatively complete and innovative ecosystem that jointly pushes forward a unified goal.

China, on the other hand, is more diverse and attempts to accelerate development by relying on more application explosions and market diversity. During the development process, higher requirements are placed on dimensions such as security, controllability, sustainability, and autonomy.

Due to technological backgrounds and market environments, there are also notable differences in business models between the two countries. American AI companies often use a software model, which allows for rapid scaling, while domestic companies excel at performance tuning and adopt more personalized and customized service approaches.

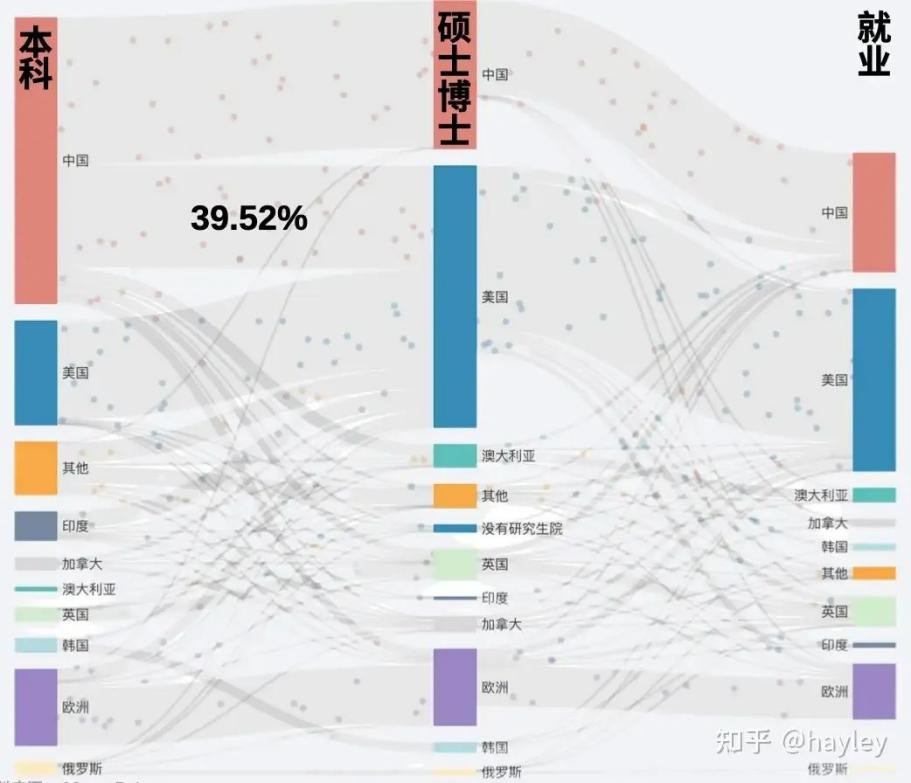

Image source: hayley on Zhihu

In terms of talent development, the above chart illustrates the distribution of AI talent development in China. While the proportion of undergraduate students in AI talent is relatively high, the proportions of master's and doctoral students gradually decrease.

The reason is that a large number of talents choose to pursue further studies and work abroad. Relevant data shows that 39.52% of AI talents in the US actually come from China. This makes it more difficult for China, which misses out on more high-end talents, to conduct basic research.

In terms of computing power, China is still lagging behind the US due to its lack of dominance in advanced process chips and computing density. However, based on China's positive policies and capital investment, the computing power challenge can be addressed in the long run.

Apart from computing power, data is another significant factor limiting the development of China's AI industry. On the one hand, the privatization of a large amount of data leads to high costs for data acquisition. On the other hand, due to the consistently high cost of data processing, companies keep their data strategies (including data allocation, sources, and processing) highly confidential.

Lastly and most crucially, in terms of industrial development paths, the US tends to restrict the distribution process of the open-source ecosystem from the bottom up and attempts to inhibit industrial innovation by limiting open source. In contrast, China prefers to vigorously promote the development of open-source models to better align with the application of vertical industries.

In terms of impact, the US's proposed restrictions on open source will not significantly affect China. Although there is still a gap in underlying R&D technologies, the emergence of GPT-3.5 signifies a phased breakthrough in technology. Moreover, due to its open-source availability, China has already obtained open-source models. Therefore, the speed of technological revolution spreads faster than legislative regulation, rendering regulation ineffective.

Comprehensively, differences in multiple perspectives have led to vastly different paths for technology implementation between China and the US. The US remains at the forefront of 0-to-1 technological exploration, while China focuses more on commercial implementation and application optimization tailored to market demands.

To "overtake" the US, focus on the "application line" While domestic enterprises are turning to the US's open-source AI model to catch up, the US is in a relatively awkward position. They have been trying to slow down China's progress by restricting microchip sales and curbing investments, but they cannot prevent companies from choosing to publish their software publicly to promote its adoption.

The US's dilemma on open-source models provides an opportunity for domestic enterprises to "overtake."

Considering the two popular models, Sora and GPT-4, Sora's algorithmic breakthroughs are not significant, and its impressive results are largely attributed to the accumulation of immense computing power. It resolves the issue of temporal consistency between frames but fails to reduce the video generation cost in the short term.

While GPT-4 is powerful, its high cost remains one of the most challenging realities to overcome. This prompts enterprises to often choose more cost-effective solutions in practical applications, such as open-source models or smaller commercial models.

Moreover, if the best open-source technology originates from China, American developers will eventually shift from being proactive to reactive, potentially even building their underlying systems on the foundation of Chinese technology.

It is evident that the US, in pursuit of technological leadership, has stumbled at the threshold of commercialization due to costs. This could potentially lead to a stalemate in the future.

In contrast, Chinese tech investors prioritize turning losses into profits as soon as possible when promoting AI, meaning funds are flowing towards readily executable applications rather than more ambitious, fundamental research goals, as stated by Yiran Chen, John Cocke Distinguished Professor of Electrical and Computer Engineering at Duke University.

Concurrently, up to 50% of AI investments in China are directed towards computer vision technologies for surveillance rather than establishing foundational models for generative AI.

Especially catering to domestic market demands, domestically developed large models like Baidu's Wenxin ERNIE Bot and Alibaba's Tongyi Qianwen have demonstrated their practicality and efficiency in addressing a wide range of application scenarios. Admittedly, these models still lag behind global top-tier large models in handling extremely complex or specific demands.

However, for the practical needs of most current production tools, both models acquired through open-source channels and domestic commercial solutions provide basic and relatively satisfactory service support.

Notably, as various application scenarios continue to expand and deepen, the actual application and implementation of domestic large models are significantly accelerating, showcasing a vigorous development trend.

Thus, while China cannot yet achieve a comprehensive technological overtake with existing large models, the US cannot effectively block China's progress. Open-source technology is both the key reason for China's rapid AI development and an opportunity for China to take the lead.

The differences in technological paths have already caused the US to stagnate at a certain stage, and China should continue to focus on application development to narrow the gap in commercial value.

In the long run, if the US genuinely restricts open source, it will mark the beginning of technological decline and simultaneously the start of China's official rise.

How the competition will ultimately evolve remains to be seen. Time will tell.

Source: Hong Kong Stocks Research Society