IPO of CamScanner's Parent Company, AI + Big Data [Scans] Out 10 Billion

![]() 10/09 2024

10/09 2024

![]() 457

457

Preface:

At the beginning of this year, given the overall cautious trend of the IPO environment in the A-share market, Hefei Information, as a company with C-end business as its core, and one of the few companies in the AI field that have achieved profitability and continued to maintain a high level of profitability and growth rate, was able to stand out and successfully land on the STAR Market, thus attracting much market attention.

Author | Fang Wensan

Image source | Network

IPO of CamScanner's Parent Company Hefei Information

More than a decade ago, Dr. Zhen Lixin of the Chinese Academy of Sciences successfully launched the [CamCard] application, which quickly became popular with its unique features such as [taking photos of business cards with a mobile phone camera and automatically completing recognition, cropping, and archiving].

Relying on the company's self-developed core technologies of intelligent text recognition and commercial big data, these three popular applications have become popular worldwide, with cumulative downloads exceeding 800 million on two major app stores and topping the charts of efficiency-related free app downloads in over 100 countries and regions on the App Store.

Recently, Shanghai Hefei Information Technology Co., Ltd. (Hefei Information), a company with significant influence in the field of artificial intelligence and big data technology, has successfully passed the review of the Shanghai Stock Exchange and is about to be listed on the STAR Market.

Today, Hefei Information is poised to become the [first stock of intelligent text recognition] on the STAR Market and even the entire A-share market.

On the first day of listing, Hefei Information's opening price was 100 yuan per share, an increase of over 80% from its issue price. By the close of trading, Hefei Information's share price was 113.62 yuan per share, an increase of 105.91%, with a market value of 11.362 billion yuan.

The issue price of Hefei Information's IPO was 55.18 yuan per share, and the total amount of funds successfully raised was 1.38 billion yuan, slightly lower than its original fundraising plan of 1.49 billion yuan.

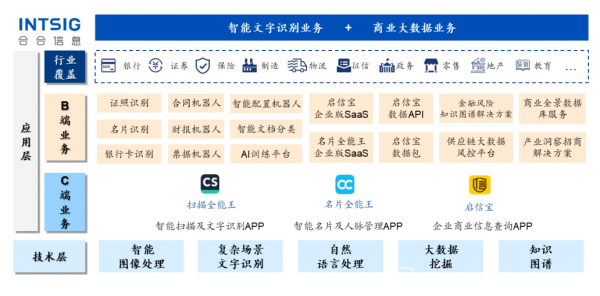

With its intelligent text recognition and commercial big data technologies, Hefei Information has successfully expanded its business territory, covering both B-end and C-end markets.

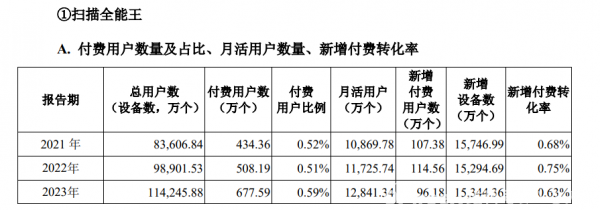

The company has three flagship products: CamScanner, CamCard, and Qixinbao, with CamScanner having an astonishing 1.142 billion registered users as of the end of 2023.

Moreover, during the IPO application period, Hefei Information's performance showed explosive growth, with revenue in 2023 increasing nearly sixfold compared to 2018.

According to the prospectus, Hefei Information's operating revenue in 2021, 2022, and 2023 was 806 million yuan, 988 million yuan, and 1.187 billion yuan, respectively; net profit reached 144 million yuan, 284 million yuan, and 323 million yuan, respectively;

Net profit after deducting non-recurring gains and losses was 139 million yuan, 265 million yuan, and 297 million yuan, respectively. The company has achieved profitability since 2020 and continued to grow rapidly.

As of December 31, 2022, Hefei Information's audited consolidated financial statements showed an undistributed profit of 354 million yuan, eliminating accumulated uncompensated losses.

During the IPO application period from 2021 to 2023, Hefei Information's operating revenue and net profit both achieved significant growth, with compound annual growth rates exceeding 20% and nearly 50%, respectively.

Founding team from Motorola

The company's current actual controller, Zhen Lixin, 56 years old, holds a Ph.D. in pattern recognition and intelligent systems from the Institute of Automation, Chinese Academy of Sciences.

Since 2000, Zhen Lixin has joined Motorola and served as a core leader in its global lab, focusing on the research and development of OCR technology - optical character recognition.

By 2006, despite still holding a senior position at Motorola, Zhen Lixin resolutely founded Hefei Information's predecessor, Hefei Limited.

In terms of core technical personnel, apart from Ding Kai, the other five members all come from Motorola China Research Institute, and most of them quickly joined Hefei Information after leaving the company.

These members focused on handwriting recognition systems and speech recognition technology during their time at Motorola.

Notably, in 2009, the same year Zhen Lixin joined Hefei Information, the company successfully launched its first product, CamCard.

The following year, the team successfully developed and launched CamScanner.

Within the company, there are not only former colleagues but also alumni with a shared academic background.

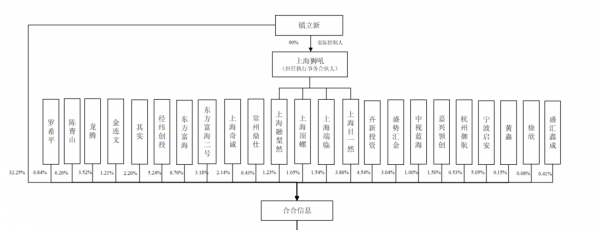

In terms of Hefei Information's shareholding structure, prior to the IPO, the actual controller, Mr. Zhen Lixin, directly held 32.2504% of the company's shares;

and indirectly controlled Shanghai Shihou, Shanghai Dingluo, Shanghai Rongliran, and Shanghai Muyiran through his controlled Shanghai Shilou, thereby controlling a total of 39.9331% of Hefei Information's shares.

Within the core technical team, Mr. Luo Xiping held a 6.84% stake, Mr. Chen Qingshan held 6.26%, and Mr. Long Teng held 3.52%.

Among external investment institutions, Matrix Partners held 5.24%, Oriental Fortune Capital held 6.76%, Oriental Fortune Capital II held 3.18%, and Changzhou Dingshi held 6.43%.

CamScanner is the key to performance improvement

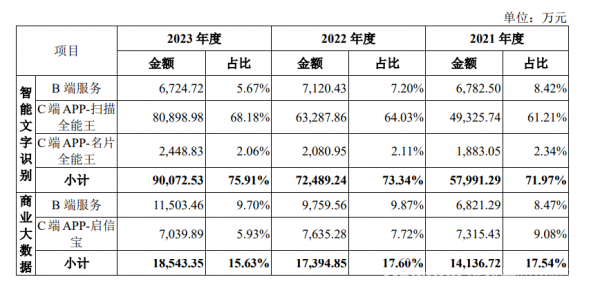

In 2023, C-end business accounted for about 76% of the company's overall revenue, with CamScanner contributing about 90% of that, meaning nearly 70% of the company's revenue directly came from CamScanner.

Further analysis shows that CamScanner not only accounts for a significant proportion of the company's revenue but also grows faster than the company as a whole, becoming an important engine for maintaining the company's medium-to-high growth in revenue.

Specifically, from 2021 to 2023, CamScanner's revenue grew at rates of 47.93%, 28.31%, and 27.83% year-on-year, all higher than the company's overall revenue growth rates during the same period (39.35%, 22.67%, and 20.04%, respectively).

The prospectus also shows that Hefei Information achieved operating revenue of 688 million yuan in the first half of 2024, an increase of 21.85% year-on-year.

Among them, CamScanner's C-end APP, as the company's revenue pillar, generated revenues of 493 million yuan, 633 million yuan, and 809 million yuan from 2021 to 2023, respectively;

accounting for an increasing proportion of the company's total revenue, reaching 61.21%, 64.03%, and 68.18%, respectively.

In addition, although ToB commercial big data services and advertising promotion services accounted for a relatively low proportion of revenue, they also showed a good trend of rapid growth.

In contrast, the revenue growth of Qixinbao, ToB text recognition, and CamCard business segments appeared to be less impressive.

The scarcity effect is gradually weakening. As a pioneer in the field of text recognition, CamScanner has successfully built strong user awareness through its diverse document and image processing functions and enjoyed the dividends brought about by the post-pandemic online office boom.

However, with the vigorous development of AI technology, the field of text recognition is attracting many industry giants, and the competitive environment is becoming increasingly severe, leading to a slowdown in the growth rate of Hefei Information's core business.

Financing may not be the primary consideration for IPO

According to Hefei Information's official announcement, in this IPO, the company issued 25% of its shares to the market and successfully raised a total of 1.3795 billion yuan in funds, corresponding to a market value of up to 5.518 billion yuan.

In terms of the use of raised funds, Hefei Information has identified four strategic directions, two of which focus on product optimization and market promotion, and the other two on basic technology research and development, with the aim of promoting the company's long-term development.

Given that Hefei Information rarely involves capital expenditures in its operations, most of the cash flow generated by its operating activities is converted into free cash flow.

As of the first half of 2024, the company's total assets reached 1.967 billion yuan, including 733 million yuan in monetary funds and 748 million yuan in bank financial products, totaling close to 1.5 billion yuan.

From the perspective of funding needs, Hefei Information's current cash reserves are sufficient to support its business development plans.

If we further consider the funds raised through the IPO, the company's monetary assets on its books will approach 3 billion yuan, accounting for about half of its issued market value.

Therefore, given the abundant cash flow, financing may not be the primary consideration for Hefei Information's IPO.

On the contrary, providing a more convenient exit channel for the company's original shareholders after going public has become a more significant possibility.

Facing competition with major players in the same industry

From an industry competition perspective, CamScanner is facing challenges from multiple areas.

These include document editing applications (such as WPS, Foxit, etc.), cloud storage services (such as Baidu Netdisk, Quark, etc.), and communication and collaboration platforms (such as DingTalk, QQ, WeChat Work, WeChat, etc.), all of which have integrated scanning and text recognition functions into their mobile apps, creating direct competition.

Meanwhile, as a product entering its mature development stage, CamCard also feels the pressure of substitution from social media apps (especially WeChat), as some users prefer to exchange contact information through social media apps instead of traditional paper business cards.

In the field of intelligent text recognition B-end basic technology services, comprehensive AI giants such as Baidu, Tencent, and Alibaba have all launched standardized intelligent text recognition services on their cloud platforms, intensifying market competition.

Although Hefei Information has a relatively small capital scale and limited financing channels, its intelligent text recognition business remains its core competitiveness.

To address these challenges, Hefei Information has planned a clear strategic path:

In the B-end business area, the company plans to expand its industry coverage, especially by strengthening its presence in key industries such as government and manufacturing;

in the C-end business area, the company will further optimize and upgrade products such as CamScanner, CamCard, and Qixinbao by developing vertical scenario functions, implementing differentiated operational strategies, and exploring new value-added functions to deeply mine user value and consolidate and enhance its position in the C-end market.

Conclusion:

As an emerging big data industry, commercial big data is extracting information and knowledge from unstructured enterprise data through natural language processing (NLP) technology.

With the support of artificial intelligence, its application scenarios are gradually enriched and maturing, further driving the continuous growth of enterprise and government demand for data asset management and facilitating rapid industry expansion.

However, the rapid development of AI also brings challenges, one of which is the uncertainty of market changes, which is also reflected in Hefei Information's prospectus, indicating a profound understanding of the potential impact in this field.

In fact, with the continuous evolution of generative AI technology, AI's capabilities in understanding and multimodal recognition are undergoing generational changes, resulting in comprehensive improvements.

This transformation not only profoundly affects the competitive landscape of the industry but also gradually degrades and popularizes the technical barriers previously built through high R&D investment, as exemplified by Hefei Information.

References: Chuangyebang: "[CamScanner] Parent Company Earns 1 Billion Yuan Annually, 55-Year-Old Chinese Academy of Sciences Ph.D. soon IPO", Lieyun Selection: "Shanghai AI Unicorn Successfully IPOs with Market Value Exceeding 11 Billion Yuan", 36Kr Finance: "Opening Up 100% Surge, Is CamScanner Really That 'Fragrant'?", Zhidongxi: "Shanghai Surges Out with a 10 Billion Yuan AI IPO! Opening Up Over 80% Surge" Quantum Bit: "Earning 1.2 Billion Yuan and Creating a 10 Billion Yuan Market Value, Chinese Academy of Sciences Automation Institute Adds Another Billionaire Alumni"