Why Apple Can Still Win Without AI Enhancement

![]() 11/07 2025

11/07 2025

![]() 560

560

Editor | Sun Jing

Apple has consistently been at the forefront of adopting new technologies, whether it's embracing large screens, 4G, or 5G. However, in the current era where artificial intelligence is all the rage, Apple's AI development significantly trails behind other Silicon Valley behemoths.

Is this lag due to a lack of internal innovation, or does Apple simply believe that AI is not as crucial at this juncture? Apple CEO Tim Cook has recently provided some insights.

The iPhone 17, despite lacking groundbreaking innovation, has become Apple's key to achieving its highest-ever revenue. During Apple's Q4 and full-year fiscal 2025 earnings call, Cook repeatedly emphasized that the iPhone 17 series is in "short supply."

▲ The iPhone 17 series is being sold on Apple's official website.

It seems that Cook is the most astute observer of user preferences in the smartphone industry—when faced with flashy AI selling points versus straightforward cost-effectiveness, the "true fragrance" principle (referring to the genuine value that stands out amidst hype) once again proves its worth.

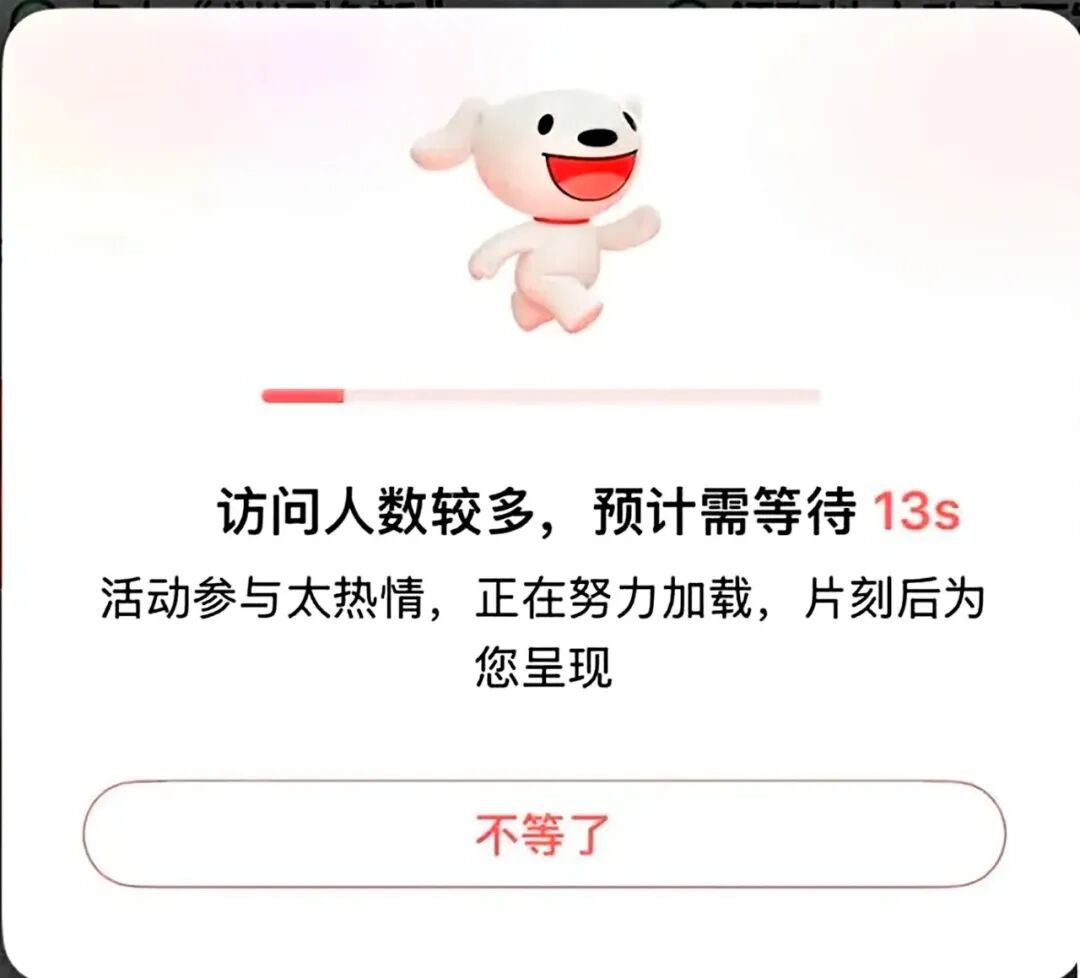

On the first day of sales, Apple's official website experienced multiple crashes. The initial batch of stock on JD.com and Tmall flagship stores sold out within 15 minutes. Unopened iPhone 17 standard versions on Xianyu (a second-hand trading platform) were being resold at a premium of 300-500 yuan, while the Pro Max version saw its price inflated by over a thousand yuan. Even top streamer Li Jiaqi admitted that he might not sell the iPhone 17 this year, stating, "It's selling too well, and I can't get stock. My own pre-ordered Pro Max hasn't even shipped yet."

▲ When sales opened at 8 a.m., JD.com's official channel displayed a loading countdown.

A Beijing user who pre-ordered a base model iPhone 17 on JD.com a week ago discovered that the order page indicated shipping would not occur until 23 days later.

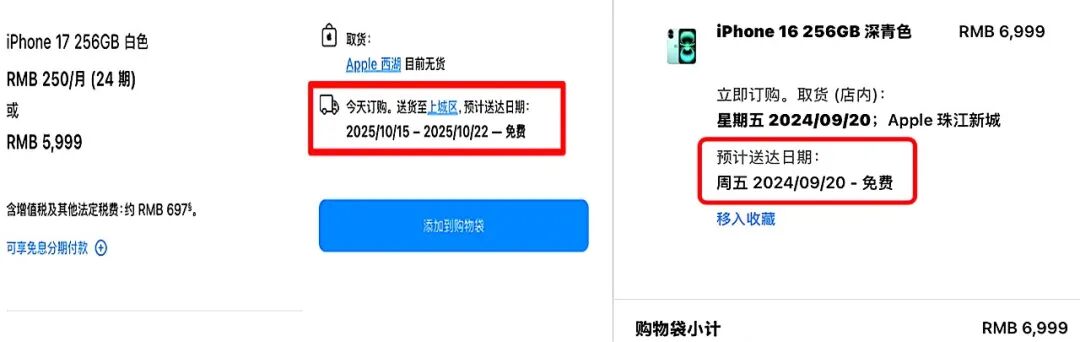

▲ Shipping times for the iPhone 17 on Apple's official website are mostly scheduled for mid-to-late October.

This stands in stark contrast to the immediate availability of last year's iPhone 16.

From a product strategy perspective, this iPhone generation deviates from Apple's traditional approach. It breaks the long-standing "major update-minor update" incremental rhythm, instead adopting a "sincere hardware stack" strategy: entry-level storage capacity doubles from 128GB to 256GB, the entire lineup comes standard with the A19 series chip, and 120Hz high refresh rate screens—a feature Android phones have had since 2020—finally "catch up" in 2025. Additionally, the thinnest iPhone Air ever was unveiled, which the market interprets as an exploration of foldable screen forms.

In terms of pricing, contrary to predictions of an increase, the base model's price dropped by 1,000 yuan compared to its predecessor, successfully creating a "high-spec, low-price" cost-effectiveness atmosphere.

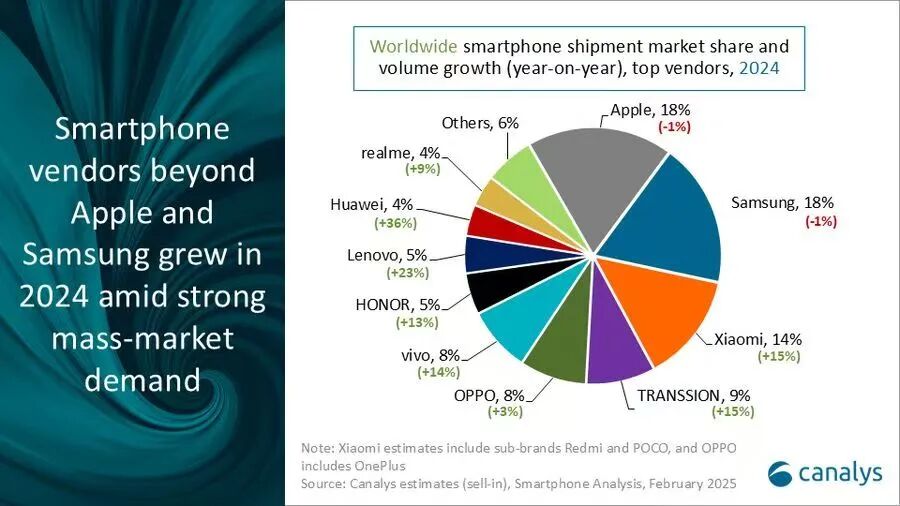

Behind this sincerity lies the relentless pressure from competitors. As rivals compete on hardware, user experience, photography, AI concepts, and even attempt to be compatible with Apple's ecosystem while flaunting flashy tricks, Apple's narrative of "8G RAM + iOS > 16G RAM" has lost its effectiveness. Last year, the global smartphone market grew by 7%, while Apple's market share declined by 0.9%.

▲ Changes in Global Smartphone Market Share in 2024. Source: Canalys

Despite the delayed AI features of the iPhone 17 series, the A19 chip showing little difference from Android flagships in daily use, and the iPhone Air being mocked by netizens as "successfully solving the problem of phones priced above 7,000 yuan lacking single cameras, single speakers, and ultra-low battery life," overall sales remain robust.

Within a month of launch, both the iPhone 17 and 17 Pro series surpassed one million units in sales, with the most expensive Pro Max model accounting for 2.5 million units alone, becoming the most popular version. With national subsidy policies in place, the standard version, previously ridiculed as "only for those who can't afford better," saw pre-sales far exceeding expectations, prompting Apple to urgently request supply chain increases for the standard model's production capacity.

Compared to the iPhone 16, which "forced its way" into the AI concept but received a lukewarm market response, the iPhone 17 series' market reaction sends a clear signal: at this stage, AI is not yet the core selling point for smartphones.

Over the past two years, capital markets have generally been cautious toward Apple, primarily due to its perceived "lag" in AI deployment. While Android manufacturers shout about the "first year of AI smartphones" and compete for computational power firsts, Apple's AI progress appears slow and measured.

Currently, AI smartphone development follows two distinct paths: in terms of capability forms, it is shifting from language models two years ago to today's voice, image, and other multimodal models; in terms of deployment focus, it is moving from emphasizing cloud-edge collaboration to landing large models on the device side.

However, clear technical paths have not translated into differentiated user selling points. Currently, highly touted AI voice assistants, AI photography, and AI-assisted office functions still have a very limited ecosystem, with few varieties and no blockbuster hits, and can even be "replaced" by third-party software.

▲ Social media complaints about iPhone AI features.

Without a unique, irreplaceable experience, the moat around AI smartphones remains unclear.

Therefore, even without Apple's AI features, consumers are still willing to vote with their wallets. In real purchasing decisions, Apple relies not on future concepts but on the certainty of "cost-effectiveness return" and ecosystem experience. Simply put, it lacks disruption but is "just right."

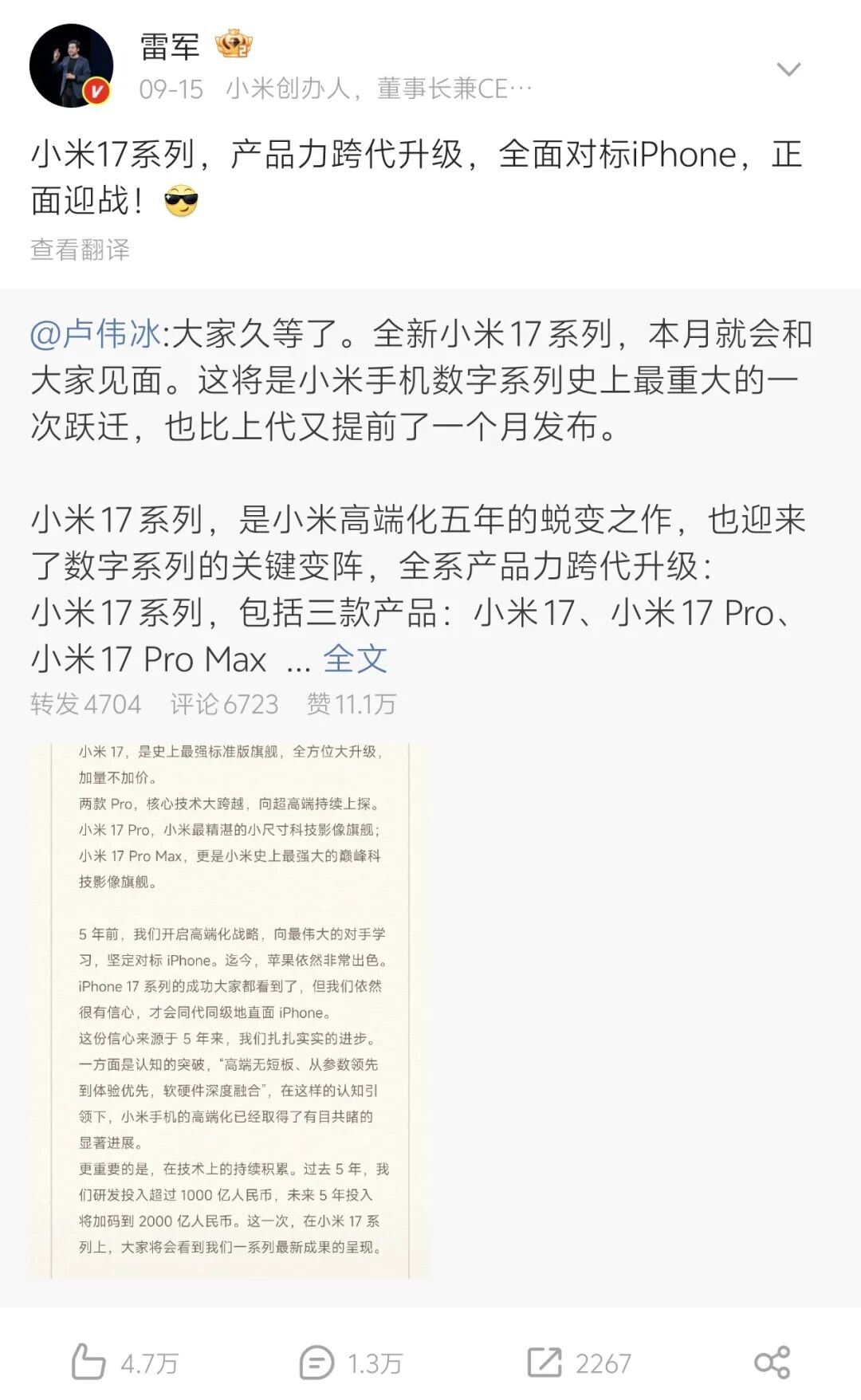

Meanwhile, Apple continues to quietly reinforce its ecosystem walls. Despite domestic manufacturers' skilled attempts to be compatible with Apple, with the OV series achieving cross-device interconnection with Apple, Xiaomi even "paying homage" to model numbers, and power banks compatible with iPhones, Apple itself is also quietly enhancing its own compatibility.

▲ Lei Jun's Weibo post introducing Xiaomi's 17 series, skipping the 16.

For example, after the Mac OS upgrade, the "iPhone Mirroring" feature allows users to directly control their phones from their computers, further enhancing convenience within the closed ecosystem. Many such convenient features exist. The seamless interoperability between products makes it difficult for Apple ecosystem users to switch to other platforms.

And while Apple appears to be pursuing a "cost-effective" route on the surface, it still tightly controls profit margins.

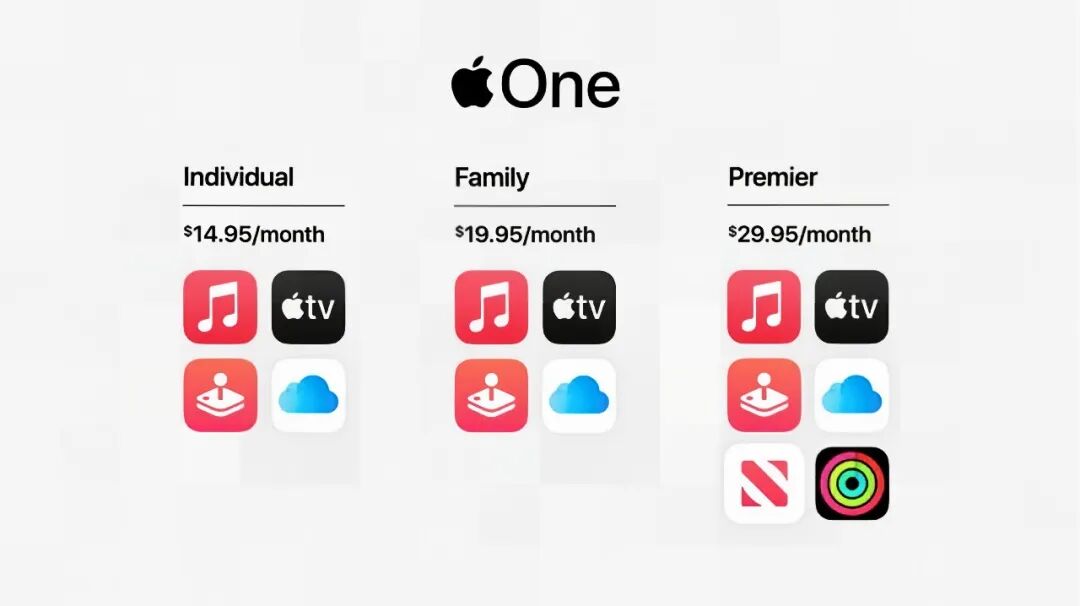

On one hand, as Android manufacturers collectively raise prices due to soaring memory costs, Apple stabilizes costs through self-developed components. At this earnings call, Apple stated that its product gross margin reached 47.2%, above the upper limit of its previous forecast range, and expects future gross margins to be between 47% and 48%. On the other hand, every iPhone sold delivers a "live user" to high-margin businesses like the App Store, Apple Music, and iCloud.

▲ Apple's Apple One software ecosystem subscription package service launched in 2020.

The capital market clearly approves of this logic. As of October 30th's close, Apple's cumulative year-to-date gain reached 8.4%, making it the third company in history to surpass a four trillion dollar market cap. For investors, an Apple that "lacks innovation but makes money" is more reassuring than one that "tells future stories but delivers no results."

In the short term, addressing hardware shortcomings has indeed made users vote with their feet. But in the long term, when the smartphone industry truly enters the AI era, whether Apple can once again deliver a game-changing product remains everyone's greatest anticipation.

Additionally, a source close to Apple's partners revealed to NoNoise that, barring any surprises, Apple Intelligence will officially land in the Chinese market before the end of this year.

In other words, in two months, the trajectory of AI competition in the domestic smartphone market may become clearer. Will the iPhone 17 continue to be in short supply?