"Silver October" Sales Surge: Multiple Brands Hit Record Highs, New Energy Penetration Rate Eyes 60%

![]() 11/07 2025

11/07 2025

![]() 592

592

Layout: Chen Yujie

Image: Sourced from the internet; removal upon notice of infringement

Produced by Qiancheng Shuzhi (Performance Marketing Intelligent Agency)

Introduction

Multiple brands shatter sales records, showcasing a clear leader effect in the auto market.

What does it signify when China's auto market new energy retail penetration rate in October is on the brink of reaching 60%?

The Passenger Car Association previously projected that October's narrow passenger car retail sales would hit approximately 2.2 million units. Despite a slight 2% month-on-month decline, new energy retail sales are anticipated to soar to 1.32 million units, with a penetration rate poised to exceed 60%, marking a historic milestone.

The primary catalyst for this rapid growth remains the looming "Sword of Damocles" – the impending phase-out of new energy vehicle purchase tax subsidies by 2026. This has not only triggered a "last-chance" buying spree among consumers but also set the countdown for automakers to fully commit. Over a dozen automakers, including Xiaomi, NIO, Zeekr, Changan, and Lynk & Co, have sequentially rolled out cross-year purchase tax subsidy guarantees, aiming to secure orders in advance and mitigate a potential "demand cliff" post-policy phase-out.

This "Silver October" performance report not only signals the completion of market leadership transition but also exposes the industry's dilemma of "rising sales, declining profits." As the penetration rate nears 60%, the looming challenge for China's auto market has shifted from "selling cars" to "achieving sustained profitability in a war of attrition."

Conglomerates: Achieving "Elephant Run" Through Systemic Strength

Under clear policy expectations and survival pressures, conglomerates have demonstrated what "systemic dominance" entails. Leveraging their massive scale, full-chain resources, and rapid transformation speed, they prove that elephants can not only pivot but also sprint.

"New energy transformation" and "globalization" are the twin engines driving this elephant run.

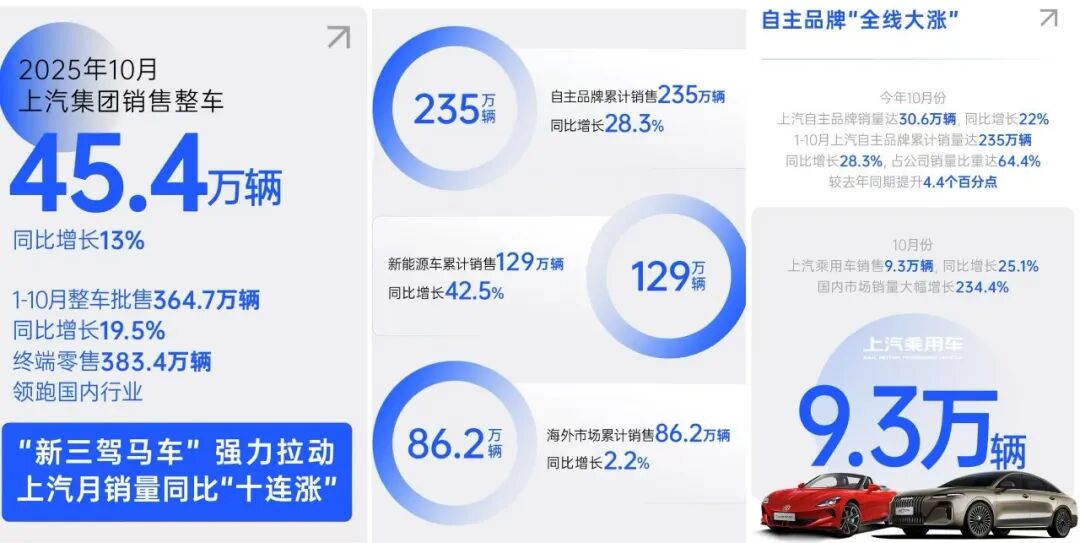

SAIC Motor cemented its industry-leading position with 454,000 units sold, marking a tenth consecutive month of sales growth. Its growth foundation has expanded from traditional joint venture strongholds to three new fronts: independent brands, new energy, and overseas markets. From January to October, SAIC's independent brand sales accounted for over 60%, reaching 2.35 million units; new energy vehicles totaled 1.29 million units, with overseas contributions at 862,000 units.

BYD set a new annual high with 441,700 units sold, continuously deepening its scale advantage. More significantly, its growth engine has shifted: October overseas sales reached 83,524 units, surging 155.5% year-on-year, marking its successful establishment of a "domestic + overseas" dual-drive model.

Geely Auto broke through the 300,000-unit monthly sales barrier for the first time, with its multi-brand strategy bearing fruit. The Geely Galaxy brand achieved its "annual sales of one million" target in just 10 months with 127,476 units sold, becoming the undisputed mainstay in the mass market. Meanwhile, Zeekr (21,423 units) and Lynk & Co (40,213 units) have respectively taken up the banners of high-end pure electric and globalization advancement. Notably, the current annual sales target achievement rate has reached 83%, making the 3 million-unit target virtually certain.

Chery Group's 281,000 units sold represent a classic case of "boosting domestic growth through overseas expansion" – with exports accounting for a substantial 45% (126,000 units). This deep overseas moat provides it with more buffer space in the fierce domestic market competition.

BAIC Group sold 160,000 vehicles in October. Its BAIC New Energy (Arcfox/Xiangjie) achieved a remarkable triple jump of "10,000+ in August, 20,000+ in September, and 30,000+ in October." Among them, the Xiangjie S9, in collaboration with Huawei, has secured a foothold in the luxury market above 300,000 yuan. This underscores that tech giants' empowerment is a shortcut for traditional automakers to achieve brand leapfrogging, but the depth and sustainability of their collaboration remain long-term questions.

Great Wall Motor, based on 143,000 units sold, achieved 57,158 units in overseas sales, growing synchronously with new energy sales. Its unique "boxy" product lineup (Haval Menglong/Tank series) not only contributed 46% of sales but also became its differentiated business card for global market impact.

Traditional Central Enterprises: Balancing "Stability" and "Progress"

FAW Group sold 305,000 vehicles in October, with the Hongqi brand surpassing 45,000 units sold in a single month and new energy product sales increasing 66.3% year-on-year. Meanwhile, FAW-Volkswagen just reached the 30 millionth vehicle production milestone, and FAW Toyota's products are accelerating their refresh, showcasing the product resilience of the joint venture sector.

Changan Auto contributed 119,000 units from new energy to its total sales of 278,000 units. The matrix formed by the Shenlan, Avita, and Qiyuan brands has achieved precise positioning in different market segments.

Dongfeng Group adopted more flexible organizational and product strategies to break through. AITO Technology achieved 31,107 units sold in October, while VOYAH delivered 17,218 units, jointly becoming important pillars for the group's electrification transformation.

New Forces: From Survival Race to Positioning Race

As conglomerates leverage systemic strength to go all-in, the internal logic of the new forces camp is quietly evolving. The market landscape has transitioned from a survival race of "who can stay alive" to a positioning race of "who can secure a top-tier spot." The competitive dimension has also upgraded from a single focus on product strength to a comprehensive system capability contest encompassing brand, scale, technology, and operations.

Among the leading camp, Leapmotor and HiPhi have taken two distinct yet equally successful paths.

Leapmotor continues to lead the new forces with 70,289 units delivered, with its core weapon being extreme cost control enabled by full-domain self-research, successfully penetrating the most mainstream consumer market and earning the title of "Volkswagen of the electric vehicle world." Meanwhile, HiPhi delivered 68,216 units across its entire lineup, setting a new record for the "fastest one million deliveries" among new forces while achieving an average transaction price of 390,000 yuan – a price band even surpassing traditional luxury brands BBA. Strong tech brand empowerment has proven capable of rapidly scaling high-end models in the Chinese market.

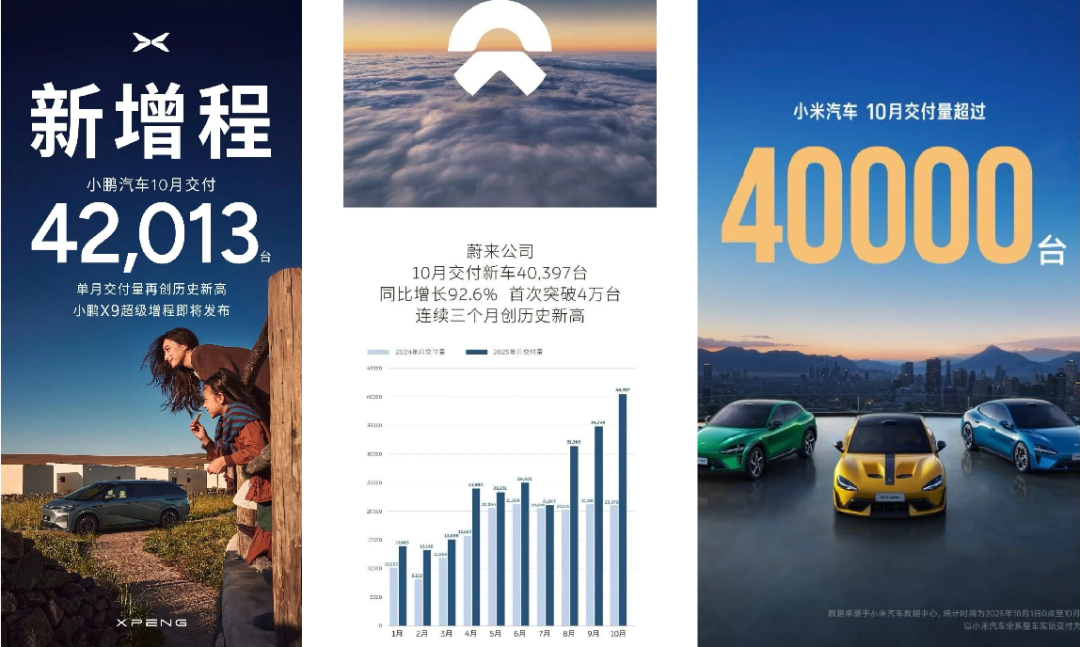

In the chasing camp, XPeng, NIO, and Xiaomi have all surpassed the 40,000-unit mark but face different challenges.

XPeng's 42,013 units reflect the stability of its tech label (intelligent driving), but it faces direct competition from tech companies like Huawei and Xiaomi. NIO broke through 40,000 units for the first time, with the Happy Path (Ledo) brand contributing 17,342 units, marking the initial success of its multi-brand strategy and opening the channel to the mass market. Meanwhile, Xiaomi maintains its momentum of over 40,000 units but is simultaneously experiencing the "heat" of production ramp-up and the "ice" of public opinion controversies.

In contrast, Li Auto's 31,767 units and its month-on-month decline highlight the growing pains of its transition from a range-extended leader to a pure electric contender. Li Auto's i6 exceeding 70,000 orders is undoubtedly a shot in the arm, but the most urgent task now is converting those orders into actual deliveries and repairing the damaged brand image following the MEGA controversy.

Auto Talk

October's sales rankings are not just a report card but a map of future market power distribution.

Conglomerates leverage systemic advantages and globalization layouts to regain control over defining market rules, while new forces seek their survival philosophies within the ranks. All players, driven by policy and market forces, are making their final sprint for the upcoming fully marketized competition.

Scale, brand, technology, globalization – the exam points for victory are clear. A Chinese auto market thoroughly dominated by new energy has arrived, and its main theme is shifting from collective sprints to a protracted war of attrition testing endurance and comprehensive strength.