OpenAI raises $6.6 billion, setting a new record for the highest funding in Silicon Valley

![]() 10/10 2024

10/10 2024

![]() 464

464

Preface:

The development and operation of AI models are essentially resource-intensive activities, essentially viewed as a game of high-cost investment.

As AI technology moves from the laboratory to the real world, aiming to improve people's lives, it still requires ample funding as the "fuel" driving its development.

Author | Fang Wensan

Image Source | Internet

OpenAI raises $6.6 billion in a new round of funding

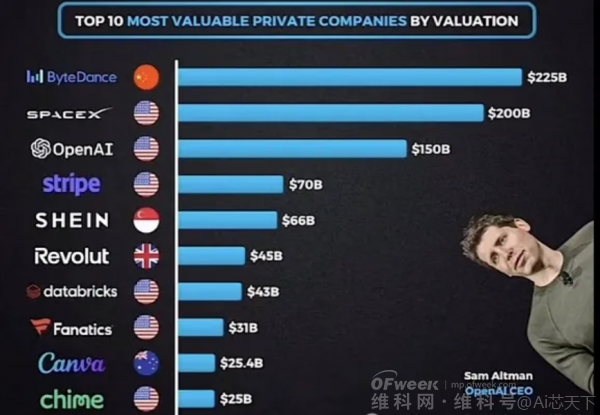

On October 2 local time, the American AI company OpenAI officially announced on its official website that it had successfully raised $6.6 billion in its latest round of funding, pushing the company's valuation to $157 billion post-funding.

This round of funding not only establishes OpenAI's leading position in funding among unicorn companies in the global AI industry but also propels it to the forefront of global tech startup valuations, second only to SpaceX.

The round was jointly participated in by multiple renowned investment institutions, including Thrive Capital ($1.3 billion), Microsoft ($750 million), NVIDIA, SoftBank ($500 million), Tiger Global ($350 million), and Altimeter Capital ($250 million).

According to data from Crunchbase, the round was led by long-term partner Thrive Capital, further pushing OpenAI's total funding to $17.9 billion.

Despite Apple's absence from the investment, OpenAI's funding process progressed smoothly, and it rejected billions of dollars in over-subscription requests.

This funding amount ranks among the top in the global generative AI field, surpassing the $6 billion raised by Musk's large model platform xAI and the $4 billion raised by OpenAI's primary competitor Anthropic.

If listed at the current valuation of $157 billion, OpenAI's market value would exceed that of Goldman Sachs, a top global investment bank, and Uber, the world's largest mobility company.

As of now, Goldman Sachs has a total market value of approximately $155.4 billion, while Uber's total market value is $154.3 billion.

The funds raised will primarily be used to strengthen OpenAI's leading role in cutting-edge AI research, consolidate its market position by enhancing computing capabilities and continuously developing tools aimed at solving practical user problems.

According to the Financial Times, citing insiders, OpenAI set a special requirement during funding negotiations: investors must commit not to fund competitors like Anthropic and xAI in the AI sector, forming an exclusive investment relationship with OpenAI.

This move aims to limit competitors' access to capital and strategic partners but has provoked dissatisfaction among some potential investors, particularly those accustomed to diversified investment strategies, such as Sequoia and Apple, who ultimately withdrew from negotiations.

Masayoshi Son and Jen-Hsun Huang participate in this round of funding

In this funding round, Thrive Capital stood out with a significant investment of up to $1.3 billion, becoming the largest investor.

In return, the firm enjoys unique rights: once OpenAI reaches predetermined revenue milestones, it will have the option to invest an additional $1 billion based on OpenAI's current valuation of $157 billion in the following year.

Thrive Capital, a venture capital firm founded in 2010 by serial entrepreneur Joshua Kushner, has a proven track record of success.

Through precise investments in industry stars like Instagram, Stripe, Spotify, Reddit, Twitch, and GitHub, the firm has rapidly risen to prominence and earned widespread acclaim.

Prior to ChatGPT's emergence, OpenAI's founder Sam Altman made his first call for help to Joshua Kushner.

Despite the uncertain future of OpenAI at the time, Kushner remained confident and injected crucial funding with a lead investment of nearly $130 million in 2023.

Recently, Masayoshi Son and Jen-Hsun Huang's names have been frequently linked, reflecting the deep strategic layouts and intense competition between SoftBank and NVIDIA in the AI sector.

Following the announcement of their AI industry alliance, Masayoshi Son swiftly responded by planning to raise up to $100 billion to challenge NVIDIA's market position by establishing an AI chip company.

During this period, Altman maintained close contact with these two industry giants, paving a broader path for OpenAI's future development.

Specifically in this funding round, SoftBank and NVIDIA invested $500 million and $100 million, respectively, in OpenAI.

Although this is their first investment in OpenAI, given their deep expertise and forward-looking layouts in the AI sector, the move did not come as a surprise.

Additionally, the participation of the United Arab Emirates investment firm MGX adds further intrigue to the funding round.

Earlier this year, rumors emerged that Altman was negotiating with Middle Eastern consortia to raise significant funds.

Meanwhile, Cathy Wood's Ark Venture Fund was also reported to have invested at least $250 million in OpenAI, although this information has yet to be officially confirmed.

This is Ark Venture Fund's second investment in OpenAI, making it the fund's third-largest holding, accounting for approximately 5% of its total assets.

Continued demand for substantial funding due to rapid expansion

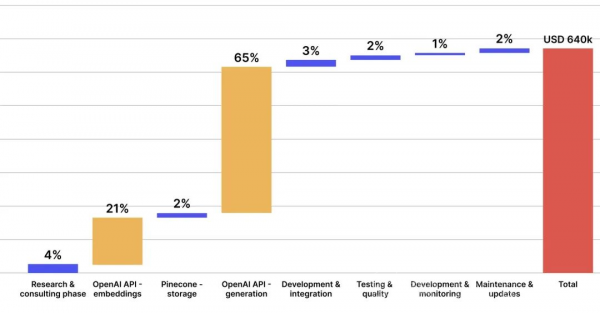

Given the exorbitant costs of training AI models, particularly advanced models like GPT-4, which have surpassed the $100 million mark in training expenses, OpenAI faces ongoing demands for massive funding.

Furthermore, OpenAI is committed to recruiting top AI research talent globally and maintaining high daily operational expenses.

The daily operating cost of ChatGPT alone is as high as $700,000.

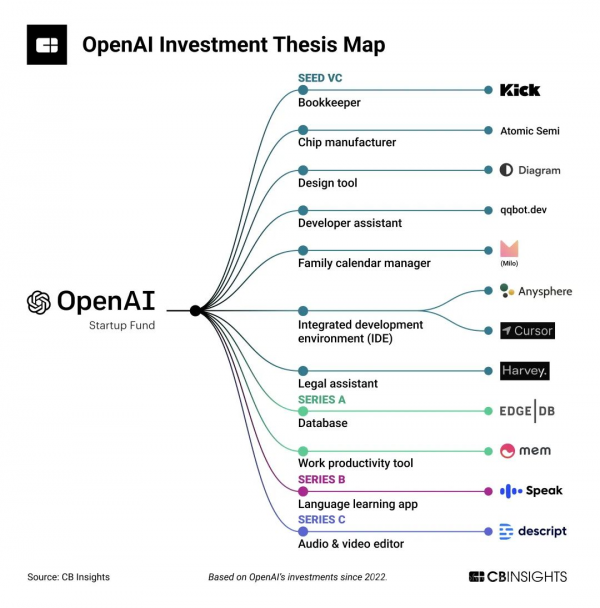

Simultaneously, OpenAI continuously invests in emerging startups within the AI ecosystem to expand its technological reach and market influence.

This strategy aims to reduce dependence on external hardware suppliers like NVIDIA and potentially lower overall operating costs, thereby enhancing market competitiveness.

Reliable sources indicate that to maintain its market leadership, OpenAI is investing billions of dollars in AI system training and production, including its newly launched o1 system, and actively recruiting top data science talent.

The Information reveals that OpenAI has invested approximately $7 billion in model training and $1.5 billion in personnel recruitment.

Despite significant growth in revenue and user numbers, OpenAI faces severe financial challenges this year, with projected losses of up to $5 billion, primarily due to high operational costs, particularly increased purchases of NVIDIA GPUs for training and running large AI models, as well as accelerated datacenter construction.

Moreover, fixed expenses like employee salaries and office rentals cannot be overlooked. To date, OpenAI employs approximately 1,700 people, with over 1,000 new hires in the past nine months.

This unprecedented $6.6 billion funding round undoubtedly provides OpenAI with crucial financial support, alleviating its current financial pressures and granting valuable time for adjustments amidst personnel changes, structural reorganizations, and security controversies.

Will operate as a for-profit company

The funding agreement explicitly stipulates that OpenAI must complete its transition to a for-profit enterprise within the next two years.

Failure to do so within this timeframe will automatically convert the $6.6 billion funding into debt, requiring OpenAI to repay the full amount.

Recently, OpenAI organized an all-hands meeting, with a core focus on discussing the feasibility of transforming the company's status from non-profit to for-profit with its board of directors.

Tracing OpenAI's historical evolution, its complex corporate governance structure stems from historical issues.

Since its inception in 2015, OpenAI operated as a non-profit research project dedicated to the development of Artificial General Intelligence (AGI) for the benefit of humanity, primarily funded by donations.

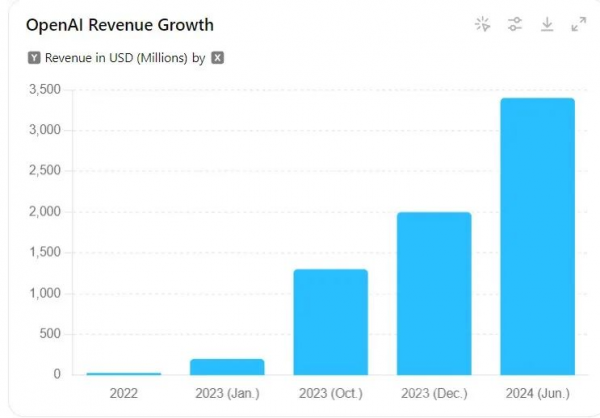

However, with the widespread success of ChatGPT, the company accelerated its commercialization process by offering subscription services for large model products to enterprises and consumers, increasingly emphasizing its profit-making attributes.

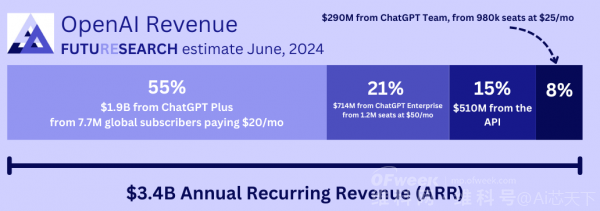

According to The New York Times, OpenAI's annual revenue surpassed $3.4 billion in 2024, with ChatGPT alone contributing $2.7 billion.

The company optimistically predicts that by 2029, its annual revenue could reach a staggering $100 billion, equivalent to Nestlé's current annual sales.

However, the cost of training large models is exorbitant, necessitating continuous massive funding.

As a non-profit entity, OpenAI faces numerous restrictions in accessing funds and resources, somewhat dampening investor appetite.

Thus, restructuring to align with market and funding demands is imperative.

However, transforming OpenAI into a fully for-profit enterprise is no easy feat, posing significant legal challenges.

Under US law, non-profit organizations must redistribute their assets and ensure that the economic compensation received by the non-profit organization is at least equivalent to the value of assets transferred to the for-profit organization during the transition.

This regulation adds complexity and uncertainty to OpenAI's transformation journey.

Notably, Reuters previously reported that the success of the new $6.6 billion funding round hinged on Altman securing equity.

Meanwhile, Bloomberg reported that if OpenAI fails to complete its transition from a non-profit to a for-profit organization within two years, investors in this funding round will have the right to reclaim their investments.

The lifting of these funding restrictions will provide OpenAI with greater freedom to explore long-term, capital-intensive investments like AI chips and entire datacenters, reducing dependence on hardware suppliers like NVIDIA.

Furthermore, this move will strengthen OpenAI's financial position, enabling it to negotiate more competitive licensing agreements with data providers like Reddit and Condé Nast, not only granting it market advantages but also effectively mitigating potential intellectual property litigation risks.

Conclusion:

It is clear that OpenAI is steadily transitioning from a non-profit organization to a profit-driven company.

If OpenAI fails to restructure its corporate structure within two years, current investors will legally have the right to request a refund of their investments.

However, it is noteworthy that OpenAI will inevitably undergo a lengthy and challenging transition period before fully transforming into a mature commercial company.

Several current and former OpenAI employees have expressed concerns that the company's eagerness to announce product launches and conduct security tests has somewhat eroded its competitive edge over rivals.

Some reference materials: Semiconductor Industry Review: "Record-Breaking! OpenAI Officially Announces $6.6 Billion Funding, Valued at Over $150 Billion", Zhongjing Club: "The Second Largest Unicorn in the US Born! OpenAI Valued at $157 Billion", Z Finance: "OpenAI Demands Investor Loyalty! Just Completed Its Largest-Ever Fundraising Round", Chen Bao: "OpenAI Raises Massive $6.6 Billion Funding, Valuation Soars to $157 Billion", APPSO: "OpenAI Officially Announces New Funding, Creating a Trillion-Dollar AI Unicorn", Guixinren Pro: "OpenAI Raises $6.6 Billion, Valued at $157 Billion, Demands Investor Loyalty, and Will Soon Help Employees 'Cash Out'", Finance Breakfast: "Behind the $6.6 Billion Frenzy, Is OpenAI in Danger?", Lao Zhou Talks AI Big Models: "Amid Internal and External Challenges, OpenAI Sets a New Record for Highest Funding in Silicon Valley History", Investment Circle: "Largest Fundraising of the Year: $46 Billion Raised