"Lucky Shen Dou and the Advancing Baidu Intelligent Cloud"

![]() 10/11 2024

10/11 2024

![]() 626

626

The significance of AI to Baidu Intelligent Cloud is likely greater than that to any other cloud computing vendor.

In May 2022, Shen Dou, the Executive Vice President in charge of Baidu's Mobile Ecosystem Group (MEG), transitioned to become the head of Baidu Intelligent Cloud Group (ACG).

Baidu Intelligent Cloud officially entered the "Shen Dou era".

Before Shen Dou, the development of Baidu Intelligent Cloud roughly went through two stages:

The first stage was from 2015 to 2019, when Baidu Cloud first emerged. From officially opening to the public to elevating its strategic position within Baidu, Baidu Cloud gradually developed on the right track. During this period, Yin Shiming, with a sales background, was at the helm.

Among them, 2019 was a crucial year for Baidu's cloud computing business.

That year, Baidu explicitly stated in an internal letter to all employees the need to elevate the strategic position of Baidu Intelligent Cloud. Simultaneously, the "Baidu Cloud" brand was officially upgraded to "Baidu Intelligent Cloud," underscoring the integration of AI and aligning more closely with Baidu's ALL IN AI strategy.

The second stage was from 2020 to 2022, when, thanks to the 2019 brand upgrade, Baidu Intelligent Cloud entered the "Cloud Intelligence Integration" phase and was directly overseen by Wang Haifeng, Baidu's CTO.

"Wang Haifeng has a technical background and is more inclined towards technology and products, while Shen Dou's previous work at MEG was more customer- and business-oriented, with a greater focus on the user level," said Liu Jie (pseudonym), an insider at Baidu Intelligent Cloud, to Guangzhui Intelligence.

As the backbone of Baidu's technology, Wang Haifeng better integrated AI-driven technology with cloud computing, enhancing Baidu Cloud's technological competitiveness. However, despite his technical background, Wang Haifeng lacked commercialization experience.

Shen Dou, who once helped Baidu navigate the mobile internet crisis and led its largest business segment, undoubtedly became the ideal choice for Robin Li, Baidu's founder and CEO, who valued both technical and commercial experience.

Robin Li had high expectations for Shen Dou, demanding quantitative and qualitative changes in the scale and health of Baidu Intelligent Cloud from the outset of his tenure. In other words, both growth and profit were essential.

However, although the strategy of "Cloud Intelligence Integration" had been proposed for two years, it was not evident in Baidu Intelligent Cloud's operations. That changed at the end of 2022 with the emergence of ChatGPT.

The advent of large models made AI a genuine driving force for cloud computing. Not only did it introduce a new MaaS layer, but it also fueled the rise of AI tool layers and a surge in computing power usage.

In 2023, Shen Dou reiterated, "Baidu Intelligent Cloud will not follow the path of Alibaba Cloud or Huawei Cloud. What Baidu truly excels at is AI, and the emergence of ERNIE Bot will fundamentally change the rules of the game in the entire cloud computing market."

The times make heroes, and Shen Dou is fortunate to have encountered a significant turning point within his first year of taking over the new business.

Yet, the business remains challenging, as all cloud vendors are vying fiercely for large models, services, and pricing. After reaping the benefits of large models in 2023, can Baidu Intelligent Cloud truly buck the trend?

Re-emphasized Cloud Business

"The technical atmosphere is strong, and R&D has a significant say," said a former employee of Baidu.

Baidu has consistently led the industry in technical reserves, particularly in AI. However, in terms of cloud services, Baidu Cloud's public cloud service arrived later than Alibaba Cloud, which was established in 2009, but it was not too late.

In 2016, Yin Shiming, recruited by former Baidu President Zhang Yaqin, joined Baidu as General Manager of Baidu Cloud to build its commercial system.

Yin Shiming, Former Vice President of Baidu and General Manager of Baidu Intelligent Cloud

With a strong sales background, Yin Shiming has held positions such as Assistant President of SAP Global Sales, Senior Vice President of SAP Greater China, General Manager of Apple Greater China Channel Enterprise Department, and Head of Ecosystem Department.

"Most of Baidu Cloud's early major customers were brought in by Watson (Yin Shiming) and Zhiqi (Zhang Zhiqi)." An early employee of Baidu Cloud once revealed to the media.

It can be said that Yin Shiming, with his sales background, built a complete B-end cloud business architecture for Baidu, but it was far from enough for a company that has always valued technology.

In December 2018, Baidu underwent a structural adjustment, upgrading the Intelligent Cloud Business Unit (ACU) to the Intelligent Cloud Business Group (ACG), which simultaneously supports the development of AI to B and cloud services.

In September 2019, in addition to further elevating the strategic position of Baidu Cloud, Baidu's internal letter to all employees announced the integration of the Intelligent Cloud Business Group with the CTO system, with Yin Shiming's team reporting directly to Wang Haifeng, Baidu's CTO.

However, during the transition from Yin Shiming to Wang Haifeng, there was a crucial issue: According to insiders at Baidu Cloud, "Robin (Li) deemed Baidu Cloud's performance in 2019 as failing to meet standards."

This source stated that Yin Shiming advocated prioritizing market share expansion, "even if it meant incurring losses," but Baidu Cloud's 2020 OKRs included profit indicators rather than cost-blind expansion.

In other words, Yin Shiming's "trading profits for scale" sales approach was not favored by Baidu.

"Robin's (Li's) OKRs for Baidu Cloud had one requirement: turning losses into profits," said an insider at Baidu Cloud. "We were told that the gross margin had to be at least 20%."

This meant that, unlike other internet companies that traded funds for scale in the early stages, Baidu did not provide additional financial support to cloud computing, given that Alibaba Cloud had reportedly invested 200 billion yuan in servers and cloud OS.

In March 2020, Baidu once again restructured its cloud business, with Wang Haifeng sending an internal email stating that the heads of Baidu Intelligent Cloud's cloud computing, intelligent finance, intelligent customer service, and channel ecosystem businesses would report directly to him, while Yin Shiming and Zhang Zhiqi would have different arrangements.

Following this organizational restructuring, in April of the same year, Yin Shiming officially left Baidu, accompanied by Zhang Zhiqi, who had previously served as Deputy General Manager of Baidu Cloud.

At this point, Baidu Cloud officially entered the phase led by Wang Haifeng, during which he clarified Baidu Cloud's core competitive advantage: "Cloud Intelligence Integration".

Wang Haifeng, CTO of Baidu (Source: People's Daily Video)

In early 2020, Wang Haifeng integrated the former AIG (AI Technology Platform System), TG (Basic Technology System), and ACG (Baidu Intelligent Cloud Group) into the AI Group (AIG).

That same year, Wang Haifeng unveiled a new strategy: "Focusing on key sectors with cloud as the foundation and AI as the driving force," followed by the close integration of cloud and AI, making "Cloud Intelligence Integration" a unique hallmark of Baidu Intelligent Cloud.

In 2021, Wang Haifeng announced the strategic upgrade of Baidu Intelligent Cloud, releasing the "Cloud Intelligence Integration" architecture 2.0, new cloud intelligence products, and significant upgrades. "AI-ready clouds" and "scenario-aware AI" jointly constitute the infrastructure of the intelligent era.

It was through the deep integration of technology and business systems during Wang Haifeng's tenure that Baidu Intelligent Cloud was able to seize the technological dividend when the trend of large model technology arrived.

In its prospectus for its secondary listing in Hong Kong in 2021, Baidu explicitly stated that Intelligent Cloud was its second growth curve.

This was the first time Baidu had elevated the status of Baidu Intelligent Cloud above intelligent driving, making it the core business second only to search.

However, at that time, Baidu Intelligent Cloud was still a follower in the industry, urgently needing a "general" to break through.

"Lucky" Shen Dou Seizes the Lead with Large Models

Having a technical team leading the way is a distinctive approach for cloud vendors.

For example, Alibaba Cloud's top leaders have included academician Wang Jian and technology-oriented Zhang Jianfeng, but Alibaba Cloud has also demonstrated that while "technical experts understand technology," they may struggle with the overall strategy for enterprise services, industry pain points, and commercialization.

Shen Dou is also a bona fide member of the AI community, having studied under renowned global AI scientist Academician Yang Qiang during his doctoral studies.

After joining Baidu in 2012, Shen Dou has successively led Baidu Union R&D, Web Search, Financial Services Group (FSG), and Mobile Ecosystem Group (MEG) business segments.

During his tenure at MEG, Shen Dou was fully responsible for the sales team, accumulating considerable experience in commercialization and sales system management. It can be said that with both a technical background and experience in commercial project management, Shen Dou's takeover of Baidu Intelligent Cloud was a natural progression.

Shen Dou, Executive Vice President of Baidu Group and President of Baidu Intelligent Cloud Group

"After taking office, Shen Dou did not make significant adjustments to the business. There may be minor adjustments at the leadership level, but the sales team is still divided by industry," said Liu Jie. "In the industry, the proportion of customers is still predominantly internet, followed by finance and government and enterprises."

However, upon taking office, Shen Dou adjusted Baidu Intelligent Cloud's development strategy, demanding a focus on core industry scenarios, optimizing existing applications upwards, incubating new applications, transforming the digital foundation downwards to make the underlying cloud more suitable for AI applications, creating a spiraling and evolving effect.

This step also demonstrates Shen Dou's clearer goal of rooting in the industry and driving the commercialization of cloud services, with AI applications as the crucial lever.

However, compared to other cloud vendors, Baidu Intelligent Cloud initially did not have a high profile in the market, with unclear product and technology differentiation advantages. Competing against vendors like Alibaba Cloud, Huawei Cloud, and Tencent Cloud had a low probability of success.

Moreover, when Shen Dou took over Baidu Intelligent Cloud, due to specific macroeconomic reasons, the entire domestic cloud computing industry was in a downturn, with growth rates of almost all leading cloud vendors slowing significantly. Baidu Intelligent Cloud, with a smaller scale, was not spared.

Relevant data shows that in the third quarter of 2022, Baidu Intelligent Cloud's growth rate was still 24%, but in the fourth quarter of 2022, the growth rate plummeted to 4%, with the low growth rate continuing until the third quarter of 2023, marking the first quarterly negative growth in Baidu Intelligent Cloud's history.

Shen Dou was actually fortunate.

"Without large models, Baidu's cloud would struggle significantly," Shen Dou admitted.

At a time when business growth hit a low point, the explosion of large model technology propelled Baidu Intelligent Cloud to a turning point in its development.

At the end of 2022, after ChatGPT ignited the generative AI boom, Baidu, which had been preparing for the AI market for years, entered a period of opportunity.

On the afternoon of March 16, 2023, Baidu launched ERNIE Bot, China's first product similar to ChatGPT. Following its launch, Robin Li revealed that Baidu had received numerous requests from partners for active testing.

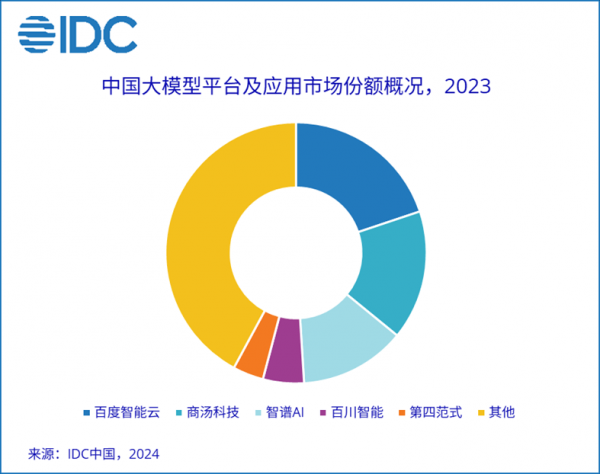

Baidu's first-mover advantage in large models drove its leadership in the commercialization of large models for Baidu Intelligent Cloud.

In the fourth quarter of 2023, Baidu Intelligent Cloud began to regain growth momentum, with revenue growing at a year-on-year rate of 12% in the quarter and maintaining a rebound trend until the second quarter of 2024.

According to public data, from January to August 2024, the number of domestic large model-related bid-winning projects reached 475, approximately five times the number of large model bid-winning projects for the entire year 2023, marking explosive growth.

Among them, more than half of the central state-owned enterprises are using Baidu Intelligent Cloud for AI innovation, achieving "four firsts" in the number of winning bids, the amount of winning bid projects, the number of industries covered, and the number of winning bid projects from central state-owned enterprises.

On the Qianfan large model platform, the ERNIE large model is called upon over 700 million times daily, helping users fine-tune over 30,000 large models and develop over 700,000 enterprise-level applications, covering dozens of industries such as industry, energy, government, transportation, finance, healthcare, and automotive.

However, for Shen Dou, the challenges and pressures have not ended here.

In January of this year, Robin Li's 2024 OKRs were revealed, with the word "profit" appearing in the goals for both the mobile ecosystem and intelligent cloud, Baidu's two core businesses. This means that in the intelligent cloud business segment, "revenue" and "profit" remain the two significant burdens on Shen Dou.

Financial reports show that in the second quarter of this year, Baidu's non-online marketing revenue was 7.5 billion yuan, up 10% year-on-year, accounting for nearly 40% of total revenue, primarily driven by the intelligent cloud business.

During the earnings call following the financial report's release, Baidu revealed that intelligent cloud revenue reached 5.1 billion yuan in the second quarter, up 14% year-on-year. Among them, the proportion of AI revenue increased to 9%, up from 6.9% in the previous quarter.

After years of discussing Cloud Intelligence Integration, it is finally reflected in the financials.

Shen Dou said, "We've always been shouting about 'delving into industries, focusing on scenarios, integrating cloud and intelligence, and democratizing AI.' What Baidu Intelligent Cloud wants to do is integrate AI into the entire To B service, making it a growth point."

Speaking of this year's performance, a sales employee at Baidu Intelligent Cloud also told Guangzhui Intelligence, "Baidu's performance has been quite good this year, with major customer projects for large models landing, and many projects have been in the works for over a year."

Large models undoubtedly gave Baidu Intelligent Cloud a head start, but in practice, how exactly should cloud vendors make money from large models?

The Cruel Reality for Cloud Vendors: Selling Models Isn't as Lucrative as Selling Computing Power

Baidu AI Image Generation

'Hundred Boats' compete on the 'Thousand Sails,' a phrase that subtly reveals the two most important products of Baidu Intelligent Cloud in the era of large models.

Qianfan is Baidu Intelligent Cloud's MaaS service platform, providing users with the ability to call large model APIs and train large models.

Baige is a high-performance cloud-native AI computing platform for large-scale deep learning, offering comprehensive support for computing cluster operations and management and lifecycle management of large model training, serving as an AI infrastructure platform.

"Last year, Baidu Intelligent Cloud focused on Qianfan, but this year, we're paying more attention to Baige," said Li Yan (pseudonym), an insider at Baidu Intelligent Cloud. "After all, reducing computing costs can drive down the costs of large models."

In fact, the shift from a large model service platform to a computing infrastructure platform reflects a cruel reality for cloud vendors in the era of large models: Large model services are far less lucrative than the core business of cloud computing – providing computing power for profit.

Of course, this is not unique to Baidu but a common situation faced by all cloud vendors. For example, ByteDance's Volcano Engine has reaped considerable benefits from selling cloud cards in recent years.

Shen Dou divides Baidu Intelligent Cloud's overall revenue into three segments:

One is the bottom IaaS layer, which is related to computing power. Its overall revenue growth is rapid, and its profit situation is also good.

The other is the middle MaaS layer, such as large model invocation, which is indeed more difficult. It needs to be gradually guided during the market cultivation process. Now the whole market is very competitive, and the revenue growth of this part is also very fast, but it is not the time to talk about profits.

The top layer is the application of basic large models, which can reflect the value of large models, and there are customers willing to pay for the value.

It is obvious that in the current revenue of Baidu Intelligent Cloud, the revenue from bottom-level computing power occupies a major position.

In Shen Dou's view, the invocation volume of the Wenxin large model is growing rapidly, and the daily invocation volume has now exceeded 700 million. "But the large model itself is still in a chaotic stage. Neither customers choosing large models nor model providers have sorted out the market yet."

Therefore, Shen Dou believes, "Some customers have actually profited from the use of large models, and the benefits should be considerable. But because this market is too chaotic and still very competitive, they are the real beneficiaries, while the model vendors pay the bill. So the value of large models is there, but it is not reflected in the price. And there are quite a few such examples."

However, the technological iteration of large models has led to a fundamental change in bottom-level computing power. In the traditional cloud computing era, bottom-level computing power was dominated by CPUs, but in the era of large models, GPUs have gradually become mainstream.

"Nowadays, customers using GPU computing power are not purely those of large language models. GPUs can support deep learning, especially deep learning based on Transformer, and the application scenarios are broad," explained Shen Dou.

Although Baidu entered the cloud computing market relatively late, it was indeed the first company in China to lay out AI, so it also used GPUs for training acceleration relatively early.

As early as 2009, Baidu had already started using GPUs for acceleration; in 2012, Baidu developed an AI accelerator based on self-developed FPGAs and began large-scale procurement and establishment of GPU computing clusters, developing the world's first parallel deep learning platform Paddle that supports both GPUs and CPUs, which later evolved into the deep learning framework PaddlePaddle; in 2018, Baidu released China's first full-featured AI chip for the cloud, "Kunlun Core," which has been deployed on a large scale with more than tens of thousands of chips deployed.

Li Yan said, "Baidu's advantage in the CPU era was not obvious, but it does have certain experience advantages in GPUs, including Baidu's own Kunlun chip, and it has advantages in the management of hardware and software."

An insider from Baidu told Guangzhui Intelligence that after being transferred to Baidu Intelligent Cloud, Shen Dou has been very close to customers.

"Some customers choose Baidu not because of its low prices but because they believe that Baidu Cloud has really trained large models like Wenxin ERNIE Bot, and Baige can improve training efficiency. I don't waste your machines, and I'm willing to choose you in the end because of your strong stability and sustainability," said Shen Dou, who never strays far from the topic of customers and has obviously become a skilled B-end business leader.

"The Baige platform generally has more large customers due to the large amount of GPU resources and related supporting resources required," said Liu Jie, adding that not only large model customers but also universities, state-owned enterprises, and other large institutions are involved.

Large models and computing power are like the relationship between a water pump and a reservoir for cloud vendors.

At this stage, although it is still computing power that generates revenue, in the long run, large models remain an important driving force. Therefore, "what Shen Dou mainly emphasized this time is the toolchain and ecosystem," an insider from Baidu told Guangzhui Intelligence at the recently concluded 2024 Baidu Wave Summit in September.

A long-term marathon battle

In one and a half years, cloud vendors have basically leveled the playing field in terms of overall capabilities, from bottom-level infrastructure to intermediate toolchains and upper-level applications.

The next two years will be a crucial period for Shen Dou and Baidu Intelligent Cloud to compete in large models.

On the one hand, the competition faced by Baidu in the field of AI large models is also increasing, so the first-mover advantage accumulated over the years is gradually diminishing. At least in the battlefield of large models, Alibaba Cloud, Zhipu AI, iFLYTEK, Huoshan Engine, and others are all formidable opponents, and everyone wants to form an AI developer ecosystem around large models.

On the other hand, in terms of infrastructure, the resources accumulated by Baidu itself have not substantially outpaced those of vendors such as Alibaba Cloud and Huawei Cloud, making it difficult to maintain a long-term leading edge.

At the same time, cloud vendors are competing on price in the hopes of trading scale for low prices. For example, Alibaba Cloud has previously offered significant price cuts, and ByteDance has reduced the price of its Doubao large model.

Liu Jie also admitted, "The economic situation this year is not so good, and customers, in addition to valuing platform capabilities and value-added services, also prioritize price."

Judging from Baidu Cloud's historical development, it is not willing to sacrifice profits for scale. Moreover, one of Li Yanhong's key objectives in his 2024 OKRs is profit.

Large models have enabled Baidu Intelligent Cloud to truly gain a certain level of voice and scale in the market since last year, but in this capital- and technology-intensive battle of large models, Baidu Intelligent Cloud is not fighting a blitzkrieg but a long-term marathon battle.

Every battle in areas such as the broader internet, government and enterprise, and finance will cumulatively determine the final outcome.

Li Yanhong's strategic resolve and Shen Dou's resilience may be the keys to whether Baidu Intelligent Cloud can truly become Baidu's second or even first growth curve.