Musk pays tribute to "domestic radish"?

![]() 10/12 2024

10/12 2024

![]() 507

507

Author | Dong Erqian

Editor | Yang Xuran

Our world is moving towards a more intense Matthew effect, with global economic power increasingly concentrated in a few major powers, and competition among them becoming increasingly fierce, especially evident in advanced technology fields such as artificial intelligence.

With the continuous deepening of the new round of technological revolution and industrial transformation, technological innovation has become a key lever for major countries around the world to seek endogenous driving forces for economic development and industrial competitive advantages. Countries have increased their investment in R&D and industrial layout for new technologies.

As the most typical application of reconstructing the physical world through large models, autonomous driving has become an important direction for major powers in laying out the future.

Across the ocean, Tesla today launched its autonomous taxi, named "Cybercab." Tesla's autonomous vehicle has no steering wheel, no pedals, and costs less than $30,000.

"This product will make Tesla a $10 trillion company," Musk once said, "People will still be talking about this moment a hundred years from now."

Meanwhile, Apollo Go has already launched its sixth-generation autonomous vehicle in 2022, with optional steering wheel and non-steering wheel modes, also costing less than $30,000. Unlike Tesla's autonomous vehicle, which is expected to be launched in 2026, Apollo Go's sixth-generation autonomous vehicle has already begun testing.

Alphabet, Google's parent company, also announced during its second-quarter earnings call that it would invest an additional $5 billion in its autonomous driving subsidiary, Waymo, over the next few years to build a world-leading autonomous driving technology company.

Currently, autonomous driving is being led by China and the United States, with most other countries merely participating.

China has firmly established itself as a leading player in global autonomous driving

In China, the core player in autonomous driving is Baidu, whose subsidiary Apollo Go has already achieved a milestone of 7 million orders nationwide.

Interestingly, it seems that Apollo Go has already laid out many of the innovations seen in the Cybercab, leading some netizens to joke that this is a tribute to "domestic radish." For example, the Cybercab has no steering wheel, no pedals, no rearview mirrors, and no driver, but Apollo Go released its sixth-generation autonomous vehicle more than two years ago, supporting both steering wheel and non-steering wheel modes.

Musk stated that the estimated cost of the Cybercab will be less than $30,000, but Apollo Go's sixth-generation autonomous vehicle, the Yichi 06, already costs less than $30,000, demonstrating that Apollo Go is more mature in terms of application implementation.

Especially considering that the Cybercab will not be available for another two years, Apollo Go has ample time to further improve its products and technologies.

In May, Baidu released Apollo ADFM, the world's first large-scale autonomous driving model that supports L4 autonomous driving applications, at Apollo Day. This model balances technical safety and generalization, achieving over 10 times the safety of human drivers and covering complex urban scenarios citywide.

Apollo Go is even looking to seize the opportunity to further penetrate the Cybercab's core market. Media reports indicate that Apollo Go is actively pursuing a global layout, engaging in in-depth discussions with multiple international companies and planning to enter overseas markets.

Industrial competition is fierce and full of strategic maneuvering. For example, the United States has frequently attempted to slow down the development of China's autonomous driving industry by citing data security concerns and restricting the entry of Chinese autonomous driving technologies. Against this backdrop, the mileage traveled by Chinese autonomous vehicles during road tests in California in 2023 decreased by approximately 70%.

In the context of unprecedented changes, autonomous driving is a "battle that cannot be lost" for any party involved, and we are bound to see even more intense competition.

A crucial racecourse

A battleground that must be fought for.

As early as 2004, the Defense Advanced Research Projects Agency (DARPA) of the United States Department of Defense held the first Grand Challenge for autonomous vehicles in the Mojave Desert in California. Unfortunately, all participating vehicles failed to go far from the starting point, earning the event the nickname "DARPA's Desert Debacle."

However, the story of autonomous vehicles did not end there, with subsequent challenges yielding notable achievements. Since then, numerous technology companies and automakers, including Google, have begun developing autonomous driving technologies, ushering in a transformation of the automotive industry.

The path to large-scale autonomous driving operations has proven to be far longer than anticipated. One of the key reasons is that traditional technical solutions struggle to handle complex scenarios. "Autonomous driving has not fully achieved its goals over the past two decades, partly due to the inability of sensor hardware and computing power to keep up, and partly due to the inadequacy of methods. The most likely path to achieving true autonomous driving is through data-driven AI large model training and deployment," said Gu Weihao, CEO of Haomo AI.

In 2017, the Transformer architecture was born at Google, enabling the training of more powerful models. In the same year, Musk recruited Andrej Karpathy from OpenAI to reconstruct the autonomous driving code, leveraging Transformer + BEV (Bird's Eye View) to delegate perception tasks to large models.

Around the same time, Baidu decided to reconstruct its autonomous driving technology stack using large models. Starting in 2017, the company began to model its entire system and transition to a data-driven approach. Since 2021, Baidu Apollo has gradually integrated multiple small model tasks within its system, expanding model scale and exploring autonomous driving large model technologies, which have since been fully deployed in vehicles.

As an integrated technology that encompasses artificial intelligence, communications, semiconductors, and automobiles, autonomous driving involves a long industrial chain and significant value creation potential, making it a crucial battleground for cross-industry competition and cooperation between the automotive and technology industries worldwide.

Taxis represent the core application of autonomous driving

According to Frost & Sullivan, the global autonomous driving market is projected to reach $1.724 trillion by 2030, with the Chinese market expected to account for $634 billion.

"Over the past two years, a new round of technological revolution and industrial transformation has been reshaping the global innovation landscape and economic structure. As a representative of new productive forces, autonomous driving has become a key area of global competition," said Xu Lijuan, Director of the Market Research Institute at Beijing Jiaotong University. "As a typical application scenario of artificial intelligence empowering the automotive industry, autonomous driving involves the development of related industries such as chips, operating systems, the Internet of Things, urban infrastructure, testing, and certification. It is an essential racecourse for the integration of the digital and real economies."

Key competition

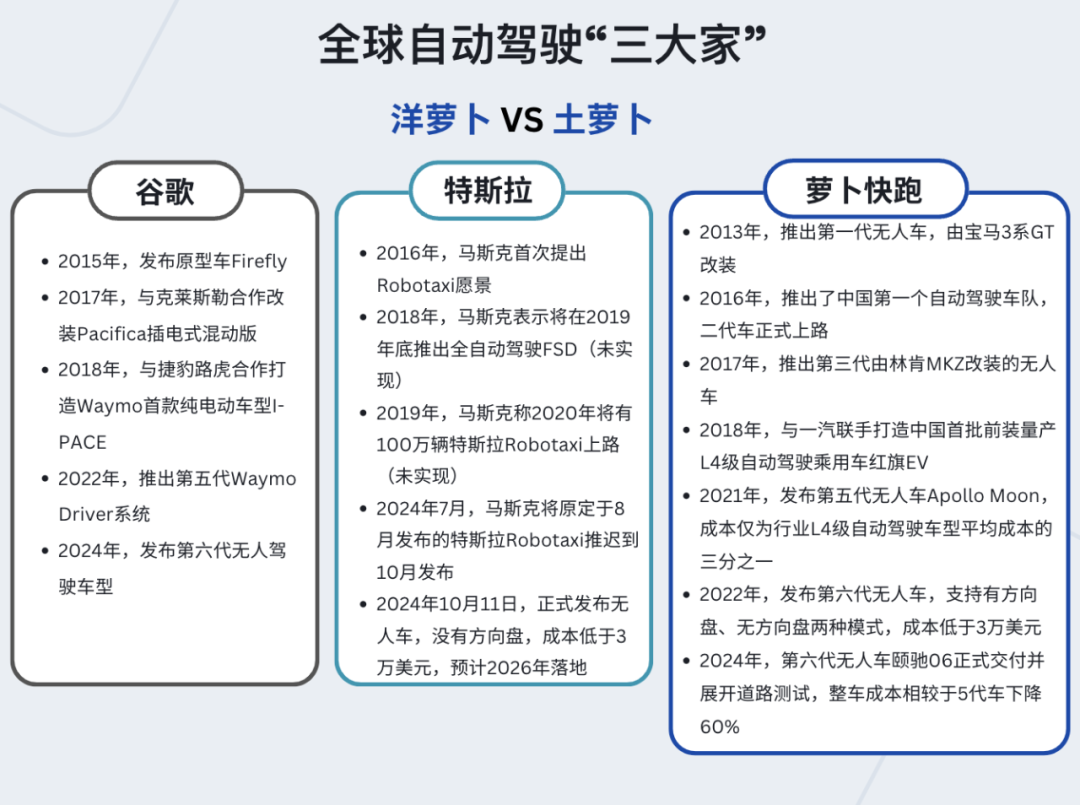

The "Big Three" in global autonomous driving

The autonomous taxi market is a blue ocean and a vast untapped pie. As the two countries with the largest number of autonomous driving enterprises globally, China and the United States will define the racecourse and export technological products to other countries by being the first to establish a commercial closed-loop and related industrial chains.

Judging from China's active policy initiatives to commercialize autonomous taxis, it is evident that China has a strong ambition in this regard. Currently, Baidu is essentially the only company capable of undertaking this task.

In May, EV Magazine, a foreign media outlet, released a ranking of global autonomous driving technology companies, primarily evaluating the technical maturity, R&D progress, and product capabilities of L4 autonomous driving systems. Among the "Leaders" quadrant, three American companies were listed, with Baidu being the only Chinese company included.

With Tesla's launch of its autonomous taxi, Robotaxi, Apollo Go, as a representative of Chinese enterprises, is now in direct competition with Google and Tesla, forming a competitive landscape among the "Big Three" in autonomous driving between China and the United States.

In terms of autonomous driving technology R&D, the United States holds a first-mover advantage. With its advanced integrated circuit technology and leading position in high-end chip design, the country has laid a solid foundation for the development of high-performance automotive chips. Both the "Waymo faction" and the "Tesla faction" prefer solutions focused on "vehicle intelligence," with core competencies in artificial intelligence algorithms and decision-making chips.

Chinese enterprises have taken a differentiated approach. Leveraging China's comprehensive infrastructure, companies like Apollo Go are actively promoting the "vehicle intelligence + vehicle-road collaboration" solution, integrating "smart vehicles" with "intelligent roads" to build an intelligent road network with comprehensive data perception across "people, vehicles, roads, and clouds."

In terms of data accumulation, Tesla's FSD has accumulated over 1.6 billion miles of driving, and Waymo's autonomous taxi service in the United States has surpassed 100,000 weekly paid trips. Currently, only Apollo Go in China has achieved large-scale and routine testing of autonomous driving. As of June 2024, its actual road testing and demonstration mileage exceeded 100 million kilometers.

Waymo autonomous taxi

It can be inferred that there is still a gap in autonomous driving between China and the United States, but it is not insurmountable. However, the cutthroat industrial competition is often more brutal than we imagine.

In July 2023, four U.S. senators wrote a letter to the U.S. Secretary of Transportation and Secretary of Commerce, requesting an investigation into China's autonomous driving technology in the United States and how to restrict it. The letter stated, "Technologies used in autonomous vehicles, LiDAR, radars, cameras, artificial intelligence, and other advanced sensors and semiconductors can be used to collect data on the American people and infrastructure, which can be shared back to China."

Since then, many Chinese autonomous driving companies have withdrawn from the U.S. market.

As Lu Benfu, Vice President of the China Association for Science and Technology and Professor at the University of Chinese Academy of Sciences, said, "We are currently in a critical window of opportunity for the development of intelligent and connected vehicles globally. Opportunities are fleeting, and only by actively embracing intelligent and connected vehicles without hesitation can enterprises avoid falling behind in the most cutting-edge frontier technologies in the future."

Scale effect

Application implementation.

What is often overlooked is that China has already taken the most crucial step in this competition.

The autonomous driving industry has gone through a prolonged downturn, primarily due to low revenues that could not cover high costs, leading to the failure of many enterprises in the face of market and consumer challenges. In this game of giants, enterprises lacking technology, capital, and the ability to implement applications ultimately struggle to succeed.

During Baidu's second-quarter 2024 earnings call, Robin Li, Baidu's founder, chairman, and CEO, revealed that its autonomous taxi business would achieve regional break-even.

Specifically, the driving force behind profitability lies in cost reduction and demand enhancement.

High vehicle manufacturing costs are currently the primary reason for elevated service costs. However, effective cost reduction strategies seem to have been identified. Taking Apollo Go as an example, the sixth-generation autonomous vehicle, the Yichi 06, costs only RMB 204,600 (less than $30,000), representing a 60% decrease from the fifth-generation model.

Demand growth stems from the continuous expansion of vehicle deployment scale and coverage area, which relies heavily on a positive, open, and inclusive policy environment from relevant authorities. This fully leverages China's rich scenario advantages to accelerate implementation.

Chen Yanyan, a professor at the School of Urban Transportation at Beijing University of Technology, also mentioned, "Currently, most cities in China developing autonomous driving are conducting small-scale commercial pilot operations in restricted areas and times, and local legislative efforts must accelerate to vigorously support autonomous driving enterprises in expanding their operational areas and facilitating large-scale implementation."

Historical experience has proven that as long as we can keep up with the United States in technology, we can achieve total output and profit surpasses through market and scale advantages. Furthermore, massive capital investments can, in turn, fuel technological advancements, ultimately leading to technological surpasses.

In the face of competition from Tesla's Robotaxi, Chinese forces like Apollo Go still have the potential to unleash their full capabilities.

Closing Remarks

The competition in technological innovation between emerging economies and traditional powers is intensifying.

Developed countries like the United States, leveraging their inherent advantages, continue to accelerate their technological innovation while maintaining a leading position. However, they still face various issues in commercial implementation. In contrast, China can rely on its infrastructure, market advantages, and policy support to continuously bring more cutting-edge models to market. By forming scale advantages and iterating on innovations, China can achieve "latecomers' advantage."

Although various issues may arise during the development of emerging industries, the ultimate outcomes are often favorable. This has been evidenced by numerous successful cases in various internet technology fields.

With this trend, China's technology industry will eventually complete a brand new path to success. As described in the "Development Plan for a New Generation of Artificial Intelligence" issued by the State Council in 2017, by 2030, China's artificial intelligence theory, technology, and application will generally reach the world's leading level, becoming the world's major artificial intelligence innovation center.