The Long-Term Strategy Behind Waymo's $100 Billion Valuation 丨 B Insights

![]() 01/08 2026

01/08 2026

![]() 547

547

Can Waymo maintain its lofty valuation, which stands at 280 times its revenue?

Is Waymo's $100 billion valuation truly justified?

As this autonomous taxi firm, a subsidiary of Alphabet (the parent company of Google), seeks funding at a valuation 280 times its annualized revenue—a figure significantly higher than that of other ride-hailing companies—investors are poised to deliver their verdict soon.

Waymo's swift expansion in recent months, despite setbacks such as a temporary halt during the San Francisco blackout, hints at its potential to sustain its valuation.

With passenger numbers on the rise across cities and the introduction of new services (whether it's capturing market share from Uber and Lyft or tapping into entirely new demand), its revenue is projected to continue its upward trajectory.

By the end of 2025, Waymo had successfully completed over 14 million autonomous paid rides (tripling the figure from the same period in 2024), with annualized revenue from services in five cities surpassing $350 million.

The company aims to roll out autonomous taxi services in at least five additional cities by 2026.

Waymo's Robust Momentum

According to the latest projections from Morgan Stanley analysts, Waymo's annualized revenue could reach a minimum of $2.5 billion by 2030.

Evan Schlossman, an investor at venture capital firm SuRo Capital who has closely followed the company, stated that Waymo's actual growth rate might far surpass expectations, potentially expanding its business footprint to approximately five times its current size.

'Waymo is a prime example of a company with robust hardware and software capabilities, a rapidly expanding revenue base, and no need for overly optimistic assumptions.'

At $2.5 billion in annualized sales, the business's anticipated valuation would decrease to 40 times revenue.

In contrast, Uber and Lyft are trading at less than three times revenue. While both may experience slower growth than Waymo, they are projected to achieve around 15% revenue growth in 2025 and have already turned profitable.

It remains uncertain to what extent autonomous taxis will cannibalize the demand for traditional ride-hailing services.

Morgan Stanley analysts predicted in a report last month that if autonomous demand directly supplements existing human-driven taxi demand, Uber's compound annual growth rate could reach 14% over the next seven years.

However, if autonomous taxis replace some human-driven taxi demand, Uber's growth rate could plummet to single digits.

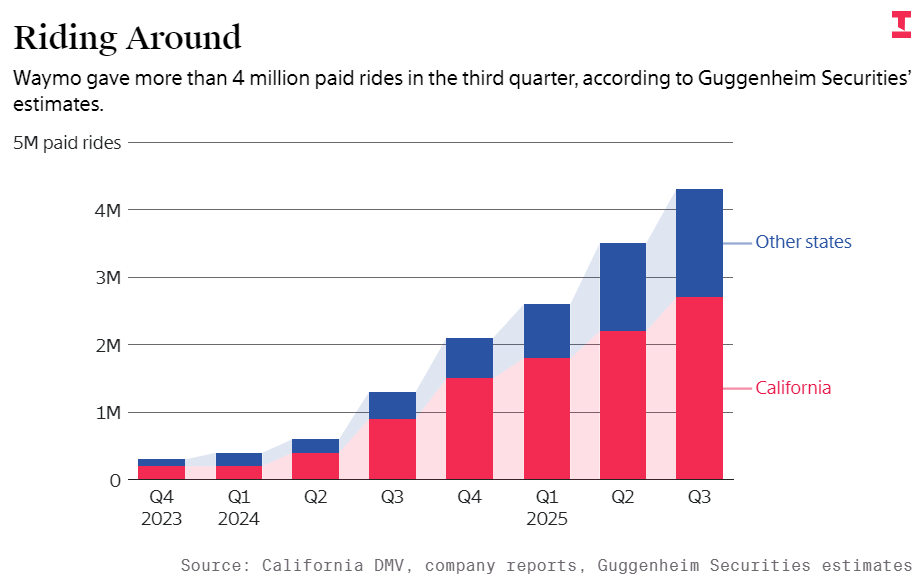

Travel Data: Guggenheim Securities estimates that Waymo provided over 4 million paid rides in Q3. (Sources: California DMV, corporate reports, Guggenheim Securities estimates)

Waymo's edge lies in its potential revenue streams beyond ride-hailing.

Co-CEO Tekedra Mawakana has stated that the company plans to diversify from autonomous taxi services into local delivery and long-haul freight, eventually licensing its self-driving technology to automakers.

Waymo's October 2025 announcement of a partnership with DoorDash to launch unmanned food delivery in Phoenix may offer a glimpse into its future trajectory.

At Uber, food delivery accounts for one-third of revenue, grows at a faster pace than ride-hailing, and contributes about 40% of operating profit (excluding stock compensation, depreciation, and amortization).

For Waymo, plans to license software to automakers may still be in the distant future. Nevertheless, these licensing fees could ultimately enhance profit margins, as the indirect costs of maintaining and improving software are likely significantly lower than deploying additional autonomous taxis.

Fortunately, if Waymo proceeds with its financing plans, there is a precedent for cash-burning ride-hailing startups to eventually achieve valuation growth (namely, Uber).

In December 2014, the then-unlisted Uber, merely five years old with revenue in the hundreds of millions, raised capital at a $40 billion valuation—double its previous funding round announced in June that year, setting a record for venture-backed startups at the time and sparking skepticism from investors and analysts.

History later proved the concerns over Uber's valuation to be excessive: the company generated approximately $1.5 billion in net revenue in 2015, nearly tripling from 2014. This meant its investors ultimately invested at around 27 times forward sales.

Tesla's Edge

While Waymo avoids labor costs, other long-term cost issues remain unresolved.

Insurance costs for autonomous vehicles are a significant unknown. Another concern is the high cost of detection sensors and supporting hardware in Waymo's vehicles.

In terms of hardware costs, Waymo is at a disadvantage compared to Tesla.

Tesla's autonomous vehicles utilize lower-cost cameras for road mapping and currently operate in only a few cities, still requiring human supervision.

Morgan Stanley analysts estimated in last month's report that Waymo's current cost per mile is approximately $1.43, while Tesla's is just $0.81.

Whether this cost differential translates into a lasting advantage for Tesla remains to be seen.

Morgan Stanley analysts noted that Waymo plans to deploy new vehicle models in 2026 with operating costs expected to fall to the $0.99-$1.08 per mile range.

This is partly because Waymo is testing lower-cost base models (chassis vehicles before autonomous technology installation)—vehicles sourced from Hyundai and China's Zeekr.

If the safety record of autonomous taxis continues to improve, insurance costs may also decline.

Beyond cost advantages, Waymo leads its competitors in regulatory approvals.

Like Zoox (Amazon's autonomous taxi company), Tesla still awaits operational permits in its target cities.

Long-term Tesla advocate Chamath Palihapitiya posted on X: 'Tesla must prove its fault tolerance is no worse than—or even better than—Waymo's.' He believes Tesla needs to reach this performance level to persuade regulators to ease its operational restrictions.

Even if Tesla or Zoox eventually receive permits, Waymo has already seized the initiative in multiple major cities, establishing a significant lead.

If Waymo aggressively captures market share like Uber did in its early expansion, its competitive moat could prove even wider than Uber's (currently valued at over 20 times rival Lyft).

When Uber went public in 2019, it was valued at $82 billion (close to its highest private valuation). Now profitable and diversified, its market cap has nearly tripled.

Waymo's investors seem to believe it is the next 'Uber.'

Editor: Bian Huiting

Source: The Information

END