"Big Model Money-Burning War, Baidu Cloud Needs a Breakthrough","","","

![]() 10/12 2024

10/12 2024

![]() 495

495

@TechNewSense Original

At the end of last month, the Baidu Cloud Intelligence Conference, themed "Intelligence Leap," garnered significant attention. The event brought together industry leaders and pioneering enterprises, with Baidu, as the host, being extremely busy. It announced a strategic partnership with Samsung, showcased its achievements on the main forum, invited key partners to jointly present benchmark cases, and created a smart interactive technology exhibition hall spanning over 10,000 square meters to fully demonstrate its smart cloud products.

"Openness, Cooperation, and Win-Win Results" were the slogans of Baidu Cloud's event. In reality, Baidu Cloud has been actively seeking partners, advertising, launching new products, and building an ecosystem. However, in China's public cloud market, Alibaba Cloud, Huawei Cloud, China Telecom Tianyi Cloud, and Tencent Cloud have long dominated, with Baidu Intelligent Cloud consistently playing catch-up.

Despite its small size, Baidu Cloud harbors grand ambitions and desires to achieve many things, leading it to fall into the trap of being rich in offerings yet mediocre in performance.

Part.1

Is Smart Cloud Not a Good Business?

The seemingly bustling cloud market hides the true feelings of its participants.

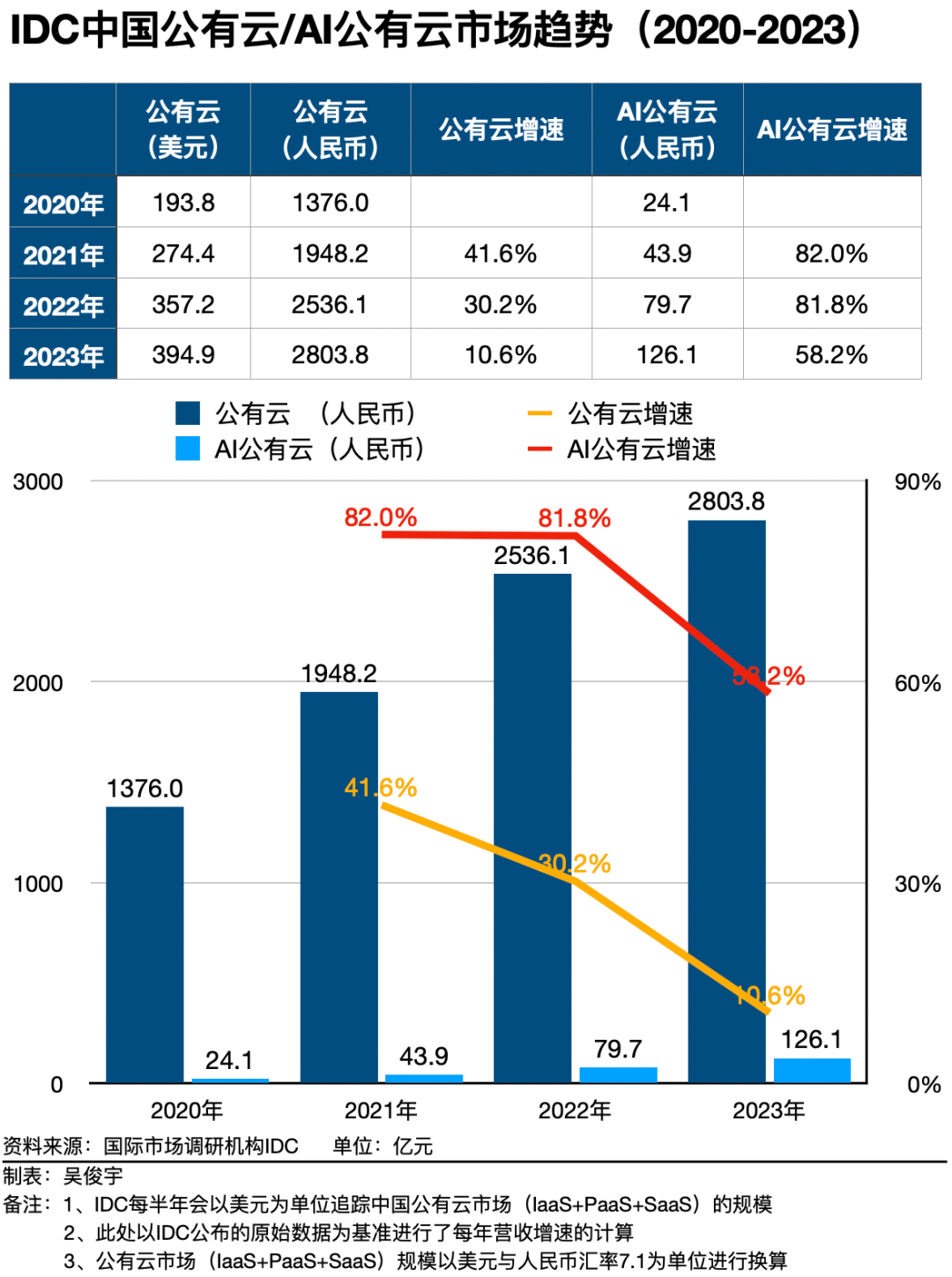

According to IDC, a global market research firm, China's public cloud market growth rate is declining. In 2023, the total size of China's public cloud market was USD 39.49 billion, with a growth rate of 12.7% for China's public cloud (IaaS+PaaS), marking the third consecutive year of decline.

In fact, even with the declining growth rate in the public cloud market, Baidu Cloud has never been a major player. Baidu Cloud, which began development in 2012, was two to three years behind Alibaba and Tencent. In Q2 2024, Alibaba Cloud's market share exceeded 36%, Tencent Cloud's exceeded 16%, while Baidu Cloud could only be categorized as "others," unnamed on the leaderboard.

However, with the rise of AI, Baidu saw an opportunity for overtaking. According to an IDC report on August 26, China's AI public cloud market size reached RMB 12.61 billion in 2023, with a year-on-year growth of 58.2%, significantly higher than that of the public cloud market. This was a five-year wait for Baidu—after establishing the "Smart Cloud" strategy in 2019, AI became Baidu's core business direction. Since then, Baidu Cloud's reputation in the AI public cloud sector has grown, with IDC data showing that Baidu Smart Cloud accounted for 26.6% of the AI public cloud market share in 2023, ranking first for five consecutive years.

However, the size of the AI cloud market remains uncertain. According to IDC's latest report, Baidu Smart Cloud ranked first in China's large model platform market share in 2023, accounting for 19.9%. However, from January to May 2024, nearly 260 announcements for winning bids for domestic large model projects were issued, with Baidu topping the list with only 10 project bids. As a large model business deeply integrated with cloud services, this performance is obviously insufficient to support Baidu Cloud's market expectations.

It is even more crucial to note that this is the market outcome after the AI market shifted from internet users to traditional industries such as government, finance, telecommunications, manufacturing, and energy, providing complete solutions. With upgraded customer structures, demands, and services, the imagination space of the AI cloud market needs to be re-examined.

A senior executive from a peer major company said that Baidu Cloud's market position is based on its differentiated AI product layout—AI computing power at the IaaS layer, AI platforms at the PaaS layer, AI models at the MaaS layer, AI applications at the SaaS layer, as well as the ERNIE large model, Qianfan large model platform, and Baige heterogeneous computing platform, which support the overall product layout.

"Fortunately, Baidu Cloud still has something in AI. If it focused on basic cloud products, it would also face a fierce market."

Part.2

Expanding Rapidly, Feeling the Pain

Baidu Cloud's ambitions are well-known.

According to Robin Li's internal sharing, Baidu Cloud has applications covering over 30 industries, including education and training, real estate and home furnishing, machinery and equipment, and business services. Such a broad scope of promotion aligns with Jack Ma's statement that "all industries are worth redoing with AI."

Moreover, Baidu Cloud, which has ventured into multiple industries, has indeed achieved results. In the past three quarters (Q4 2023 to Q2 2024), revenue growth rates were 11%, 12%, and 14%, respectively. During the Q2 2024 earnings call, it was disclosed that Baidu Smart Cloud's large model revenue share had increased from 4.8% in Q4 2023 to 9% in Q2 2024.

This is a noteworthy achievement, but insiders have raised questions. Some believe that Baidu Cloud's excessive exaggeration of usage effects, regardless of actual application outcomes, to expand market influence and attract developers, will invite criticism. They argue that "marketing and technology are fundamentally different logics."

However, it is evident that Baidu Cloud currently needs more market recognition. According to agency records, Baidu won 143 projects in the first half of 2024, of which 30 were strongly related to large models or AI products, and had significantly higher gross margins than general contracting projects primarily based on human services. An even better achievement lies in usage frequency. Data shows that the Qianfan large model platform recorded 700 million daily calls in September, over ten times higher than in 2023, reflecting significant market recognition.

However, paradoxes also emerge here. "The competition in large models is essentially a competition of computing power, where Baidu is not yet a match for the top players. Yet with the onset of price wars, Baidu cannot afford to back down," said an industry insider, observing Baidu's current predicament. "As a result, profits are bound to be affected."

"Previously, everyone was making some money, but with these price cuts, gross margins have plummeted from over 60% to 0%, with each call resulting in a loss. It's a competition of who has more ammunition rather than focusing on expanding the market," said an industry insider, expressing doubts about the brutal price wars.

The choice between preserving existing customers and acquiring new ones is a dilemma. A typical case comes from leading startup Minimax, which held a bidding conference to procure computing power to support its business. Alibaba Cloud, Baidu Cloud, and ByteDance's Volcano Engine all participated in the bidding. During the PPT presentation, each company showcased its unique strengths, but Minimax, the buyer, was solely concerned with price.

No one wanted to lose the high-quality existing customer Minimax. For regular customers, cloud computing platforms can offer prices ranging from 40% to 50% off, but this time, bidding prices plummeted to as low as 20% off, a brutal competition.

Baidu Cloud's logic represents the attitude of most major players involved: the large model market is still in its early stages, and customer numbers are crucial for market growth.

However, a more pronounced trend is emerging. Some experts point out that the number of large model calls will grow exponentially in the next 1-2 years. Under the marginal effect, cloud vendors' computing power costs will be diluted as customer demand grows, ultimately leading to positive profits. This means that after the elimination round begins, only 3 to 5 basic model enterprises will survive, with an absolute advantage in market share as a prerequisite.

It seems like a dead-end situation. At this juncture, Baidu Cloud is betting on its technical capabilities, including the ERNIE large model, Qianfan large model platform, and Baige heterogeneous computing platform, all of which have focused on computing power scheduling and performance, hoping to gain market recognition by helping customers address issues of computing power shortages and high costs.

While this appears to be a promising path, the problem is that other competitors likely share the same mindset, making homogenization an inevitable issue for all players.

Part.3

Can AI Cloud Be Afforded?

In fact, the number of calls to large model platforms, which make various companies proud, is a money-burner, and the costs are bottomless. Baidu Cloud has also faced rumors as a result.

Last month, rumors circulated that Baidu was likely to abandon its general-purpose large model. The content suggested that intense competition and disproportionate input-output ratios had led Baidu to consider abandoning the large model.

As the rumors intensified, Baidu had to respond. On September 9, Zhang Quanwen, the head of ERNIE's marketing department, posted on WeChat Moments, "The so-called 'abandoning general-purpose large model research and development' is purely a rumor! ERNIE has just completed a comprehensive functional upgrade. We will continue to increase R&D investment in the field of general-purpose large models."

Large models are crucial to Baidu Cloud, and withdrawing from the field at this point would be illogical. However, the rumors did serve as a warning to players in the field: how long can they sustain the money-burning race?

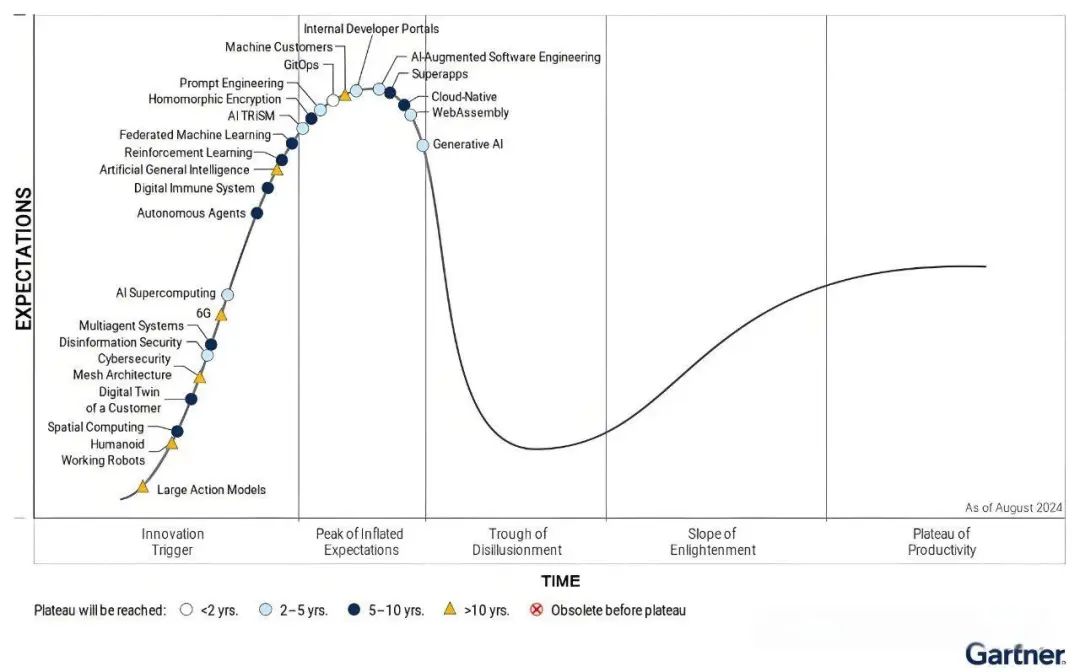

Gartner's "Hype Cycle for Emerging Technologies, 2024" released in August this year shows that generative AI is 2-5 years away from production maturity. However, during this period, which is neither too long nor too short, the costs can be substantial. Taking Anthropic as an example, its CEO revealed that the training cost of its currently under-development AI model is as high as USD 1 billion. Future training costs for large models are projected to rise to USD 10 billion within just three years.

This is true for foreign companies, and Baidu's costs are no lower. A year ago, Guosheng Securities estimated that the training cost of GPT-3 was approximately USD 1.4 million per run. For larger LLM models, training costs ranged from USD 2 million to USD 12 million. Baidu's large language model, ERNIE Bot, which strives to rival ChatGPT, undoubtedly incurred astronomical costs. Moreover, significant expenses stem from cloud infrastructure. Baidu AI's desire to excel in the market relies on basic computing power support, and the amount Baidu needs to invest in this arms race is likely substantial.

Is Baidu prepared? It's concerning. Baidu's Q2 2024 financial report shows total revenue of RMB 33.9 billion, with core revenue of RMB 26.7 billion and core operating profit of RMB 5.6 billion, up 23% year-on-year. However, Baidu's largest source of revenue, online advertising, generated RMB 19.2 billion, down 2% year-on-year. In cloud services, Baidu Cloud revenue was RMB 5.1 billion, with 9% coming from external customer demand for large models and generative AI-related services. Notably, there are no direct data on the profit composition of these two major revenue sources.

"How much money does Baidu have to spend on cloud and large models is a mystery," commented an industry observer on Baidu Cloud's future investments. According to him, while Baidu held cash, cash equivalents, restricted cash, and short-term investments totaling RMB 162 billion as of June 30, 2024, "these funds are not inexhaustible, with only RMB 6.2 billion in actual free cash. If cloud platform price wars don't end soon, Baidu will face a complex situation."

In fact, Baidu Smart Cloud has repeatedly lowered its product prices this year: in May, it announced that the ERNIE-Speed, ERNIE-Lite, and ERNIE-Tiny series of model pre-configured services would be open to customers for free; in July, it announced significant price reductions for its flagship ERNIE 4.0 and ERNIE 3.5 models, with ERNIE 4.0 Turbo fully open to enterprise customers at prices as low as RMB 0.03 per thousand tokens for input and RMB 0.06 per thousand tokens for output.

This may explain why individual profit data is concealed in financial reports: losing money to gain market share is not a pretty sight.

The dilemma extends beyond Baidu Cloud to its parent company. Insufficient cash flow support during this intense period of competition challenges Baidu Cloud's ability to commercially empower its products. Ultimately, customers must make money for Baidu to earn its share. The principle is simple, but the process is difficult.

Reference Materials:

IDC: Post-pandemic Growth Falls Short of Expectations - China's Public Cloud Service Market Growth Continues to Slow in H1 2023, IDC: Surprising Top Three in 230 Large Model Bidding Projects, Digital Frontline: Not Just Baidu is Haunted by 'Ghost Stories' of Large Models, Business Password: Baidu's 'AI Password' for Growth Revealed! ERNIE Large Model Exceeds 600 Million Daily Calls, Sina Finance