What does the executive rotation mechanism bring to Baidu?

![]() 10/15 2024

10/15 2024

![]() 533

533

Text/Leon

Editor/Hou Yu

Recently, Baidu announced a new round of executive rotation and organizational structure adjustment, attracting widespread attention.

On October 8, Baidu Group (9888.HK) announced that Luo Rong would serve as Executive Vice President of Baidu Group and be responsible for Baidu Mobile Ecosystem Group (MEG) effective immediately, and would no longer serve as CFO (Chief Financial Officer). Meanwhile, He Junjie would be appointed as Acting CFO of Baidu Group effective immediately and would no longer serve as Senior Vice President and Head of MEG.

Baidu's founder and CEO Robin Li said in the announcement, "On behalf of the board of directors and senior management, I welcome Mr. Luo Rong as the head of Baidu Mobile Ecosystem Group (MEG). We firmly believe that his leadership skills will continue to play a critical role in this new position. At the same time, we are confident that Mr. He Junjie's extensive experience in management, investment, and finance will be invaluable in driving Baidu's future strategic initiatives."

In addition, Baidu's organizational structure has also undergone some changes, with Baidu Health Group (HCG) officially incorporated into MEG. Baidu Health Group, established in 2021, comprises three major brands: Baidu Health, Lingyi Zhihui, and GBIhealth, corresponding to the three segments of Internet healthcare, smart healthcare, and pharmaceutical enterprise services.

After this change takes effect, Baidu Group's organizational structure will consist of four primary business groups: Mobile Ecosystem Group (MEG), AI Cloud Group (ACG), Intelligent Driving Group (IDG), and Technology Platform Group (TPG).

Transformed from Baidu Search Company, MEG is responsible for Baidu's most profitable business lines, including Baidu Search, Baidu App, Baidu Advertising Business, Wen Xiaoyan (formerly known as ERNIE Bot App), Baidu Netdisk, Baidu Library, and ERNIE Bot AI Agent. It can be described as Baidu's "blood-making machine." According to Baidu's second-quarter 2024 financial report, Baidu's total revenue during the reporting period was RMB 33.9 billion, of which online marketing revenue accounted for RMB 19.2 billion, or 56.6% of total revenue.

It is reported that Robin Li has high expectations for this rotation and has repeatedly mentioned "intelligent ecosystem" in internal emails. Within Baidu, the intelligent ecosystem strategy is considered key to business growth in the AI era. Li expressed his expectation for the deep integration of HCG's healthcare business with MEG's mobile ecosystem, further realizing the advantageous combination of AI technology and frontend products to build a more prosperous intelligent ecosystem.

Both of the rotated executives have financial backgrounds. Luo Rong holds a bachelor's degree from Peking University and a master's degree from Tsinghua University. He is also a Chartered Global Management Accountant (CGMA). He has previously served as senior financial managers at Microsoft and Lenovo, CFOs at eLong and TAL Education, and CFO of Baidu since 2021, with no product development background.

Similarly, He Junjie graduated from Peking University and has served as managing partner at multiple investment institutions. After joining Baidu, he served as Vice President, overseeing the Group's Investment and M&A Department and Strategic Investment Management Department. He led projects such as the merger of Baidu Waimai and Ele.me, the spin-off and independent financing of Duxiaoman, and iQIYI's IPO financing. In May 2022, he began rotating as the head of MEG.

So, is this just a routine executive rotation, or does Robin Li have deeper intentions?

The Logic Behind Robin Li's OKRs and Executive Rotation

Executive rotation systems are not uncommon in internet and technology companies. For example, Huawei has a rotating chairman system, with Xu Zhijun, Hu Houkun, and Meng Wanzhou rotating every six months.

Relatively speaking, Baidu's executive rotation rules are unique, not only involving specific business lines but also occurring relatively frequently. The last rotation was in 2022, followed by one in 2019, roughly maintaining a frequency of every 2-3 years. In particular, the core business group MEG has seen three executives in the past five years: Shen Dou, He Junjie, and Luo Rong.

In contrast, companies like Tencent, Alibaba, and JD.com have seen more personnel appointments and dismissals in recent years rather than large-scale business line rotations.

The book "Alibaba Management's Three-Pronged Approach" points out that the benefits of rotation include addressing job burnout among executives and facilitating the transmission of corporate culture. For Baidu during extraordinary times, it occasionally has the implication of "dispensing with military power over a cup of wine," as Baidu has previously experienced serious corruption among senior executives. Such rotations can avoid fiefdom culture and structural corruption.

The logic behind Baidu's executive rotation is actually driven by OKRs (Objectives and Key Results). Introduced by Robin Li in 2019, OKRs replaced KPIs as the company's assessment system. Simply put, it involves setting objectives to achieve key results, breaking them down top-down, and further enhancing individual initiative.

It is reported that in Robin Li's 2024 OKRs, "profit" is a keyword appearing in both the MEG and AI Cloud objectives. Meanwhile, there are five profit assessments among the key results, including content, cloud computing, healthcare, personal cloud, and Xiaodu, with MEG accounting for three of them. From this perspective, Luo Rong's rotation makes sense.

After the completion of Baidu's AI business restructuring, the business level has stabilized, but the data has declined somewhat, with online marketing revenue declining by 2% year-on-year in the first half of the year. In this context, Luo Rong should be able to stabilize Baidu's most profitable core business through a series of financial measures and business adjustments.

Luo Rong

Although Luo Rong has no actual business management experience on his resume, it does not mean that he does not understand the business at all. In an interview, Luo Rong talked about his work: "Today's post-80s CFOs are more focused on the company's investment and financing operations, project management, and product project incubation, so their scope of work has changed significantly."

Luo Rong's next challenge is to explore the integration of AI and healthcare business. Baidu's healthcare business is not the same as previous medical bidding rankings but rather a comprehensive entity for both C-end and B-end customers. Baidu Health primarily targets patients, offering online consultation and internet hospital services. Lingyi Bot provides industrial solutions to medical institutions through its large model. GBIhealth provides databases and consulting services to pharmaceutical and medical investment companies. Adjustments to the healthcare business, especially on the B-end, may be the key to influencing Baidu's profits this year.

As for He Junjie, serving as Acting CFO is essentially returning to his old profession and does not involve new challenges.

Has Executive Rotation Improved Baidu's Performance?

The most direct indicator of an executive's performance during their tenure is performance.

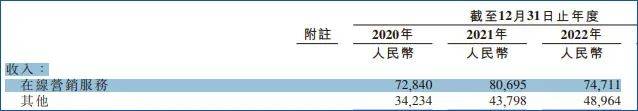

In May 2019, Shen Dou succeeded Xiang Hailong as head of MEG. During his three-year tenure, Baidu's online marketing service revenue for 2020-2022 was RMB 72.8 billion, RMB 80.6 billion, and RMB 74.7 billion, respectively.

Briefly introducing Shen Dou, he holds a Ph.D. from the Hong Kong University of Science and Technology, a master's degree from Tsinghua University, and a bachelor's degree from North China Electric Power University. With a technical background, he holds over 10 patents in the internet and AI fields and has over 15 years of experience in management and product development at leading technology companies in China and the United States.

Since May 2022, Shen Dou has been the head of AI Cloud Group (ACG) for over two years, and this business has become Baidu's second-largest growth curve after advertising in recent years, accounting for a significant portion of non-online marketing revenue and being highly anticipated.

After He Junjie took over MEG, Baidu's online marketing service revenue in 2023 was RMB 75.1 billion, with little change.

Considering the Group's overall performance, while revenue remained relatively stable, Baidu's net profit attributable to shareholders declined significantly in 2021 and 2022, primarily due to increased R&D investment in preparation for subsequent AI restructuring. After the restructuring in 2023, Baidu's net profit returned to the RMB 20 billion level.

It is evident that while Baidu's online marketing service (managed by MEG) has stable revenue, there is limited growth, even under the leadership of technically proficient Shen Dou.

During He Junjie's tenure at MEG, he was primarily involved in the AI restructuring of a series of Baidu applications. This was actually a group-wide strategy, and He Junjie rode the wave.

He Junjie once said in an interview that Baidu Mobile Ecosystem adhered to the dual-engine drive model of "intelligent search + intelligent recommendation" and the strategic direction of "information + service." Simply put, it is about adding new variables while stabilizing the basic plate. During this period, MEG participated in the development of new technologies such as "Zhiyi" and "Qianliu" search technologies and new products such as the Wen Xiaoyan App.

He Junjie

In fact, Baidu Search remains a significant traffic entry point for the Chinese internet market, especially on mobile apps. Baidu hopes to use AI to turn it into the decision-making entry point closest to transactions, guiding users to third-party platforms through smart mini-programs and further increasing online marketing service revenue.

However, the dividend period brought about by Baidu's AI restructuring strategy seems shorter than expected. Baidu's mid-year report for 2024 showed that the company's revenue for the first half of the year was RMB 65.444 billion, a slight increase of 0.37% year-on-year. Net profit attributable to shareholders was RMB 10.936 billion, a year-on-year decrease of 0.9%. If this level is maintained in the second half of the year, Baidu's revenue for 2024 will remain at the same level as 2023.

Looking back at Baidu's development over the past decade, AI has undoubtedly been the core strategy of the "post-search era," pulling Baidu back from its missed opportunities in the mobile internet era. The ERNIE Bot large model, Xiaodu smart products, and Luobo Kuaipao self-driving vehicles are all built on AI, broadening the dimensions of Baidu's business to varying degrees.

In this process, executive transfers may be more driven by personnel and management structure considerations, with no significant results in product and business innovation. However, it is certain that Robin Li has always firmly grasped the overall direction of Baidu's development in his own hands. (For details, see: Centrifugal Baidu Executives)