"Baidu vs Google Comparative Study 2024: The Current State and Future Trends of the 'Ancient AI Leaders' of China and the United States"

![]() 10/16 2024

10/16 2024

![]() 677

677

This article is written based on publicly available information and is intended solely for information exchange and does not constitute any investment advice.

Baidu and Google are the most representative platform companies in China and the United States during the Internet era. As the two internet companies with the most prominent technological endowments, they were also the first to turn to AI research and layout.

To date, with the emergence of OpenAI, Microsoft's strategic comeback, and NVIDIA's dominance in computing power, Google and Baidu, the pioneers, seem to have lost some of their luster.

In the capital market, Google's market value has been significantly surpassed by Microsoft and NVIDIA; Baidu, on the other hand, has remained lukewarm, with its valuation and market value trends consistently remaining in the lower range historically.

Is this phenomenon a bias in market aesthetics, or do these two ancient AI leaders indeed have hidden issues? This question is becoming an important topic of the moment.

As the opening chapter of an in-depth study on the AI industry, this article will take Baidu as the primary perspective, starting from the company's fundamentals reflected in recent financial reports, and delve into the issue through a comparative study with Google and the trends in the Chinese internet industry.

01

Baidu vs Google Comparative Study 2024

Let's first examine Baidu's fundamentals.

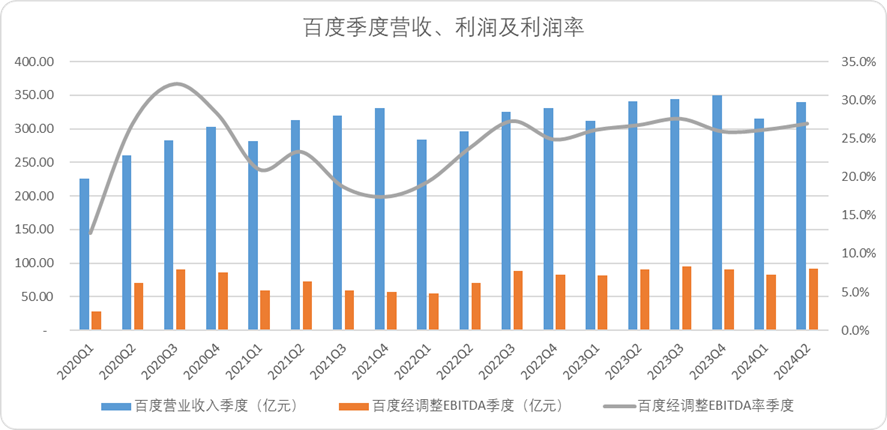

Based on quarterly data, Baidu's revenue has grown from 22.5 billion to 33.9 billion since 2020Q1, an increase of 51%. In terms of revenue trends, Baidu has maintained a consistent growth trajectory over the past five years.

Simultaneously, Baidu's profit margin has remained relatively high, with an adjusted EBITDA margin of 27% in the mid-year report of 2024, an increase of approximately 14 percentage points from its five-year low. Since 2022Q2, Baidu has maintained a profit level of around 25% for nine consecutive quarters.

Figure: Baidu's quarterly revenue, profit, and profit margin. Source: Corporate financial reports, collated by JinDuan Research Institute

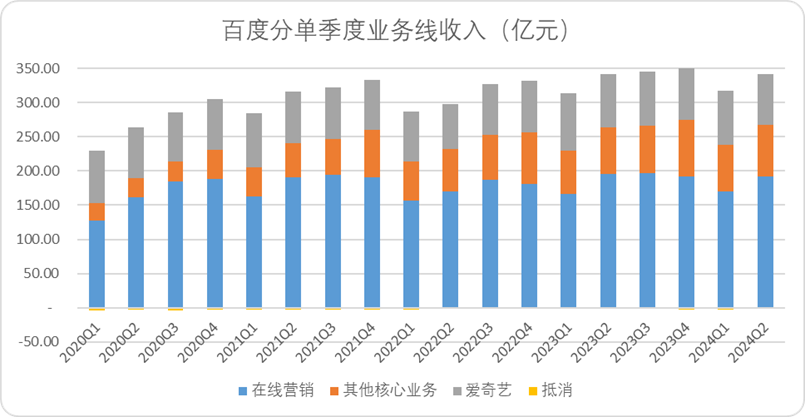

In terms of business segments, Baidu's revenue is primarily divided into two main lines and three types of businesses. The two main lines, Baidu and iQIYI, are accounted for separately. Baidu's core business is further divided into online marketing revenue, primarily driven by advertising, and other core businesses, including smart cloud, autonomous driving, and mobile ecosystem.

Over the past five years, Baidu's fastest-growing segment has been its other core businesses, with revenue growing from 2.5 billion to 7.5 billion, an increase of over 200%. However, the absolute growth in revenue has been most significant in online marketing, rising from 12.8 billion to 19.2 billion, a five-year growth rate of approximately 50%.

Figure: Baidu's quarterly revenue by business segment. Source: Corporate financial reports, collated by JinDuan Research Institute

iQIYI has been the poorest performer, with revenue declining by 2% over five years, far below Baidu's other business segments. Nevertheless, iQIYI has been the most aggressive in cost-cutting, with its main operating costs (production, distribution channels, etc.) falling by approximately 28% over five years, marketing and administrative expenses decreasing by 26%, and R&D expenses by 34%. As a result, iQIYI has become one of Baidu's core profit contributors after these cost-saving measures.

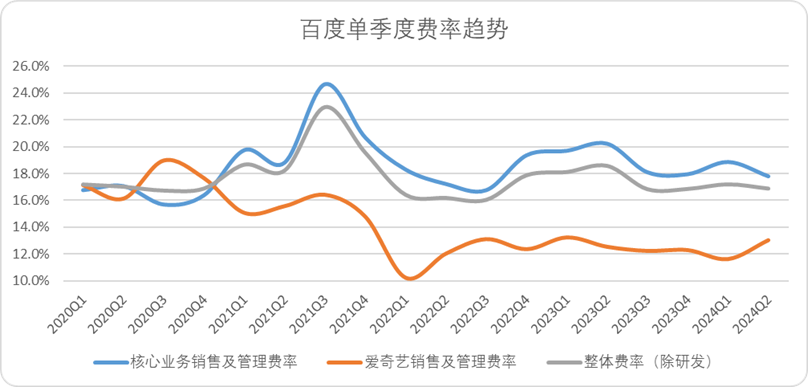

In comparison, although Baidu's core business fees have also shown a relative decline, the decrease is not significant. In the second quarter of this year, sales and administrative expenses decreased by 11% year-on-year, R&D expenses were cut by 4%, and overall fees decreased by 5% compared to the same period last year.

Figure: Baidu's quarterly fee trends. Source: Choice Financial Terminal

Overall, Baidu's fundamentals are robust, with revenue growth and significant cost reduction in shrinking business segments, while growth rates remain stable.

However, it is crucial to consider multiple perspectives. A narrow focus on Baidu alone can lead to biased perceptions. Only by comparing things within a broader context can we truly appreciate their differences.

Therefore, we have selected two axes to compare Baidu's performance over the past five years vertically. One is its 'twin brother' Google, with broadly similar business lines; the other is the top 10 Chinese internet companies by market capitalization, providing a supplementary axis for comparison in a similar market environment.

(1) Core Axis: Google

Google, as Baidu's 'fraternal twin,' is not merely a figure of speech. Apart from Google's advantages in hardware and software integration, particularly with Android and related ecosystem products (where Baidu lacks a significant software tax similar to Google Play), most of their businesses can be matched.

Figure: Comparison of Baidu and Google's business lines. Source: Collated by JinDuan Research Institute based on publicly available information

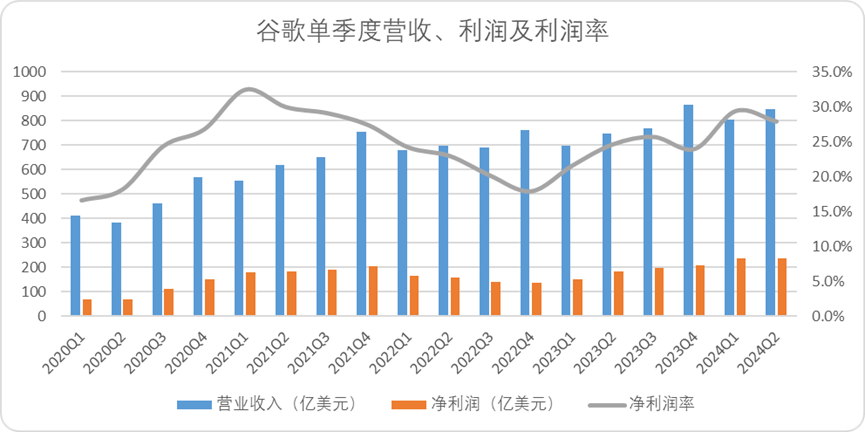

Upon closer examination of their revenue structures, it becomes evident that Google's advertising business has grown by approximately 128% over five years, compared to Baidu's 50%. As the largest contributor to both companies' revenues, Google's advertising business significantly outperforms Baidu's.

Baidu's advertising business has grown at a compound quarterly rate of approximately 2.4%. During the same period, Google's revenue grew from $38.3 billion to $84.7 billion, an increase of 121%, with a compound quarterly growth rate of approximately 4.8%, more than double that of Baidu.

Figure: Google's quarterly revenue, profit, and profit margin. Source: Corporate financial reports, collated by JinDuan Research Institute

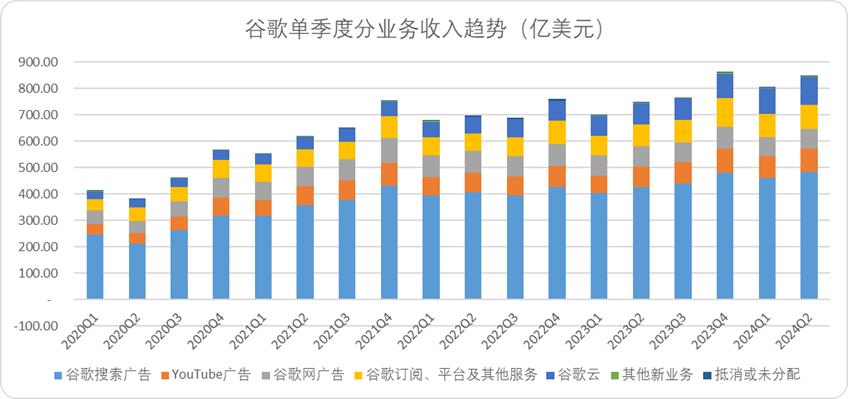

In terms of revenue by business segment, almost all of Google's business lines have doubled over five years.

Among them, Google Cloud has grown the fastest, with a growth rate of over 272%, followed by YouTube advertising. Google Search advertising has been one of the slowest-growing segments. The overall revenue growth structure is similar to Baidu's, except that YouTube's growth rate is much higher than iQIYI's.

Figure: Google's quarterly revenue by business segment. Source: Corporate financial reports, collated by JinDuan Research Institute

From a cost perspective, Baidu and Google's fee trends are also quite similar.

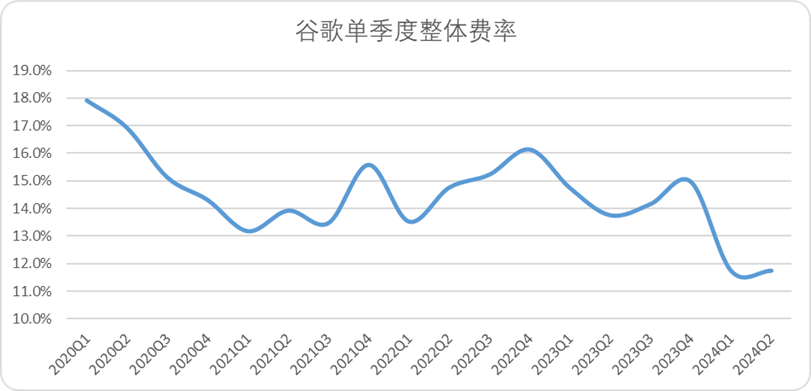

Baidu discloses expenses by business line quarterly, with core business lines experiencing an upswing from 2020 to 2021, followed by a sharp contraction after Q3 2021. Although Google does not disclose costs by specific business lines, its overall fee rate has also declined significantly, from 18% to less than 12%.

Figure: Google's quarterly fee trends. Source: Corporate financial reports, collated by JinDuan Research Institute

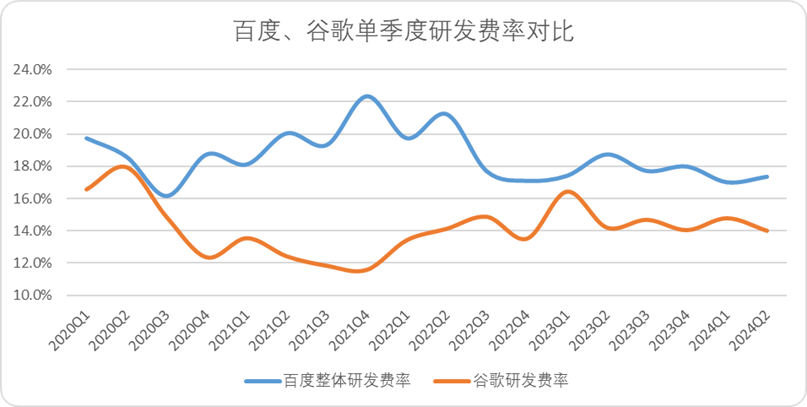

The only difference in costs is that Baidu maintains a higher R&D expense rate quarterly. In absolute terms, Google's R&D expenses have grown by approximately 79% since 2020Q1, compared to only 32% for Baidu. The primary reason is that Google's revenue growth has diluted its high R&D expense rate, and both companies have maintained a high willingness to invest in technology over the past five years.

Figure: Comparison of Baidu and Google's quarterly R&D expense rates. Source: Corporate financial reports, collated by JinDuan Research Institute

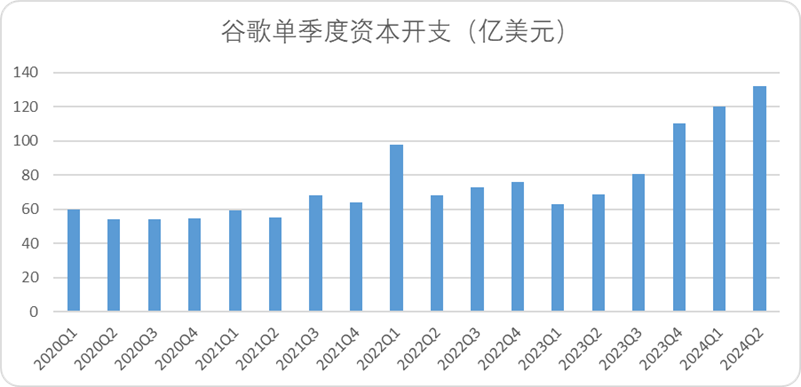

In terms of capital expenditure, Baidu does not disclose quarterly capital expenditure but, on an annual basis, capital expenditure for building fixed assets has increased from 5 billion to approximately 11.2 billion last year. Meanwhile, Google's quarterly capital expenditure has been continuously positive, surging from $5.4 billion to $13.2 billion.

It is worth noting that the growth rates of both companies' capital expenditures are closely related to the computing power race in the AI era, reflecting their cognitive and decisiveness in breaking through the technology cycle of large models.

Figure: Google's quarterly capital expenditure trends. Source: Corporate financial reports, collated by JinDuan

In summary, the primary reasons for the significant differences between Google and Baidu are:

● As traffic portals, YouTube has demonstrated significantly higher growth potential than iQIYI. Over the same period, YouTube's revenue grew from $3.8 billion to $8.7 billion, while iQIYI's revenue contribution remained virtually unchanged since 2020.

● In the years 2021-2022, when online traffic patterns shifted (with short-form video traffic significantly surpassing search traffic), Google regained growth momentum faster than Baidu. According to Google's earnings call, the online retail market drove the recovery of Google Search, with the cross-border e-commerce battle providing a new turning point for the struggling Silicon Valley giant.

The commercial development of short-form video e-commerce in China has been rapid, permeating nearly every aspect of commodity trading, from marketing and promotion to transaction logistics. In contrast, portal search may only tangentially impact e-commerce transactions, primarily limited to traditional customer acquisition.

As the user base of leading domestic e-commerce platforms nears saturation, the value of search portal traffic naturally diminishes. Meanwhile, TikTok and Reels' commercial ecosystems are still developing, and cross-border e-commerce is in its growth phase, with platforms like Shein and Temu relying heavily on traditional channels for customer acquisition.

Therefore, the actual reason for the difference in revenue growth between Baidu and Google may be a timing issue: the relatively untapped markets of new and cross-border e-commerce in Europe and the United States, coupled with their aggressive customer acquisition strategies, have brought substantial short-term growth to traditional search and content platforms. In the long run, however, the value of search traffic for both Google and Baidu is declining, with no significant difference between them.

(2) Supplementary Axis: Chinese Internet Companies

Next, let's compare the growth rates of Baidu with other Chinese internet companies in the same market but with different business lines.

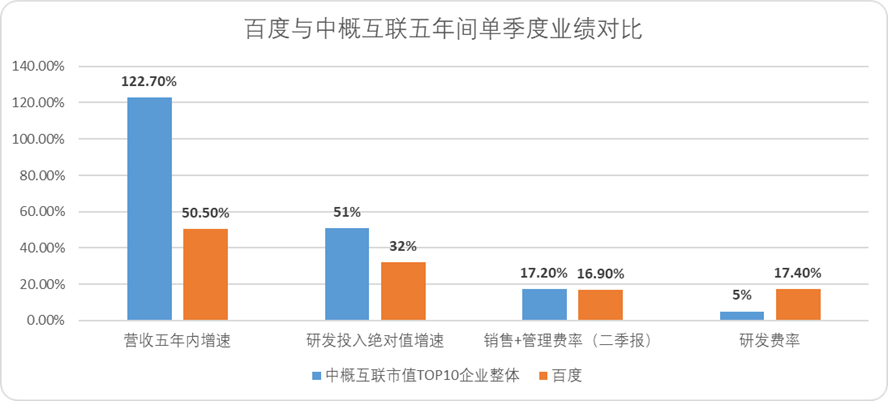

In terms of revenue, among the top 10 Chinese internet companies by market capitalization, Baidu ranks eighth in quarterly revenue growth over the past five years, slightly ahead of Tencent and NetEase (by less than 1%). The overall growth rate for Chinese internet companies is 122.7%, while Baidu's is only 50.5%.

In terms of costs, the overall quarterly fee rate for the sample Chinese internet companies has increased from 14.6% to 17.2% over the past five years, an increase of 2.6 percentage points. During the same period, Baidu's fee rate decreased from 17.2% to 16.9%, a contraction of 0.3 percentage points.

In terms of expenses, the overall R&D expenses for the sample Chinese internet companies have grown by 51% over the past five years, compared to 32% for Baidu. However, Baidu's R&D expense rate is 17.3%, while the overall rate for Chinese internet companies is 5%. It is evident that Baidu's willingness to invest in R&D is higher than that of most Chinese internet companies.

Figure: Comparison of Baidu's and Chinese internet companies' quarterly performance over five years. Source: Choice Financial Terminal

Due to its relatively slower growth, Baidu has effectively fallen out of the top tier of internet companies (ranked 3-4). In the second quarter of this year, Baidu ranked sixth in revenue among listed Chinese internet companies (excluding ByteDance) and seventh in market value.

It is worth noting that Google's market valuation is also not as robust as expected, currently trading at a valuation range of only 20-23x, the lowest among the 'Silicon Valley Seven Sisters,' even lower than META by approximately 5x. This suggests that the market is unwilling to grant higher valuations to traditional search platforms in the absence of further development of innovative products.

In summary, Baidu currently holds no advantage on either axis. Compared to Google, the domestic market lacks the benefits of e-commerce customer acquisition, while compared to Chinese internet companies, its business growth is insufficient. As a result, Baidu finds itself at a valuation trough.

02

Struggling in the Octagon

After comparing the two axes, let's first discuss the commonalities between Baidu and Google and why the market currently does not favor these ancient AI giants.

(1) The 'Technical Golden Cross' Is Not Yet Clear

Compared to other internet companies, a prominent shared characteristic of Baidu and Google is their strong willingness to invest in R&D. Whether it's early web search technology, distributed computing power, or the current trends in AI and autonomous driving, both Baidu and Google have been pioneers in their respective markets.

Innovation and marketing are the two core drivers of corporate growth. While marketing, as a pillar of 1-100 growth, is easily quantifiable for the market through performance metrics, innovative technology represents a 0-1 process that is more challenging to quantify. With the proliferation of media channels, investors are confronted with a deluge of information on technological advancements daily, making it difficult to ascertain their precise impact on a company's future.

To verify a company's true technological breakthrough capabilities, we can examine the relationship between its growth and economic cycles. In the elevator of the times, whether one is standing or lying down, they will still ascend. It is only when the tide recedes that we see who is swimming naked.

If a company's growth can ignore the turning points of economic cycles, it must be led by technological innovation that can effectively translate into growth, effectively 'breaking through' the ceiling of economic cycles, achieving what we call the 'technical golden cross.'

But without similar performance, technology-driven enterprises often suffer greater backlash and pressure.

For example, during the explosion of innovative technologies, different technological routes can determine the success or failure of technological applications. For instance, before the emergence of ChatGPT, the amount of data and rule algorithms determined the level of autonomous driving. However, the advent of large models opened up another end-to-end technological route, completely disrupting the logic of autonomous driving.

For companies that have invested heavily in capital expenditures and pursued the "previous generation" technological route, they will incur significant sunk costs, making it difficult to abandon their investments. This is particularly challenging for listed companies, as constraints from multiple stakeholder interests may create systemic pressure.

Indeed, as mentioned earlier, neither Baidu nor Google has been able to achieve growth rates that surpass industry and cyclical benchmarks in both dimensions. Therefore, the advantages of being technology-driven have yet to be proven at this stage.

(2) The Curse of the Crown

Returning to the initial question, why haven't Google and Baidu, once equally powerful, built insurmountable barriers in certain businesses or services like "AMN" (Apple, Microsoft, NVIDIA) or "ATJ" (Alibaba, Tencent, ByteDance)?

From Baidu's perspective, if we look at its 25-year history, only search can be considered a product that constitutes a barrier. Portal search was a typical high-quality product in the early days of traditional internet.

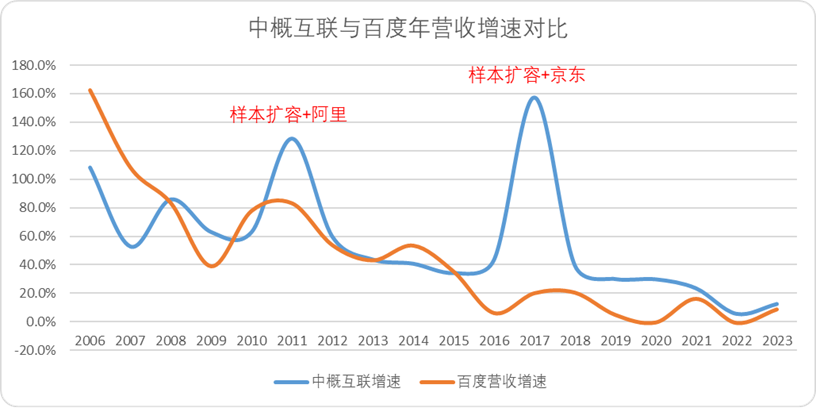

Apart from surviving the dot-com bubble, Baidu has struggled to break through the narrative of internet cycles for a long time. Apart from two instances of sample expansion, a horizontal comparison of Baidu's and China Internet's revenue growth over the past 20 years shows that it has barely surpassed the industry's growth ceiling since 2008.

Figure: Comparison of Revenue Growth between China Internet and Baidu, Source: Choice Financial Client

Baidu itself does not possess the strength to rival top internet companies. However, the market perceives Baidu as a leading internet company due to two main reasons: its absolute first-mover advantage and the underlying logic of "taking the difficult road and seeking answers outside." This has made Baidu a Iconic symbol of the internet.

In recent years, however, Baidu's products and technological practices, whether content-based platforms like Baijiahao, Tieba, Zhihu, or product tools like translation and music software, as well as mobile internet services like local life and short videos, have not been able to compete with more specialized products in the native era. As a result, Baidu often finds itself starting early but finishing late.

Moreover, the crown of being the leading Chinese internet company has brought tremendous pressure on Baidu. In both the traditional and mobile internet eras, Baidu has hoped to rely on this status to build new growth engines, leading to irrational cost expenditures and a lack of specialization in various areas.

A typical example is that Google, facing similar challenges in the post-pandemic period, has focused most of its capital expenditures on fixed assets, while Baidu has still invested heavily in acquiring YY.

In summary, as the traditional leader in the portal era, search has lost its traffic barrier in the more closed content ecosystem of the mobile era. The technological route that Baidu has bet on has not yet demonstrated the ability to support it in breaking through cyclical barriers.

Compared to leading internet companies, Baidu finds itself in a tough position in the mobile era, facing opponents from all sides with bare hands, regardless of the business it pursues. In most cases, it ends up failing.

The low level of capital recognition and the delayed discovery of a second growth curve are inevitable consequences of Baidu's predicament.

Rationally speaking, AI has undoubtedly been the most successful area for Baidu's investments over the past decade. While there may have been short-term deviations in technological route choices, Baidu still maintains advantages in cloud computing, search content, and long-term accumulated computing power and corpus assets. As of the end of 2023, Baidu remains one of the companies with the largest number of patents in the field of artificial intelligence across all areas.

The invisible advantages of technological accumulation persist. Even if Nokia and Motorola lagged behind in the smartphone era, their accumulated technological advantages in communication technologies continued to provide them with a steady stream of nutrients. The same is true for Baidu.

Of course, a comprehensive portrayal of Baidu's diverse endeavors goes beyond a few hundred words. After clarifying the overall fundamentals, we will continue to explore Baidu's strengths, weaknesses, potential issues, and challenges from multiple dimensions, including search traffic, cloud services, large model technologies, autonomous driving, operations, and content. This will serve as a sample to construct a typical profile of the AI cycle for traditional Chinese internet companies.

Let's meet again in our next detailed discussion.