ASML: "Fracture-level" embarrassment, becoming the first killer of AI?

![]() 10/16 2024

10/16 2024

![]() 410

410

ASML accidentally released its third-quarter 2024 financial report (ending September 2024) ahead of schedule during the U.S. stock trading session on the evening of October 15, 2024, Beijing time. The key points are as follows:

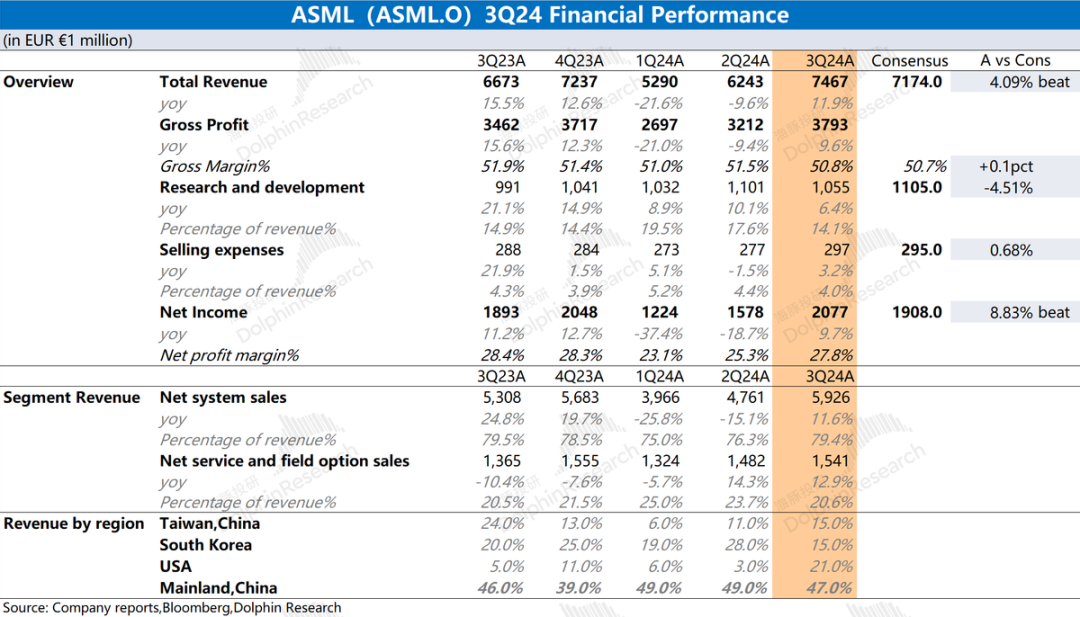

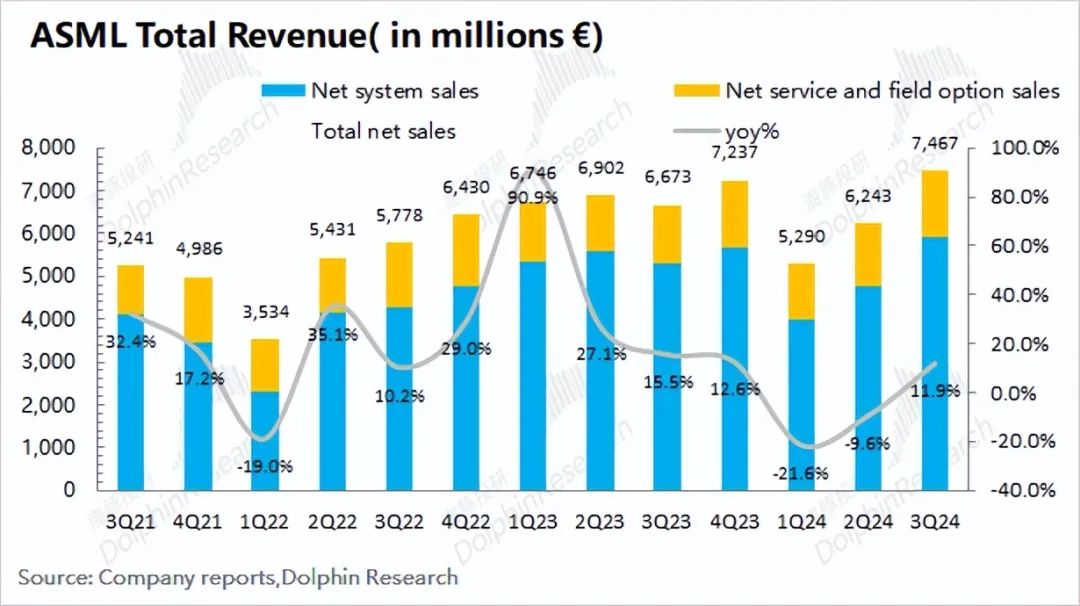

1. Core Data: While revenue reached a new high, orders collapsed significantly. ASML achieved revenue of €7.467 billion in the third quarter of 2024, exceeding market expectations (€7.174 billion). Quarterly revenue continued to recover, primarily driven by increased shipments of DUV systems. The company's net profit in the third quarter of 2024 was €2.077 billion, up 9.7% year-over-year and above market expectations (€1.908 billion). Despite the strong quarterly performance, orders in hand plunged to €2.6 billion, significantly below market expectations (€5.4 billion).

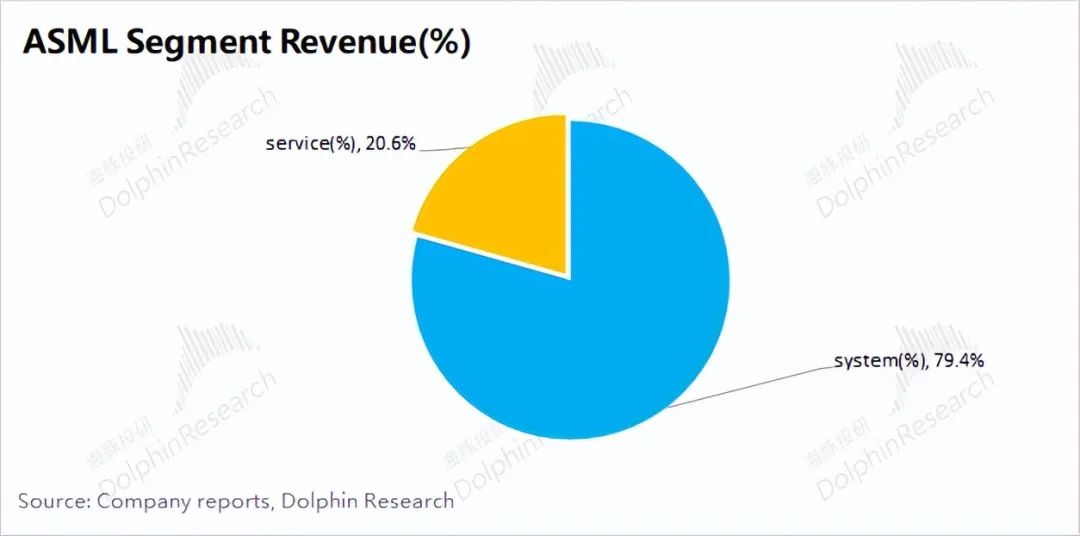

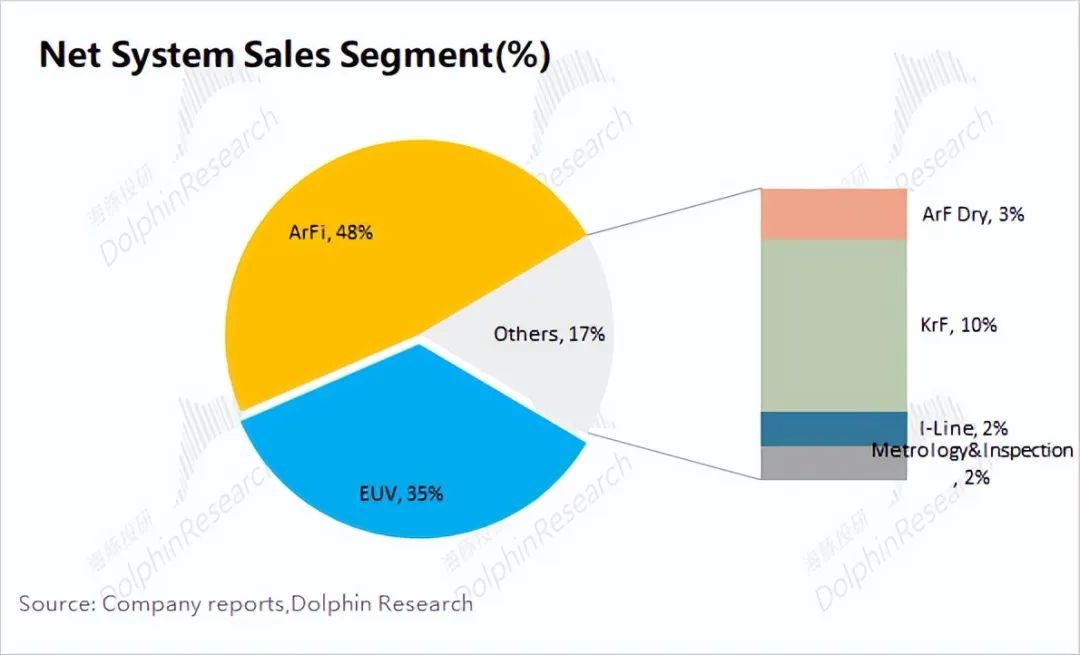

2. Business Segments: EUV and ArFi are the primary sources of revenue. System sales revenue remains the company's primary source of income, accounting for nearly 80% of total revenue. The quarterly growth was primarily driven by increased shipments of ArFi systems. Specifically, 11 EUV systems were shipped, flat year-over-year, while 38 ArFi systems were shipped, up 6 units from the previous year. The average selling price of ASML's lithography systems in the quarter was €51 million.

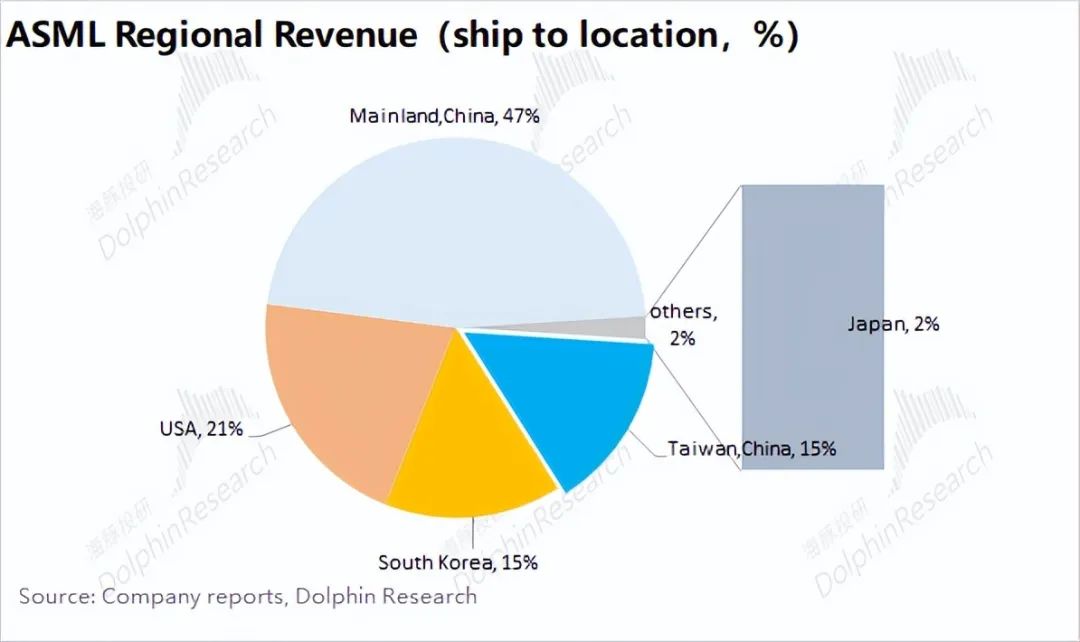

3. Revenue by Region: Mainland China accounts for half. Despite regulatory restrictions, Mainland China's revenue contribution remained at the top, primarily due to countercyclical expansion, which boosted demand for ArFi and ArF Dry systems. Shipments from TSMC and the US rebounded, while demand from South Korea and memory customers weakened.

4. ASML Outlook: The company expects revenue of €8.8-9.2 billion (in line with market expectations of €8.95 billion) and a gross margin of 49-50% (below market expectations of 50.49%) in the fourth quarter of 2024.

ASML originally planned to release its financial results before the U.S. market opened on Wednesday, but due to an "error," the company accidentally released them on Tuesday, leading to a sudden collapse in semiconductor stocks.

Overall Assessment: While ASML's financial results were decent, orders in hand fell significantly below expectations.

Financial Highlights: The company's revenue and profit both rebounded significantly in the quarter, with quarterly profit exceeding €2 billion. Although demand for EUV systems remained weak, ASML benefited from increased shipments of DUV products, primarily to customers in China. Looking ahead, the company expects revenue of €8.8-9.2 billion in the fourth quarter of 2024, in line with market expectations (€8.95 billion), and a gross margin of 49-50%, slightly below market expectations (50.5%).

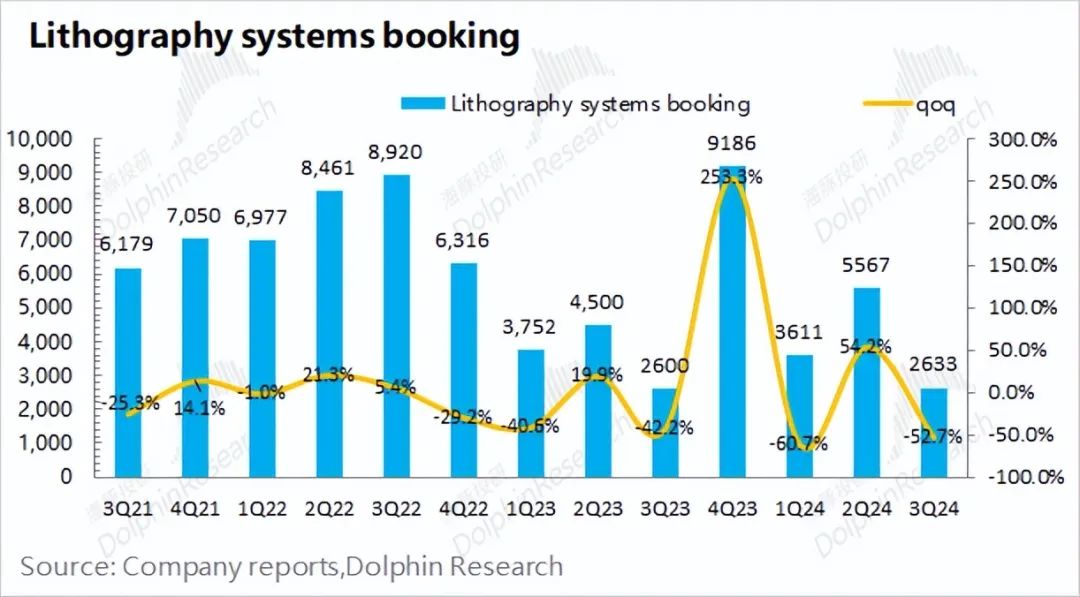

Upon closer inspection, the most disappointing aspect of the financial report was the significant decline in orders in hand. Orders in hand fell sharply to €2.63 billion, well below market expectations (€5.4 billion). This directly impacts future performance. Against the backdrop of AI and memory upgrades, the lack of growth in orders in hand and the substantial decline are undoubtedly a disappointment to the market. The €2.6 billion in orders in hand represents a return to the lowest level in nearly three years.

Based on industry trends and the company's circumstances, Dolphin Insights believes that the sharp decline in orders in hand in this quarter was primarily driven by export restrictions, Intel's reduced capex, and weakness in the memory industry: 1) Intel has indicated plans to significantly reduce capex in 2024 and 2025, directly impacting lithography system shipments; 2) Although the memory industry had shown signs of recovery, recent price declines have weakened demand; 3) TSMC, while increasing its capex guidance for 2024, only marginally raised the lower end of the range; 4) Regulatory risks in China, with the Dutch government considering further restrictions on the export of 1970i and 1980i deep ultraviolet immersion lithography tools, aligning with the U.S.'s unilateral export restrictions last year.

In summary, while AI may bring new growth opportunities to the supply chain, the slow pace of technological iteration in the logic sector has directly impacted EUV shipments. As the upstream player in the semiconductor supply chain, ASML's performance is directly influenced by downstream demand and capex spending by its key customers. The significant decline in orders in hand will likely impact market confidence in the AI and semiconductor supply chain in the short term and raise concerns about TSMC's capex guidance in its upcoming financial report. (For more information on ASML and its management, please stay tuned for Dolphin Insights' upcoming ASML investor conference call summaries, which will be posted in our community groups.)

Detailed Analysis

I. Core Data: While Revenue Reaches New High, Orders Collapse

1.1 Revenue: ASML achieved revenue of €7.47 billion in the third quarter of 2024, exceeding market expectations (€7.17 billion), with quarterly revenue continuing to rise. The 11.9% year-over-year growth was primarily driven by increased shipments of DUV systems, with ArFi quarterly revenue reaching a new high.

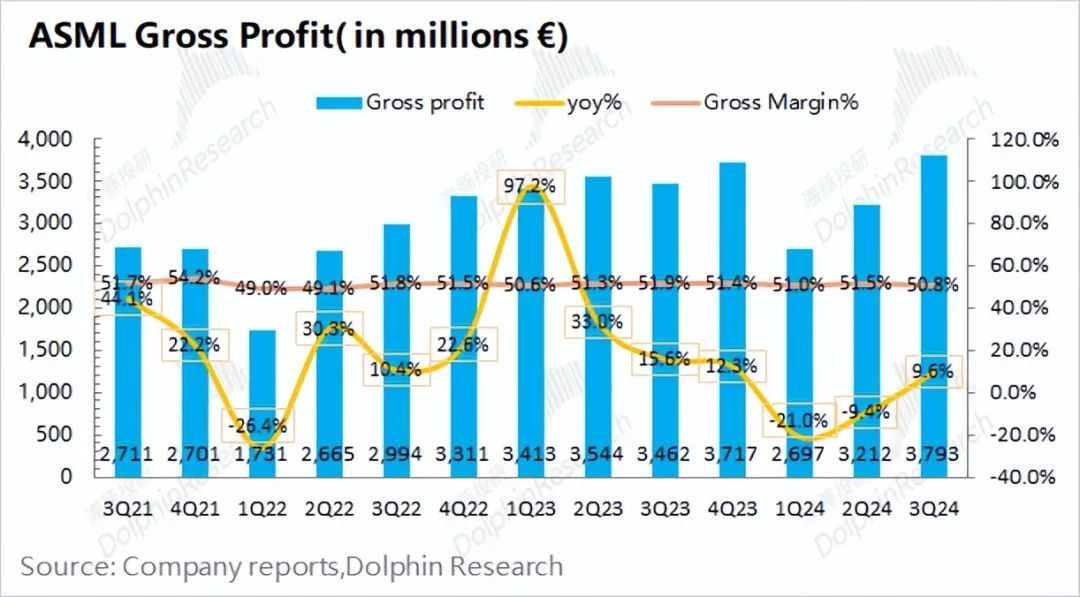

1.2 Gross Profit and Margin: ASML achieved gross profit of €3.793 billion in the third quarter of 2024, up 9.6% year-over-year. The gross margin for the quarter was 50.8%, slightly down but in line with market expectations (50.7%). The company expects its gross margin to range between 51% and 53% in 2025, which, while up slightly, is still below its previous guidance. This is primarily due to delayed EUV demand.

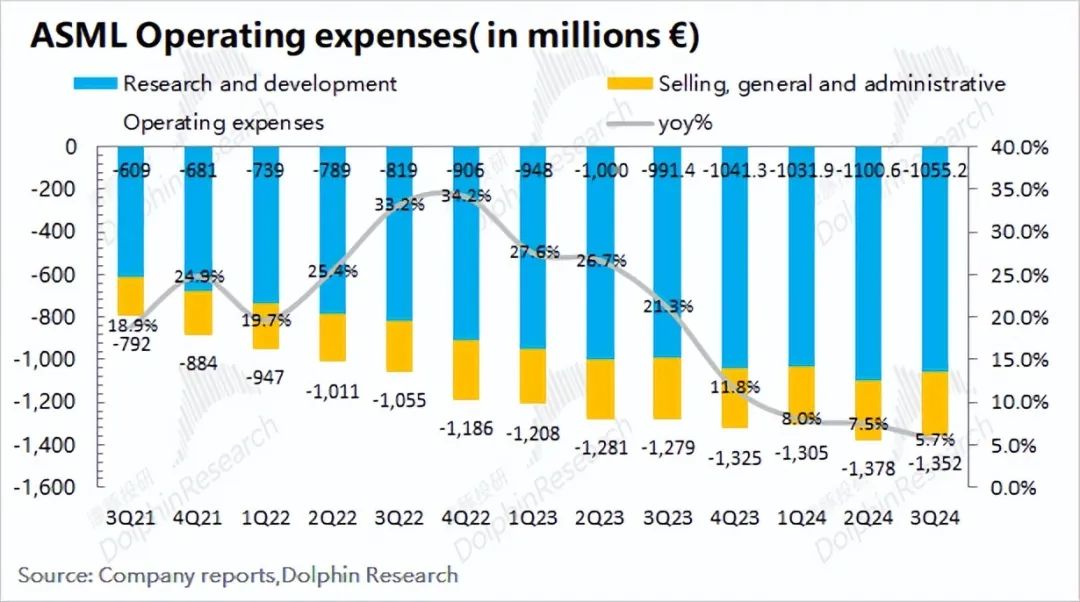

1.3 Operating Expenses: ASML's operating expenses in the third quarter of 2024 were €1.352 billion, up 5.7% year-over-year.

Specifically:

1) R&D Expenses: R&D expenses were €1.055 billion in the quarter, up 6.4% year-over-year. The R&D expense ratio declined to 18.1%, returning to a stable level around 18% due to increased revenue.

2) Selling, General, and Administrative Expenses: Selling and administrative expenses were €297 million in the quarter, up 3.2% year-over-year. The selling, general, and administrative expense ratio remained relatively stable at 4%.

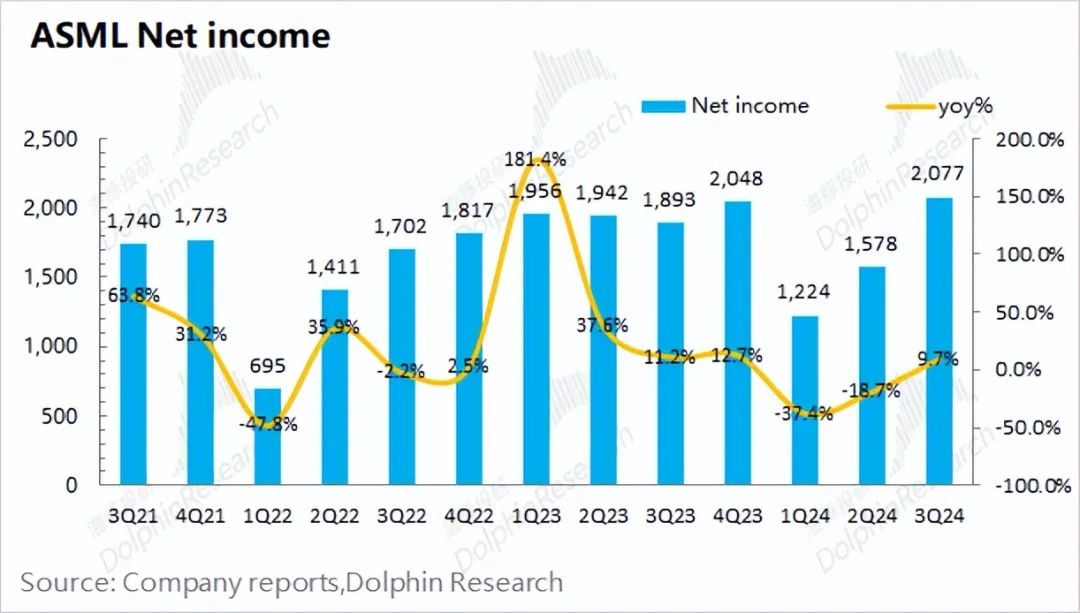

1.4 Net Profit: ASML's net profit in the third quarter of 2024 was €2.077 billion, up 9.7% year-over-year and exceeding market expectations (€1.908 billion). Quarterly profit returned to over €2 billion, primarily driven by increased shipments of DUV systems.

Despite the quarterly revenue recovery, orders in hand fell sharply to €2.6 billion, well below market expectations (€5.4 billion). Dolphin Insights believes this was primarily due to weakening EUV demand, Intel's reduced capex, and weakness in memory demand.

II. Segmental Data: EUV Demand Remains Weak

ASML's business comprises system sales revenue and service revenue, with system sales accounting for nearly 80% of total revenue and being the company's core source of income.

2.1 Business Segments

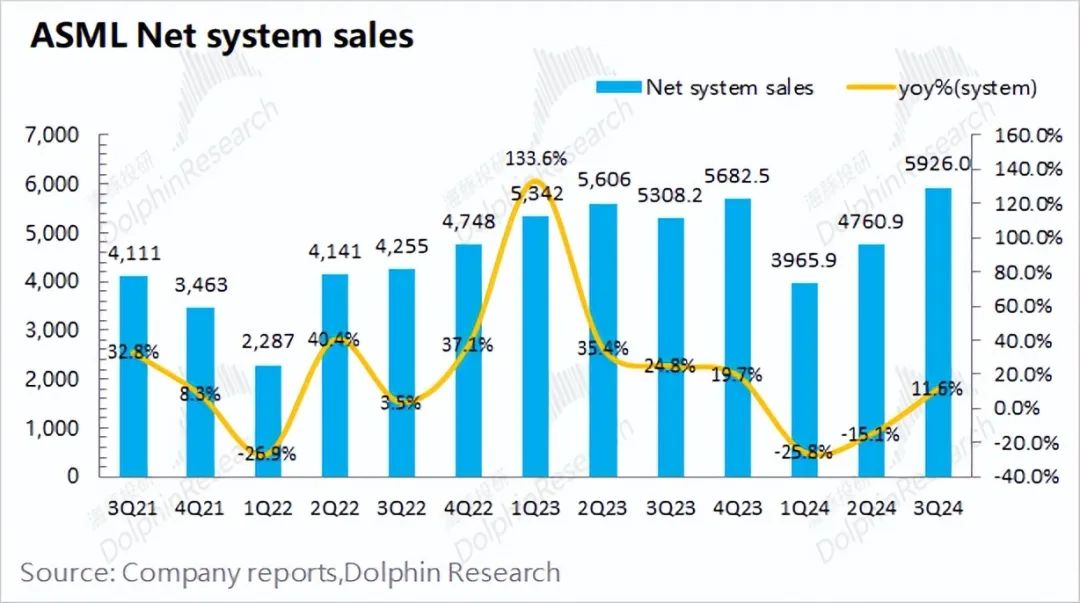

1) System Sales Revenue: ASML's system sales revenue was €5.926 billion in the third quarter of 2024, up 11.6% year-over-year. The growth was primarily driven by increased shipments of DUV lithography systems.

System sales revenue primarily comes from EUV and ArFi systems, which together account for 83% of total system sales. In terms of shipments, 11 EUV systems were shipped, flat year-over-year, while 38 ArFi systems were shipped, up 6 units from the previous year, representing the primary growth driver in the quarter. Driven by increased shipments of ArFi systems, the average selling price of ASML's lithography systems rose to approximately €51 million in the quarter.

Despite revenue growth, orders in hand declined significantly to €2.6 billion. While there is still incremental demand in the AI sector, recovery in other sectors remains slow. The slowdown in technology node iterations in the logic sector has impacted EUV shipments, and demand in the memory sector has also weakened.

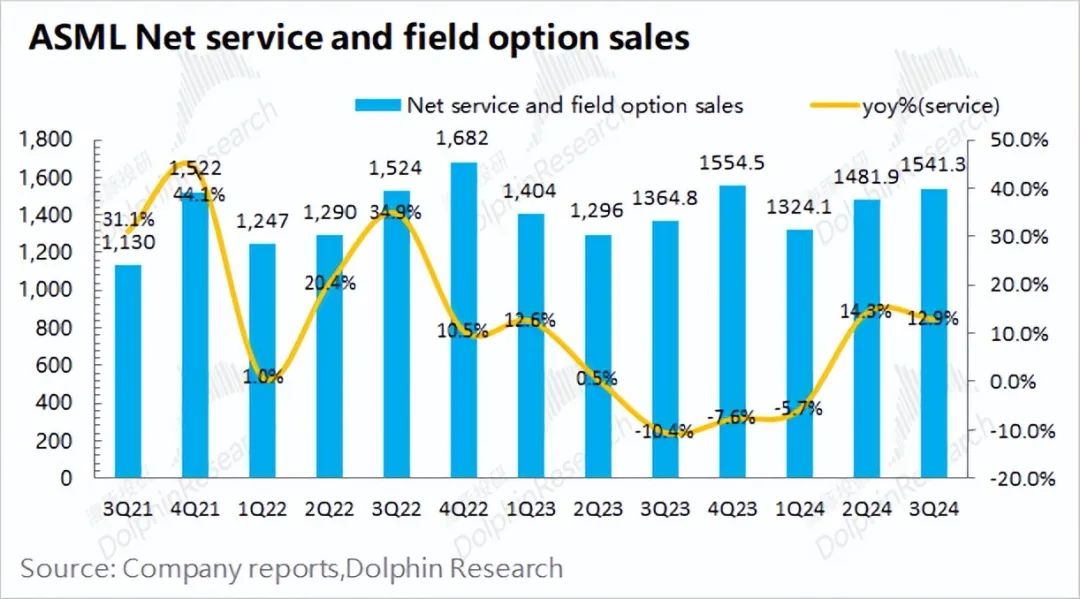

2) Service Revenue: ASML's service revenue was €1.541 billion in the third quarter of 2024, up 12.9% year-over-year. Service revenue, which primarily comprises equipment maintenance, is more stable than system sales revenue.

2.2 Revenue by Region: Mainland China accounted for nearly 50% of revenue in the quarter, continuing to be ASML's largest customer. This was primarily due to increased shipments of ArFi and ArF Dry systems to customers in Mainland China, driving ASML's ArFi revenue to a new high in the quarter.

While revenue rebounded in the quarter, there were notable structural features. Shipments from TSMC and the US increased, while revenue from South Korea declined significantly. Dolphin Insights believes that revenue growth in the US was primarily driven by Intel's shipments of EUV systems (each High-NA EUV lithography system is valued at nearly €400 million). However, the stagnation in memory price increases has slowed demand for lithography systems from South Korea (Samsung, SK Hynix).

Dolphin Insights' Related Research on ASML and the Semiconductor Supply Chain

ASML Q3 2024 Earnings Review: High Expectations, Slow Delivery, Falling Short of the 'AI Dream' - July 17, 2024

ASML Q1 2024 Earnings Review: Collapsing Performance, AI Winds Failing to Reach Lithography Machines? - April 17, 2024

ASML Q4 2023 Earnings Review: Explosive Orders, Pointing to Semiconductor Growth? - January 24, 2024

ASML Q3 2023 Earnings Review: The Crown Jewel, Unable to Escape the Cycles - October 18, 2023

In-Depth Analysis: ASML - Valued at Less Than 30x, Is the Lithography King Expensive? - September 21, 2023

In-Depth Analysis (Part 1): 'Ultimate Faith' in ASML - July 14, 2023

Semiconductor Industry: Will NVIDIA and Others Truly Rebound After Their Magical Performances? - March 7, 2023

Semiconductor Meltdown? Only After the Worst Declines Will True Resilience Emerge - December 29, 2022

Semiconductor Shake-up: Are We Witnessing a Sea Change? - June 24, 2022

Order Cancellations: Is the Semiconductor Industry Really Changing? - June 17, 2022

Consumer Electronics: 'Ripe' for Change, Apple Holding Strong, Xiaomi Struggling - June 17, 2022

TSMC In-Depth: Price Discounts, Faith Unshaken - April 8, 2022

After the Market Crash, Revisiting the Legendary Foundry King TSMC - March 16, 2022

SMIC In-Depth (Part 2): The Undervalued 'Chip' of China - July 16, 2021

SMIC In-Depth (Part 1): The 'Core' Strategies of a Leading Chipmaker - July 9, 2021

- END -

// Reprint Permission

This article is original content created by Dolphin Insights. For reprint permission, please add us on WeChat.