Horizon begins offering shares, Alibaba and Baidu each invest $50 million, with a maximum market value exceeding RMB 50 billion

![]() 10/17 2024

10/17 2024

![]() 518

518

Horizon is sprinting towards its IPO on the Hong Kong Stock Exchange and has entered the final stage. If everything goes as planned, it will officially begin trading on October 24, just a few days away.

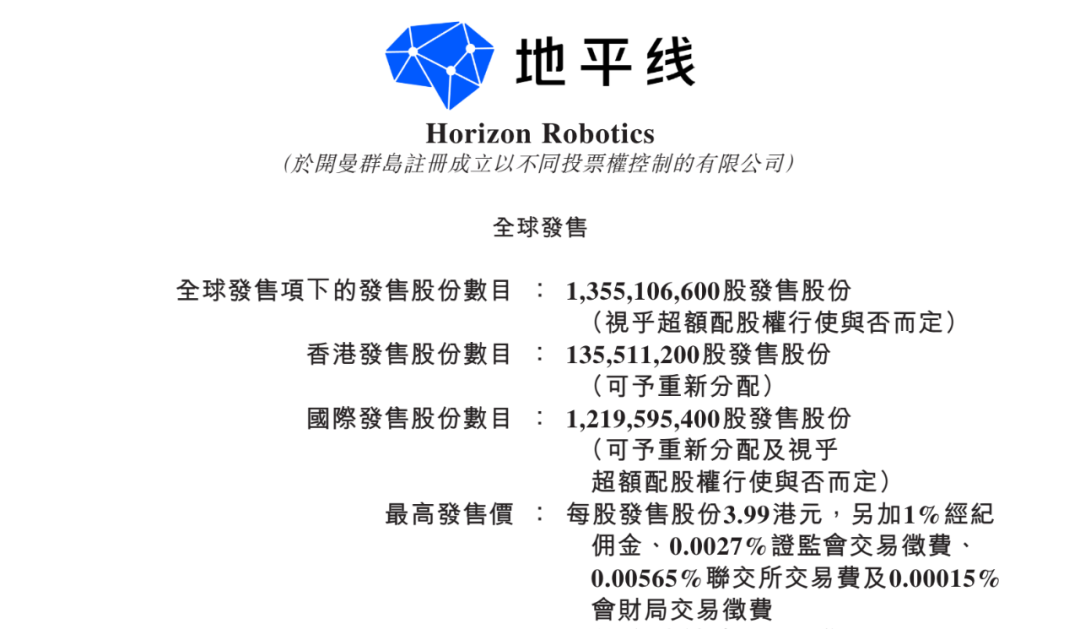

The latest news is that at 9:00 am on October 16, Horizon officially launched its share offering on the Hong Kong Stock Exchange under the stock code "9660," planning to issue no more than 1.355 billion Class B ordinary shares priced between HK$3.73 and HK$3.99 per share.

Based on the offering price, Horizon is expected to raise HK$5.054 billion to HK$5.406 billion (approximately RMB 4.628 billion to RMB 5 billion) through its IPO. Similarly, based on the offering price and the number of shares issued, Horizon's final market value after its IPO on the Hong Kong Stock Exchange will not exceed HK$54.06 billion (approximately RMB 49.5 billion).

Compared to previously listed smart driving chip companies like Black Sesame and smart driving startups listed in 2024, this IPO market value is significantly higher.

Horizon's high market value is largely supported by its ability to mass-produce more than 285 models for 27 OEM customers.

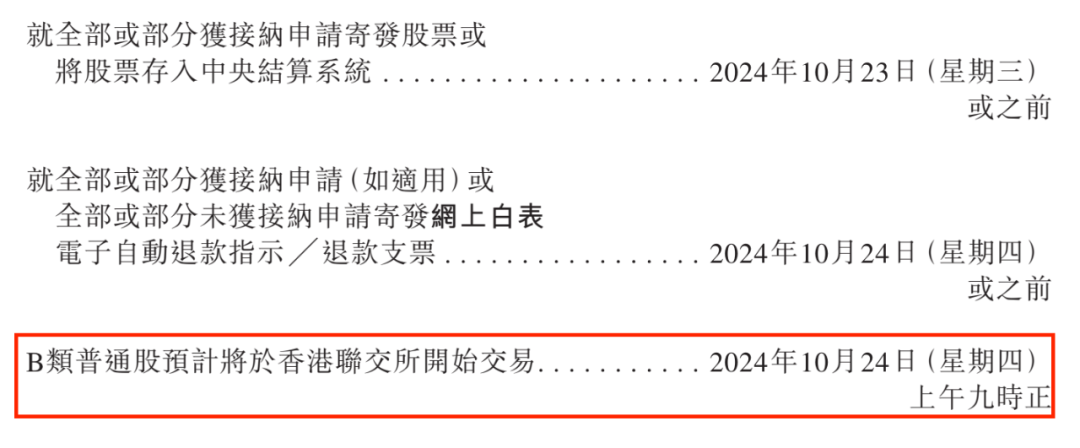

The share offering period will end on October 21, with trading expected to commence on the Hong Kong Stock Exchange on October 24.

01 Horizon begins offering shares, with Alibaba and Baidu as cornerstone investors

According to Horizon's share offering document submitted to the Hong Kong Stock Exchange on October 16, the following key details of its IPO should be noted.

Horizon's latest share offering document on the Hong Kong Stock Exchange

Firstly, Horizon plans to globally offer 1.355 billion Class B ordinary shares for its IPO on the Hong Kong Stock Exchange, with Goldman Sachs, Morgan Stanley, and China Securities International acting as joint sponsors.

Of these, approximately 136 million shares will be offered in Hong Kong, accounting for approximately 10% of the total offering; while 1.22 billion shares will be offered internationally, accounting for approximately 90% of the total offering.

Additionally, under the over-allotment option, international underwriters may require Horizon to issue up to approximately 203 million (not exceeding 15% of the global offering) additional Class B ordinary shares at the international offering price within 30 days of the listing date.

Secondly, the offering price range for new shares is set at HK$3.73 to HK$3.99 per share, with the specific offering price to be determined on October 22. Based on this range and the number of shares offered, Horizon's IPO is expected to raise HK$5.054 billion to HK$5.406 billion (approximately RMB 4.628 billion to RMB 4.95 billion).

If the over-allotment option is exercised, the total amount raised will further increase to HK$6.218 billion (approximately RMB 5.694 billion).

Similarly, based on the offering price, Horizon's IPO market value will range from HK$50.54 billion to HK$54.06 billion (approximately RMB 46.3 billion to RMB 49.5 billion).

This IPO market value is not insignificant in the context of Hong Kong's stock market this year and is expected to be the largest among smart driving startups listed in Hong Kong this year, barring any unforeseen circumstances.

Horizon's funding situation

However, it is important to note that prior to its IPO, Horizon had raised 11 rounds of funding, amassing over US$3.4 billion (approximately RMB 23.9 billion) in total. Following its last funding round, Horizon was valued at US$8.71 billion (approximately RMB 61.5 billion).

This indicates that in order to successfully list, Horizon and its investors made certain concessions in this regard.

Thirdly, Horizon has introduced four cornerstone investors for its IPO, including Alibaba (investing US$50 million), Baidu (investing US$50 million), CMA CGM (investing US$9.9 million), and JSC (Ningbo Yongning Gaoxin SP, investing US$30 million).

Collectively, these four cornerstone investors have subscribed for HK$1.707 billion (approximately US$219.8 million) worth of shares, accounting for one-third of the total funds raised.

Horizon's official IPO on October 24

Finally, Horizon's listing on the Hong Kong Stock Exchange is scheduled for October 24. If everything goes as planned, we will witness Horizon's official listing and trading on the Hong Kong Stock Exchange on that day.

Thus, after submitting its listing application to the Hong Kong Stock Exchange in March this year, Horizon's journey towards listing has finally culminated in a satisfactory conclusion after more than half a year.

02 Horizon's overall financial health is improving

Horizon had previously considered listing on the U.S. stock exchange, with plans to raise US$1 billion. However, it shifted its focus to Hong Kong and submitted its listing application to the Hong Kong Stock Exchange in March this year, after which there were no further updates.

It was not until the National Day holiday this year that Horizon updated its listing prospectus, accelerating its listing timeline. The latest prospectus reveals Horizon's business performance, including revenue fundamentals and customer dynamics, over the past three and a half years, with an overall positive trend.

From 2021 to 2023, Horizon's revenue grew from RMB 467 million to RMB 906 million and then to RMB 1.552 billion, representing a compound annual growth rate of over 82.3%. In the first half of this year, revenue reached RMB 935 million, an increase of 151.6% year-on-year.

Horizon's automotive solutions accounted for the majority of its revenue, rising from 87.9% in 2021 to 94.8% in 2023 and further to 97.7% in the first half of this year.

This trend is largely attributed to its licensing and service business within the automotive solutions segment. In the first half of this year, Horizon's licensing and service revenue reached RMB 691 million, an increase of 351.6% year-on-year, accounting for 73.9% of its total revenue for the period.

In fact, Horizon's licensing and service business has been growing rapidly since the second half of last year, contributing RMB 811 million in revenue during this period, almost double that of 2022. Volkswagen has played a significant role in this rapid growth.

Horizon and Volkswagen establish a joint venture

In October 2022, Horizon and Volkswagen's intelligent software company CARIAD established a joint venture. Starting in 2023, Horizon began licensing algorithms and software related to advanced driver assistance systems (ADAS) and autonomous driving solutions to this joint venture.

In 2023 and the first half of this year, Horizon generated licensing revenue of RMB 627 million and RMB 351 million, respectively, from this joint venture. Volkswagen's revenue contribution has also increased Horizon's dependence on a single major customer.

Data shows that in the first half of this year, Horizon's top five customers accounted for 77.9% of its revenue, an increase of 9.1 percentage points from the previous year. It is worth noting that before Volkswagen generated revenue in 2021 and 2022, this figure was 60.7% and 53.2%, respectively.

Horizon's dependence on its single largest customer, which remains the joint venture with Volkswagen, has increased from 24.7% of revenue in 2021 to 37.6% in the first half of this year. Volkswagen has been instrumental in supporting Horizon's strong first half of 2024.

However, for a company primarily focused on hardware and software products, relying heavily on licensing and service revenue in the long run may pose potential risks and become a factor for investors to assess Horizon's investment value.

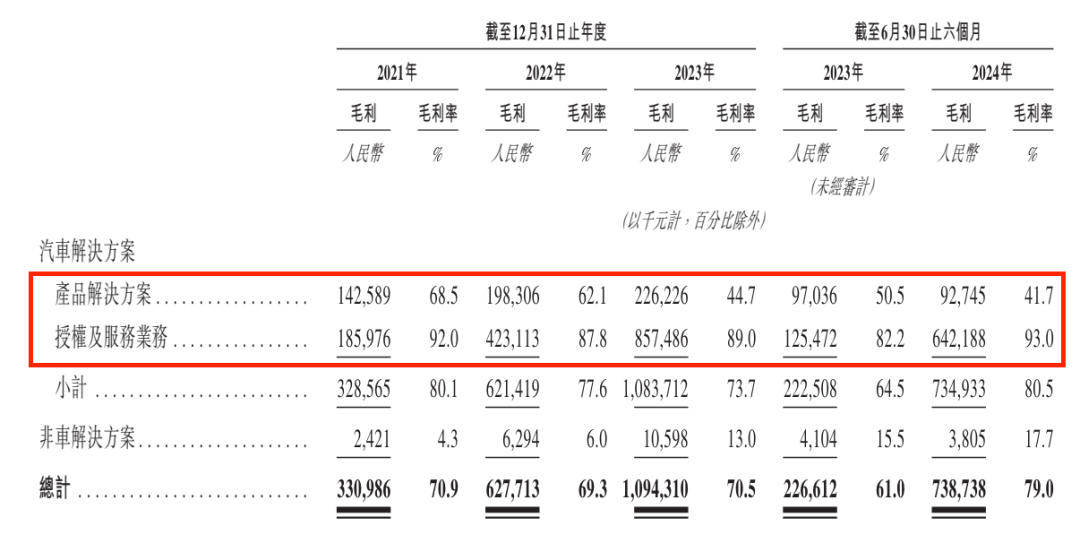

In addition to revenue, Horizon's gross margin has improved significantly due to its licensing and service business. From 2021 to 2023, Horizon's gross profit was RMB 331 million, RMB 628 million, and RMB 1.094 billion, respectively. In the first half of 2024, gross profit reached RMB 739 million, an increase of 226% year-on-year.

Gross margin increased from 70.9% in 2021 to 79% in the first half of this year.

Horizon's gross margin by business segment

In its prospectus, Horizon stated that the cost of fulfilling services provided to customers in its licensing and service business is relatively low, which is the primary reason for the increase in gross margin.

However, Horizon is still incurring losses. In the first half of this year, it reported a net loss of RMB 5.098 billion, an increase of over 170% year-on-year. However, after adjusting for non-operating items such as preferred shares and other financial liabilities, and share-based payments, its adjusted net loss for the first half of the year was RMB 804 million, a decrease of nearly RMB 200 million from the same period last year.

Over time, Horizon's adjusted net loss for the first half of the year has continued to narrow, although it is still some distance from breakeven, the overall trend is positive. Intense research and development (R&D) expenditures are the primary factor contributing to Horizon's ongoing losses.

In the first half of this year, Horizon's R&D expenditures amounted to RMB 1.42 billion, an increase of 35.3% year-on-year. Combined with cumulative investments over the past three years, Horizon's total R&D expenditures have exceeded RMB 6.8 billion. In terms of cash, as of June 30, 2024, its cash and cash equivalents stood at RMB 10.542 billion.

Some of Horizon's customers

Meanwhile, Horizon's customer base has been steadily growing. According to the latest data, as of the latest practicable date, Horizon's hardware-software integrated solutions have been adopted by 27 OEMs (with 42 OEM brands represented), equipping over 285 vehicle models, an increase of 55 models compared to the previous prospectus submission.

In terms of market share, according to Gaogong data, in the first half of this year, Horizon led the market with a 28.65% share of smart driving solutions equipped in independent brand passenger vehicles in China. It also ranked first in the forward-facing integrated computer vision system (L2 ADAS) market with a 33.73% share.

03 Horizon's 'hard' background telling a 'soft' story at the product level

For a long time, Horizon was known primarily as a hardware supplier focused on smart driving chips. However, since initiating its IPO process, Horizon's narrative has shifted towards emphasizing its software algorithm capabilities.

Especially after this year's Beijing Auto Show, Horizon's positioning has become more prominent as a provider of advanced driver assistance systems (ADAS) and autonomous driving solutions for passenger vehicles, with a core focus on algorithm software capabilities.

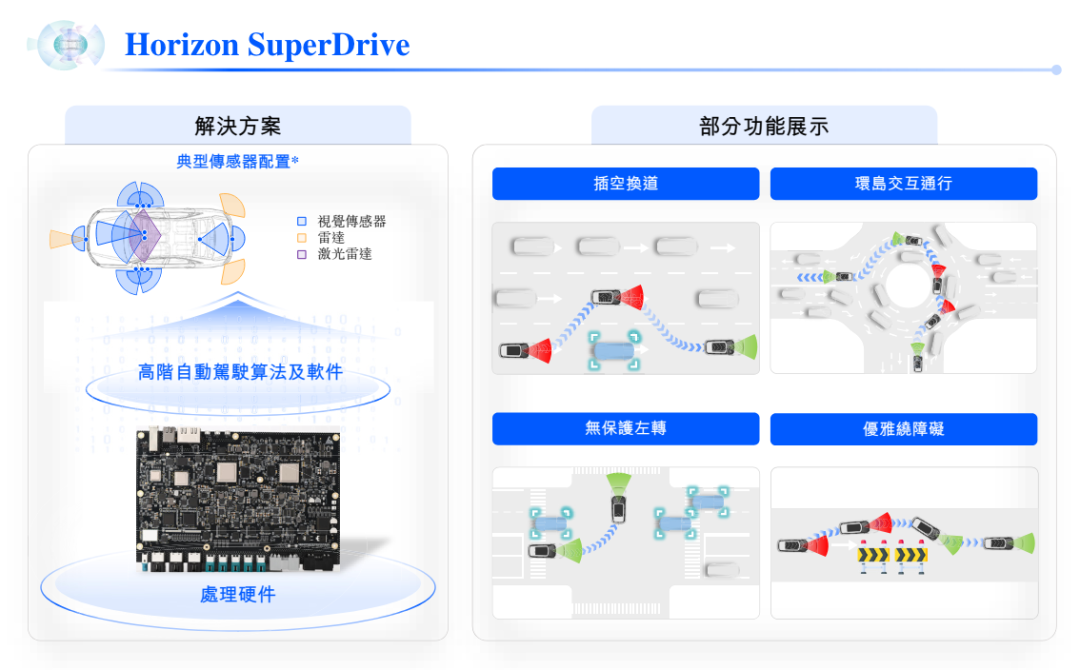

At the heart of this narrative is Horizon's newly launched Horizon SuperDrive, a full-scenario city NOA solution.

Horizon SuperDrive for full-scenario advanced driving

Announced just before this year's Beijing Auto Show in April, this solution employs an end-to-end large model architecture for perception algorithms, complemented by an Occupancy Network that accurately reconstructs the real-world environment, embodying Horizon's 'three-in-one' perception end-to-end architecture.

Surrounding this core system, a set of external engines is designed to validate decisions and provide safety boundaries, clear objectives, and guidance on decision-making and trajectory planning. Ultimately, a set of lightweight validation rules ensures system performance, safety, and user experience.

On the hardware side, this solution is based on Horizon's Journey 6P compute chip, which boasts 560 TOPS of computing power and is tailored for advanced, full-scenario smart driving. With high integration, computing power, efficiency, processing capabilities, connectivity, and security, a single Journey 6P chip can handle the full stack of computing tasks, including perception, planning, decision-making, and control.

Prior to this, Horizon has released corresponding software algorithms in tandem with each generation of hardware products, such as Horizon Mono based on Journey 3 and Horizon Pilot based on Journey 5.

Yu Kai speaking at Horizon's technology day

According to Horizon's founder and CEO Yu Kai, the SuperDrive solution aims not only to create a full-stack hardware-software showcase but also to establish a global benchmark for intelligent driving, going beyond previous software solutions built on Journey 2, Journey 3, and Journey 5.

This shift in narrative may be an attempt to circumvent sanctions or emphasize the superiority of Horizon's integrated hardware-software capabilities.

Regardless of the motivation, Horizon's ambition and goals, as reflected in its changed narrative and the launch of Horizon SuperDrive, extend beyond being just a Tier 2 supplier.

Judging from the products on display, from chips, software, to upper-level software solutions, and then to direct customer information transmission, Horizon has done everything in SuperDrive, even more seriously and comprehensively than the OEMs.

In short, compared with previous Horizon software solutions, Horizon SuperDrive is a shelf product that can be delivered directly to OEMs.

This solution has also been designated by automakers and is expected to be mass-produced in 2026.

04 Horizon's ambition: Going public is just the beginning

What is Horizon's ambition?

Previously, Yu Kai expressed in a sharing session:

'If Horizon cannot support a very high ceiling for intelligent driving, Horizon's entire business ecosystem will not be sustainable.'

The logic behind this statement is that Horizon invests 3 billion yuan in R&D annually, while automakers need to allocate their R&D investments across many areas, such as cockpits, intelligent driving, and chassis, but Horizon focuses all its 'ammunition' on intelligent driving.

Large sums of money, long-term investment, and dedication to one thing have supported Horizon's entire business logic.

However, it cannot be ignored that the ceiling is still far from being reached, and Horizon's most advanced solution is yet to be mass-produced and validated. For a considerable period thereafter, Horizon needs to maintain high-intensity investment as it strives to reach that ceiling.

Therefore, going public is just the beginning of Horizon's efforts to sustain its entire business ecosystem.