Pony.ai sprints towards NASDAQ: Potential 'first Robotaxi stock globally', with approximately RMB 1.2 billion in revenue over two and a half years

![]() 10/18 2024

10/18 2024

![]() 536

536

Leading the mass production and commercialization of global Robotaxi services.

Author: Stone Jin | Source: IPO Early Bird | WeChat Official Account: ipozaozhidao

According to IPO Early Bird, Pony.ai Inc. (hereinafter referred to as 'Pony.ai') officially submitted an F-1 filing to the U.S. Securities and Exchange Commission (SEC) on October 17, 2024, Eastern Time, planning to list on NASDAQ under the ticker symbol 'PONY'. Goldman Sachs, Bank of America Merrill Lynch, Deutsche Bank, and Huatai Securities are serving as the lead underwriters.

This means Pony.ai could potentially become the 'first global Robotaxi stock.' On April 22 of this year, the International Cooperation Department of the China Securities Regulatory Commission disclosed the overseas listing registration notice for Pony.ai Inc.

Founded in 2016, Pony.ai primarily provides autonomous driving technologies and solutions for the global market in the areas of transportation and logistics, developing 'Virtual Driver' technology applicable to various vehicle types and application scenarios. Based on this, Pony.ai's revenue primarily comes from autonomous ride-hailing (Robotaxi), autonomous trucks (Robotruck), and technology licensing and application services. Currently, Pony.ai's autonomous road tests have accumulated nearly 400 million kilometers.

In December 2018, Pony.ai launched PonyPilot, China's first autonomous ride-hailing service (Robotaxi), and became one of the few companies globally to achieve fully driverless operations, truly leading the mass production and commercialization of global Robotaxi services. According to Frost & Sullivan, Pony.ai is one of the first companies in China to obtain permits for driverless ride-hailing services (Robotaxi) in Beijing, Shanghai, Guangzhou, and Shenzhen, and the only autonomous driving technology company with all available regulatory permits in these four major domestic cities.

Since its inception, Pony.ai has raised over USD 1.3 billion in seven funding rounds prior to its IPO. Investors include state-owned enterprises such as China Merchants Capital, top automakers like Toyota Motor Corporation and FAW Group, renowned venture capital firms like Sequoia China, IDG Capital, Matrix Partners China, CPE, Fidelity, Carlyle Group, as well as capital support from the Middle East. Toyota is the largest strategic investor in terms of shareholding, while Sequoia is the earliest and largest financial investor.

In its prospectus, Pony.ai stated that the net proceeds from the IPO will be primarily used for the large-scale commercialization and market expansion of autonomous ride-hailing and freight services; continuous research and development of autonomous driving technologies; and potential strategic investments and acquisitions to enhance technological capabilities and build an ecosystem within the industry chain.

Autonomous ride-hailing services begin large-scale operations; break-even point for individual vehicle operations may soon arrive

Among Pony.ai's three major business segments, autonomous ride-hailing services (Robotaxi) are clearly its core and most promising business.

Since its inception, Pony.ai has deployed over 250 Robotaxis nationwide and has initiated fully driverless commercial charging for Robotaxi services in Beijing, Guangzhou, and Shenzhen. To date, Pony.ai's Robotaxis have accumulated over 33.5 million kilometers of autonomous road tests, including over 3.9 million kilometers of driverless road tests.

In terms of operational data, as of June 30, 2024, the number of registered users on Pony.ai's PonyPilot mobile app exceeded 220,000; by the end of August 2024, approximately 70% of registered users had used Pony.ai's (PonyPilot) services multiple times.

Furthermore, Pony.ai has integrated with third-party ride-hailing platforms such as Amap, Alipay, and Ruqi Limousine & chauffeur. As of June 30, 2024, the average daily number of orders for Pony.ai's fully driverless Robotaxis exceeded 15 per vehicle.

Of course, to achieve large-scale operations of Robotaxi services, mass production is a prerequisite—it requires not only the forward development of automotive-grade autonomous driving hardware and software systems but also cooperation with third parties like OEM manufacturers for production.

To date, Pony.ai has comprehensively cooperated with various mainstream automakers such as Toyota, GAC Motor, FAW Group, SAIC Motor, and Sany to jointly promote the development of autonomous vehicles. In August 2019, Pony.ai and Toyota officially announced their strategic partnership to begin development of the first Robotaxi model; in April of this year, Pony.ai, Toyota China, and GAC Toyota established a joint venture with an investment exceeding RMB 1 billion to jointly promote the mass production and service deployment of autonomous taxis. Currently, the joint venture is conducting joint research and development and production planning for the first Bozhi 4X Robotaxi model, with production preparations underway. It is expected to deploy over 1,000 Robotaxis in first-tier cities from 2025 to 2026.

This means that Pony.ai's operational break-even point may soon arrive. After all, in first-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen, when the deployment of Robotaxis reaches 1,000 units, operations are expected to reach the break-even point; once this threshold is crossed, it will enter a stage of continuous self-sustaining growth. Based on this, Pony.ai's Robotaxi operations could achieve profitability on a per-vehicle basis as early as 2025.

Robotruck can highly reuse Robotaxi technology; autonomous driving technologies and products accelerate overseas expansion

Apart from its Robotaxi business, Pony.ai's autonomous truck (Robotruck) business is also experiencing rapid growth. Currently, Pony.ai operates a fleet of over 190 autonomous trucks, including self-operated vehicles and those operated in partnership with Sinotrans, China's largest freight logistics company. This fleet has accumulated approximately 5 million kilometers of autonomous driving. During its commercial operations, it has transported a total weight of 767 million tonne-kilometers. Simultaneously, Pony.ai is also developing L4 autonomous trucks in collaboration with Sany Group.

It's worth noting that Robotruck and Robotaxi can share a set of underlying 'Virtual Driver' technologies, with 80% of the technologies reusable. For instance, both urban and highway roads are structured, and most traffic rules can be shared. Large-scale testing tasks for hardware and software solutions can also be shared. The remaining 20% of technologies need to be tailored to meet the demands of faster speeds, greater momentum, and non-rigid structures specific to freight transportation.

This means that Pony.ai's Robotaxi and Robotruck businesses have considerable synergies, significantly reducing costs as business scales continue to expand, leading to a healthier operational state. Moreover, Pony.ai is the first autonomous driving company in China to obtain both taxi transportation and freight road transport operation permits.

It's worth mentioning that while its domestic business is experiencing rapid growth, Pony.ai has also deployed autonomous driving services in countries and regions such as South Korea, Luxembourg, Saudi Arabia, the United Arab Emirates, and Singapore, realizing the overseas expansion of its technologies and products. Specifically:

In October 2023, Pony.ai signed a cooperation agreement with the Abu Dhabi Investment Office (ADIO) to join the Abu Dhabi Smart Autonomous Vehicle Industry Cluster (SAVI) in Masdar City. In the same month, Pony.ai and NEOM planned to establish a joint venture in NEOM, a city of the future in northwest Saudi Arabia, to provide autonomous driving technology solutions for the region. In March of this year, Pony.ai and Korean tech company GemVaxLink announced the establishment of a joint venture to create leading autonomous ride-hailing technologies and services for the Korean market through deep integration of resources and technological advantages. Also in March, Pony.ai announced the signing of a memorandum of understanding with the Grand Duchy of Luxembourg to promote the development of autonomous vehicles and technologies in the country. In July, Pony.ai signed a memorandum of cooperation with Singapore taxi operator ComfortDelGro Group to jointly promote large-scale commercial operations of driverless taxis.

Revenue increased by 101.2% year-on-year in the first half of this year; technological investments are continuously translating into commercial benefits

From a financial perspective, Pony.ai's revenue in 2022 and 2023 was USD 68.39 million and USD 71.9 million, respectively. In the first half of this year, Pony.ai's revenue increased by 101.2% year-on-year to USD 24.72 million. In other words, over the past two and a half years, Pony.ai's total revenue has exceeded USD 165 million (approximately RMB 1.2 billion).

In terms of revenue composition, Pony.ai's Robotaxi revenue increased by 86.0% year-on-year, Robotruck revenue increased by 62.4%, and technology licensing and application services revenue increased by 894.1% in the first half of this year. Notably, Pony.ai's Robotruck revenue exceeded RMB 100 million in 2023, indicating that its Robotruck business has entered a small-scale commercial operation phase.

Pony.ai's net losses were USD 148 million and USD 125 million in 2022 and 2023, respectively, while its net loss in the first half of this year was USD 51.78 million, a year-on-year narrowing of 25.6%.

As of June 30, 2024, Pony.ai held total cash, cash equivalents, short-term investments, and restricted cash of USD 473 million, indicating relatively ample financial resources. It's worth noting that Pony.ai's R&D expenses in 2022, 2023, and the first half of this year were USD 153 million, USD 122 million, and USD 58 million, respectively, accounting for 75.7%, 76.6%, and 79.0% of operating expenses, significantly higher than sales and administrative expenses.

The decrease in R&D expenses in 2023 was primarily attributed to reduced employee compensation expenses. As Pony.ai's revenue items and scale increased, part of the compensation expenses for R&D personnel were reallocated to cost of revenue, while a small portion of the reduced compensation expenses were offset by increased development and testing expenses. From another perspective, this also corroborates that Pony.ai's technological investments are translating into commercial benefits.

Currently, Pony.ai has established R&D centers in Silicon Valley, Beijing, Shanghai, Guangzhou, and Shenzhen. As of June 30, 2024, Pony.ai employed 620 engineers, researchers, and scientists.

Certainly, Pony.ai's co-founders, James Peng and Lou Tiancheng, possess profound technical expertise, having built their careers from scratch in autonomous driving and artificial intelligence. James Peng, co-founder and CEO, served as the Chief Architect of Baidu's autonomous driving business before founding Pony.ai, responsible for autonomous driving technology development. He previously worked at Google for seven years and received the Google Founders Award. Lou Tiancheng, co-founder and CTO, is a globally renowned computer programmer known by his competition ID 'ACRush.' He won the TopCoder China championship for 11 consecutive years and the Google Code Jam championship twice. Before founding Pony.ai, Lou worked on self-driving car technology at Google X (Waymo) and later served as the Technical Committee Chairman of Baidu's Autonomous Driving Unit, becoming the youngest T10-level engineer in history.

With vast market potential in Robotaxi and Robotruck, Pony.ai is poised to further amplify its leading position

It is undeniable that autonomous driving products and services like Robotaxi are experiencing rapid development driven by technological advancements, policy support, and declining hardware costs. According to Frost & Sullivan, Robotaxi is expected to achieve commercialization around 2026 and enter a mature commercialization phase with deployments in major global regions by 2030.

Frost & Sullivan forecasts that the global Robotaxi market size will grow from USD 290 million in 2025 to USD 66.6 billion in 2030, at a CAGR of 195.6%, and further to USD 352.6 billion in 2035.

China is projected to become the largest Robotaxi service market, with its market size growing from USD 160 million in 2025 to USD 39 billion in 2030, at a CAGR of 199.6%, and further to USD 179.4 billion in 2035. This represents over half of the global Robotaxi service market size and a growth rate higher than the global average.

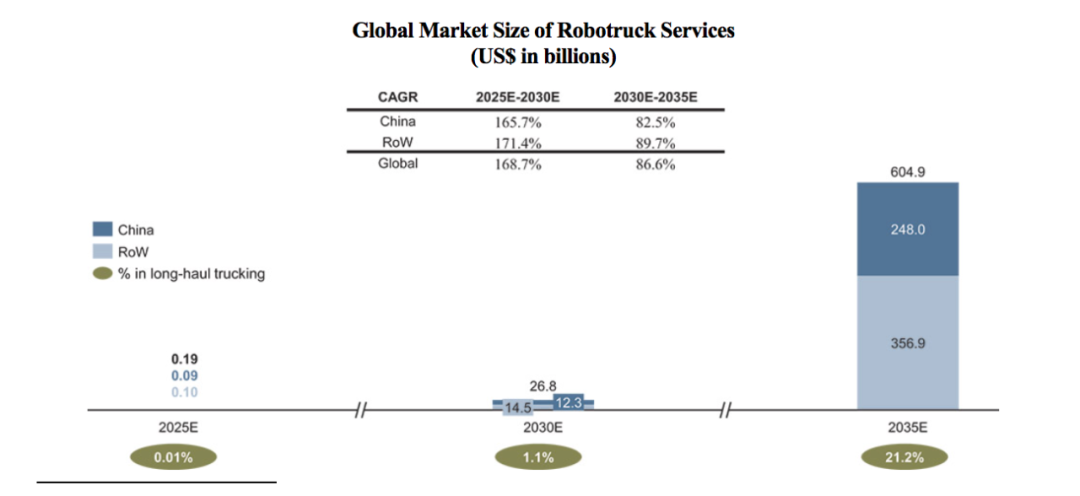

Similarly, the global Robotruck market size is expected to increase from $190 million in 2025 to $26.8 billion in 2030 at a CAGR of 168.7%, and will further increase to $604.9 billion in 2035. Among them, the size of the Chinese Robotruck market is expected to increase to $12.3 billion in 2030, accounting for 45.8% of the global Robotruck market size that year.

In summary, both the global Robotaxi and Robotruck markets have considerable incremental space, and the Chinese market will account for about half of the market share.

For Pony.ai, an autonomous driving company that already has a first-mover advantage in regulatory approval, safety verification, technology reserves, large-scale mass production, and commercial operations, the future development prospects are promising. In particular, if it can successfully land on NASDAQ, it is bound to amplify its leading effect and increase its influence globally, thereby generating a "flywheel effect" to drive its scale and performance growth.

This article was originally written by the official account IPO Zaozhidao (ID: ipozaozhidao). For reprinting, please contact Uncle C.