"Cold reception at IPO, AIGC fails to save Qiniu Cloud"

![]() 10/21 2024

10/21 2024

![]() 558

558

Recently, Qiniu Intelligent Technology Co., Ltd. (hereinafter referred to as "Qiniu Cloud") officially landed on the Hong Kong Stock Exchange, becoming a member of the capital market. However, despite years of meticulous preparation, Qiniu Cloud's IPO did not receive a warm reception from the market. The company opened trading at an issue price of HK$2.75, but its share price plummeted significantly after opening, closing at HK$1.19 on the first day, marking a decline of 56.73%.

Since its establishment in 2011, Qiniu Cloud initially focused on B-end cloud storage services, and now its main products and services include MPaaS (Mobile Platform As a Service) products and APaaS (Application Platform As a Service) solutions.

According to iResearch data, Qiniu Cloud's revenue accounted for 1.5% of the overall audio and video cloud services market in 2023. Based on revenue in 2023, Qiniu Cloud is China's third-largest audio and video PaaS service provider, with a market share of 5.8%. Similarly, based on APaaS revenue in 2023, Qiniu Cloud is China's second-largest audio and video APaaS service provider, with a market share of 14.1%.

As a leading company in the audio and video cloud services sector, Qiniu Cloud was once the focus of capital pursuit. Since its establishment, Qiniu Cloud has raised over RMB 3 billion in cumulative financing, with well-known investors such as Alibaba, Yunfeng Fund, Matrix Partners China, and Qiming Venture Partners on its shareholder list.

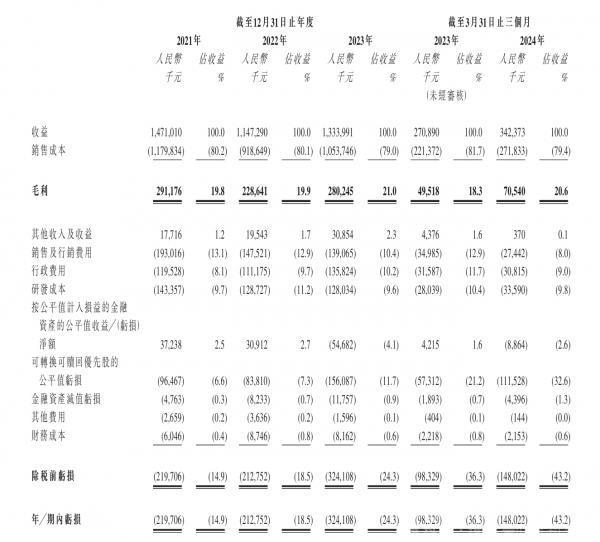

Despite strong support from well-known investors, Qiniu Cloud's financial performance has not met expectations. According to financial data disclosed in its prospectus, Qiniu Cloud has faced considerable performance pressure in recent years. Specifically, from 2021 to 2023 and the first quarter of this year (hereinafter referred to as the "reporting period"), Qiniu Cloud's revenues were RMB 1.471 billion, RMB 1.147 billion, RMB 1.334 billion, and RMB 342 million, respectively. During the reporting period, the adjusted net losses were RMB 106 million, RMB 119 million, RMB 116 million, and RMB 24 million, respectively, totaling a cumulative loss of RMB 365 million.

The sustained losses and lack of business growth momentum have led to disappointing market performance for Qiniu Cloud after its IPO. However, this outcome is not surprising and reflects the prevailing difficulties faced by small and medium-sized cloud vendors to some extent.

Struggling for survival amidst sluggish growth and competition from large cloud vendors

Audio and video cloud services represent a niche segment within the broader cloud services market. In 2023, the total size of China's cloud services market reached RMB 513.7 billion, with the audio and video cloud services market accounting for 17.8% of this total, or RMB 91.5 billion.

With the growing demand for computing power and the rapid development of AIGC technology, China's cloud services market is expected to continue its growth trajectory, reaching a market size of RMB 1,268.8 billion by 2028. By that time, the audio and video cloud services market is projected to reach RMB 240.5 billion, accounting for 19.0% of China's overall cloud services market.

In China's audio and video cloud services market, SaaS, PaaS, and IaaS are the three main segments. Qiniu Cloud primarily offers MPaaS products and APaaS solutions.

MPaaS products encompass a range of audio and video solutions, including the proprietary content delivery network (QCDN) for accelerating content distribution, the object storage platform (Kodo) for storing content, interactive live streaming products, and the smart media data analysis platform (Dora). These products primarily serve customers with strong development capabilities and high demands for flexibility. The APaaS solutions, on the other hand, leverage Qiniu Cloud's MPaaS capabilities and are built on a low-code platform to provide contextualized audio and video solutions. These solutions enable customers to easily deploy and quickly access different functionalities, with a focus on five key application scenarios: social entertainment, video and imaging, visual networking, intelligent new media, and the metaverse.

As a cloud service provider that caters more to small and medium-sized enterprises, Qiniu Cloud has secured a foothold in the fiercely competitive cloud services market thanks to its price advantage and more flexible, customized cloud service solutions that cater to long-tail demands.

However, the overall size of China's audio and video PaaS market is relatively limited. In 2023, the public audio and video PaaS market reached RMB 16.4 billion, accounting for 71.6% of the entire audio and video PaaS market, while the private audio and video PaaS market was valued at RMB 6.5 billion, accounting for 28.4%. Although iResearch predicts that the share of PaaS in the audio and video cloud services market will increase from 24.9% in 2023 to 32.3% in 2028, driven by technological advancements and the expansion of application scenarios, the current scale of the entire industry remains limited.

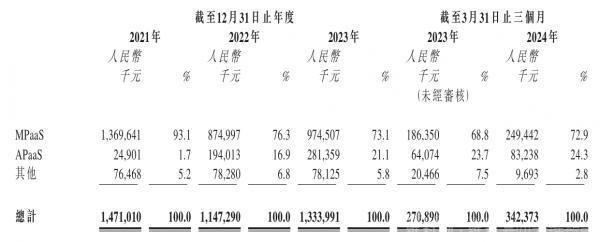

According to the prospectus, during the reporting period, Qiniu Cloud's revenues from MPaaS business were RMB 1.37 billion, RMB 875 million, RMB 975 million, and RMB 249 million, respectively, accounting for 93.1%, 76.3%, 73.1%, and 72.9% of total revenues during the corresponding periods. Revenues from APaaS were RMB 24.901 million, RMB 194 million, RMB 281 million, and RMB 83.238 million, respectively, accounting for 1.7%, 16.9%, 21.1%, and 24.3% of total revenues during the same periods.

From the data disclosed by Qiniu Cloud, while the number of paying customers for its MPaaS business has increased, the growth rate has not been robust. Specifically, the number of paying customers has risen from 68,808 in 2021 to 83,970 in 2022 and 92,480 in 2023. In the three months ending March 31, 2024, the number of MPaaS paying customers was 62,563, marking a limited increase from 62,311 at the end of the previous quarter.

Similarly, the number of paying customers for APaaS business has shown a similar growth trend. From 2021 to 2023, the number of paying users was 1,319, 1,967, and 2,597, respectively. In the three months ending March 31, 2024, the number of APaaS paying customers increased to 2,303, representing a growth from 1,867 at the end of the previous quarter, though the growth rate remained modest.

The reasons for this can be attributed to several factors. Firstly, IaaS providers have ventured into the audio and video PaaS market, intensifying market competition. For instance, on May 18, 2021, Tencent Cloud officially launched its "Tencent Cloud Audio and Video" brand, introducing a series of audio and video communication infrastructure networks, PaaS product lines, and joint solutions tailored for vertical industries such as industry and security.

In September of the same year, Huawei Cloud also joined the fray, introducing its real-time audio and video service (SparkRTC), which has been applied in various scenarios including online education, entertainment interaction, e-commerce live streaming, and video conferencing. Leveraging Huawei Cloud's extensive edge nodes and CDN nodes, SparkRTC provides infrastructure support for audio and video services.

Moreover, Alibaba Cloud has also been actively deploying in the audio and video PaaS market. In March 2022, DingTalk completed the acquisition of real-time audio and video PaaS company "Palycloud" and earlier established an independent audio and video business unit dedicated to exploring the next-generation form of audio and video conferencing.

On the other hand, Qiniu Cloud, which has long relied on capital support, faces severe challenges in the cloud computing market's price war. In recent years, major cloud vendors such as Alibaba Cloud, Tencent Cloud, and JD Cloud have initiated price wars to compete for market share. Qiniu Cloud has had to follow suit, offering discounts and promotions such as "up to RMB 30,000 savings on CDN orders" and "92% reduction in storage prices" prominently displayed on its official website.

However, relying solely on price cuts to compete in the market is clearly not a sustainable strategy for Qiniu Cloud.

According to research firm Canalys, in Q2 2024, Alibaba Cloud, Huawei Cloud, and Tencent Cloud continued to dominate the market, accounting for 71% of the overall share. Meanwhile, China Mobile, China Telecom, and China Unicom, the three major telecom operators, have risen rapidly due to their inherent advantages in network infrastructure. Small and medium-sized cloud service providers represented by Qiniu Cloud, including listed companies like Beisen Holdings, UCloud, and QingCloud, have struggled with losses, casting doubt on their profitability prospects.

Can increased focus on AIGC and audio-video APaaS turn the tide?

Faced with profitability challenges, Qiniu Cloud acknowledges in its prospectus that "companies operating in the audio and video PaaS industry typically have not yet achieved profitability, and profitability usually takes more than 10 years."

Regarding future profitability plans, Qiniu Cloud has identified two key strategies: firstly, focusing on and deepening its APaaS business, which has stronger profitability potential; and secondly, maintaining and continuously enhancing the competitive advantage of its MPaaS business.

As evident from Qiniu Cloud's fluctuating performance, the company is expanding its APaaS business to address changes in industry development and market demand. According to iResearch analysis, as low-code solutions for APaaS gradually satisfy the diverse needs of the market, APaaS is expected to gradually capture market share from MPaaS and SaaS, and penetrate into the audio and video PaaS and SaaS markets.

Industry insiders believe that "AIGC + Audio-Video APaaS" has the potential to emerge as a new form in the audio and video APaaS space, with AIGC technology integrated into audio and video APaaS products to empower creative ideas, content innovation, and intelligent content generation.

In response to this trend, Qiniu Cloud plans to expand its APaaS solutions to a more diverse range of application scenarios. In terms of enhancing AIGC capabilities, Qiniu Cloud is focusing on upgrading its 3D content generation platform, integrating the creativity of AIGC with 3D content generation technology, and exploring the in-depth application of AI technology in 3D creation and rendering. For example, AI technology can be used to generate 2D and 3D digital humans, which can be widely applied in live streaming, live streaming marketing, animation, and game character creation.

Furthermore, in terms of storage, Qiniu Cloud plans to explore a one-stop AIGC data storage solution to help customers reduce storage costs and processing time.

It's worth noting that other companies have already taken the lead in exploring "AIGC + Audio-Video APaaS."

As a direct competitor of Qiniu Cloud, Agora has recently launched its "Agile Meeting" APaaS product, targeting video conferencing scenarios. This product supports multi-modal large model information processing (such as image, audio, and text processing) to meet the demands of complex meeting scenarios.

Meanwhile, as a predecessor of Qiniu Cloud, Agora, although it successfully listed on NASDAQ in late June 2020 with its share price surging on its debut day and a market valuation of nearly USD 5.1 billion, has seen its market value shrink significantly to less than USD 300 million. This decline is mainly attributed to Agora's heavy reliance on the online education market for its primary revenue source. Following the implementation of China's "Double Reduction" policy in 2021, the market size shrunk dramatically, significantly impacting Agora's performance.

Currently, Agora is actively exploring entertainment social networking, IoT, healthcare, and other application scenarios both domestically and internationally. According to its Q2 2024 financial results, Agora's revenue was USD 132 million, marking the first year-over-year growth in 10 quarters. Notably, nearly half of Agora's revenue came from overseas markets during this quarter. While the company still incurred a net loss of USD 9.2 million, this was a significant improvement from the USD 45.3 million net loss recorded in the same quarter last year.

Recently, Volcano Engine has also announced a large model training video preprocessing solution, exploring the deep integration of AI large models with video technology to provide solutions for businesses across technology infrastructure, processing pipelines, and business growth. Facing the aggressive layout of competitors, Qiniu Cloud's pursuit of overtaking in the AIGC field appears even more urgent.

In its future strategy, Qiniu Cloud has also set its sights on overseas markets. Apart from supporting Chinese enterprises in expanding into overseas markets, Qiniu Cloud has already established subsidiaries in Hong Kong, Singapore, and Vietnam, generating significant revenue. To further tap into the potential of overseas markets, Qiniu Cloud plans to conduct feasibility studies on audio and video cloud markets in Indonesia, Malaysia, and Saudi Arabia.

However, implementing these profitability measures inevitably requires increased investments in R&D and infrastructure, including the establishment of local sales and technical teams. Given Qiniu Cloud's limited self-sustaining capabilities at present, these strategies may pose even greater challenges to its profitability and cash flow position.

To address these challenges, Qiniu Cloud must not only innovate continuously at the technological level but also delve deeper into service scenarios, offering audio and video solutions that are more closely aligned with user needs. According to iResearch, in the current real-time audio and video space, consumer internet applications such as online education and entertainment still dominate, representing the primary application scenarios. In contrast, industrial internet scenarios like healthcare, security, autonomous driving, and industry are poised to become the blue ocean for real-time audio and video technologies in practical production processes.

Therefore, for audio and video cloud vendors like Qiniu Cloud, closely integrating with specific business scenarios and providing audio and video solutions that are more closely aligned with user needs is crucial to bringing audio and video technologies to the masses and realizing broader applications and greater social value.