Over 360 projects were awarded in Q3 for large model, and the industry is still grappling with implementation challenges

![]() 10/22 2024

10/22 2024

![]() 553

553

Large model implementation projects continue to set new records, with most projects focused on exploring application scenarios for large models.

Large model implementation projects continue to break new records.

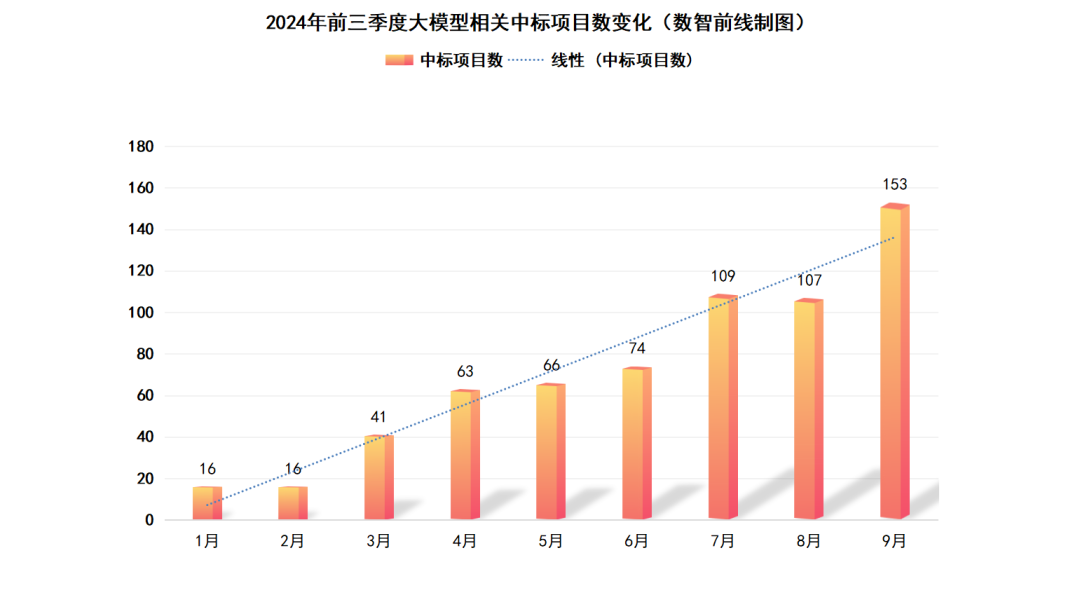

Based on incomplete statistics from channels such as the Chinese Government Procurement Network and the China Bidding Public Service Platform, Digit front found that in Q3 2024 alone, there were at least 369 publicly available and statistically significant large model-related projects awarded, far exceeding the total number of 276 projects awarded in the first half of the year. Large models are rapidly gaining traction across various industries.

However, at the same time, large model implementation faces challenges such as a shortage of talent and an ecosystem gap, resulting in less obvious value from implemented projects. The content of awarded projects also reflects the industry's efforts to address these issues. For example, some projects are exploring core business scenarios, others involve talent training, and still others focus on end-to-end products or hardware-software integration.

01

Monthly awarded projects frequently exceeded 100, with September setting a new high

Since the beginning of the year, the number of large model projects awarded each month has grown rapidly, from just 15 in January to 154 in September.

This growth has accelerated in the second half of the year, particularly since July, when the number of monthly awarded projects has consistently exceeded 100. September saw a new high, with 153 projects awarded, representing a month-on-month increase of over 40%.

In terms of procurement regions, the scope of large model implementation further expanded in Q3 this year, reaching a wider range of areas. However, first-tier cities such as Beijing, Guangdong, Shanghai, Zhejiang, and Jiangsu remained the top regions for project awards.

In terms of industry distribution, education, telecommunications operators, government affairs, energy, and finance continued to rank at the forefront. Notably, the energy industry saw a surge of projects completed in Q3, with leading energy companies like China Southern Power Grid completing at least 20 large model-related procurement projects, three of which exceeded 10 million yuan in contract value.

The procurement parties for these projects are no longer limited to central and state-owned enterprises, with local state-owned enterprises also participating.

From the perspective of contract values, the procurement threshold for large model projects is further lowering. While many projects are valued at hundreds of thousands to millions of yuan, there are also numerous large model-related projects valued at tens or even a few hundred thousand yuan. For instance, China Agricultural University's "Research Service Procurement Project for Intelligent Agent of Fruit and Vegetable Nutrient Complex Based on Large Models" was worth just 106,000 yuan, and many talent training-related projects were generally priced below 100,000 yuan.

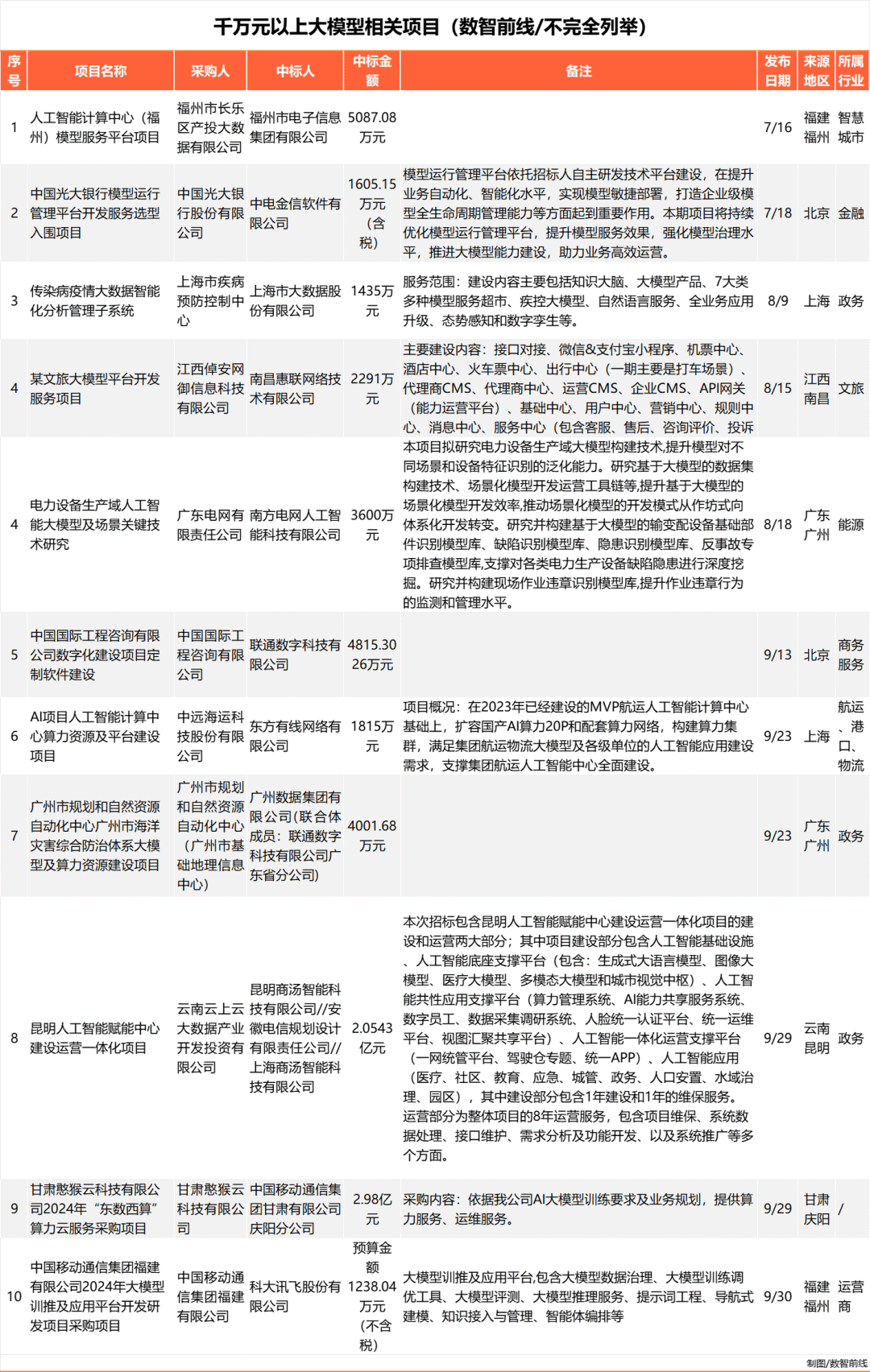

On the higher end, there were 21 projects valued at over 10 million yuan, an increase from 8 in Q1 and 17 in Q2. Among them, two projects exceeded 100 million yuan, with the largest being Gansu Hanhou Cloud Technology Co., Ltd.'s 2024 "East to West Data Flow" Computing Power Cloud Service Procurement Project, valued at 298 million yuan.

02

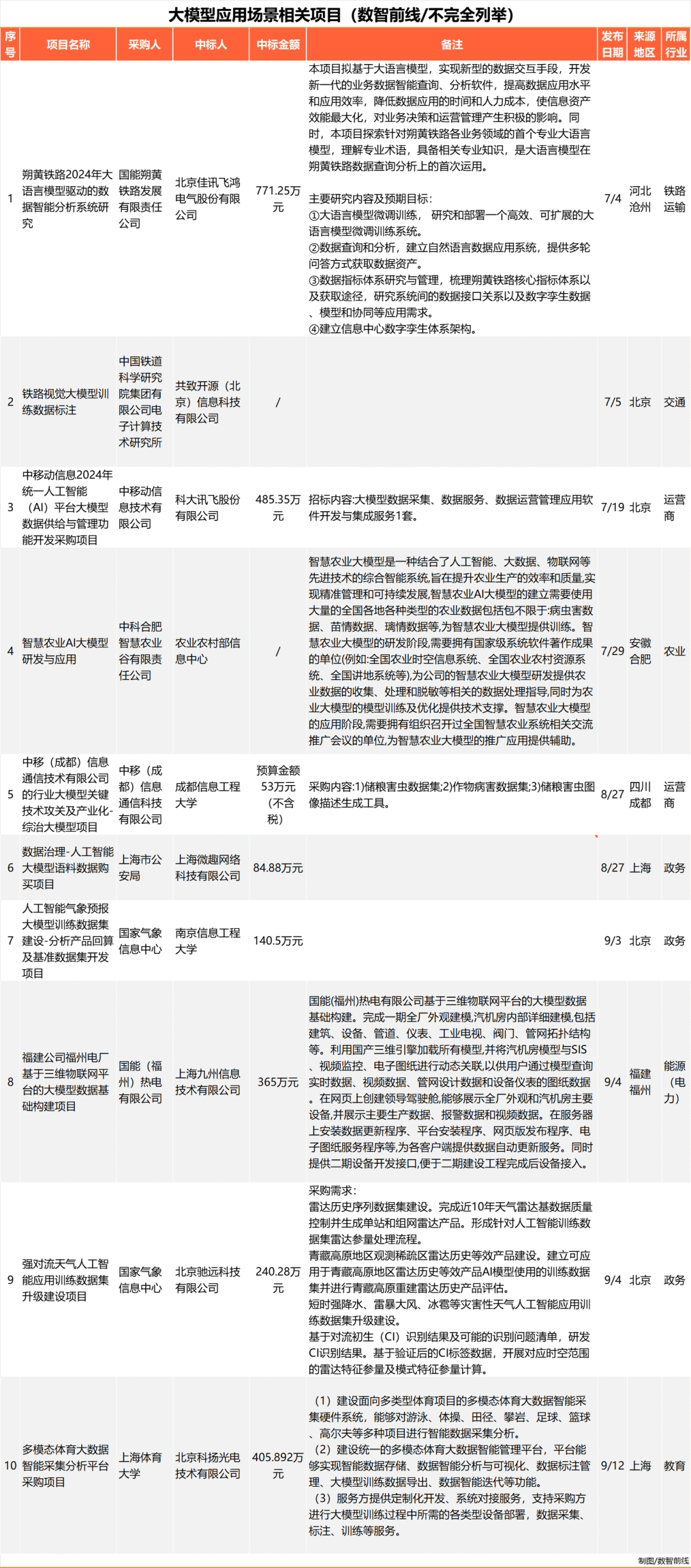

Application scenarios are becoming more segmented, but a blockbuster scenario is still lacking

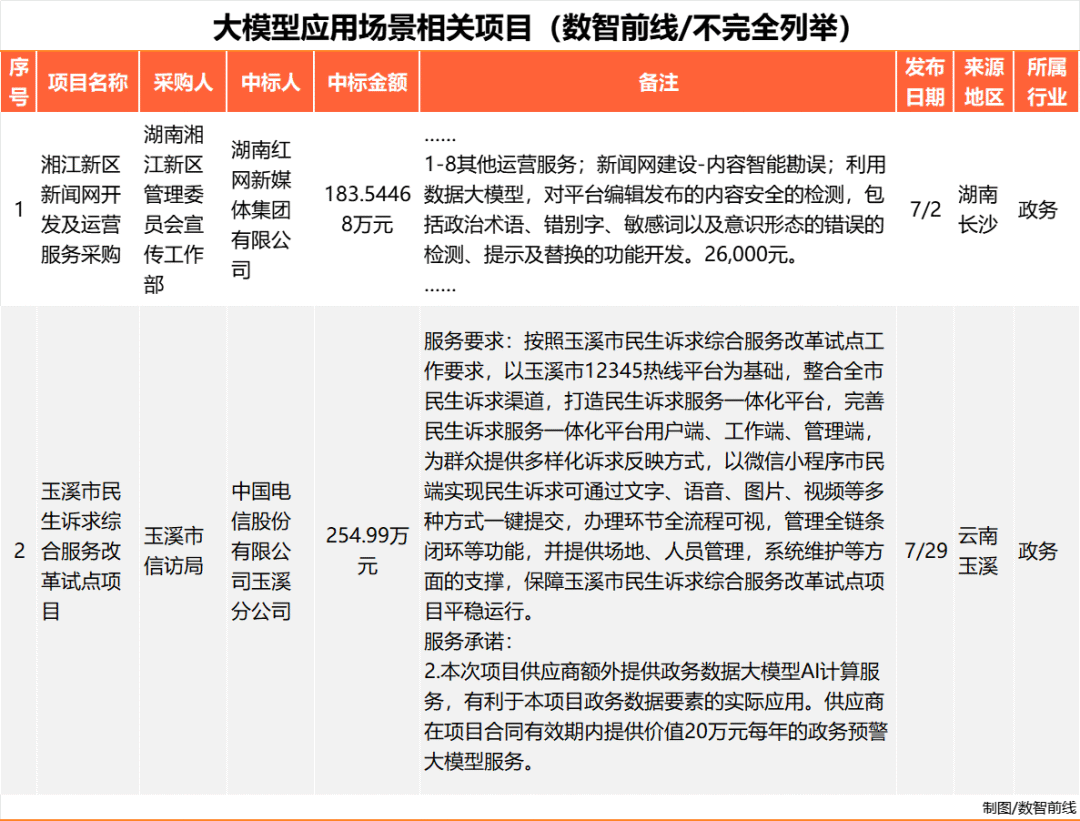

Compared to the first half of the year, the number of awarded projects related to large model implementation scenarios increased significantly in Q3 2024, as enterprises across various industries explored more segmented application scenarios.

For example, in the medical industry, hospitals procured large models to empower psychological assessment systems; in the publishing industry, enterprises sought to improve library operational efficiency and service levels using large models; in agriculture, large models were explored for grain warehouse management; and in the judiciary, courts leveraged large models to develop intelligent auxiliary case-handling systems, among other examples.

Additionally, some enterprises explicitly requested the utilization of large model capabilities for functional development and upgrades as part of their procurement requirements when bidding for conventional digital projects.

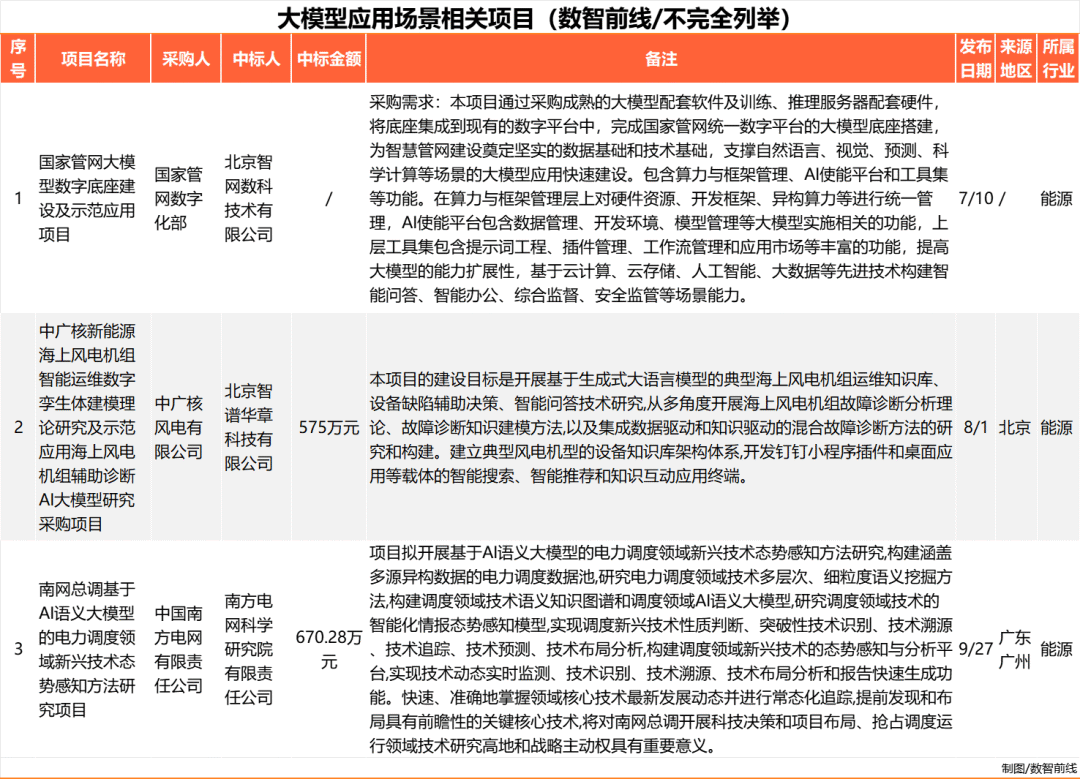

On the other hand, the market still lacks a high-value scenario recognized by the industry. However, Q3 awarded projects indicate that some enterprises have begun delving into deeper scenarios, with companies like Baidu Intelligent Cloud, iFLYTEK, and Zhipu AI exploring core scenarios with enterprises or initiating forward-looking technical research for specific scenarios.

03

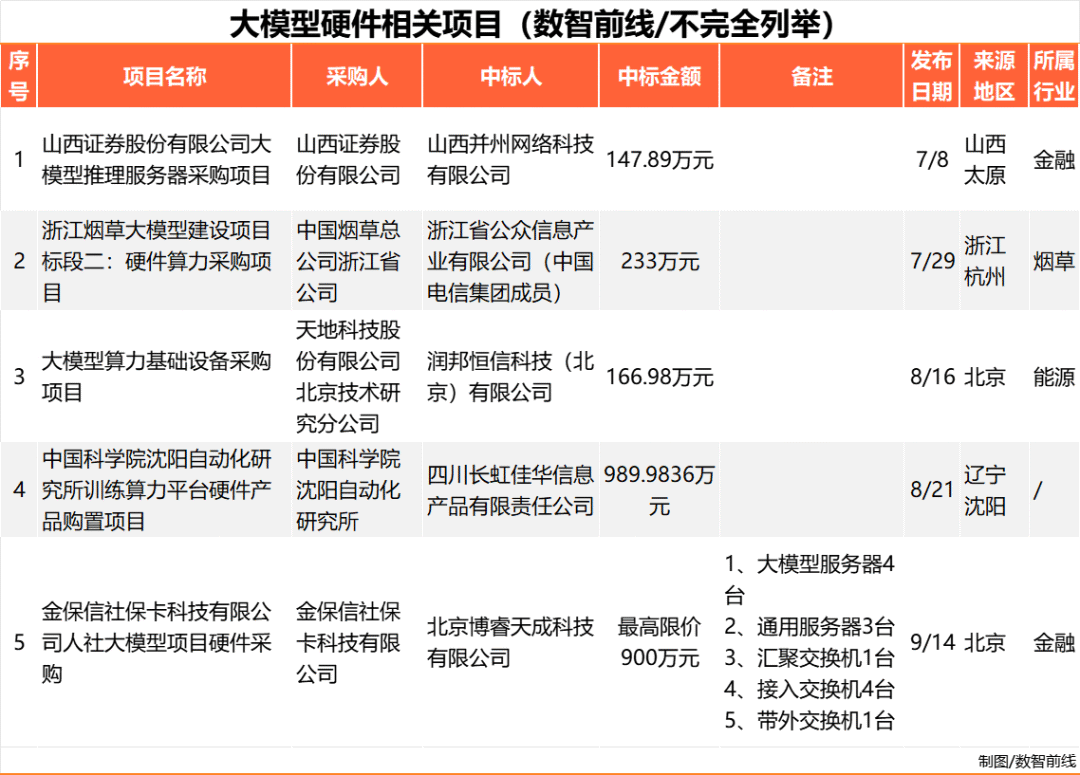

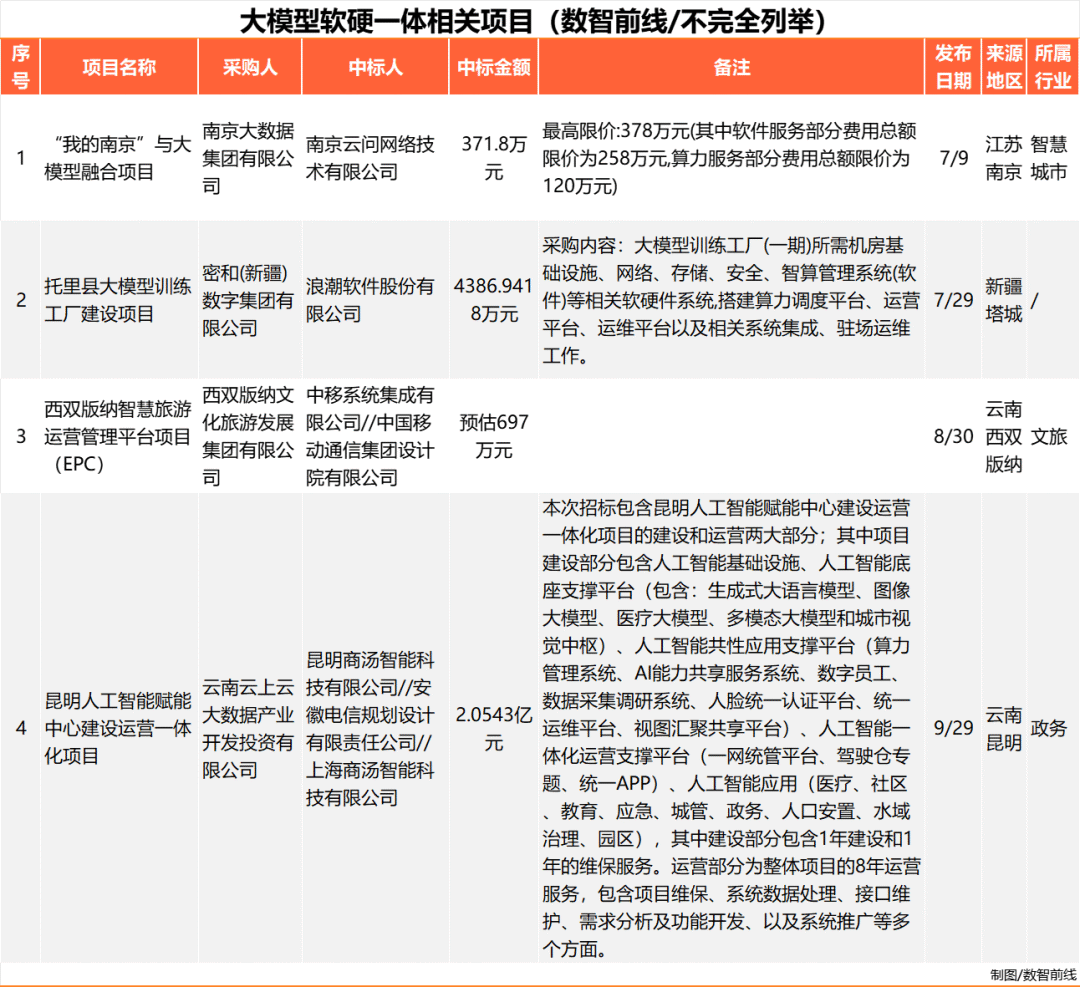

Hardware dominates project budgets, with hardware-software integration emerging as a trend

In Q3 2024, hardware remained a significant component of large model-related procurement projects, with approximately 20% of projects involving direct purchases of computing hardware and cloud resources. These procurement entities encompassed not only large pioneering enterprises but also numerous small and medium-sized enterprises, universities, and hospitals.

Relevant data indicates that hardware accounted for 60% of total procurement in the first half of this year. Against this backdrop, projects integrating hardware and software are increasingly prevalent. For service providers, the hardware-software model is more lucrative, while for procurement parties constrained by talent and technology gaps, end-to-end solutions are in higher demand.

04

Lack of talent prompts enterprises to invest in training

Another notable feature of Q3 2024 large model awarded projects was the proliferation of talent development-related projects, with at least 14 projects related to talent, far exceeding the number in the first half of the year.

This trend stems from a broader shortage of talent in all aspects related to large models. For instance, developers and ISVs are required to understand both the underlying training and inference mechanisms and upper-level application demands, on which software development is based. However, such talent remains scarce. Without a robust ISV capability and developer ecosystem, large model implementation becomes challenging.

To address talent shortages in large model implementation, various industry players have already taken action, as evidenced by Q3 awarded projects.

Some enterprises have sought to bridge the talent gap by partnering with research institutions. For instance, Chery Huiyin Automobile Finance Co., Ltd. initiated a "Scientific Research Cooperation Project for Financial Large Models." Others have invested in training services to enhance in-house talent levels, such as China Telecom Shanghai Branch's "2024 Shanghai ICNOC Large Model Technology Series Training Project" (with a maximum price of 94,300 yuan) and China Post Group Chongqing Information Technology Center's "AI + Large Model In-house Training Project Procurement" (53,980 yuan).

05

Data issues are beginning to be addressed more urgently

One of the biggest challenges in large model implementation is the lack of readiness of data. User data often comprises a mix of images, Word documents, PDFs, Excel files, etc.

As large model implementation progresses, this issue has gained increased prominence. In Q3 this year, the number of data-related awarded projects significantly increased. Of the 369 projects included in our incomplete statistics, at least 39 were directly related to data issues, far exceeding the dozen or so projects in the first half of the year.

These projects covered the entire process of data collection, governance, annotation, operation management, and corpus procurement. Additionally, some enterprises are leveraging large model technologies to further enhance their data processing capabilities.

06

Leading enterprises focus on different aspects

Having overviewed the overall situation, let's delve into the awarded projects of mainstream large model vendors in the industry.

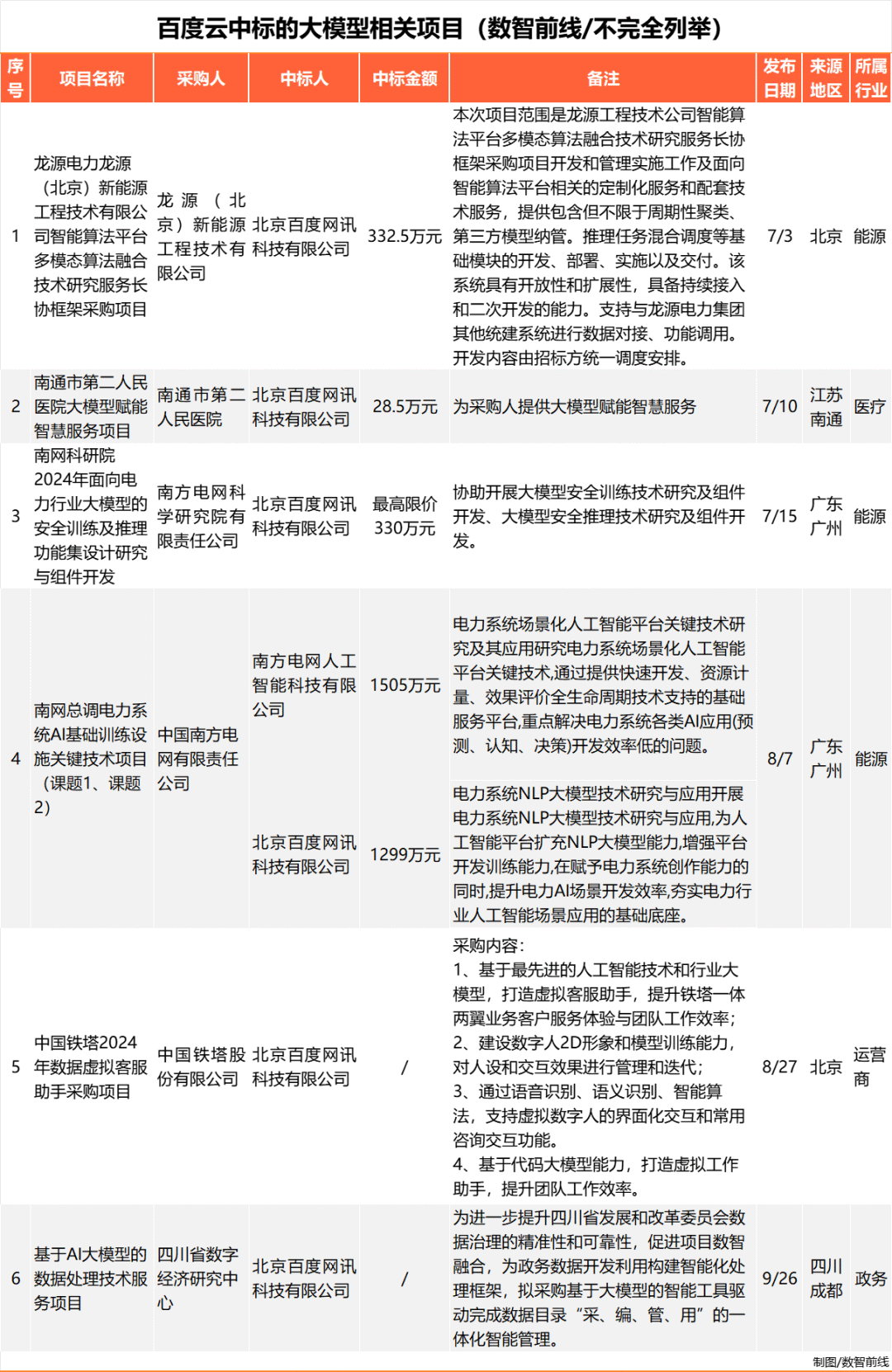

Baidu Cloud: Projects involving core industry scenarios

From January to September 2024, Baidu Cloud maintained steady growth in large model project procurements, with at least 4, 8, and 9 projects awarded in Q1, Q2, and Q3, respectively.

Unlike the first half of the year, which evenly covered various industries such as finance, telecommunications operators, automobiles, water utilities, government affairs, energy, and ports, Baidu Cloud's performance in the energy industry stood out in Q3. For instance, China Southern Power Grid launched its self-controlled large model, "Dawatte," in September 2023, with its core power dispatch scenario built on Baidu Wenxin Large Model and powered by Baidu Intelligent Cloud Qianfan Large Model Platform. In Q3 2024, China Southern Power Grid completed at least 20 large model-related procurement projects, some of which were awarded to Baidu.

Notably, several Baidu-awarded projects in Q3 involved exploring core business scenarios with leading clients and encompassed specialized technologies such as data governance, model security, model evaluation, and tool platforms, covering the entire lifecycle of large model implementation. These projects also adopted Baidu's end-to-end solutions, including customer service, digital humans, and coding capabilities.

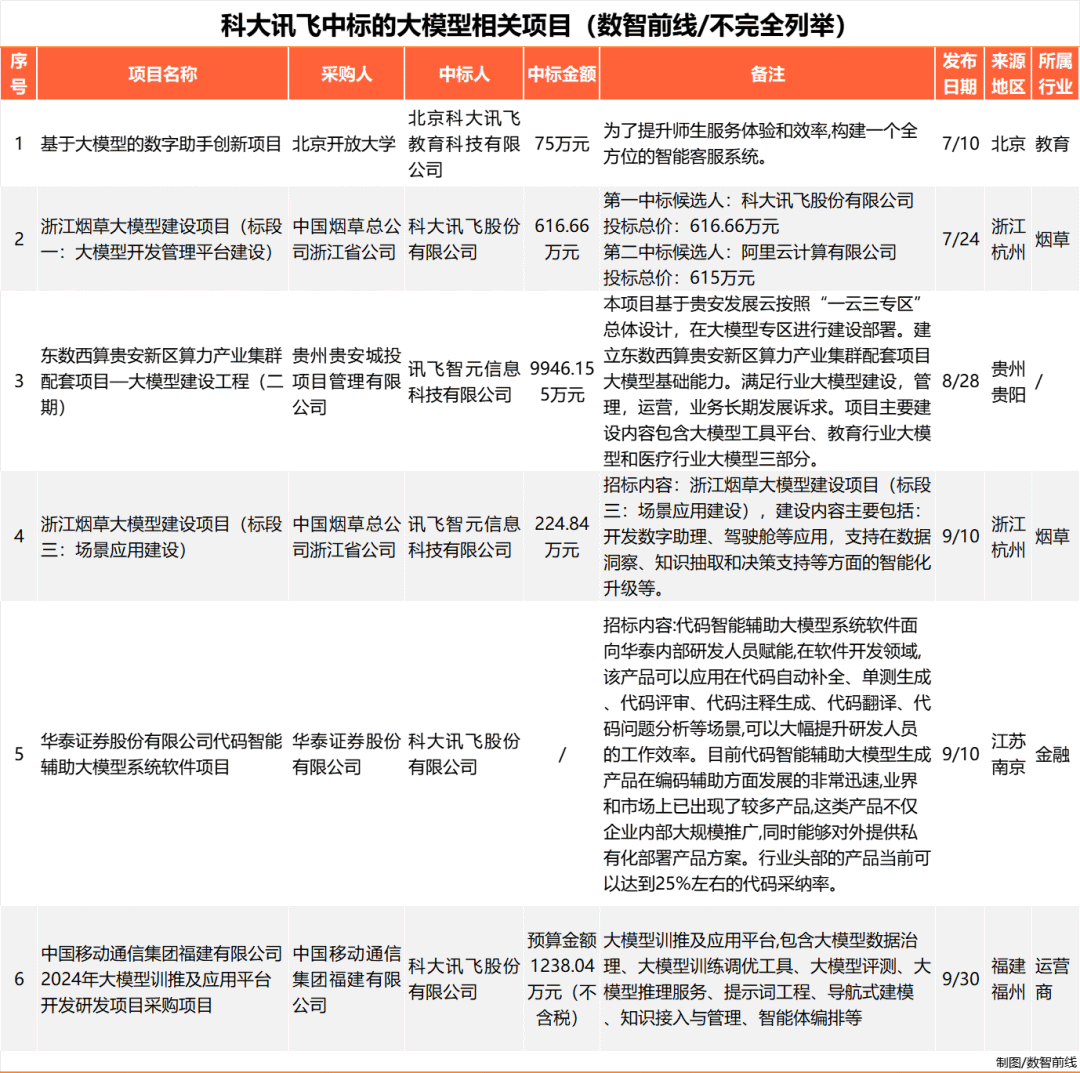

iFLYTEK: Maintaining an aggressive procurement stance

In Q3 2024, iFLYTEK remained one of the most aggressive enterprises in procurement, securing at least 12 large model-related projects, second only to China Telecom and China Mobile and surpassing its Q1 (6 projects) and Q2 (11 projects) performances. Notably, in July, including POC testing qualifications, iFLYTEK secured at least 7 projects, continuing its momentum from June, when it won 8 projects in a single month.

Similar to the first half of the year, telecommunications operators remained one of iFLYTEK's top procurement sources, with at least 4 projects awarded to companies under China Mobile. Additionally, iFLYTEK achieved significant success in the tobacco industry, securing two projects worth over 8.4 million yuan from China National Tobacco Corporation Zhejiang Branch.

Finance, education, and healthcare also remained its competitive sectors. Its largest Q3 project, valued at nearly 100 million yuan, involved supporting the infrastructure development of large models for the "East-West Data Flow" computing power cluster, focusing on building large model tool platforms, education industry large models, and healthcare industry large models.

Furthermore, many enterprises and schools are procuring iFLYTEK's smart notebook hardware devices integrated with large model capabilities. iFLYTEK's hardware-software integration in the large model office sector has become a cost-effective option for users to experience large models.

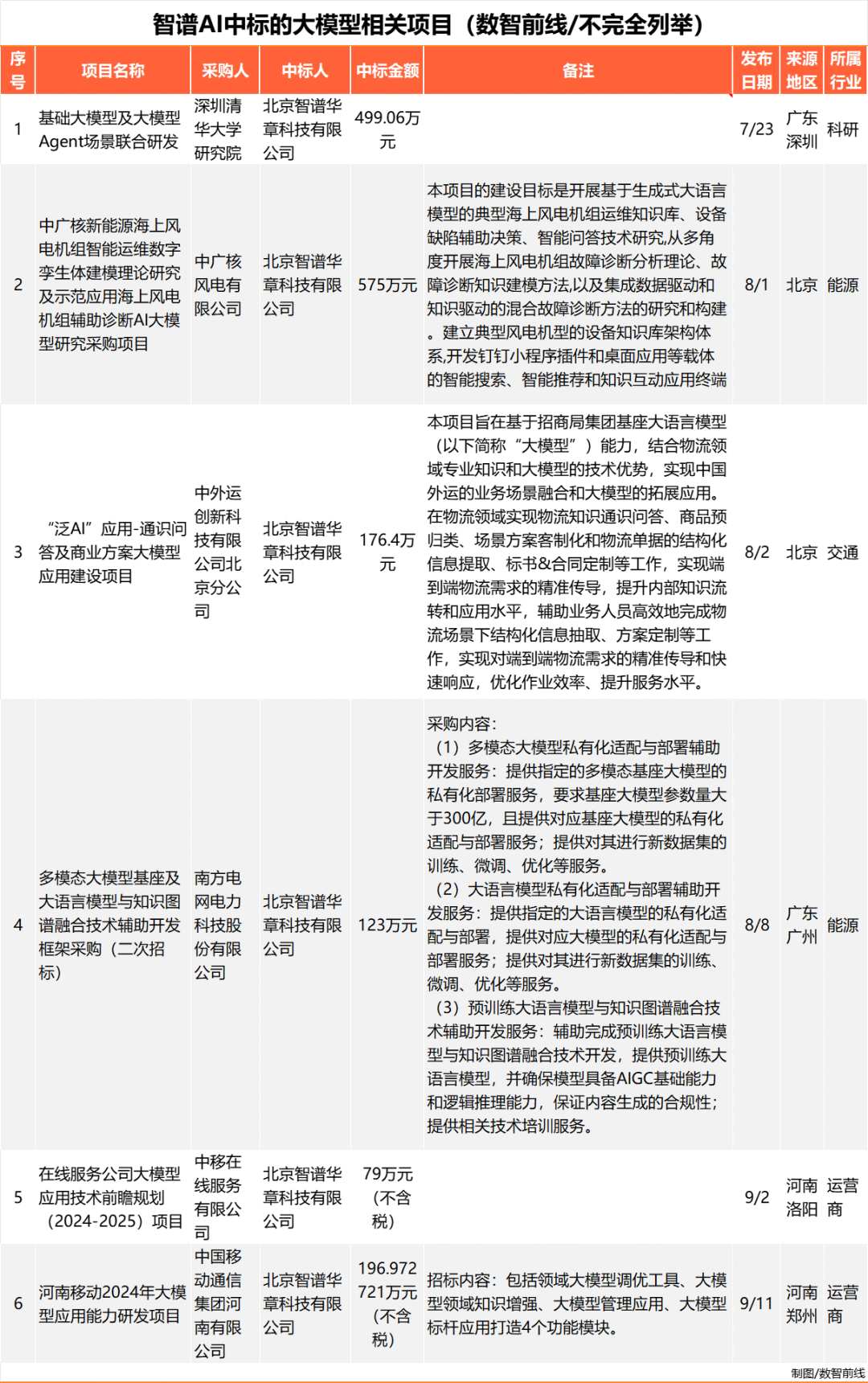

Zhipu AI: Increased average contract value in Q3, involving forward-looking technologies

In Q3 2024, Zhipu AI secured at least 6 related projects. Compared to Q1 (2 projects) and Q2 (10 projects), while Q3 lagged behind Q2 in terms of project count, it surpassed Q2 in terms of project value, with individual project values increasing from the hundreds of thousands to millions of yuan.

For example, the "Joint Research and Development of Basic Large Models and Large Model Agent Scenarios" project with Tsinghua Shenzhen Graduate School was worth 4.9906 million yuan, with Agent being a popular direction in the industry.

Zhipu AI's projects also involved exploring cutting-edge large model implementation areas. For instance, its 5.75 million yuan project with China General Nuclear Power Group's Wind Power Co., Ltd. aimed to leverage large models to support digital twin research and applications, a forward-looking direction widely recognized in the industry. NVIDIA has previously announced its intention to provide services and tools in this area in China.

Additionally, telecommunications operators are procuring forward-looking technical planning and research related to large models from Zhipu AI. As a company spun off from the technological achievements of Tsinghua University's Computer Science Department, this seems to be facilitating its access to more technology projects.

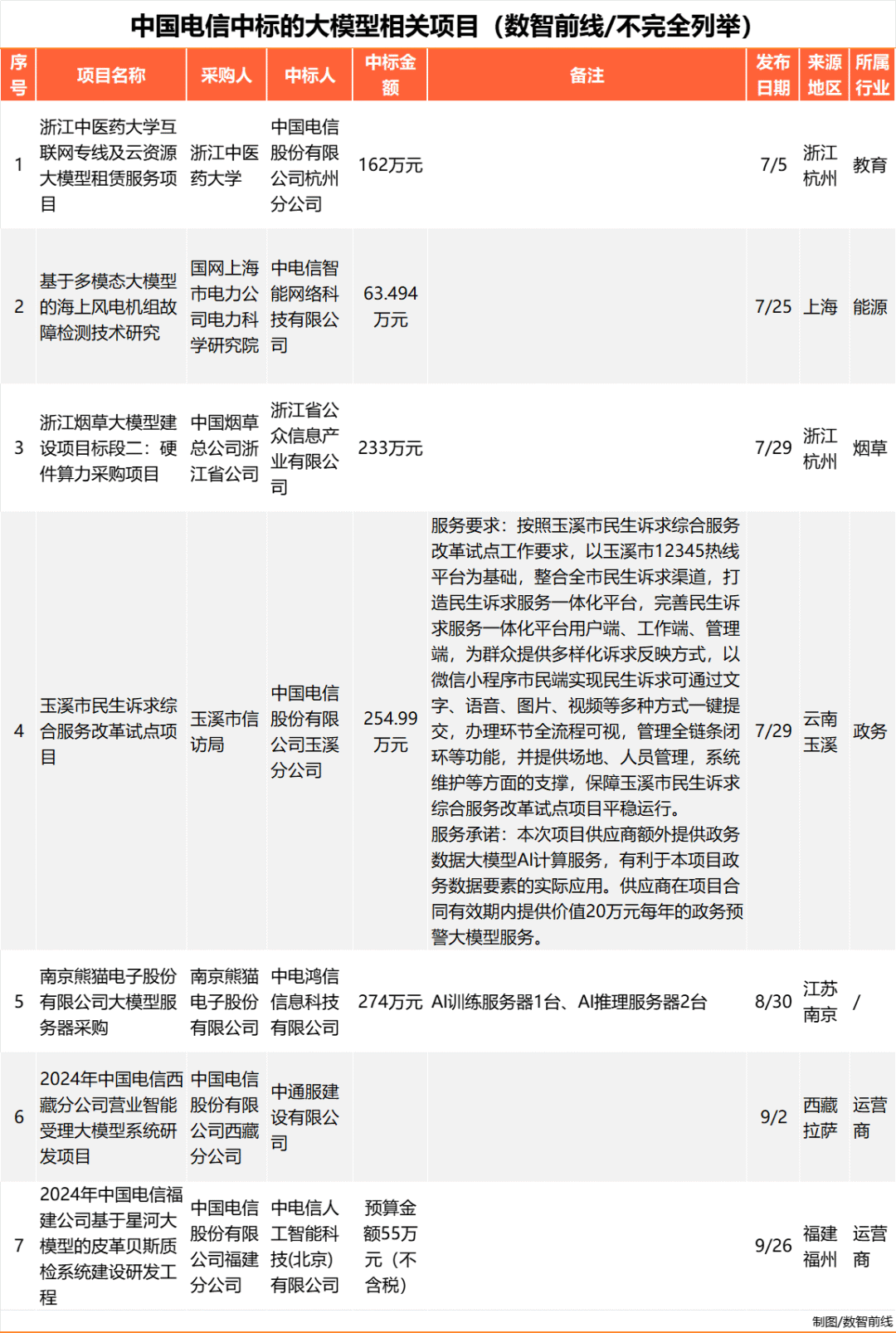

China Telecom: Awarded nearly 40 projects, two-thirds from internal contributions

Similar to the first half of the year, China Telecom remained the top procurer among large model vendors in Q3 2024. According to incomplete statistics, it secured at least 39 large model-related projects, with approximately two-thirds involving China Telecom's various subsidiaries and branches across multiple cities nationwide.

In addition to numerous internal application exploration projects, China Telecom also procured projects from external industries such as education, energy, tobacco, and government. These included both research-oriented projects for specific business scenarios, like the "Research on Fault Detection Technology for Offshore Wind Turbines Based on Multi-modal Large Models" project by State Grid Shanghai Electric Power Research Institute, and projects focused on computing power and government affairs assistants. Moreover, Anhui Telecom Planning & Design Co., Ltd., a member of China Telecom, jointly won a project worth over 200 million yuan with SenseTime for the "Kunming AI Empowerment Center Construction and Operation Integration Project."

China Mobile: Awarded a 300 million yuan large model-related computing power project

In Q3 2024, China Mobile secured at least 7 large model-related projects. Unlike previous quarters, where most projects were sourced internally, Q3 projects primarily originated from external enterprises, covering industries such as education, government, culture, and tourism.

Among them, the largest single order came from the "2024 'East to West Computing' Cloud Computing Power Service Procurement Project" tendered by Gansu Hanhou Cloud Technology Co., Ltd., worth 298 million yuan, requiring the winning bidder to provide computing power services and operation and maintenance services in accordance with the company's AI large model training requirements and business planning.

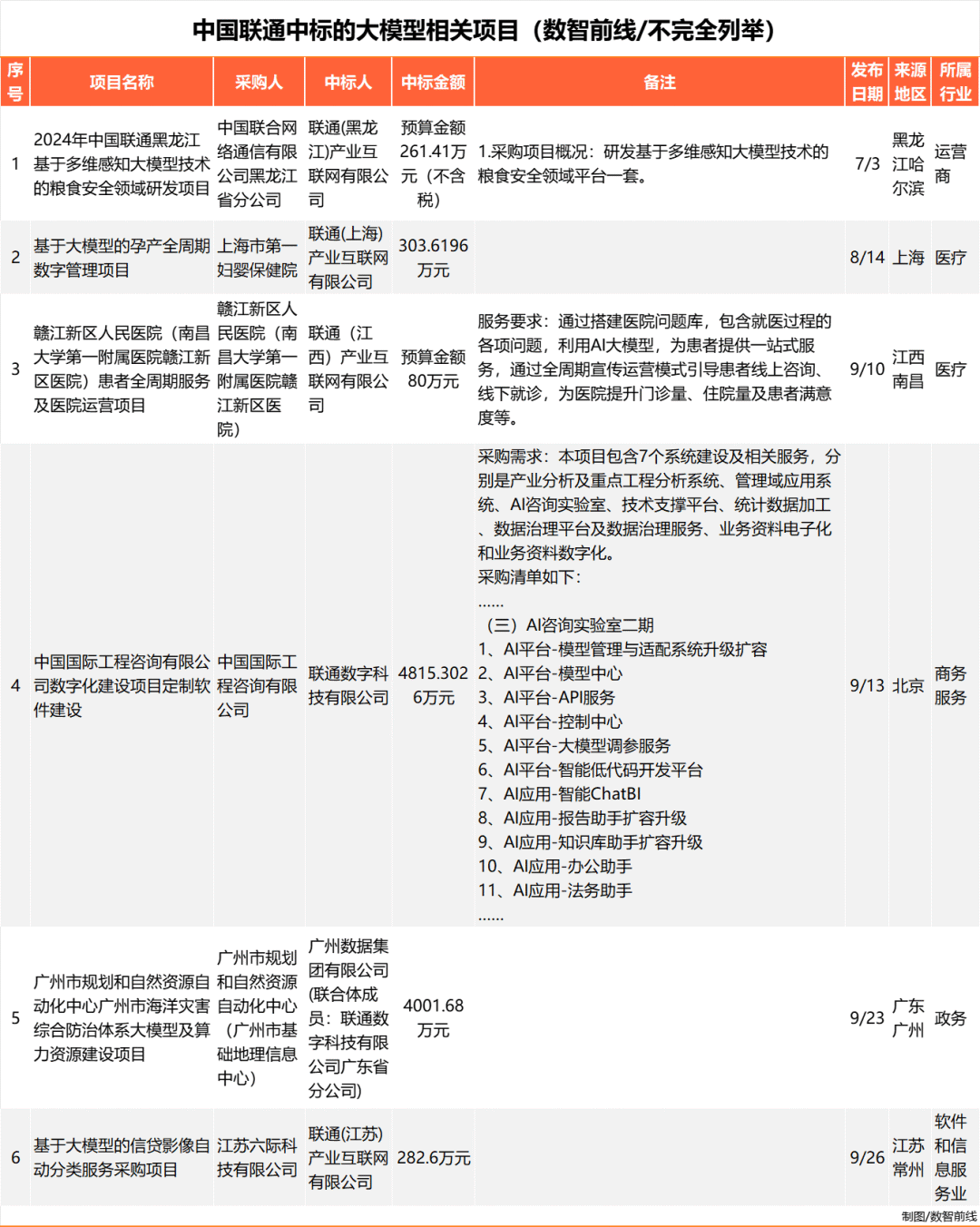

China Unicom: Most of the winning projects are application development

In the third quarter of 2024, according to incomplete statistics, China Unicom won at least 11 projects in the large model bidding market, a significant increase compared to the previous two quarters. Among them, there are 5 projects sourced from internal procurement, and the rest are all external projects.

In terms of specific projects, the majority is scene development across various industries. Some explore applications in areas such as food security, warehousing supervision, and agricultural finance based on multi-dimensional perception large model technology; others use large models for full-cycle digital management of pregnancy and childbirth, as well as improving outpatient volume and patient satisfaction, which are issues that many hospitals hope to prioritize and address at present.

In addition, China Unicom also won two projects worth over ten million yuan, such as the "Guangzhou Marine Disaster Comprehensive Prevention and Control System Large Model and Computing Power Resource Construction Project" won jointly with Guangzhou Data Group Co., Ltd. as a consortium.

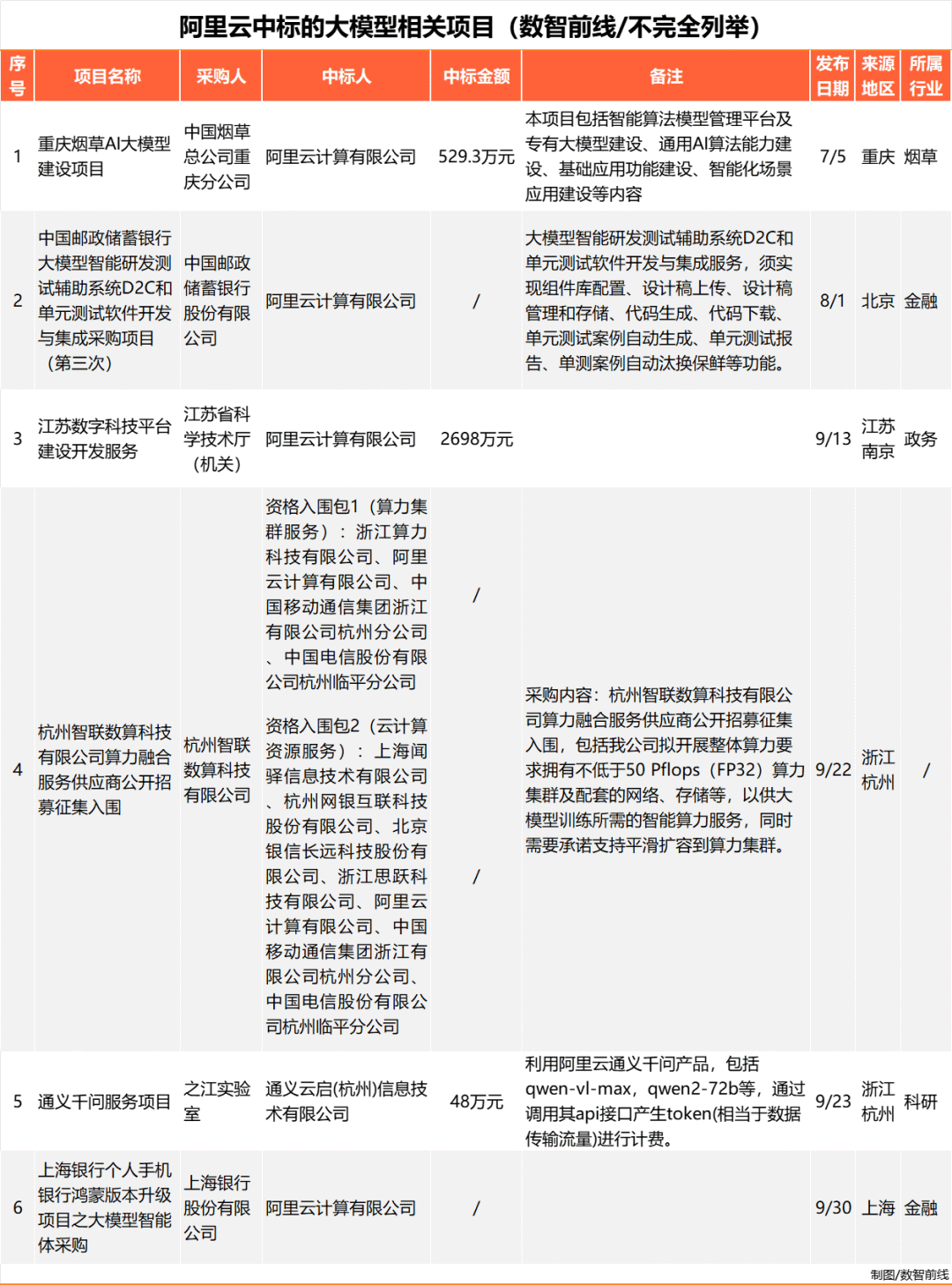

Alibaba Cloud: Open source has proven effective

Unlike the first half of this year, when Alibaba Cloud only won 5 projects, most of which were computing power projects, in Q3 2024, Alibaba Cloud secured at least 7 large model-related projects in one go, many of which were related to large model software and application scenarios. It is not difficult to see that Alibaba Cloud's open-source strategy is starting to bear fruit.

For example, in the tobacco industry, Alibaba Cloud ultimately won the "Chongqing Tobacco AI Large Model Construction Project" worth 5.293 million yuan by competing against Zhipu AI and another service provider on the same stage, responsible for providing an intelligent algorithm model management platform, proprietary large model construction, general AI algorithm capability building, basic application function construction, and intelligent scenario application construction.

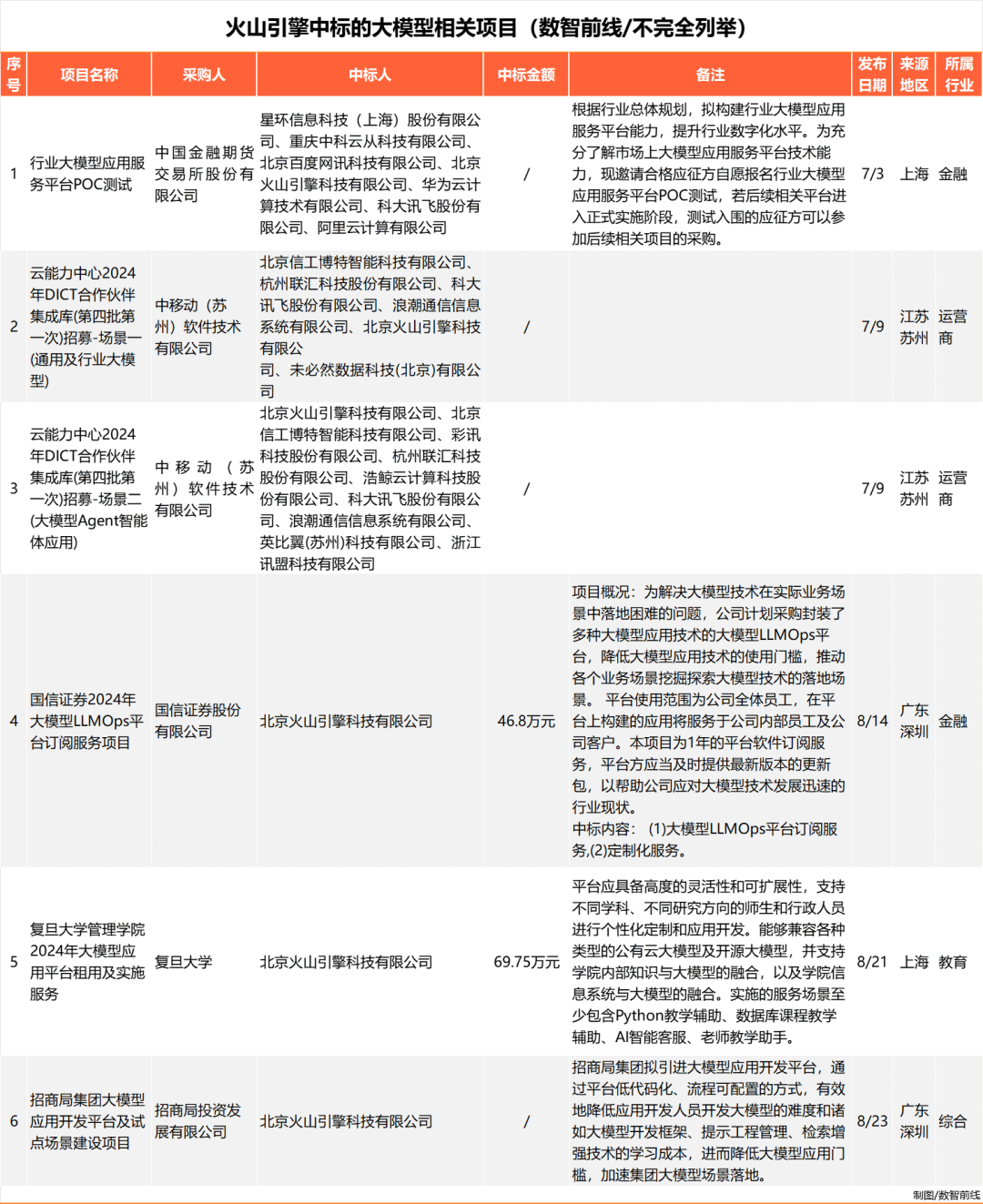

Volcano Engine: Most winning projects are public cloud application services

As the latest entrant into the B-end large model market and the first internet giant to initiate a price war, Volcano Engine secured large model-related projects in Q2, two of which were computing power procurement projects.

However, entering the second half of the year, the situation seems to have changed. In Q3, Volcano Engine won at least 6 large model-related projects, and whether they were pre-qualified projects or actual wins, all were related to large model application development.

Previously, reports indicated that due to high manpower demands and low efficiency, Volcano Engine rarely undertakes privatized deployment business, only making exceptions for some key customers. This is also reflected in the winning projects in Q3, all of which adopt public cloud services.

Regarding agents, which are of widespread interest in the industry, Volcano Engine, Colorful Technology, iFLYTEK, and other companies were selected as partners for China Mobile (Suzhou) Software Technology Co., Ltd.'s "Large Model Agent Intelligent Agent Application" recruitment.

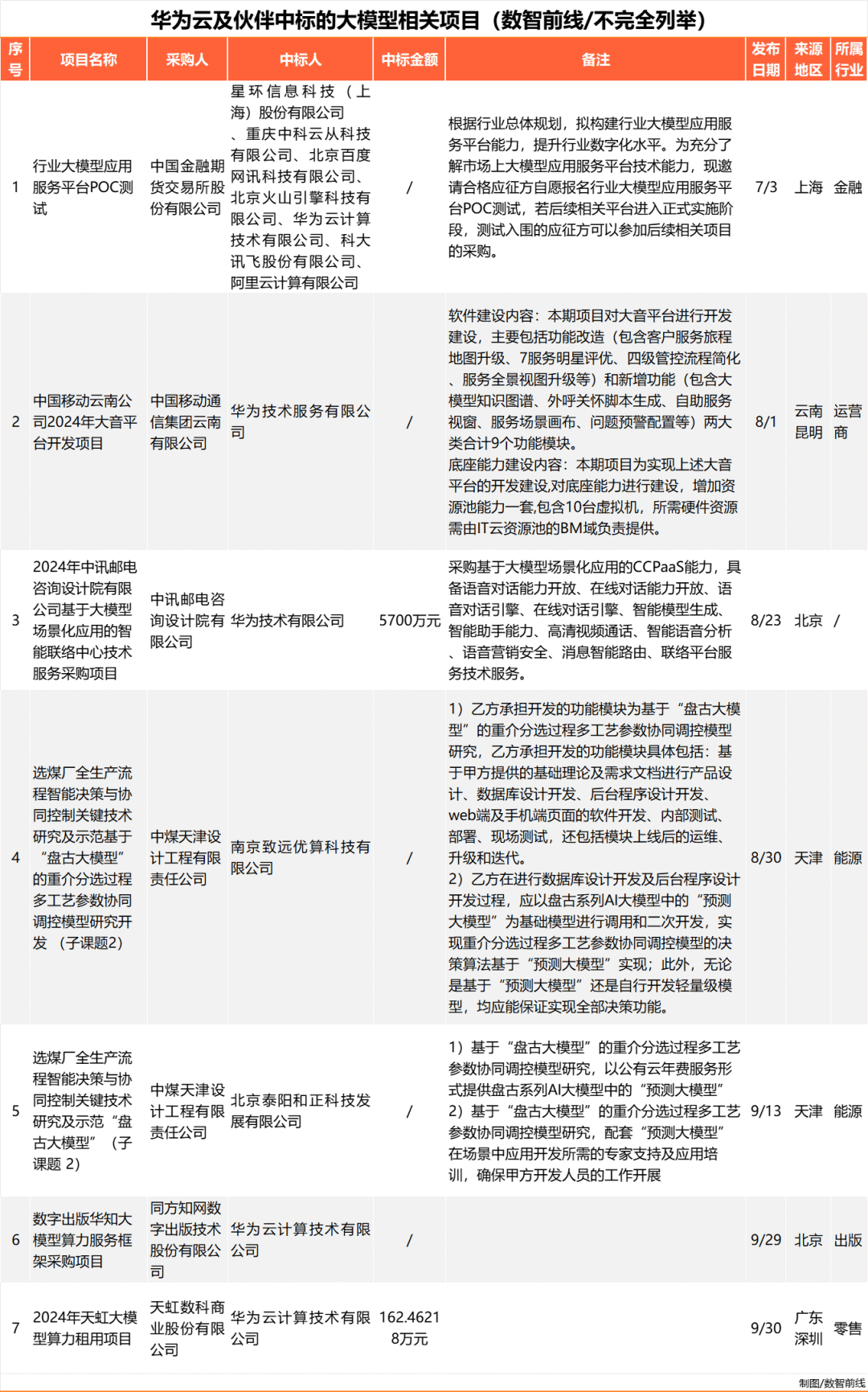

Huawei Cloud: Integrated hardware and software enter more core scenarios

In Q3 2024, in addition to participating in tenders and bids through partners for the vast majority of projects, Huawei personally won at least 5 large model-related projects, covering industries such as finance, telecom operators, and publishing, with an increase in the number of projects compared to 2 in Q1 and 4 in Q2.

At the same time, the trend of integrated hardware and software in Huawei Cloud's large model field is becoming more pronounced, with most projects encompassing both models and related platform software, as well as hardware facilities such as computing power, storage, and networking.

Additionally, after personally exploring benchmark scenarios in industries such as mining, coal, and meteorology, Huawei Cloud's partners have also begun to enter more core industry scenarios alongside the Pangu large model. For example, in Q3 of this year, China Coal Tianjin Design & Engineering Co., Ltd. completed tenders and bids for two projects related to the Pangu large model.

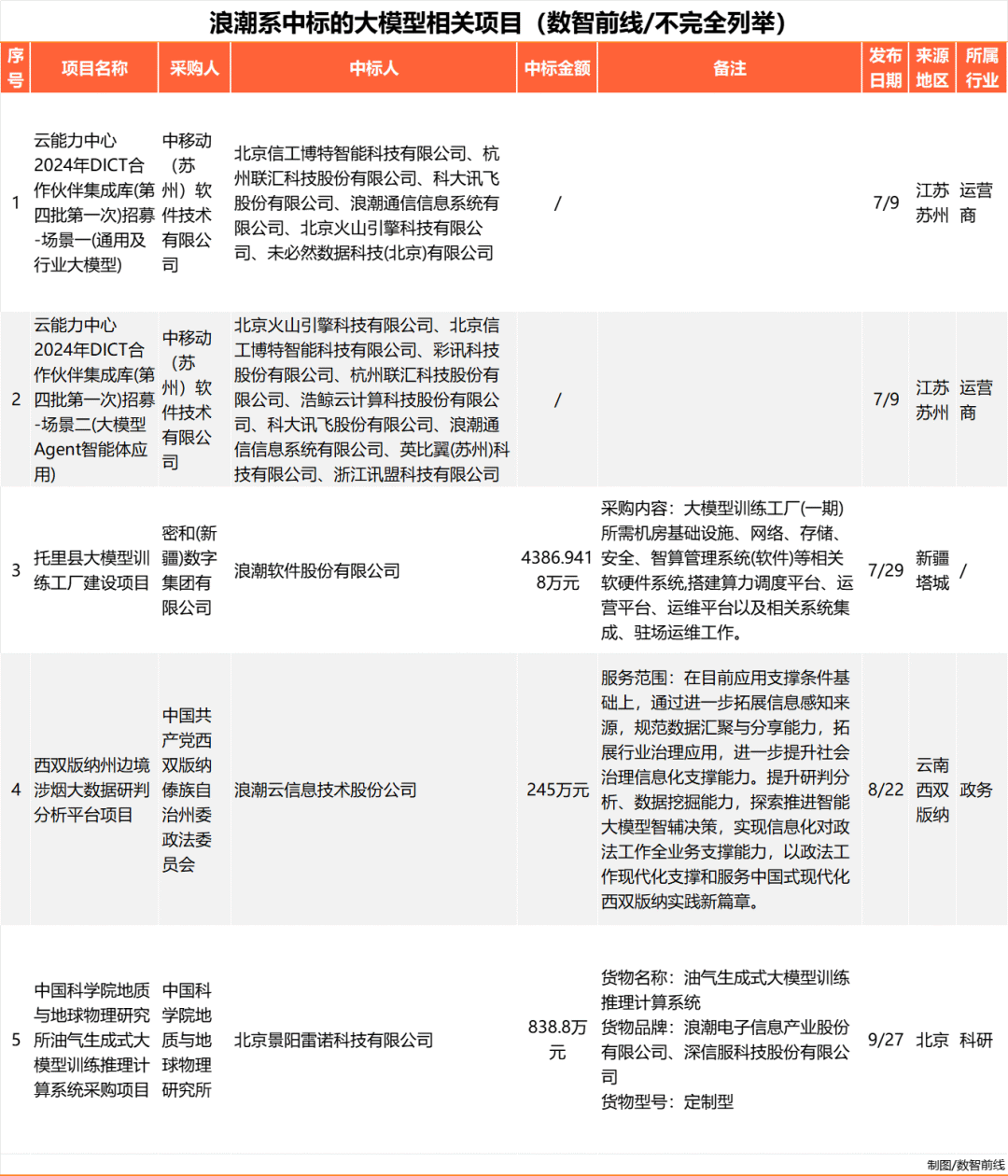

Inspur Group: Integrated hardware and software, prominent advantages in the government sector

In Q3 2024, Inspur Group companies also made significant gains in the large model open tender market, winning at least 7 large model-related projects, with about half of them originating from the government sector.

From the perspective of procurement needs, most of these projects involve a wide range of hardware and software products such as computing power, networking, storage, and security required for large models, resulting in winning bids generally ranging from several million to over ten million yuan.

Inspur Information, a subsidiary of Inspur Group, is a major player in the AI server field, and its products are purchased in the large model open tender market. Inspur Cloud, on the other hand, has achieved significant success in the government market.

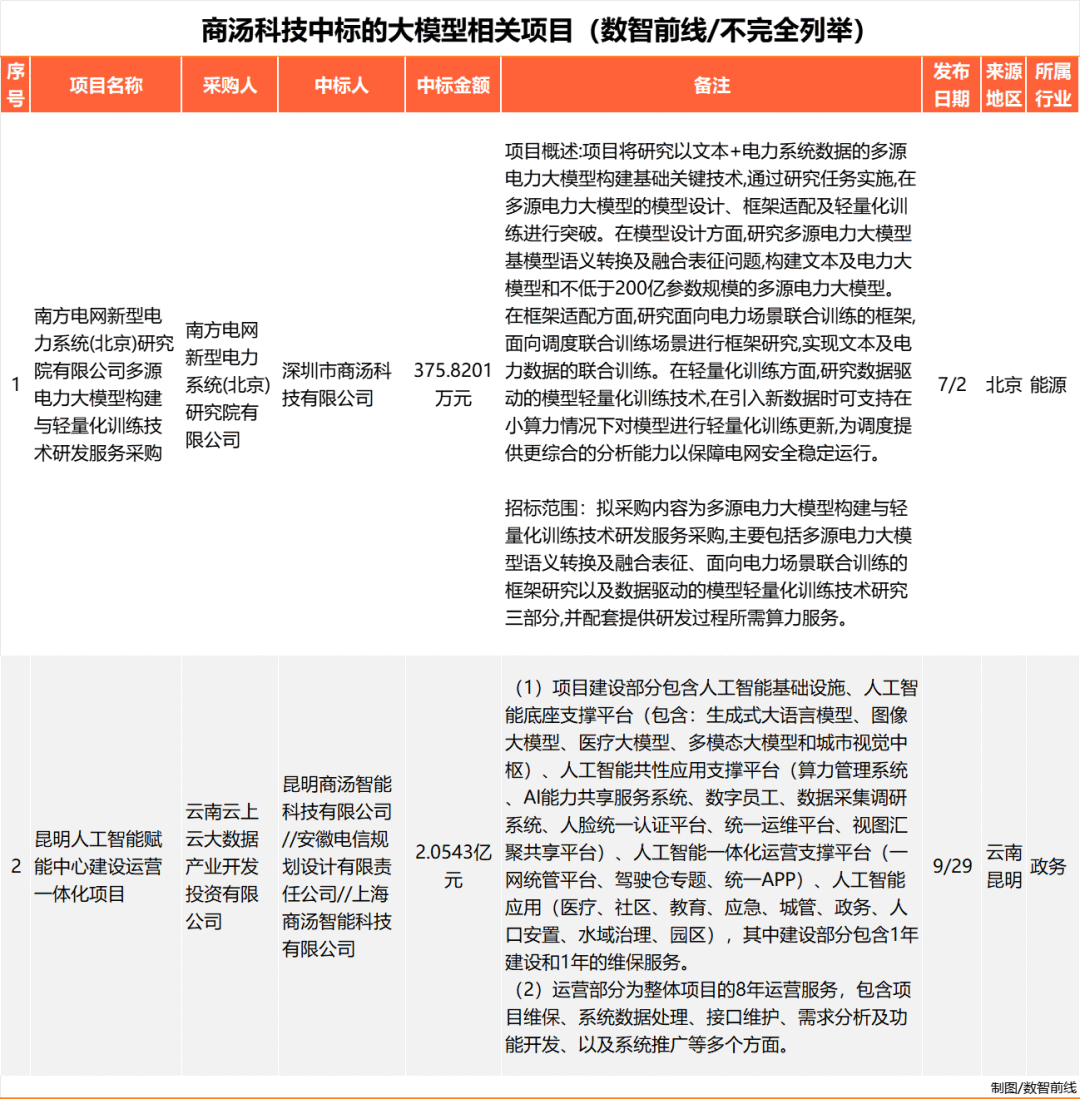

SenseTime: Won a super large order worth 200 million yuan

In Q3 2024, SenseTime only won at least 2 projects, but led the way in terms of winning bid value, securing a super large order worth 205 million yuan. Another project from the energy industry also reached a winning bid value of 3.7582 million yuan.

SenseTime's winning projects also exhibit an integrated hardware and software approach, earning revenue from both large model-related software and computing power. Previously, SenseTime built Asia's largest AI Computing Center (AIDC) in Lingang, Shanghai, and operates multiple AI Computing Centers on behalf of others across the country.

For example, the Kunming AI Empowerment Center Construction and Operation Integration Project, worth over 100 million yuan, requires both infrastructure and an AI foundation support platform including generative large language models and medical large models, as well as various application and operation-related services. Another project tendered by a company in the China Southern Power Grid system also clearly states the need to "provide computing power services required during the development process."

Tencent Cloud: Won at least 2 large model-related projects

While accelerating the adoption of large models across its various product applications, Tencent Cloud won at least 2 large model-related projects in Q3 2024. One was the procurement of AI code assistants, which are widely used in the industry, and the other was research and development related to agents.