Can Roborock replace Ecovacs as the leading floor cleaning robot company?

![]() 10/23 2024

10/23 2024

![]() 553

553

Original by Digits·Digital Economy Studio

Author | Uncle You

WeChat ID | yds_sh

Robots are a hot topic in technology this year, and the most familiar to consumers are the intelligent floor cleaning robots that have entered millions of households. Like many consumer electronics products, the floor cleaning robot market is also fiercely competitive. Currently, Ecovacs and Roborock together account for about 60% of the domestic market, making them undoubtedly the industry leaders. These two companies are typical examples of traditional manufacturers encountering internet players. Against the backdrop of rapid industry iteration, the battle between these two giants has extended from China to overseas markets.

Industry leader founded in a village factory faces growth bottleneck

The domestic floor cleaning robot market began to accelerate in 2019, with a market size of only 70 million yuan that year. Four years later, in 2023, the size of China's cleaning appliance market reached 34.38 billion yuan, of which the floor cleaning robot market accounted for 12.21 billion yuan. In just four years, the market size increased by 174 times. During this period, Ecovacs, which entered the market early, established its position as an industry leader.

In 1998, Qian Dongqi, who was then a salesperson for a foreign trade company, conceived the idea of starting his own manufacturing business while traveling back and forth for trade deals. Using funds accumulated from his trading business, he rented a village factory in Xianfeng Village, Wuzhong District, Suzhou, and founded Tek Electronics. Over the next three years, Tek Electronics became a contract manufacturer for the world's largest vacuum cleaner brand, Hoover, as well as international brands such as Philips, Panasonic, and Electrolux, rapidly achieving revenues of 1 billion yuan.

However, as a contract manufacturer, Tek Electronics did not have its own brand and was always working for others. If it continued to focus solely on assembly and processing, the fate of the contract manufacturer would always be in the hands of downstream brands, and there would be no way to unlock greater corporate value. Therefore, starting in 2000, Tek Electronics prepared for the establishment of a research and development institution, and in 2006, it launched the "Ecovacs" brand, embarking on the path of independent branding.

In 2010, Ecovacs launched the world's first air purification robot, Airbot A330, and gradually expanded its product portfolio to include window cleaning robots and butler robots. In 2013, the company released the Deebot 9 series, which featured global planning and remote control capabilities, ushering in the era of global planning floor cleaning robots in China.

In 2021, Ecovacs introduced its Omnipotent Station product, which comprehensively upgraded the capabilities of floor cleaning robots by integrating automatic dust collection, mop cleaning, water replenishment, sterilization, and drying into one unit, enabling independent cleaning operations. The product experience of "placing the robot and letting it do the cleaning while you relax" led to the sale of 100,000 units of the Omnipotent Station-equipped Ecovacs X1 within just two months of its launch. Sales continued to rise, significantly boosting Ecovacs' online market share.

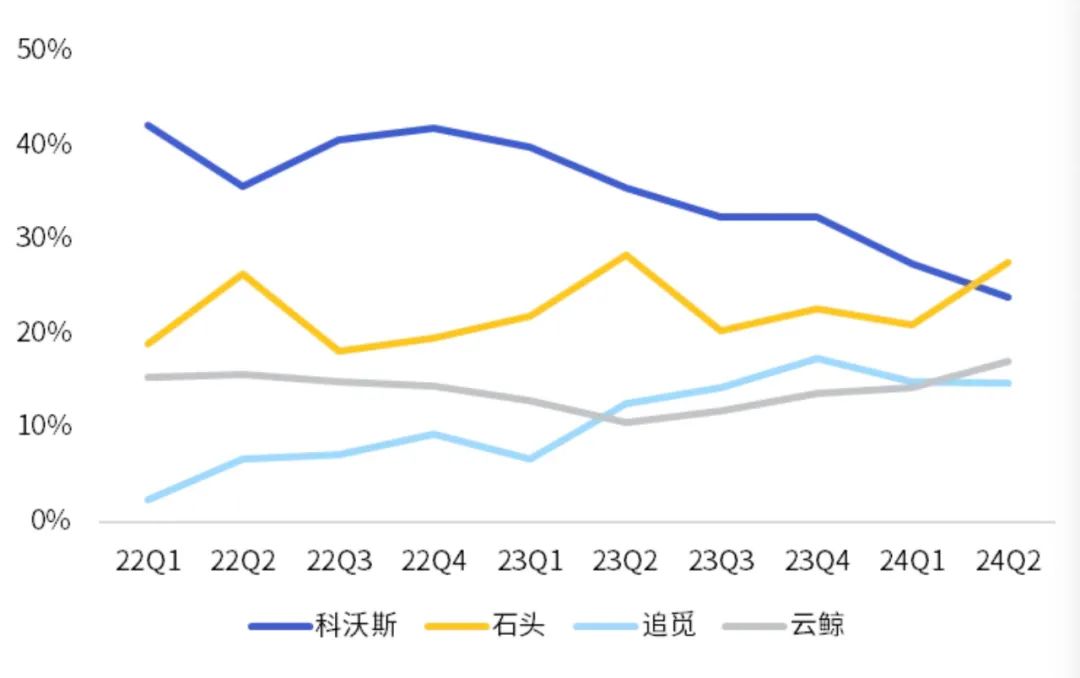

In 2022, Ecovacs' brand of floor cleaning robots accounted for 44.4% of online retail sales in the Chinese market and 82.8% of offline retail sales, ranking first in market share nationwide. Starting with floor cleaning robots, Ecovacs began to deploy in various living scenarios, connecting points into lines and then surfaces. Also in 2022, targeting the lifestyle needs of Europeans and Americans, Ecovacs launched the intelligent lawnmower robot GOAT G1. Its product vision extends beyond floor cleaning robots to encompass a full range of service robots for various scenarios.

Every industry has its peaks and valleys, and the floor cleaning robot industry experienced a collective decline in sales in the second half of 2022. As the market entered a stable period, demand struggled to grow significantly, and with narrowing technological gaps among companies, competition in the floor cleaning robot industry intensified. With the relentless pursuit of upstarts like Roborock, Dreame, and NARWAL, the cleaning appliance industry faced a shakeup.

As the industry leader, Ecovacs was the first to initiate a price reduction, with the average prices of flagship products such as the X1 and T10 dropping by more than 20% from 618 to Singles' Day. Under pressure from Ecovacs' price cuts, brands like Roborock, Xiaomi, Dreame, and NARWAL had no choice but to follow suit. However, Ecovacs, which implemented the most significant price reductions, triggered negative market feedback, resulting in a decline in its online market share instead of an increase, while other manufacturers saw their market shares rise.

The root cause lies in Ecovacs' consistent path of groundbreaking innovation, which to some extent underestimated the difficulty of major technological iterations. These major innovations did not adequately address consumers' actual usage needs, and Ecovacs' focus on developing "groundbreaking" products like square-shaped floor cleaning robots did not receive positive market feedback. In contrast, Ecovacs lagged behind other manufacturers in some "micro-innovations": for example, it did not introduce mop lifting technology until 2023, and it was also the last to enter the field of biomimetic robotic arms. In addition, on the Black Cat Complaints platform, a large number of users have complained about the quality of Ecovacs products, and the decline in reputation caused by these quality issues may be another reason for the decline in sales.

2023 was a turning point for Ecovacs, with revenues reaching 15.5 billion yuan, a meager year-on-year increase of just 1.16%, indicating a growth bottleneck. Net profit plummeted 63.96% to 610 million yuan. Ecovacs, which once boasted a market value exceeding 140 billion yuan due to soaring share prices and earned the nickname "the king of floor cleaning robots," has gradually been caught up by its younger sibling Roborock under the backdrop of three consecutive years of share price declines. As of press time, its market value was only about 60% of Roborock's, leaving the former industry leader in an awkward position.

An internet upstart founded in a three-bedroom apartment struggles with patent disputes despite reaching the top

Roborock's meteoric rise in performance began in the second quarter of 2023. With three consecutive quarters of strong growth, Roborock's revenues surged 30.55% year-on-year to 8.654 billion yuan last year, with net profit reaching 2.051 billion yuan, a staggering 73.32% increase from the previous year. In comparison, Ecovacs' revenues were almost flat at 15.5 billion yuan, with net profit plunging 60% year-on-year to 611 million yuan.

It can be said that last year, Roborock generated more than three times the profit with half of Ecovacs' revenues. This is attributed to Roborock's launch of a series of cost-effective flagship products in 2023, leveraging price advantages to catch up with Ecovacs in market share.

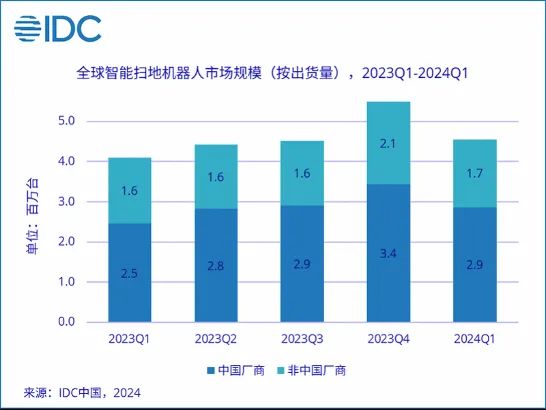

From a global perspective, although the growth rate of the floor cleaning robot market has slowed down, the share of Chinese manufacturers continues to increase. The latest report from IDC shows that in the second quarter of this year, 5.117 million smart floor cleaning robots were shipped globally, up 15.7% year-on-year. Among the top ten companies in terms of shipments, nine were Chinese or Chinese-controlled companies. Specifically, Roborock ranked first globally in both shipments and revenue for floor cleaning robots, marking the first time a Chinese company has topped the global smart floor cleaning robot market. Meanwhile, US-based iRobot saw its shipments decline 6% year-on-year to second place, while Ecovacs' shipments fell 9.4% to third place.

The starting point for Roborock's achievement can be traced back to a startup story from ten years ago. On July 1, 2014, a group of engineers gathered in a three-bedroom apartment in Beijing's Olympic Spring Community. Most of them were graduates of prestigious universities with over 15 years of experience in the hardware industry, including stints at major companies like Microsoft, Tencent, and Baidu. In the era of the internet startup boom, this team of tech-savvy entrepreneurs was a sought-after target for investors. Convinced that they could create the world's best floor cleaning robot by pooling their wisdom and efforts, they set out on their mission. Xiaomi, too, was confident in their abilities and invested in Roborock in September 2014, making it part of Xiaomi's ecosystem.

In August 2016, Roborock launched its first product, the "Mi Smart Floor Cleaning Robot." In its first month on the market, only 3,000 units were sold. However, sales picked up in the second month, reaching 10,000 units, and by the third month, cooperating sales channels were requesting 100,000 units. Sales continued to snowball from there.

Coinciding with the rapid growth of the industry, Roborock leveraged Xiaomi's supply chain and sales channels to grow rapidly, with Xiaomi playing a crucial role in its early stages. In September 2017, building on the reputation and recognition gained from its first product, the "Mi Floor Cleaning Robot," Roborock launched its own brand of smart floor cleaning and mopping robots. As revenues from its own-brand products continued to expand, those from Xiaomi contract manufacturing gradually declined. By 2019, the company had achieved "de-Xiaomi-ization," with self-brand revenues accounting for more than 50% of total revenues for the first time, reaching 65.73%.

(Changes in online market share of the top four floor cleaning robot brands in China, source: AVC)

While once following in the footsteps of others, Roborock has now reached the top of the industry, but patent disputes and quality concerns remain persistent headaches.

On the eve of this year's 618 shopping festival, Dreame accused Roborock's P10 Pro and P10S Pro floor cleaning robots of infringing on its patent for a "cleaning device and cleaning equipment." On June 3, Dreame filed a pre-litigation behavioral preservation application with the Quanzhou Intermediate People's Court, requesting that Roborock immediately cease manufacturing, selling, and offering to sell the two products. The court ruled in favor of Dreame's request on June 5, resulting in the removal of the two Roborock products from e-commerce platforms.

On July 16, the Supreme People's Court disclosed this case, which was the first nationwide behavioral preservation review case. Subsequently, Roborock's behavioral preservation ruling was overturned, allowing the re-sale of the products in question. However, the case unfortunately caused Roborock to miss out on the crucial 618 sales event for these two products.

In August of this year, the verdict in Dreame's lawsuit against Roborock in Germany was announced. Dreame alleged that Roborock had infringed on its patents, and the Düsseldorf Regional Court in Germany ruled that Roborock must cease sales, use, importation, and other activities in Germany.

For the floor cleaning robot industry, as technological innovations in new products become increasingly refined, product homogenization has become a common pain point in the industry before the next disruptive innovation emerges. The competition for patents is fierce, and the focus on "micro-innovations" has led to the accumulation of excessive features in many products, driving up prices. For Roborock, which relies on cutting-edge technology and sees itself as an industry pioneer and trendsetter, maintaining its leading position and truly guiding the industry in technological innovation is a question it must consider, or risk losing its reputation as a worthy leader.

So, will Roborock eventually replace Ecovacs as the leading floor cleaning robot company? Perhaps consumers will have the answer. What do you think?

'Rolling out' to overseas markets and tapping into domestic potential

The growth rate of the domestic floor cleaning robot market has slowed down in recent years, and a development pattern of "two superpowers (Ecovacs, Roborock) and multiple strong players (NARWAL, Dreame, Xiaomi, Midea, Haier)" has emerged. With the formation of this "internal competition" pattern, the "external competition" pattern has begun to extend globally.

After a century of vacuum cleaner development, consumers in overseas countries, especially developed countries like Europe and the United States, have a higher acceptance of cleaning appliances. Their larger per capita living spaces and higher disposable incomes make them more willing to spend on household appliances and pay a premium for house cleaning and hands-free convenience.

In 2015, Qian Cheng, the son of Ecovacs founder Qian Dongqi, took over Ecovacs and led the establishment of an international business unit to further expand into international markets. In 2023, Ecovacs set up an overseas headquarters in Singapore to enhance its market share in the Asia-Pacific region and globally. Roborock entered overseas markets in 2018 and has gradually established a global distribution network.

In the first half of 2024, Ecovacs' overseas business revenue increased by 11.3% year-on-year, accounting for 39.3% of the company's overall revenue. Roborock reported in its interim report that its overseas revenue was approximately 2.294 billion yuan, accounting for 51% of its total revenue.

Led by these two giants, the "Chinese floor cleaning robot army" has captured a large share of the global market. Dreame has established more than 5,500 offline physical stores in over 100 countries worldwide, while brands like Haier and Midea have also reaped substantial benefits from their existing global sales networks. In 2023, Chinese players accounted for half of the global smart floor cleaning robot market, with shipments reaching approximately 9 million units out of a total of 18.52 million.

With promising overseas sales prospects, the author hopes that these Chinese technology brands venturing abroad will compete healthily, inspire each other, and grow stronger, establishing a genuine brand influence and a positive technological image overseas. Shaking off the perception of low-cost, low-quality Chinese products is crucial for the overall development of Chinese brands in overseas markets.

Written at the end...

While expanding overseas, there is still huge potential to be tapped in the domestic market. Since 2021, in just three years, the share of domestic base station products has risen rapidly to over 80%, driving the average price of floor sweepers in the domestic market to double, from around 1,500 yuan to over 3,000 yuan. However, sales have remained at around 5 million units, and the penetration rate among urban households is still around 5%.

The reasons for this are two-fold. On the one hand, there is an internal competition for innovation on the supply side. On the other hand, the development and education time for floor sweepers in China is extremely short, and the demand has not been fully stimulated. The current stock of users is concentrated in high-tier cities, where they are insensitive to price and willing to pay for better products. To capture the incremental market, domestic brands need to consider how to lower purchase thresholds, educate consumers, and fully tap into the demand in second- and third-tier cities.

In the era where artificial intelligence is reshaping everything, the future technological competition in the smart floor sweeper market will undoubtedly focus on high-end products. The introduction of AI capabilities can enable products to deeply understand user instructions, allowing floor sweepers to reach new levels in deep cleaning, instant cleaning, and cleaning in complex environments. After iterating to the stage where they are sufficiently functional and can fully cover daily needs, floor sweepers are expected to become essential household appliances after cost reduction through large-scale production. They may experience a surge in penetration similar to that seen in the air conditioning, refrigerator, and washing machine industries, ushering in the era of robotic housekeeping services.