Transformation in pain: the AI truth behind SenseTime's layoffs

![]() 10/24 2024

10/24 2024

![]() 584

584

Yesterday, SenseTime, a leading company among the "AI Four Little Dragons," celebrated its 10th anniversary. On this memorable day, a round of layoffs was underway within the company.

Starting on October 22, news of SenseTime's layoffs began to spread on social media. According to interviewees, the layoffs affected multiple departments, including SCG (Smart City and Commercial Group), IAG (Intelligent Automotive Group), the Research Institute, and the Medical Group, with the exact layoff ratios in each department remaining uncertain.

Within these layoffs, the two departments focused on large models and large computing facilities emerged as "safe zones." Sources close to SenseTime told Guangzhui AI that these two departments were largely spared from layoffs.

The layoffs came as a surprise, with employees sharing on social media stories of being laid off just a day before their probation period ended, fresh graduates being let go, and job offers being rescinded.

In response to the layoff news, SenseTime told Guangzhui AI, "SenseTime is actively advancing its strategic transformation, focusing on key businesses and strategic growth areas such as 'large computing facilities - large models - applications,' and optimizing and adjusting its organizational and talent structures accordingly to better meet the needs of business development. Currently, SenseTime's social and campus recruitment is proceeding normally, and the overall business is developing steadily."

In his 10th-anniversary internal letter, Xu Li, the Executive Chairman and CEO of SenseTime's board, stabilized the company's morale while also revealing the truth behind the transformation of this established AI company.

Xu Li believes that "SenseTime has taken two steps: the traditional AI 1.0 and the generative large model AI 2.0 that we often talk about." In his view, the cost of model production in the era of generative large model AI 2.0 primarily lies in the investment in computing resources, and the popularization and commercialization of generative large model AI require efforts to reduce the production and usage costs of large models.

Based on this assessment, SenseTime has defined a new strategic direction.

"In the field of generative AI, SenseTime's core strategy is to achieve seamless integration of large computing facilities (SCO), large models, and applications (CNI), with applications driving models and models optimizing computing power," Xu Li wrote in his internal letter.

While the layoffs are undoubtedly painful for SenseTime, they are a necessary part of the transition from an AI 1.0 company to an AI 2.0 company.

Through this painful process, SenseTime can transform from a project-based company primarily serving government and enterprise clients to one that generates efficient returns through AI large models, truly turning a profit.

Consolidating Loss-Making Businesses, SenseTime Transforms to Stem Losses

SenseTime does not want to continue carrying the burden of redundant traditional AI businesses.

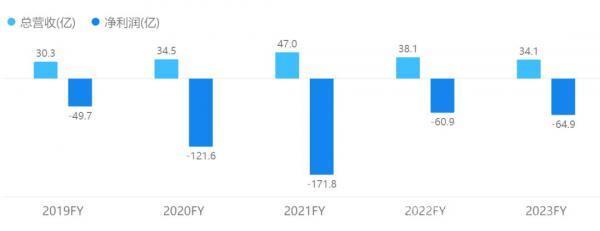

From 2018 to 2023, SenseTime's performance remained in the red, with operating losses of RMB 3.4 billion, RMB 5 billion, RMB 12.2 billion, RMB 17.2 billion, USD 6 billion, and USD 6.4 billion over the six-year period.

SenseTime's Revenue and Net Profit from 2019-2023 Source: Futu Securities

It was not until the first half of this year that SenseTime delivered a financial report showing narrower losses: in the first half of 2024, the group achieved operating revenue of RMB 1.74 billion, a year-on-year increase of 21%. During the period, losses continued to narrow, with EBITDA losses narrowing by 26.5% year-on-year and net losses narrowing by 21% year-on-year.

Taking the IAG (Intelligent Automotive Group) as an example, as a business unit that also maintained growth, SenseTime's Jueying Automotive Business generated revenue of RMB 170 million in the first half of 2024, a year-on-year increase of 100%. While the revenue was positive, the income from the intelligent driving segment was merely a drop in the ocean for SenseTime.

SenseTime also appears to be intentionally streamlining its overly Huge business structure in this round of adjustments. A former SenseTime employee told Guangzhui AI, "The IAG department already has over a thousand people, and the current human efficiency ratio is too low."

From a business composition perspective, the traditional business, which once encompassed three major segments, showed a significant decline in revenue after consolidation: the first-half financial report for 2024 showed that traditional AI revenue was RMB 520 million, a year-on-year decrease of 50.6%.

Furthermore, facing substantial losses, cost reduction and efficiency enhancement have become the main themes of SenseTime's adjustments in recent years. According to the financial report, administrative expenses have decreased by 7.7% to RMB 734 million due to reduced employee benefits expenditures.

In fact, this is not the first time SenseTime has initiated layoffs. Starting in 2023, rumors of layoffs at SenseTime began to circulate: According to Caixin, in August 2023, SenseTime began large-scale layoffs internally, with the Smart City and Commercial Group (SCG) seeing layoffs of approximately 10% to 15%.

A former SenseTime employee told Guangzhui AI that since the beginning of this year, SenseTime has been conducting layoffs intermittently. Facing consecutive years of losses, SenseTime has been forced to cut internally to stem the bleeding and survive.

Amid internal and external challenges, SenseTime, burdened with the task of turning a profit, must, as mentioned in the internal letter, "return to a startup mindset" and cut businesses with low ROI and severe losses, navigating the era of large models with a lighter footprint.

Therefore, SenseTime chose to consolidate its generative AI-related businesses scattered across other business groups, leading to organizational restructuring.

After the completion of the business reorganization at the end of 2023, Smart City, Smart Commerce, and Smart Living ceased to exist as separate business segments. The non-generative AI businesses of these three segments were consolidated and classified as traditional AI businesses, alongside generative AI and intelligent automobiles, to form the new three core businesses.

On the occasion of its 10th anniversary, Xu Li, through an internal letter to all SenseTime employees, chose this juncture to change course and steer towards more profitable businesses.

Betting on Large Models and High Computing Power: Is SenseTime Transforming into a Cloud Vendor?

SenseTime's decision to cut traditional businesses was not impulsive.

"In the field of generative AI, SenseTime's core strategy is to achieve seamless integration of large computing facilities (SCO), large models, and applications (CNI), with applications driving models and models optimizing computing power," Xu Li wrote in his internal letter to all SenseTime employees.

"We have established a trinity strategy of 'large computing facilities - large models - applications,' striving to become the most knowledgeable large model service provider in terms of computing power and the most knowledgeable computing power service provider in terms of large models," Xu Li continued.

Xu Li's strategic transformation is also a result of internal business drivers.

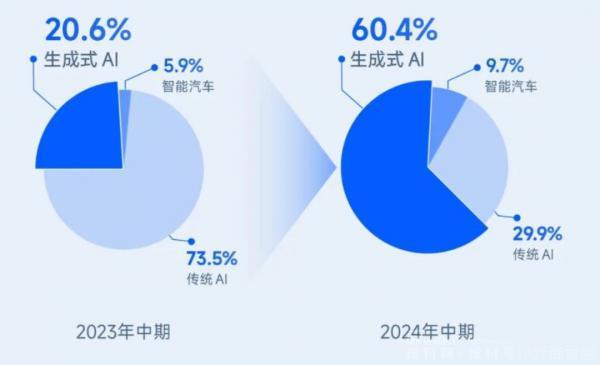

In the first-half financial report, revenue from generative AI business approached RMB 1.1 billion, achieving astonishing growth of 256%, accounting for up to 60% of total revenue. SenseTime officials stated that generative AI has become the dominant business of the group.

Generative AI gradually becoming the group's core revenue business Source: SenseTime Group

But with many large model companies still struggling with commercialization, what businesses is SenseTime actually profiting from?

The financial report shows that the growth in SenseTime's generative AI business revenue primarily stems from the explosive increase in market demand for generative AI model training, fine-tuning, and inference.

This indicates that an increasing number of enterprises are beginning to experiment with integrating large model services into various fields. At the same time, based on the demand for computing power for training and inference, SenseTime's deployed "large computing facilities" provide revenue for the generative AI business by offering computing power services. As of August this year, over 3,000 leading enterprises in various industries have utilized SenseTime's large models and intelligent computing services, with the overall invocation volume of the "Ririxin" large model achieving a 400% increase.

Although SenseTime has not disclosed specific figures, based on the current state of the industry, a significant portion of this revenue likely comes from "intelligent computing services" rather than "large models."

This is similar to the situation we observe with domestic cloud vendors.

Whether it's Aliyun, Baidu Cloud, or Huawei Cloud, they all consider intelligent computing services as their primary source of customer revenue, with large models serving as an important driving force rather than a truly "high-income product." For instance, this year, Baidu Intelligent Cloud shifted its business focus from Qianfan, which provides large model services, to Baige, a computing power service platform.

This is why Xu Li emphasizes the trinity strategy of "large computing facilities - large models - applications."

Faced with a new and profitable business and an old one with stable revenue but limited growth prospects, SenseTime has made its choice. Consequently, adjustments such as cutting underperforming businesses like SGC and healthcare have become expected moves, from changes in revenue structure to strategic shifts.

However, in terms of self-built computing power infrastructure, SenseTime has continued to invest heavily over the past year to maintain its leading edge. According to the announcement, as of the end of 2023, the company operated 45,000 GPUs. By August 2024, its total computing power had surpassed 20,000 PetaFLOPS, with the number of GPUs rising to 54,000, an increase of approximately 70% from March of this year.

It can be said that SenseTime's computing power infrastructure is still in a phase of high investment.

By embracing "large models" and "large computing facilities," SenseTime has identified two profitable businesses. However, as more players enter the market and industry trends evolve, SenseTime will face no shortage of challenges:

On the one hand, in terms of large model services, SenseTime needs to offer more cost-effective products to compete with large model service providers intent on igniting a price war.

On the other hand, from the perspective of developing "large computing facilities," to some extent, this is a business that combines technology and scale. In this regard, SenseTime is no longer competing against AI companies but rather against more financially capable cloud computing vendors and a wave of private deployment computing power service providers.

While challenges lie ahead, SenseTime has chosen to prioritize its strongest cards and make way for healthier business development.

Transforming from the AI 1.0 era, SenseTime is destined to tighten its belt during the transition to the AI 2.0 era, rapidly advancing towards profitability goals.