This domestic smart driving ace is hotly contested by BYD and Lixiang

![]() 10/24 2024

10/24 2024

![]() 616

616

Data Analysis of New Energy & Auto

Will the IPO be another turning point for Horizon Robotics?

Total words: 5685

Estimated reading time: 25 minutes

In June 2021, a company secured $1.5 billion in funding. According to reports at the time, this was the company's C+++++ round of financing.

Yes, this company alone raised seven rounds of funding during its C round.

Starting from the end of December 2020, the company received funding every month. Investors included not only star capital firms like Highland Capital and China International Capital Corporation Limited (CICC), but also renowned automakers like BYD, Dongfeng, and Great Wall Motor, as well as industry giants like Contemporary Amperex Technology Co., Ltd. (CATL).

This company is called Horizon Robotics, and it recently listed on the Hong Kong Stock Exchange, with its shares surging nearly 30% in pre-market trading yesterday.

Notably, cornerstone investors prior to the IPO included Alibaba, Baidu, French shipping giant CMA CGM, and a Ningbo municipal government fund.

From internet companies to automakers, from venture capital firms to industry chains, from central enterprises to government investment institutions, all are vying for Horizon Robotics.

Who is this mysterious company, and why is it so sought after?

#

Vol.1/ Development History

Horizon Robotics was founded in December 2015.

In that year, Yu Kai left Baidu and invited Huang Chang, former Chief Architect of Baidu IDL, Yang Ming, founder of Facebook FAIR, and Fang Yi, former Vice President of Nokia, to start a business together. Initially, the team excelled in software and algorithms, but Yu Kai aspired to reconstruct AI solutions from the bottom up, encompassing new product architectures and software algorithms. Hence, they recruited Zhou Feng, former chip architect at Huawei.

Initially, Horizon Robotics aimed to create intelligent brains for all things, with two main business directions: the Andersen platform for smart homes and robots, and the Hugo platform for intelligent driving in automobiles. However, the intelligent driving business grew faster, and Horizon Robotics has since focused exclusively on autonomous driving.

Horizon Robotics cleverly chose the path of a tier-two supplier, offering a solution that combines algorithms, software, and hardware to provide core technologies for Advanced Driver Assistance Systems (ADAS) and Advanced Driving Automation (AD). This solution boasts "three highs and two lows": high processing power, high reliability, high cost-effectiveness, low latency, and low energy consumption. In other words, Horizon Robotics neither competes with automotive chip manufacturers nor autonomous driving solution providers. Its customers include both OEMs (Original Equipment Manufacturers) and tier-one automotive suppliers, thus avoiding direct competition.

In 2015, Horizon Robotics secured millions of dollars in angel funding. The participation of star investors like ZhenFund, Innovation Works (founded by Kai-Fu Lee), Sequoia China, Highland Capital, and GSR Ventures indicated that this company was destined for greatness.

After receiving angel funding, Horizon Robotics demonstrated remarkable momentum. In March 2016, it unveiled its first-generation BPU (Brain Processing Unit). At the launch of Singulato Motors, Horizon Robotics demonstrated an ADAS prototype system that simultaneously detected lane lines, vehicles, and pedestrians on actual vehicles. Thanks to this demonstration, Horizon Robotics secured orders from two tier-one suppliers, providing them with ADAS solutions, including algorithms. It is rumored that these two suppliers were Bosch and Continental.

This marked the first step in Horizon Robotics' take-off. After securing these orders, Horizon Robotics completed two rounds of funding within three months, with venture capital firms as the main participants during this period.

In early 2017, Horizon Robotics' first-generation processing hardware, Journey, was showcased in an ADAS system jointly developed with Intel. Simultaneously, it initiated a strategic partnership with SAIC Motor to promote the mass production and application of automotive-grade AI chips. That same year, Horizon Robotics secured another round of funding, with Intel Capital leading the investment.

In 2019, Horizon Robotics released its first mass-produced automotive-grade intelligent chip, Journey 2, and secured $3 billion in Series B funding, which included investments from chip company SK China and several leading automakers (although specific automaker names were not disclosed at the time, it is now known that SAIC Motor was among the investors, with a significant investment).

In 2020, Horizon Robotics' Journey 2 began to be integrated into mass-produced vehicles, and the company officially launched the Journey 3 chip.

What truly propelled Horizon Robotics into the limelight was its 2021 partnership with Lixiang Auto. Horizon Robotics' Horizon Mono (Advanced Driver Assistance System), powered by Journey 3, achieved mass production on the Lixiang ONE, making it the first domestic supplier to achieve front-mounted mass production. That year, the company delivered one million processing hardware units.

Thanks to this success, Horizon Robotics became highly sought after in the market. From the beginning to the middle of the year, the company was hotly contested by both automakers like BYD and suppliers like Sunny Optical and BOE. It raised seven rounds of Series C funding, an extremely rare feat among startups.

In 2022, Horizon Pilot, powered by Journey 5, achieved mass production on Lixiang Auto's L series. In addition to Chery Automobile, Horizon Robotics also attracted investments from state-owned automaker FAW, further enhancing its credibility.

By 2023, Horizon Robotics launched the Journey 6 series, delivering four million processing hardware units and forming partnerships with FAW and several top OEMs. That year, Horizon Robotics and Volkswagen established a joint venture, CoreChip, marking a deeper level of cooperation between Horizon Robotics and its customers.

By 2024, the company had delivered five million processing hardware units.

Now, as it enters the capital market, Horizon Robotics takes another step forward in expanding its influence, breaking through its own "horizon" and becoming better known to the public.

#

Vol.2/ Team

Horizon Robotics' team boasts a distinct technical background, with many members having worked at NEC Lab and Baidu.

The founder and CEO is Yu Kai, who oversees the overall strategy and business development. With over 25 years of R&D experience in computer engineering and over 100 published papers, Yu Kai held key R&D positions at companies like Siemens and NEC Lab and served as an adjunct faculty member in the Computer Science Department at Stanford University. In April 2012, he joined Baidu as Vice President of Baidu Research and participated in launching the autonomous driving project. He left Baidu in June 2015 to found Horizon Robotics.

Huang Chang, co-founder, Executive Director, and CTO, oversees the overall R&D efforts. A renowned expert in both industry and academia, Huang Chang holds over 80 international patents. He met Yu Kai at NEC Lab and joined Baidu in 2012, where he served as Chief Architect of Baidu USA LLC and Chief Research Architect of Baidu.

Tao Feiwen, co-founder, Executive Director, and Chief Operating Officer, has been responsible for finance, human resources, legal affairs, marketing, and administration. She and Yu Kai are alumni of Nanjing University, and both joined Baidu in 2012 alongside Huang Chang. Prior to joining Baidu, Tao worked in sales and operations at Google headquarters.

Chen Liming serves as President, overseeing overall management with a strategic focus on supply chain and quality assurance. He has been a member of the Global Automotive Elite Organization since October 2017 and held various senior positions at Bosch Group.

Fang Yi, co-founder of Horizon Robotics and Vice President of Hardware, has 19 years of experience in product development and management. An expert in hardware products, he served Nokia for 13 years, including as Vice President of R&D for Nokia's smartphone business in Greater China.

Zhou Feng, Chief Chip Architect, leads the FPGA technology team, responsible for FPGA technology development for autonomous driving and video recognition. He was previously a chip development architect and leader at companies like Aitech, Vimcro, and Huawei. In September 2015, he joined Horizon Robotics as Chief Chip Architect, collaborating with co-founder Fang Yi to establish the chip design team and oversee chip IP development.

Xu Wei, Chief AI Scientist, worked at Facebook, where he founded and led a large-scale recommendation platform. His later work overlapped with the main founding team, including serving as a Senior Researcher at NEC Lab and Head of Deep Learning Development for Baidu's Heterogeneous Computing Team.

It is evident that the core team at Horizon Robotics had connections before starting the business, either as alumni or colleagues. Their academic backgrounds mainly intersect at Tsinghua University and Nanjing University, while their professional experiences overlap at NEC Lab and Baidu.

#

Vol.3/ Core Competitiveness

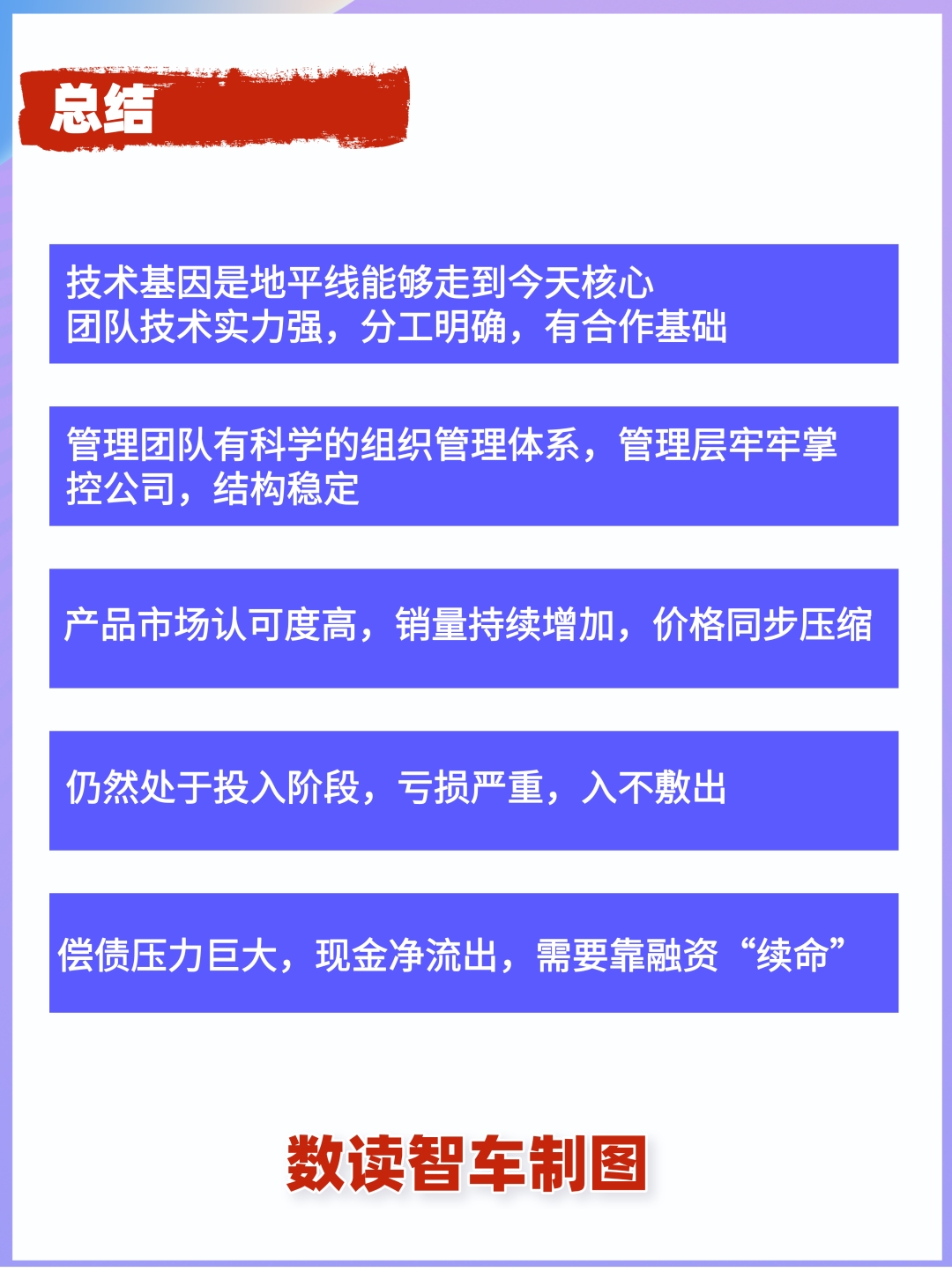

An elite management team and talented personnel are the foundation of Horizon Robotics' competitiveness.

The team at Horizon Robotics boasts impressive credentials, with members having extensive industry experience, such as Yu Kai's 100 published papers and Huang Chang's 80 international patents.

The senior management team at Horizon Robotics has deep relationships and years of collaboration experience. This is common in the tech industry, where startup teams often consist of several technical experts leading their former teams. Such teams have undergone prolonged running-in and operate with high efficiency, giving Horizon Robotics a solid foundation for success.

The technical team at Horizon Robotics embodies the philosophy of "professionals doing what they do best." This underscores the clear boundaries and specialized roles within a technology company, where division of labor and collaboration are paramount.

Simultaneously, Horizon Robotics operates with rigorous and standardized management practices.

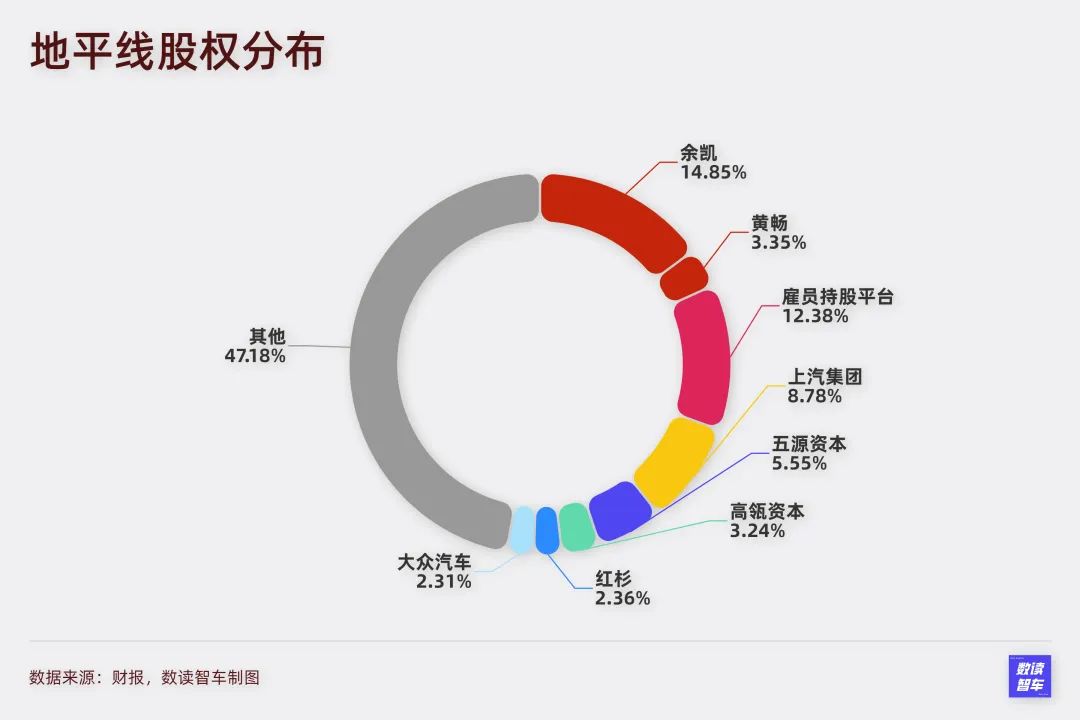

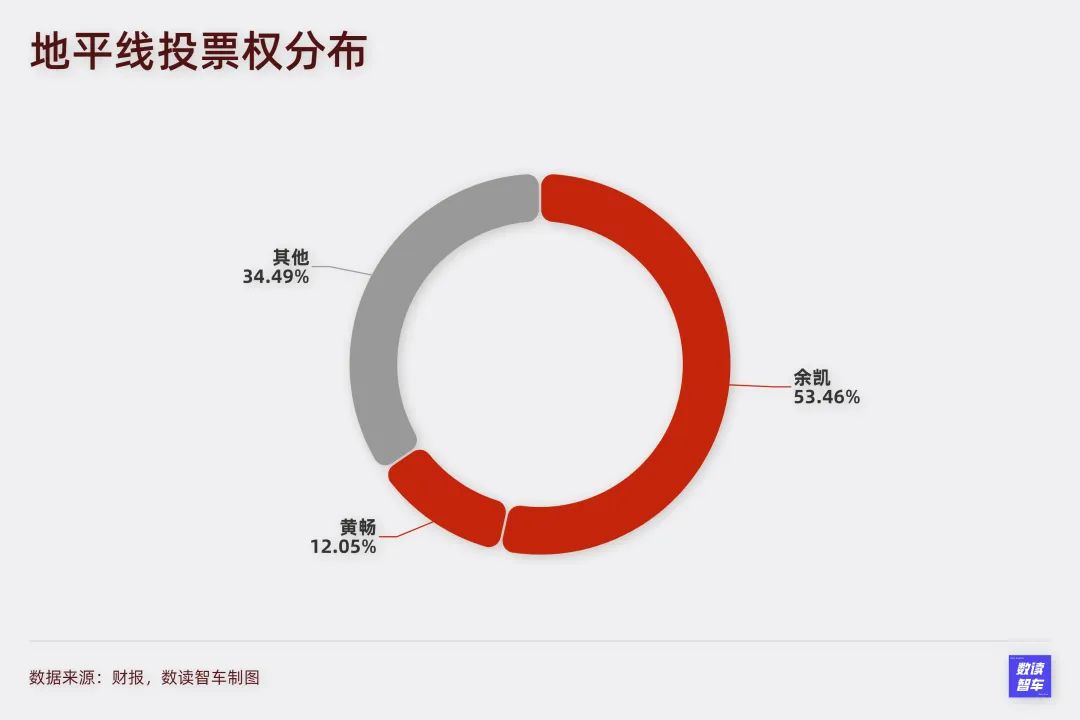

According to official sources, Horizon Robotics has undergone 11 rounds of funding, resulting in a relatively low shareholding for management. Yu Kai holds only 14.85% of the shares, while Huang Chang holds 3.35%. Together, management and employee shareholding platforms hold only 32% of the total shares. Among institutional investors, SAIC Motor is the largest shareholder with an 8.78% stake. Additionally, Wuzhen Capital, an early investor that participated in multiple funding rounds, holds a 5.55% stake, while Highland Capital and Sequoia China hold 3.24% and 2.36%, respectively.

However, through the dual-class share structure, the management team at Horizon Robotics maintains tight control. Yu Kai holds 53.46% of the voting rights, while Huang Chang holds 12.05%.

Yu Kai's absolute say and the controlling stake held by Yu Kai and Huang Chang together form a blueprint for organizational management, ensuring stable company operations and minimizing unnecessary disputes.

Strong technical capabilities, a stable team, and efficient division of labor likely contributed to Horizon Robotics' early stable development.

Building on years of development, Horizon Robotics has established a solid market position with strong customer loyalty. For instance, after launching its latest hardware, Journey 6, Chery Automobile announced cooperation on multiple models, integrating the technology into its four major brand vehicles (Chery, EXEED, JETOUR, and iCAR).

Moreover, Horizon Robotics' integrated hardware and software solution strengthens its partnerships and customer loyalty in an ecological manner, similar to NVIDIA's approach.

#

Vol.4/ Products and Market Performance

Horizon Robotics offers an integrated hardware and software solution.

The latest hardware product is Journey 6, launched in April this year, with the first batch of mass-produced vehicles expected to be delivered in the fourth quarter. Combining CPU, BPU, GPU, and MCU into a single unit, Journey 6 boasts a maximum computing power of up to 560 TOPS, making it the industry's first series of automotive intelligent computing solutions capable of covering the full range of intelligent driving needs. Journey 6 has garnered significant market attention, with Wang Chuanfu himself endorsing the product.

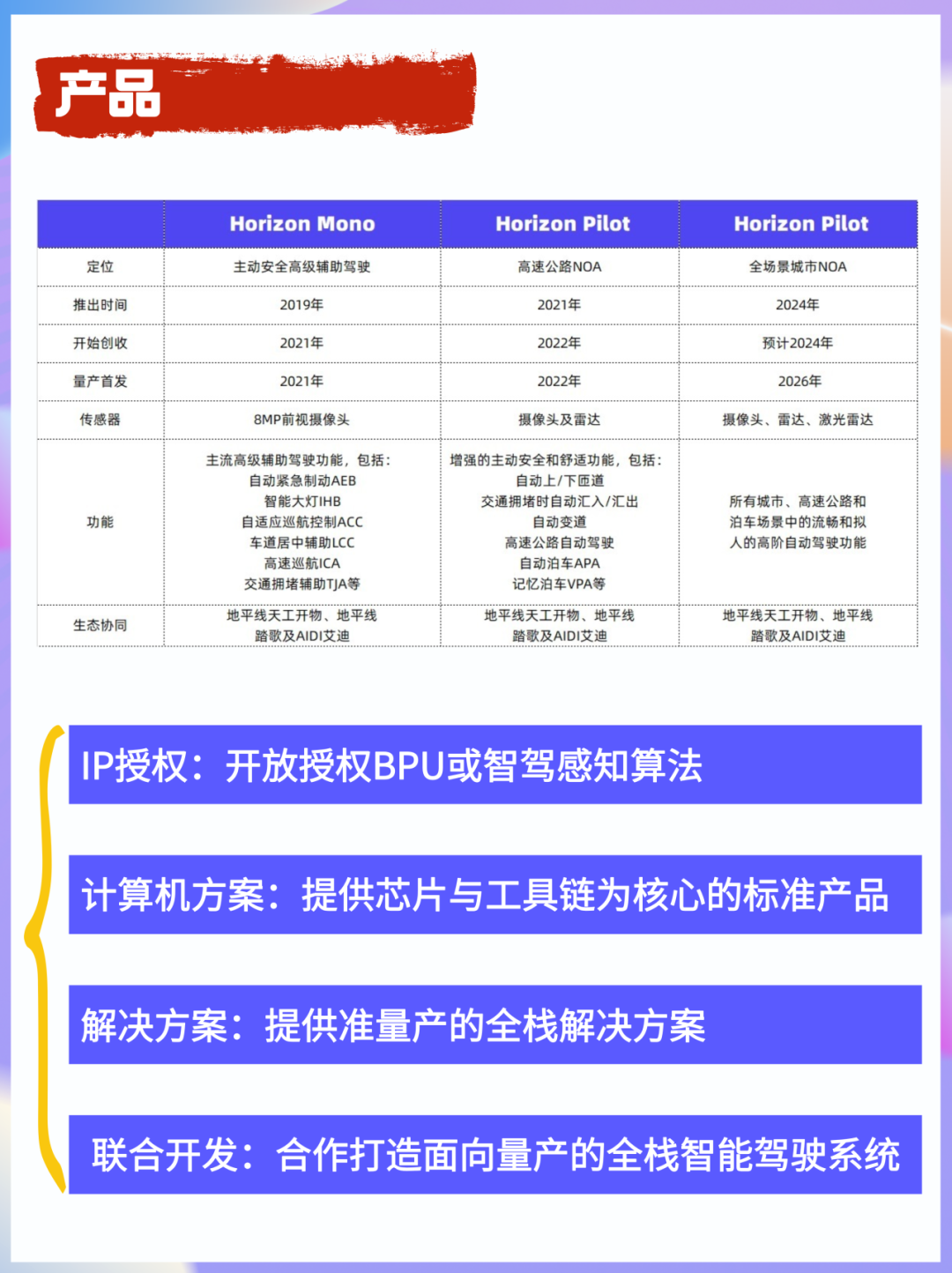

In summary, Horizon Robotics offers three comprehensive solutions and five technical toolkits.

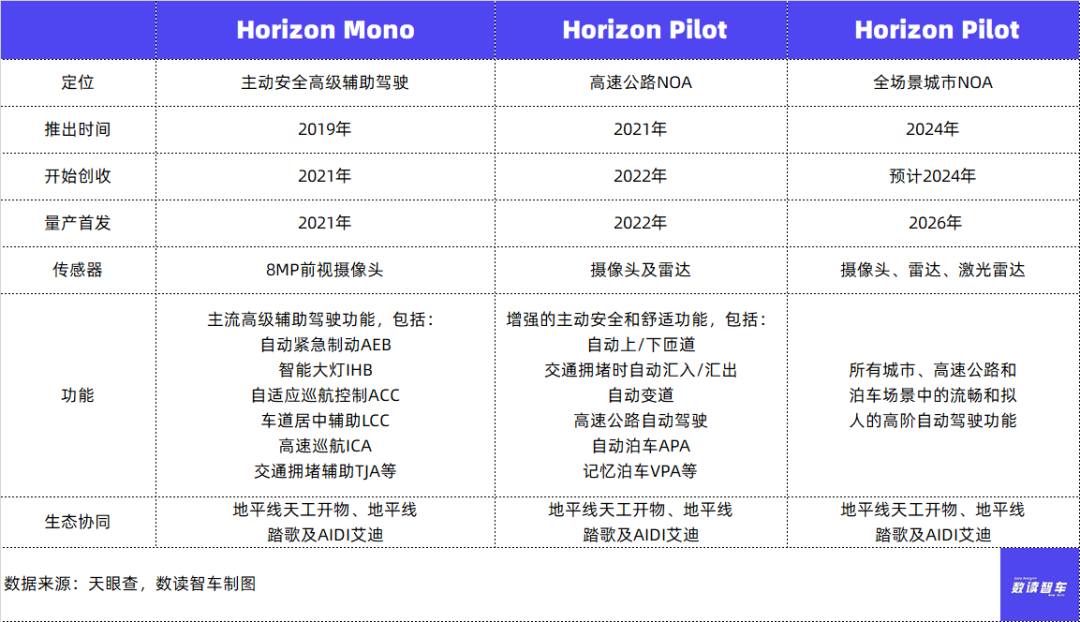

The three comprehensive solutions are Horizon Mono (Advanced Driver Assistance System), Horizon Pilot (Highway Autonomous Navigation Solution), and Horizon SuperDrive (Advanced Autonomous Driving Solution), which are progressively upgraded.

Horizon Mono provides safety features like Automatic Emergency Braking (AEB) and Intelligent Headlight Beam Control (IHB), as well as comfort features like Adaptive Cruise Control (ACC) and Traffic Jam Assist (TJA). It is integrated with Journey 2 or Journey 3 processing hardware.

Horizon Pilot enables higher-level driving tasks, such as automatic ramp merging, traffic jam assistance, automatic lane changing, and highway autonomy. It also includes parking assistance features like Automatic Parking Assist (APA) and Valet Parking Assist (VPA). It is integrated with Journey 3 or Journey 5 processing hardware.

Horizon SuperDrive is a product that is not yet fully realized. It was recently showcased at the end of September and is expected to enter mass production in 2026. As envisioned, Horizon SuperDrive will enable city-wide NOA (Navigate on Autopilot) scenarios, including graceful obstacle avoidance, human-like smooth braking, dynamic speed control, and stable unprotected left turns. It will be integrated with the latest Journey 6 processing hardware.

Underpinning these three comprehensive solutions are five technical toolkits, including algorithms, BPU, "Tiangong Kaiwu," "Tage," and "Eddie."

The algorithms are specifically designed and optimized by Horizon Robotics for driving scenarios.

BPU is a custom-designed processing architecture for automotive applications.

'Tiangong Kaiwu' is an algorithm development toolchain that includes a series of ready-to-use modules and reference algorithms, enabling efficient deployment of algorithms and software.

'Tage' is an embedded middleware that provides standardized automotive-grade services and tools to accelerate development, integration, and validation, thereby significantly advancing and accelerating mass production processes.

" Eddie " is a software development platform that helps software developers optimize the entire software development process, from deployment, training, validation, evaluation to iteration, by providing various tools, application programming interfaces, and streamlined workflows.

Based on the five toolkits mentioned, Horizon Robotics has identified four cooperation models: IP licensing, computer solution, solution model, and joint development. The degree of cooperation deepens with each subsequent model.

The IP licensing model involves granting licenses for BPU or intelligent driving perception algorithms.

The computer solution model provides standard products centered around chips and toolchains.

The solution model offers full-stack solutions ready for mass production.

The joint development model establishes in-depth strategic partnerships with customers, integrating respective technological advantages to jointly create full-stack intelligent driving systems tailored for mass production.

According to official disclosures and information from Gaogong Intelligent Automobile Research Institute, in the first half of this year, Horizon Robotics held a 33.73% market share in the forward-facing integrated machine computing solution market and a 28.65% market share in the intelligent driving computing solution market, ranking first in both categories.

According to the prospectus, based on the total installed capacity of solutions in 2023 and the first half of 2024, Horizon Robotics ranks fourth among all global advanced driver assistance systems (ADAS) and high-level autonomous driving solution providers in China, with market shares of 9.3% and 15.4%, respectively.

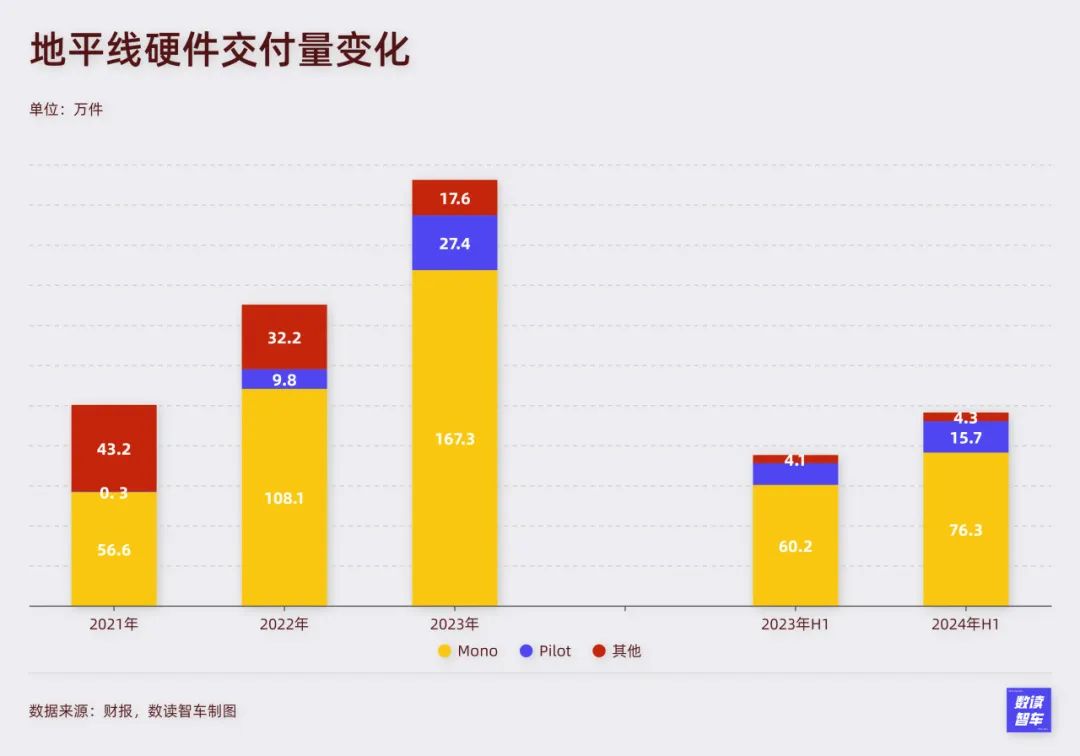

From a hardware perspective alone, Horizon Robotics maintains a healthy growth rate, with shipments of high-speed navigation on autopilot (NOA) solutions continuously increasing. According to Horizon Robotics' monetization projections, the speed of monetization for related products is accelerating.

As a technology company founded less than a decade ago, such market acceptance is highly commendable.

#

Vol.5/ Business Performance

Strictly speaking, Horizon Robotics does not currently meet the conditions for going public, as its business model is still immature and highly dependent on external funding for growth.

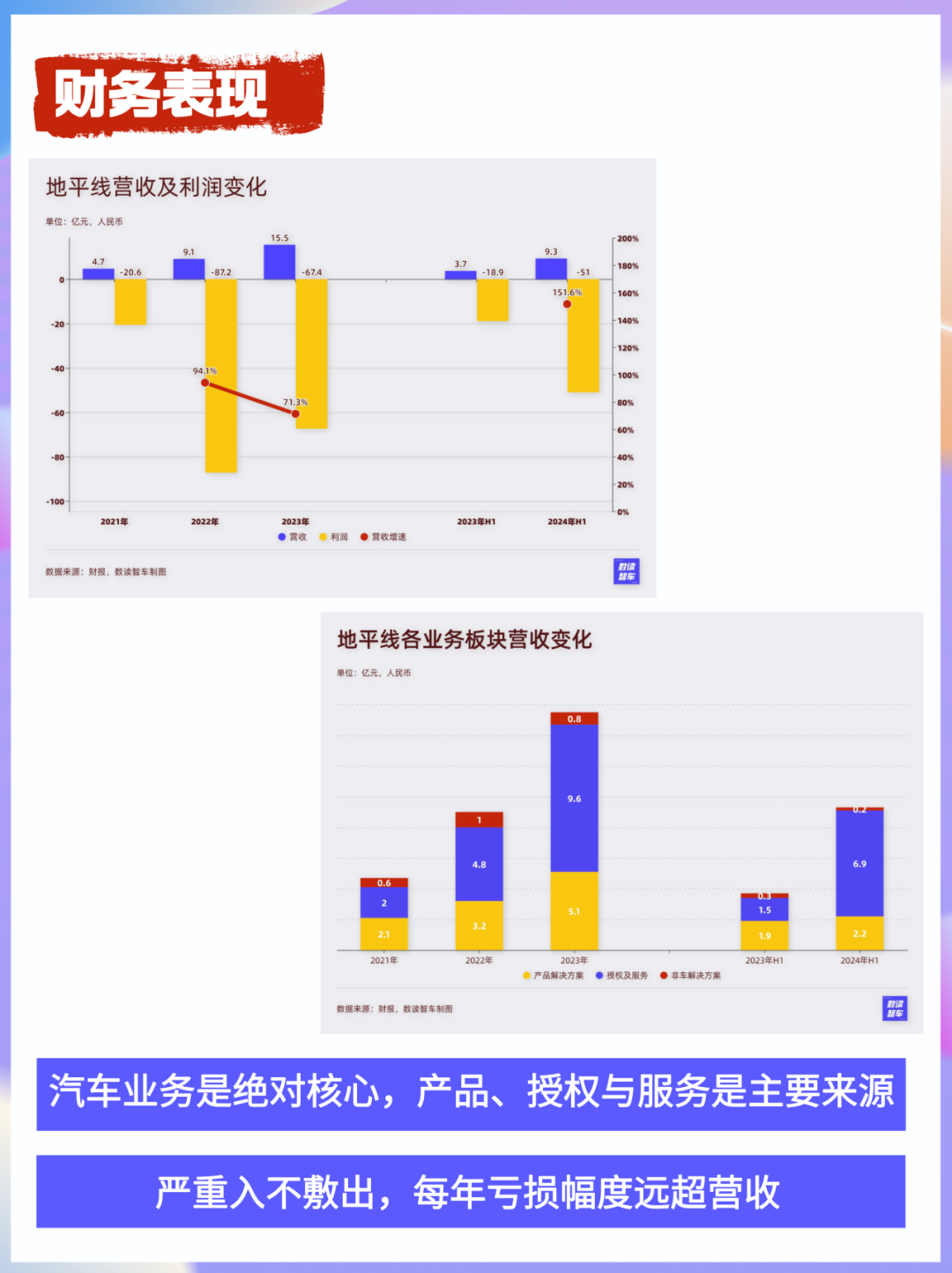

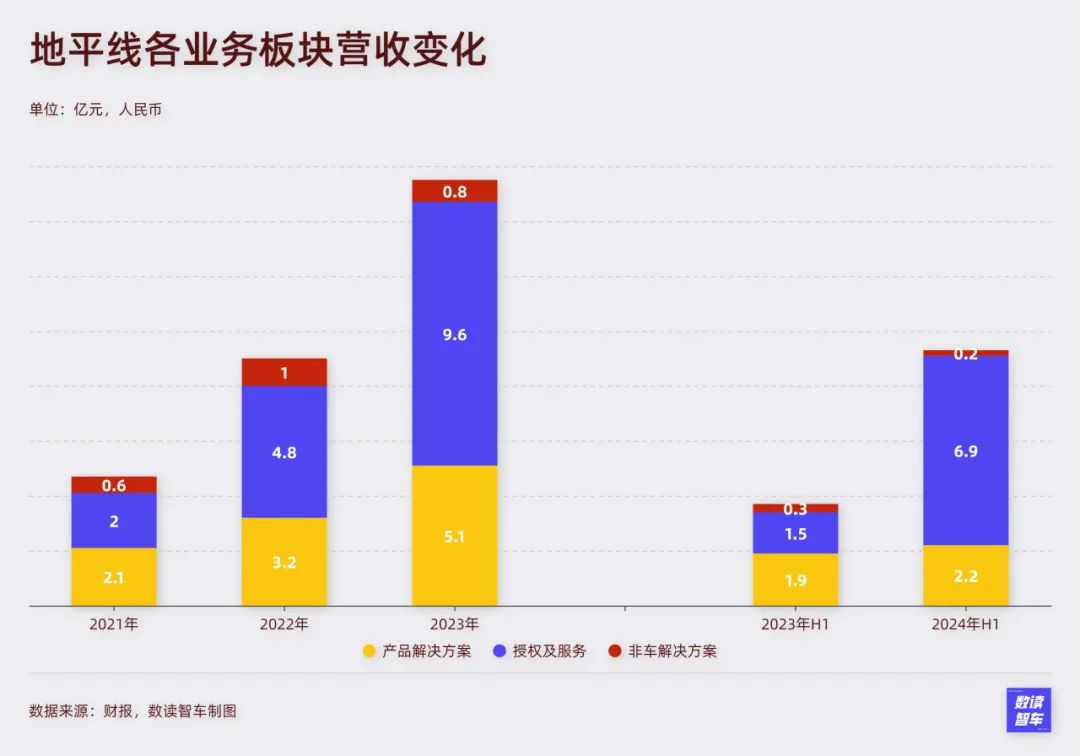

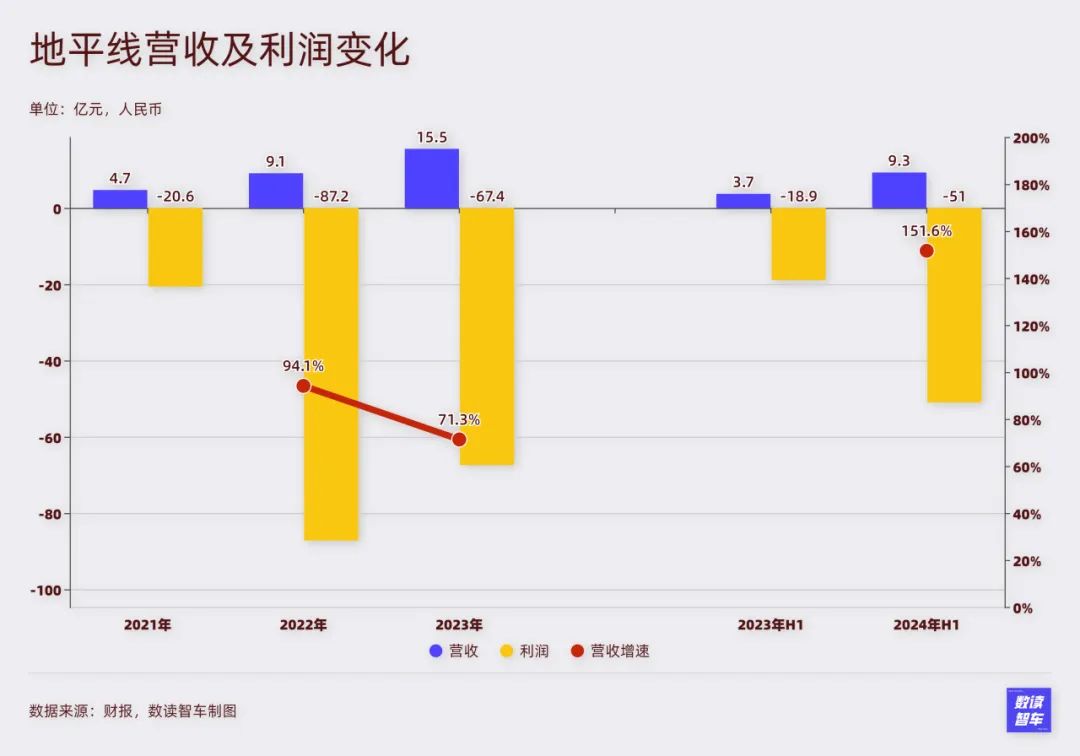

Rapid growth is a hallmark of Horizon Robotics and perhaps its only notable metric. In terms of annual revenue, the company reported RMB 467 million in 2021, RMB 906 million in 2022, and RMB 1.552 billion in 2023. In the first half of this year, revenue reached RMB 935 million, an increase of 152% year-on-year, with projected revenue for 2024 exceeding RMB 2 billion.

Despite Horizon Robotics' diverse business segments, its revenue streams are straightforward: product sales, licensing, and services.

Horizon Robotics' revenue can be categorized into automotive and non-automotive solutions, with automotive solutions being the core. This business segment further divides into product solutions, licensing, and services. The proportion of these varies, with product solutions typically accounting for less than 40% and licensing and services comprising the remaining 60% in most cases.

Notably, Horizon Robotics' revenue model heavily relies on major customers. In terms of annual revenue, the top five customers accounted for 60.7%, 53.2%, and 68.8% of total revenue in 2021, 2022, and 2023, respectively. In the first half of this year, this figure rose to 77.9%, with the largest customer contributing 37.6% of total revenue, indicating a growing dependence on major clients.

Horizon Robotics' business model exhibits strong profitability, with annual gross margins of 70.9%, 69.3%, and 70.5%, and a gross margin of 79% in the first half of 2024. Although there are fluctuations, the gross margins remain exceptionally high, primarily driven by licensing and services. In the first half of this year, the gross margin for licensing business reached 96.7%, while that for services stood at 73%.

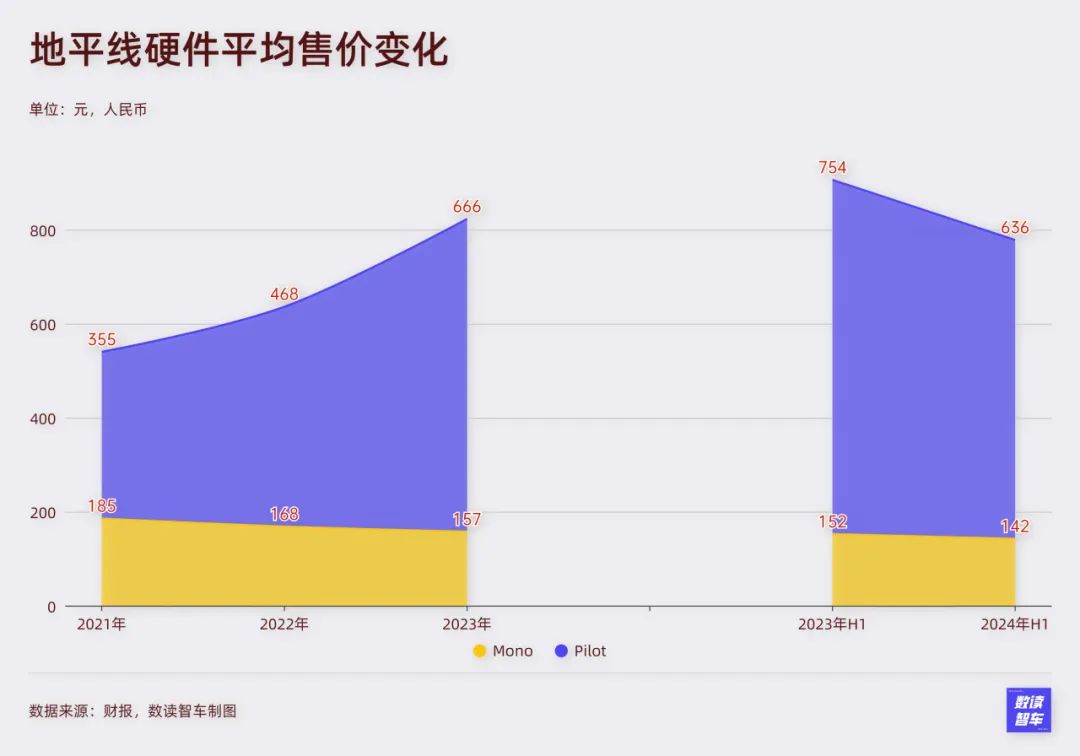

However, Horizon Robotics currently requires significant investments, and given the numerous competitors and the nascent stage of the industry, price wars are likely in the future. As products mature, average selling prices (ASPs) tend to decline. For instance, the ASPs of Mono and Pilot products have decreased after peaking in 2023, indicating that Horizon Robotics may continue to experience operating losses in the foreseeable future.

Considering R&D expenses alone, Horizon Robotics incurred RMB 2.37 billion in 2023 and RMB 1.42 billion in the first half of this year, far exceeding its revenue. Additionally, administrative expenses amounted to RMB 440 million, and sales expenses totaled RMB 330 million. In the first half of this year, these figures were RMB 240 million and RMB 200 million, respectively. Non-R&D expenses alone accounted for half of revenue, making profitability unlikely under these circumstances.

This has resulted in net losses of RMB 2.06 billion, RMB 8.7 billion, and RMB 6.7 billion in 2021, 2022, and 2023, respectively, and RMB 5.1 billion in the first half of this year. While these figures include the impact of fair value changes, the annual operating loss of approximately RMB 2 billion has become the norm.

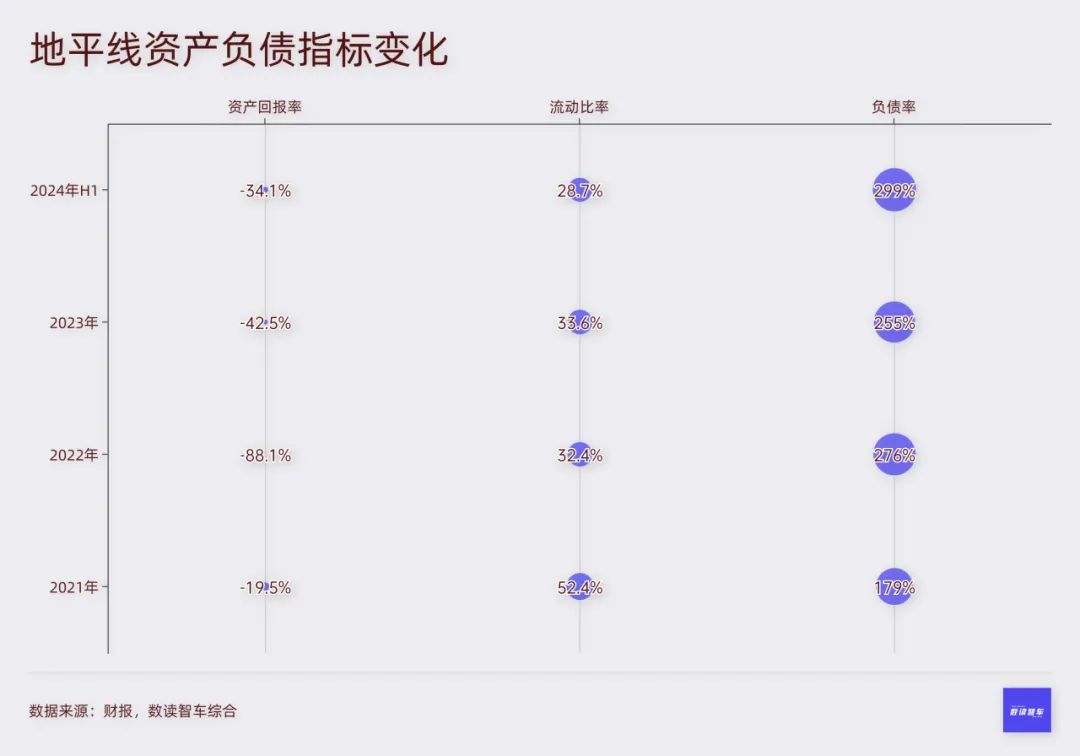

Given this scenario, Horizon Robotics must raise funds to sustain its operations. On the one hand, the company's assets total RMB 14.95 billion, while liabilities amount to RMB 44.77 billion, resulting in an alarming debt-to-asset ratio. On the other hand, the company continues to incur losses and experience a net outflow of cash, with an additional RMB 700 million outflow in the first half of this year. As of the end of June, the current ratio stood at just 28.7%, with the only cushion being RMB 10.45 billion in cash and cash equivalents. Horizon Robotics has limited ability to withstand risks.

While fundraising is crucial, Horizon Robotics failed to secure any funding throughout 2023, making an IPO a necessity rather than a choice.

This trend is prevalent in the autonomous driving sector this year.

On March 28, autonomous driving unicorn Zongmu Technology submitted its IPO application to the Hong Kong Stock Exchange.

On July 10, Ruqi Limousine & chauffeur, the smart mobility platform under GAC Group, successfully went public, becoming the first publicly traded robotaxi company in China.

On August 8, Black Sesame Technologies listed on the Main Board of the Hong Kong Stock Exchange, becoming the first Chinese autonomous driving chip company to go public.

On October 17, after multiple setbacks, WeRide obtained overseas IPO filing registration.

On October 18, Pony.ai publicly submitted its IPO prospectus to the U.S. Securities and Exchange Commission (SEC).

In fact, the current time is optimal for an IPO. Firstly, Horizon Robotics has undergone multiple rounds of funding in its early stages, and this presents an opportunity for existing shareholders to reap returns. Secondly, autonomous driving and large AI models have garnered significant attention this year. In this context, market recognition, popularity, and share price performance are likely to improve.

Over the past few years, Horizon Robotics has gained widespread market recognition, from tier-one suppliers to Ideal Auto. However, as a technology company, Horizon Robotics cannot rest on its laurels but must continue to invest to maintain its industry position and further expand its market share. Amidst consecutive losses and the lack of further funding, Horizon Robotics must resort to an IPO to secure funding and sustain its operations. This is both a necessity and an opportunity to enhance its visibility. An early IPO could mark another significant turning point for Horizon Robotics following its partnership with Ideal Auto.

#

Report