Unicorn with 10 billion valuation breaks the curse of breaking the issue, market value exceeds 65 billion

![]() 10/24 2024

10/24 2024

![]() 610

610

“Core” Original — NO.58

The giant unicorn fires the first shot!

Produced by I Xinchao IC

ID I xinchaoIC

Image I unsplash

On October 24, Horizon Robotics, a leading company in autonomous driving technology, officially listed on the Hong Kong Stock Exchange. On the first day of listing, the opening price increased by more than 20%, and the latest market value exceeded 65 billion.

Since Horizon Robotics submitted its prospectus to the Hong Kong Stock Exchange, discussions about the company and the entire industry have not stopped. Horizon Robotics is in the automotive-grade artificial intelligence chip industry. Although it has become the first and largest Chinese company to provide advanced driver assistance systems (ADAS) and high-level autonomous driving solutions for pre-installed mass production every year, it faces competition from NVIDIA, which dominates the market, and other startups and automakers that are accelerating the development of their own automotive-grade AI chips.

However, since its establishment in 2015, Horizon Robotics has secured over 30 Chinese automakers as mass production customers through countless “dirty work.” At the same time, Horizon Robotics is a prominent unicorn in the chip industry. Since its inception, Horizon Robotics has completed 11 rounds of 15 financings, with investors including automotive capital from companies such as SAIC Motor, GAC Capital, Great Wall Motor, Dongfeng Motor, BYD, FAW Group, and Chery Automobile, as well as renowned investment institutions like Sequoia Capital China, Hillhouse Capital, and CICC Capital, and upstream and downstream companies in the domestic and foreign industrial chains such as Intel, SK Hynix, CATL, and Luxshare Precision. As a result, Horizon Robotics is a super unicorn in the autonomous driving sector in recent years.

However, despite Horizon Robotics’ substantial R&D investment over the years, it has yet to achieve profitability, posing a significant challenge for this star company. So, how will Horizon Robotics navigate through the fog? How does the capital market view this giant unicorn wrapped in a golden cloak?

A chip unicorn founded by a top student from Nanjing University

Market value exceeds 65 billion

01

From scientist to businessman: How did Yu Kai complete his transformation?

Yu Kai, a scientist by training, boasts an impressive resume. He studied at the School of Electronic Science and Engineering, Nanjing University, where he earned his bachelor's and master's degrees. In 2004, he obtained his Ph.D. in Computer Science from the University of Munich. After graduation, Yu Kai had a smooth academic career, working at NEC Laboratories America (a leading hub for deep learning research) and later leading the establishment of Baidu Deep Learning Institute at Baidu. He is a renowned international expert in machine learning and a key driver of deep learning technology in China.

In 2015, Yu Kai made a surprising decision that shocked both the academic and entrepreneurial circles. He realized that the revolutionary power of artificial intelligence lies not in software but in new processor architectures. Thus, he founded Horizon Robotics, becoming China's first company to enter the deep neural network chip market from a software algorithm perspective.

One characteristic of scientists-turned-entrepreneurs is their strong technical background but sometimes biased market judgments. When Horizon Robotics was first established, its goal was to become the Intel of the robotic era, focusing on AIoT and automotive businesses. However, as they delved deeper into AIoT, they found that the field was highly fragmented with limited commercial value. In late 2017, Horizon Robotics released its first smart chips: the “Journey” for intelligent driving and the “Rising Sun” for AIoT.

To win over automotive customers, Horizon Robotics had to dive into factories and assembly lines, performing arduous and menial tasks to build a moat.

“It took me five years to finally have an epiphany in 2019,” Yu Kai once admitted in a public speech. In 2018, Horizon Robotics began to feel anxious about commercialization and started supplying chips to autonomous vehicle manufacturers, with the largest customer receiving hundreds of vehicles, each equipped with several chips. During this time, Horizon Robotics had already been working with Changan Automobile for some time.

There was a small episode in Horizon Robotics' cooperation with Changan Automobile. At that time, Changan Automobile was under pressure to transform its business into a smarter model, while Horizon Robotics, though not yet recognized by the industry, was the only company willing to provide free services to Changan. Horizon Robotics stayed in Changan for several months, resting in a nearby playground after late-night work shifts. During breaks, Horizon Robotics' engineers even played soccer matches with Changan employees, fostering a deep bond between the two companies and laying the groundwork for Horizon Robotics' future focus on the automotive sector.

In 2019, Yu Kai made a decisive move to scale back AIoT operations and focus solely on autonomous driving. That year, Horizon Robotics officially announced the mass production of China's first automotive-grade AI chip, the Journey 2. Its first pre-installed chip mass production project was for Changan's popular UNI series, marking the beginning of Horizon Robotics' mass production of automotive-grade AI chips.

In September 2020, Chery Ant, an electric SUV equipped with the Journey 2, was launched, achieving L2+ level autonomous driving. Furthermore, Horizon Robotics has established in-depth partnerships with domestic OEMs such as Changan, SAIC Motor, GAC Motor, FAW Group, NIO, Chery Automobile, and Great Wall Motor, as well as international renowned OEMs and Tier 1 suppliers like Audi and Continental AG, to rapidly build an intelligent automotive chip ecosystem.

Gradually, Horizon Robotics carved out a differentiated path. Yu Kai once positioned the company as follows: “We are the company that understands software algorithms best among chip companies, understands chips best among software algorithm companies, and understands automotive standards best among companies that do both software algorithms and chips.”

Amid a widespread chip shortage, Horizon Robotics entered a high-production period. In January 2020, Horizon Robotics launched the Matrix 2 autonomous driving computing platform, which can be equipped with the Journey 2 automotive-grade chip and combined with deep learning perception technology to provide stable and reliable computing power support for high-level autonomous driving. In September 2020, Horizon Robotics officially released the Journey 3 chip, powered by a new digital engine to boost automotive intelligence. In July 2021, Horizon Robotics unveiled the Journey 5, a high-performance, high-compute chip for vehicle intelligence. The Journey 5 is Horizon Robotics' third-generation automotive-grade product and the first domestic chip to follow the ISO 26262 functional safety certification process and pass ASIL-B certification.

With the launch of the Journey 5, Horizon Robotics also introduced the Matrix 5, a full-scenario intelligent driving computing platform. Equipped with four Journey 5 chips, the Matrix 5 boasts a single-board computing power of 512 TOPS, with a combined power of 1024 TOPS when using two boards. Matrix 5 is an industry-leading central AI computing platform for next-generation software-defined vehicles, aiming to help Tier 1 suppliers, ODMs, and OEMs fully unleash their AI potential and create highly competitive solutions to meet the diverse needs of high-level autonomous driving and multi-modal human-machine interaction (HMI) in smart cockpits. Within a short period, Horizon Robotics completed the hardware design and prototype production of four reference designs based on Matrix 5 with four Tier 1 and ODM launch partners: Continental AG, Neusoft Reach Auto Electronics, Luxshare Precision, and Liancheng Kaituo.

This year, Horizon Robotics also unveiled the Journey 6 series, a new generation of in-vehicle intelligent computing solutions, and the Horizon SuperDrive full-scenario intelligent driving solution. At the launch event, Horizon Robotics (Horizon Robotics) announced ten initial mass production partners for the Journey 6 series, including SAIC Motor, Volkswagen Group, BYD, NIO, GAC Motor, Deep Blue Automobile, Beijing Automotive Group, Chery Automobile, EXEED, and Voyah Automobile. Additionally, the Journey 6 series is set to deliver its first pre-installed mass production model in 2024 and is expected to achieve mass production of over 10 models by 2025.

From technology to engineering and then to large-scale mass production, this journey is fraught with pain and struggle, naturally requiring the accumulation of forward-looking algorithms and hardware computing facilities. In the end, Horizon Robotics rose to the top through its chips and customer satisfaction. In November 2022, Horizon Robotics completed its Series D funding round, with a post-investment valuation of US$8.71 billion, equivalent to approximately RMB 62 billion.

During this process, Yu Kai also transformed into a businessman while retaining his scientific foundation. Looking ahead, he remains acutely aware: “In the rare window of opportunity for the development of the intelligent automobile industry, China has a great chance to give birth to world-class Windows, world-class operating system companies, and world-class chip companies.” As a participant in the commercial world, Yu Kai may hope that Horizon Robotics can become that world-class chip company.

Losing 17 billion in three years

How does Horizon Robotics make money?

02

What gives Horizon Robotics the confidence to become a great company?

Horizon Robotics positions itself as a supplier of advanced driver assistance systems (ADAS) and high-level autonomous driving (AD) solutions for passenger vehicles. It can either work directly with OEMs (original equipment manufacturers) or through Tier 1 suppliers to integrate its products into mass-produced vehicles.

The prospectus also reveals that as of the last practicable date, Horizon Robotics' hardware-software integrated solutions have been adopted by 24 OEMs (31 OEM brands), equipping over 230 models, including mainstream automakers such as Volkswagen, SAIC Motor, BYD, Geely, NIO, and Xpeng, as well as multinational component giants like Bosch and ZF.

According to data from Zhuo Zhi Consulting, Horizon Robotics is the second-largest ADAS solution provider for domestic OEMs in China in terms of installed capacity in 2023, with a market share of 21.3%. It is emphasized that as of December 31, 2023, all of the top ten Chinese OEMs are Horizon Robotics' customers. It is evident from the customer base that Horizon Robotics' revenue primarily comes from automotive solutions, accounting for 87.9%, 88.5%, and 94.8% of total revenue in 2021, 2022, and 2023, respectively. The total revenue generated by the top five customers in 2021-2023 was RMB 283 million, RMB 482 million, and RMB 1.067 billion, respectively, accounting for 60.7%, 53.2%, and 68.8% of total revenue. Among them, the largest customer accounted for 24.7%, 16.0%, and 40.4% of revenue, respectively. Horizon Robotics' revenue in 2021-2023 was RMB 467 million, RMB 906 million, and RMB 1.552 billion, respectively.

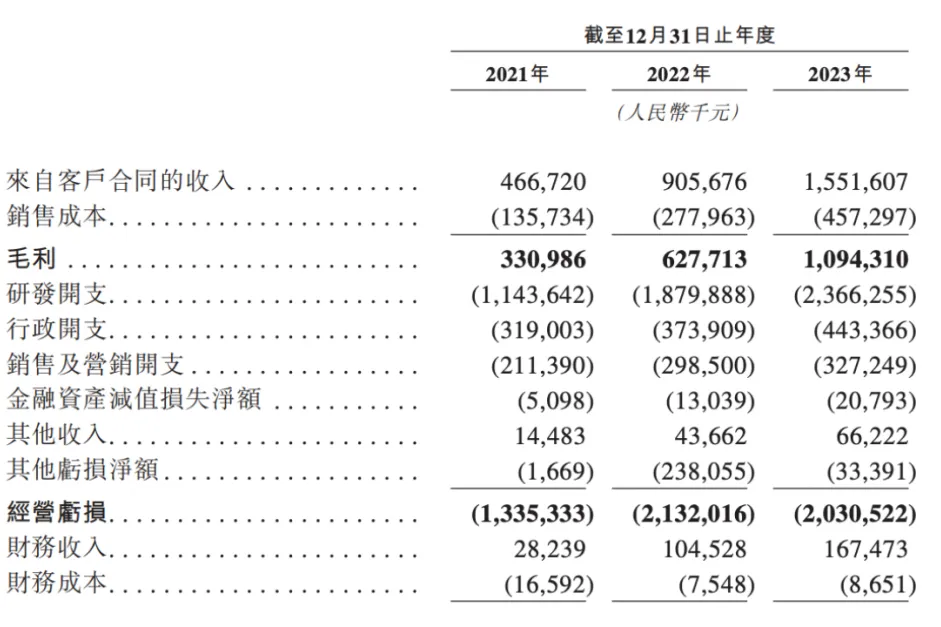

As revenue continues to grow, so does Horizon Robotics' gross margin, which remains high and stable. From 2021 to 2023, Horizon Robotics' gross profit was RMB 331 million, RMB 627 million, and RMB 1.094 billion, respectively; gross margins were 70.9%, 69.3%, and 70.5%, respectively. Licensing and services are the primary support for Horizon Robotics' high gross margin. Specifically, Horizon Robotics licenses algorithms + software + development toolchains to customers, enabling them to develop customized applications. Simultaneously, Horizon Robotics provides design and services to help customers integrate its solutions into their vehicles.

However, Horizon Robotics is not immune to the common problem of bleeding while going public as a chip company. According to the prospectus, Horizon Robotics' net losses for 2021-2023 were RMB 2.064 billion, RMB 8.72 billion, and RMB 6.739 billion, respectively; adjusted net losses were RMB 1.103 billion, RMB 1.891 billion, and RMB 1.635 billion, respectively. It can be seen that the economies of scale in Horizon Robotics' business have yet to be unleashed, and losses continue to increase. The primary cause of the losses points to substantial R&D expenditures. From 2021 to 2023, Horizon Robotics' R&D expenditures were RMB 1.14 billion, RMB 1.88 billion, and RMB 2.366 billion, respectively, far exceeding its total revenue. As of the end of 2023, Horizon Robotics had 1,478 full-time R&D personnel, accounting for 71.5% of its total workforce.

Fortunately, adjustments to the Hong Kong Stock Exchange rules have provided Horizon Robotics with an opportunity to list on the exchange. On March 31, 2022, the Hong Kong Stock Exchange added Chapter 18C to its Main Board Listing Rules, introducing a listing mechanism for specialized technology companies, allowing technology companies with no revenue or profit to list in Hong Kong. This new rule applies to companies in five specialized technology sectors: new-generation information technology, advanced hardware, advanced materials, new energy and energy conservation, and new food and agricultural technology. Horizon Robotics falls into this category.

However, going public is just the beginning for Horizon Robotics. Its mission is to make global OEMs and Tier 1 suppliers more competitive in China and globally. As Yu Kai wrote in his social media post: “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Luxurious shareholder lineup

Is it a beginning or an end?

03

As a star unicorn, how luxurious is Horizon Robotics' investor lineup?

Since its inception, Horizon Robotics has completed 11 financing rounds, raising a cumulative total of over US$3.4 billion (approximately RMB 23.9 billion). Its investor lineup includes both top VC/PE firms such as Yunfeng Capital, Matrix Partners China, Sequoia Capital China, Hillhouse Capital, and Blackstone, as well as a host of industrial investors from upstream and downstream of the automotive industry, including SAIC Motor, GAC Motor, Great Wall Motor, BYD, FAW Group, Intel, CATL, Luxshare Precision, Xingyu Auto Parts, Well Lead Electronics, and Sunny Optical Technology.

Horizon Robotics' shareholder list is extensive, and the stories behind it are equally fascinating. As a renowned scientist in the industry, investors flocked to Yu Kai as soon as news of his entrepreneurial venture surfaced, actively offering term sheets. While this scenario may seem exaggerated, it is precisely what happened to Horizon Robotics.

At the time, many investors did not fully understand Horizon Robotics' chosen technological path, but they still chose to believe in the founder. Just two months after its establishment, Horizon Robotics completed a seed round of financing of approximately US$15 million, with investors including Sequoia Capital China, Hillhouse Capital, Matrix Partners China, Linear Venture Partners, CATL, and Dongfeng Motor Group, valuing the company at approximately US$121 million.

Among them, Hillhouse Capital was not only an early and steadfast supporter but also provided direct assistance in subsequent financing rounds and international expansion. Matrix Partners China not only invested multiple times but also maintained frequent communication with Yu Kai, proactively offering various forms of help.

At that time, Horizon Robotics caught the wave of fervent chip investments, and each financing round progressed smoothly. In October 2017, Horizon Robotics completed its Series A+ round of financing led by Intel, with participation from investors such as Hillhouse Capital, Matrix Partners China, Linear Venture Partners, and Harvest Capital Management. In November 2018, Horizon Robotics completed its Series B round of financing totaling over US$400 million, with investors including SK Hynix, Oceanwide Holdings, Matrix Partners China, Hillhouse Capital, Linear Venture Partners, and Sunqi Capital.

Many investors need to try every means to get a share of Horizon Robotics. "Investors with purely financial backgrounds have difficulty getting a share, and industrial capital has more advantages." In 2021, Horizon Robotics completed a super luxurious Series C funding round with a total of 7 rounds, with more than 35 known investment institutions, almost covering the most active industrial capital and leading financial investment institutions at that time.

But the story is far from reaching its climax. In November 2022, Horizon Robotics completed a US$210 million Series D funding round with investors including Shangqi Capital and Volkswagen, and its valuation reached US$8.71 billion (approximately RMB 60.97 billion). The presence of Volkswagen gave this super-giant unicorn even more confidence to pursue an IPO.

In October 2022, Volkswagen's software company CARIAD joined hands with Horizon Robotics to establish a joint venture; in December 2023, CoreChip, the joint venture between Horizon Robotics and Volkswagen CARIAD, was officially established. Therefore, Volkswagen has not only become a shareholder of Horizon Robotics but also an important customer and main source of revenue for the company. In 2023 and up to the first half of 2024, after deducting unrealized gains and losses from transactions with CoreChip, Horizon Robotics' revenue from CoreChip amounted to RMB 627.3 million and RMB 351.6 million, respectively, accounting for 40.4% and 37.6% of total revenue.

Although Volkswagen has supported half of Horizon Robotics' operations, it also leaves hidden concerns. Horizon Robotics' dependence on a single major customer can become a risk factor for investors assessing its investment value. This is also an issue that Horizon Robotics needs to address after going public.

Now, Horizon Robotics has successfully broken the curse of breaking even, setting a good example for other unicorns in urgent need of funding. However, the future market will still be a battlefield for a few players. The once-glorious financing stories have become history, leaving behind expectations for exits and down-to-earth efforts and refinement.

Disclaimer:

1. The content of this article is original to Xinchao IC and is for reference only. It does not constitute any investment advice. The information cited in the article is sourced from publicly available market data, and our company does not guarantee the accuracy or completeness of the cited information.

2. This article may not be reprinted, copied, published, quoted, or referred to without permission. For reprinting, please contact us.