Yu Kai wins big at Hong Kong stock market bell ringing, Horizon Robotics opens with a surge of up to 38%

![]() 10/24 2024

10/24 2024

![]() 570

570

Horizon Robotics officially listed on the Hong Kong stock market, opening for trading as scheduled on October 24 at the Hong Kong Stock Exchange, with stock code 9660.

Clearly, Horizon has had a very good start, with the opening share price at HK$5.12 per share, an increase of over 28% from the offer price of HK$3.99 per share.

In fact, signs of this positive start had already emerged. Just the day before the listing, Horizon's share price rose to HK$5.21 per share in pre-IPO trading, an increase of over 30% from the offer price, closing at HK$5.02 per share with an increase of over 25%.

In the final placement results announced by Horizon, the final public subscription multiple reached 33.83, reflecting investors' optimism about its prospects. Thus, Horizon's journey towards its IPO has come to an end. Based on the final offer price and issue size, Horizon's Hong Kong IPO raised a total of HK$5.406 billion (approximately RMB 5 billion), with an IPO market value of HK$52 billion (approximately RMB 47.7 billion).

However, after the IPO, Horizon must embark on a long journey to prove its commercial value. As Horizon's founder and CEO Yu Kai puts it:

"If Horizon cannot support a very high ceiling for intelligent driving, its entire business ecosystem will not be sustainable."

And now, with high losses and a rapid burn rate, it is clear that the road ahead remains bumpy. The IPO is just the beginning.

01 Opening surge of over 28%, Horizon's low-open-high-close trajectory

Describing Horizon's IPO trajectory as low-open-high-close is quite apt.

In fact, during the pricing stage of this IPO, Horizon demonstrated some caution and conservatism. Based on the previously announced offer price range of HK$3.73 to HK$3.99 per share, its maximum IPO valuation would be less than RMB 50 billion.

However, this number is significantly lower than Horizon's post-investment valuation of over RMB 60 billion in its final round of funding. Nevertheless, for investors, this valuation of RMB 60 billion seems quite acceptable.

Horizon's opening share price performance

Market news showed that on October 24, Horizon's shares opened at HK$5.12 per share, an increase of over 28% from the offer price of HK$3.99 per share, with a market value of approximately RMB 61 billion.

Within the first hour of trading, its share price rose to a high of HK$5.5 per share, representing a maximum increase of 38%.

Horizon's subscription situation, as outlined in its Hong Kong Stock Exchange filings, also pointed to this surge. According to the filings, since the start of subscriptions on October 16, Horizon's public subscription multiple reached 33.83, while the international placement subscription multiple exceeded 13.

This subscription situation underscores the market's optimism about this new stock.

Ultimately, the hammer fell, and in this IPO, Horizon successfully raised HK$5.406 billion (approximately RMB 5 billion) at an offer price of HK$3.99 per share and an issue size of 1.355 billion shares.

Why are investors optimistic?

To a large extent, this has a lot to do with Horizon's internal factors.

02 Horizon's main business lines show positive trends

According to the prospectus, Horizon's business performance over the past three and a half years, including revenue fundamentals and customer situations, takes up a significant portion of the document and shows an overall positive trend.

From 2021 to 2023, Horizon's revenue grew from RMB 467 million to RMB 906 million and then to RMB 1.552 billion, with a compound annual growth rate of over 82.3%. In the first half of this year, revenue was RMB 935 million, up 151.6% year-on-year and 152% compared to the same period last year.

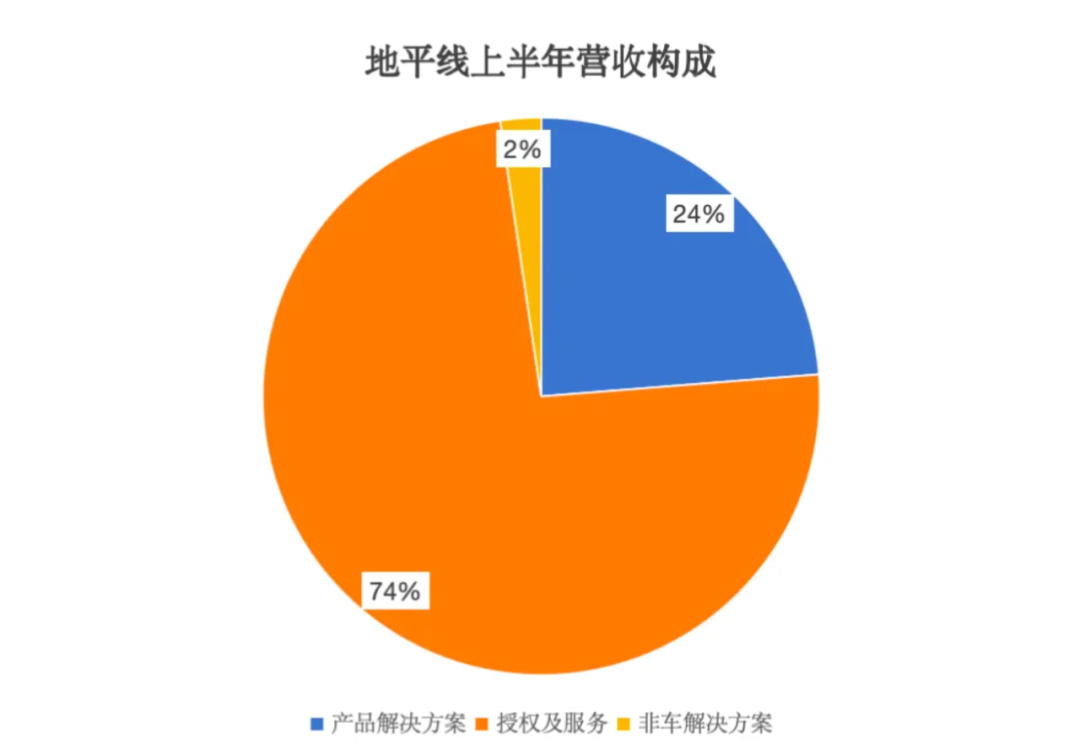

Among them, Horizon's automotive solutions accounted for the majority of its revenue, with the proportion rising from 87.9% in 2021 to 94.8% in 2023. In the first half of this year, this figure reached 97.7%.

This trend is largely driven by the licensing and service business within its automotive solutions. Data shows that in the first half of this year, Horizon's licensing and service revenue reached RMB 691 million, an increase of 351.6% from RMB 153 million in the same period last year, accounting for 73.9% of its total revenue for the first half of the year.

In fact, Horizon's licensing and service business has been growing rapidly since the second half of last year. During this period, this business contributed RMB 811 million in revenue to Horizon, almost double that of 2022. Volkswagen played a significant role in this rapid growth of licensing and service business.

Horizon and Volkswagen establish a joint venture

In 2023 and the first half of this year, the joint venture between Horizon and Volkswagen generated licensing revenue of RMB 627 million and RMB 351 million, respectively. Volkswagen's revenue contribution has also increased Horizon's dependence on this single major customer.

Data shows that in the first half of this year, Horizon's top five customers accounted for 77.9% of its revenue, an increase of 9.1 percentage points from the previous year. It is worth noting that in 2021 and 2022, before Volkswagen generated revenue, this figure was 60.7% and 53.2%, respectively.

The dependence on this single largest customer (as a percentage of revenue) has risen from 24.7% in 2021 to 37.6% in the first half of this year. This single largest customer is still the joint venture established with Volkswagen.

Horizon's gross margin level

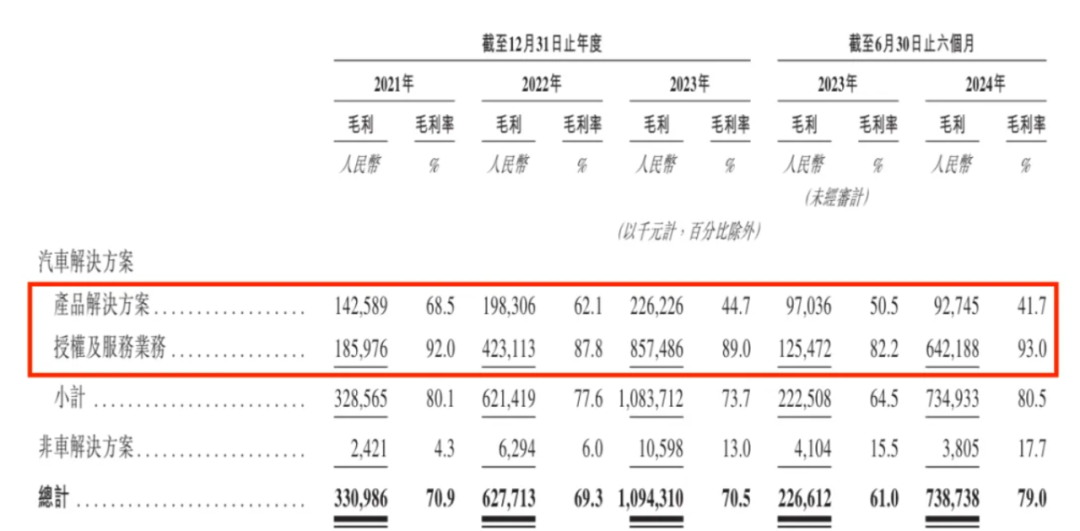

In addition to revenue, Horizon's gross margin improved significantly due to its licensing and service business. From 2021 to 2023, gross margins were RMB 331 million, RMB 628 million, and RMB 1.094 billion, respectively. In the first half of 2024, gross margin reached RMB 739 million, an increase of 226% year-on-year.

The gross margin increased from 70.9% in 2021 to 79% in the first half of this year.

Regarding this, Horizon stated in its prospectus that the fulfillment costs of providing services to customers in the licensing and service business are relatively low, making the increase in this business the primary reason for the rise in gross margin levels.

However, Horizon is still incurring losses. In the first half of this year, it incurred a net loss of RMB 5.098 billion, an increase of over 170% year-on-year. However, after deducting non-operating items such as preferred shares and other financial liabilities, and equity-based compensation, its adjusted net loss for the first half of the year was RMB 804 million, a decrease of nearly RMB 200 million from the same period last year.

Intense R&D expenditure is the primary factor contributing to Horizon's continuous losses. In the first half of this year, its R&D expenditure was RMB 1.42 billion, an increase of 35.3% year-on-year. Coupled with cumulative investments over the past three years, Horizon's R&D expenditure has exceeded RMB 6.8 billion.

With positive trends in its main business lines and narrowing losses, Horizon is in a good position.

Some of Horizon's customers

Meanwhile, Horizon's customer base is steadily growing. The latest data shows that as of the last practical date, Horizon's hardware and software integrated solutions had been adopted by 27 OEMs (with 42 OEM brands adopting them), equipped in over 285 models, an increase of 55 models from the data submitted in the prospectus earlier.

In terms of market share, according to Gaogong data, Horizon ranked first with a 28.65% market share in intelligent driving solutions for self-owned brand passenger vehicles in the Chinese market in the first half of this year, and also led the forward-looking integrated computer solution market (L2 ADAS) with a 33.73% market share.

In terms of products, Horizon's computing hardware includes Journey 2, Journey 3, and Journey 5, with the Journey 6 series (including six chip models) launched in April this year ahead of the Beijing Auto Show. Based on this series of intelligent driving chips, Horizon has developed a range of intelligent driving software solutions from low to high levels, such as Horizon Mono based on Journey 3 and Horizon Pilot based on Journey 5.

Horizon's product overview

The latest product is the Horizon SuperDrive all-scenario urban NOA solution based on Journey 6P (the most powerful chip in the Journey 6 series, capable of supporting high-level autonomous driving according to Horizon's specifications).

It is reported that this product implements end-to-end large models at the perception level, enabling high-level autonomous driving functions in all urban, highway, and parking scenarios.

In terms of funding, the prospectus shows that since its establishment in 2015, Horizon has completed 11 rounds of funding, raising a cumulative total of over US$3.4 billion (approximately RMB 23.9 billion). After its final round of funding, its valuation reached US$8.17 billion (approximately RMB 58.5 billion).

Investors come from diverse backgrounds, including mainstream automakers such as SAIC, BYD, and Volkswagen, as well as industry players like CATL and Intel.

In terms of equity, the core founding team, including CEO Yu Kai, CTO Huang Chang, and COO Tao Feiwen, hold 14.85%, 3.35%, and 1.45% of the company's share capital, respectively.

03 The IPO is just the beginning, and the journey continues

In March this year, when Horizon officially submitted its prospectus to the Hong Kong Stock Exchange, signaling the start of its IPO, Yu Kai wrote in his social media post:

"This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

From the current reality faced by Horizon, this description is quite apt.

Horizon's market share

On the one hand, Horizon's journey from 0 to 1 can be considered complete, and it has done so quite impressively. One piece of evidence is its market share, as mentioned earlier, where in the first half of this year, Horizon ranked first with a 28.65% market share in intelligent driving solutions for self-owned brand passenger vehicles in the Chinese market, and also led the forward-looking integrated computer solution market (L2 ADAS) with a 33.73% market share.

In other words, since its establishment in 2015, Horizon has surpassed traditional giants like Mobileye, at least in the domestic market and the low-level L2 autonomous driving assistance market.

Yu Kai, Founder and CEO of Horizon

On the other hand, in terms of Horizon's goals or ambitions, the road ahead is still quite long, especially for high-level intelligent driving and even autonomous driving.

At a previous Horizon technology open day, Yu Kai expressed his ambition to become a "world-class benchmark" in intelligent driving and to "break through the ceiling".

The key to achieving this goal is its newly launched Horizon SuperDrive all-scenario urban NOA solution, which targets the end-to-end urban NOA phase that is currently being implemented by leading players in the market.

Horizon has high expectations for this solution, as it is no longer just a showcase software solution but is being implemented as a shelf product directly with automakers.

However, mass production of this solution is not expected until 2026, which is nearly two years later than the market.

How will the market change in these two years? How will Horizon respond to these changes and keep up the pace? Finally, how will it become the benchmark?

Horizon will need to provide answers in the future.