Horizon Robotics' IPO in Hong Kong with a valuation exceeding RMB 60 billion, is the domestic smart driving industry about to usher in a boom period?

![]() 10/25 2024

10/25 2024

![]() 416

416

LAIKA

2024/10/24

How does Horizon Robotics, favored by all parties, actually perform

Horizon Robotics-W (09660.HK), a leading domestic smart driving technology company, officially launched its IPO process in Hong Kong on October 16. It is understood that Horizon Robotics plans to issue approximately 1.355 billion shares globally, with approximately 136 million shares publicly offered in Hong Kong, accounting for approximately 10%, and approximately 1.22 billion shares allocated internationally, accounting for approximately 90%. Additionally, there is a 15% greenshoe option. Goldman Sachs, Morgan Stanley, and CSC International are the joint sponsors.

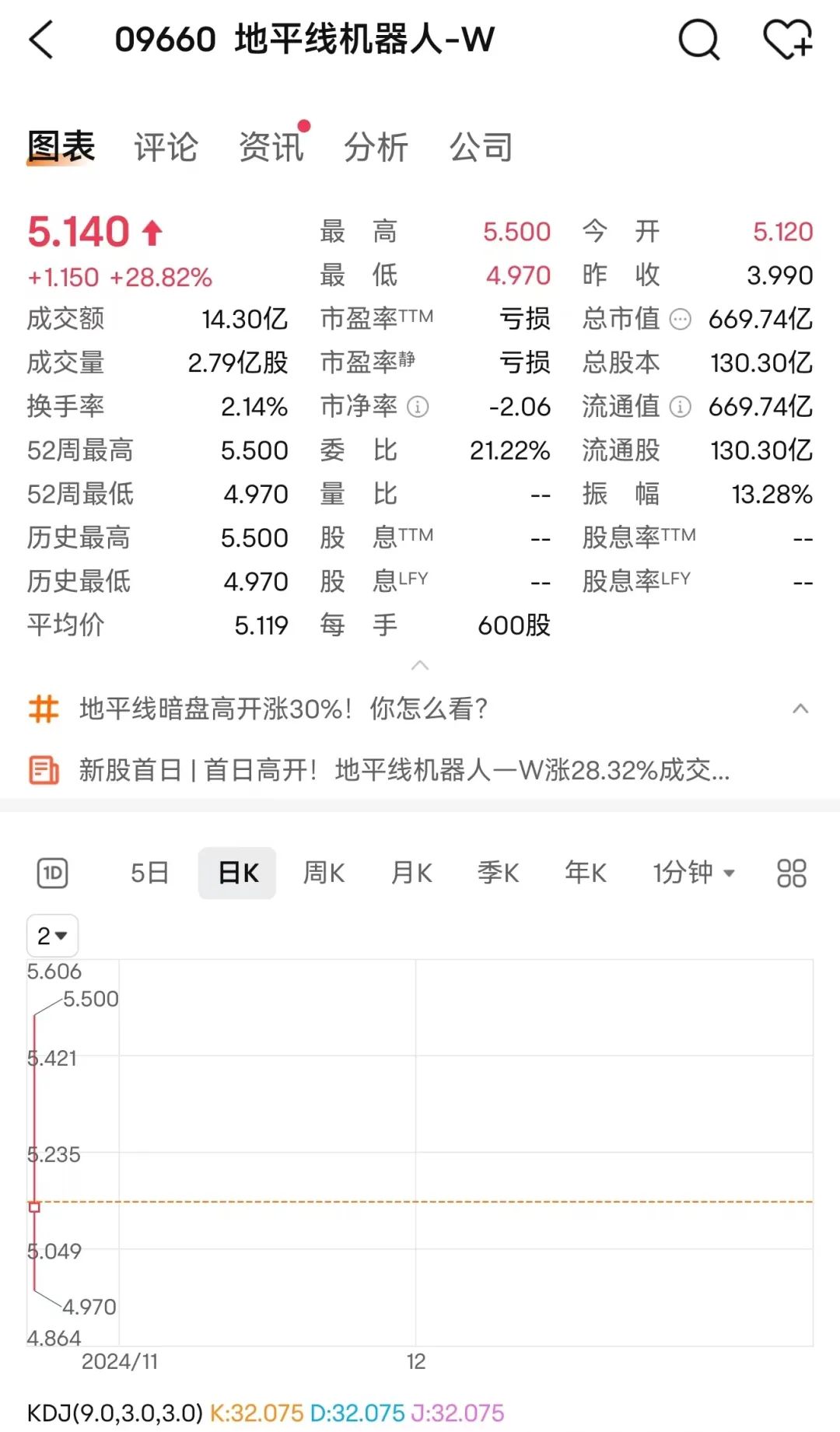

On the first day of listing on October 24, Horizon Robotics opened 28.32% higher, and its share price once reached HK$5.5, significantly exceeding the previously estimated offer price range of HK$3.73-3.99, demonstrating the strong appeal of domestic substitution to the market.

According to other reports, during the IPO period, Horizon Robotics has attracted enthusiastic participation from many well-known institutional investors both domestically and internationally. Alibaba, Baidu, DHL Express, and a Ningbo municipal government fund have joined as cornerstone investors, subscribing to a total of approximately US$220 million (approximately HK$1.7 billion).

01

How does Horizon Robotics, favored by all parties, actually perform

According to the prospectus, Horizon Robotics has been attracting attention from both capital and automakers since its inception, having received eleven rounds of investment from investors including Intel, Matrix Partners China, Sequoia Capital, CATL, and automakers such as SAIC Motor, GAC Motor, Great Wall Motor, BYD, and FAW Group. It has raised over US$3.4 billion in total funding. The latest round of funding was disclosed in September 2022 as a strategic investment from Chery Automobile, with a post-investment valuation of US$8 billion.

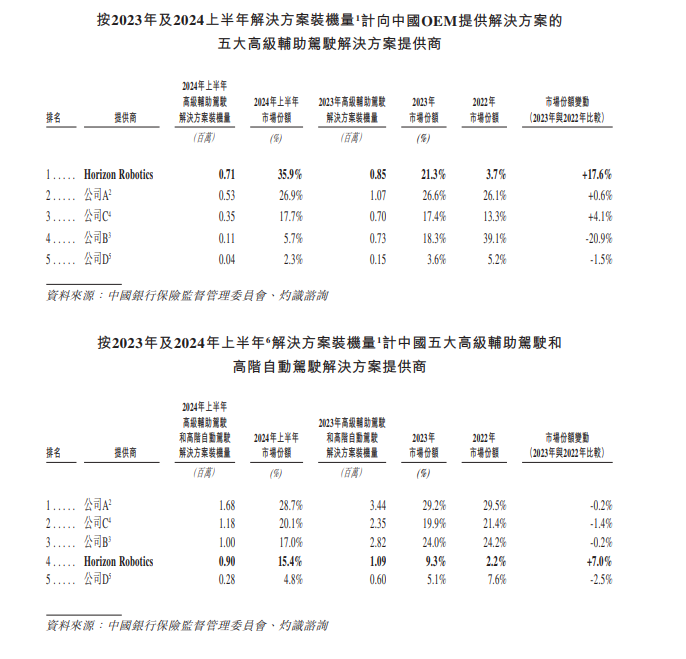

The reason for Horizon Robotics' widespread market attention lies primarily in its strong capabilities. According to the prospectus, the company is a market-leading provider of solutions for advanced driver assistance systems (ADAS) and advanced driving (AD) for passenger vehicles. Since 2021, when it began mass-producing solutions on a large scale, Horizon Robotics has been the first and largest Chinese company to provide pre-installed, mass-produced advanced ADAS and AD solutions annually, based on the total installed capacity of solutions. In terms of total installed capacity of solutions in 2023 and the first half of 2024, the company ranks fourth among all global ADAS and AD solution providers in China, with market shares of 9.3% and 15.4%, respectively. As a tier-two supplier, it boasts a vast global customer base, including leading OEMs and domestic automotive manufacturing tier-one suppliers.

Horizon Robotics' advanced ADAS and AD solutions are built on a comprehensive technology stack that encompasses algorithms for driving functions, underlying processing hardware, and various tools to facilitate software development and customization. The company adopts a hardware-software integration development concept, and by providing flexible business models and open, easy-to-use development tools, its ecosystem partners can accelerate the large-scale development and mass production of smart driving solutions. Currently, the company's hardware-software integrated solutions have been adopted by 27 OEMs (42 OEM brands), equipping over 285 models. All of China's top ten OEMs have selected these solutions for mass production of passenger vehicles. As of December 31, 2021, 2022, and 2023, and June 30, 2024, the company had secured a total of 44, 101, 210, and 275 model designations (excluding terminated projects), respectively. In 2023 alone, the company secured cooperation for over 100 new models.

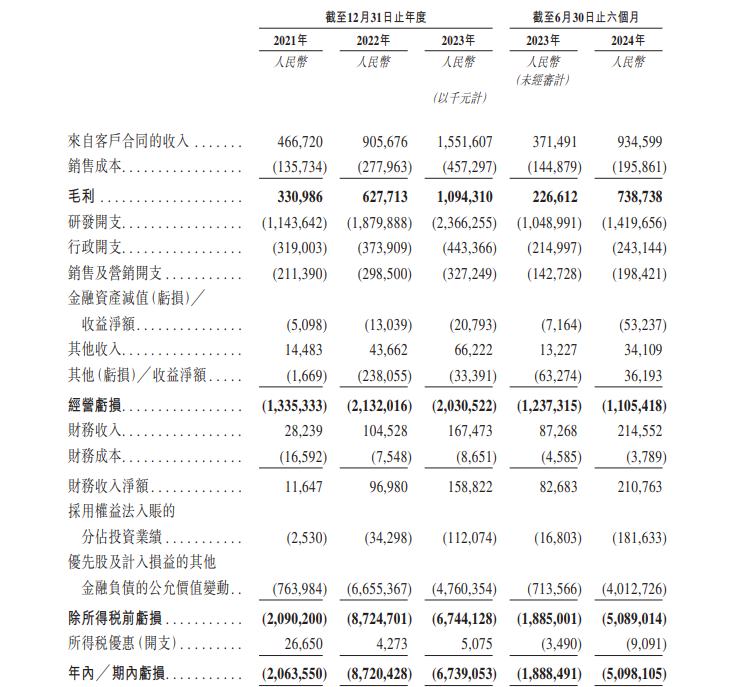

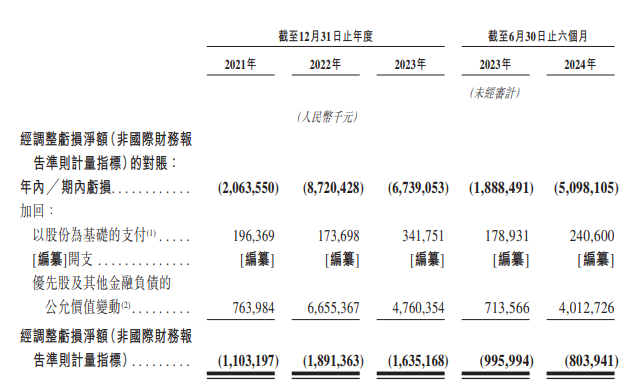

In terms of financial data, Horizon Robotics' prospectus reveals the latest figures for the first half of 2024, with some impressive results. In the first half of 2024, revenue from customer contracts amounted to RMB 935 million, representing a 152% increase from RMB 371 million in the same period last year. Gross profit for the first half of the year was RMB 739 million, with a gross margin of 79%, compared to RMB 227 million in the same period last year.

In terms of operating losses, Horizon Robotics has been working to continuously reduce them in recent years. After adjustments, the first half-year loss was RMB 804 million, further reduced from RMB 996 million in the same period last year.

Regarding financial data and future profitability prospects, Horizon Robotics has provided further explanations in its prospectus. In the coming years, the company plans to achieve break-even and profitability by implementing measures such as expanding revenue scale, maintaining gross margin levels, and improving operating leverage. The current losses are primarily due to the company's need for significant upfront investments to gain market share, and it is expected that economies of scale will be achieved as the business expands.

02

Is smart driving about to usher in a boom period?

Horizon Robotics, which is not yet profitable, repeatedly mentions in its prospectus that the company's business scale will maintain long-term high growth in the future. Is this the company's grasp of the future market or merely a grandiose promise to investors? Let's take a look at the overall development of the automotive market.

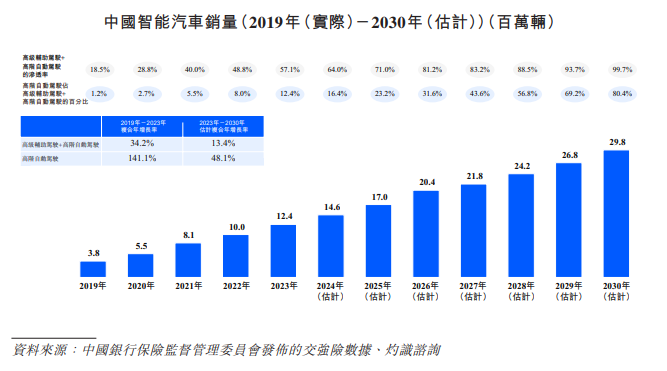

Globally, the number of smart cars is growing rapidly, especially those equipped with smart driving capabilities. In 2023, approximately 39.5 million of the 60.3 million new passenger vehicles sold worldwide were smart cars with driving automation capabilities, representing a penetration rate of 65.6%. It is projected that by 2026 and 2030, smart car sales will further increase to 55.9 million and 81.5 million units, respectively, with penetration rates of 80.3% and 96.7%, respectively. Additionally, advanced driving automation solutions are expected to gradually become mainstream. According to Frost & Sullivan, by 2030, advanced driving automation solutions will account for over 60% of the driving automation solutions market.

China is the world's largest market for new passenger vehicles, with 21.7 million new passenger vehicles sold in 2023, of which 12.4 million were smart cars, representing a penetration rate of 57.1%. According to Frost & Sullivan, it is projected that by 2026 and 2030, smart car sales in China will reach 20.4 million and 29.8 million units, respectively, with penetration rates of 81.2% and 99.7%, respectively. Chinese OEMs, especially those in the new energy vehicle sector, are leading the trend in adopting advanced driving automation solutions. It is projected that by 2027, nearly half of the driving automation solutions deployed in Chinese passenger vehicles will be advanced solutions, and by 2030, this proportion will further increase to over 80%, significantly outpacing the global penetration rate of advanced driving automation solutions. According to Frost & Sullivan, domestic OEMs typically update their models every 3-4 years and introduce new generations every 5-6 years.

In other words, smart driving technology will be the mainstream trend in the automotive industry both globally and domestically.

For consumers, smart driving is no longer as mysterious or expensive as it once was. An increasing number of new vehicles are being equipped with basic L2-level smart driving assistance. The so-called L2 level refers to a system that continuously performs lateral and longitudinal motion control of the vehicle during dynamic driving tasks under its design operating conditions and possesses partial object and event detection and response capabilities compatible with the lateral and longitudinal motion control being performed. The driver and the system jointly perform all driving tasks. Currently, the ADAS (Advanced Driver Assistance Systems) provided by Horizon Robotics falls under the L2 level category.

More advanced smart driving services, such as L2+, L3, and L4, are no longer a pipe dream. Currently, domestic new energy vehicles priced between RMB 200,000 and RMB 300,000 are already using advanced smart driving as a selling point, with brands like Huawei AITO, AVATR, Xiaomi, and XPeng leading the way. Consumers' willingness to pay for domestic vehicles after experiencing current smart driving levels speaks volumes about the advanced nature of this technology. Five years ago, this price range was dominated by joint venture brands, with domestic vehicles mostly priced below RMB 200,000. It can be said that smart driving technology has also elevated the status of domestic brands.

Although advanced smart driving is still confined to vehicles priced above RMB 200,000, through technological iteration and economies of scale, it is inevitable that advanced smart driving will eventually be accessible to ordinary vehicles, becoming part of everyday consumer spending. Chinese consumers have a high acceptance and strong preference for automated features. According to Frost & Sullivan, a 2022 consumer survey revealed that, when considering the purchase of a new energy vehicle, driving automation is the second most important factor after price and performance ratio. Therefore, the Chinese market will be a key battleground for smart driving in the future.

Horizon Robotics is the only Chinese company among the top five providers of advanced ADAS and AD solutions in China. According to Frost & Sullivan, based on installed capacity in 2023 and the first half of 2024, the company is the second-largest and largest provider of advanced ADAS solutions to domestic OEMs in China, with market shares of 21.3% and 35.9%, respectively. Similarly, in terms of total installed capacity of solutions in 2023 and the first half of 2024, the company ranks fourth and first among advanced ADAS and AD solution providers in China, with market shares of 9.3% and 15.4%, respectively.

It can be said that the global smart driving market is indeed ushering in a boom period, and Horizon Robotics has seized a certain opportunity. Whether the company can maintain its strong competitive advantage after going public, as stated in its prospectus, remains to be tested by the market.

Conclusion

Horizon Robotics' Hong Kong IPO undoubtedly positions it at the forefront of the smart driving era. Relying on its deep technological accumulation, capital support, and extensive industrial cooperation, its growth trajectory outlines a blueprint for the rise of domestic smart driving. Driven by the global automotive intelligence wave and the demand for advanced driving automation in the Chinese market, Horizon Robotics has not only seized the initiative but also won market recognition with its innovative hardware-software integration model. However, going public is merely a new starting point, and the challenge of balancing expansion and profitability will test its strategic resilience. As the smart driving boom gathers momentum, whether Horizon Robotics can emerge as a leader in Chinese smart driving technology and ultimately realize this vision will depend on the passage of time and the test of the market.