"AI chip first stock", soared 156.5 billion yuan

![]() 10/25 2024

10/25 2024

![]() 620

620

In just two years, Cambrian Genomics, hailed as the "first AI chip stock", staged a stunning comeback.

Standing at the forefront of AI, Cambrian Genomics has finally managed to temporarily shake off its crisis.

However, in the long run, no matter how popular the concept is, performance is ultimately what counts. And judging from Cambrian Genomics' current financial performance, there is no sign of turning around its losses.

From a capital market perspective, if Cambrian Genomics fails to seize the opportunity to turn around its losses after the AI boom subsides, it is highly likely that it will once again be "abandoned" by the capital market.

Of course, the market has not been entirely unkind to Cambrian Genomics; it's just that the company failed to seize the previous opportunity.

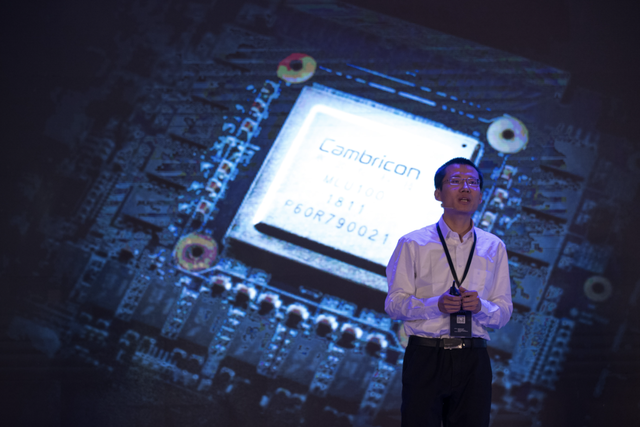

As everyone knows, Cambrian Genomics was once a dazzling "rising star" in China's chip industry, with high hopes placed on its star founder, Chen Tianshi. As a genius in the chip industry, founder Chen Tianshi and his brother Chen Yunji attracted close market attention from the very beginning of their entrepreneurial journey. Chen Tianshi's rapid entry into the industry was largely due to his brother's influence.

In 2015, Chen Tianshi and his team developed the world's first prototype chip dedicated to deep learning. Due to the cutting-edge nature of the project at the time, commercialization posed significant challenges. It was not until 2016, with the support of the investment management platform of the Chinese Academy of Sciences' Institute of Computing Technology, that Chen Tianshi co-founded Beijing Cambrian Genomics Technology Co., Ltd. with the Chinese Academy of Sciences.

Shortly after its establishment, the company quickly caught the eye of Huawei.

At that time, Huawei's market team approached Chen Tianshi to inquire about the possibility of combining AI with smartphone chips, which inspired Chen Tianshi greatly. He adjusted his early-stage chip and sold it to Huawei. With Huawei on board, Cambrian Genomics began to ride the wave of success. In September 2017, Huawei unveiled the world's first AI-powered smartphone chip, the Kirin 970, at a conference in Germany. With its integration of Cambrian Genomics' 1A processor, Cambrian Genomics achieved legendary status in the industry.

It is worth noting that at that time, Cambrian Genomics' primary source of revenue was IP licensing, which laid the groundwork for its future downfall.

In 2020, Cambrian Genomics, once the pride of the industry, made its debut on the STAR Market, becoming the de facto "first AI chip stock." Tragically, soon after its listing, Cambrian Genomics lost its largest customer, Huawei. The impact of this event on Cambrian Genomics is still being felt to this day.

Due to limited revenue growth, Cambrian Genomics' share price embarked on a two-year downward spiral, with declines exceeding 80% at one point. Fortunately, just as Cambrian Genomics teetered on the brink of danger, the global AI boom arrived.

Amid the global AI boom, Cambrian Genomics once again caught the eye of investors. According to statistics, since mid-2022, Cambrian Genomics' share price has soared from a low of 46.59 yuan per share (adjusted for splits) to a high of 503.33 yuan per share in just two years, representing an increase of over 1000% and a surge in market value of over 190 billion yuan. As of the latest close, the company's share price remains over 156.5 billion yuan above its lowest point.

For the time being, Cambrian Genomics' crisis has been temporarily averted, but its continuous losses have become an inescapable issue. If the company fails to turn around its losses, the "bubble" surrounding Cambrian Genomics will quickly burst once the AI boom subsides.

Continuous Losses

A review of Cambrian Genomics' financial statements reveals that its sustained and substantial R&D investments are the root cause of its long-term losses.

Compounding Cambrian Genomics' woes is its stagnant revenue scale.

According to financial statements, Cambrian Genomics' revenue from 2019 to 2023 was 444 million yuan, 459 million yuan, 721 million yuan, 729 million yuan, and 709 million yuan, respectively. This indicates that from 2021 to 2023, Cambrian Genomics' revenue remained stagnant and even showed a downward trend.

In contrast, its net profit losses for the same period were 1.179 billion yuan, 435 million yuan, 825 million yuan, 1.256 billion yuan, and 848 million yuan, respectively.

According to Cambrian Genomics' financial statements, its performance is expected to deteriorate further in mid-2024. In the first half of the year, its revenue was 64.7653 million yuan, a year-on-year decrease of over 43%; its net loss was 530 million yuan, with no sign of narrowing.

It is thus evident that losses have become the norm for Cambrian Genomics. Furthermore, due to the impact of the interest rate hike cycle, market financing has become more difficult, putting Cambrian Genomics on the brink of danger.

Cambrian Genomics' long-term losses combined with stagnant revenue growth have resulted in an unfavorable operating cash flow. According to financial statements, Cambrian Genomics' operating cash flow from 2021 to 2023 was -873 million yuan, -1.33 billion yuan, and -596 million yuan, respectively. Although the operating cash flow loss narrowed in 2023, the situation appears to have worsened this year.

According to Cambrian Genomics' mid-year report for 2024, its operating cash flow in the first half of the year was -631 million yuan, exceeding the entire amount for the previous year. Notably, as of the end of June 2024, its ending cash and cash equivalents balance was a mere 1.383 billion yuan, a decrease of 2.571 billion yuan from the previous quarter.

For Cambrian Genomics, while the AI boom has once again helped it avert crisis and offered boundless imagination, the market's ultimate test of the company will inevitably return to its performance in the long run. Take NVIDIA, the global chip leader, as an example. In the first half of this year, NVIDIA generated revenue of $56.084 billion, up 170.95% year-on-year; its net income attributable to shareholders was $31.480 billion, up 282.41% year-on-year.

In other words, despite NVIDIA's significant gains, its performance is highly commensurate with its stock price. In contrast, Cambrian Genomics' current performance is hardly sufficient to support its current market value. Moreover, since its inception, Cambrian Genomics has never turned a profit and has relied heavily on financing to sustain its operations. Prior to its listing, Cambrian Genomics raised a total of 4.6 billion yuan through six rounds of financing. Including the funds raised through its IPO, the company has accumulated a total of 7.1 billion yuan in funding.

From this perspective, if Cambrian Genomics fails to quickly turn around its losses and expand its revenue sources, it faces significant risks in the future.

Bubbles and the Future

In the capital market, high returns often come with high risks, but this does not necessarily mean that investors have a high risk appetite.

What concerns investors most about Cambrian Genomics is the uncertainty of its future. The failure of Royole, a previous flexible display giant, has already taught the market a painful lesson.

Since Cambrian Genomics lost its largest customer in 2020, institutions began voting with their feet. Consequently, starting in 2021, multiple institutions, including Guotai Junan Securities, Zhide Investment, State Investment Ningbo Hangao, China Merchants Bank International, iFLYTEK, and Beijing Nayuan, began gradually reducing or liquidating their holdings in Cambrian Genomics.

It is worth noting that the exodus of institutions has not stopped. Taking advantage of the stock price recovery in the second half of 2023, several venture capital shareholders of Cambrian Genomics engaged in block sales, drawing criticism from the market.

To stabilize market sentiment, in September 2023, Cambrian Genomics announced that its actual controller and CEO, Chen Tianshi, voluntarily committed not to sell any of his shares in the company until December 31, 2024. However, due to new regulations on share sales, controlling shareholders and actual controllers of unprofitable companies at the time of listing are prohibited from selling their pre-IPO shares for three years before the company becomes profitable, with restrictions on the proportion of shares that can be sold in the fourth and fifth years.

Therefore, Chen Tianshi's commitment not to sell his shares appears to be redundant.

On July 26, 2024, Cambrian Genomics announced a share repurchase plan. According to the announcement, Cambrian Genomics intends to repurchase shares worth no less than 20 million yuan and no more than 40 million yuan through centralized bidding, at a price not exceeding 297.77 yuan per share. The repurchased shares will be used entirely for employee stock ownership plans or equity incentives.

Kanjian Finance believes that for a giant enterprise with a market value of nearly 200 billion yuan, a repurchase plan of no more than 40 million yuan is unlikely to provide meaningful support to its share price.

In July of this year, Sina Tech also reported that Cambrian Genomics' intelligent driving chip business, Xingge Technology, was undergoing significant layoffs. Sina Tech noted that Cambrian Genomics' new projects in the intelligent driving chip business had been suspended, with nearly half of its software team laid off and only a small number of hardware team members retained for "cleanup" work. This is the second time Cambrian Genomics has been reported to be laying off employees since a major round of layoffs in April 2023.

In an interview with Sina Tech, an industry insider commented that Cambrian Genomics' current approach resembles that of most cloud vendors, but the company does not seem to have sufficient resources and capabilities to undertake such systematic work.

Kanjian Finance believes that regardless of the vast imagination space offered by AI, Cambrian Genomics must ultimately return to the consideration of its performance. If it cannot support its basic operations with solid performance, its current market value may prove to be illusory. If Cambrian Genomics fails to effectively capitalize on the current AI boom, it is highly likely that its future situation will be even more difficult than it was in 2023.

In addition, Kanjian Finance notes that in the past six months, a total of 11 brokerages have rated Cambrian Genomics, with 6 giving it a "buy" rating and 5 giving it an "overweight" rating.