Three authoritative reports, 461 transactions reveal AI trends: "Money-burning" game can't be afforded, ICT mergers and acquisitions are the most active

![]() 10/30 2024

10/30 2024

![]() 424

424

This is my 348th column article.

The latest developments in artificial intelligence (AI) have attracted much attention. Recently, several authoritative institutions have released a series of heavyweight reports focusing on the current status of AI applications and the development trends of enterprises, providing valuable insights into the development trajectory of this cutting-edge technology.

The first report, "State of AI 2024 Report", jointly written by top global AI investors and practitioners, serves as an annual benchmark. Updated annually for seven years since its inception, the report summarizes the past and looks into the future from multiple dimensions, including technological breakthroughs, industry development, policy regulation, economic impacts, and security risks. It is an authoritative guide to grasping the overall trend of AI development.

The second report, "AI M&A Landscape 2021-2023: Large Tech Firms Lead the Way," released by research firm Transforma Insights, focuses on investment and M&A trends in the AI industry. It meticulously examines and analyzes 461 M&A transactions from January 2021 to December 2023.

The third report, "Global Cloud Platform AI Projects and Capabilities Development Report 2024" by IoT Analytics, provides a panoramic view of the AI layouts of leading cloud platforms. According to the report, AI has emerged as a key driver of cloud platform demand, with generative AI playing an increasingly pivotal role.

Throughout 2023, significant breakthroughs were made in AI foundation models. In 2024, AI enterprises are transitioning from solely building AI models to creating practical products, marking a pivotal year for AI integration and enhancement.

Undoubtedly, generative AI products have evolved from "novelties" to "daily necessities." OpenAI has generated billions of dollars in revenue through its blockbuster products, and many Fortune 500 companies have integrated AI applications into their daily operations.

However, buyer's remorse after purchasing AI products is not uncommon, especially in EU countries.

Summarizing these three reports, we can draw several key conclusions about AI development in 2024:

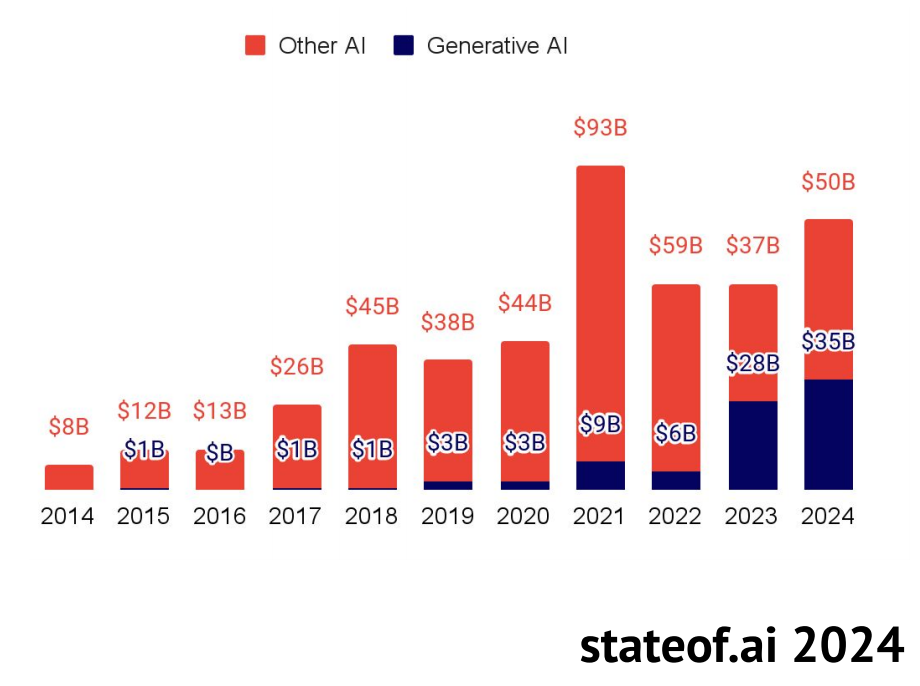

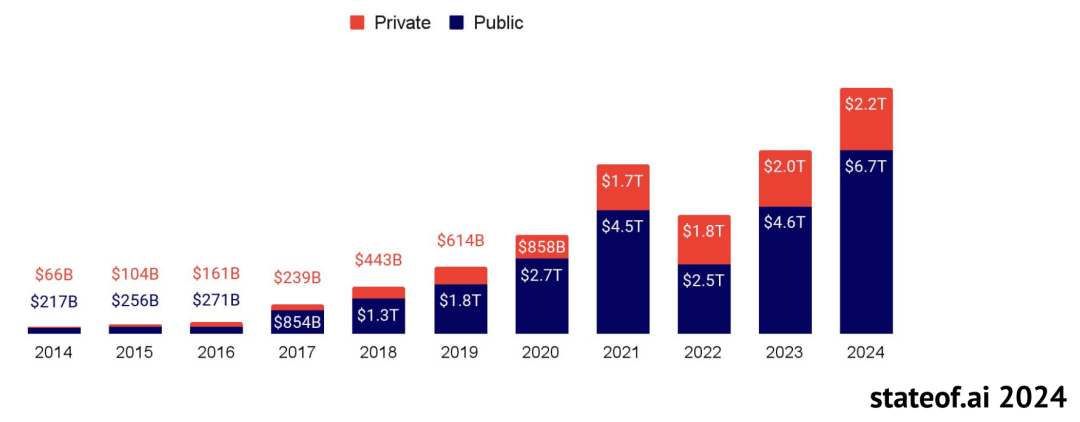

1. The total market value of AI companies has reached $9 trillion. Despite the success of generative AI and increased investment in AI startups, overall funding has declined.

2. A few leading AI companies are starting to generate significant revenue, including developers of AI foundation models and startups focused on niche areas like video and audio generation. However, achieving long-term sustainable profitability remains a challenge as AI model costs continue to decline.

3. M&A has emerged as a vital exit strategy for some AI companies struggling to find viable business models.

In this article, let's delve into these three AI reports to explore the development trajectory and future outlook of AI.

AI model costs have dropped significantly, and tech giants are shifting from AI model building to AI product design

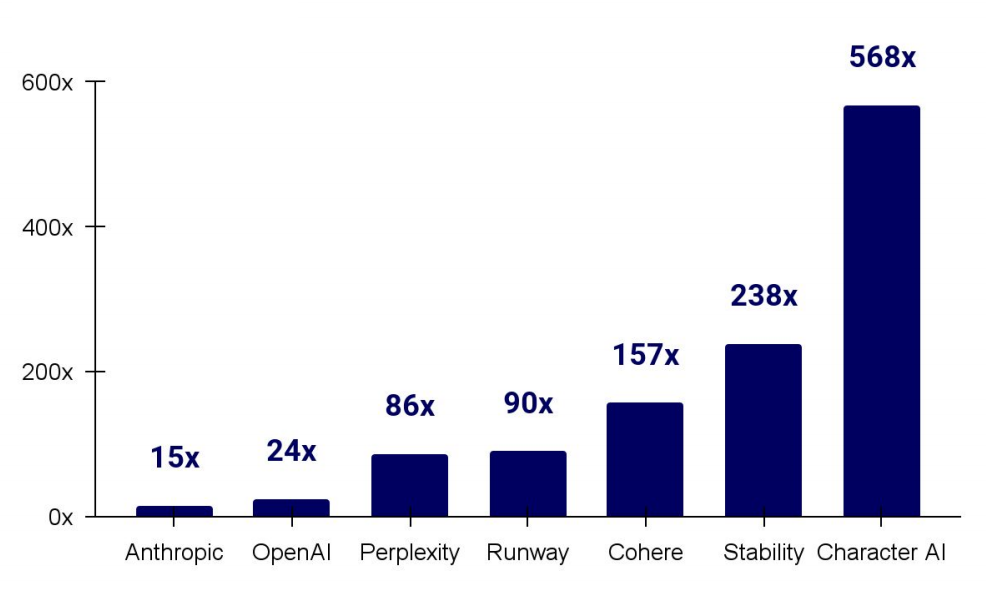

The "State of AI 2024 Report" reveals that star startups in the generative AI space are raising funds at a record pace, often achieving valuations hundreds of times their revenue.

While this may indicate investors' confidence in future returns, it also sets a high bar as many of these companies have yet to find a clear path to profitability.

Fortunately, the largest AI model providers are starting to see revenue growth.

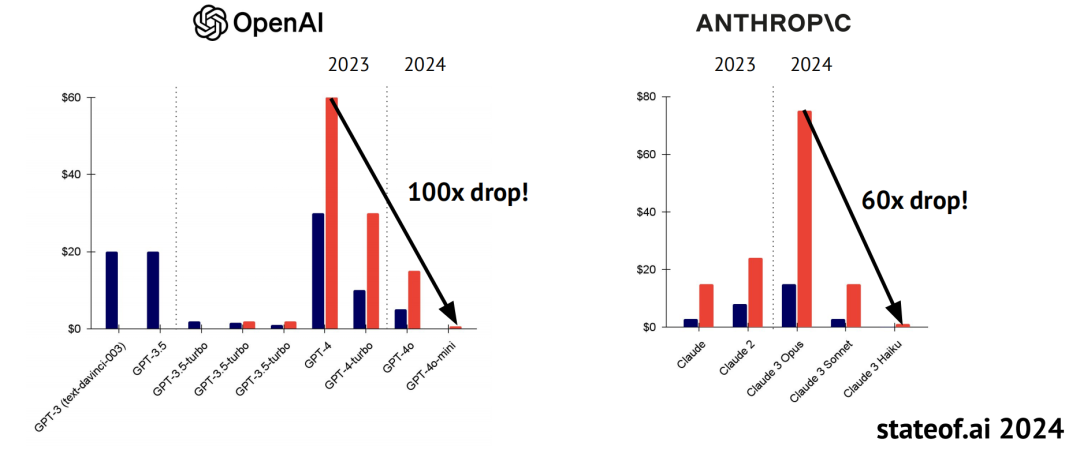

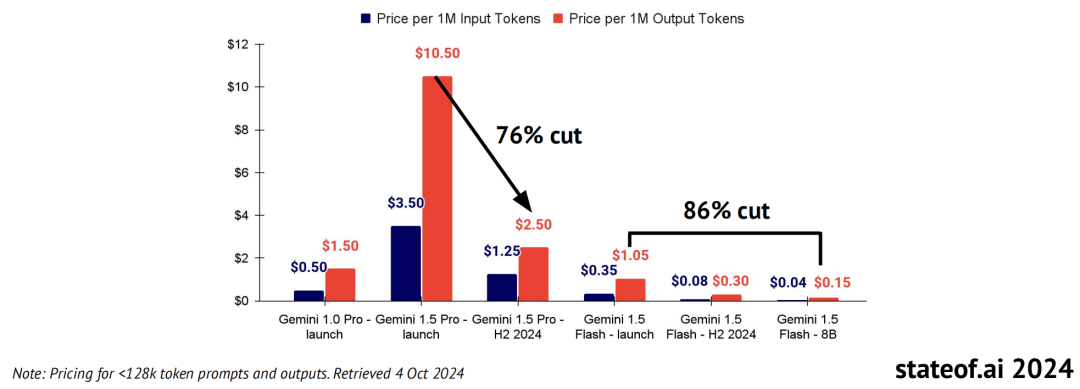

As the inferencing costs of powerful models continue to drop, once-unaffordable service costs are becoming more accessible.

Google's Gemini series offers high-performance models at competitive prices. The Gemini 1.5 Pro and 1.5 Flash saw price reductions of 64-86% within months of their launch while maintaining robust performance. For instance, Flash-8B is 50% cheaper than 1.5 Flash but performs comparably in many benchmarks.

As AI labs shift from model building to product design, the most successful tech companies like Apple, Google, and TikTok have adopted a product-first strategy rather than simply constructing AI foundation technologies and APIs.

With the convergence of foundation model performance, OpenAI, Anthropic, and Meta are increasingly focused on the look and feel of their "products." Whether it's Claude's Artifacts, OpenAI's advanced voice capabilities, or Meta's hardware partnerships and lip-syncing tools, these indicate that building a good model alone is no longer sufficient.

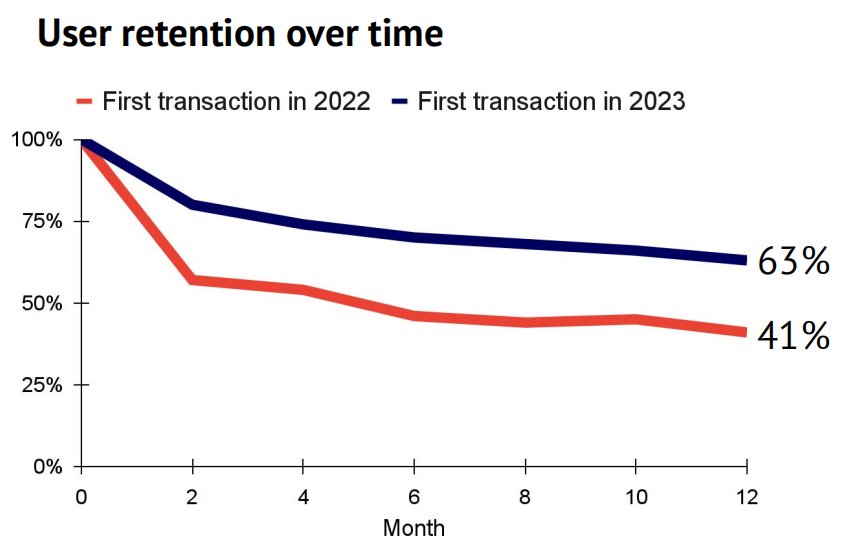

AI products are starting to demonstrate stickiness in the enterprise market.

New data from Ramp, a US corporate fintech company, shows significant improvements in customer spending and retention rates from 2022 to 2023.

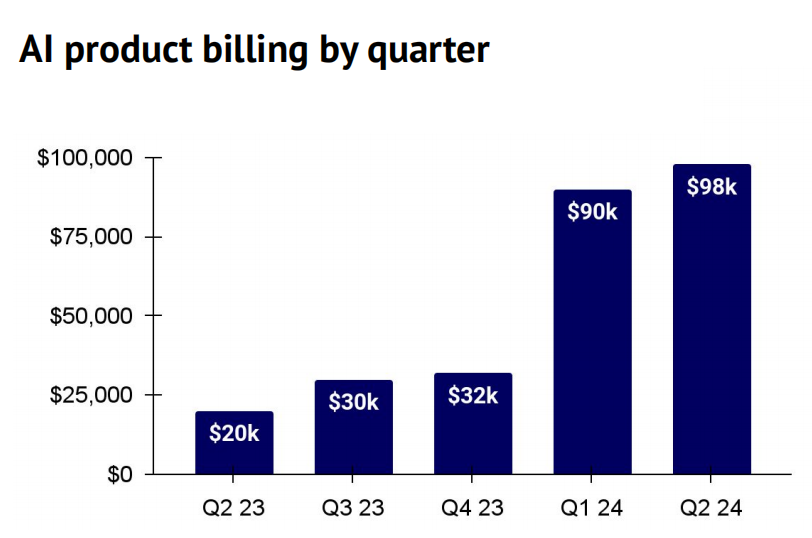

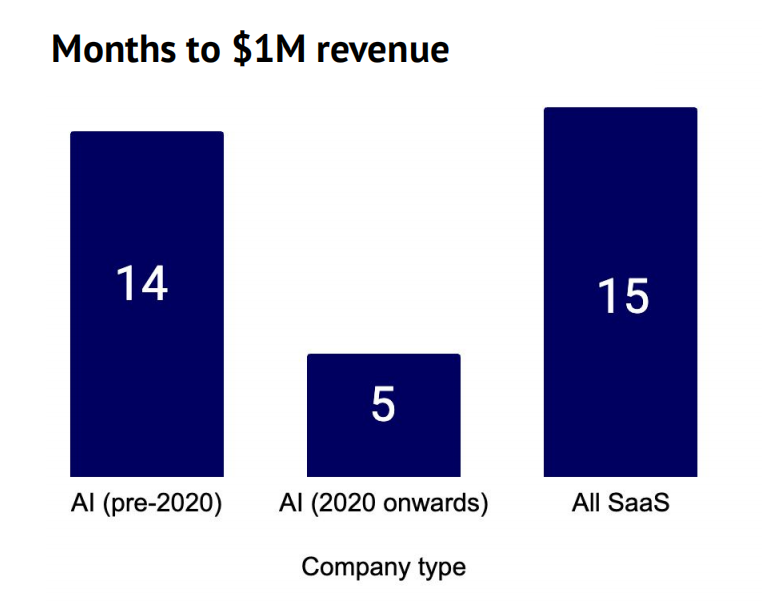

Meanwhile, AI challengers are growing their revenue much faster than their SaaS peers.

An analysis of the top 100 AI companies using Stripe reveals that, as a group, they are growing their revenue much faster than previously high-performing SaaS companies.

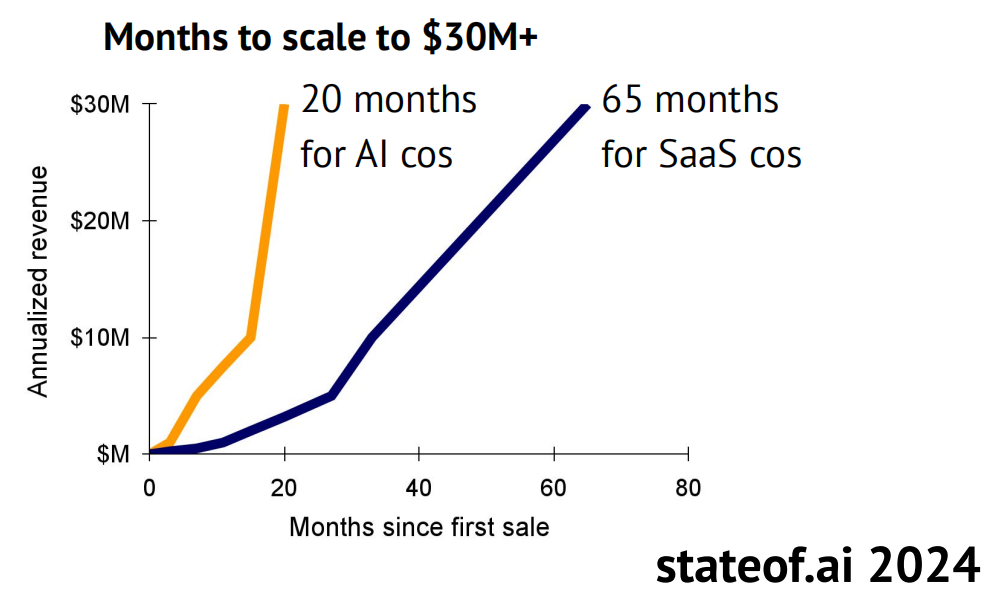

Notably, AI companies reaching over $30 million in annual revenue have done so in an average of just 20 months, compared to 65 months for similarly promising SaaS companies.

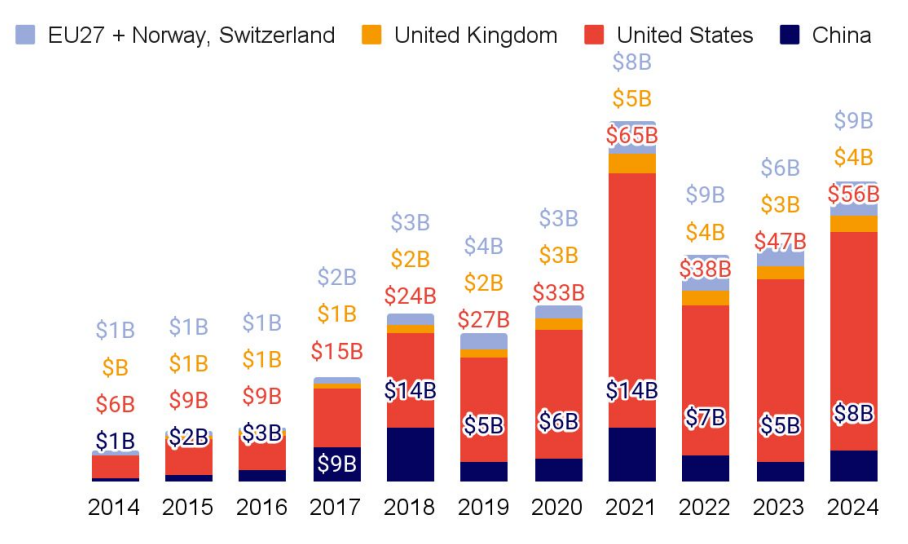

AI investment is soaring across regions, with the US private market continuing to lead the way, driven by $6 billion in funding rounds for companies like xAI and OpenAI, bringing total AI company investment close to $100 billion.

Driven by listed companies, the value of AI companies approaches $9 trillion. While startup valuations continue to climb steadily, only a handful of listed companies like Atlas support the overall market value.

The enterprise value of listed companies alone exceeds that of the entire market in 2023.

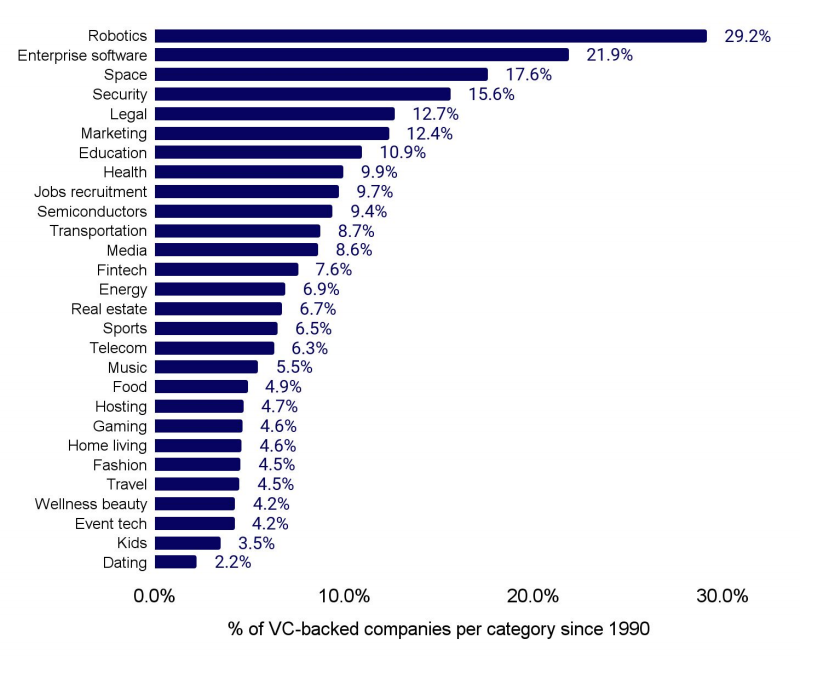

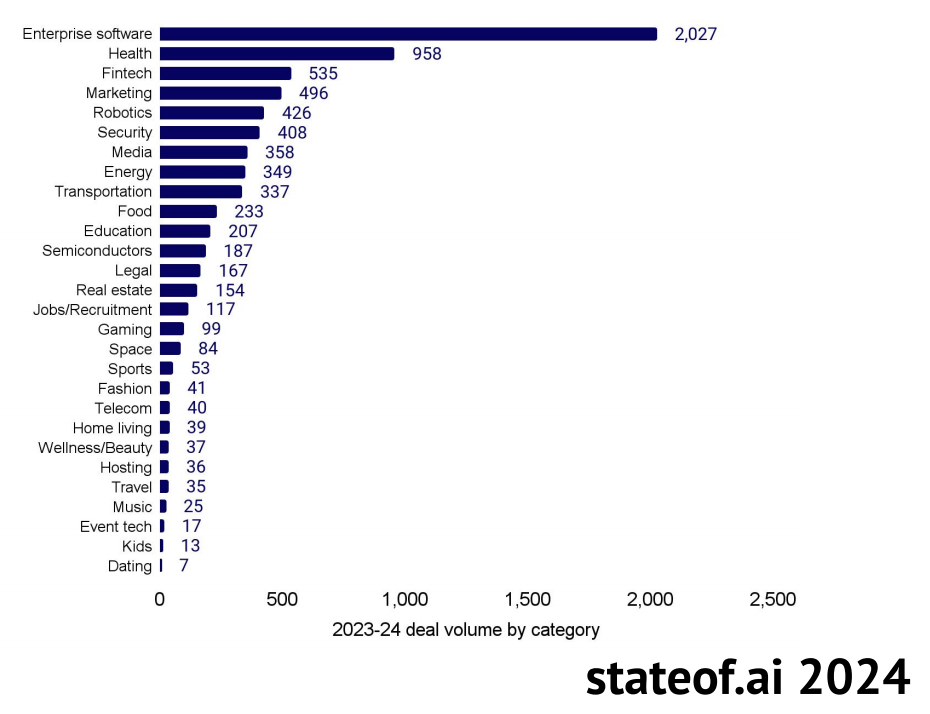

Among all venture-backed companies, AI firms make up the highest proportion in robotics, enterprise software, aerospace, and security. Last year, enterprise software, healthcare, finance, and marketing were the most active AI categories for funding.

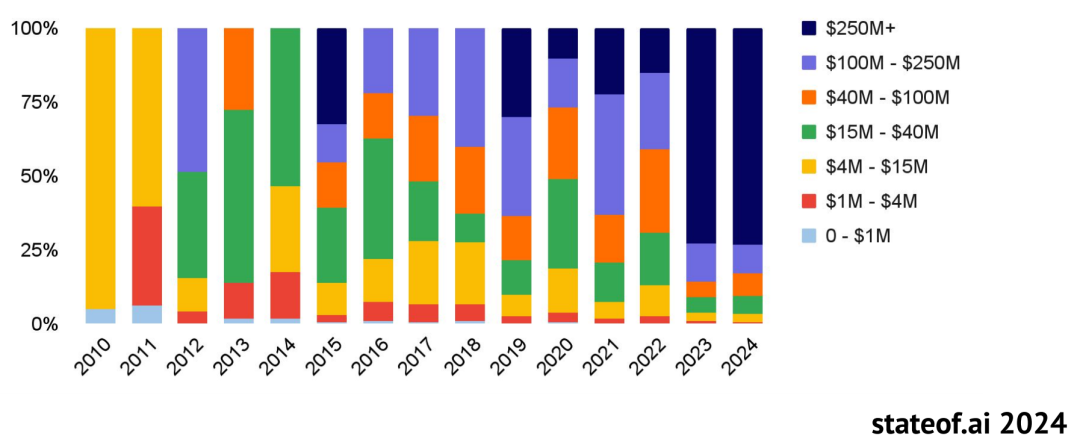

Over the past two years, mega-rounds of funding over $250 million have dominated AI financing.

A clear divide emerged around the launch of GPT-4, with various companies seemingly entering a "mega-funding" state.

The IPO market remains subdued, with M&A activity down 23% from the 2021 peak.

Amid increasing regulatory scrutiny and a post-pandemic uncertain market, companies generally adopted a "wait-and-see" attitude, pushing deal activity to an all-time low.

The story behind 461 deals: AI M&A focuses on the ICT sector, with transaction volumes stabilizing

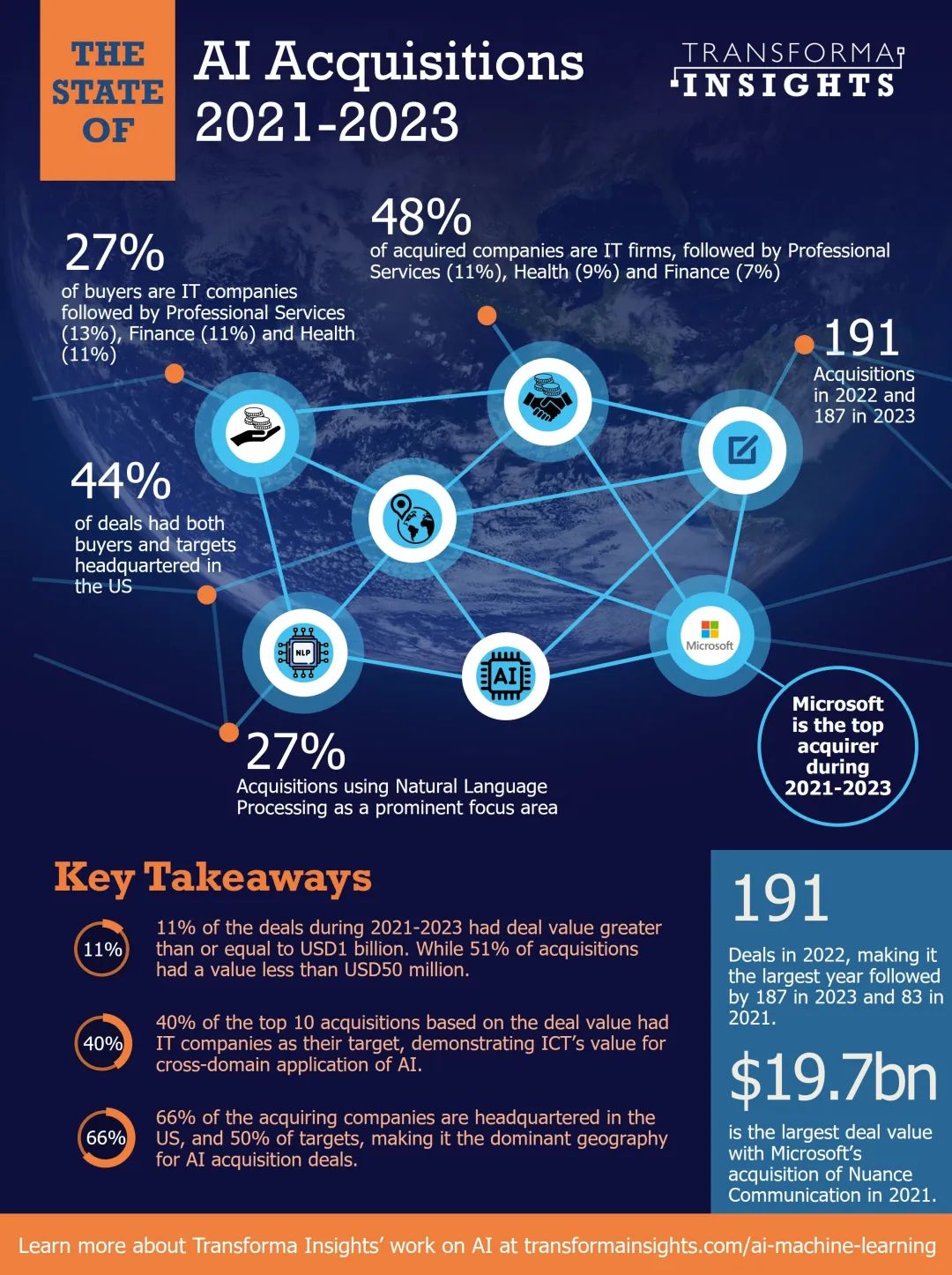

In recent years, major deals like Microsoft's $19.7 billion acquisition of Nuance Communications and Panasonic's $7.1 billion takeover of Blue Yonder have garnered significant attention. Acquiring AI companies has become a "standard" for global tech giants, who are investing heavily to strengthen their AI capabilities.

IoT research firm Transforma Insights conducted an in-depth investigation into AI M&A trends and summarized its findings in the report titled "AI M&A Landscape 2021-2023: Large Tech Firms Lead the Way."

The report focuses on 461 AI M&A transactions from January 2021 to December 2023.

So, what's the growth trend of AI M&A numbers in recent years?

Between 2021 and 2023, a total of 461 AI M&A deals were recorded, with 191 transactions in 2022 topping the list, followed by 187 in 2023 and 83 in 2021.

Overall, these M&A deals were evenly distributed over the past few years, with only slight fluctuations in quarterly transaction volumes compared to the previous quarter. After a surge in M&A activity from 2021 to 2022, transaction volumes stabilized in 2023, maintaining a robust level of AI M&A.

Which subsectors are most favored in AI M&A?

In terms of industry distribution, the information and communication technology (ICT) sector stands out, accounting for 27% of total transactions involving buyers and target companies.

The professional services sector (primarily consulting, legal, and advertising firms) ranks second with a 13% share. The healthcare industry contributes 11% of transactions, while manufacturing, retail, and wholesale make up 8% each.

What are the five major application directions of AI M&A?

Among the various applications targeted by acquiring companies, natural language processing (NLP) stands out, accounting for 27% of transactions.

NLP applications cover a wide range of scenarios, including chatbots, voice assistants, social media platforms, monitoring tools, grammar correction, and search engines.

Workflow optimization and image processing analysis follow closely, attracting 21% and 15% of M&A demand, respectively.

Workflow optimization leverages AI to identify patterns and automate repetitive, time-consuming tasks. This area recorded 94 M&A deals.

Image processing analysis technology excels in healthcare and entertainment, with medical institutions using it for medical imaging research and gaming companies leveraging it to create realistic graphics and procedural content like virtual avatars for social media.

Personalized marketing and data cleaning are also favored, accounting for 13% and 11% of application demand, respectively.

AI technology in personalized marketing enables businesses to create personalized profiles based on customer behavior and preferences, facilitating precise marketing and targeted outreach to specific audiences.

In the field of data cleaning, AI technology, particularly large language models (LLMs), significantly enhances data processing efficiency by identifying similarities and differences within datasets. This technology is widely used in industries such as IT, healthcare, and professional services.

Perspective on the Development Trends of AI in Global Cloud Platforms in 2024

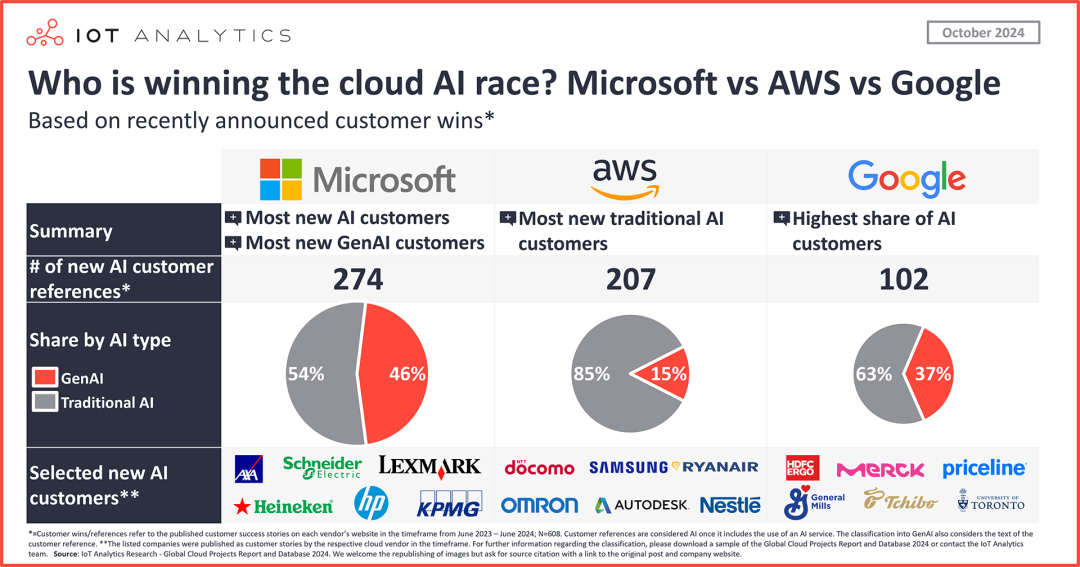

In the fierce cloud AI competition, the giants are going all out. IoT Analytics' latest report, "Global Cloud Platform AI Projects and Capabilities Development Report 2024," provides an in-depth analysis of this competition.

The report found that among the 608 new cloud AI case studies, Microsoft leads with 274 cases (45%). Insurance giant AXA, professional services firm KPMG, industrial automation leader Schneider Electric, and beer manufacturer Heineken have all become new AI customers of Microsoft.

AWS ranks second with 207 cases (34%), with electronics giant Samsung and food and beverage giant Nestlé as its new star AI customers.

Google ranks third with 102 cases (17%), with pharmaceutical giant Merck and online travel platform Priceline.com among its new AI customers.

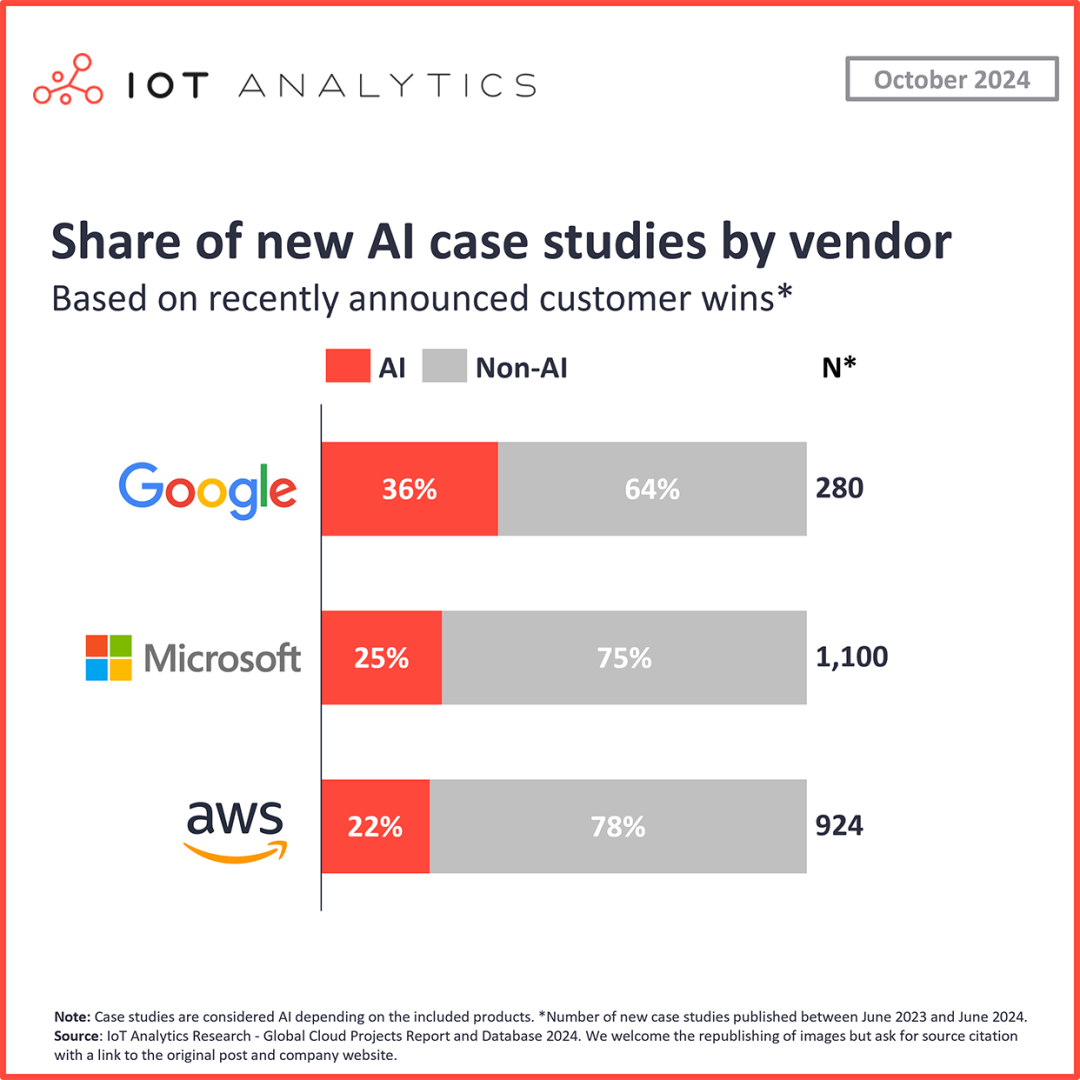

It is worth mentioning that in terms of the number of traditional AI cases (excluding GenAI), AWS leads with 176 cases. Meanwhile, compared to the overall number of new cloud cases, Google has the highest proportion of AI cases, at 36%.

Comparing each company's performance in AI cases with their cloud market share, Microsoft has the most significant gap between its proportion of new cases and market share.

AWS's proportion of new AI cases (34%) is 3 percentage points lower than its 2023 cloud market share (37%), while Google's proportion of AI cases (17%) is 8 percentage points higher than its cloud market share (9%), and Microsoft's proportion of new AI cases (45%) is 16 percentage points higher than its cloud market share (29%).

This shows that both Microsoft and Google are outperforming their overall cloud market positions in the AI field.

Currently, Microsoft is leading the way in cloud AI, especially in the field of GenAI.

Thanks to its close collaboration with OpenAI, Microsoft has seized an early advantage in the cloud GenAI race. As early as 2019, Microsoft provided significant support to OpenAI. In January 2023, less than two months after ChatGPT's public release, Microsoft further deepened its cooperation with OpenAI by increasing its investment and fully opening up Azure OpenAI services.

Building on Microsoft's AI technology stack, many large enterprises have initiated their first GenAI projects. However, as other large language models (LLMs) continue to narrow the performance gap with OpenAI's models, it remains to be seen whether Microsoft's first-mover advantage can be sustained.

In traditional AI, AWS remains dominant. Excluding GenAI projects, AWS leads the way in traditional cloud AI cases without GenAI elements.

Meanwhile, AWS's AI/ML platform Amazon SageMaker has the highest proportion of cloud AI cases, at 21%. As AWS further refines its cloud AI product portfolio (especially GenAI) and promotes these services to existing and potential customers, it is expected to win more cloud AI projects and increase its share of new projects.

Google has a clear advantage in AI-driven customer growth.

Google Cloud has long been favored by small and medium-sized enterprises, which has translated into a unique advantage in the cloud AI competition. Among the new cases of various cloud service providers, Google Cloud AI cases account for the highest proportion of overall new cases. Its 36% of new cloud cases involve cloud AI products, indicating that AI is the leading driver of Google Cloud's growth among cloud service providers.

Closing Remarks

Three authoritative reports reveal the latest developments in AI: AI companies are seeing impressive investment and financing performance, giants are intensifying their competition in cloud AI, and declining model costs are accelerating the productization process.

However, many AI companies are gradually struggling to achieve profitability, and mergers and acquisitions may be a viable solution. AI is becoming the primary driver of cloud demand, with giants like Google and Microsoft rushing to promote the adoption of generative AI applications.

As AI evolves from a novelty to an everyday essential, its commercialization exploration has entered a critical phase.

References:

State of AI 2024 Report, Source: stateof.ai

The State of AI Acquisitions 2021- 2023: Big Tech Leading the Charge, Source: Transforma Insights

Global Cloud Projects Report and Database 2024, Source: IoT Analytics