Another Internet insurance agent heads to the U.S. for an IPO, exploring the prospects of 'AI+Insurance'

![]() 10/31 2024

10/31 2024

![]() 418

418

Author | Fangfang

Source | New Economy Observer Group

Artificial intelligence is gradually infiltrating and reshaping our way of life, and both personal consumption habits and corporate operating models are undergoing profound transformations. Simultaneously, AI technology has opened up new possibilities in the financial sector, particularly the insurance industry, attracting significant interest from capital markets.

Yuanbao Digital Technology (Beijing) Co., Ltd. (hereinafter referred to as "Yuanbao") has capitalized on this trend and launched an assault on the capital market. On September 17, Yuanbao, with its focus on the "AI+Insurance" concept, submitted an IPO application to the SEC, aiming for a listing on the Nasdaq stock exchange.

As an emerging Internet insurance intermediary platform founded in 2020, Yuanbao primarily utilizes artificial intelligence technology to provide customers with more personalized and efficient insurance solutions. However, based on financial data and market conditions, the path to an IPO for this insurance technology unicorn has not been smooth.

01

Using AI to expand, but facing losses

According to the prospectus, Yuanbao is an online insurance distributor that partners with insurance companies to issue policies to consumers, who in turn pay commissions to Yuanbao based on a percentage of the premiums as fees for insurance distribution services. Additionally, Yuanbao provides system services to insurance companies, optimizing the distribution efficiency of insurance products and generating revenue through means such as assisting in the production of promotional videos for insurance products.

In 2020, Yuanbao obtained a national insurance brokerage license under the name Yuanbao Insurance Brokerage (Beijing) Co., Ltd. and officially went online. Leveraging its unique "AI+Insurance" business model, Yuanbao positions itself in the inclusive health insurance market, focusing on short-term insurance products and expanding insurance services to broader regions through digital advertising and mobile internet. In the first half of 2024, over 70% of Yuanbao's claims users came from third-tier cities and below, with an out-of-pocket medical expense reimbursement rate of up to 81%.

Public information indicates that Fang Rui, the founder and CEO of Yuanbao, previously served as Vice President and head of the technology department at NetEase Group. He founded NetEase's e-commerce and payment platforms and served as CEO for 17 years, laying a solid foundation for the company's AI business development.

In March 2021, Fang Rui led his team in creating the "Yuanbao Smart Insurance Brain," leveraging big data and AI technology to precisely match insurance products to individual users.

During its development, Yuanbao has developed numerous models, including media models, user models, and product models. As of the end of June 2024, Yuanbao had developed over 4,400 models, covering the entire service chain from user targeting and acquisition to sales conversion and after-sales service. This includes over 700 media models, more than 3,000 user models, approximately 700 product models, and over 4,300 user data tags for analysis.

As a result, Yuanbao has garnered capital interest. In May 2021, Yuanbao announced that it had accumulated millions of paying users, covering over 90% of regions in China, and completed a nearly 1 billion C-round financing led by Source Code Capital, with participation from Cathay Capital, Hillhouse Capital, and existing investors including Shanxing Capital, Northern Light Venture Capital, Qiming Venture Partners, and SIG. Yuanqi Capital served as the exclusive financial advisor, making Yuanbao the fastest Internet insurance platform in China to complete a C-round financing.

According to the prospectus, by first-year premium in 2023, Yuanbao has become the second-largest distributor in China's life insurance market and the largest independent insurance distributor.

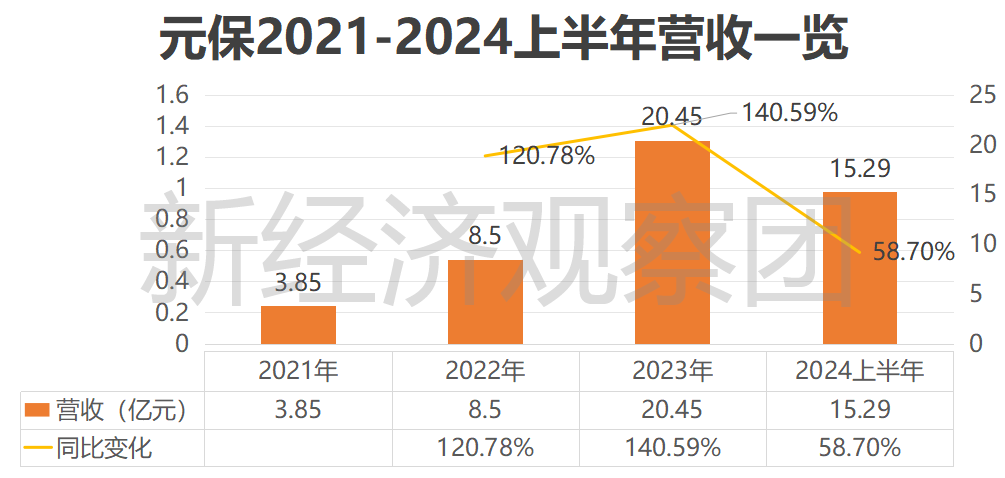

As its business expands, so does Yuanbao's revenue. According to the prospectus, from 2021 to 2023, Yuanbao's revenue was 385 million yuan, 850 million yuan, and 2.045 billion yuan, respectively, with revenue growth rates increasing from 120.78% in 2022 to 140.59% in 2023, achieving double-digit growth. However, in 2024, Yuanbao's revenue growth rate significantly declined, with first-half revenue reaching 1.529 billion yuan, a year-on-year increase of 58.70%.

While expanding its market share, Yuanbao also faces numerous challenges. The company's initial investments in technology research and development, market expansion, and customer service have increased its operating costs in the short term, leading to continuous losses.

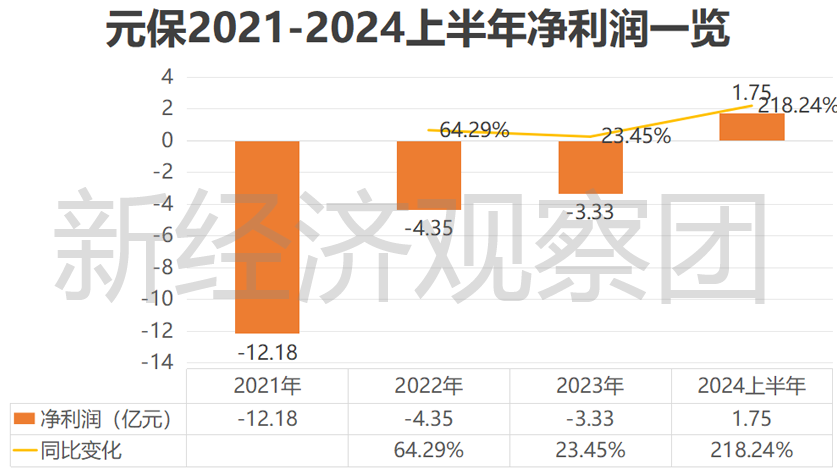

From 2021 to 2023, Yuanbao's net losses attributable to shareholders were 1.218 billion yuan, 435 million yuan, and 333 million yuan, respectively. Over three years, Yuanbao accumulated losses of 1.986 billion yuan. Although the first half of 2024 saw an improvement with a net profit attributable to shareholders of 175 million yuan, it is still not sufficient to say that Yuanbao has completely shaken off its loss dilemma. With tightening regulatory policies and intensified market competition, Yuanbao must find effective ways to improve profitability while maintaining high growth rates.

02

Emphasis on marketing over R&D, frequent online complaints

As an emerging insurance technology company, Yuanbao inevitably invests heavily in marketing, which is a significant contributor to its losses.

According to the prospectus, from 2022 to the first half of 2024, the company's total operating costs and expenses were 866 million yuan, 1.87 billion yuan, and 1.214 billion yuan, respectively, accounting for 101.9%, 91.4%, and 79.4% of revenue for the corresponding periods. During the same periods, Yuanbao's sales and marketing expenses were as high as 657 million yuan, 1.462 billion yuan, and 956 million yuan, respectively, accounting for 75.8%, 78.2%, and 78.8% of total operating costs. The cumulative cost over three years reached 3.075 billion yuan.

In contrast, Yuanbao, which bills itself as an AI company, is actually quite stingy when it comes to R&D. From 2022 to the first half of 2024, Yuanbao's R&D expenses were 78.43 million yuan, 129 million yuan, and 89.79 million yuan, respectively, accounting for only 9.0%, 6.9%, and 7.4% of total costs, far less than its marketing expenses.

By leveraging big data and technology, Yuanbao achieves personalized marketing, enabling it to analyze user behavior and preferences in greater detail and push customized content to target groups more accurately. However, if not managed properly, this precise marketing based on user personas can easily lead to the creation of misleading marketing strategies that appear considerate but are actually manipulative.

On public complaint platforms, we can see that Yuanbao is facing a significant number of complaints due to these issues. Promotions such as "0.1 yuan for the first month" or "3 yuan for the first month" seem attractive but essentially "induce" users to purchase insurance at extremely low prices during the first month, with premiums returning to normal levels thereafter. Many users may not notice the subsequent premium amounts or realize they have agreed to automatic renewal, resulting in unexpected deductions. To date, there have been over a thousand complaints related to "inducement to purchase insurance" and "automatic deductions," significantly impacting Yuanbao's reputation.

Moreover, this type of marketing carries the risk of violating regulatory guidelines. As early as 2020, the former China Banking and Insurance Regulatory Commission issued notices and penalties to multiple insurance companies and brokerages for deceptive promotions such as "0 yuan for the first month" and "1 yuan for the first month." In November 2023, the China Banking and Insurance Regulatory Commission issued the "Notice on Further Improving Short-term Health Insurance Business" and "Risk Warning on Short-term Health Insurance Products," introducing new requirements for Internet sales platforms and urging insurance companies to strengthen management of third-party sales channels and avoid misleading promotional language.

Based on Yuanbao's user data, this marketing strategy currently attracts short-term customers, with low long-term customer retention.

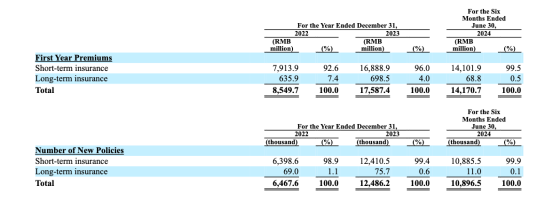

From 2022 to the first half of 2024, Yuanbao's first-year premium income from long-term insurance was 636 million yuan, 699 million yuan, and 68.8 million yuan, respectively, accounting for 7.4%, 4.0%, and 0.5% of its insurance distribution service revenue. Short-term insurance accounted for the majority of revenue. Similarly, the number of new long-term insurance policies was 69,000, 75,700, and 11,000, respectively, accounting for 1.1%, 0.6%, and 0.1% of the total number of new policies. While the current marketing strategy attracts a large number of users in the short term, it remains uncertain whether these users will become long-term loyal customers.

03

High concentration of major customers, short-term products accounting for over 99% of revenue

With advanced technology and a unique business model, Yuanbao has achieved remarkable growth in a short period, becoming a leader in the industry. However, behind this rapid development lie several structural issues, the most prominent being a high concentration of major customers.

According to public data, from 2022 to the first half of 2024, the top three customers contributed revenue proportions as high as 69%, 56%, and 61%, respectively. This means that Yuanbao's revenue primarily depends on a handful of major customers, posing a potential risk for any company.

From a financial stability perspective, heavy reliance on a few customers makes Yuanbao's revenue highly susceptible to changes in these customers' businesses. If a major customer reduces cooperation due to operational issues or turns to competitors, Yuanbao's revenue will be directly impacted. Additionally, major customers often hold advantageous negotiating positions, potentially demanding more favorable prices or terms, further compressing Yuanbao's profit margins. Should these customers raise demands for improved services or products, Yuanbao must invest more resources to meet their needs, increasing operational costs.

Furthermore, the high concentration of customers also increases the risk of customer loss. Losing even one major customer can significantly impact Yuanbao's overall business due to their significant contribution to revenue. This dependence leaves Yuanbao in a passive position in maintaining customer relationships, exposing the company to significant uncertainty in case of relationship issues.

Yuanbao acknowledges in its prospectus that its partnerships with insurance companies are typically non-exclusive. If insurance companies are dissatisfied with Yuanbao's services or believe they cannot improve profitability through these partnerships, they may terminate their collaboration.

Concurrently, Yuanbao's revenue structure poses another challenge: an excessive proportion of short-term insurance products. According to the prospectus, from 2022 to the first half of 2024, short-term insurance products accounted for 92.6%, 96.0%, and 99.5% of Yuanbao's total first-year premiums, respectively.

While attracting consumers with their flexibility and ease of sale, particularly among first-time insurance users, short-term insurance products generate quick revenue but suffer from low renewal rates and limited customer loyalty, hindering long-term sustainability. Additionally, short-term insurance products typically offer lower profit margins than long-term ones, meaning that despite growing revenue, Yuanbao's profitability will be constrained if it cannot effectively convert short-term insurance users into long-term customers.

Conclusion:

For Yuanbao to achieve sustainable growth, it must optimize its cost structure, enhance user stickiness, and improve service quality to ultimately gain long-term recognition from capital markets.

Even if Yuanbao succeeds in its IPO, it will not be the end of its journey. Previously listed Internet insurance companies, such as Shuidi, known as the "first insurance technology stock on the NYSE," have seen their share prices plummet by over 90% in three years since their listing. Currently trading at 1.16 USD per share, Shuidi's stock price is perilously close to the 1 USD delisting threshold.

Behind this lies several reasons. One is the sluggish penetration of Internet insurance in China, currently at around 10%, far below the nearly 50% penetration rate of the e-commerce industry. Another is the heightened regulatory scrutiny faced by the Internet insurance industry, with regulations such as the "Measures for the Supervision of Internet Insurance Business" and the "Notice on Further Regulating Internet Personal Insurance Business of Insurance Institutions" effectively blocking loopholes for profiteering.

Both Shuidi and Yuanbao must shift their focus back to competition based on service and product quality after the initial benefits of scenarios and traffic dividends are exhausted. As a younger player, Yuanbao may face even more challenges on this path.