10 years of over 10 rounds of financing, another autonomous driving company is about to list on the Hong Kong Stock Exchange

![]() 10/31 2024

10/31 2024

![]() 478

478

I wonder how many autonomous driving companies the stock market can still accommodate?

Recently, the IPO bell ringing of domestic autonomous driving companies has been ringing non-stop, including WeRide and Horizon Robotics. Now, it seems that another startup is on the verge of good news:

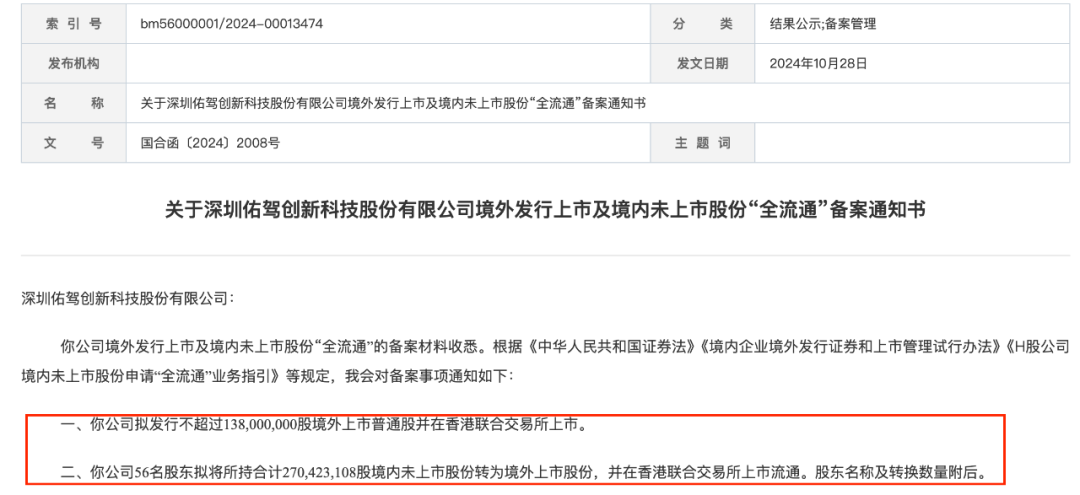

Youjia Chuangxin, also known as MINIEYE, obtained overseas listing registration with the China Securities Regulatory Commission (CSRC) on October 28th, planning to issue no more than 138 million overseas listed ordinary shares on the Hong Kong Stock Exchange.

At the same time, the company's 56 shareholders plan to convert their combined holdings of approximately 270 million domestic unlisted shares into overseas listed shares and list them on the Stock Exchange of Hong Kong Limited for trading.

So far, this 10-year-old autonomous driving company has reached a crucial milestone in its development.

Before that, Youjia Chuangxin's prospectus had already been submitted to the Hong Kong Stock Exchange. The prospectus shows that Youjia Chuangxin's business covers a wide range of areas, including intelligent driving, intelligent cockpit, and some vehicle-road collaboration services.

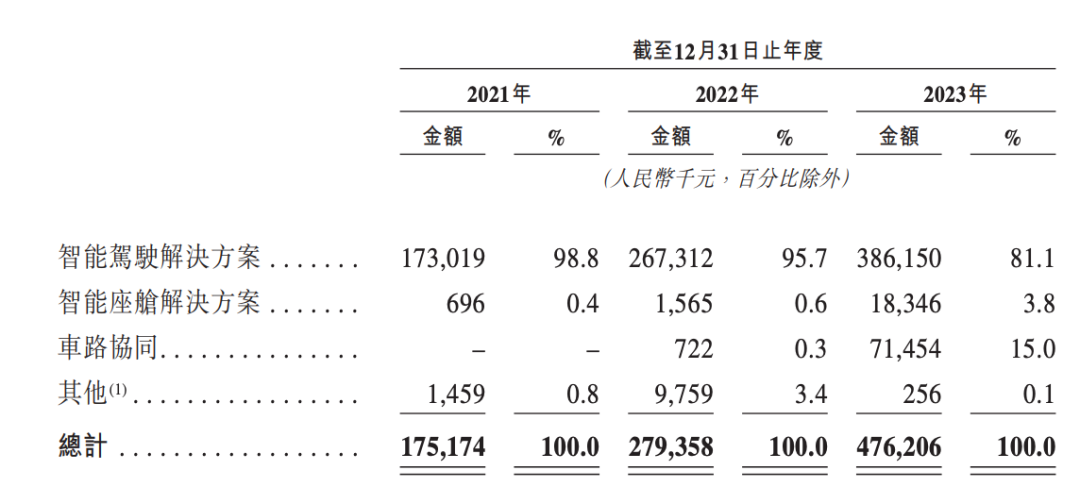

Its three major business segments generated revenues of 175 million yuan, 279 million yuan, and 476 million yuan, respectively, from 2021 to 2023, with a compound annual growth rate exceeding 64%. However, due to long-term low gross profit margins and continuous investment in research and development, Youjia Chuangxin also faces considerable pressure to reduce losses.

Data shows that its net losses for 2021-2023 were 140 million yuan, 220 million yuan, and 207 million yuan, respectively.

As of the end of last year, Youjia Chuangxin had less than 200 million yuan in cash and cash equivalents on its books, making an IPO to raise funds imminent.

01 A Second-tier Player Established for 10 Years

Compared to companies like WeRide and Horizon Robotics mentioned earlier, Youjia Chuangxin's presence in the industry is not as strong. Its early capital appeal and subsequent business performance can be generally classified as that of a second-tier player in the industry.

Public information shows that Youjia Chuangxin was established in December 2014, making it an early entrant in the first wave of autonomous driving. The company positions itself as a leading provider of intelligent driving and intelligent cockpit solutions in China and expanded into some vehicle-road collaboration services in 2021.

Youjia Chuangxin Founder Liu Guoqing (right in the photo)

The founding team of Youjia Chuangxin is made up of people born in the 1980s. Among them, Co-founder, Chairman, and General Manager Liu Guoqing graduated from Huazhong University of Science and Technology and later obtained a Ph.D. in Computer Science from Nanyang Technological University in Singapore in 2013.

According to the prospectus, after completing his Ph.D., he served as General Manager and Chief Engineer at CheRui Information Technology (specializing in telematics services) in Nanjing.

Another Co-founder and Deputy General Manager, Yang Guang, also graduated from Huazhong University of Science and Technology and is primarily responsible for Youjia Chuangxin's intelligent driving solutions business, as well as production, manufacturing, and quality control.

In addition, the founding team includes Zhou Xiang and Wang Qicheng, who graduated from renowned domestic universities such as Southeast University and Tsinghua University, bringing professional technical backgrounds and management experience.

However, compared to other top autonomous driving companies with teams of "genius youths," this team resume may not be as impressive, especially in the eyes of investors.

The prospectus shows that since its establishment, Youjia Chuangxin has completed over 10 rounds of financing, raising a cumulative total of 1.448 billion yuan. As of the latest practicable date, 194 million yuan in financing remained unused.

Clearly, 10 years of operation with only this much funding is insufficient. During this process, Youjia Chuangxin has also achieved certain commercial returns.

Data shows that from 2021 to 2023, Youjia Chuangxin generated revenues of 175 million yuan, 279 million yuan, and 476 million yuan, respectively, with a compound annual growth rate exceeding 64%.

Revenue Breakdown by Business Segment of Youjia Chuangxin

The primary source of revenue is the intelligent driving solutions business, which generated 173 million yuan, 267 million yuan, and 386 million yuan in revenue over three years, accounting for over 80% of total revenue consistently.

Revenue growth has been significant, and gross profit margins have gradually improved, reaching 9.7%, 12%, and 14.3% in 2021-2023, respectively.

Nonetheless, these gross profit margins remain low in the long term, largely due to the high procurement costs of raw materials and consumables, which have consistently accounted for over 70% of revenue.

In terms of expenses, Youjia Chuangxin's research and development (R&D) expenditures are not excessive compared to other autonomous driving companies but are still considered high-intensity investments relative to revenue. R&D expenditures for 2021-2023 were 82.201 million yuan, 139 million yuan, and 150 million yuan, respectively.

Ultimately, these factors contribute to an expanding loss, with net losses of 140 million yuan, 221 million yuan, and 207 million yuan in 2021-2023, respectively, for a cumulative loss of 568 million yuan.

As of the end of 2023, the company had only 198 million yuan in cash and cash equivalents on its books.

02 A 'Triple Threat' Player in Automotive Intelligence

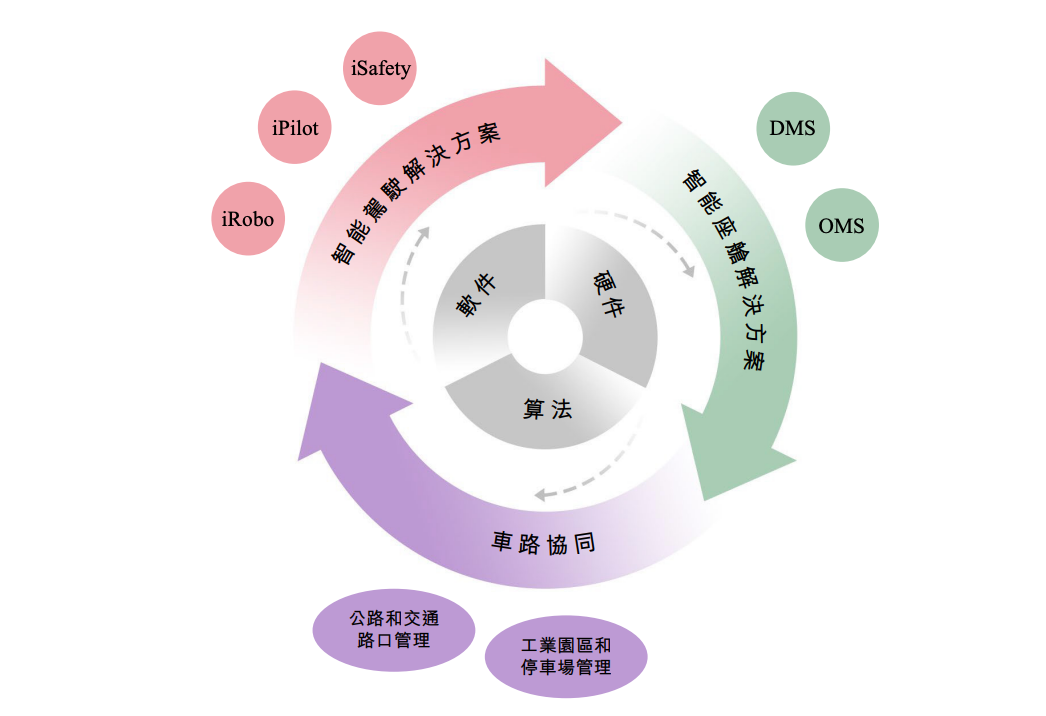

As mentioned earlier, Youjia Chuangxin's primary business is divided into three segments: intelligent driving, intelligent cockpit, and some vehicle-road collaboration services.

Youjia Chuangxin's Business Segments

The intelligent driving business was the company's first foray and currently generates significant positive commercial returns.

In terms of strategic layout, Youjia Chuangxin adopts a gradual autonomous driving approach, starting with basic L2 ADAS functions and eventually offering a comprehensive portfolio of solutions from L0 to L4, catering to diverse scenarios and vehicle models.

The company has also developed a full-stack, in-house solution covering perception to decision-making, compatible with mainstream SoC chip deployments.

Intelligent Driving Product Layout

Specifically, the company offers products ranging from basic to advanced, including iSafety, which features L2 ADAS functions like AEB, TJA, ICA, ACC, LKA, FCW, and LDW;

The L2+ product is primarily the iPilot intelligent driving solution, offering functions from active safety to highway pilot assistance. The company is currently developing the iPilot 4 version, which will ultimately enable urban pilot functionality on an 80TOPS computing chip.

The L4 product solution, iRobo, debuts with a driverless Robobus, expected to be delivered this year.

Youjia Chuangxin's Driverless Minibus

Overall, Youjia Chuangxin's intelligent driving solutions follow a similar cost-effective approach to that of DJI. According to the prospectus, since January 1, 2024, the company has collaborated with 12 automakers on the continuous development of designated projects for 17 vehicle models. During the same period, Youjia Chuangxin's solutions have been mass-produced on 60 models across 22 automakers.

In the intelligent cockpit business, Youjia Chuangxin primarily focuses on vision-related DMS and OMS systems. Since January 1, 2024, the company has been continuously engaged in designated projects with 8 automakers for intelligent cockpit solutions for 18 vehicle models and has mass-produced solutions for 30 models across 9 automakers.

Lastly, there's the vehicle-road collaboration business, which may be related to the founders' early experience in telematics companies. According to the prospectus, this business generated commercial returns in 2022 and generated over 70 million yuan in revenue in 2023, accounting for 15% of total revenue during the same period.

As of the latest practicable date, Youjia Chuangxin has participated in 13 typical vehicle-road collaboration projects across China.

03 Seeking Rapid Listing with 'Full Circulation' of Listed Shares

A unique detail in Youjia Chuangxin's overseas listing registration documents with the CSRC is the 'full circulation' of domestic unlisted shares.

Youjia Chuangxin's Overseas Listing Registration Documents

This means that in addition to the up to 138 million overseas listed ordinary shares to be issued through the IPO, the domestic RMB shares held by internal shareholders (domestic shares) will also be converted into H shares for trading and circulation in overseas markets.

As a supplementary information, 'full circulation of H shares' refers to the listing and trading of some restricted domestic unlisted shares (including unlisted domestic shares held by domestic shareholders before overseas listing, unlisted domestic shares issued domestically after overseas listing, and unlisted shares held by foreign shareholders) on the Hong Kong Stock Exchange by mainland-registered companies.

This regulation was introduced in 2019. Before that, when mainland-registered companies listed in Hong Kong, unless using a red chip structure, some domestic shares could not be traded in the market.

As a result, the IPO valuation and fundraising scale of mainland-registered companies seeking listing were somewhat affected.

By adopting full circulation of H shares, companies can avoid the time, effort, and funds required for structural changes compared to a red chip structure. Additionally, it enhances stock liquidity, IPO valuation, and fundraising potential.

This is precisely what Youjia Chuangxin needs at present. With limited funds, the company aims for a swift listing process to raise as much capital as possible, vital for survival in the fierce competition ahead.

The same applies to many other second-tier autonomous driving players waiting in line to enter the stock market.