"Timid" guidance from AMD: does AI implementation mean a downward trend for AI?

![]() 10/31 2024

10/31 2024

![]() 703

703

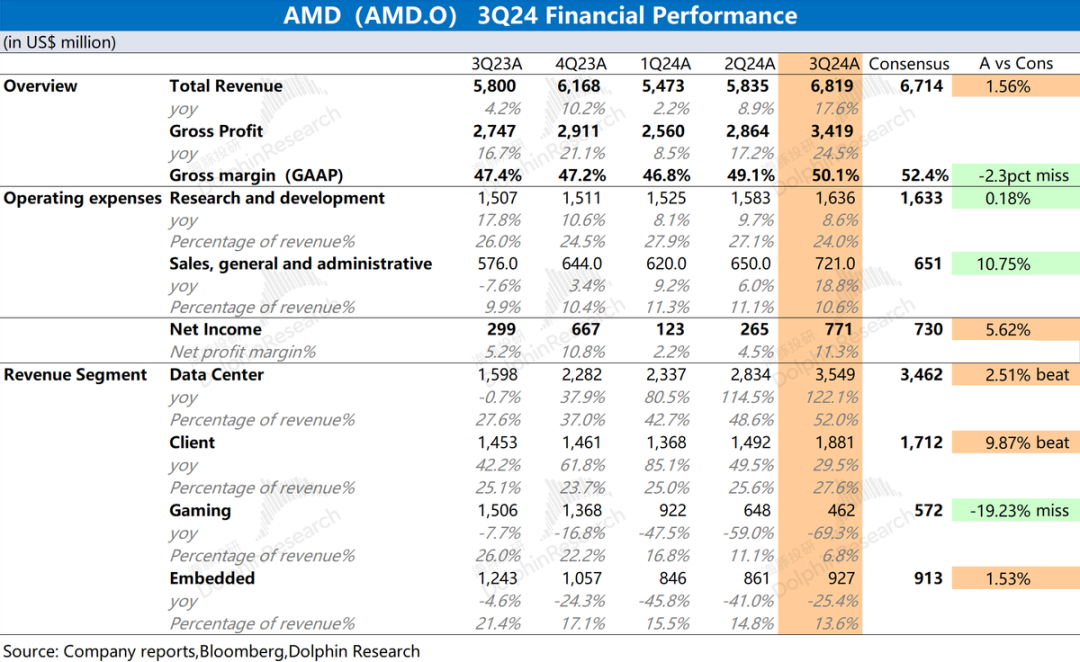

AMD (AMD.O) released its third-quarter financial report for 2024 (ended September 2024) after the US market close on October 30, 2024, Beijing time. The key points are as follows:

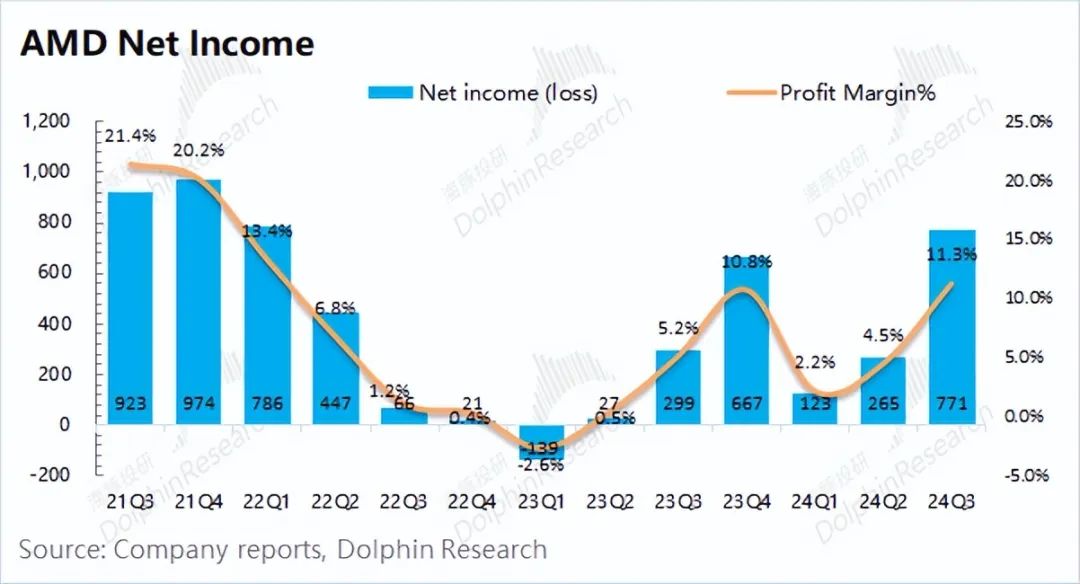

1. Overall Performance: Both revenue and gross margin increased. AMD achieved revenue of $6.819 billion in the third quarter of 2024, an increase of 17.6% year-over-year, slightly exceeding market expectations ($6.714 billion). The growth in quarterly revenue was primarily driven by the client and data center businesses. AMD reported a net profit of $771 million in the third quarter of 2024, an improvement from the previous quarter and slightly better than market expectations ($730 million). Both revenue and gross margin increased, while operating expenses remained relatively stable, contributing to the increase in profit.

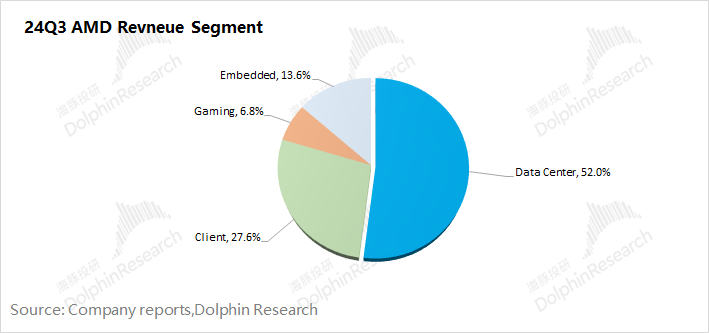

2. Business Segments: Client segment recovery, new high for data center. Driven by growth in the data center and client businesses, the combined revenue from these two segments accounted for nearly 80% of total revenue.

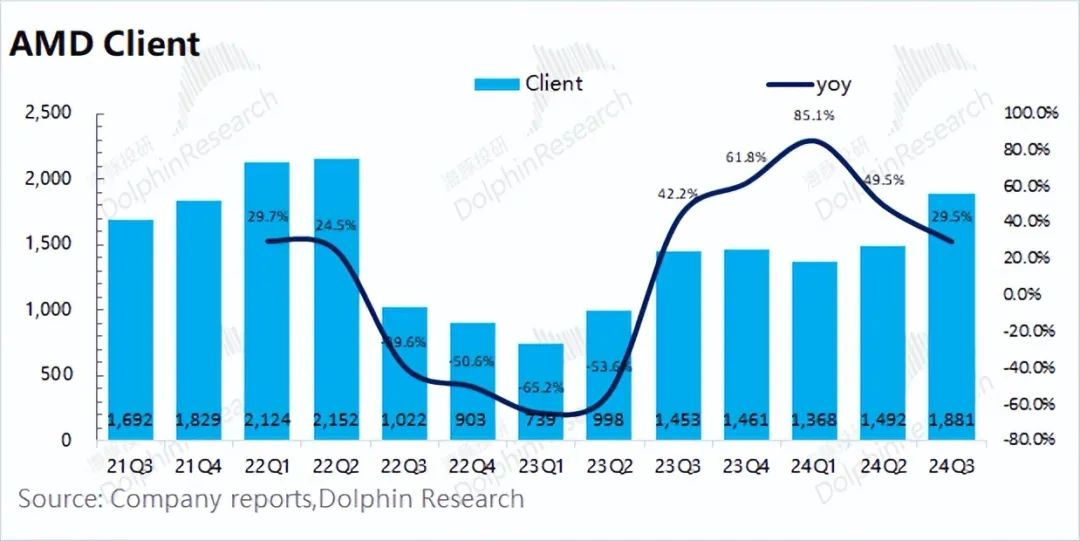

1) Client Segment Recovery: Revenue for the quarter rebounded to $1.881 billion, an increase of 29.5% year-over-year, successfully emerging from a trough, primarily due to an increase in the company's PC market share;

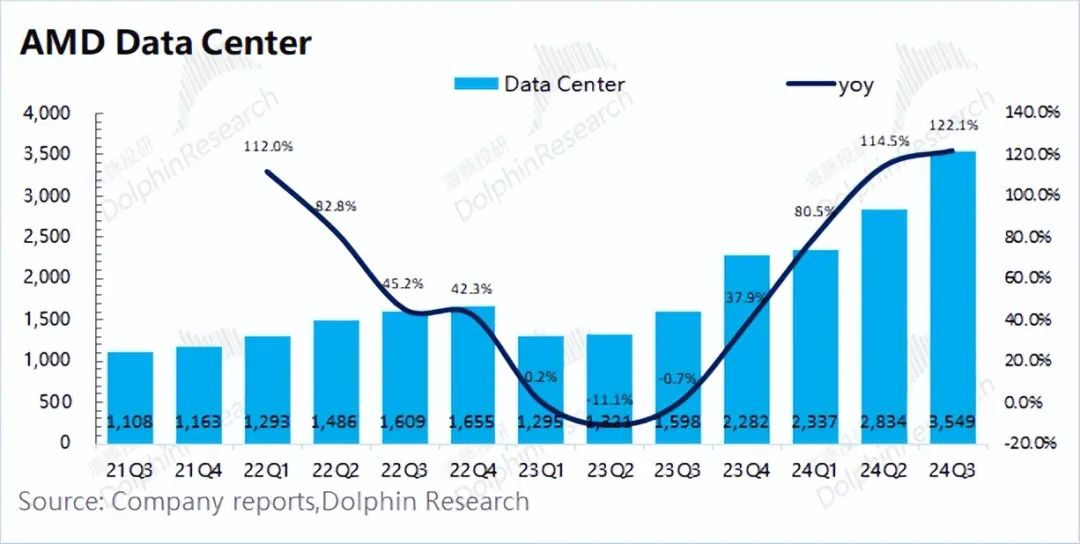

2) New High for Data Center: Revenue reached $3.55 billion for the quarter, a new quarterly high. This was primarily due to increased shipments of related products (GPUs and CPUs), reflecting the continued high capital expenditures by core cloud vendors.

3. AMD's Financial Guidance: AMD expects revenue of $7.2-7.8 billion in the fourth quarter of 2024 (market expectation: $7.55 billion) and a non-GAAP gross margin of approximately 54% (market expectation: 54.21%). Both core guidance figures are generally in line with market expectations. Revenue is expected to grow quarter-over-quarter (5.6%-14.4%), primarily driven by the data center and client businesses.

Dolphin's Overall View: AMD's quarterly numbers were decent, but the guidance did not exceed expectations.

AMD's quarterly revenue and gross margin improved, primarily driven by the recovery of the data center and client businesses. Operating expenses, including research and development and sales and related costs, remained relatively stable. The company's core operating profit exceeded $1 billion this quarter, marking an overall recovery from the trough.

For the company's core businesses, specifically: 1) Client Business: Achieved $1.881 billion in revenue, an increase of 29.5%. Considering the single-digit growth in the PC industry, Dolphin believes that AMD further squeezed Intel in the PC market this quarter, gaining a larger CPU market share (AMD's share increased by 3.8 percentage points year-over-year in the second quarter of 2024, and is expected to gain more share with new products); 2) Data Center Business: Reached a new high of $3.55 billion, primarily due to strong growth in shipments of Instinct series GPUs and EPYC (Zen) series CPUs, suggesting that core cloud vendors continued to maintain high capital expenditures this quarter; 3) Other Businesses: No significant improvement in demand for gaming graphics cards, while the embedded business is still in the inventory adjustment phase for customers.

Although the quarterly revenue and profit figures were decent, AMD did not provide guidance that exceeded expectations. For the next quarter, the company expects revenue of $7.2-7.8 billion in the fourth quarter of 2024 (market expectation: $7.55 billion) and a non-GAAP gross margin of approximately 54% (market expectation: 54.21%). These guidance figures are not particularly ideal, with the central range slightly below market expectations, which has to some extent affected market confidence in AMD and the AI supply chain.

AMD was originally the second supplier in the AI market, and the market expected to see the company catch up to NVIDIA and gain more market share. With signs of easing supply constraints from NVIDIA, the market would have preferred AMD to provide guidance that exceeded expectations, demonstrating the product strength and market demand for its MI300. However, the current guidance is clearly unsatisfactory to the market.

For AMD, Dolphin believes that the main focus of performance remains on the data center business, which currently accounts for over 50% of revenue. The data center business can not only bring short-term revenue but also provide the market with confidence in sustained growth in the medium to long term. Since the primary end customers for AMD's GPUs and CPUs in the data center business are Microsoft, Google, and other vendors, Dolphin will continue to monitor the capital expenditure plans of core cloud vendors in the future. Keep an eye out for the company's explanations on the conference call, specific business progress in data centers and clients, perspectives on the gaming graphics card market, and detailed outlooks for the company's next quarter and future business.

Detailed Analysis

I. Overall Performance: Revenue & Gross Margin, Both Increased

1.1 Revenue Side

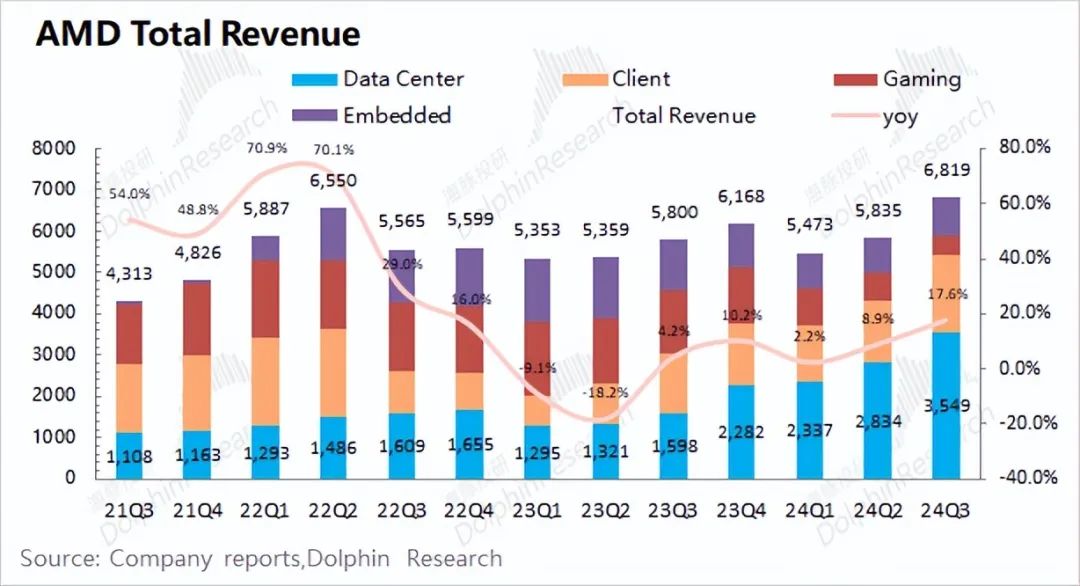

AMD achieved revenue of $6.819 billion in the third quarter of 2024, an increase of 17.6% year-over-year, slightly exceeding market expectations ($6.714 billion). The company's quarterly revenue reached a new high, primarily driven by growth in the data center and client businesses.

AMD's increasing PC market share fueled the recovery of its client business. Influenced by AI and other related demands, AMD's Instinct series GPUs and EPYC (Zen) series CPUs in the data center business also showed significant growth.

1.2 Gross Margin

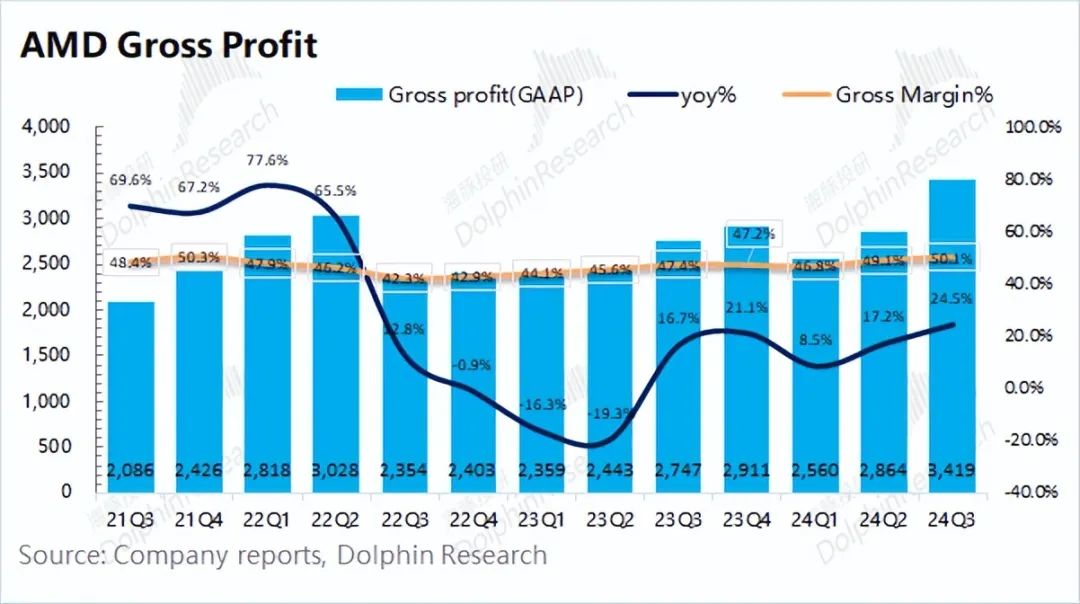

AMD achieved a gross profit of $3.419 billion in the third quarter of 2024, an increase of 24.5% year-over-year. The growth rate of gross profit exceeded that of revenue, primarily due to an increase in gross margin.

AMD's gross margin was 50.1% in the quarter, up 2.7 percentage points year-over-year but below market expectations (52.4%). The gross margin improved quarter-over-quarter, primarily due to an increase in the proportion of high-margin data center business (now accounting for over 50%), driving an overall increase in the company's gross margin.

1.3 Operating Expenses

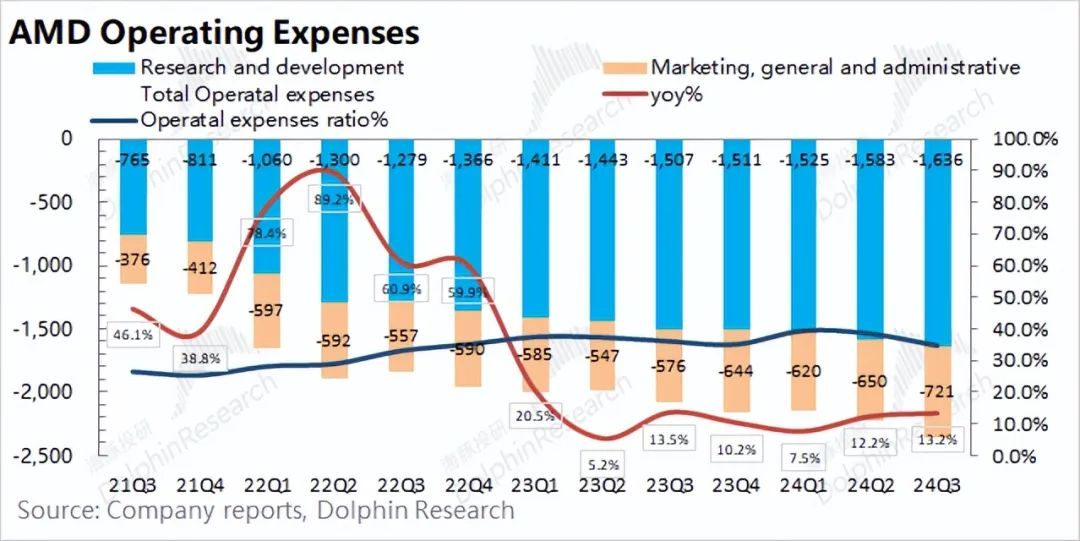

AMD's operating expenses were $2.357 billion in the third quarter of 2024, an increase of 13.2% year-over-year. Operating expenses also increased quarter-over-quarter, but the growth rate was slightly lower than that of revenue.

Breaking down the expenses:

1) Research and Development Expenses: The company's research and development expenses were $1.636 billion in the quarter, an increase of 8.6% year-over-year. Research and development expenses have consistently shown a growing trend. As a technology company, AMD continues to prioritize research and development. Simultaneously, due to revenue growth, the company's research and development expense ratio fell to 24% in the quarter, within a relatively reasonable range;

2) Sales and Administrative Expenses: The company's sales and administrative expenses were $721 million in the quarter, an increase of 25.2% year-over-year. Sales expenses are closely correlated with revenue growth, which also increased in the quarter.

1.4 Net Profit

AMD achieved a net profit of $771 million in the third quarter of 2024, with a quarterly net profit margin of 11.3%, continuing to improve quarter-over-quarter.

Due to AMD's ongoing acquisition of Xilinx, which has resulted in significant deferred expenses, profit will continue to be eroded for some time. Regarding the company's actual operating performance in the quarter, Dolphin believes that "core operating profit" is a more accurate indicator.

Core Operating Profit = Gross Profit - Total Operating Expenses

After excluding the impact of acquisition expenses, Dolphin estimates AMD's core operating profit for the quarter to be $1.062 billion, an increase of 68.3% quarter-over-quarter. With both revenue and gross margin growing, the company's overall operating performance has significantly improved. Although the company's gaming graphics card business remained weak, the client and data center businesses showed marked improvement.

In particular, with only single-digit growth in the PC market, the company's client business revenue increased by 29.5% year-over-year, primarily due to increased market share. Additionally, with continued shipments of GPUs and CPUs, the data center business set a new quarterly revenue high.

II. Business Segments: Client Segment Recovery, New High for Data Center

From a business segment perspective, the growth of the data center business has pushed its proportion to over 50%. The client business proportion also rebounded to 27.6%, while the proportions of the other two businesses declined again.

2.1 Data Center Business

AMD's data center business generated revenue of $3.549 billion in the third quarter of 2024, an increase of 122.1% year-over-year, slightly exceeding market expectations ($3.462 billion). This growth was primarily driven by strong shipments of AMD's Instinct series GPUs and EPYC (Zen) series CPUs.

In conjunction with recent information from the Advancing AI 2024 event, the company announced plans to introduce: 1) the new AMD EPYC 9005 series processors to meet various data center needs, available for use on various OEM and ODM platforms; 2) the AMD Instinct MI325X accelerator, offering leading performance and memory capabilities for the most demanding AI workloads, with plans to launch the next-generation AMD Instinct accelerators in 2025 and 2026; 3) the acquisition of ZT Systems for $4.9 billion to expand its data center AI systems business. ZT Systems, which ships hundreds of thousands of servers annually, focuses on providing hyperscale server solutions for cloud computing and artificial intelligence, with major customers including Microsoft, Amazon, and others.

Additionally, the company further increased its full-year revenue guidance for AI chips from $4.5 billion to $5 billion, indicating continued strong demand for its data center business. Since the data center business is primarily influenced by the capital expenditures of cloud vendors, Dolphin believes that several core cloud vendors maintained high capital expenditures in the quarter.

2.2 Client Business

AMD's client business generated revenue of $1.881 billion in the third quarter of 2024, an increase of 29.5% year-over-year and exceeding market expectations ($1.712 billion). The growth in the client business was primarily driven by increased shipments of fifth-generation Ryzen CPUs.

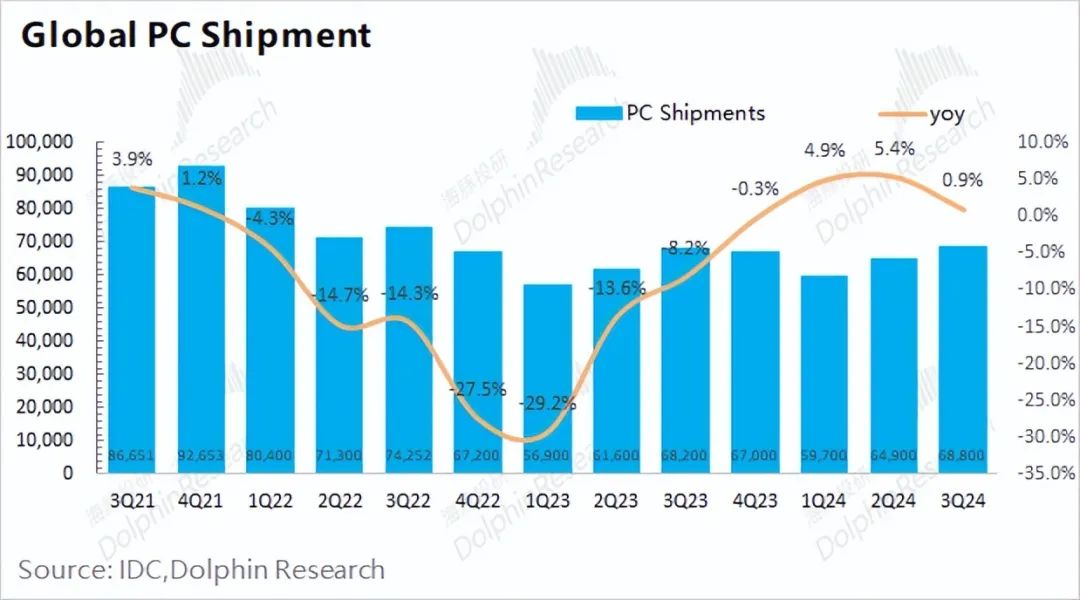

According to industry data, global PC shipments reached 68.8 million units in the third quarter of 2024, an increase of 0.9% year-over-year. Despite this modest growth, AMD's client business achieved nearly 30% year-over-year growth, indicating that AMD gained a larger market share in the PC market during the quarter, potentially posing a threat to Intel's financial results.

Furthermore, the company announced the launch of its new Ryzen AI PRO 300 series mobile processors, offering 50+ AI TOPs for next-generation AI PCs. Additionally, AMD is expected to introduce its next-generation Ryzen 9000 X3D processors in the fourth quarter of 2024. With the support of enhanced computing power and new product launches, AMD is poised to gain more market share from Intel and emerge from the trough in the PC business.

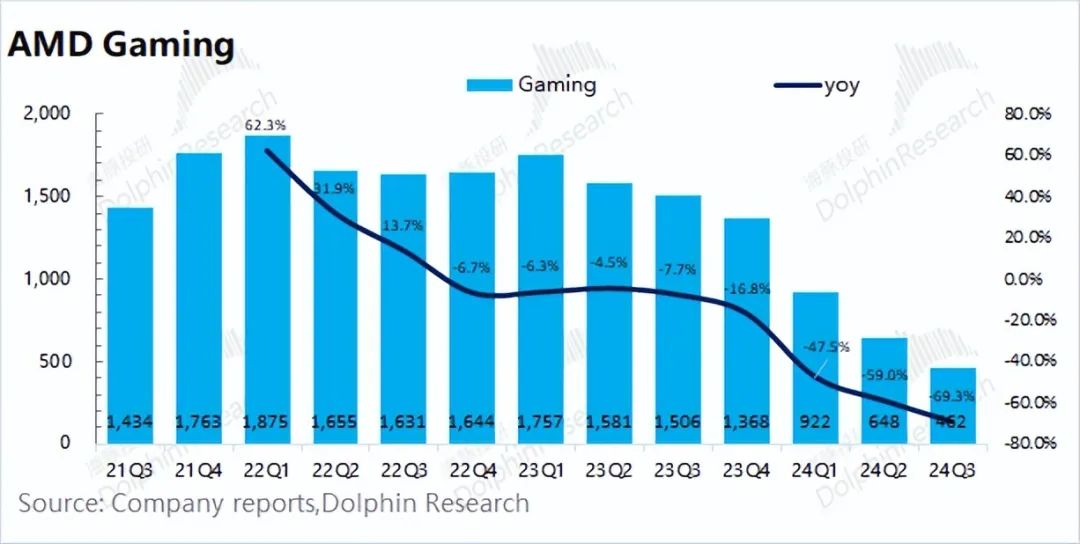

2.3 Gaming Business

AMD's gaming business generated revenue of $462 million in the third quarter of 2024, a decline of 69.3% year-over-year and below market expectations ($572 million). The decline in the gaming business was primarily due to a drop in semi-custom business revenue.

Despite a notable recovery in the client business, the gaming business remained weak. Considering the industry situation, Dolphin believes that the PC industry is slowly recovering, but demand for gaming graphics cards has not improved significantly. While AMD gained market share in the client business primarily due to Intel's underperformance, the company did not see a significant increase in market share in the gaming graphics card market, where its primary competitor is NVIDIA.

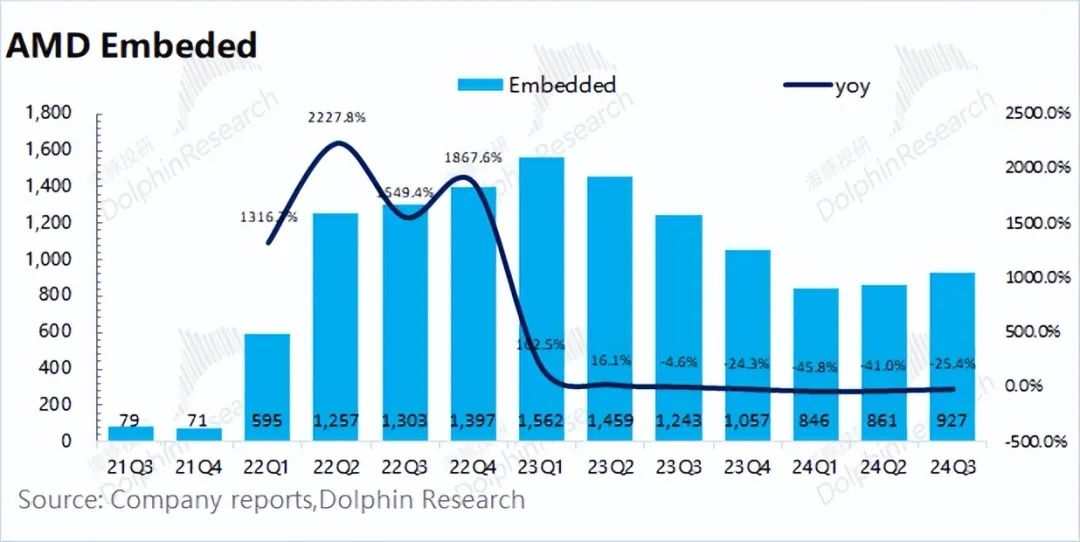

2.4 Embedded Business

AMD's embedded business generated revenue of $927 million in the third quarter of 2024, a decline of 25.4% year-over-year but generally in line with market expectations ($913 million). The company's embedded business is primarily based on its acquisition of Xilinx. Although some downstream demand improved this quarter, the company was still affected by customer inventory adjustments, and shipments remained relatively low.

Dolphin Investment Research related research on AMD and computing power chip industryAMD DepthMarch 8, 2024 "Continuously surging NVIDIA and AMD, is there a bubble?"June 21, 2023 "AMD's AI Dream: Can MI300 Snipe NVIDIA?"May 19, 2023 "AMD: The 'Second' for a Thousand Years, Can There Be a Counterattack?"AMD Financial Report SeasonJuly 31, 2024 Financial Report Commentary "AMD: Big Factories Hoarding Like Crazy, AI Guidance Shifts Upwards Again"May 1, 2024 Financial Report Commentary "AMD: A 'Chicken Rib' Guidance, Pouring Cold Water on AI"January 31, 2024 Financial Report Commentary "AMD: PCs Have Bowed Their Heads, AI Left with Only a Third of the Heat?"November 1, 2023 Financial Report Commentary "Without NVIDIA's Explosive Power, AMD's Recovery is Too 'Snail-like'"August 2, 2023 Financial Report Commentary "AMD: Climbing Out of the Valley, PCs Lead the Way in Recovery"

NVIDIA Financial Report SeasonMay 23, 2024 Financial Report Commentary "NVIDIA: The Strongest Stock in the 'Universe', Continual Bonus Packages"February 22, 2024 Financial Report Commentary "NVIDIA: AI Stands Alone, the True King of Chips"November 22, 2023 Financial Report Commentary "NVIDIA: Computing Power Czar Maxes Out Firepower? A Flickering 'False Flame'?"August 24, 2023 Financial Report Commentary "NVIDIA: Another Explosion, the AI King's 'Solo Performance'"May 25, 2023 Financial Report Commentary "Explosive NVIDIA: The New Age of AI, the Future Has Arrived"February 23, 2023 Financial Report Commentary "Surviving the Cyclical Storm, Meeting ChatGPT, NVIDIA's Faith Returns"November 18, 2022 Financial Report Commentary "NVIDIA: Profits Cut by 70%, When Will the Turning Point Come?"August 25, 2022 Financial Report Commentary "NVIDIA Stuck in the Mud, Will It Relive 2018?"May 26, 2022 Financial Report Commentary "'Pandemic Fat' Gone, NVIDIA's Performance Looks Ugly"February 17, 2022 Financial Report Commentary "NVIDIA: Hidden Worries Behind Exceeding Expectations | Reading Financial Reports"November 18, 2021 Financial Report Commentary "Explosive Computing Power, Metaverse Boost, Will NVIDIA Keep Rising?"DepthJune 6, 2022 "US Stock Market Shock, Were Apple, Tesla, and NVIDIA Wrongly Killed?"February 28, 2022 "NVIDIA: High Growth is True, but in Terms of Cost-Effectiveness, It's Still Lacking"December 6, 2021 "NVIDIA: Valuation Can't Rely Solely on Imagination"September 16, 2021 "NVIDIA (Part 1): How Did This 20-Fold Chip Giant in Five Years Come About?"September 28, 2021 "NVIDIA (Part 2): Dual-Wheel Drive No More, Coming is the Davis Double Kill?"