Horizon's confidence in Hong Kong's largest technology IPO this year

![]() 10/31 2024

10/31 2024

![]() 458

458

As A-shares and H-shares have recovered strongly, the intelligent driving industry has set off an IPO wave.

On October 24, Horizon Robotics (Horizon Robotics-W, stock code: 9660.HK) was officially listed on the Hong Kong market, opening up 28.32% and with a total market value exceeding HK$66 billion, making it the largest technology IPO in Hong Kong this year.

Prior to this, Black Sesame Technologies, RoboSense, and Ruqi Limousine & chauffeur had already gone public in Hong Kong, while Pony.ai, WeRide, and Momenta were also accelerating their entry into the capital market.

Currently, both upstream and downstream industries of intelligent driving have entered a fiercely competitive stage. Not long ago, Tesla unveiled its self-driving taxi "Cybercab," and Elon Musk even claimed that "this product will make Tesla a $10 trillion company, and people will still talk about this moment a hundred years from now."

Among domestic enterprises, whether it's NIO, Xpeng, Li Auto, or Huawei-supported HarmonyOS Intelligent Drive, as well as latecomers like Xiaomi Motors, and traditional automakers such as GAC Motor, Chery Automobile, and Geely, have all embarked on the intelligent battle. Advanced intelligent driving features have even extended to vehicles priced below RMB 200,000.

The era of intelligent driving is upon us, and the degree of intelligence has become an important reference indicator for consumers when purchasing cars. With the support of new technologies such as AI, big data, and cloud computing, intelligent driving has also become a new direction for the transformation of the automotive industry.

Amidst fierce competition, what makes Horizon stand out and become the most noteworthy IPO target in intelligent driving?

[Soaring performance and recognition from the industry and investment institutions]

Although it may not be the first intelligent driving enterprise to go public, Horizon's strength and scale are unquestionably leading in the industry, earning it the title of "first stock."

Since its establishment, the company has consistently garnered the favor of leading enterprises and investment institutions. In 2015, its seed round of financing valued the company at USD 60 million, and by the end of September 2022, after its D round of financing, the valuation soared to USD 8.71 billion, a staggering 144-fold increase in seven years, establishing it as a bona fide super unicorn.

▲Horizon investors, source: Intelligent Vehicle Reference

Early investors included top OEMs and automakers such as SAIC Motor, Great Wall Motor, BYD, and CATL, as well as world-class investment institutions like Hillhouse Capital, Sequoia Capital, and Blackstone Group.

During the IPO process, Horizon's cornerstone investors were truly impressive, including Alibaba, Baidu, the CMA CGM Group of French shipping billionaire Rodolphe Saadé, and the Ningbo Municipal Government Fund. Together, these four investors subscribed to USD 220 million worth of shares, raising a total of no more than HK$5.41 billion (approximately RMB 5 billion) for the company. Both the industry and investment institutions have expressed their recognition of Horizon with real money.

The company's performance is impressive. In the first half of this year, revenue surged 151.6% to RMB 935 million, with gross profit growing faster than revenue, reaching RMB 739 million, up 226% year-on-year. The gross margin increased to 79%, reflecting the strong fundamentals of a technology growth stock and standing out in the automotive supply chain amid price wars.

Moreover, the company's losses are narrowing. From 2021 to 2023, adjusted net losses were RMB 1.103 billion, RMB 1.891 billion, and RMB 1.635 billion, respectively. In the first half of this year, adjusted net losses were RMB 804 million, compared to RMB 996 million in the same period last year, a year-on-year narrowing of 13.5%. In today's cash-is-king environment, Horizon boasts ample "cash reserves," with RMB 10.452 billion in cash on hand as of the first half of the year.

As a hard tech company, Horizon is generous with its R&D investments. Over the past three years, it has invested a total of RMB 5.4 billion in R&D. In the first half of this year, R&D investment reached RMB 1.42 billion, up 35.3% year-on-year, far exceeding revenue for the same period.

As the first company in China to achieve large-scale pre-installed mass production of intelligent driving solutions, Horizon leads the industry in terms of market share, commercialization potential, and technological strength gained through exceptional R&D investments. These factors will continue to drive the company's growth post-IPO.

[Top Player, Scarce Investment Target]

How long does it take to achieve shipments of 6 million intelligent driving solutions?

Horizon's answer is – four years!

Since commencing pre-installed mass production in 2020, Horizon's Journey family of computing solutions has continued to surge in production scale, making it the largest pre-installed mass producer of automotive intelligent computing solutions in China.

Since 2021, based on total installed capacity of solutions, Horizon has been the first and largest Chinese company to mass-produce advanced driver assistance systems (ADAS) and high-level autonomous driving solutions every year. Ten of China's largest OEMs have adopted Horizon's solutions, with core customers including SAIC Motor, Changan Automobile, BYD, NIO, Li Auto, Geely, and Volkswagen.

From 2022 to 2023, Horizon's installed capacity of ADAS and AD solutions grew rapidly by fourfold.

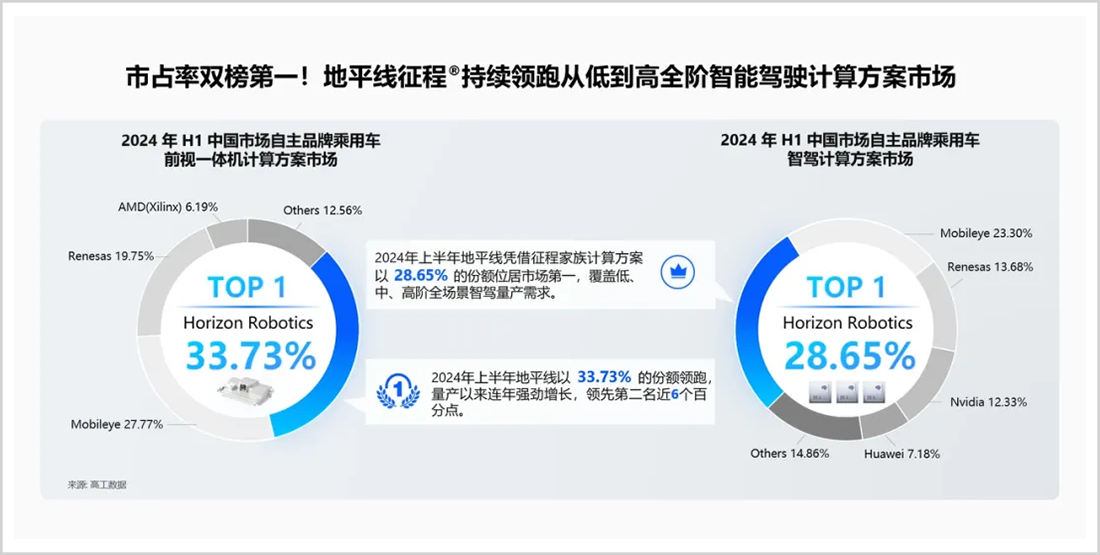

In the first half of 2024, Horizon ranked first in both the forward-facing monocular camera computing solution and intelligent driving computing solution markets in China, with market shares of 33.73% and 28.65%, respectively.

The data speaks for itself. From its inception less than a decade ago, Horizon has consistently been the industry's undisputed "top player."

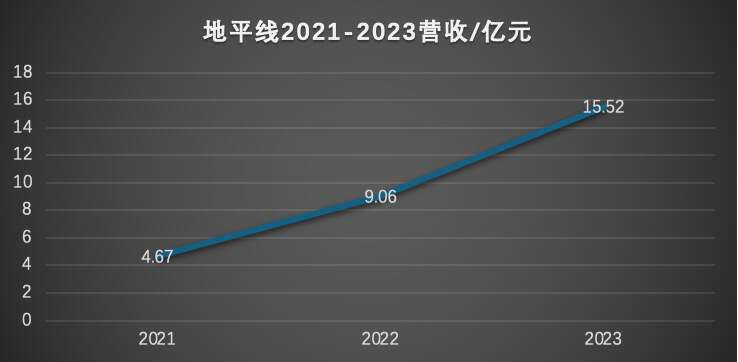

In terms of growth, the company's performance over the past four years has shown a steep upward trend, with revenue compound annual growth reaching an astonishing 82.3% from 2021 to 2023;

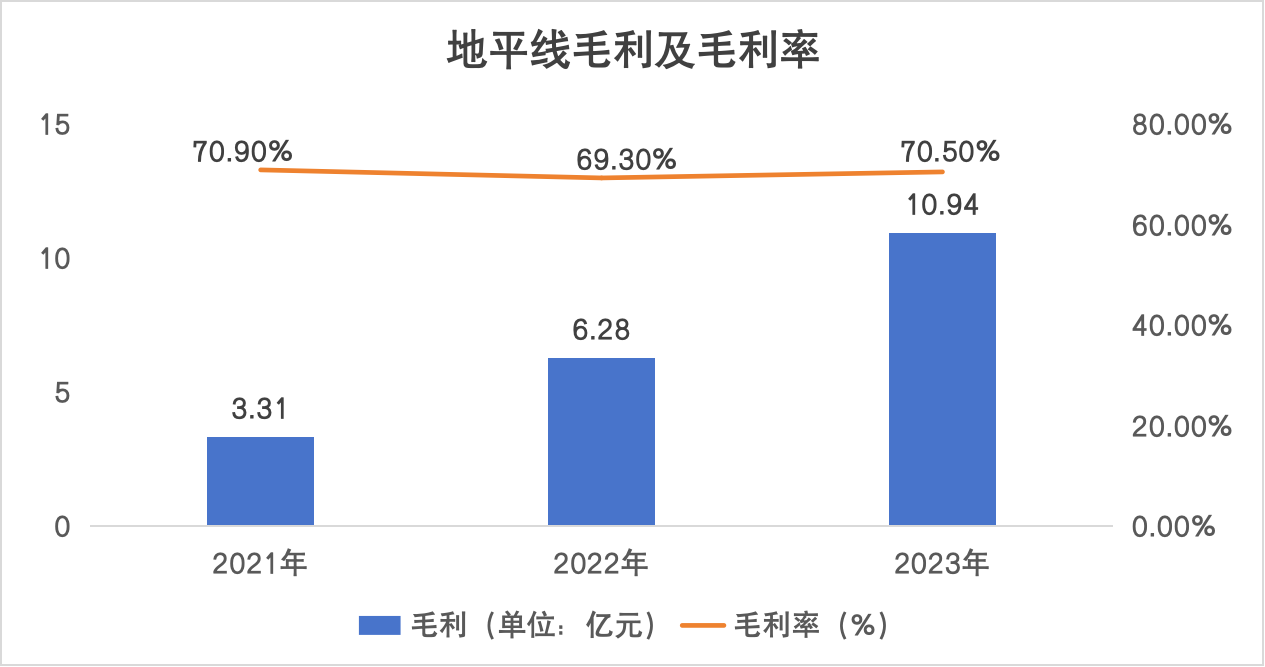

Not only revenue but also Horizon's gross margin has consistently maintained a high level, with gross margins of 70.9%, 69.3%, and 70.5% over the past three years; in the first half of this year, the gross margin increased significantly to 79%.

Moreover, Horizon is accelerating its lead, having secured 290 designated models to date, with 152 models having achieved SOP (Start of Production).

Securing designations means that as models go into mass production, these orders will translate into future revenue. With a substantial portfolio of designated orders, Horizon has built a deep commercial moat, ensuring continued growth in future performance.

Meanwhile, Horizon boasts a super elite management team, with founding members who are technological giants in the industry and have held positions in major domestic and international companies, even contributing to advancements in machine learning, computer vision, and pattern recognition in China.

Founder Yu Kai is a renowned expert in deep learning, with 25 years of experience in computer engineering and R&D, having published over 100 papers cited over 30,000 times.

Currently, Horizon has established close partnerships with leading automakers such as Changan, Li Auto, Volkswagen, and BYD, and its "network" continues to expand.

In 2020, just five years after its establishment, Horizon achieved mass production of its automotive-grade computing solution Journey 2 in the Changan UNI model, marking a milestone in the mass production of domestic automotive intelligent chips.

Since then, Horizon's Journey 3 and Journey 5 products have been globally premiered in Li Auto's ONE and L8 models. Currently, Horizon and Li Auto are steadily advancing their cooperation based on Journey 6, with Li Auto being the first mass production partner for the Journey 6 series, and Journey 6M having achieved platform designation.

BYD is an early investor in Horizon, and the two companies have collaborated deeply in intelligent driving and algorithms. Wang Chuanfu once publicly stated, "BYD has over one million vehicles equipped with Horizon's Journey 2, Journey 3, and Journey 5 series, and we will become Horizon's largest mass production partner." In the future, BYD will adopt the Journey 6 series computing solutions, maintaining a close partnership with Horizon.

In addition to domestic enterprises, Horizon has also partnered with Volkswagen Group's software company CARIAD to establish a joint venture, Coreal, signifying Horizon's recognition by international automakers and its seat at the global automotive industry table. Currently, Coreal is an important customer for Horizon.

With astonishing growth and fruitful commercialization, Horizon is undoubtedly a scarce investment target in the industry and the most noteworthy listed company in the intelligent driving sector.

[Unique Methodology Driving Long-Term Growth]

Unique Know-How is a company's differentiated competitiveness and the key to driving its long-term growth.

Unlike other players in the industry, Horizon is an atypical company that adheres to a "hardware-software integration" approach. "We are a software company disguised as a chip company, and Horizon's essence has never changed," Yu Kai once said.

Compared to blindly stacking technical parameters, hardware-software integration can outperform general-purpose chips by a factor of ten, delivering an experience that exceeds consumer expectations. Based on this philosophy, none of the over 6 million computing solutions delivered by Horizon have been delivered as single chips. As a result, the company has become the only vendor in the industry that can provide full-stack intelligent driving solutions.

From PCs to mobile internet, hardware-software integration has played a crucial role in every industrial transformation. Whether it's the "Wintel" alliance of Intel and Microsoft or Qualcomm and Google (Android) dominating the smartphone era, this is evident.

'We are the chip company that understands software algorithms best, the software algorithm company that understands chips best, and the company that understands automotive standards best among those that do both software algorithms and chips,' said Horizon. Horizon aims to achieve new breakthroughs in intelligent driving through hardware-software integration.

In April this year, the company unveiled its new generation of automotive intelligent computing solutions, Journey 6 series, and Horizon SuperDrive (HSD), a full-scenario intelligent driving solution.

The Journey 6 series secured cooperation with 10 mass production automakers right out of the gate and is expected to deliver over 10 mass-produced models by 2025. High-level intelligent driving has become a standard feature in flagship models, and in the competition for performance, HSD will empower automakers to accelerate towards the ultimate goal of high-level intelligent driving. Horizon has partnered with Joyson Electronics and Zerobound Technology, and SuperDrive will launch a standard mass production solution in the fourth quarter, with the first mass-produced model expected to be delivered in the third quarter of next year.

Under the leadership of AI technology, the global tech industry is witnessing a new wave of transformation, with the emergence of ChatGPT and the advent of autonomous driving. However, while the outside world rejoices, Yu Kai has been calmly contemplating. Rather than focusing solely on technological superiority, Horizon is committed to a user-centric approach, creating value for users, and building a trinity capability model.

Whether it's the "Wintel" alliance in the PC era, where the Windows system was tightly coupled with Intel's X86 computing architecture, or the hardware-software synergy of Android + ARM + Qualcomm in the mobile era, hardware-software integration has played a crucial role in every industrial transformation.

Currently, both Tesla and Huawei adopt hardware-software integration and ecosystem collaboration strategies to reshape the intelligent automotive industry and provide users with ultimate and disruptive experiences.

Since its inception, Horizon has aspired to bridge the gap between software and hardware, from end to cloud, building a "trinity" capability model: industry-leading technological prowess + refined engineering capabilities + a human-centric product system.

Based on this comprehensive and three-dimensional capability, Horizon has been able to achieve shipments of over 6 million units in such a short time, secure 290 designated models, and achieve SOP for 152 models. It has become the fastest-growing mass producer of intelligent driving solutions in China, with the broadest brand reach and the largest number of models, achieving the largest-scale mass production for four consecutive years.

After the launch of the new Journey 6 hardware, the first batch of mass-produced models was delivered in the fourth quarter. Chery even officially announced cooperation on multiple designated models, with all four of its brands (Chery, EXEED, JETOUR, and iCAR) set to adopt the solution.

Moreover, Journey 6 integrates CPU, BPU, GPU, and MCU into a single chip, delivering up to 560 TOPS of computing power. It is the industry's first automotive intelligent computing solution that can cover the full range of intelligent driving needs, from low to high levels.

Empowered by the Journey family of hardware, SuperDrive has undergone system generalization capability tests in 12 cities across China. Since the launch of the HSD project in October last year, Horizon's HSD has achieved nationwide generalization in less than a year and will launch a standard mass production solution in the fourth quarter of this year, with the first mass-produced cooperation model expected to be delivered in the third quarter of 2025.

As the competition for city NOA (Navigate on Autopilot) fully unfolds, Journey 6 Flagship and HSD are accelerating the pace. Committed to creating a world-class benchmark for intelligent driving, Horizon aims to raise the bar for high-level intelligent driving, making it a standard feature and bringing a "user-friendly" and "loved" intelligent driving experience to millions of households.

On one hand, through hardware-software integration, and on the other, leveraging the experience gained from being the largest mass producer in China, Horizon is accelerating the pace of industrialization, leaving its competitors far behind.

In the first half of the electric vehicle era, CATL grew into a trillion-yuan giant in China's new energy vehicle industry. In the second half of the automotive intelligence era, it is not inconceivable that another trillion-yuan intelligent solution provider will emerge.

Currently, the singularity of the industry has begun to explode, and Horizon is well-prepared in terms of technological strength, industrial development, and post-IPO capital support.

Disclaimer

The content related to listed companies in this article is based on the author's personal analysis and judgment based on information publicly disclosed by the listed companies in accordance with their legal obligations (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice, and Market Value Watch assumes no responsibility for any actions taken as a result of adopting this article.

——END——