Meta: Completely Becoming an "AI Fanatic", Can High Growth Withstand High Investment?

![]() 11/01 2024

11/01 2024

![]() 545

545

Hello everyone, I'm Dolphin!

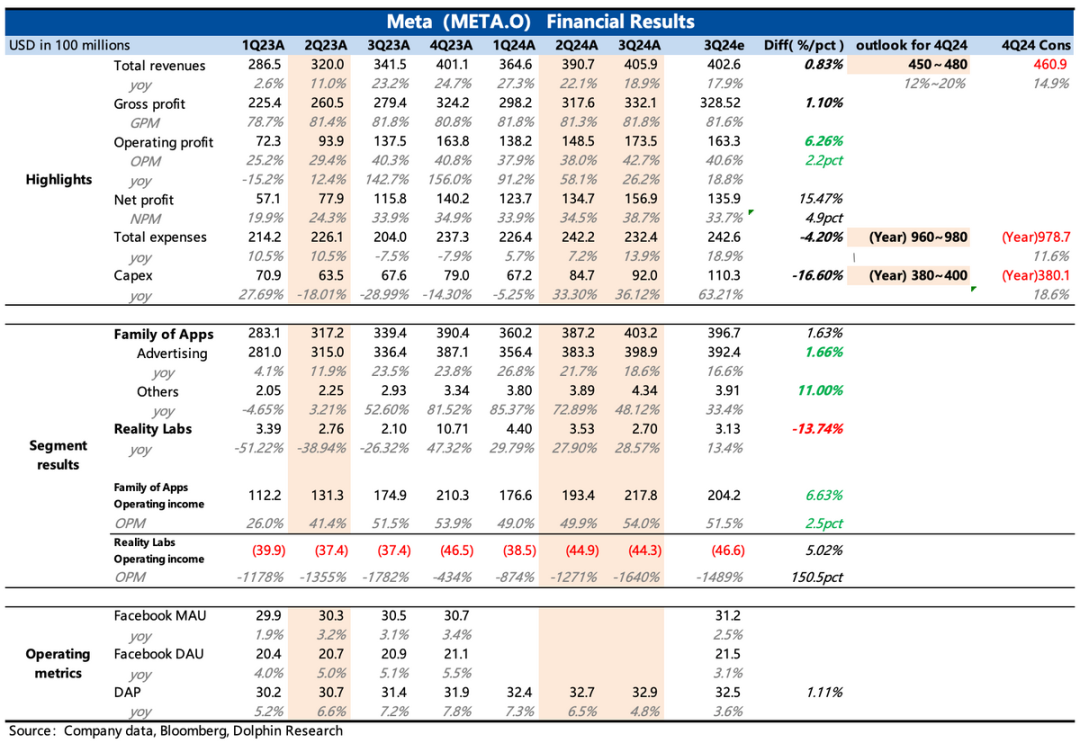

Meta released its third-quarter 2024 financial report after market close on October 30, Eastern Time. Here are the key points:

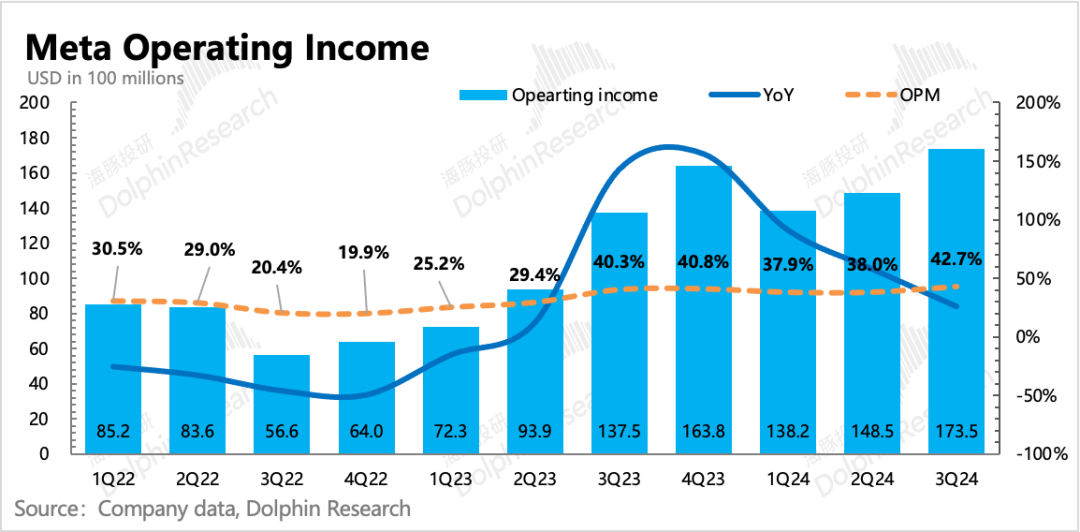

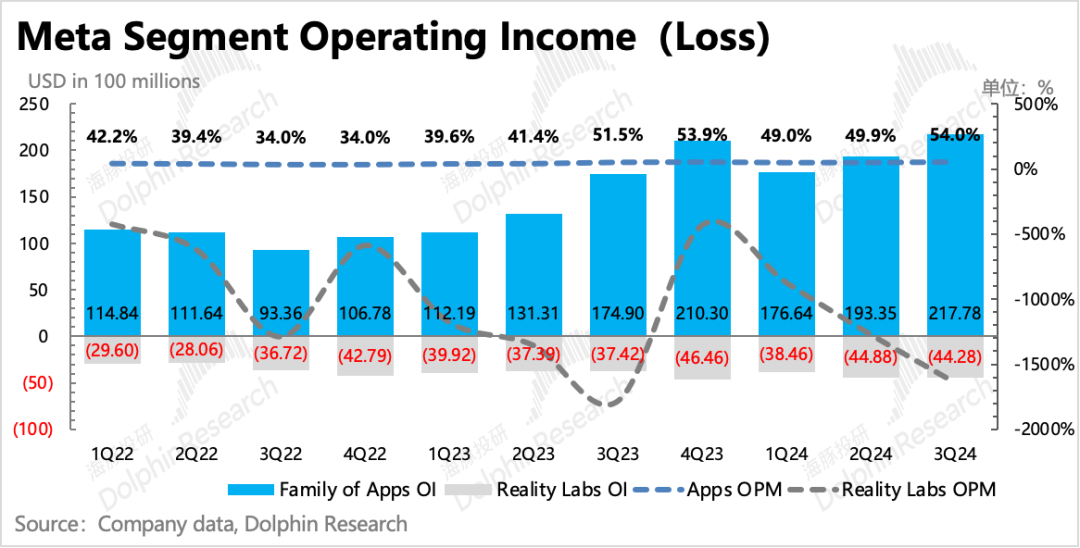

1. Basically passed the test under high expectations: Q3 performance was actually quite good, with strong revenue growth, especially profit margins exceeding expectations. There were some concerns in the market about increased pressure on profit margins due to AI cost recognition. However, Meta's actual operating profit in Q3 actually increased quarter-over-quarter to 42.7%, the highest since business headwinds in 2022.

However, with advertising experts giving almost universally positive feedback on Meta's Q3 performance, market expectations had already been elevated. Compared to the latest expectations of investment banks, Meta's performance was actually in line or even slightly below some indicators. At high valuations, any small flaw may be amplified.

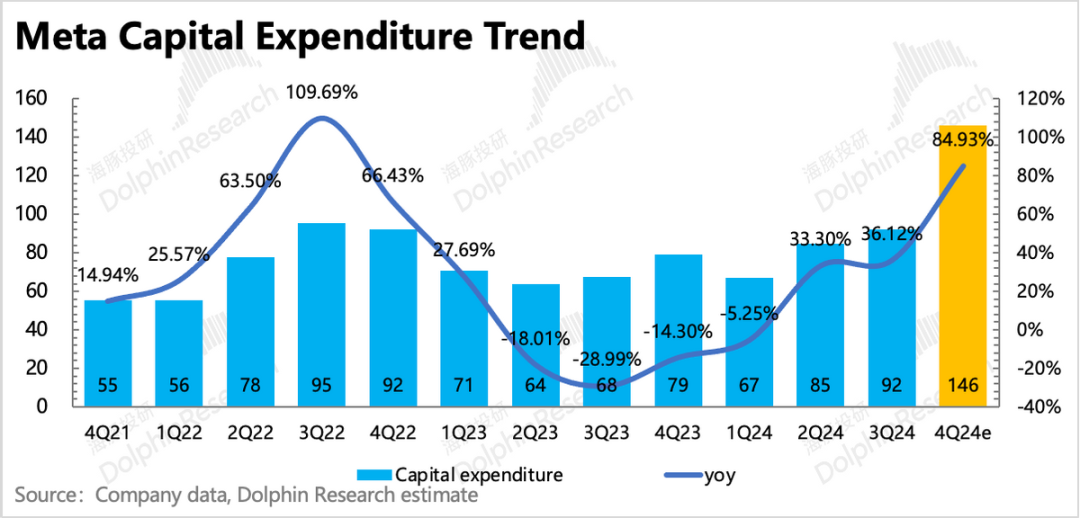

2. Capex acceleration in the next quarter: Since Meta's advertising logic is currently smooth (Reels & Advantage+, competitive advantage in social media, etc.), the market is more concerned about the negative impact on profitability due to high investment compared to revenue growth expectations.

Q3 Capex was $9.2 billion, slightly lower than expectations, but the full-year Capex guidance raised the lower limit, with the new range being $38-40 billion, implying a sharp increase in Q4 capital expenditure to $13.5-15.5 billion (a year-on-year increase of 72%-98% and a quarter-on-quarter increase of 59%-70%). This may be good news for NVIDIA, a pillar of the US stock market.

Currently, the market expects Capex for 2025 to be around $45 billion, with a slightly more aggressive estimate of $50 billion, representing a growth rate of about 15%-28%. If the short-term trend in Q3 and Q4 continues, the above market expectations may not hold when Q4 financial results provide guidance for the full year 2025.

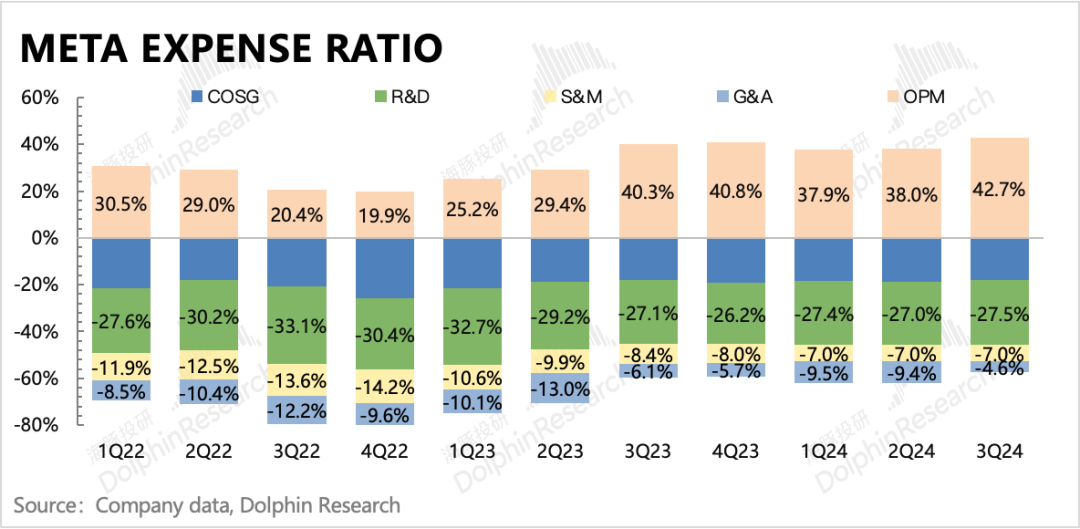

3. The "aftermath" of high investment begins to emerge: Total operating expenses accelerated by 12% in Q3 as expected. R&D expenses increased by 21% year-on-year, further reflecting the investment cycle driven by high Capex and the expansion of AI teams with higher salaries (the number of employees returned to positive growth in Q3).

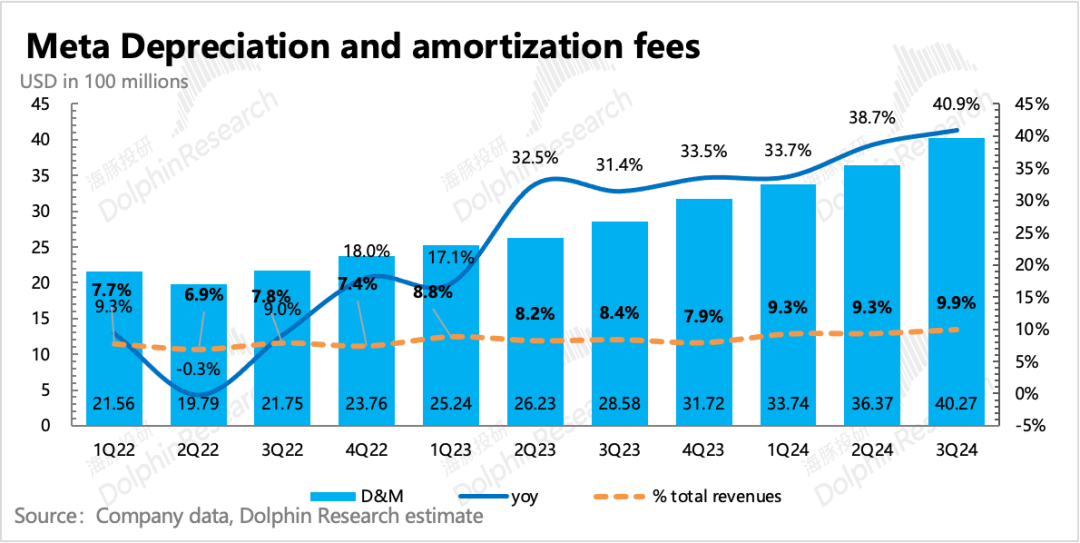

This investment cycle is dominated by infrastructure such as GPU servers. Correspondingly, the high growth in short-term depreciation and amortization expenses (Q3 growth accelerated to 40%) has already reflected the impact of high Capex.

4. Will profit pressure next year resemble 2022? Theoretically, increased expenses will inevitably affect profitability. However, from a short-term profit margin perspective, like Google yesterday, Meta also bucked the trend in Q3.

This is closely related to the current strength of advertising. The increase in profit margins also means that while investing heavily, Meta has offset profit pressure through stronger commercialization on the business side. In other words, this investment is not blind like the investment in the RL department three years ago but efficient investment in projects that can be quickly monetized, such as AI advertising.

Meanwhile, Dolphin believes that while investing in AI, Meta should also have the same advantage as Google, namely, realizing resource reuse and cost optimization of basic technologies through AI, allowing the company to reap the benefits of AI efficiency improvement internally first.

Therefore, under the premise of macroeconomic stability in the United States, although this round of capital expenditure expansion may affect the trend of profit growth to some extent, it is unlikely to repeat the nightmare of 2022. Moreover, Meta's investment in AI is clearly beneficial (compared to Google, where AI has a substitution effect on existing businesses). From a financial technique perspective, after significantly updating high-end GPU servers, Meta can also extend the depreciation period based on actual usage to alleviate the apparent pressure on financial profits. Both Google and Microsoft implemented this strategy in the past two years.

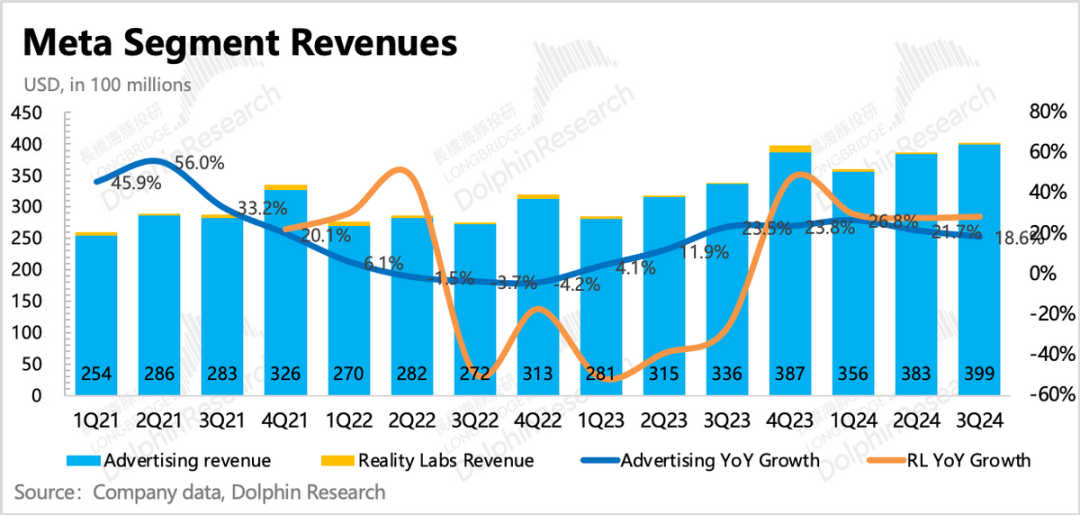

5. The advertising boom phase is over: Advertising grew by 18.6% in Q3, a remarkable growth rate given the high base (with only a 3% quarter-on-quarter slowdown). However, some market expectations directly pulled the year-on-year growth rate to 20%.

The company's guidance for total revenue in Q4 is 15%-20%. Current market expectations, including relatively positive ones, are around the median of the guidance range. Although the growth trend is still very strong, it can only be said to be basically in line with expectations. In the past, Meta's indicators often significantly exceeded expectations.

Will Meta's subsequent revenue growth gradually slow down? Dolphin believes this is quite possible.

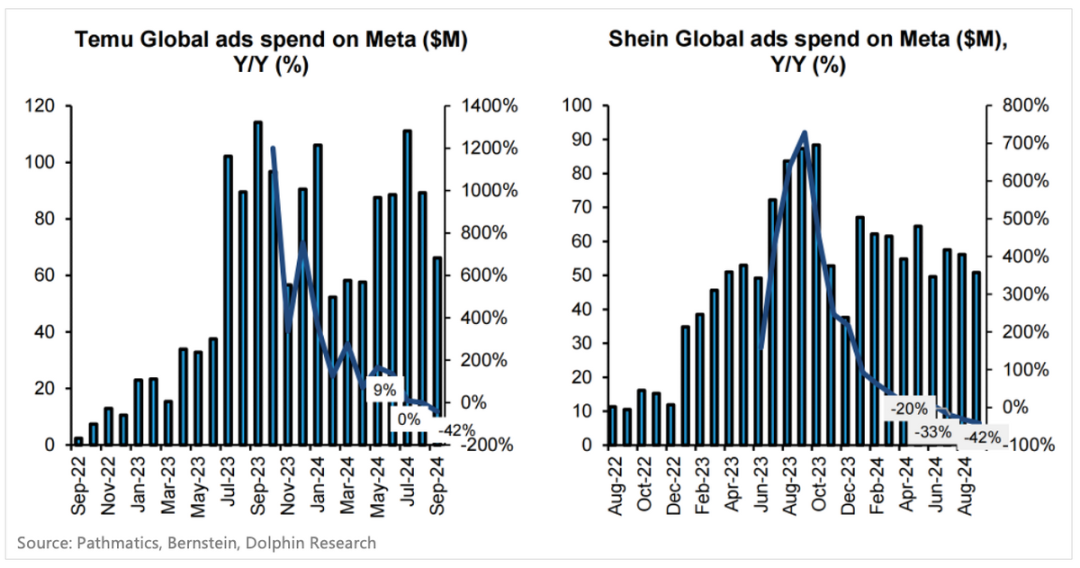

Meta's current strength is mainly due to three factors, in chronological order: the competitive advantage from the TikTok ban, Advantage+ compensating for the impact of Apple's IDFA on ROI, and Reels accelerating user penetration and commercialization. Of course, there was also a temporary boost from cross-border e-commerce platforms like Temu and Shein from China last year (contributing 10% of total revenue).

However, the last of these three positive factors has begun to weaken (T&S significantly reduced their advertising scale on Meta in September). The logic behind these changes was discussed in detail in Dolphin's last quarterly financial report. Among the first three factors, besides Reels, which may continue to grow through higher unit prices, the influence of the other two positive factors will gradually weaken under the pressure of a high base.

On the other hand, from the perspective of advertising volume and price, Q3 growth was mainly driven by an increase in unit prices, reflecting the current strong US economy and Meta's relative competitive advantage. However, Meta's current CPM is uniquely high among peers, and continuous increases in unit prices will to some extent weaken advertisers' ROI, causing some less resilient advertisers to turn to other emerging platforms with higher cost-effectiveness or faster traffic growth.

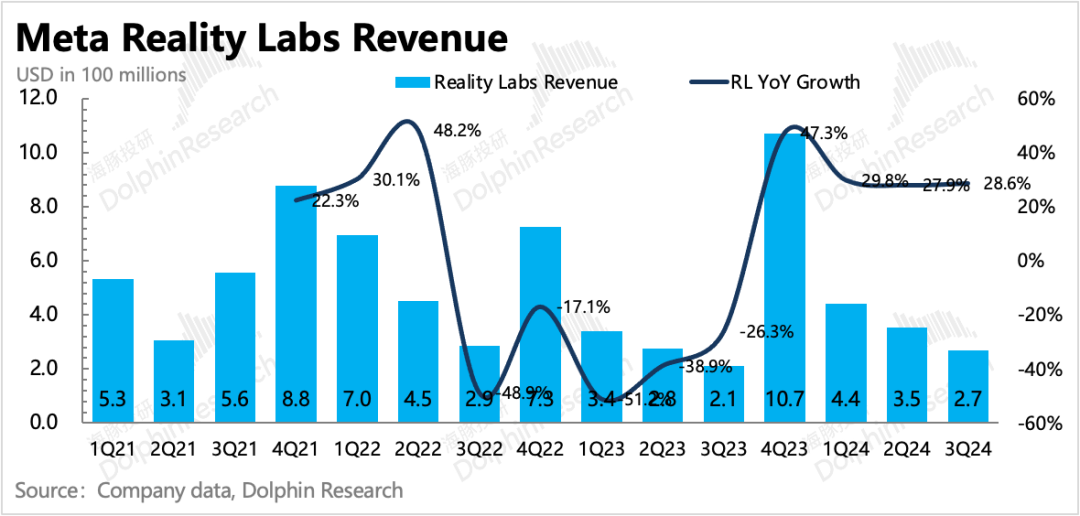

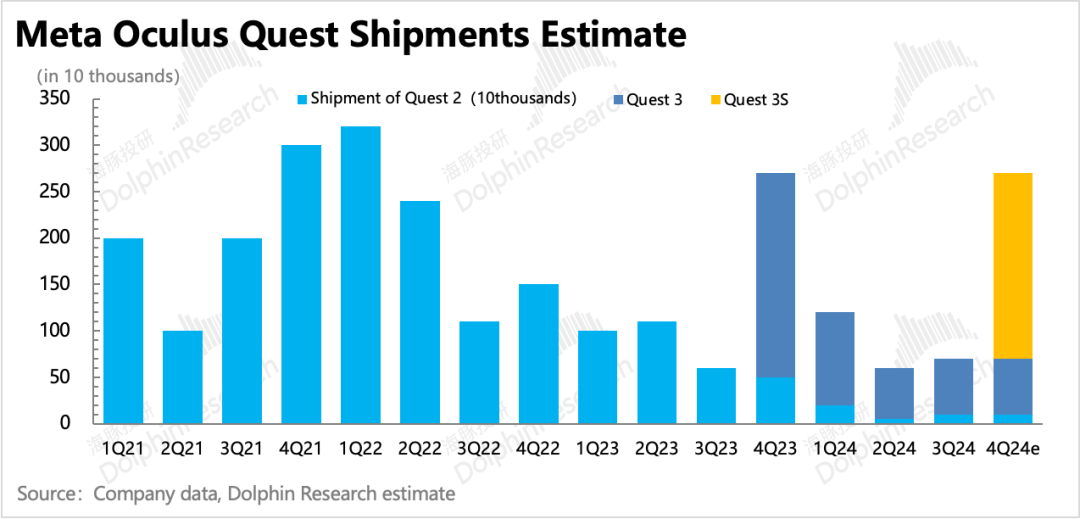

6. VR is expected to benefit from new product sales during the shopping season: VR-related Reality Labs revenue was $270 million in Q3, a year-on-year increase of 29%, maintaining stable growth due to a low base but still representing conventional off-season performance.

Current VR still relies on new products for stimulation. The cheaper new Quest 3S VR headset was released at the Meta Connect conference at the end of September, and it is expected to boost sales during the fourth-quarter shopping season.

7. Cash usage and shareholder returns: At the end of Q3, Meta had a total of $70.9 billion in cash and short-term investments, with $42.1 billion in net cash after deducting long-term borrowings. The company generated $15.5 billion in free cash flow in the quarter, repurchased $8.9 billion in shares, and paid $1.3 billion in dividends, estimating an annualized shareholder return rate of 3%.

8. Overview of performance indicators

Dolphin's Perspective

At the current historically high valuation (25x Forward P/E), the market has some mixed feelings about Meta.

On the one hand, the drive of AI on advertising is clearly visible, and the company's internal efficiency improvement through AI has also become more apparent in the past six months. The expected gap in this logical deduction has gradually been corrected in Meta's outperformance of technology stocks this year.

On the other hand, with the nearly doubled implied growth rate of capital expenditure in Q4 2024, market concerns about overinvestment weakening profitability reemerge intermittently. If Meta provides unexpectedly strong advertising revenue guidance, the potential impact of increased investment on profitability can still be justified by the logic of "benefits outweighing drawbacks."

However, Meta's guidance this time is relatively modest, so profit concerns are further amplified against the backdrop of high valuations. It is recommended to pay attention to the management's explanation during the conference call and any changes in tone regarding the 2025 profit guidance.

However, compared to investment issues, Dolphin believes that under Meta's efficiency-focused strategy, there is no need for excessive concern. Whether through structural adjustments in personnel or extending the depreciation period through financial techniques (Meta's server depreciation period is already shorter than that of peers, and high-end GPU servers have a longer actual service life), adjustments can be made opportunistically in the coming year.

But we are more concerned about the risk of a noticeable slowdown on the revenue side. As mentioned earlier, the dividend factors driving Meta's strong growth over the past 1-2 years are expected to gradually weaken in Q4 this year and next year. So what will be the new growth engines? One is the improved monetization of Reels, but what else? Threads? Meta AI?

If revenue growth falls back to around 15% or even 10-15% next year, and the likelihood of a significant increase in profit margins due to increased investment is low, how can Meta support a valuation of 25x or even higher?

Although fundamentally, we do not doubt Meta's more significant competitive advantage compared to peers in the medium to long term, the "original sin" lies in overly high and consistent short-term expectations. Additionally, Trump's presidency seems to bring some disturbances to short-term trading sentiment. Therefore, from a risk-reward ratio perspective, it may be more appropriate to wait for a better position.

Detailed Interpretation Below

I. Revenue: Withstood High Expectations

Meta's Q3 revenue was $40.6 billion, a year-on-year increase of 19%, with some normal slowdown due to the higher base. The main surprise was the advertising business, which accounted for 98% of revenue, while VR was still in the off-season, with the potential for a revenue surge next quarter due to the shopping season and new product excitement.

Q4 Guidance:

(1) Total revenue in line with expectations

Meta management expects total revenue in Q4 2024 to be in the range of $45-48 billion, corresponding to a year-on-year increase of 15%-20%. Current market expectations, including relatively positive ones, are also around the median of the guidance range. Although the growth trend is still very strong when viewed individually, it can only be said to be basically in line with expectations. In the past, Meta's indicators often significantly exceeded expectations.

If Meta continues its conservative and low-key guidance style this time, the implied revenue outlook for the next quarter is close to the upper end of the range, indicating a very good year-on-year growth rate. The main reason is that although the fourth quarter is the shopping season, it has nearly a week fewer days than last year. Historically, the length of the period has an impact on current performance.

Specifically, by business segment:

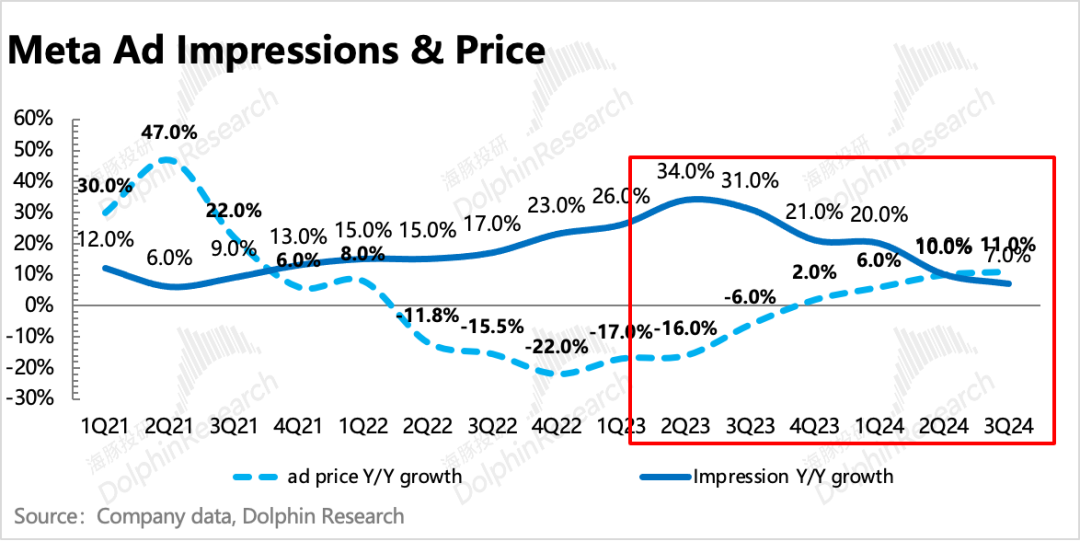

1. Advertising business: Continues to be mainly driven by unit price growth

For the advertising business, Dolphin tends to analyze the growth trends in volume and price separately to better understand the current macro environment, competition, and other issues.

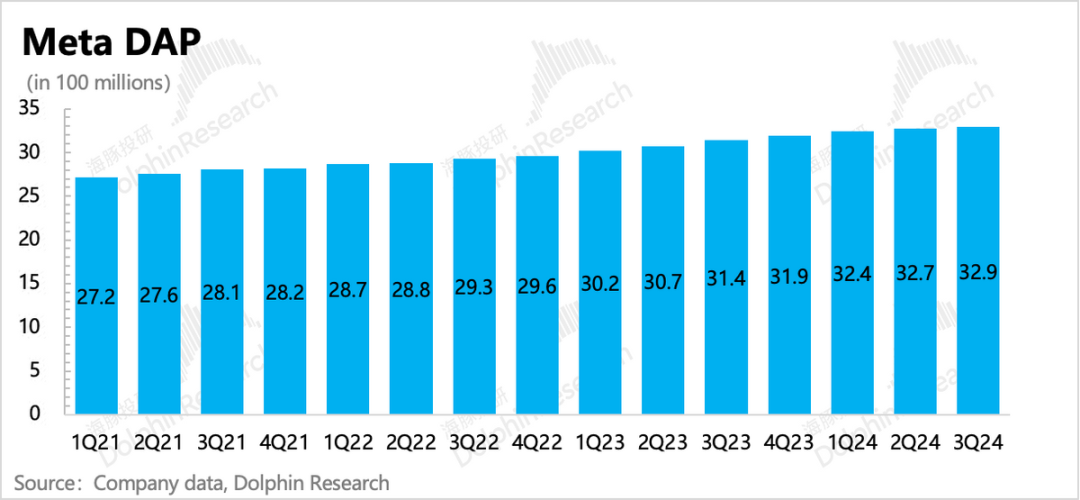

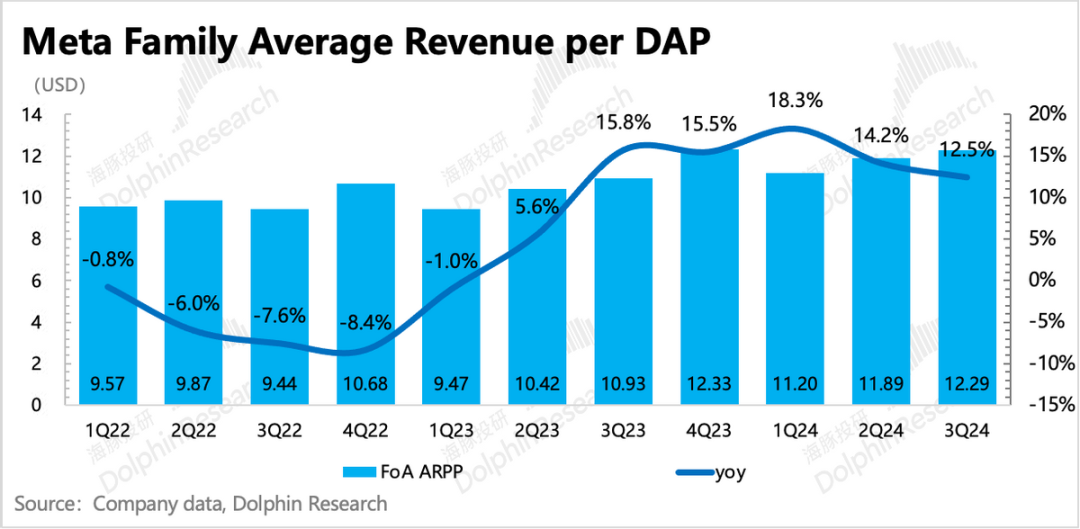

(1) The growth rate of advertising impressions continued to slow down to 7% in Q3, but the user base was still expanding (total daily active users (DAP) in the ecosystem increased by 4.7% year-on-year). Calculated this way, the average number of impressions per user increased only slightly by 2%.

Theoretically, Reels is in a period of rapid advertising inventory filling, so the sudden slowdown in impression growth is surprising. Is it because Reels inventory has reached a plateau? Or is Meta deliberately tightening the advertising inventory tap to maintain high CPMs within the platform and optimize its own ROI? Pay attention to the conference call for more information.

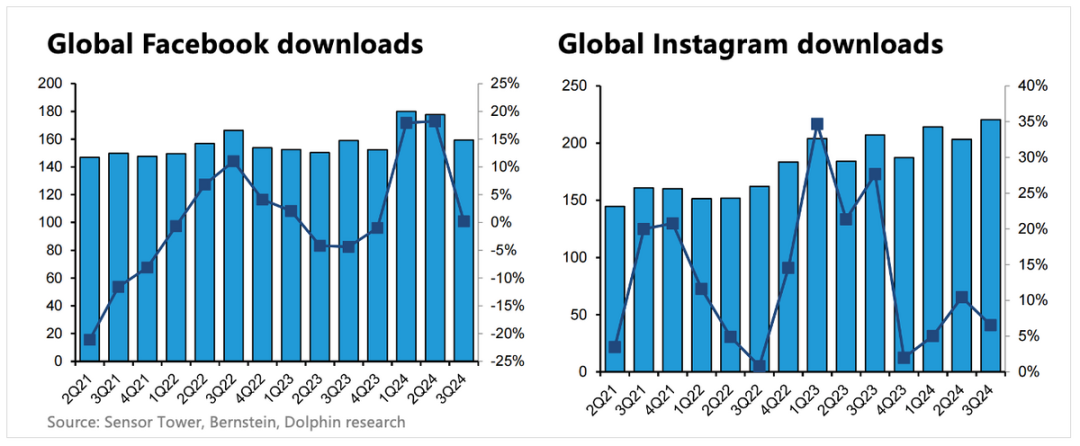

Since monthly active user data for the Facebook main site and ecosystem were no longer disclosed starting from Q1 2024, Dolphin mainly refers to third-party platforms (Sensor Tower) to track app download data and user engagement time trends.

a. From the download data, both the FB and IG main platforms showed slowing growth rates.

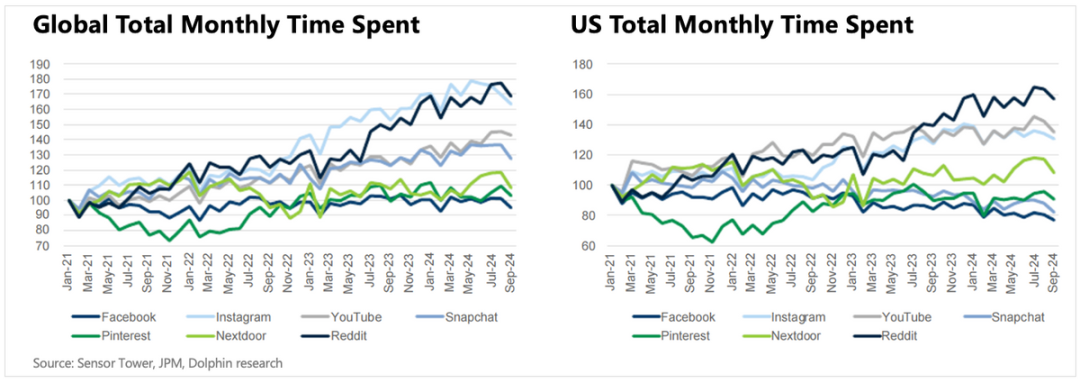

b. User engagement time is temporarily stable

In Q3, IG's user engagement time continued to grow, while FB barely maintained its level. Combining these, it to some extent indicates that as the proportion of short video content on Reels increases, IG's user stickiness is also increasing (growth in single-user engagement time).

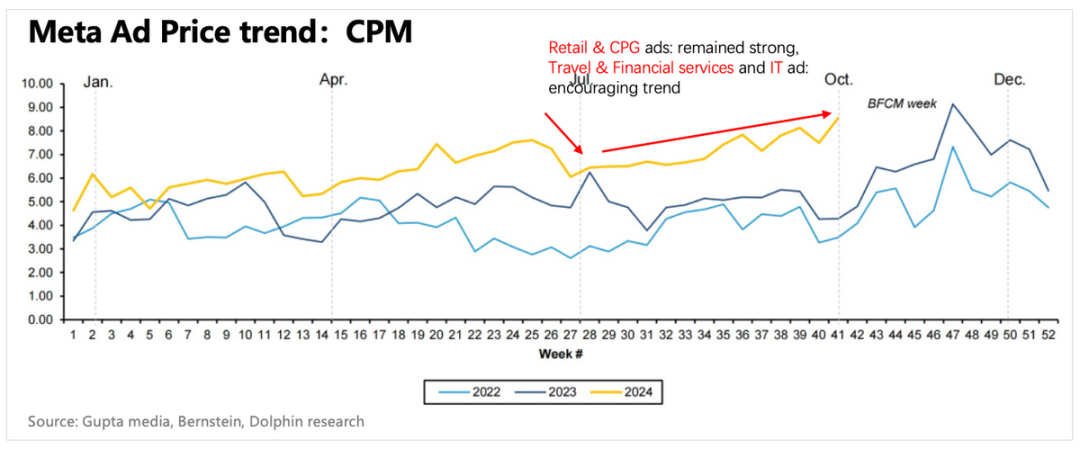

(2) Accelerated growth in advertising unit prices

We previously mentioned that advertising unit prices are related to whether the economy is in an upcycle and whether the platform's competitive advantage has increased, but this is under the condition of stable traffic on the Meta platform.

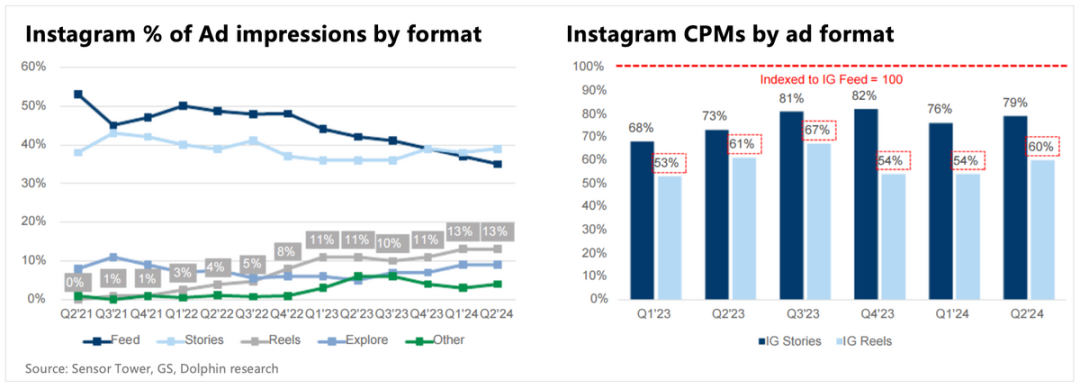

In the past year, although Reels has contributed new advertising inventory after its launch, its quotes have been relatively low within the ecosystem due to ROI issues. As the proportion of AI video content recommendations increases (reaching 50% in Q1 2024), advertising accuracy and conversion rates have also improved to some extent, giving Reels an incentive to raise its quotes.

Moreover, the macro economy remained strong in Q3, so most peer platforms also increased their quotes (YouTube's inclination to allocate traffic to Shorts has dragged down its overall CPM quotes).

Meta's comprehensive CPM growth rate reached 11% in Q3 (vs. 10% in Q2 2024), further accelerating compared to the previous quarter. Third-party platforms showed that initial quotes in Q3 declined due to the transition from peak to off-peak seasons but rebounded in the latter half of the month as consumption remained stable, and advertising in verticals such as retail, financial services, fast-moving consumer goods, and tourism remained strong or rebounded, along with increased CPM quotes due to improved ROI on Reels, jointly driving comprehensive CPM growth to a new high.

In the absence of significant economic weakness, CPM can still narrow the monetization gap with modules such as Feeds and Stories through Reels.

However, Meta's current CPM is unusually high compared to its peers, and the average APP service revenue per user continues to increase. Is there a risk of overdrawing traffic monetization? Continuous price increases may weaken advertisers' ROI to a certain extent, causing some less resilient advertisers to turn to other emerging platforms with higher cost-effectiveness or rapidly growing traffic.

2. VR: A lull during the off-season, looking forward to Q4

The strong sales of Ray-Ban in the third quarter did not bring much surprise in revenue generation. The low base did not lead to growth dividends, remaining stable at around 29%, similar to the previous quarter. Dolphin believes that the lack of growth is mainly due to the lower demand for AR glasses compared to VR headsets.

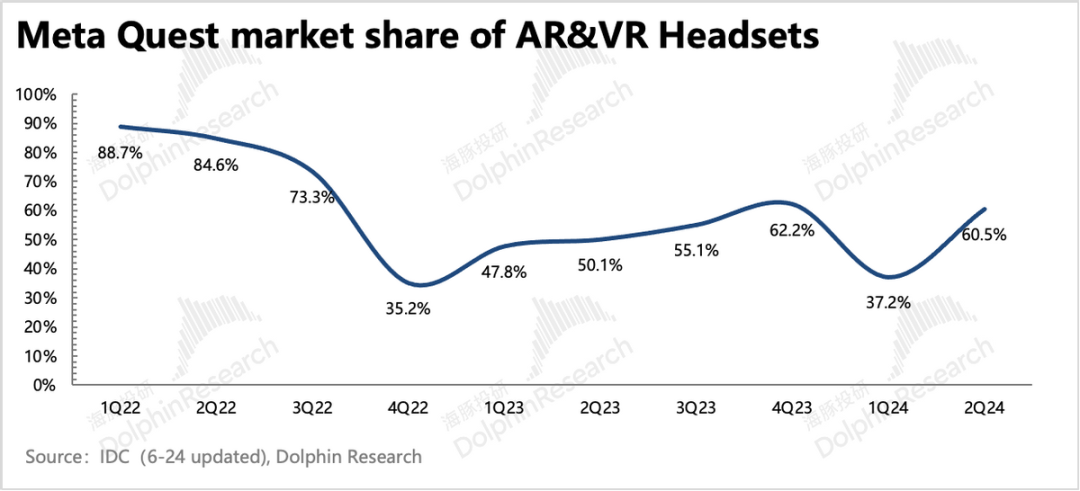

The current VR market still relies on new products for stimulation. At the end of September, Meta Connect unveiled a cheaper new Quest 3S VR headset priced at $299 (compared to $499 for the Quest 3). It is expected that, combined with the shopping season effect in the fourth quarter, sales will surge.

Combining IDC data and revenue calculations, sales of the Quest series in the fourth quarter are expected to reach levels similar to Q4 2023. (All are Dolphin's estimates and are only used for trend reference)

II. Capital expenditures continue to accelerate; how much profit pressure will there be next year?

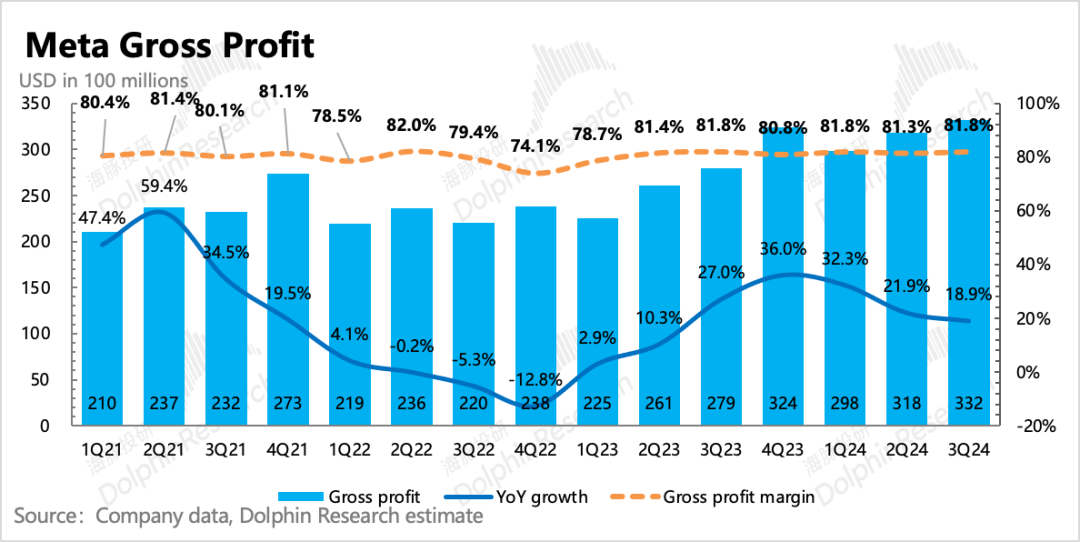

In the third quarter, although operating expenses increased at an accelerated rate, they did not significantly drag down profits. Instead, operating profit in Q3 rose to 42.7%, the highest level since business headwinds in 2022.

Although capital expenditures in the third quarter were $9.2 billion, lower than market expectations, the lower limit of the annual Capex guidance for this quarter was raised, with the new range being $38-40 billion, implying a significant surge in capital expenditures in Q4 (+72% to 98%).

Currently, the market expects Capex for 2025 to be around $45 billion, with a slightly more aggressive estimate of $50 billion, representing an increase of about 15% to 28%. However, if the short-term trends in Q3 and Q4 continue, the anticipated growth rates mentioned above may not hold when the Q4 earnings report provides guidance for the entire year of 2025.

Dolphin believes that the reverse change in short-term operating margins and capital expenditures may stem from two reasons: Firstly, the impact of the recognition window, where funds invested in the current period have not yet been expensed. Secondly, the company may have improved operational efficiency through other means, such as consolidating office space, reusing basic resources, and replacing traditional technologies with AI tools.

However, looking at directly related expenditure indicators, one can still visually observe the impact of the investment cycle. For example:

1) Depreciation and amortization expenses

Depreciation and amortization expenses in the third quarter increased by 40% year-on-year, showing some acceleration compared to the second quarter. The incremental depreciation recognized here may not yet include the impact of the significantly increased new investment cycle since the second quarter. If Meta does not adjust its depreciation cycle, even if the other efficiency enhancement methods mentioned above are used to offset the impact, the profit margin in 2025 may still face some pressure due to the growth momentum of capital expenditures in Q4 2024.

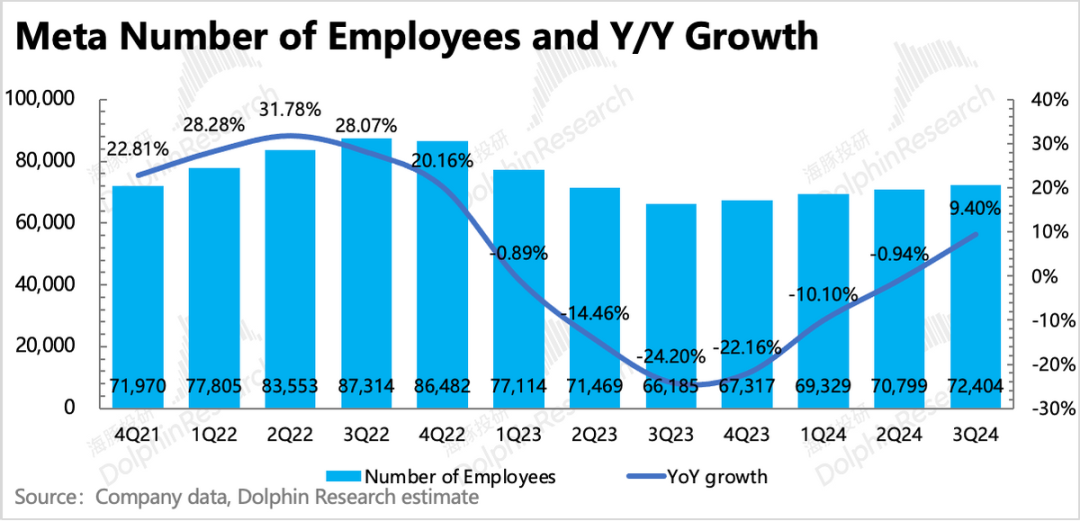

2) Employee compensation expenses

The workforce in the third quarter was 72,404, with a net increase of 1,600 from the previous quarter and a return to positive year-on-year growth. After more than a year of downsizing and efficiency enhancement, the dividend of layoffs at Meta has ended due to investments in AI.

The company had already anticipated this change in the previous quarter, and Dolphin expects this trend to continue into 2025. However, due to the management's emphasis on structural adjustments and reorganizations, the net increase in employees will not be as high. Instead, it may be more reflected in the increased salaries of AI developers, driving up overall R&D costs.

Other expenses remained stable overall:

a. Administrative expenses continued to decline

There were relatively few lawsuits involving Meta this year, so administrative expenses, including legal fees, have been contracting at a double-digit rate. However, the EU is expected to strengthen its scrutiny of Meta's compliance with DSA regulations next year, and it is not ruled out that further fines may be imposed on Meta. Nevertheless, these are non-recurring events. For cash-rich giants, as long as the penalties are not crippling, they can ignore short-term legal disturbances and focus more on their core business operations.

b. Sales expenses are expected to resume growth

Although sales expenses declined in the third quarter, the rate of decline has significantly slowed. With many new products in the coming years, marketing expenditures are expected to gradually resume modest growth.

c. Gross margin remained stable

The gross margin remained stable at 81.8% in the third quarter. Although there are seasonal fluctuations, it is not immediately apparent how much AI costs are dragging down performance.

In the end, Meta's operating margin was 42.7% in the third quarter. Breaking it down by advertising and VR business segments, as expected by the company's management, VR losses are still expanding, and significant loss reduction will require blockbuster sales of major products.

However, in the short to medium term, due to unresolved issues regarding the disruptive nature of the technology and lackluster demand, there are currently no promising hardware products on the horizon. The market has become accustomed to the performance of the Reality Labs business. As long as Zuckerberg does not make excessive investments and losses do not significantly worsen, there will not be too many demands on the VR business during the strong period of AI-driven advertising growth.

Dolphin Research's "Google" article reviews earnings season: July 24, 2024 earnings review, "360-degree scrutiny: Is Google really that stable?" April 26, 2024 earnings review, "Google soars? Learning from Meta, striving to be the best" January 31, 2024 earnings review, "Google: Expectations are too fanatical, the leader pours cold water" October 25, 2023 earnings review, "Google: Advertising is still king, cloud slowdown due to 'AI failure'?" July 26, 2023 earnings review, "Google: Breaking doubts, the advertising leader is ready to make a comeback?" April 26, 2023 earnings review, "Google: Defying expectations? There are joys amidst concerns" February 3, 2023 earnings review, "Short-term pressure is not small, Google needs to learn from Meta" October 26, 2022 earnings review, "Google: Recession looms, the advertising leader has fallen" April 27, 2022 earnings review, "Google: Continuous headwinds, even the leader is struggling" February 2, 2022 earnings review, "Outstanding performance, rare stock split, Google is about to soar again" October 27, 2021 earnings review, "Google: Flaws do not obscure virtues, the advertising leader stands alone in beauty" July 28, 2021 earnings review, "Google: Riding the wind, 'growth' soars to the clouds" April 28, 2021 earnings review, "Google: The strong remain strong, the advertising leader once again impresses" February 3, 2021 earnings review, "Dolphin Research | Emerging from the pandemic haze, Google makes a strong comeback" In-depth articles: December 12, 2023, "The love-hate relationship between Meta and Chinese companies going global: TikTok challenges, Temu delivers treasures" June 14, 2023, "Long in-depth article: Is ChatGPT the 'Thanos Snap' that will kill Google?" February 21, 2023, "U.S. stock market advertising: After TikTok, will ChatGPT spark a new 'revolution'?" July 1, 2022, "TikTok is teaching the 'big brothers' a lesson, Google and Meta are about to change" February 16, 2022, "Internet Advertising Overview - Google: Watching the Storm Unfold" November 23, 2021, "Google: Performance and stock price soar together, strong recovery is the theme of the year"