Sudden change in Q3 report, Roborock 'collapses'

![]() 11/01 2024

11/01 2024

![]() 586

586

Is the crazy stone so fragile?

Handcrafted labor/Excavator handmade editing/Produced by Uncle Jiao/Unicorn Observation

October 31 was the final battle of A-shares in October, with the three major indexes collectively closing up, and most stocks rose while a few fell. The two markets were glowing red.

But for investors holding Roborock, this was a sad day.

On the evening of October 30, Roborock released its third-quarter financial report. The previously surging Roborock suddenly hit the brakes in the third quarter.

Affected by this, Roborock opened significantly lower by 9.82% on October 31. The stock hit a daily low of 20% and closed at 235.60 yuan, down 11.02% for the day, ranking first in market declines, with a market value evaporation of 5.4 billion yuan in one day.

As a highly sought-after star stock in the AI sector, why did Roborock collapse so easily? 01 Star Halo

Roborock was founded in July 2014 by Chang Jing, a native of Yueyang, Hunan Province.

Chang Jing is a typical science and technology enthusiast, having graduated from South China University of Technology with a degree in computer science. Before founding Roborock, Chang Jing worked at Microsoft, Tencent, and other major internet companies.

Chang Jing's inspiration for founding Roborock came from the then-popular science fiction movie "Pacific Rim".

In his early 30s, Chang Jing was inspired by the movie's scenes of robots fighting monsters and believed in the future trend represented by robots and artificial intelligence. When analyzing Double 11 sales data, Chang Jing noticed that sales of robotic vacuum cleaners had maintained rapid growth for several consecutive years, leading him to dive into the robotic vacuum cleaner market.

Initially, Roborock was "attached" to Xiaomi, receiving investment from Xiaomi and becoming its ODM (Original Design Manufacturer). At that time, the annual sales of the entire Chinese market were only 2.2 billion yuan.

As the robotic vacuum cleaner market exploded, Roborock began seeking transformation in 2017, shifting from ODM to selling its own brand.

In February 2020, Roborock successfully listed on the STAR Market, marking its moment of glory: The issue price of Roborock was 271.12 yuan, setting a record for the highest IPO price on the STAR Market, with a share price increase of 82.58% on the day of listing; at the same time, it only took 15 months to reach an all-time high of 1494.99 yuan from its listing price.

Since then, as the capital market adjusted overall, Roborock's share price also began to correct, but the "king of robotic vacuum cleaners" halo made Roborock a star company in the capital market.

Overall, Roborock's performance lived up to the reputation given by the market.

According to the IDC's Quarterly Tracking Report on the Global Smart Home Device Market for the second quarter of 2024, Roborock shipped 8% more smart robotic vacuum cleaners in the second quarter of this year compared to the same period last year, ranking first globally in both shipment volume and revenue. This surpassed iRobot, the pioneering foreign brand, making Roborock the first Chinese smart robotic vacuum cleaner manufacturer to top the list.

Performance reversal

The market expected Roborock to build on its momentum of topping the global rankings, but the third-quarter report was a cold shower.

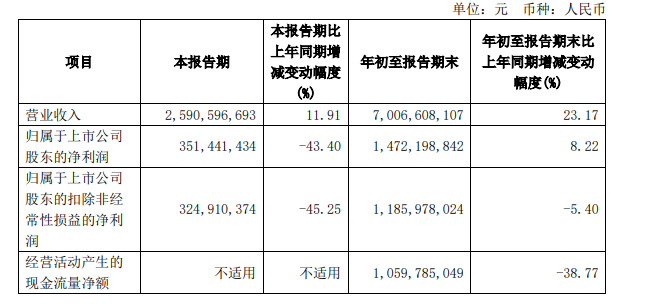

On the evening of October 30, Roborock released its third-quarter report for 2024, reporting revenue of 7.007 billion yuan for the first three quarters, an increase of 23.17% year-on-year; net profit attributable to shareholders was 1.472 billion yuan, an increase of 8.22% year-on-year.

If judged by the data for the first three quarters, the overall performance was decent, but it was entirely due to the excellent performance in the first half of this year.

For example, Roborock achieved revenue of 1.841 billion yuan in the first quarter of 2024, a year-on-year increase of 59%; net profit attributable to shareholders was 399 million yuan, a year-on-year increase of 95%; and deducted non-recurring profit and loss was 342 million yuan, a year-on-year increase of 110%.

Excluding the first half data, looking solely at the third-quarter performance, the extent of the reversal was somewhat unexpected.

In the third quarter of 2024, Roborock's revenue was 2.591 billion yuan, an increase of 11.91% year-on-year; net profit attributable to shareholders was 351 million yuan, a decrease of 43.40% year-on-year; and deducted non-recurring profit and loss was 325 million yuan, a decrease of 45.25% year-on-year.

Since the second quarter of 2023, Roborock has maintained double-digit revenue growth for six consecutive quarters, with considerable profits.

So why did revenue growth drop to only 11.91% in the third quarter of this year, while profits plummeted from substantial gains to significant losses?

In its third-quarter report for 2024, Roborock attributed the decline mainly to the company's further expansion in domestic and international markets in the third quarter and the launch of multiple new products, resulting in increased sales and R&D expenses.

At the same time, Roborock also disclosed the reason for the substantial increase in R&D investment during the reporting period, stating that the company continued to introduce and cultivate core technical talents, continuously increased R&D funding, and fully ensured the continuous improvement of the company's independent R&D capabilities.

The capital market was obviously dissatisfied with this explanation and chose to "vote with their feet." On that day, Roborock's share price fell against the market trend, closing at 235.60 yuan, ranking first in market declines with a drop of 11.02%.

This share price was roughly the same as the price at the end of September. In other words, if investors held Roborock shares at the end of September, they basically missed out on this round of major market trends.

No wonder investors complained; this wasn't buying stocks; it was stepping on a landmine.

03 Precise Operations

Although investors are suffering, interestingly, as the company's founder, Chang Jing successfully executed a round of "buy high, sell low" operations.

According to the announcement, Chang Jing transferred some company shares in the second quarter of this year.

On June 8, Chang Jing planned to transfer 1.3158 million shares through an inquiry-based transfer. On June 12, the company announced that the pricing for the shareholder inquiry-based transfer on June 11 was 376.88 yuan. The company's closing price on June 11 was 400.8 yuan, equivalent to a discount of about 6%.

If calculated based on the transfer price of 376.88 yuan, Chang Jing received funds of 496 million yuan after the transfer. According to calculations by Blue Whale Finance, if calculated at the then share price (around 200 yuan), the additional holding amount exceeded 2 billion yuan. Even if calculated at the closing price of 235.6 yuan on October 31, Chang Jing's floating profit from this additional shareholding has exceeded 390 million yuan.

Company announcements show that some directors, supervisors, and senior management among the top ten shareholders also reduced their holdings at relatively high prices in the second quarter of this year and increased their holdings when prices were low in the third quarter.

However, if Roborock continues to show weakness in the future, this round of share increases by senior management may be buried. (End)