Intel: Can It Rise Again After Shedding Its 'Big Burden'?

![]() 11/04 2024

11/04 2024

![]() 557

557

Intel released its Q3 2024 earnings report (ending September 2024) after the US market closed on November 1, 2024, Beijing time. The key points are as follows:

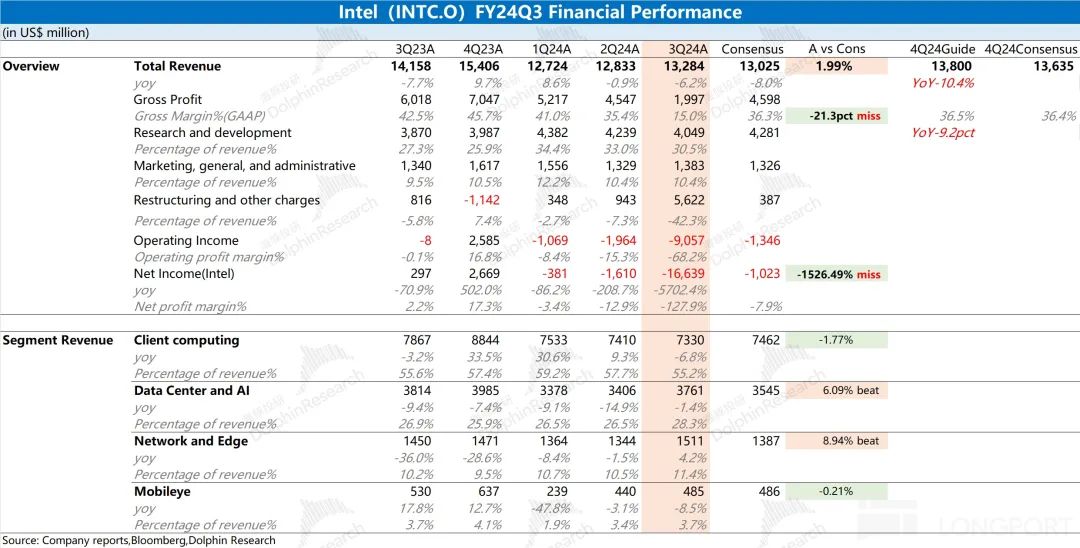

1. Core Data: Fell into Loss Again. Intel reported revenue of $13.28 billion in Q3 2024, down 6.2% year-over-year but slightly better than market expectations ($13.03 billion). The decrease in quarterly revenue was mainly driven by declines in the Client Computing Group (CCG) and Data Center and AI Group (DCAIG). Intel reported a net loss of $16.6 billion in Q3 2024, mainly due to multiple one-time charges taken by the company during the quarter. Excluding these impacts, the company's operating profit was near the breakeven point this quarter.

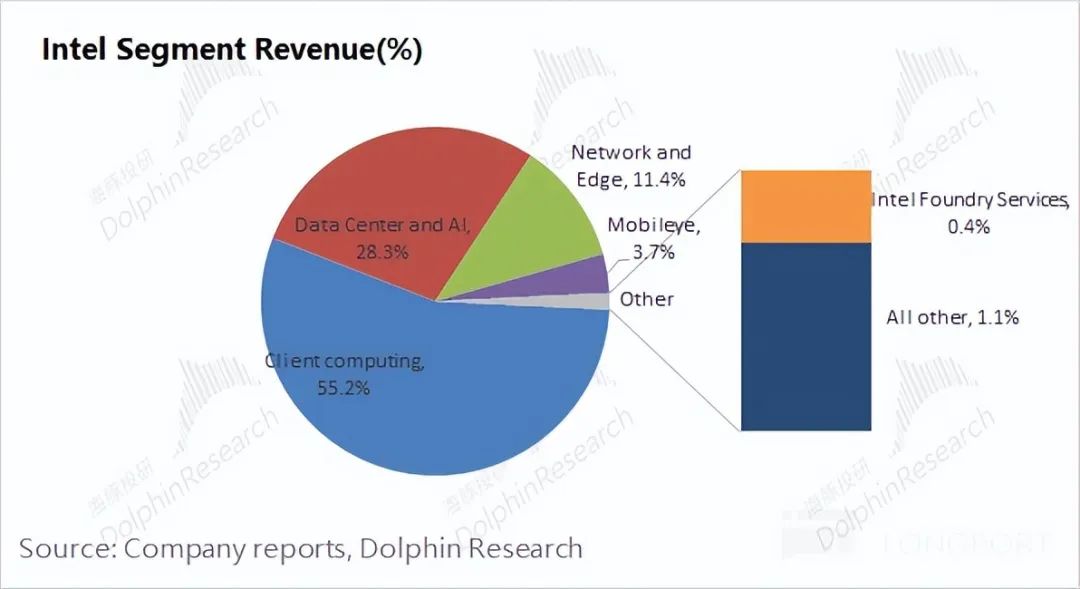

2. Business Performance: Lost Market Share in Core Segments, Struggled to Enter the Main AI Battlefield. CCG and DCAIG are Intel's largest revenue sources, accounting for over 80% of total revenue combined.

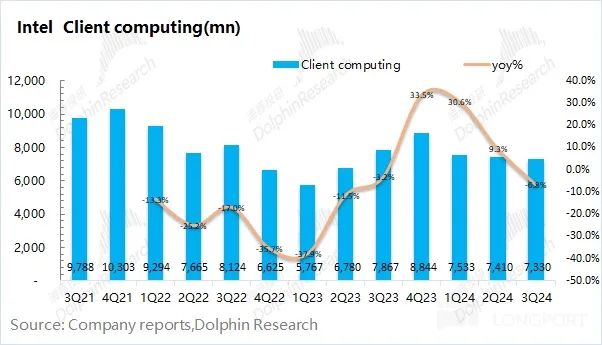

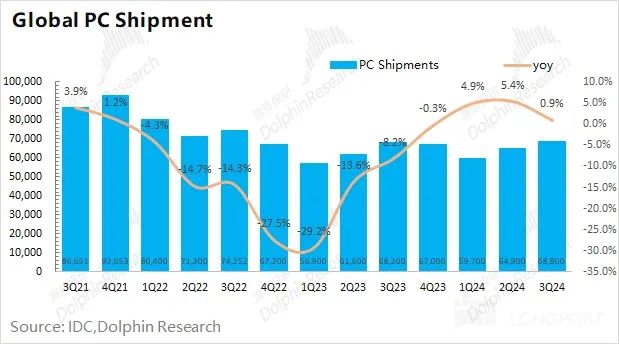

1) CCG: Lost PC Market Share. CCG revenue was $7.33 billion in Q3, down 6.8% year-over-year and below market expectations ($7.46 billion). Meanwhile, global PC shipments grew 0.9% during the same period, and AMD's CCG revenue increased 29.5%, further eroding Intel's market share.

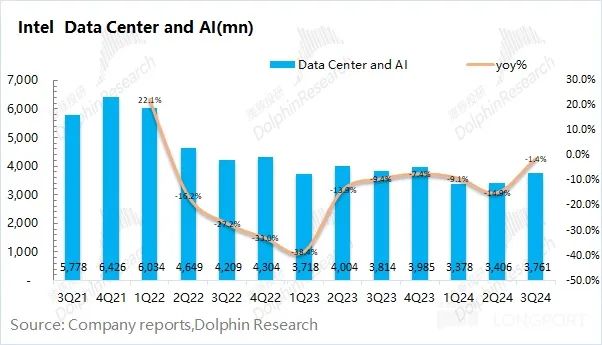

2) DCAIG: DCAIG revenue (including Altera) was $3.76 billion in Q3, down 1.4% year-over-year but better than market expectations ($3.55 billion). Although DCAIG revenue still declined, it exceeded market expectations due to a recovery in demand for traditional services. However, Intel still struggles to enter the main AI battlefield.

3. Intel's Guidance: Intel expects Q4 2024 revenue of $13.3-$14.3 billion (market expectation: $13.635 billion) and a GAAP gross margin of 36.5% (market expectation: 36.4%). The midpoint of the revenue and gross margin guidance ranges is slightly above market expectations.

Dolphin's Overall View: Intel's earnings report was actually decent.

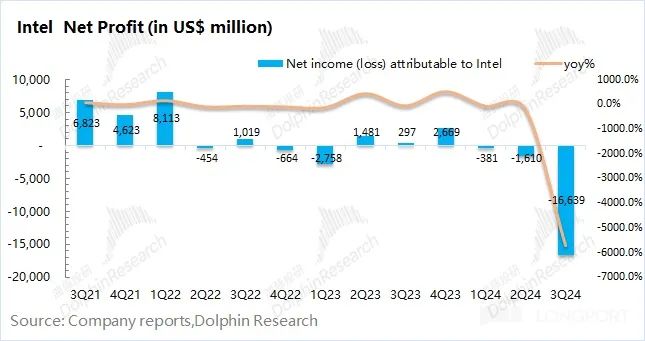

Although Intel reported a loss of $16.6 billion this quarter, a closer look at the financial statements reveals that much of this loss came from one-time impairments and related expenses. Excluding these impacts, Intel's revenue and gross margin met market expectations, and its profit was near the breakeven point. Overall, the situation was not as dire as it appeared on the surface.

In terms of individual businesses, CCG and DCAIG are Intel's core segments, accounting for over 80% of total revenue. However, neither segment showed clear signs of improvement: 1) CCG: Continued to decline even as competitors grew by double digits; 2) DCAIG: Saw a recovery in demand for traditional servers but made no significant progress in AI, the market's current focus. The total capital expenditures of the four major cloud vendors grew by double digits this quarter, but Intel's DCAIG revenue still declined, indicating that the company has not entered the main AI battlefield.

So, why is this earnings report considered decent despite showing no profit, losing market share in core segments, and making no progress in AI? It's because market expectations were even lower or missed, but Intel's actual operating results and next-quarter guidance met expectations. Additionally, Intel's series of actions since this quarter have demonstrated its strong execution capabilities. While over $10 billion in impairments and other expenses directly impacted short-term profits, they will benefit the company's long-term prospects by lightening its load and allowing it to start anew.

Although Intel may still struggle to enter the main AI battlefield in the short term, its business integration, personnel adjustments, impairment processing, and other actions have allowed it to solidify its strengths and navigate through this crisis.

Below is a detailed analysis

I. Core Data: Large Impairments Led to Profit Collapse

1.1 Revenue: Intel reported revenue of $13.284 billion in Q3 2024, down 6.2% year-over-year but slightly better than market expectations ($13.025 billion). The decrease in quarterly revenue was mainly driven by declines in CCG and DCAIG.

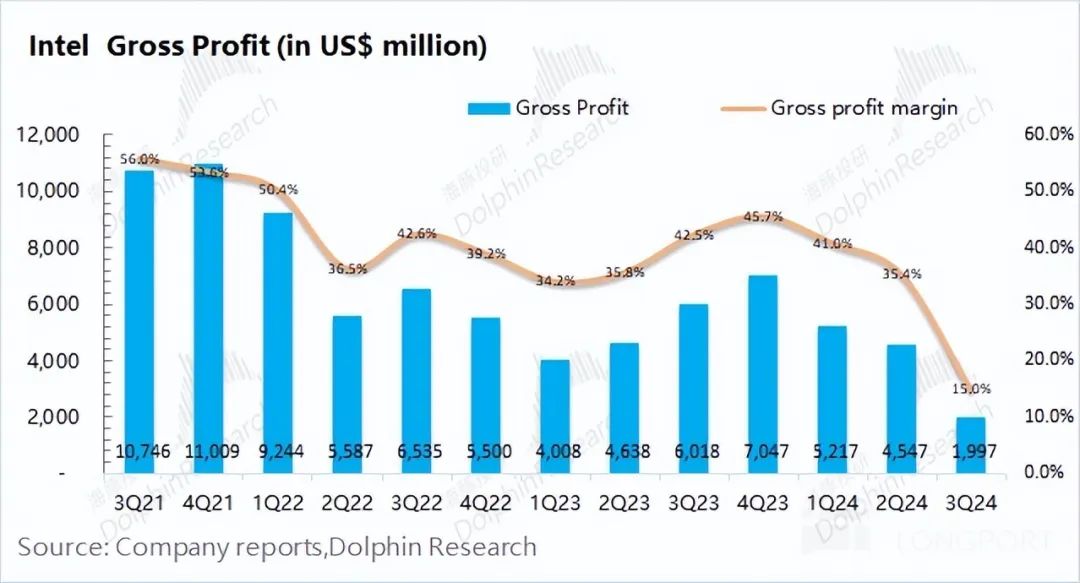

1.2 Gross Profit and Gross Margin: Intel reported a gross profit of $1.997 billion in Q3 2024, down 66.8% year-over-year. The company's profits mainly came from its PC client business.

Specifically, the company's gross margin was 15% this quarter, down 20.4 percentage points (pct) from the previous quarter and well below market expectations (36.5%). The significant decline in gross margin was due to a one-time manufacturing asset impairment charge of $3.1 billion (primarily non-cash impairments or accelerated depreciation for intel7), which was included in cost items. Excluding this impact, Intel's gross profit would have been $5.1 billion, with a gross margin of 38.4%, meeting market expectations for actual operating performance.

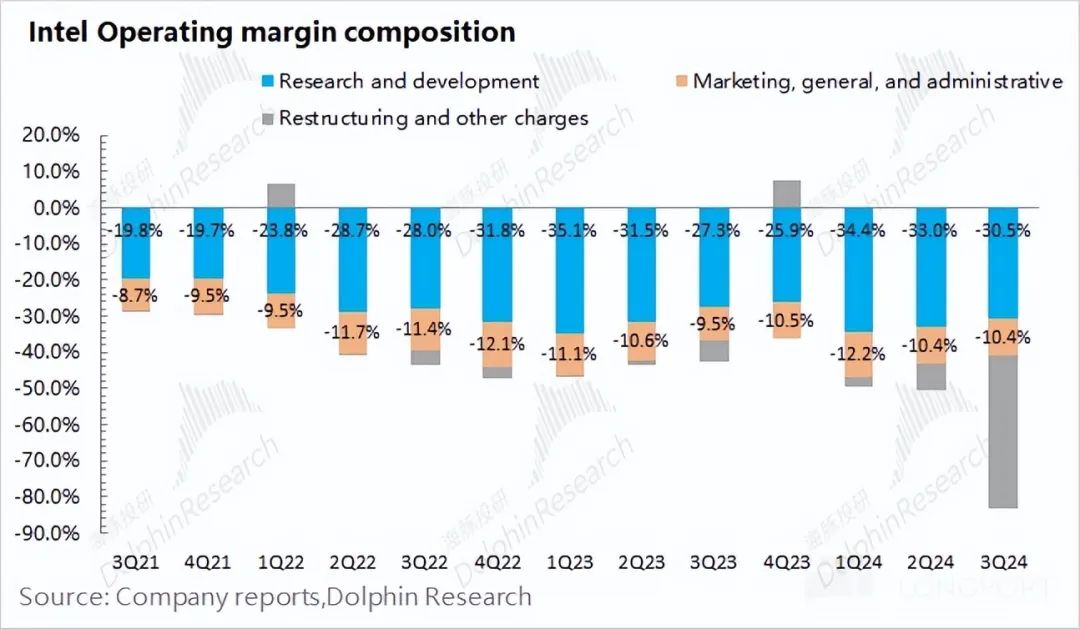

1.3 Operating Expenses: Intel's operating expenses were $11.054 billion in Q3 2024, up 83.4% year-over-year, primarily due to significant increases in restructuring costs and goodwill impairments.

Key components include:

1) R&D Expenses: R&D expenses were $4.049 billion this quarter, up 4.6% year-over-year, with an R&D expense ratio of 30.5%. Intel began personnel adjustments in Q3, and R&D expenses declined sequentially this quarter but remained a significant portion of operating expenses.

2) Selling, General, and Administrative Expenses: Selling and administrative expenses were $1.383 billion this quarter, up 3.2% year-over-year, with a selling and administrative expense ratio stable at 10.4%.

3) Restructuring and Other Expenses: Restructuring and other expenses were $5.622 billion this quarter, up significantly year-over-year. Specifically, restructuring costs related to cost reduction plans were approximately $2.8 billion, and goodwill and other intangible asset impairments were approximately $2.9 billion.

1.4 Net Profit: Intel reported a net loss of $16.64 billion in Q3 2024, a significant quarterly loss.

This huge loss was mainly due to multiple one-time charges taken by the company this quarter (including impairments on manufacturing assets such as production lines, restructuring costs, goodwill and intangible asset impairments, and valuation allowances for deferred tax assets), totaling $18.5 billion. Excluding these charges and tax impacts, Intel's operating loss was $140 million, near the breakeven point.

II. Segment Data: Lost Market Share in Core Segments, Struggled to Enter the AI Battlefield

Intel's business consists of CCG, DCAIG, Network and Edge Group (NEX), Mobileye, and Foundry Services. CCG and DCAIG are Intel's largest revenue sources, accounting for over 80% of total revenue combined.

Intel adjusted its financial reporting starting in Q1 2024, separating Altera's revenue from DCAIG and reclassifying Intel's foundry revenue for external customers as Foundry Services and internal offset items. For continuity, Dolphin will analyze based on the original business structure.

2.1 Client Computing Group Revenue

Intel's CCG revenue was $7.33 billion in Q3 2024, down 6.8% year-over-year and slightly below market expectations ($7.46 billion), which was the main driver of the company's revenue decline this quarter. Specifically, Desktop revenue declined 24.8%, while Notebook revenue grew 8.5%.

From an industry perspective, global PC shipments grew again this quarter. Global PC shipments reached 68.8 million units, up 0.9% year-over-year, indicating weak overall demand. AMD's CCG revenue grew 29.5% year-over-year this quarter.

Comparing these figures, we see that while overall industry demand was sluggish, it did not decline. Intel's decline was mainly due to losing market share.

2.2 Data Center and AI Group

Intel's DCAIG revenue was $3.761 billion in Q3 2024, down 1.4% year-over-year. After separating Altera's revenue from DCAIG, pure DCAIG revenue was approximately $3.35 billion, up 9% year-over-year, mainly due to improved demand for traditional servers this quarter.

For continuity, Dolphin will analyze based on the original business structure. Intel's overall DCAIG revenue declined slightly, mainly due to a 44% year-over-year decline in Altera's revenue, which is expected to normalize inventory in the first half of next year. Compared to its rapidly growing peers (NVIDIA & AMD), Intel has not benefited significantly.

Current DCAIG demand is mainly concentrated on GPUs. Even the increased CPU demand driven by AI is being met by NVIDIA and AMD's bundled CPU/GPU product combinations. Intel has struggled to enter the GPU market, and its traditional strength in CPUs is also under threat from competitors.

Based on the latest capital expenditures of the four major cloud vendors (Microsoft, Google, Meta, and Amazon), their combined capital expenditures reached $64.9 billion this quarter, up 74% year-over-year and 11% sequentially. Meanwhile, Intel's DCAIG revenue declined 1.4% year-over-year, indicating that it has exited the market growth competition.

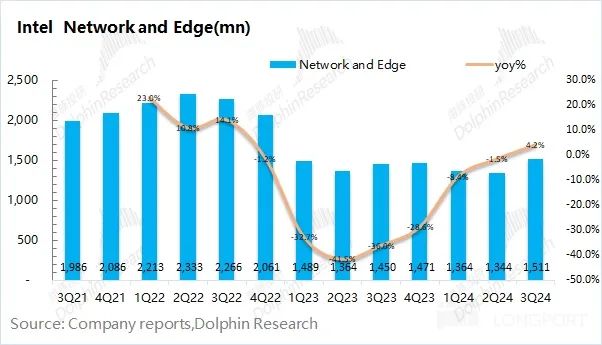

2.3 Network and Edge Group

Intel's NEX revenue was $1.511 billion in Q3 2024, up 4.2% year-over-year and accounting for only 10% of total revenue. After previous CCG inventory adjustments, Intel's NEX business recovered from its lows, and the company shifted its focus to networking and telecommunications.

2.4 Other Major Businesses

1) Intel's Mobileye revenue was $485 million in Q3 2024, down 8.5% year-over-year and accounting for less than 5% of total revenue. Although this decline was partially due to a more than 50% reduction in shipments to China, Intel maintained its full-year revenue guidance.

2) Intel's foundry revenue for external customers was $55 million in Q3 2024. Intel reclassified its foundry business this quarter, disclosing foundry revenue and internal offset items. Dolphin combined these to estimate Intel's foundry revenue for external customers. Since Q1 this year, this figure has been below $100 million for three consecutive quarters, indicating that Intel's foundry business has not yet secured large-scale customer orders.

Dolphin Investment Research Articles on Intel and Data Center Companies: Intel Financial Report Review on August 2, 2024, "Complete Collapse, Intel's 'Pipedream'" Intel Financial Report Review on April 26, 2024, "Intel: A Marginalized AI Observer" Intel In-depth Article on January 17, 2024, "Intel: Is AI PC the Lifeline for the 'Paste Factory'?" NVIDIA Financial Report Review on November 22, 2023, "NVIDIA: Full Steam Ahead for the Computing Power Tsar? 'Phantom Heat' Looms" AMD Financial Report Review on November 1, 2023, "Without NVIDIA's Explosive Power, AMD's Recovery is Too 'Snail-Like'"