Net profit growth slows, cash flow tightens, and solvency declines. Is Midea Group hitting a growth plateau?

![]() 11/04 2024

11/04 2024

![]() 532

532

By Leon

Edited by Hou Yu

The financial report season is here again, and recently, home appliance companies have successively released their third-quarter reports for 2024. The market is severe, and the industry's expectations for the future are unclear, making the performance of leading companies naturally attract much attention. As China's largest home appliance company, Midea Group (000333.SZ/00300.HK) is a bellwether.

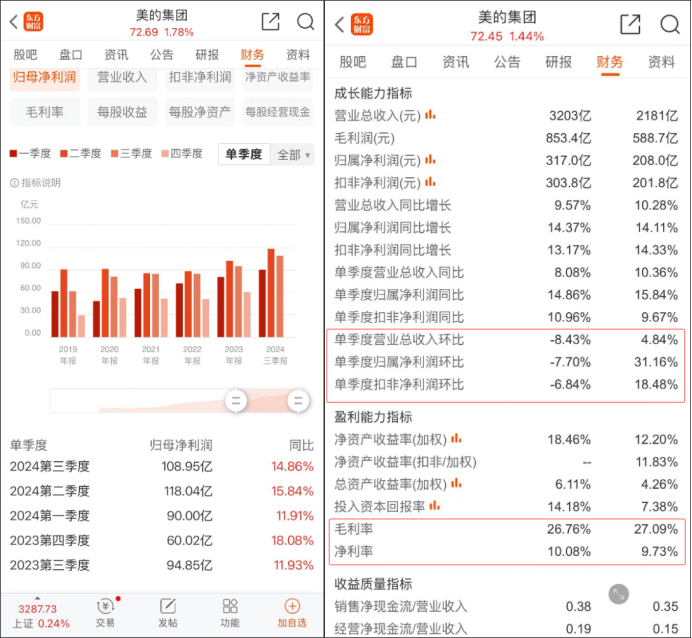

In the third quarter of this year, the company's revenue was 101.7 billion yuan, a year-on-year increase of 8.05%; net profit attributable to shareholders was 10.894 billion yuan, a year-on-year increase of 14.86%. From the beginning of the year to the end of the reporting period, revenue was 318.974 billion yuan, a year-on-year increase of 9.57%; net profit attributable to shareholders was 31.699 billion yuan, a year-on-year increase of 14.37%.

After the financial report was released, investment institutions were optimistic about Midea Group's performance, and many investment banks and securities firms in A-shares and H-shares gave a "buy" rating, including Southwest Securities, Hua'an Securities, Citibank, and Goldman Sachs. The general evaluation of institutions is that trade-ins have boosted domestic demand and overseas growth has been impressive, making Midea Group's business stable and resilient.

Based on the current revenue scale and growth, it is estimated that Midea's revenue for the entire year of 2024 will exceed 400 billion yuan, surpassing last year's 373.7 billion yuan, solidifying its position as the largest home appliance company in China in terms of revenue.

While revenue scales are outstanding, other core financial indicators are hardly optimistic. On the whole, Midea Group's core financial data not only exposes the phased challenges it faces in its operations but also reflects the current state of the industry. 80% of Midea's revenue still comes from its home appliance business. Currently, the incremental market in the home appliance industry is saturated, and fierce competition has led to a general decrease in industry profits, affecting Midea Group's overall profitability. In addition, Midea Group's To B transformation is still in a critical investment period, which has also impacted the company's overall cash generation and solvency.

Revenue and profit declined quarter-on-quarter, and net profit growth was limited.

To analyze Midea Group's true operating conditions, one can start from three aspects: revenue and profit, net profit margin, and liquidity.

The most critical revenue and profit in core financial indicators both declined quarter-on-quarter. Revenue, net profit attributable to shareholders, and non-deductible net profit in the third quarter decreased by 8.43%, 7.70%, and 6.84%, respectively. (For details, see: Midea's Fang Hongbo Reflects: Timely Self-denial, Adhering to Industrial Upgrading Through Cycles)

Objectively speaking, the third quarter of each year is the off-season for home appliance sales, which has a certain impact on a company's sales, especially air conditioners. Among them, Gree Electric Appliances, which is overly reliant on air conditioners, fared even worse in the third quarter, with revenue declining by 26% quarter-on-quarter. Among the top three white goods giants, only Haier Smart Appliances achieved a slight increase of 1.06% in revenue quarter-on-quarter. (For details, see: 41.8 billion yuan, payment before delivery: For channels, Midea Group has the final say!)

Net profit margin refers to the proportion of a company's net profit to its operating revenue and is a key indicator for measuring a company's profitability. Gree Electric Appliances, whose revenue is less than half of Midea's and whose air conditioner sales account for 70% of total sales, still leads in net profit margin. Its net profit margin for the third quarter of this year was as high as 14.46%; in contrast, Midea's combined To C + To B business only achieved a net profit margin of 10.08%.

The reason for this situation is related to Midea's brand positioning. Most of Midea's home appliance products are known for their cost-effectiveness. Taking air conditioners as an example, they are priced lower than Gree's but higher than second- and third-tier brands for the same configuration, often preferred by price-sensitive groups. Over the years, Midea has tried to cultivate high-end brands such as Vandelo, COLMO, and Toshiba. However, in the high-end market, their market acceptance is far inferior to Haier's Casarte. Under such circumstances, there has been no significant improvement in Midea's premium capacity in its home appliance business segment, which has also directly affected its net profit margin.

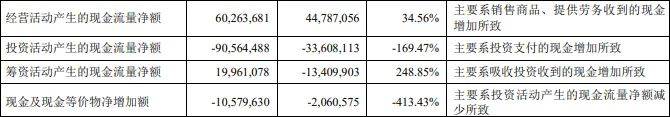

Indicators related to liquidity and solvency are also noteworthy. Midea Group's net cash flow growth rate for the first three quarters declined quarter-on-quarter. In the third quarter, Midea's cash payments for investments increased, but the net cash flow generated from investing activities dropped significantly by nearly 170%.

Increasing investment intensity means an increase in financial leverage, coupled with investment risks and a downturn in the market environment, which poses certain market and operational risks for business operations. Data also indicates this trend. The financial report shows that Midea Group's net increase in cash and cash equivalents decreased by 413.43% compared to the beginning of the period (or the cumulative amount for the same period last year), indicating weakened immediate solvency, tightened liquidity, and increased operational risks for the enterprise.

Three measures to increase profits in the To C business

Therefore, from a financial fundamentals perspective, the overall listed Midea Group has a leading scale effect, which can bring significant centralized procurement and cost advantages, thereby attracting a steady stream of customers. Midea's core smart home business currently maintains a 10% revenue growth rate, which is remarkable considering its size. To continue increasing the incremental market, Midea's current direction is to expand overseas markets, create OBM brands, and compete for the high-end market.

Midea Group's 2023 financial report stated that the high-end brand strategy has achieved remarkable results, with retail sales of the COLMO and Toshiba brands increasing by more than 20% year-on-year, with COLMO significantly increasing its market share in high-end segments. According to data from AVC Revo, Haier's Casarte has a market share of 33.7% in the 10K+ price range for refrigerators, 40.2% in the 10K+ price range for washing machines, and 22.4% in the 16K+ price range for air conditioners. Midea's high-end brands still need to strive to gain more market share.

The current financial report shows that Midea's overseas business income accounts for more than 40% of its total revenue. In the third quarter, Midea's overseas e-commerce sales revenue maintained a 50% growth rate, with further room for growth. It should be noted that part of Midea's overseas revenue comes from OEM (original equipment manufacturing for other brands), which affects profit margins to a certain extent. (For details, see: The lesser-known He's heir apparent, creating imagination for Midea Group's To C business)

Currently, Midea has recognized this issue and further deepened its global layout, replacing OEM with OBM (original brand manufacturing). In the first three quarters of this year, Midea's overseas OBM revenue increased by more than 25% year-on-year, with overseas e-commerce sales increasing by 50% year-on-year in Q3, and sales during Amazon Prime Day promotions increasing by more than 35%. (For details, see: Midea Group's share price surged by more than 20% after one month of listing in Hong Kong, with Fang Hongbo betting on globalization)

Of course, OBM alone is not enough. In overseas markets, Midea not only faces home appliance giants such as Samsung, Electrolux, and Haier Smart Home but also needs to further enhance its brand value, especially the influence of its high-end brands.

Robot revenue continues to decline, and the To B business is still in the investment phase

Under Midea Group's three-pronged strategy, it remains to be seen whether there will be a noticeable improvement in the To C main business. The To B business is Midea Group's second battlefield. How did it perform in the third quarter?

Currently, Midea Group divides its business segments into four categories: smart homes (home appliances), new energy and industrial technology, smart building technology, and robotics and automation. (Fang Hongbo: To C business upgrades existing stock, and To B business creates incremental value)

The third-quarter report shows that the revenues of the four segments from the beginning of the year to the end of the reporting period were 215.4 billion yuan (up 10% year-on-year), 25.4 billion yuan (up 19% year-on-year), 22.4 billion yuan (up 6% year-on-year), and 20.8 billion yuan (down 9% year-on-year), respectively. The robotics and automation business is undoubtedly a weakness. In fact, since the beginning of 2024, the revenue of the robotics and automation business has declined for three consecutive quarters.

As one of the representatives of Midea Group's To B business, Midea entered the robotics market through the acquisition of a German company, Kuka.

Founded in 1898, Kuka specializes in industrial robots, automation equipment, and solutions and is a representative enterprise in the industry. In 2015, Midea Group sought manufacturing upgrades and To B market development and began gradually acquiring shares of Kuka, ultimately holding a controlling stake of over 95% and privatizing Kuka in 2022.

In the five years after acquiring a controlling stake in Kuka, Midea and Kuka have yet to complete their integration period. Kuka was privatized by Midea in 2021. In 2023, the integrated Kuka experienced phased revenue growth. Midea Group Chairman and CEO Fang Hongbo specifically stated at the year-end performance briefing that Kuka Group achieved record-high revenue and profits in 2023, with Kuka China's revenue contribution increasing by more than 22%. Correspondingly, Midea Group's revenue from its robotics and automation business increased to 37.2 billion yuan in 2023, a year-on-year increase of 24.49%, and its proportion of total revenue also increased to 10.01%.

This good situation did not last long. Starting from the first quarter of 2024, Midea's robotics and automation business revenue has continued to decline. The explanation in the financial report is that the year-on-year decline in revenue during the reporting period for robotics and automation was mainly due to the temporary suspension of new capacity expansion plans by domestic automakers and product strategy adjustments by overseas automakers. Considering the current obstruction of new energy vehicles going to sea, it is expected that there will not be significant improvement in this business within the year.

The short-term bottleneck does not seem to have affected Midea's confidence in its robotics business. Wei Chang, Vice President and CTO of Midea Group, recently stated that Midea is conducting exploratory research on humanoid robots, mainly focusing on core component areas. Midea will also continue to increase investment in robotics and automation, such as exploring next-generation heavy-load robot technology in the industrial robotics field.

As Midea Group's second growth curve, sustained growth in the To B business is essential. Currently, among the three major segments, only new energy and industrial technology have maintained double-digit growth, adding some uncertainty to Midea's To B development. Of course, objectively speaking, it is very normal for new businesses to experience sluggish growth or cyclical declines due to environmental factors. This requires Midea to improve its cash generation capacity and continuously provide funds to the B-end.

Written at the end:

Looking ahead to the fourth quarter and full-year performance, thanks to the continuation of the subsidy cycle for trading in old home appliances for new ones, coupled with the Double 11 sales promotion, Midea Group's revenue is expected to exceed 400 billion yuan within the year, and the basic home appliance business can still maintain stable growth. However, both premiumization and To B business adjustments take time, and there will not be significant short-term growth in net profit margin.

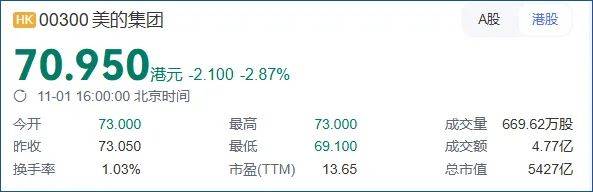

Of course, Midea Group is still the most valuable home appliance enterprise in China. On September 17th of this year, Midea Group achieved a dual listing in Hong Kong, becoming the largest IPO in Hong Kong in nearly three years. Since its listing for more than a month, the share price has increased from HK$54.8 per share to HK$70.95 per share at the time of writing, an increase of approximately 29%, with a total market value of HK$542.7 billion. After listing in Hong Kong, Midea's financing capacity has further improved, which will help the group better expand its overseas business and increase profitability.