Microsoft: AI Only Costs Money, Not Making Money

![]() 11/05 2024

11/05 2024

![]() 559

559

$Microsoft.US released its fiscal Q1 2025 earnings report after the market close on October 30, covering the period ended September. Investors should note that due to changes in financial disclosure starting in FY25, some performance indicators are not comparable to past data. Overall, Microsoft's performance met expectations, with indicators slightly exceeding or meeting market forecasts, but growth lacked significant highlights and profit pressure was beginning to show. Key points are as follows:

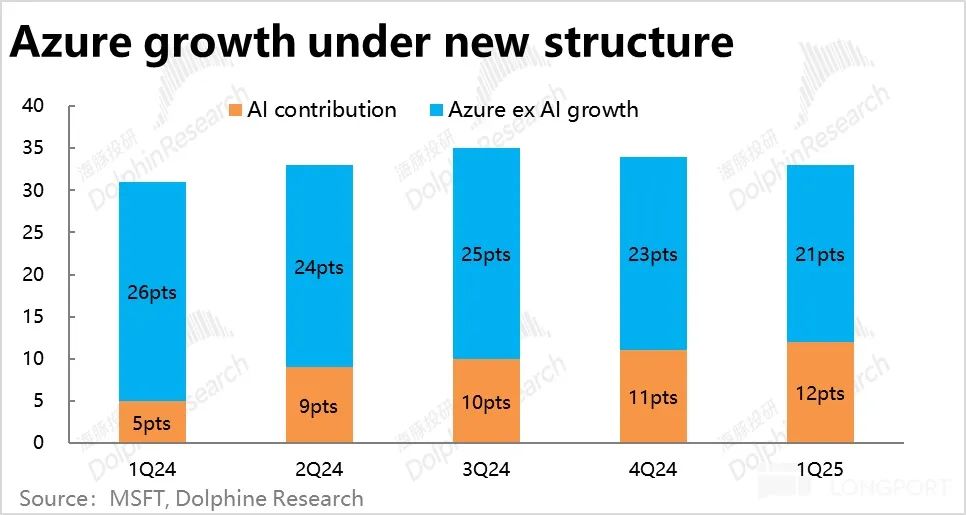

1. Despite AI support, Azure growth slows: Azure's year-over-year (YoY) growth rate was 33%, and growth at constant currency was 34%, both down 1 percentage point (ppt) from the previous quarter. Although in line with previous guidance and market expectations, it did not indicate strong cloud demand growth like Google Cloud Services (GCS). As previously mentioned, GCS's strong growth, as a smaller player and share gainer, may not reflect the industry as a whole.

In detail, AI-driven revenue growth reached 12ppt this quarter, up 1ppt from the previous quarter, but traditional demand growth slowed by 2ppt. More concerningly, Microsoft's guidance for Azure's next quarter growth indicates another 1-2ppt slowdown. This suggests that AI has not significantly boosted Azure's growth but may be slowing it down.

Dolphin Research speculates possible reasons: ① A large number of AI-related demands have not yet been recognized as revenue and are backlogged in unconfirmed contract amounts; GPU supply bottlenecks still limit Azure's growth; ② After the peak of GPU supply constraints, the significant drop in computing power leasing prices has dragged down revenue growth; ③ Azure's AI lead has been eroded by AWS and GCS, potentially leading to market share loss.

2. Office business growth is flat, and Copilot 2.0 fails to drive rapid penetration: Office 365 revenue, the business most closely related to AI, grew 15% (16% at constant currency), flat from the previous quarter. Next quarter's growth guidance is also down 2ppt. Similarly, this quarter's growth was unremarkable, with further declines expected. Despite the recent launch of Copilot 2.0, it has not led to a significant increase in user adoption rates. AI's commercialization potential in C-end productivity tools remains unproven.

3. Advertising business continues to grow rapidly; is search still AI's best outlet? The Personal Computing segment's revenue increased 16.8% YoY, accelerating 2.3ppt from the previous quarter and showing the most significant revenue acceleration among the three segments. It exceeded market expectations by nearly 5%, also the largest beat among the segments. This was primarily driven by the accelerated growth of the advertising business after integrating Copilot Pro. Excluding acquisition costs, advertising revenue grew 3ppt to 18% this quarter. From both absolute and marginal perspectives, this is impressive. It appears that AI functions are most widely used and profitable in search-like applications.

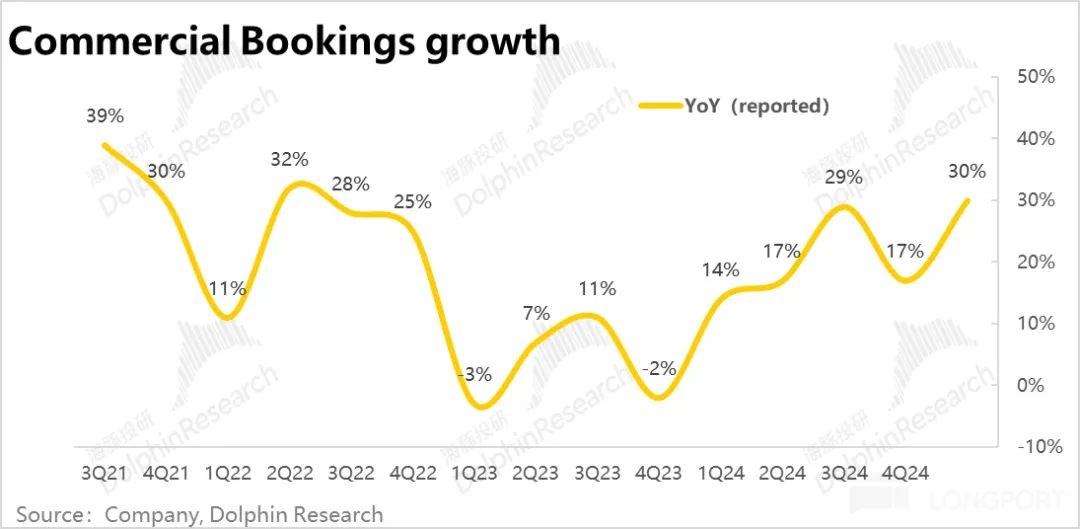

4. Leading indicators offer hope? While current revenue performance was unremarkable and forward-looking guidance was weak, leading indicators reflecting future revenue growth trends were relatively optimistic. The growth rate of new enterprise cloud contract amounts surged to 30%, with a more realistic 23% at constant currency, up 4ppt from the previous quarter. This suggests that incremental demand may still be at the contract stage and has not yet reflected in revenue.

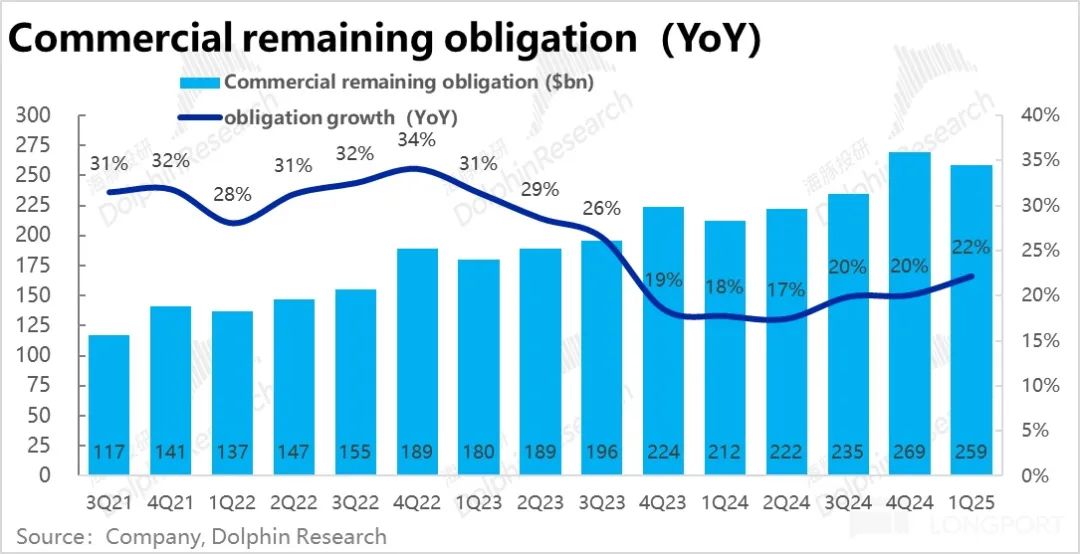

Similarly, the YoY growth rate of the backlog of contracted but unfulfilled revenue (deferred revenue from received payments not yet recognized as income + contracted amounts not yet paid) accelerated 2ppt to 22%, indicating that more demand may still be in the pipeline before revenue recognition.

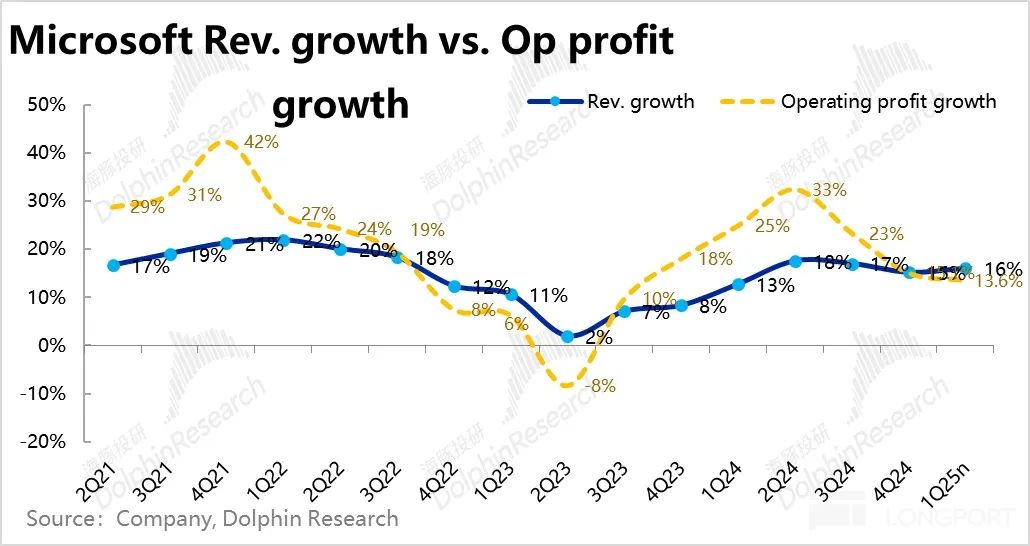

5. Is the cycle of revenue growth and profit margin expansion coming to an end? While revenue growth lacked highlights, the need to validate whether and when incremental AI demand will arrive remains. The pre-expense Capex is already putting pressure on profits.

The most significant impact is on gross profit. This quarter's gross margin was 69.4%, down 1.8ppt YoY and 0.2ppt QoQ. As a result, gross profit only increased 13% YoY, lagging revenue growth. Notably, amortization and depreciation this quarter doubled from the same period last year, increasing by over $3 billion.

Although operating expenses fell passively by a total of 0.8ppt, Microsoft's operating profit margin still fell 1ppt YoY to 46.6%. Operating profit increased only 13.6% YoY, marking the first time since FY23 Q3 that profit growth lagged revenue growth, indicating the end of the company's profit margin expansion cycle and the beginning of a contraction. This quarter's Capex expenditure surged to $20 billion, up 79% YoY, equivalent to reinvesting 70% of operating profit in fixed assets in a single quarter. With such significant investments, profit margins may continue to face pressure.

6. Is next quarter's guidance too conservative or genuinely poor? For FY25 Q2 guidance, the continued slowdown in core Azure and Microsoft 365 business growth has already been mentioned. Regarding profits, next quarter's median operating profit margin guidance is 44%, down sequentially but up 0.4ppt YoY, suggesting some easing of profit margin pressure.

Dolphin Research Perspective:

As mentioned, Microsoft's key indicators this quarter met or slightly exceeded expectations with no significant shortcomings. However, based on the company's guidance for future revenue and profit growth of around 10%-20%, the current LTM PE of over 30x implies more than just meeting expectations.

As we mentioned last quarter, the market is willing to give Microsoft a valuation premium due to investors' expectations of significant future AI-driven revenue growth and Microsoft's relatively high visibility in the mid-to-downstream AI sector. However, the key Azure and Microsoft 365 businesses have yet to demonstrate significant AI-driven growth, and future guidance indicates further slowdown.

Given the significant quarterly Capex investments of tens of billions of dollars, which must be made in advance, and the lack of clear AI-driven revenue growth or even the uncertainty of its eventual realization, the recent quarters have already shown significant pressure on profit margins, primarily from the gross margin perspective.

Therefore, if the ROI of high investments versus incremental revenue does not improve significantly in the coming quarters, Dolphin Research reminds investors to be aware of the potential risks associated with the current valuation of over 30x.

Below is a detailed review of the earnings report:

I. Changes in Financial Reporting

After last quarter's earnings report, Microsoft announced significant changes to its financial reporting structure starting in FY25. The main change was moving all enterprise-facing Microsoft 365 services (including Windows 365 and Cybersecurity 365 in addition to Office 365 for businesses) under the Productivity and Business Processes (PBP) revenue category, renaming Office 365 revenue as Microsoft 365 revenue.

Specifically, the new PBP revenue includes:

1. Microsoft EMS (Enterprise Mobility and Security, similar to enterprise cybersecurity) and Power BI, both originally part of Intelligent Cloud (IC) and essentially SaaS services. Like Office 365, these are subscription-based.

2. Windows commercial cloud, sold as part of Microsoft 365 services.

These changes clarify Azure's PaaS business and make it easier to compare with peers. All enterprise-facing SaaS businesses are now classified under PBP, providing a clearer picture of Microsoft's SaaS and PaaS revenues.

In addition to major changes, there were some minor adjustments:

1. Within PBP, besides enterprise-facing Microsoft 365, there is a small portion of traditional software products sold to enterprises (e.g., some traditional Office suites with on-premises deployment).

2. PBP now separately reports consumer-facing products, primarily Office suites and cloud services sold to consumers (e.g., OneDrive).

These adjustments clarify the distinction between B2B and B2C within PBP.

Other minor adjustments were made to the More Personal Computing (MPC) segment:

1. After removing Windows commercial cloud revenue, Windows and Device revenues are now reported together. While this reduces granularity, it can be understood as both selling Windows to OEMs like Lenovo and directly selling Surface essentially involve selling PCs.

2. The newly launched Copilot product has been moved from Office revenue to MPC within More Personal Computing.

This adjustment suggests that Copilot as a separately chargeable incremental service module within Office (a SaaS-like business model) is not viable. Instead, it is being repositioned within the C2C search business as a new form of search and Q&A, aiming to improve the future prospects of the search business (which may include both advertising and paid Copilot services).

For more details on the adjustments, see the summary below:

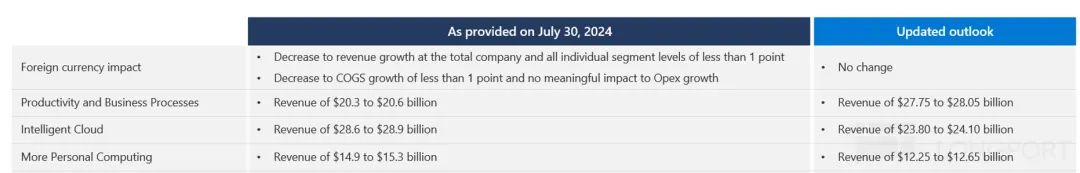

Due to the reallocation of some businesses from IC and MPC to PBP, the new PBP segment's revenue guidance is about $7-8 billion higher. IC segment revenue is expected to decrease by about $4-5 billion, and MPC segment revenue by about $2-3 billion under the new guidelines.

II. AI Hype Without Substance?

1.1 Despite AI support, Azure growth slows:

Azure's growth, closely tied to AI model training and inference costs, is a crucial indicator of AI development and demand dynamics. Under the new guidelines, Azure's YoY growth was 33%, and growth at constant currency was 34%, both down 1ppt from the previous quarter. While in line with previous guidance and market expectations, it did not show the unexpectedly strong growth seen in Google Cloud Services (GCS). In detail, AI-driven revenue growth reached 12ppt this quarter, up 1ppt from the previous quarter, but traditional demand growth slowed by 2ppt.

More concerningly, Microsoft's guidance for Azure's next quarter growth indicates another 1-2ppt slowdown. Together, this suggests that AI demand has not significantly boosted Azure's growth but may be slowing it down. Dolphin Research speculates possible reasons: ① A large number of AI-related demands have not yet been recognized as revenue and are backlogged; GPU supply bottlenecks still limit Azure's growth; ② After the peak of GPU supply constraints, the significant drop in computing power leasing prices has dragged down revenue growth; ③ Azure's AI lead has been eroded by AWS and GCS, potentially leading to market share loss.

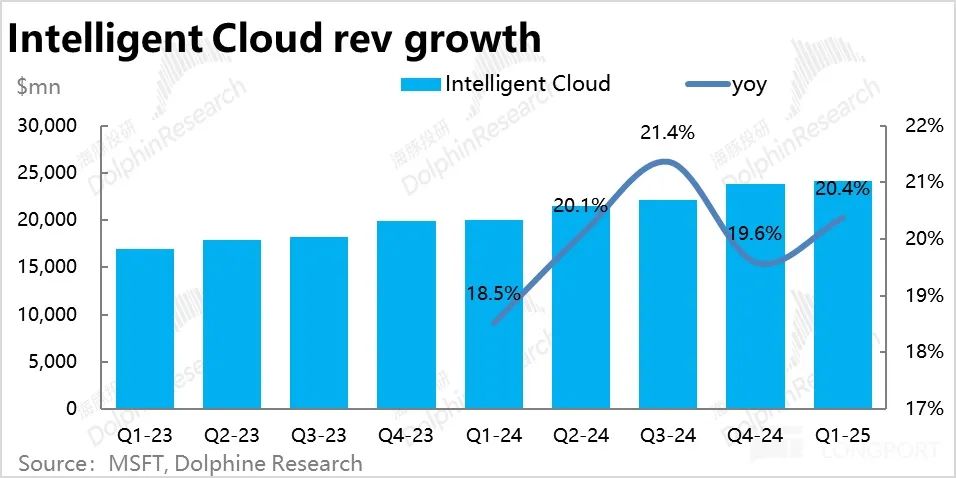

Overall, the core Azure segment's performance was unremarkable. The Intelligent Cloud segment's total revenue was $24.1 billion, in line with market expectations and not exceeding them. However, the overall segment growth accelerated QoQ, suggesting significant growth in Enterprise Services this quarter.

1.2 365 Growth Remains Flat, Copilot Promotion Shows No Significant Progress

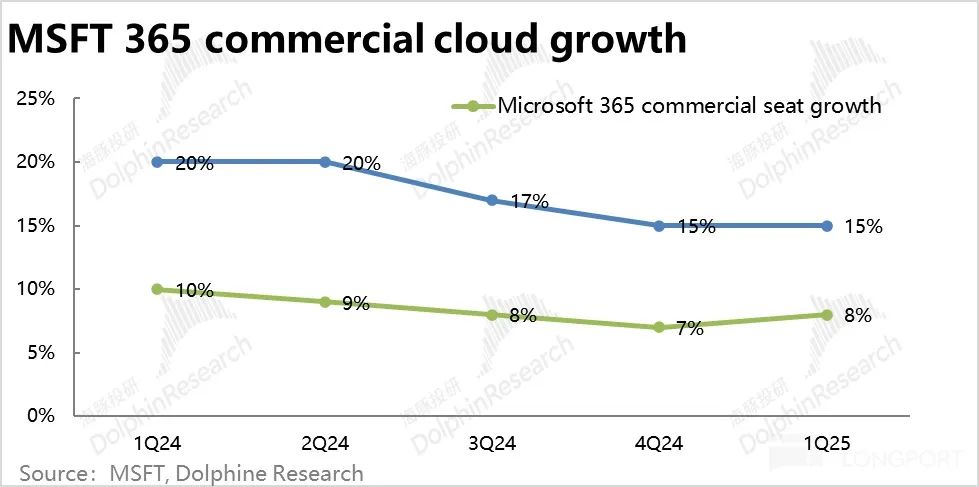

Microsoft 365 business (Microsoft 365 commercial), the company's second-highest AI integration and revenue contributor after adjustment, reported a 15% revenue increase this quarter (16% increase at constant currency), flat compared to the previous quarter. For the next quarter, guidance indicates a 2% sequential decline in growth rate. Similar to Azure, this quarter's growth did not accelerate, and future outlooks suggest further deceleration.

It is reported that Office Copilot recently launched a new 2.0 feature update, but so far, it has not demonstrated significant incremental demand driven by AI.

Breaking down from a volume and price perspective: 1) The number of enterprise Microsoft 365 subscription customers increased by 8% year-on-year, a slight improvement from the previous quarter. 2)

Correspondingly, the year-on-year growth rate of average revenue per user (ARPU) decreased slightly from 7.5% in the previous quarter to 6.5% this quarter. It is evident that the increase in ARPU driven by enterprises adopting higher-priced products like E5 continues, but the pricing power and speed are narrowing.

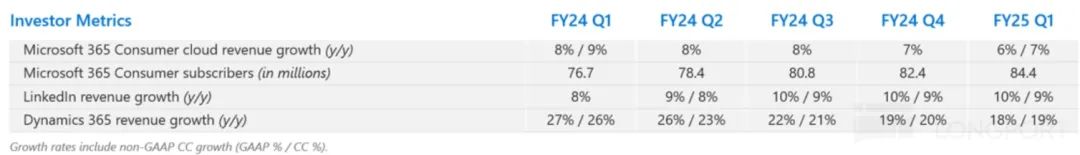

Among other major businesses in the Productivity segment, the growth rates of Consumer 365, LinkedIn, and Dynamics 365 remained largely unchanged or slightly declined compared to the previous quarter. In terms of absolute growth rate, Dynamics, with nearly 20% growth, is clearly the second-largest incremental revenue source after Azure.

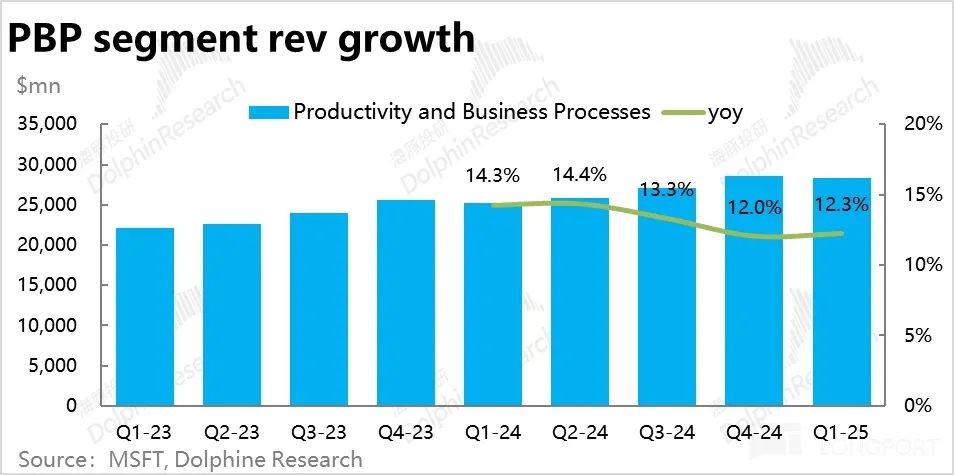

Overall, as there were no significant changes in the growth rates of major businesses, the adjusted revenue for the Productivity segment this quarter was $28.3 billion, in line with market expectations. It increased by 12% year-on-year, a slight increase of 0.3 percentage points from the previous quarter, without any particular highlights.

III. Advertising Continues to Grow Strongly; Is Search Still the Primary Outlet for AI?

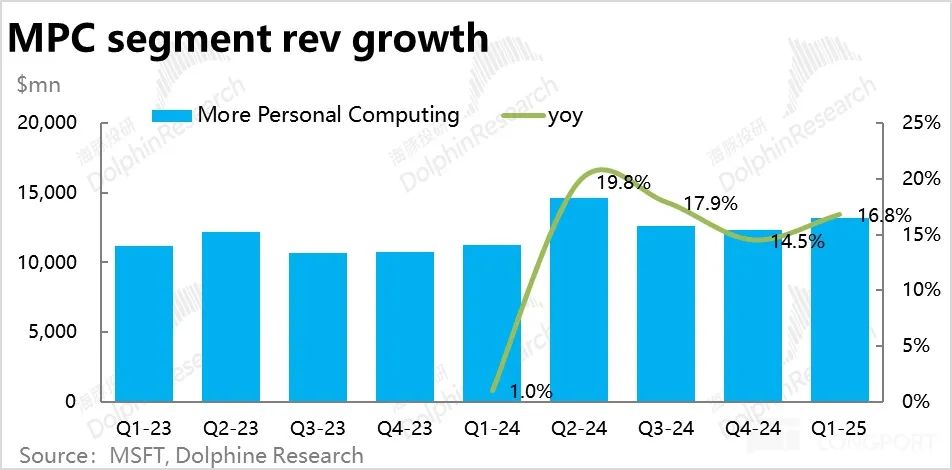

The adjusted revenue for the Personal Computing segment this quarter increased by 16.8% year-on-year, an acceleration of 2.3 percentage points from the previous quarter, making it the most significant acceleration in revenue growth among the three segments. Actual revenue exceeded market expectations by nearly 5%, also the most significant beat among the three segments.

Specifically, the significant acceleration in advertising revenue, which includes the Copilot pro business, contributed substantially. Excluding user acquisition costs, the growth rate of the advertising business increased by 3 percentage points quarter-on-quarter to 18%. Both in terms of absolute growth rate and marginal trend, the performance is quite impressive. This suggests that AI functionalities are currently most successfully applied and monetized in search-like scenarios.

Other business segments: ① Windows OEM and device revenue increased by 2% year-on-year, still showing stagnant growth. ② After acquiring Activision Blizzard, gaming revenue increased by 61% year-on-year, but the actual growth rate after excluding consolidation effects was only 4%, also lingering at a low level.

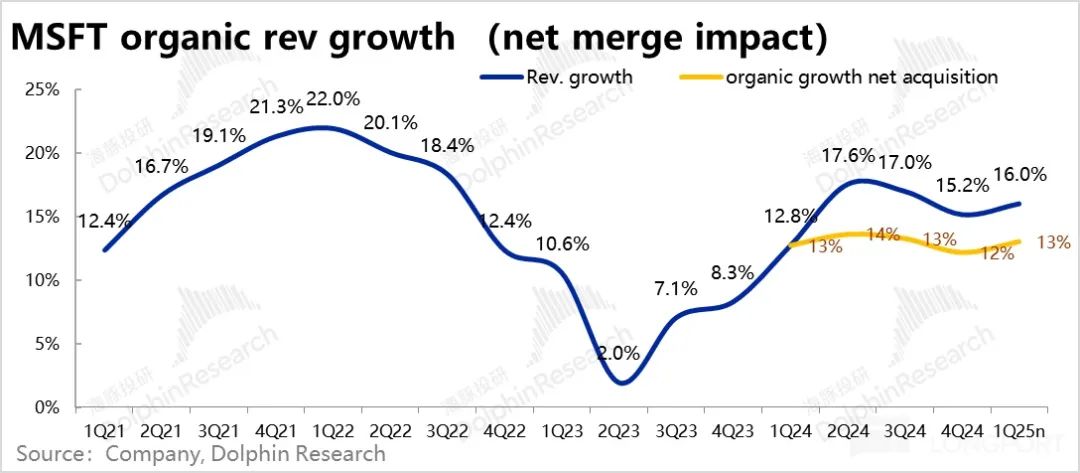

IV. Improvement in Leading Revenue Indicators: A Glimmer of Hope?

The company's total revenue for this quarter was $65.6 billion, slightly above market expectations, with a year-on-year growth rate of 16%, a slight acceleration of 0.8 percentage points from the previous quarter. As mentioned above, this was primarily driven by the acceleration in MPC and its advertising business. Excluding the impact of the Activision Blizzard acquisition, Microsoft's comparable revenue growth was approximately 13%, also showing some acceleration from the previous quarter. However, the overall growth rate remained within the range of 12% to 14% over the past five quarters, indicating no substantial acceleration in growth.

In summary, while AI has demonstrated a positive impact on search business, there are no signs that the core Azure and Microsoft 365 businesses have benefited from AI-driven growth acceleration. Instead, future guidance even suggests further deceleration.

Although current revenue performance is unremarkable and forward-looking prospects are not promising, leading indicators reflecting future revenue growth trends are relatively optimistic. The growth rate of newly signed enterprise contract values surged again to 30%. Although the more realistic growth rate at constant currency is 23%, it still represents a 4 percentage point quarter-on-quarter acceleration. This suggests that incremental demand may still be at the contract stage and has not yet been reflected in revenue.

Similarly, the balance of existing contracted but unfulfilled obligations (i.e., deferred revenue from payments received but not yet recognized as income + contracted amounts not yet paid) was $259 billion this quarter, with a year-on-year growth rate that accelerated by 2 percentage points to 22%, also indicating that more demand may not have reached the revenue recognition stage.

V. While AI Explosion Has Not Been Seen, the "Cost" of Declining Profit Margins Must Be Paid in Advance

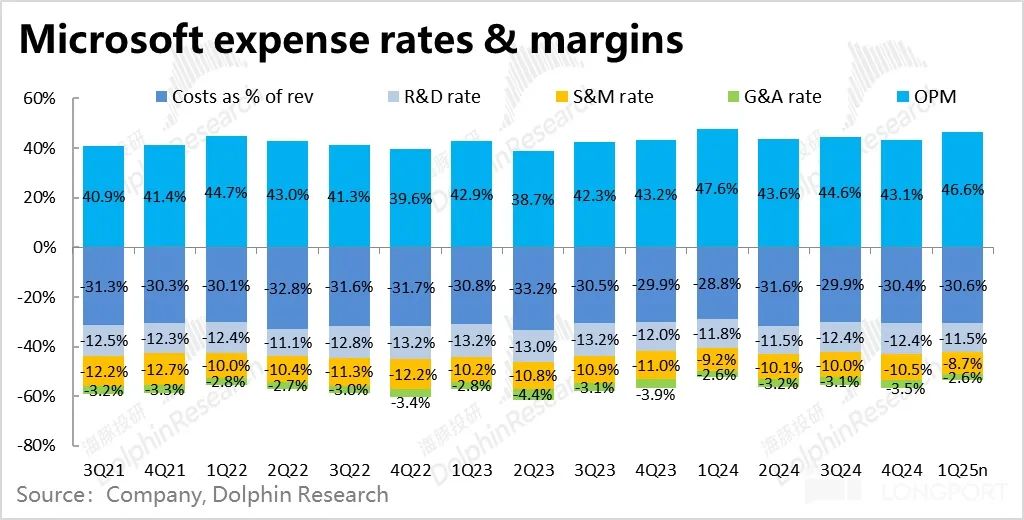

If revenue growth lacks highlights, it remains to be seen whether and when incremental AI demand will arrive. From a profit perspective, the pressure on profit margins from upfront investments is already evident. 1) From a gross margin perspective, Microsoft's gross margin for this quarter was 69.4%, a year-on-year decrease of 1.8 percentage points and a quarter-on-quarter decrease of 0.2 percentage points. As a result, gross profit only increased by 13% year-on-year, lagging behind revenue growth.

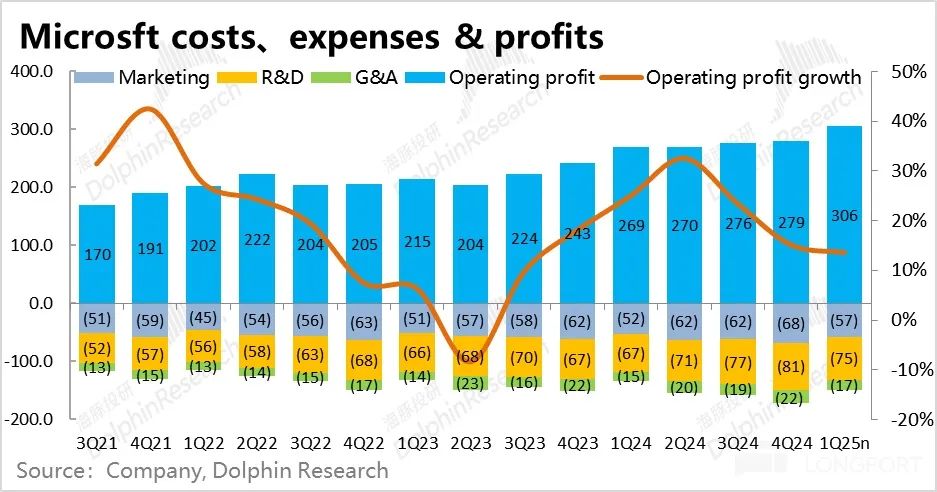

2) In terms of expenses, Microsoft's marketing, research and development, and administrative expenses all increased by approximately 10% to 14% year-on-year, lower than the growth rates of revenue or gross profit. Therefore, the combined expense ratio passively contracted by 0.8 percentage points, indicating that the company's internal cost control and efficiency improvements helped offset some of the profit margin decline caused by high Capex.

3) Overall, due to the more significant decline in gross margin caused by high Capex, Microsoft's operating profit margin still declined by 1 percentage point year-on-year to 46.6% this quarter. As a result, the company's operating profit only increased by 13.6% year-on-year, marking the first time since FY23 Q3 that profit growth lagged behind revenue growth, signaling the end of the company's profit margin expansion cycle. Under high investments related to AI, the company has slipped into a profit margin contraction cycle.

4) The decline in profit margins is evident from Microsoft's Capex expenditures, which surged to $20 billion this quarter, a year-on-year increase of 79%. This equates to nearly 70% of operating profit being reinvested in fixed assets in a single quarter. Additionally, amortization and depreciation this quarter have doubled compared to the same period last year, increasing by over $3 billion. Free cash flow has declined by 7% year-on-year due to high Capex, and the pressure on profits from massive investments in AI infrastructure is becoming fully apparent.