After securing $100 million, Zhou Guang revealed Yuanrong Qixing's next steps

![]() 11/06 2024

11/06 2024

![]() 473

473

Rumors eventually come true.

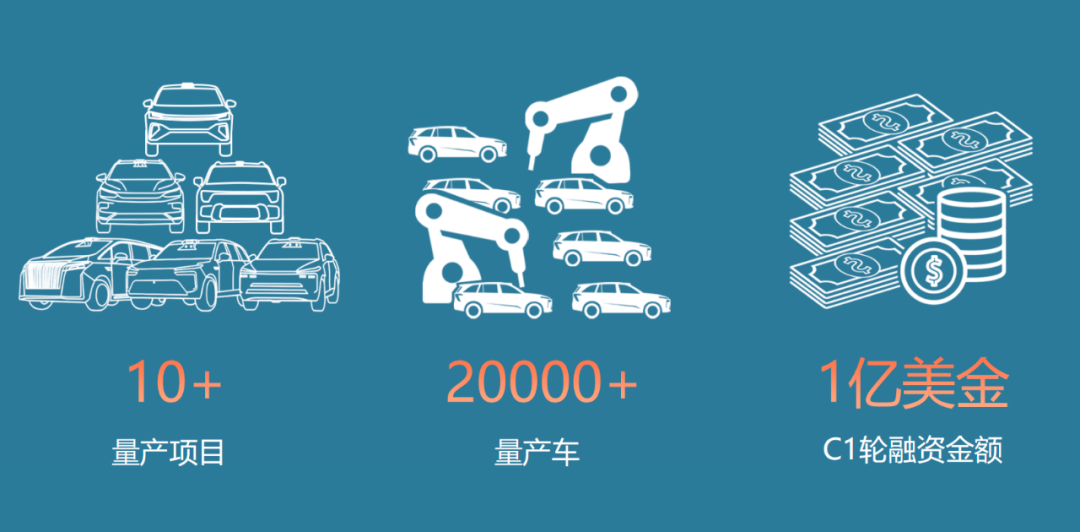

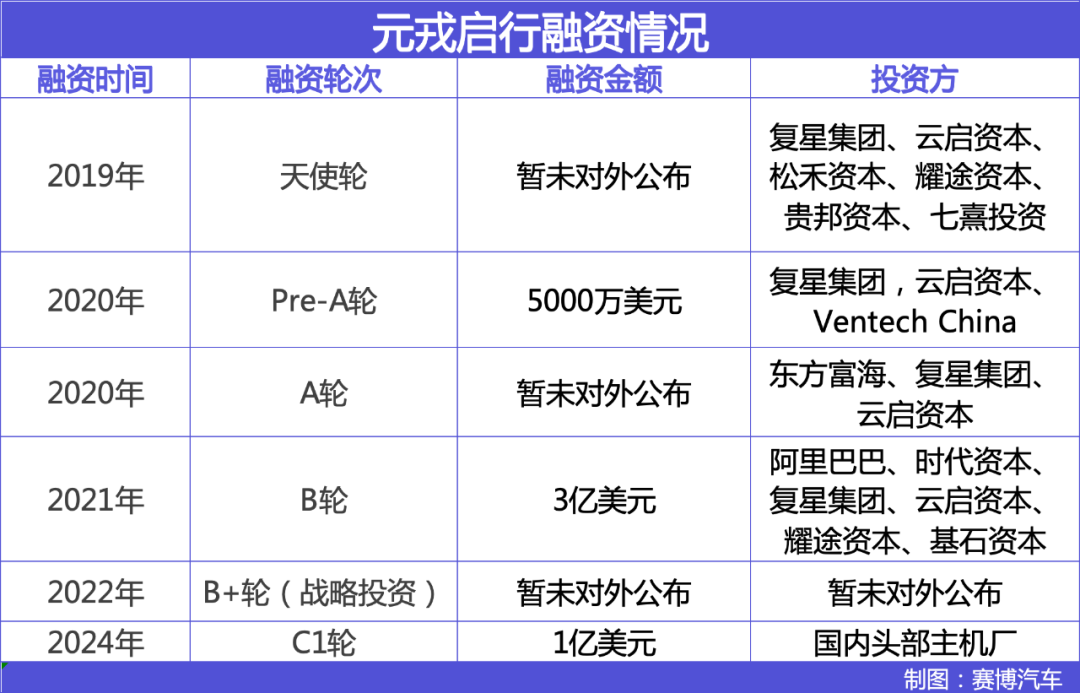

On November 5, Yuanrong Qixing held a C1 round financing conference and officially announced that it had secured $100 million (approximately RMB 710 million) in funding. To date, Yuanrong Qixing has completed six rounds of financing, raising a cumulative total of over $500 million.

However, regarding the source of this funding, Yuanrong Qixing did not specify, only stating that it came from a leading domestic OEM. This is also likely the largest single financing for a domestic intelligent driving solution provider this year.

"Many people say that this round of funding is not only a starting point for Yuanrong Qixing but also has a significant impact on the industry," said Zhou Guang, CEO of Yuanrong Qixing. "Over the past two years, fundraising for autonomous driving has been quite difficult, and most of it has been government-aided financing. Our funding may have some significance for the entire autonomous driving industry."

Yuanrong Qixing's Latest Progress

Subsequently, he shared Yuanrong Qixing's latest achievements: nearly 20,000 models have been mass-produced; it is expected that by the end of 2024, at least three vehicles equipped with Yuanrong Qixing's intelligent driving system will enter the market; over 10 mass production projects are in the pipeline, including the smart Fortwo 5, covering various models such as SUVs, MPVs, and off-road vehicles.

As for why automakers choose Yuanrong Qixing, Zhou Guang believes it is due to the company's tech vision, which has been proven by the industry over the past few years. Specifically, Yuanrong Qixing has successfully predicted the evolution of intelligent driving technology paths multiple times and has taken the lead in transitioning to a "map-free" and "end-to-end" approach.

The entire conference had a casual and free-spirited atmosphere, indicating that Zhou Guang has been in good condition recently. He even stated that in multiple scenario tests in the urban high-end market, Yuanrong Qixing is far ahead of M-Factory and H-Factory.

"The next five years will be the main battleground for intelligent driving," said Zhou Guang. Yuanrong Qixing aims not only to accelerate mass production but also to expand into Robotaxi and overseas markets.

01 How to Impress the First OEM?

All beginnings are difficult.

Although as early as March 2023, Yuanrong Qixing launched DeepRoute-Driver 3.0, China's first high-end intelligent driving solution that does not rely on high-precision maps and can achieve point-to-point functionality across the entire region.

However, convincing OEMs that the solution is truly "map-free" and usable required considerable effort from Yuanrong Qixing. One of the most frequently used methods was the "trailer test."

Yuanrong Qixing Impresses OEMs with "Trailer Tests"

"Many people didn't believe us when we promoted the 'map-free' concept last year. One OEM said that a competitor claimed Yuanrong Qixing must be using maps and it was fake." Therefore, Zhou Guang asked customers to specify a location, and a test vehicle was towed by a trailer to that location and immediately driven away, covering scenarios in county towns, alleys, internal roads, etc. Finally, they convinced the OEM.

Behind the true map-free concept lies the support of end-to-end technology.

Simultaneously with the release of DeepRoute-Driver 3.0, Yuanrong Qixing was already engaged in the research and development of end-to-end models.

At this year's Beijing Auto Show, Yuanrong Qixing showcased its high-end intelligent driving platform, DeepRoute IO, and the first solution based on DeepRoute IO, which employs the NVIDIA DRIVE Orin system-on-chip, offering over 200 TOPS of computing power, one solid-state LiDAR, and 11 cameras, forming an end-to-end solution.

Currently, this solution has been mass-produced and installed in vehicles.

"End-to-end technology often speaks more to the upper limit of the system. While we offer a very human-like driving experience, we also ensure excellent system safety. During our test track evaluations, AEB performs exceptionally well during the day, at night, and even in rainy or foggy conditions," said Zhou Guang. He pointed out that end-to-end technology and AI capabilities are the cornerstones of Yuanrong Qixing's market position, but active safety must also be top-notch.

Yuanrong Qixing's Intelligent Driving Test Performance Compared to Multiple Solution Providers

Yuanrong Qixing selected several scenarios for testing and comparison, such as avoiding large vehicles and Cut-in situations. Zhou Guang stated that Yuanrong is far ahead of both H-Factory and M-Factory. "Our online popularity or buzz might not reflect this, but these are actual test data. I believe that even with more frequent and longer tests, the results would not differ significantly, with the top three remaining in a commanding lead."

However, in Zhou Guang's view, Yuanrong Qixing's intelligent driving solution differs from collaborations with other vendors, preferring deeper cooperation with automakers. They engage in in-depth cooperation with selected models and provide customized solutions based on customer needs, aiding in their transformation.

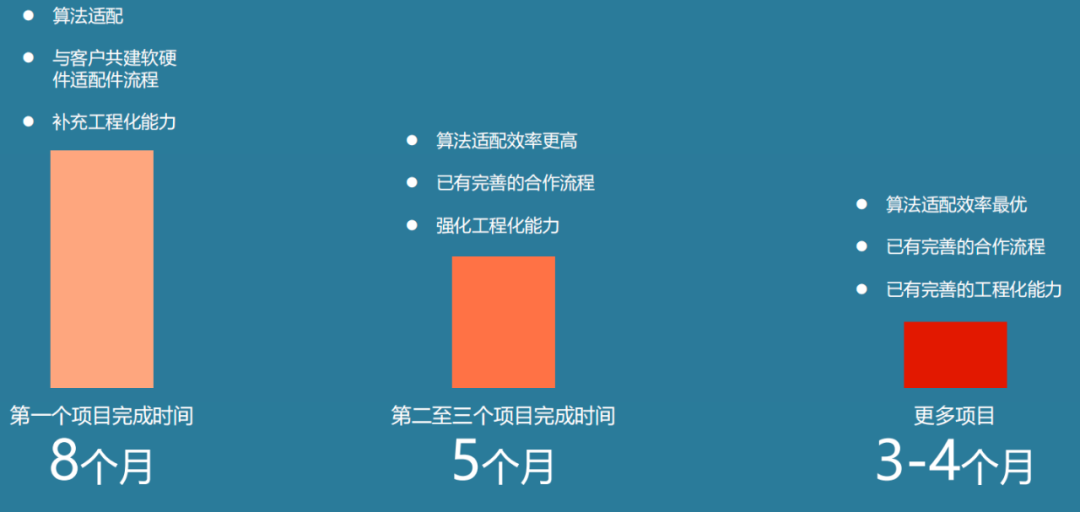

He introduced that Yuanrong Qixing's first mass-produced vehicle took only eight months, with the second and third projects completed in five months. It is expected that the second vehicle will be available by the end of this year, and subsequent model adaptation times will be shortened to three to four months.

Yuanrong Qixing Continues to Accelerate Mass Production

Currently, Yuanrong Qixing is involved in over 10 mass production projects. Zhou Guang pointed out that as of now, the Yuanrong Qixing team comprises approximately 800 people. "The entire mass production process is accelerating. The AI model and architecture can be understood as the foundation model of our company, and the next step is to continuously adapt it to other vehicles."

During the implementation process, the SOP timing for each project varies. Zhou Guang believes that the company can reasonably stagger these timings to ensure a good experience for each project.

02 Next Steps: VLA Model, Robotaxi, and Overseas Expansion

Having secured its initial victory and obtained new funding, how does Yuanrong Qixing plan its next steps? Zhou Guang also provided answers.

"The next five years will be the main battleground for intelligent driving and also the sprint field for Yuanrong Qixing," said Zhou Guang. After the C round of financing, the enterprise will undergo a comprehensive upgrade.

The first step is to further accelerate the research and development of End-to-End 2.0.

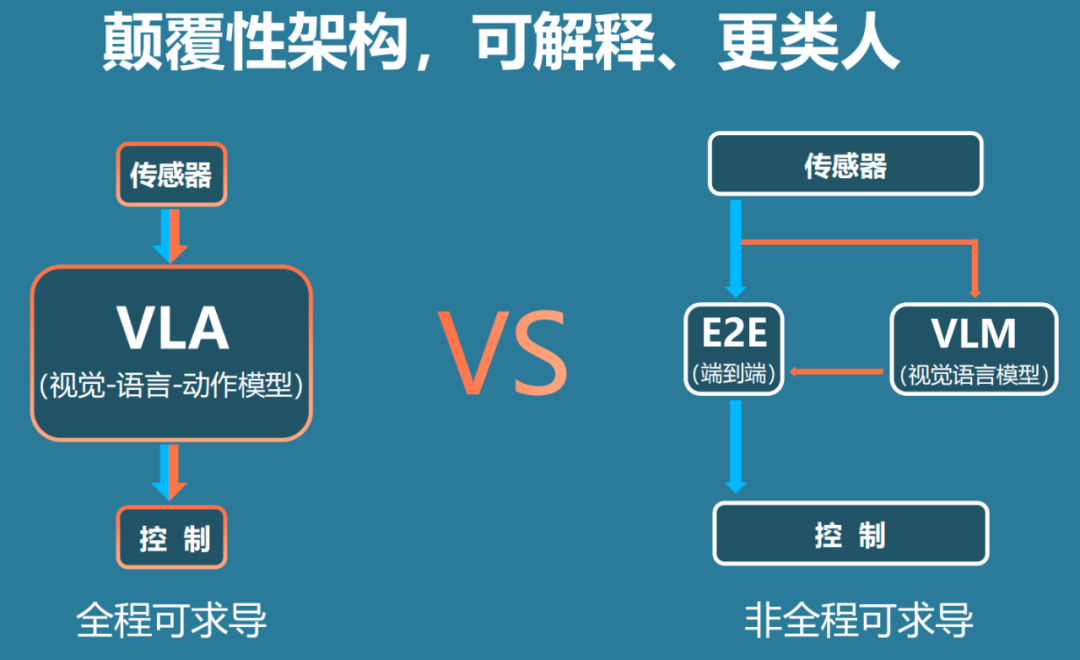

"We at Yuanrong Qixing have never competed in one-stage or two-stage models; our entire approach has been End-to-End 1.0," said Zhou Guang. The reason for not engaging in such debates is that the company has already invested operational efforts in the next station, the VLA model, or End-to-End 2.0.

He used an analogy, stating that the Vision Language Action Model (VLM) is like having a coach sitting next to a novice driver, which undoubtedly results in better driving than the novice alone. In contrast, Yuanrong's VLA is like having an experienced driver take the wheel.

Comparison of VLA and VLM Routes

The VLA model obviously requires more computing power. Therefore, Yuanrong Qixing will conduct research and development based on NVIDIA's Thor chip.

However, Zhou Guang also emphasized, "While computing power, fleet size, and data are crucial for performance, the prerequisite is having a solid algorithm. End-to-End and VLA do require significant computing power but not as much as large language models. It's not something that can be handled with just eight or 100 cards. Firstly, we have already invested considerable funds in cards and own thousands of them. Secondly, Alibaba is also one of our shareholders, so we can seek their assistance when computing power is scarce."

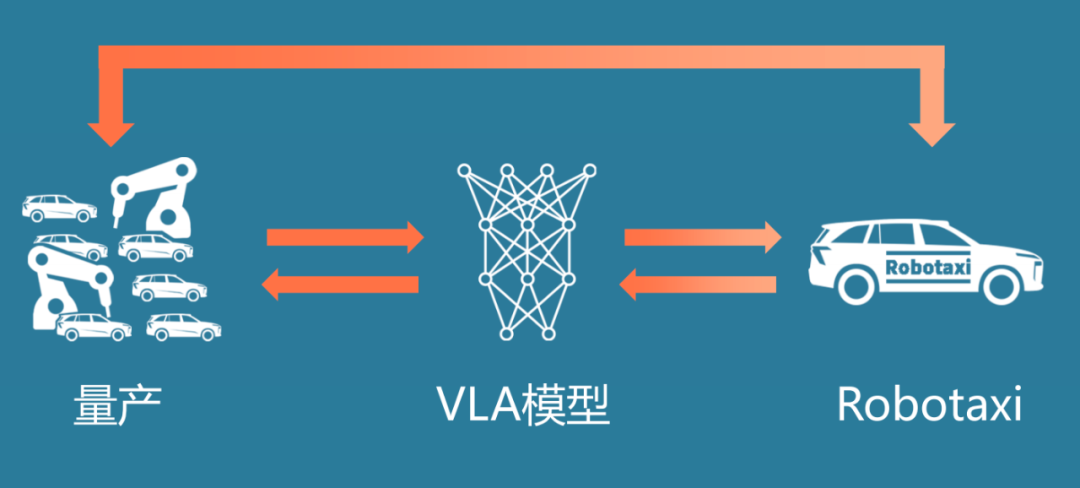

The second step is to deploy Robotaxi.

At this year's BAIC Group Technology Day, Zhou Guang criticized L4 autonomous driving. He stated, "We were once an L4 company, but in 2022, we decided to abandon L4 and focus on creating maps. That's nonsense; there's no business model there."

This once plunged him into a whirlwind of public opinion.

At this conference, he explained, "Six months ago, I said there were issues with L4, which was misunderstood by many as criticism of Robotaxi. In fact, L4 and Robotaxi are two different things."

He believes that Robotaxi is a commercialization process, referring to using robots to drive without any technical definition, merely a business model. In contrast, L4 is a technical path that involves modularization and using high-precision maps for autonomous driving. "What I said at the time was that L4 could be questioned."

In Zhou Guang's view, Tesla's recently announced autonomous driving based on an AI data-driven large model has the potential to be highly successful in Robotaxi, unlike rule-based or modular systems.

Yuanrong Qixing Will Use the VLA Model to Support Mass Production and Robotaxi

"Commercializing with the correct technical approach is only logical. By adopting this AI-Driven End-to-End 2.0 architecture, Yuanrong Qixing can achieve excellent results in Robotaxi," said Zhou Guang. Yuanrong Qixing will expand its Robotaxi business based on mass-produced vehicles, adopting an open cooperation model and partnering with ride-hailing platforms. This will not only help these platforms with their Robotaxi services but also contribute to Yuanrong Qixing's core technology.

The third step is overseas expansion.

"Currently, China leads in new energy, and we want to follow the national strategy and go overseas. We plan to expand our business in Europe, Japan, and South Korea," said Zhou Guang. Since Yuanrong Qixing's system is naturally map-free and does not require patches, technology implementation will be swift. "We will also participate in next year's Tokyo Motor Show."

From technology to products to overseas expansion, Zhou Guang has grand plans for Yuanrong Qixing.

03 How to View Automakers' Choice of 'One-to-Many' Strategies?

Founded in 2019, Yuanrong Qixing initially aimed to be an autonomous driving company and was once favored by the capital market.

Especially in September 2021, after securing $300 million in funding led by Alibaba, Yuanrong Qixing quickly became a unicorn in the autonomous driving industry in China, following in the footsteps of Pony.ai, WeRide, Momenta, and other companies, with a valuation exceeding $1 billion.

However, at that time, due to the persistent inability to resolve the long tail scenarios of L4 and the impossibility of achieving profitability, a large number of autonomous driving companies underwent business transformations or "dimensional reductions."

Some companies reduced their scope, shifting from Robotaxi to relatively simpler sectors such as trunk logistics and unmanned delivery. Others reduced their technology scope, shifting their business focus from L4 to L2.

Yuanrong Qixing chose the latter and began research and development on L2 in 2022.

At that time, companies such as Momenta and Huawei had already achieved some results in the field of intelligent driving. As a latecomer, Yuanrong Qixing had to closely follow the latest technological trends: first, map-free technology, followed by end-to-end technology.

Today, it is evident that Yuanrong Qixing made the right bet.

Although Yuanrong Qixing has not disclosed who its investors are, the outside world generally believes it to be Great Wall Motors. The first mass-produced model of Yuanrong Qixing's solution is the Great Wall Motors-owned WEY Blue Mountain intelligent driving version.

Prior to this, Great Wall Motors primarily relied on its internally incubated subsidiary, HAOMO.AI, for intelligent driving solutions. Over 20 models under the WEY, Tank 300, Tank 500, Tank 700, Haval H6S, Haval Dragon, SHANHAI PAO, ORA Lightning Cat, and ORA Ballet Cat brands were equipped with HAOMO.AI's intelligent driving solutions.

Great Wall Motors Models Equipped with HAOMO.AI Intelligent Driving Products

Since HAOMO.AI failed to timely deliver city intelligent driving solutions, Yuanrong Qixing seized the opportunity.

However, in addition to Yuanrong Qixing, there are reports that Momenta has also secured a model order for Great Wall's end-to-end solution. Meanwhile, sources close to Great Wall Motors told CyberAuto that at least since last year, DJI's intelligent driving subsidiary, JoyWay Technology, has been testing its pure vision solution on WEY models, and these tests are still ongoing.

In response, Zhou Guang expressed understanding. He believes that every company must consider its own security. "It is not safe enough for automakers to only choose one-to-one collaborations. However, each automaker may only choose two or at most three partners. Collaboration is tight, not like buying and replacing tires. Additionally, intelligent driving represents a company's brand, and too many partners make it difficult to establish a brand image," he said.

As a startup company, with continuous product launches, the question of going public inevitably arises. In response, Zhou Guang stated that capital will plan according to its own rhythm. "Yuanrong Qixing's goal is to develop universal artificial intelligence for the physical world. IPOs and fundraising are processes to achieve this goal, and we will pursue anything beneficial to us," he said.