MiniMax's overseas success fails to alleviate domestic profit anxiety

![]() 11/08 2024

11/08 2024

![]() 682

682

"Contrary to the optimistic consensus within the MiniMax team, the AI track focused on emotional companionship appears to be facing a bottleneck."

"@TechNewKnowledge Original

Can MiniMax's success in overseas markets alleviate its actual anxiety?

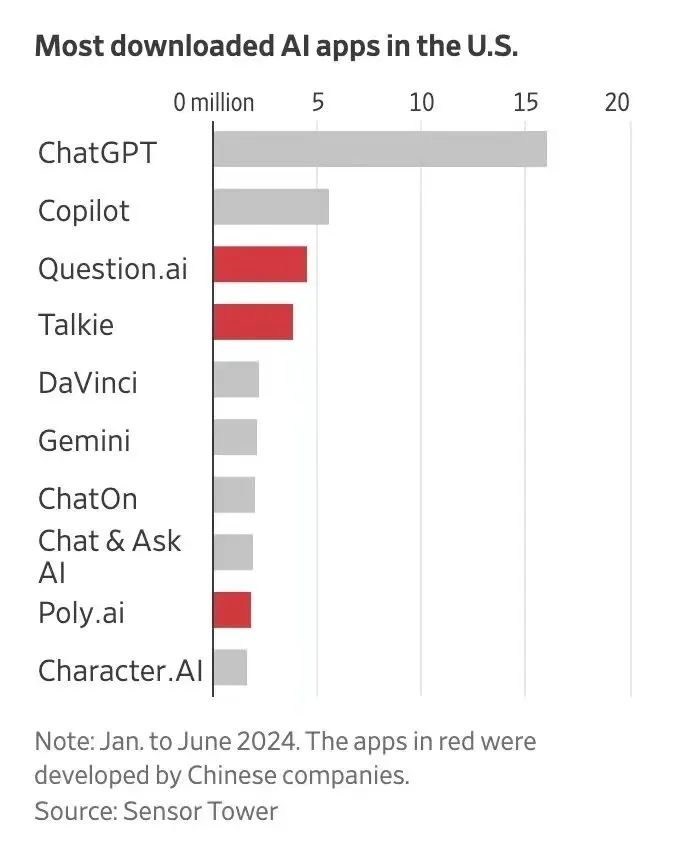

Recently, MiniMax's overseas star AI product, Talkie, has skyrocketed in popularity, with downloads surpassing that of its category leader, character.ai. According to media projections, MiniMax is expected to generate revenue of $70 million this year, with most of it coming from Talkie's advertising.

MiniMax is undoubtedly a low-key presence among the current "AI Six Little Tigers." Until recently, founder Yan Junjie broke his usual demeanor and stood proudly in the spotlight to unveil the video generation model abab-video-1, officially joining the fray of video generation models.

This makes it difficult for outsiders to judge whether such "mystery" stems from the pragmatism of a technology-driven team or is merely a smokescreen to distract attention. Its frequent teasers have piqued public interest but have yet to provide clear answers.

In fact, the company was founded even before ChatGPT emerged. It boasts an impressive foundation: an all-star entrepreneurial team from SenseTime, and a self-developed national first-of-its-kind large model with an MoE architecture comparable to GPT 4, along with popular overseas applications like Talkie, which interact with global users 3 billion times daily.

In March of this year, MiniMax secured $600 million in Series A+ funding, with Alibaba leading the investment, valuing the company at over $2.5 billion (approximately RMB 17.8 billion). Other investors include Tencent, Sequoia Capital China, Hillhouse Capital, IDG Capital, and miHoYo.

But this is not enough.

A valuation of RMB 20 billion has become a watershed for domestic large model players. Moonshot, Baichuan Intelligence, and Zhipu AI have all surpassed this threshold, with the first two having been established for only about a year.

The outlook for domestic large model startups remains uncertain. Zhu Xiaohu, managing partner of GSR Ventures, has stated that startups in this field have no advantage over large companies. In his view, the best outcome for the "Six Little Tigers" would be acquisition by a large company. Previously, there were rumors that two of the "AI Six Little Tigers" had ceased pre-training.

While MiniMax's "mysterious" tactics have piqued public interest, they have also left many unanswered questions.

01.

The Ticket to a New World

Huang Mingming, founding partner of Mingshi Capital and an early investor in MiniMax, sees investing in this company as "a ticket to a new world." Their connection dates back to 2021, before Chat GPT's emergence.

By 2023, also known as the Year of AI, the number of publicly disclosed large models in China peaked at over 300.

During this period, nothing seemed surprising in the industry. For example, some AI startups with no products had initial funding valuations of up to $1 billion, joining the unicorn club. Some titans from the mobile internet era personally ventured into the field with tens of millions of dollars in startup capital. Executives from large companies also started their own ventures, fearing they might miss out. As entrepreneurial players emerged like mushrooms after rain, investors also eagerly provided "provisions."

Whether it's established investment institutions like Sequoia and Hillhouse or new players in the investment circle like Alibaba, Tencent, InnoVen Capital, and QiJi ChuangTan, influential investors with substantial funds have placed bets across model and application layers, showering money to secure a seat at the table in this AI boom.

According to incomplete statistics from "TechNewKnowledge," there were 815 investment and financing events in the domestic AI industry in 2023, with a total financing amount of RMB 263.1 billion. With ample funding, AI large models, often dubbed "money-eaters," have flourished.

Zhipu AI, Moonshot, MiniMax, Stepwise Stars, Baichuan Intelligence, and Lingyi Wuwan also emerged victorious that year, forming the first tier of domestic large model startups, known as the "Six Little Dragons." Among them, Moonshot and MiniMax, both belonging to the younger generation, gained more market attention.

As a genius scholar with a Ph.D. from Carnegie Mellon University, one of the top computer science institutions, Yang Zhilin founded Moonshot in 2023 with a clear focus on long-text capabilities and iterative text models. Currently, its 2 million-character length model is in beta testing. As a favorite of capital, Moonshot has released only one large language model with 100 billion parameters and is already valued at $3 billion.

If Moonshot represents the bold and visionary younger generation, MiniMax belongs to the same generation but with strong technical talent and rich product experience.

Founder and CEO Yan Junjie previously served as Vice President of SenseTime Group, Deputy Dean of the Research Institute, and CTO of the Smart City Business Group. During his tenure at SenseTime, he led the development of general computer vision models, deep learning toolchains, and face recognition-related technologies. MiniMax is also the first team in China to develop the MoE (Mixture-of-Experts) architecture.

While the public marveled at the astronomical data, including 3 billion daily interactions, 3 trillion text tokens processed daily, 20 million images generated, and 70,000 hours of synthesized speech, MiniMax was already building a full matrix of multimodal models tailored to product needs. As of September 2024, MiniMax had launched large models for video (abab-video-1), music (abab-music-1), speech (abab-speech-1), and text (abab-text-7), with the latest valuation reaching $2.5 billion.

On the product front, MiniMax has also chosen a very aggressive path. Among domestic AI startups, MiniMax can be considered one of the earliest and most prolific in terms of applied products. A month before chatGPT 3.5 was launched, MiniMax had already released its first virtual AI social product, Glow, which gained nearly 5 million users in just four months. Although the product was later reported and removed from app stores due to privacy and sensitive content issues, MiniMax did not give up.

In June 2023, MiniMax launched another AI companionship product, "Talkie," for overseas users and later introduced its domestic version, "Xingye," which gained user favor again. According to the AI Companionship August APP Ranking released by QuantumBit Intelligence, Xingye had over 14 million downloads, with the highest monthly download growth and DAU among similar domestic AI products.

Describing MiniMax as "quietly doing great things" is not an exaggeration. In January 2024, MiniMax released abab6, a model with 100 billion parameters and an MoE architecture, marking significant progress in exploring accelerated realization of Scaling Laws, involving optimizations in model architecture, data pipeline reconstruction, and improvements in training algorithms and parallel training strategies.

Just three months later, the MiniMax team further tapped into the potential of the MoE architecture, unveiling the abab 6.5 series of models with 1 trillion parameters. In various core capability tests, abab 6.5 demonstrated performance close to GPT-4, Claude-3, and Gemini-1.5.

Additionally, MiniMax is also deploying productivity application tools. In May 2024, it launched "Hailu AI," a productivity assistant that supports most C-end user needs, including long text understanding, intelligent search, data query, image recognition, and copywriting.

02.

Commercialization Dilemma Amid the Wave

However, contrary to the optimistic consensus within the MiniMax team, the AI track focused on emotional companionship appears to be facing a bottleneck.

Talkie's biggest selling point is AI character customization, allowing users to create personal AI agents on the platform by adjusting their appearance, voice characteristics, personality preferences, etc., to deeply customize their exclusive chat partners.

From the perspective of overall user scale, the top landscape is relatively stable, with the three domestic products with tens of millions of downloads still being Dadao, X Eva, and Xingye. In terms of user growth, emotional companionship AI products have shown sluggish growth. In September, the new downloads of the top 15 AI products generally declined by about 30%, with Xingye falling out of the million-level tier by nearly 30%. In terms of user activity, while old users' activity has stabilized, new users' three-day and seven-day retention rates have declined by about 7% overall, posing new challenges to user stickiness.

In terms of user groups, emotional companionship AI products are mainly used by young people, who have limited willingness and ability to pay. Moreover, Xingye's overseas version, "Talkie," faces not only the same issues but also stricter overseas regulation and censorship, especially regarding data security and privacy. Additionally, cultural differences and user preferences across different countries and regions present inevitable operational challenges.

A more serious and realistic problem lies beyond user scale and commercialization.

One of the original design intentions of emotional companionship AI products is to provide timely emotional support to people, which can even be highly beneficial to many lonely or depressed individuals. Although AI companions can influence their users in a "human" way, within the legal framework, AI does not exist as an independent legal person. Hovering between the virtual and real, its moral hazards, language boundaries, and other security risks are difficult to define.

The emotional companionship AI track is showing signs of a bottleneck, and productivity assistant AI also lacks a clear advantage. Hailu AI, as MiniMax's flagship productivity assistant product, is still in its infancy. In terms of core functions such as text generation, it does not differ significantly from major domestic products and lacks a strong competitive barrier. Hailu AI's recently launched music and video generation features seem to aim at differentiating itself through these unique capabilities.

User satisfaction, product penetration, and technological progress can evolve around iterative optimization of the model itself. For AI startups growing from 0 to 1, commercialization is of greater concern to the outside world than product form. There are two main forms of AI commercialization: To B and To C.

The To B approach involves integrating AI technology into industries and products to provide vertical customization services. For To B products to be highly usable and targeted at high-value scenarios, such as legal consulting, financial services, and programming, which rely heavily on expertise and involve complex processes, further input from professionals is needed. This makes it difficult to standardize operations, keeping customization costs high.

Especially in the domestic To B AI market, which is a shortcut for large companies to expand their territories, it has long been divided among various large players. For large model companies that have not yet turned a profit, the more competitive the market becomes, the more B-end projects they gain, but their marginal costs do not decrease, and their pace inevitably slows down. The previous generation of AI companies, such as SenseTime, also faced similar dilemmas and failed to provide satisfactory answers.

Kai-Fu Lee, founder of Lingyi Wuwan, is also reflecting on this issue. He suggests that the primary task for large models in the To B sector is "to find a few methods that can charge based on usage rather than project customization, focusing on orders that can generate higher profit margins."

"The To C market is ten times larger than the To B market," Wang Xiaochuan, CEO of Baichuan Intelligence, once stated. The To C business model targets individual users, providing productivity aids and monetizing through paid subscriptions, as seen in MiniMax's Xingye and Talkie.

Parallel development of models and products is also the path chosen by MiniMax. By focusing on both the B-end and C-end, it meets the needs of ordinary users while also valuing developer requirements, optimizing technology and products based on user feedback.

In its To B layout, MiniMax uses APIs as a bridge to build an open platform, with primary application scenarios including role-playing, AI customer service, smart hardware, AI education, office work, and recruitment. Currently, over 30,000 enterprises have accessed the platform, all of which are stable paying customers.

Regarding the C-end business, founder Yan Junjie previously revealed that it accounts for up to 80% of the company's revenue. For MiniMax's current commercialization, Yan Junjie mentioned two paths: one is the open platform, which already has over 30,000 enterprise users and developers; the other is the advertising mechanism within the company's products, enabling commercialization through monetization.

However, rather than strictly dividing To B and To C, industry insiders believe that the product experience and market fit of AI applications are more crucial. They are the key factors in attracting users and the core of AI product commercialization.

As founder Yan Junjie said, "The value of AI lies in serving ordinary people, as the majority of society is composed of them. If you want to serve ordinary people, the only way is to reach them through products."

His understanding of technology and products seems like that of a pure AGI believer: user creation is part of the model and product, not two separate entities.

However, for the cost required to train a large model with trillion-level parameters, the revenue generated by domestic large model enterprises is only a drop in the bucket, and MiniMax is no exception.

Constrained by various environments and uncertainties in industrial development, VC and PE firms have been more cautious in investing in AI this year. Leading companies like Baidu and ByteDance are placing their bets on themselves, gambling that they can do well; while others like Tencent, Alibaba, and Meituan adopt a dual strategy of "self-research + investment".

Among the remaining AI start-ups, only those that can achieve self-sufficiency or even profitability in the short term will have a chance to sit at the table for the second half. Time is running out for MiniMax.

03.

The "war flames" of large models shift westward in the second half

Even though they haven't figured out how to "make money," domestic large model enterprises have already accelerated into a reshuffling period.

In May 2024, Zhipu AI took the lead in announcing a price reduction for entry-level large models from 0.005 yuan per thousand tokens to 0.001 yuan per thousand tokens, a drop of 80%. Subsequently, companies like ByteDance, Alibaba, Baidu, Tencent, and iFLYTEK successively lowered their large model prices, with some API calling fees for large models targeting the B-end market dropping to zero, marking the beginning of a price war among large models.

This is a game with no exit; there is no optimal solution for choosing to join or not to join.

Zhang Peng, CEO of Zhipu AI, believes that from a macro perspective, price wars are beneficial to the Chinese large model industry, enabling more people to use them and truly turning large models into infrastructure. Li Kaifu said that large model companies should not be so irrational, as technology is the most important factor, and losing money to do business is unsustainable.

Regardless, the scene of lowering prices while spending money, which was common during the era of "burning money for scale" in internet companies, continues to play out in the era of large models.

It was recently revealed that the dark side of the moon had driven up the advertising prices of AI companies on Bilibili, with Kimi paying at least 30 yuan for each user acquired. On the other hand, the traffic buyer behind MiniMax stated that domestic AI enterprises are not too concerned about customer acquisition costs for their overseas products. Taking AI development tools as an example, the cost per customer acquisition may reach $10-20 or even more...

This is yet another manifestation of commercialization anxiety.

It seems that the "acquisition time" predicted by Zhu Xiaohu has already arrived. On October 22, media reported that the large model startup Wave Intelligence was acquired by OPPO, and its CEO Jiang Yuchen will join OPPO. Relevant personnel from Wave Intelligence confirmed this matter and stated that the company and its products will continue to operate.

On the other hand, large model startups are also taking the initiative to seek a way out across the ocean.

According to The Financial Times, MiniMax is expected to achieve sales of $70 million this year, with most of it expected to come from the chatbot social app Talkie. This overseas app has already gained a large number of loyal users on the other side of the globe.

According to Sensor Tower data, Talkie has 11 million monthly active users globally, with over 50% coming from the United States. It is becoming a global application, much like its predecessor TikTok.

For startups like Six Little Tigers, it is inevitable to have a "head-on" competition with large factories, but this is not what entrepreneurs want to see.

Yan Junjie looks forward to the birth of a killer app like Douyin or WeChat. In the foreseeable future, MiniMax's goal for this year is to reach 10 million DAU in China. In his vision, "there should be a product with 100 million DAU in China next year, but it may take another form." All of this will be derived from the development of large model capabilities, resources, and technology.

In the first half of this year, MiniMax began to realize that domestic players were beginning to gain local advantages in some productivity-oriented scenarios. In fact, in the field of large models, globally, the total number of general large models released by the United States and China accounts for 80% of the global releases. According to data from the Ministry of Industry and Information Technology, there are nearly 200 generative AI service large models in China that have completed registration and are available to the public, with over 600 million registered users.

Although the objective gap between China and the United States still exists, many voices in the industry believe that the rise of the "engineer dividend" in China can provide sufficient talent reserves for the development of large models.

It's not just MiniMax. According to a June report by overseas media the Information, the dark side of the moon seems to be preparing to enter the US market. The company is developing several products targeting the US market, including an AI role-playing chat app and a music video generator. However, the dark side of the moon responded to this report, stating that there are currently no plans to develop and release any overseas products. Zhang Peng of Zhipu AI also revealed that the company is also deploying overseas business, with target customers including international enterprises entering China and Chinese enterprises going overseas.

For MiniMax, although it is called a "giant Chinese AI companion" by the media, the company obviously has more plans. Sheng Jingyuan, General Manager of MiniMax's International Business, emphasized in an interview with the media, "What we do is not chatting or emotional companionship of AI, but a new generation of content generation platform."

However, the AI market is moving too fast. Being in it, people don't have time to remember stories and concepts. The battlefield is fiercer than ever before—competing in data, applications, implementation, and monetization. In each aspect, MiniMax has to pay a high price for its own story.

Yan Junjie is confident in the future of Chinese AGI companies. He once told the media that although there will be many challenges in the short term, looking ahead to 5 or even 10 years, if there are only five AGI companies left in the world, "at least the second one should be a Chinese company."

Of course, the reason is simple. He further supplemented this answer, "There are 1 billion internet users in China.