Intel's Darkest Hour: Forming an Alliance with AMD, Can AI Save the Day?

![]() 11/08 2024

11/08 2024

![]() 673

673

Saw a picture today that Intel will resume offering free drinks to boost employee morale.

2024 is indeed Intel's darkest hour.

Before 2020, when Intel was mentioned, people first thought of its superior performance and stability; whereas AMD was primarily associated with high cost-effectiveness. However, the shift from Intel's i5 dominance to AMD's R5 dominance seemed to happen overnight. More alarmingly, Intel's decline is not limited to the consumer market; its share in the commercial market is also being eroded by AMD and NVIDIA.

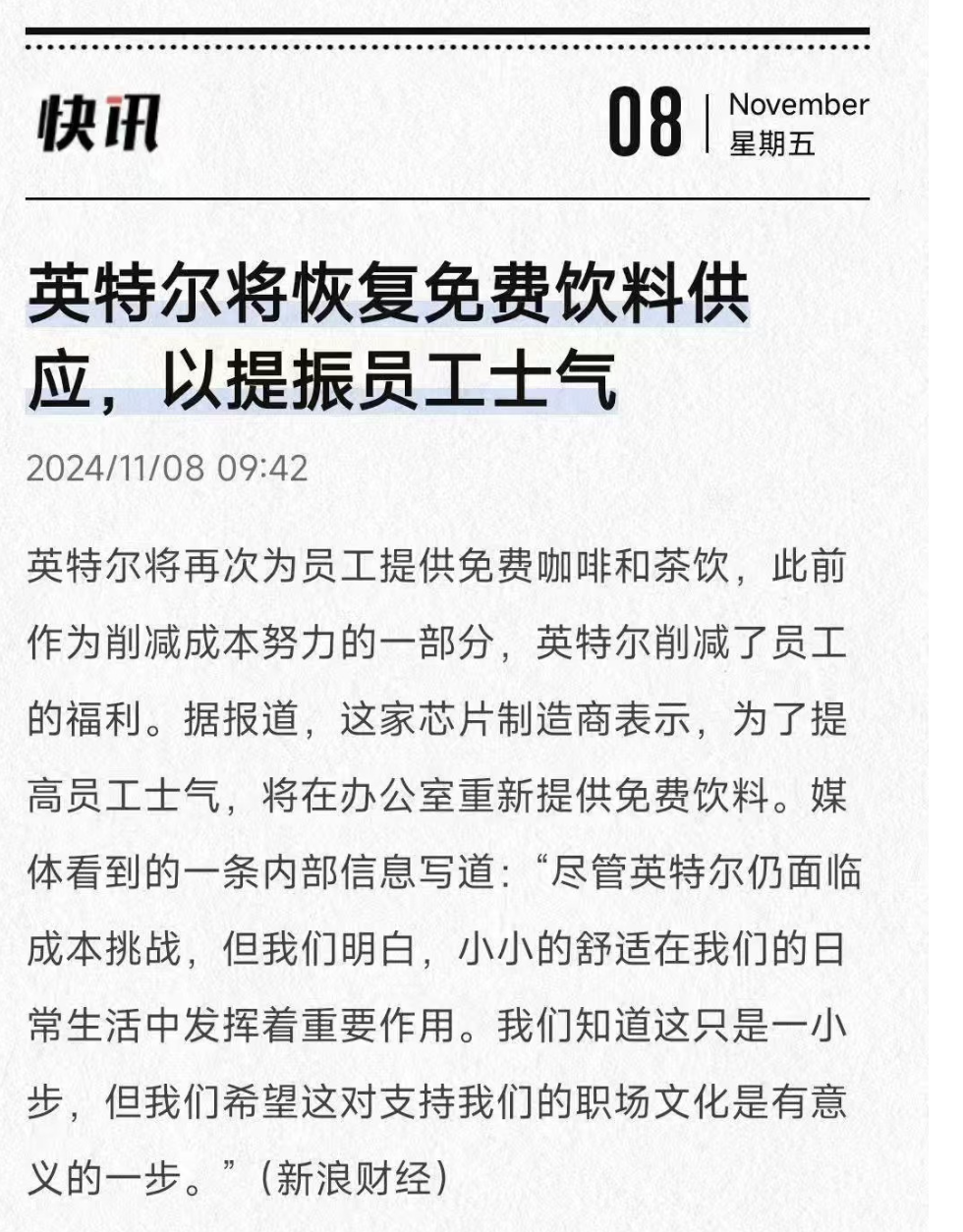

Recent AMD financial reports reveal that in Q3 2024, AMD's data center business revenue reached $3.549 billion, slightly surpassing Intel's $3.3 billion, marking AMD's first-ever surpass of Intel. From the revenue curve shared by X netizens, it's evident that NVIDIA had already surpassed Intel in the data center business, and now AMD has done the same, showcasing Intel's visible decline.

(Image Source: Screenshot from X Platform)

In fact, Intel's decline began earlier than we realize. Choosing the IDM model doomed Intel's failure. Selling the baseband division to Apple marked the beginning of Intel's decline, while rumors of selling its fabs to Qualcomm signaled Intel's deep trouble.

In deep trouble, Intel struggles to move forward

Founded in 1968, Intel has been around for over half a century, but hidden dangers have never disappeared behind its glory. Any industry's development path inevitably encounters changes in new technologies and models. For industry giants, making one wrong choice isn't dreadful, but repeated mistakes will inevitably lead to decline.

Intel's first major mistake was adhering to the IDM model. The IDM model, where semiconductor manufacturers handle the entire process from chip design to testing, production, and packaging, is asset-heavy and requires significant investment. Falling behind in process technology can also affect chip design. Intel once refused to venture into foundry services, disdaining TSMC's profits, leading to minimal pressure on its fabs to upgrade processes.

Starting with the 10nm process, Intel's fabs showed signs of lagging behind. As Samsung and TSMC subsequently introduced 7nm and 5nm processes, Intel's process technology lag became increasingly apparent. In frustration, Intel simply renamed its 10nm process technology as "Intel 7".

Intensifying competition in the consumer market has also put considerable pressure on Intel. On one hand, AMD's Ryzen series chips, starting with the Ryzen 3000 series, have become increasingly powerful with each generation, continually eroding Intel's share of the consumer CPU market. On the other hand, Apple abandoned Intel's CPUs, switching to self-developed M-series chips based on the Arm architecture.

(Image Source: Apple)

Arm, with its Reduced Instruction Set Computing (RISC) architecture, offers significant energy efficiency advantages, making it ideal for thin and light laptops. Driven by Apple, Qualcomm has also invested more resources in developing Arm-based PC processors, launching the Snapdragon X Elite. Market research firm TechInsights predicts that by 2025, laptops with Arm-based CPUs will account for 20% of the market share, potentially reaching 40% by 2025, continuously squeezing the survival space of Intel and AMD.

Faced with difficulties, Intel chose to venture into discrete graphics cards and AI. However, NVIDIA dominates the graphics card market. Not only Intel but even NVIDIA's long-time rival AMD has reportedly abandoned high-end graphics cards, retaining only mid-range and entry-level options. In the AI field, NVIDIA holds a near-monopoly with an 80% market share, leaving little room for Intel and AMD, which also lack technological advantages.

(Image Source: NVIDIA)

Recently, Intel released its latest financial report. Unsurprisingly, Intel's revenue for Q3 this year was $13.284 billion, a 6% year-on-year decrease, with a net loss attributable to shareholders of $16.639 billion, compared to a net profit of $297 million in the same period last year. After adjustments, Intel's net loss attributable to shareholders was $1.976 billion, compared to an adjusted net profit of $1.739 billion in the same period last year.

From a net profit of over $10 billion in a single quarter to a loss of over $10 billion, Intel achieved this transformation in just one year, comparable to the dramatic decline of Nokia, which was the world's top mobile phone seller in 2011 but fell to third globally in 2012. Fortunately, Intel differs fundamentally from Nokia; there are few competitors in the CPU field, and Intel's products are not significantly behind AMD in various aspects.

Even a lean camel is bigger than a horse. Despite its predicament, Intel still has a chance to revive. Facing industry changes, Intel first aims at its stronghold in the consumer PC and server markets, planning to collaborate with long-time rival AMD to weather the storm together.

Intel Joins Forces with AMD: A "Weak Alliance" Against Arm

Consumer-grade CPUs are Intel's bread and butter, but recent generations of Core processors have been underwhelming. The 12th-gen Core processors were lauded as exceptional, while the 13th-gen were seen as minor overclocks of the 12th-gen. The 14th-gen were "overclocked to the extreme" versions of the 13th-gen, with modest performance improvements across generations.

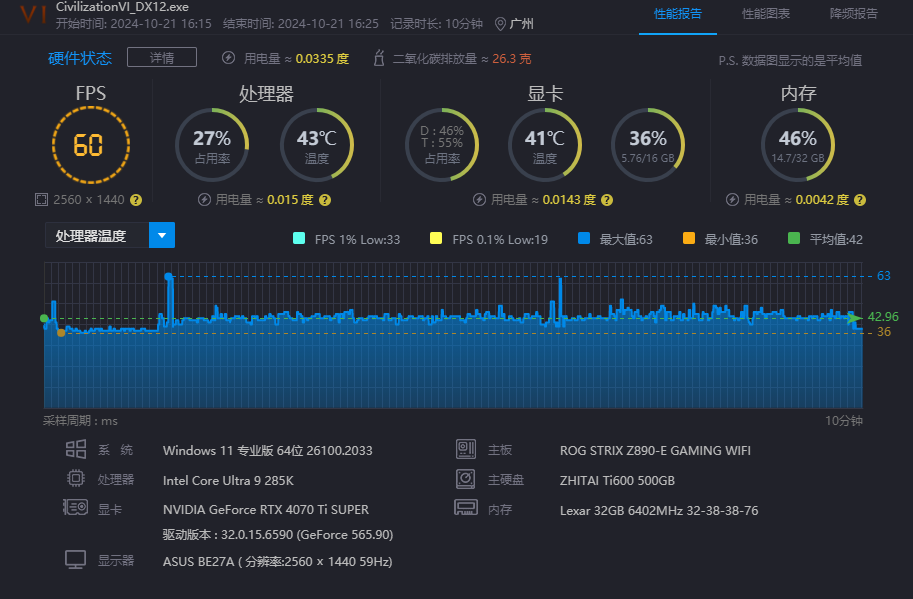

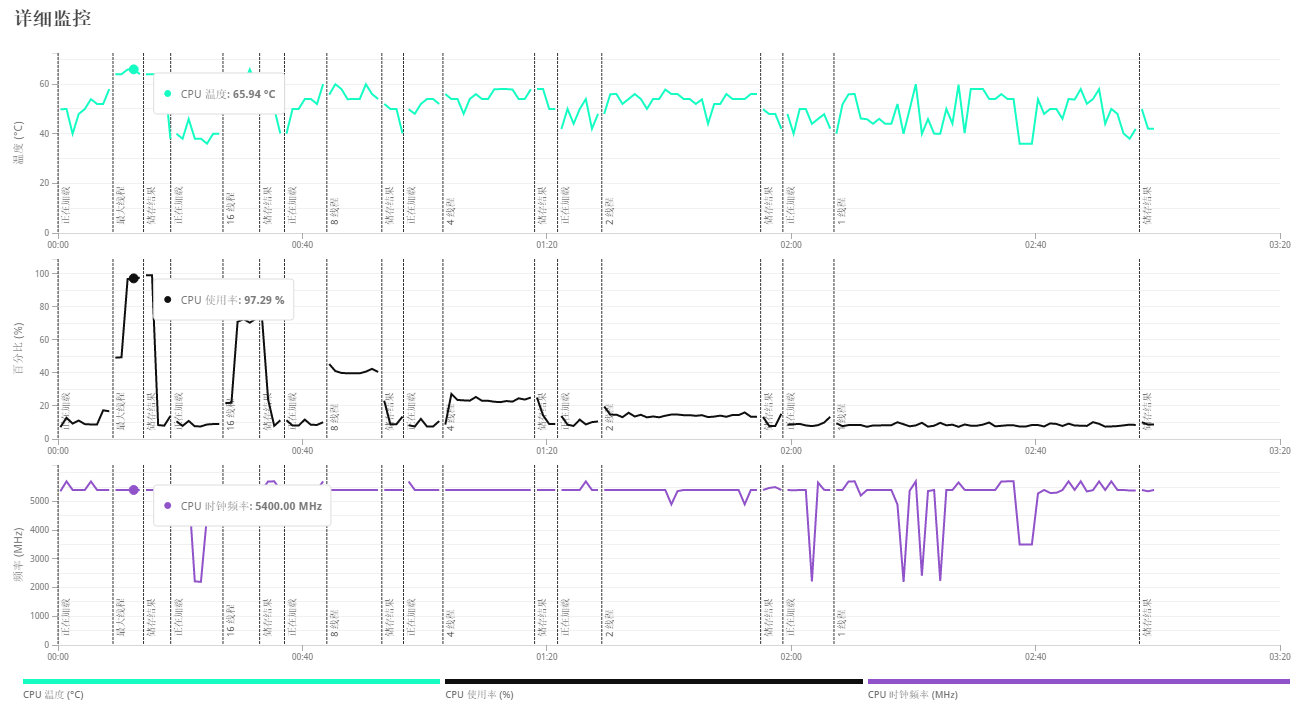

Subsequently, Intel abandoned the "XXth-gen Core" naming convention, introducing the Core Ultra series. Unlike the past emphasis on performance, feeling the pressure from Arm, the Core Ultra series now focuses on energy efficiency rather than performance. In Lei Technology's tests, the Core Ultra 9 285K showed minimal performance gains compared to the i9-14900K but significant energy efficiency improvements.

(Image Source: Lei Technology)

In 3D Mark tests, the Core Ultra 9 285K peaked at only 65.94°C, about 16°C lower than the i9-14900K. However, performance is paramount for desktop chips, with energy efficiency taking a back seat. After the Core Ultra's release, Intel failed to regain consumer support. Data from German retailer Mindfactory shows that AMD holds 94.81% of the desktop PC processor market share, with Intel accounting for only 5.19%.

(Image Source: Lei Technology)

Given this situation, Intel set aside its grievances with AMD to join forces against their common enemy, Arm.

Arm's low-power RISC architecture offers significant advantages in the server and mobile markets. According to 2023 data from Bernstein Research, nearly 10% of global servers already use Arm-based chips. While Intel once held over 99% of the server CPU market, its share is now declining, though it still leads the market.

Exploring power consumption optimization, Intel introduced the Lunar Lake and Arrow Lake processor architectures, significantly boosting energy efficiency. However, battery life still falls short of Apple's M-series, and performance improvements are modest, even showing signs of regression.

Relying solely on Intel itself, it's challenging to maintain substantial performance boosts while optimizing x86 architecture's energy efficiency. AMD also faces the Arm threat. If Intel and AMD collaborate, x86 architecture may still compete with Arm in terms of future energy efficiency. Coupled with x86's ecosystem advantages, Arm's development may not proceed as smoothly as predicted.

(Image Source: Intel)

Through collaboration with AMD, Intel aims to regain its peak position in the server and consumer PC processor markets. However, AMD and Intel dominate the x86 architecture processor market, raising potential monopoly concerns if they unite.

For Intel, it cannot rely solely on AMD. Enhancing technical capabilities and product strength are crucial to maintaining market share and advancing amidst industry changes.

Can Intel Ride the AI Chip Wave?

Selling the baseband division and fabs was, in my opinion, the right choice. After abandoning the mobile processor business, Intel's baseband division lost significance, and selling it to Apple was a financially beneficial move. As for the fabs, they had become a burden on Intel. AMD's outstanding chip performance is partly due to TSMC's advanced process technology.

Intel's choice in CPU products was correct. Consumers demand low-power, high-performance chips. The Core Ultra series' lack of popularity mainly stems from minimal performance gains. Intel's reputation for stability remains strong; many of my friends still prefer Intel CPUs for their builds. If the next-gen Core Ultra delivers significant performance improvements, consumers will surely respond positively. In the laptop sector, Intel can maintain its current strategy, prioritizing energy efficiency upgrades with performance enhancements as a secondary focus.

In the server domain, Intel also needs to optimize x86 architecture chips' energy efficiency and tailor optimizations for specific tasks to boost performance and close the gap with Arm architecture.

Finally, in AI, both Intel and AMD struggle to compete with NVIDIA. However, investing in AI is an inevitable trend in industry development, and neither can nor will easily abandon this path.

It's worth noting that despite recent revenue declines, Intel still surpassed Samsung and matched NVIDIA in 2023. After releasing its Q3 financial report, Intel's stock did not plummet as expected but rather saw a notable rebound, indicating investors' renewed trust in Intel.

While challenges persist, Intel possesses solid strengths. As the semiconductor industry advances into the AI era, Intel's position in the server and consumer CPU markets has slightly wavered but remains a leader in the short term. The energy efficiency explorations of the Lunar Lake and Arrow Lake architectures will eventually bear fruit. If Intel successfully collaborates with AMD to optimize the x86 architecture, profitability may not be far off.

Source: Lei Technology