NVIDIA enters the CPU industry! Betting on ARM and AI PCs, Intel's situation worsens

![]() 11/11 2024

11/11 2024

![]() 495

495

After multiple failed attempts, NVIDIA has finally made up its mind. Recent news from Taiwan's supply chain confirms that NVIDIA will enter the CPU field next year, releasing a PC platform based on the Arm architecture that integrates both CPU and GPU.

In the GPU field, NVIDIA is undoubtedly the industry leader. According to market research firm JPR, NVIDIA's share of the global discrete GPU market reached 88% in the second quarter of this year, with AMD barely surviving on cost-effectiveness, and Intel's share negligible. Both Intel and AMD already have CPU and GPU businesses, and now NVIDIA is taking a crucial step, with the three PC giants soon to compete head-to-head in both CPU and GPU markets.

(Image source: NVIDIA)

As early as 2011, NVIDIA created the Tegra 3 processor based on the Arm architecture, testing the waters in the CPU industry. This chip was eventually first used in Microsoft's Surface RT. NVIDIA did not fully explore the CPU market in the past because it lacked confidence and ability to compete with Intel and AMD, not because it didn't want to make money from CPUs.

Now, the situation has changed. The advent of the AI era, coupled with increasing consumer demand for energy efficiency, has created the best opportunity for AI giant NVIDIA to expand into the CPU business.

Times create heroes, and heroes seize the moment

In recent years, the rapid development of AI has led to a surge in demand for computing cards. NVIDIA has risen to prominence, with a market capitalization of $3.65 trillion, surpassing Apple and Microsoft to rank first globally. In terms of revenue, NVIDIA's total revenue for fiscal year 2024 (from the end of January 2023 to the end of January 2024) reached $60.922 billion, a year-on-year increase of 126%, with a net profit of $39.76 billion under GAAP standards, a year-on-year increase of 581%.

With record-high market capitalization and revenue, NVIDIA has sufficient financial resources to develop CPUs and expand its PC platform business. The advent of the AI era and the rise of the Arm architecture are key to NVIDIA's competition with industry giants like Intel and AMD in the CPU market.

(Image source: NVIDIA)

In recent years, many manufacturers have added AI functions to their PCs, tablets, mobile phones, and other devices to enhance daily convenience and work efficiency. In the era of cloud-side large models, devices' AI functions were not closely related to their computing power. However, as end-side large models gradually mature, the era of end-side large models is about to arrive, potentially replacing high-cost cloud-side large models and becoming a low-cost AI tool favored by consumers.

According to statistics from Wells Fargo, NVIDIA currently holds a 98% share of the AI data center market, with AMD accounting for only 1.2% and Intel less than 1%. NVIDIA's strength in AI is undeniable, and the AI performance of its PC platform is likely to be a highlight as well.

The rise of the Arm architecture stems from consumers' increasing demand for longer battery life. The mainstream X86 architecture used in current PC chips has a complex instruction set to ensure compatibility, which increases energy consumption. The streamlined Arm architecture, with its low energy consumption advantage, offers longer battery life.

Apple's success with its self-developed M-series chips based on the Arm architecture has given other companies confidence to develop Arm-based PC chips. Qualcomm, which previously launched the Arm-based Snapdragon 8cx series, released the Snapdragon X Elite in October last year.

(Image source: Apple)

Market research firm TechInsights predicts that the market share of laptops equipped with Arm-based CPUs will reach 20% by 2025 and is expected to exceed 40% by 2029. In the desktop market, where users are less sensitive to power consumption and prioritize performance and ecosystem, Arm-based CPUs are unlikely to gain significant market share in the short term. However, in the mobile market, Arm's low energy consumption gives it a chance to compete with X86. In the server field, where application ecosystems are not required and targeted optimization is crucial, Arm-based CPUs are highly suitable.

NVIDIA, with its expertise in AI technology and Arm architecture, has not only caught the fast-growing wave of the AI industry but also encountered the rise of the Arm architecture. However, it will still be challenging for NVIDIA to carve out a market in the CPU field.

Will NVIDIA overthrow Intel and AMD?

With the right timing and sufficient financial resources, NVIDIA has the foundation for rapid development in the CPU field, but this does not guarantee success. In the CPU field, Intel and AMD remain formidable obstacles for NVIDIA.

The CPU industry has been lively in recent years. After the 12th-generation Intel Core processors gained popularity, the 13th and 14th generations, as well as subsequent Core Ultra processors using new architectures, have encountered issues, and performance improvements have been minimal. As a result, there has been much online criticism of Intel. During the heyday of Core processors, Intel users often disparaged AMD Ryzen chips with the phrase "i5 beats all by default." However, since the Ryzen 5000 series, the situation has reversed, with AMD users countering with "R5 beats all by default."

However, sales data tells a different story from online sentiment. According to statistics from market research firm Mercury Research, Intel's share of the client market was still as high as 78.9% in the second quarter of this year, with a share of 75.9% in the server market. Clearly, although Intel's Core and Ultra series have not seen significant performance improvements, their strong stability and durability remain deeply impressed on consumers, resulting in a substantial market share lead over AMD.

After years in the PC industry and several clashes with Intel, AMD has yet to seize a significant share of the client market from Intel, let alone newcomer NVIDIA. Just as Intel's foray into the GPU market has yielded lackluster results, NVIDIA's entry into the CPU market will face high difficulty in gaining share from Intel and AMD.

Apart from competition from these two giants, NVIDIA's entry into the CPU field also faces a major challenge – the software ecosystem.

Although Microsoft is continuously improving the Windows on Arm ecosystem, there are still too few native Arm-based applications at this stage. In practical use, Lei Technology found that performance losses are severe when 32-bit X86 applications are translated to the Arm platform, leading to noticeable lag. 64-bit software and some games may even crash after translation, and there are many bugs, significantly affecting daily use.

(Image source: Lei Technology)

To put it bluntly, Windows on Arm can currently only handle very light media entertainment and word processing tasks, far from comparable to a normal Windows system. Recently, Microsoft was reported to be testing an update that allows Arm-based CPUs to run any 64-bit software and games through Prism emulation, potentially solving the ecosystem problem for Windows on Arm. However, even if translation resolves the ecosystem issue, performance losses and bugs will still plague users.

Moreover, Intel and AMD are not sitting idle. In mid-October, AMD CEO Lisa Su and Intel CEO Pat Gelsinger announced the joint establishment of an x86 ecosystem advisory group. This collaboration likely aims to counter the threat from Arm, strengthen their competitiveness, and potentially optimize the energy efficiency of the X86 architecture, shedding some of its burdens.

In Lei Technology's tests, Intel's Lunar Lake and Arrow Lake architectures showed modest performance improvements but significant energy efficiency gains, demonstrating the potential for low-power, high-performance X86. With the advantage of an established ecosystem and potential optimizations by AMD and Intel, if the energy consumption of X86 architectures does not exceed that of Arm-based CPUs by much, the chances of a true rise of Arm architectures will diminish significantly.

Therefore, although NVIDIA has waited for the most opportune time to enter the CPU industry, it is still uncertain whether it can gain a significant share in the CPU field, as the future remains full of variables.

Will NVIDIA drive a major boom in ARM PCs?

Lei Technology completely disagrees with the data predicted by TechInsights. Apart from the aforementioned ecosystem issues and the presence of Intel and AMD, another common problem with current PCs equipped with Arm-based CPUs is their exorbitant prices, often around $10,000, making them unacceptable to ordinary consumers.

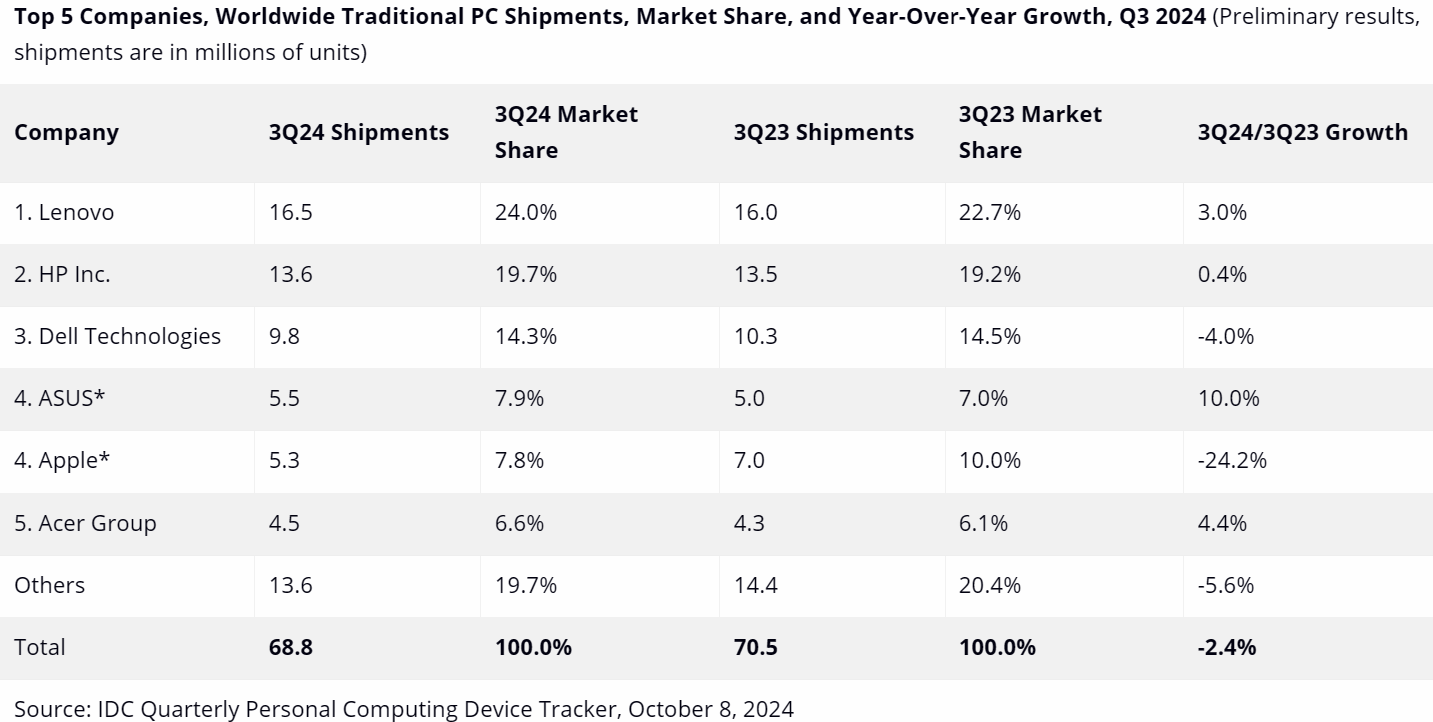

Not to mention the lack of a robust application ecosystem and the difficulty in providing a smooth user experience on Windows on Arm devices, even Apple's Mac, which has macOS and a rich application ecosystem, is currently in a precarious situation. IDC statistics show that Apple's Mac shipments plummeted 24.2% year-on-year in the third quarter of this year.

(Image source: IDC)

While pursuing long battery life, consumers also consider purchase costs. Products with generally high prices are obviously not suitable for popularizing Arm-based CPUs. Without a large user base, developers are naturally reluctant to develop native applications for Windows on Arm, and translation inevitably leads to bugs and performance losses.

The reason why PCs equipped with Arm-based CPUs dare to sell at such high prices is the lack of competition. Apart from Apple's closed-system Mac, almost all mainstream Arm platform PCs use Qualcomm Snapdragon chips. Regardless of how NVIDIA's Arm-based CPUs actually perform, their existence is good news for consumers.

Competition between NVIDIA and Qualcomm over Arm-based CPUs will drive down prices of Arm-based CPUs and devices equipped with them, providing consumers with more benefits and giving us the right to choose. Various indications suggest that the PC industry is about to undergo a transformation, which may even shake Intel's leadership position. How much of the pie AMD, Qualcomm, NVIDIA, and other companies intending to enter the market can secure will depend on their performance over the next three to five years.

Source: Lei Technology