ARM: Can AI faith support a hundredfold valuation?

![]() 11/11 2024

11/11 2024

![]() 593

593

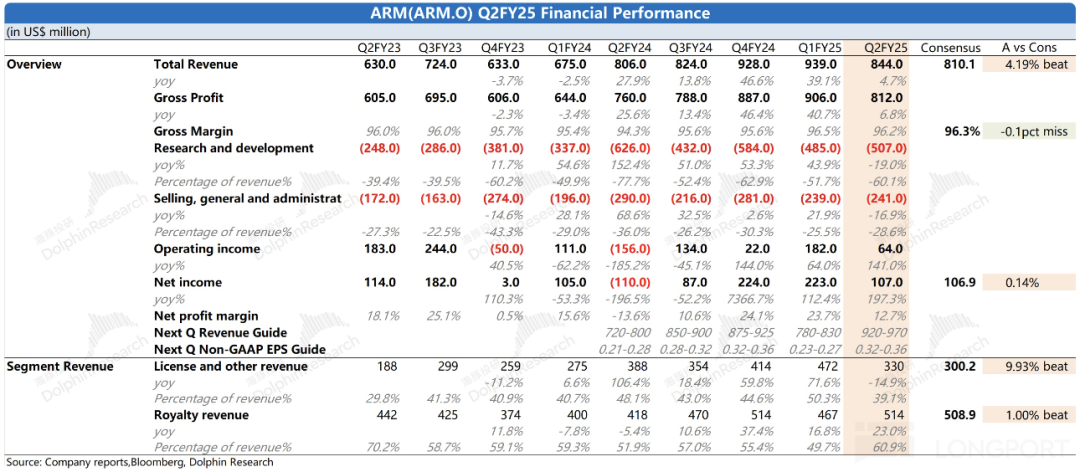

ARM (ARM.O) released its fiscal second-quarter report for 2025 (ending September 2024) after the US market close on November 7, 2024, Beijing time. The key points are as follows:

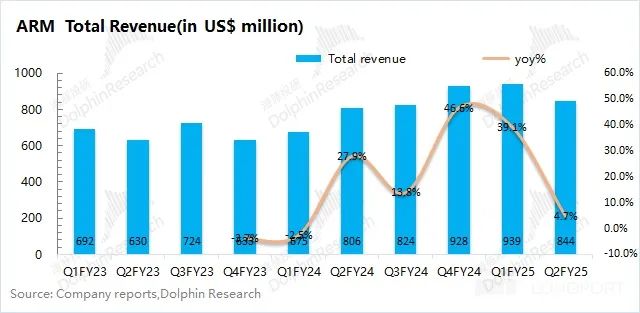

1. Overall Performance: Both revenue and profit met market expectations. ARM achieved revenue of $844 million in the second quarter of fiscal year 2025 (i.e., 24Q3), up 4.7% year-on-year, slightly better than market expectations ($810 million). The growth in revenue this quarter was mainly driven by the rapid growth of royalty business; the company's gross margin this quarter was 96.2%, up 1.9 percentage points year-on-year, in line with market expectations (96.3%), maintaining above 96%.

2. Business Segments: Royalty Business Hits New High. Although the company's license revenue declined this quarter, the total number of ARM.US customers continued to increase, and annual and unfulfilled contracts remained on the rise. The royalty licensing business was the main contributor to the increase this quarter, primarily due to a 40% year-on-year increase in revenue from mobile phone customers, significantly outperforming the single-digit growth in global mobile phone market shipments. Additionally, the company's share in the automotive and cloud services sectors continued to rise this quarter.

3. ARM Performance Guidance: Expected revenue for the third quarter of fiscal year 2025 (i.e., 24Q4) is $920-$970 million (market expectation: $951 million) and adjusted profit per share is expected to be $0.32-$0.36 (market expectation: $0.34).

Dolphin's Overall View: ARM's financial report this time is generally good.

The company's revenue and profit this quarter met market expectations. The increase in revenue this quarter was mainly due to the increase in royalty business revenue, with royalty revenue from mobile phones increasing by 40% year-on-year. Although license revenue declined this quarter, annual and unfulfilled contracts continued to grow, affected by revenue recognition timing this quarter.

Combined with the company's guidance for the next quarter, both revenue and profit performance are in line with market expectations. Revenue will rebound significantly quarter-on-quarter, consistent with annual contract data, and revenue recognition will occur later. Additionally, through collaborations with major companies such as NVIDIA, Microsoft, and Google, the company's share in the AI and cloud services markets continues to grow.

Regarding the company's performance, due to its ultra-high gross margin of 96%, there is little room for improvement in gross margin. Currently, the company's R&D expense ratio and selling, general, and administrative expense ratio combined account for more than 70% in the long term, directly compressing the company's profit. The company itself is relatively asset-light, and the focus of improving performance lies in expanding revenue scale and reducing operating expenses.

Due to the company's high-tech nature, it continues to expand its research and development personnel. The number of engineers has increased from less than 5,000 before the IPO to 6,429 now, making current R&D expenses relatively rigid. The company's main focus remains on expanding revenue to create economies of scale to absorb the growth in expenses. Judging from this financial report, the company is on the right track for expansion. The number of licensed customers and related orders are growing this quarter, and the company's share in major markets for royalty business is also increasing. Considering the company's full-year revenue forecast, although revenue data was weak this quarter, Dolphin expects a quarter-on-quarter increase in the next two quarters ($950 million/$1.22 billion), with revenue in the company's final quarter of this fiscal year reaching a new high of $1.2 billion.

Although the company's business continues to improve, with revenue expected to achieve more than 20% growth, the current market value still corresponds to over 100 times the company's profit for this fiscal year in terms of PE. This high valuation already incorporates the market's optimistic expectations for AI and the company's business. As long as the company's performance, the AI industry chain, and funding continue to improve, they can still support market confidence. However, once related businesses deteriorate, the company's high valuation will also face corresponding pressure.

Below is Dolphin's detailed analysis of ARM:

1. Overall Performance: Both Revenue and Profit Met Market Expectations

1.1 Revenue

ARM achieved revenue of $844 million in the second quarter of fiscal year 2025 (i.e., 24Q3), up 4.7% year-on-year, slightly better than market expectations ($810 million). The company's revenue continued to increase this quarter, although the license business declined, benefiting from the rapid growth of the royalty business.

1.2 Gross Profit

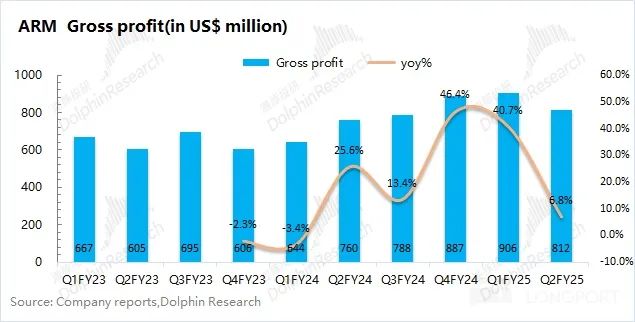

ARM achieved gross profit of $812 million in the second quarter of fiscal year 2025 (i.e., 24Q3), up 6.8% year-on-year. The year-on-year growth rate of gross profit was slightly higher than that of revenue.

ARM's gross margin this quarter was 96.2%, up 1.9 percentage points year-on-year, better than market expectations (95.9%). Driven by the continuous growth of royalty revenue and economies of scale, the company's gross margin continued to improve, reaching above 96% for two consecutive quarters. Additionally, the revenue share of the company's Armv9 has increased to 25% this quarter.

1.3 Operating Expenses

ARM's operating expenses were $724 million in the second quarter of fiscal year 2025 (i.e., 24Q3), up 35.8% year-on-year. The company maintained high investment and continued to expand its R&D personnel.

Specific expense breakdown:

1) R&D Expenses: The company's R&D expenses this quarter were $507 million, down 19% year-on-year. The year-on-year decline was mainly due to stock compensation and other expenses incurred by the company for relevant personnel in the same period last year. The number of engineers continued to increase to 6,429 this quarter, and R&D investment also increased slightly quarter-on-quarter.

2) Selling, General, and Administrative Expenses: The company's selling, general, and administrative expenses this quarter were $241 million, down 17% year-on-year. These expenses remained stable quarter-on-quarter.

1.4 Net Profit

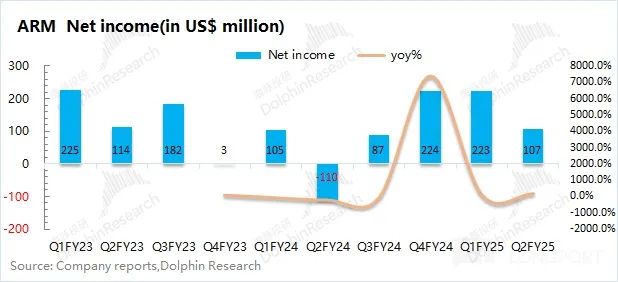

ARM achieved a net profit of $107 million in the second quarter of fiscal year 2025 (i.e., 24Q3), turning a loss into a profit year-on-year, in line with market expectations ($107 million). The net profit margin this quarter was 12.7%.

Looking solely at operating performance, the company's operating profit increased quarter-on-quarter to $64 million, turning positive year-on-year. Although ARM has an ultra-high gross margin, most of the company's investments are in R&D and other expense areas. Even with a 96% gross margin, the nearly 60% R&D expense ratio directly compresses the company's final profit.

Currently, there is not much room for improvement in the company's gross margin. The company mainly aims to expand its revenue scale to generate economies of scale, thereby reducing the proportion of operating expenses and increasing profit.

2. Business Segments: Royalty Revenue Hits New High

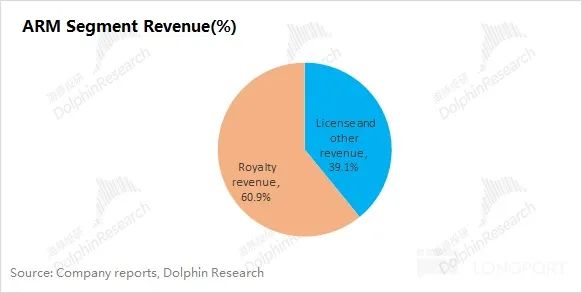

From ARM's business segments, license business and royalty business were almost evenly split this quarter. The company's business currently benefits mainly from demand driven by AI, etc. With the continuous growth of royalty revenue, the current revenue share has increased to 60.9%, and the license business share is 39.1%.

2.1 License Business

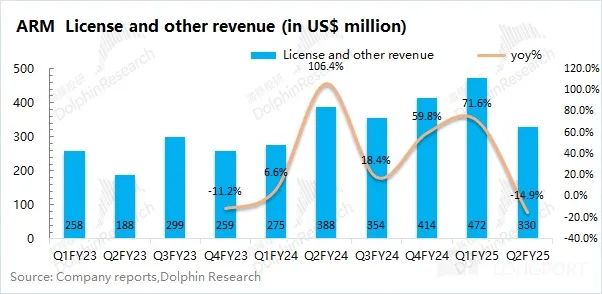

ARM's license business achieved revenue of $330 million in the second quarter of fiscal year 2025 (i.e., 24Q3), down 14.9% year-on-year. In the company's financial report this time, both the annual contract value and the unfulfilled portion increased quarter-on-quarter, indicating that the license business was still on the rise. The decline this quarter was mainly due to quarterly revenue recognition and other factors.

The number of full-license customers and flexible-license customers both increased this quarter. The number of full-license customers increased to 39, and the number of flexible-license customers increased to 269, with the company's overall customer base continuing to rise.

2.2 Royalty Business

ARM's royalty licensing business achieved revenue of $514 million in the second quarter of fiscal year 2025 (i.e., 24Q3), up 23% year-on-year. The growth in royalty licensing business was mainly driven by contributions from smartphones.

In particular, royalty revenue from smartphones increased by about 40% year-on-year this quarter, significantly outperforming the single-digit growth in smartphone shipments, mainly due to the increased share of processors based on Armv9 and an increase in royalty rates. The company's market share in the automotive and cloud service provider sectors also continued to rise. The current revenue share of the company's Armv9 architecture has increased to 25%, significantly higher than the 10% in the same period last year.

Dolphin Investment Research on ARM and Related CompaniesAugust 1, 2024 Financial Report Review: "ARM: Guidance Cools, AI Faith Fades"May 9, 2024 Financial Report Review: "ARM: After the Frenzy, Is AI Slowing Down?"February 8, 2024 Financial Report Review: "ARM: How Long Can AI's Wings Fly?"September 13, 2023 In-depth Analysis of ARM: "ARM: After Selling Alibaba, Is SoftBank's Next Lifeline Really Worth Fifty Billion?"Related CompaniesJanuary 26, 2024 Intel Financial Report Review: "Intel: No Longer the King of Processors, AI Battle in Disarray"